|

市场调查报告书

商品编码

1910927

印尼煤炭市场:份额分析、产业趋势、统计和成长预测(2026-2031年)Indonesia Coal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

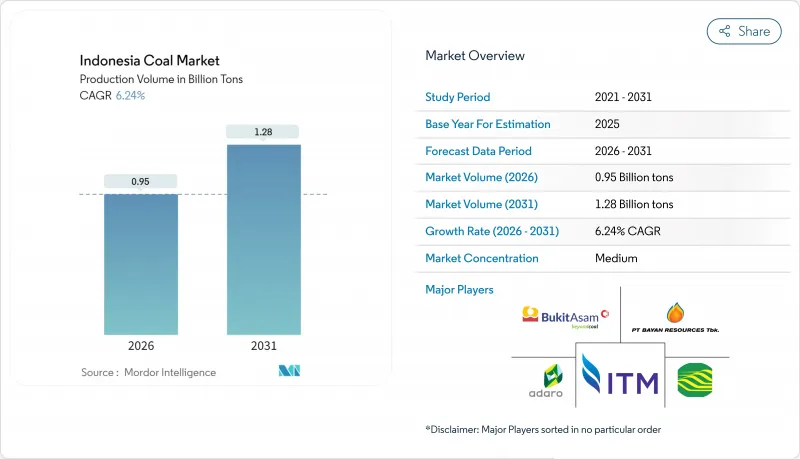

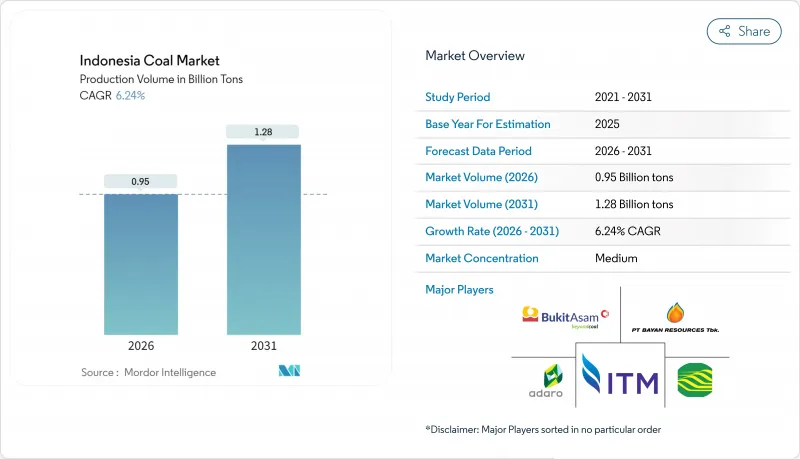

预计印尼煤炭市场将从 2025 年的 8.9 亿吨成长到 2026 年的 9.5 亿吨,到 2031 年将达到 12.8 亿吨,2026 年至 2031 年的复合年增长率为 6.24%。

这一市场规模反映了印尼作为全球最大动力煤出口国的地位及其在该国电力结构中的强势地位。在脱碳讨论活性化的背景下,印尼国家电力公司(PLN)持续的基本负载需求、镍冶炼业的蓬勃发展以及不断扩大的“中国+1”战略,都在支撑着需求增长。综合矿业公司不断签订长期销售合同,从而稳定现金流,而战略储备的品质也为优质煤炭生产商提供了额外的定价权。同时,促进煤气化和二甲醚计划的监管改革正在为低阶煤开闢新的国内市场。这些并行的趋势表明,即使全球煤炭资本成本不断上升,印尼煤炭市场仍保持强劲势头。

印尼煤炭市场趋势及展望

PLN主导的低热值煤炭基本负载需求持续存在

由于印尼国家电力公司 (PLN) 快速扩张可再生能源的空间有限,煤炭仍然是印尼电力供应系统的核心。政府对电价的收费系统要求电力公司优先选择成本最低的发电燃料,而次烟煤仍然是为爪哇-峇里岛负载中心供电最具成本效益的选择。为了确保电网稳定,需要进一步加强供应优先顺序,因为燃煤发电厂提供频率和电压调节服务的边际成本低于电池储能。从财务角度来看,PLN 的煤炭采购预算可预测,这降低了交易对象的信用风险,并允许矿业公司签订固定数量、多年期的销售合约。因此,即使可再生能源渗透率逐步提高,印尼煤炭市场仍受惠于持续的结构性需求下限。

镍冶炼厂和电动车电池冶炼厂的燃煤自发电量迅速成长

印尼2020年禁止镍矿出口的政策促使超过150亿美元的资金流入镍加工厂。这些工厂需要不间断的电力供应来运作电弧炉。中资冶炼厂通常会自建200至350兆瓦的燃煤发电厂,进而形成一个不受印尼国家电力公司(PLN)输电优先级影响的专属市场。这些自建电厂通常签订以美元计价的购电协议,使矿商能够获得比公用事业公司更高的收益。这种经营模式既能确保高额利润,又能实现收入来源多元化。随着下游企业拓展前驱体、正极材料和电池材料业务,需求将进一步成长,看似矛盾地将煤炭的使用与低碳经济连结起来。预计到2030年,这些趋势将推动工业用电需求成长超过国内平均消费量。

国内市场义务(DMO)价格上限

印尼的国内煤炭价格管制(DMO)制度要求煤矿企业必须以政府设定的基准价格在国内销售其年产量的25%。由于在价格高企时期,该基准价格可能比出口价格低至每吨30美元,强制性折扣限制了利润空间的扩张,并奖励企业专注于生产高热值(高CV)煤炭,这些煤炭主要用于出口。金融机构已逐步下调受DMO价格上限影响的蕴藏量估值,导致企业难以取得扩张资金筹措。虽然这项政策保护了国有电力公司PLN和工业用户免受价格飙升的影响,但也抑制了对新的低阶煤计划的投资,从而限制了印尼煤炭市场的供应成长。

细分市场分析

到2025年,次烟煤将占印尼煤炭市场46.85%的份额,这得益于东加里曼丹和南加里曼丹丰富的煤层资源,可为国内外买家提供具有成本竞争力的燃料。儘管目前次焦结煤的产量将以7.86%的复合年增长率增长,其在印尼煤炭市场的份额将从2025年的26.40%增长到2031年的约三分之一。高热值煤的价格溢价为每吨15-20美元,并符合超超临界电厂的规格要求,而超超临界电厂在亚洲正变得越来越普遍。区域高炉对冶金煤的需求将进一步增强拥有优质蕴藏量的生产商的定价权。褐煤的成长预计将保持平稳,这主要受国内气化先导工厂和老旧、低效锅炉的影响。生产区域与煤炭等级分布相符,例如东加里曼丹的Kaltim Prima Coal等业者专注于生产优质煤,而苏门答腊的矿商则主要向印尼国家电力公司(PLN)供应次烟煤。这种品质细分使企业能够根据价格差异和物流成本调整不同等级煤炭的混合比例,从而对冲市场波动风险并维持均衡的投资组合。

印尼煤炭市场报告按煤炭类别(褐煤/低阶煤、次烟煤、烟煤和炼焦煤)和应用领域(发电、钢铁冶金、水泥及其他应用)进行细分。市场规模和预测以产量(吨)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- PLN长期主导的低热值煤炭基本负载需求

- 镍冶炼厂和电动车电池冶炼厂的燃煤自发电量迅速成长

- 受「中国+1」策略影响,海运需求转向印尼。

- 政府对低阶煤「气化和二甲醚」製程的诱因

- CCUS试点计画实现高热值煤出口溢价

- 市场限制

- 国内市场义务(DMO)价格上限

- 由JETP资助的燃煤发电厂提前退役

- 州级暂停发放新的采矿许可证(加里曼丹、苏门答腊)

- 环境、社会及公司治理(ESG)因素推升印尼煤炭贸易融资成本

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- PESTEL 分析

第五章 市场规模与成长预测

- 按煤级

- 褐煤/低品位

- 次烟煤

- 烟煤和焦结煤

- 透过使用

- 发电

- 钢铁冶金

- 水泥及其他用途

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、联盟、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- PT Bumi Resources Tbk

- PT Adaro Energy Indonesia Tbk

- PT Bayan Resources Tbk

- PT Bukit Asam Tbk

- PT Indo Tambangraya Megah Tbk

- PT Kaltim Prima Coal

- PT Arutmin Indonesia

- PT Kideco Jaya Agung

- PT Berau Coal Energy Tbk

- PT Indika Energy Tbk

- Golden Energy & Resources Ltd

- BlackGold Natural Resources

- PT Bhakti Energi Persada

- PT Bayan International

- PT Multi Harapan Utama

- Adani Indonesia(Adaro JV)

- Glencore(PT Balangan Coal)

- PT Petrosea Tbk

- PT Delta Dunia Makmur Tbk

- PT Resource Alam Indonesia Tbk

第七章 市场机会与未来展望

The Indonesia Coal market is expected to grow from 0.89 Billion tons in 2025 to 0.95 Billion tons in 2026 and is forecast to reach 1.28 Billion tons by 2031 at 6.24% CAGR over 2026-2031.

The market's scale reflects Indonesia's position as the world's largest thermal-coal exporter and its entrenched role in the country's power mix. Ongoing PLN baseload demand, a nickel smelting boom, and a widening China-plus-One strategy collectively underpin demand growth, despite intensifying decarbonization rhetoric. Integrated miners continue to secure long-term offtake contracts that stabilize cash flows, while strategic reserve quality gives premium-grade producers additional pricing power. At the same time, regulatory reforms encouraging gasification and dimethyl-ether projects are opening new domestic outlets for low-rank coal. These parallel trends signal that the Indonesian coal market will remain resilient even as global capital costs for coal rise.

Indonesia Coal Market Trends and Insights

Prolonged PLN-led Baseload Demand for Low-CV Thermal Coal

PLN's limited headroom for rapid renewable build-out keeps coal in the core of Indonesia's power dispatch stack. Subsidized electricity tariffs require the utility to prioritize the lowest-cost generation fuel, and sub-bituminous coal remains the most cost-effective option delivered to Java-Bali load centers. Grid stability needs further reinforcement of dispatch preference because coal plants provide frequency and voltage services at a lower marginal cost than battery storage. Financially, PLN's budget allocation for coal procurement is predictable, reducing counterparties' credit risk and enabling miners to structure multi-year offtake agreements that lock in volumes. Consequently, the Indonesian coal market benefits from a structural demand floor that persists even as renewable penetration rises incrementally.

Surge in Coal-fired Captive Power for Nickel & EV-battery Smelters

Indonesia's 2020 nickel-ore export ban sparked capital inflows exceeding USD 15 billion into nickel processing complexes that require uninterrupted power for electric-furnace operations. Chinese-backed smelters routinely install on-site coal plants sized at 200-350 MW, providing a dedicated market immune to PLN's dispatch priorities. Captive arrangements typically involve dollar-linked power-purchase agreements, which grant miners higher realizations than utility deliveries. The business model thus secures premium margins while diversifying revenue streams. Demand expands further as downstream players move into precursor-cathode and battery materials, linking coal usage paradoxically to the low-carbon economy. These trends keep industrial offtake growth ahead of national average consumption through 2030.

Mandatory Domestic Market Obligation (DMO) Price Caps

Indonesia's DMO mechanism obliges miners to sell 25% of annual output at a government-set benchmark that trails export parity by up to USD 30 per ton during high-price cycles. This enforced discount compresses margin expansion opportunities and incentivizes firms to skew production toward higher-CV grades, which are earmarked exclusively for export. Financiers increasingly mark down reserve valuations that are exposed to DMO ceilings, complicating debt-raising for expansion. Although the policy shields PLN and industrial buyers from price spikes, it reduces investment appetite in new low-rank coal projects, thereby dampening incremental supply growth in the Indonesian coal market.

Other drivers and restraints analyzed in the detailed report include:

- China-plus-One Strategy Shifting Seaborne Demand to Indonesia

- Government "Gasification & DME" Incentives for Low-rank Coal

- Accelerated Coal-plant Retirement under JETP Funding

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sub-bituminous coal accounted for 46.85% of the Indonesian coal market in 2025, leveraging abundant East and South Kalimantan seams that deliver cost-competitive fuel to both domestic and export buyers. Despite this current dominance, bituminous and coking coal output is forecast to grow at an 7.86% CAGR between 2026 and 2031, lifting its share of the Indonesian coal market from 26.40% in 2025 to nearly one-third by 2031. Higher-CV grades unlock premiums of USD 15-20 per ton and align with emerging ultra-supercritical power-plant specifications in Asia. Metallurgical coal demand from regional blast furnaces further reinforces pricing power for producers with suitable reserve quality. Lignite remains oriented toward domestic gasification pilots and legacy low-efficiency boilers, implying flat growth. Production geography mirrors grade distribution; East Kalimantan operators, such as Kaltim Prima Coal, focus on premium grades, whereas Sumatra miners largely supply sub-bituminous coal to PLN. This quality segmentation enables portfolio balancing, as companies hedge against market swings by adjusting blend ratios between grades according to price differentials and logistics economics.

The Indonesia Coal Market Report is Segmented by Coal Grade (Lignite/Low-Rank, Sub-Bituminous, and Bituminous and Coking) and Application (Power Generation, Iron, Steel, and Metallurgy, and Cement and Other Applications). The Market Size and Forecasts are Provided in Terms of Production Volume (Tons).

List of Companies Covered in this Report:

- PT Bumi Resources Tbk

- PT Adaro Energy Indonesia Tbk

- PT Bayan Resources Tbk

- PT Bukit Asam Tbk

- PT Indo Tambangraya Megah Tbk

- PT Kaltim Prima Coal

- PT Arutmin Indonesia

- PT Kideco Jaya Agung

- PT Berau Coal Energy Tbk

- PT Indika Energy Tbk

- Golden Energy & Resources Ltd

- BlackGold Natural Resources

- PT Bhakti Energi Persada

- PT Bayan International

- PT Multi Harapan Utama

- Adani Indonesia (Adaro JV)

- Glencore (PT Balangan Coal)

- PT Petrosea Tbk

- PT Delta Dunia Makmur Tbk

- PT Resource Alam Indonesia Tbk

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Prolonged PLN-led baseload demand for low-CV thermal coal

- 4.2.2 Surge in coal-fired captive power for nickel & EV-battery smelters

- 4.2.3 China-plus-One strategy shifting seaborne demand to Indonesia

- 4.2.4 Government "Gasification & DME" incentives for low-rank coal

- 4.2.5 CCUS pilots unlocking high-CV export premiums

- 4.3 Market Restraints

- 4.3.1 Mandatory Domestic Market Obligation (DMO) price caps

- 4.3.2 Accelerated coal-plant retirement under JETP funding

- 4.3.3 Provincial moratoria on new mining permits (Kalimantan, Sumatra)

- 4.3.4 Rising ESG-driven trade financing costs for Indonesian coal

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Coal Grade

- 5.1.1 Lignite/Low-Rank

- 5.1.2 Sub-bituminous

- 5.1.3 Bituminous and Coking

- 5.2 By Application

- 5.2.1 Power Generation

- 5.2.2 Iron, Steel, and Metallurgy

- 5.2.3 Cement and Other Applications

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 PT Bumi Resources Tbk

- 6.4.2 PT Adaro Energy Indonesia Tbk

- 6.4.3 PT Bayan Resources Tbk

- 6.4.4 PT Bukit Asam Tbk

- 6.4.5 PT Indo Tambangraya Megah Tbk

- 6.4.6 PT Kaltim Prima Coal

- 6.4.7 PT Arutmin Indonesia

- 6.4.8 PT Kideco Jaya Agung

- 6.4.9 PT Berau Coal Energy Tbk

- 6.4.10 PT Indika Energy Tbk

- 6.4.11 Golden Energy & Resources Ltd

- 6.4.12 BlackGold Natural Resources

- 6.4.13 PT Bhakti Energi Persada

- 6.4.14 PT Bayan International

- 6.4.15 PT Multi Harapan Utama

- 6.4.16 Adani Indonesia (Adaro JV)

- 6.4.17 Glencore (PT Balangan Coal)

- 6.4.18 PT Petrosea Tbk

- 6.4.19 PT Delta Dunia Makmur Tbk

- 6.4.20 PT Resource Alam Indonesia Tbk

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment