|

市场调查报告书

商品编码

1910930

商用地面行动无线:市场份额分析、行业趋势和统计数据、成长预测(2026-2031 年)Land Professional Mobile Radio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

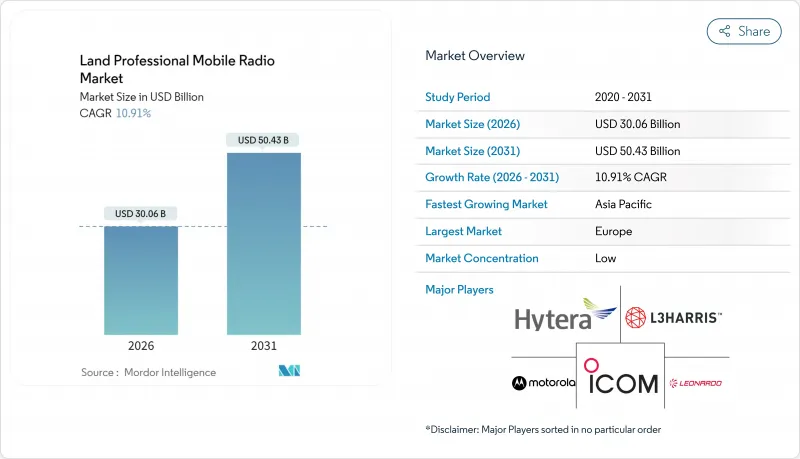

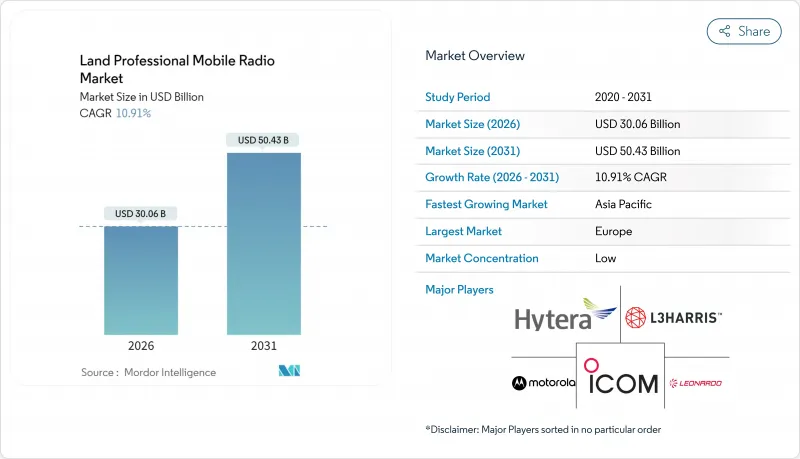

预计到 2025 年,商用地面行动无线市场价值将达到 271 亿美元,到 2031 年将达到 504.3 亿美元,高于 2026 年的 300.6 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 10.91%。

持续的模拟到数位迁移、频谱效率的提升以及5G回程传输链路的集成,正在加速公共、交通运输、公共产业和工业用户系统的升级。国家互通性要求、气候变迁导致的日益增长的灾害应变需求,以及现场作业对安全语音和资料通讯需求的不断增加,都进一步推动了5G技术的普及。供应商正透过软体定义架构、人工智慧辅助功能和多频段支援等差异化特性,确保其投资能够面向未来,同时促进与专用LTE和MC-X平台的整合。日益增强的网路安全风险意识也促使各机构转向符合不断发展的合规标准的加密数位通讯协定。

全球商用地面行动无线市场趋势与洞察

对相容 5G 的 PMR回程传输的需求迅速增长

行动电话电信商和无线设备供应商目前正将 5G回程传输与窄频PMR 连结结合,以扩大覆盖范围并分流高峰流量,同时确保关键任务的运作。洛杉矶区域互通通讯系统等早期部署案例表明,5G 通道能够支援即时影像、地图绘製和生物识别资料等高频宽应用,同时保持语音和讯号在授权的 PMR 频道上传输。小型基地台成本的下降、基础设施共用模式以及公共部门对关键通讯的持续投入,都推动了这种混合方案的广泛应用。这种混合设计提高了频谱效率,确保了优先排序,并延缓了高成本的设备更换,促进了商用地面行动无线市场的持续扩张。

从类比协议过渡到数位通讯协定

面对安全漏洞、频道容量有限和语音品质不佳等挑战,各机构正加速淘汰老旧的类比系统。 TETRA、P25 和 DMR 等数位标准提供加密功能、更高的频谱效率和向下相容模式,从而促进系统迁移。正如 BK Technologies 与加州消防救援部 (CAL FIRE) 签订的价值 910 万美元的合约所表明的那样,公共订单负责人在采购新设备时优先考虑面向未来的方案。开发中国家通常完全跳过类比阶段,直接迁移到数位平台,加速了全球设备数量的成长。随着无线电台、中继器和主机的同步更新,这种更新周期推动了商用地面行动无线市场的硬体和软体收入成长。

1 频宽以下频段短缺

低频宽频率非常适合广域覆盖,但正面临来自商业宽频和物联网服务的重复使用压力。美国通讯委员会 (FCC) 对 900 MHz 频段分配的审查就是一个例证,它体现了政策制定者如何在行动和规划风险之间寻求平衡,而这些风险会给专用行动无线电 (PMR)拥有者持有者带来影响。如果现有业者被迫转型或接受更严格的频道划分,部署时间将会延长,无线电设备翻新成本也会上升。各机构越来越多地采用能够漫游到蜂巢式网路的双模无线电设备来分散风险,但这增加了商用地面行动无线市场采购决策的成本和复杂性。

细分市场分析

预计到2025年,数位平台将占据商用地面行动无线市场60.85%的份额,并在2031年之前以13.05%的复合年增长率成长。这项优势主要得益于其加密功能、资料吞吐量和频谱效率,这些优势均符合严格的公共标准。 P25在北美市场占据主导地位,而TETRA则是欧洲和亚洲紧急通讯网路的基础。同时,对成本较为敏感的DMR技术在商用车辆中日益普及。技术整合的压力正在加速多标准终端的采用,使机构能够在保持向下相容性的同时逐步迁移。模拟技术预计将失去部分市场份额,但在对成本敏感的应用和遍远地区仍然具有可行性,因为在这些地区,简单易用比高级功能更为重要。商用地面行动无线市场的规模,与技术升级密切相关,再加上软体授权和无线电加密金钥带来的持续价值创造,将继续成为核心收入驱动因素。

从2025年起,供应商将日益专注于按需载入通讯协定堆迭的软体定义无线电,从而减少库存单位数量和仓储成本。 JVC Kenwood的NEXEDGE系列就是一个很好的例子,它是一款支援类比和数位模式的混合终端,能够平滑使用者过渡。开放的生态系统使整合商能够轻鬆地将无线电整合到GIS系统、事件指挥系统和资产追踪套件中。这种互通性提高了切换的弹性,参与企业正致力于发展开发者计画和API工具包,以在不断扩展的、多厂商的商用地面行动无线市场中维持其市场份额。

到2025年,手持和可携式设备将占据58.10%的市场份额,这主要得益于它们在各个细分市场的第一线效用。然而,随着各机构加强网路覆盖并透过IP骨干网路连接分散的语音群组,到2031年,中继器和网关的复合年增长率将达到13.95%。都市区隧道、高层建筑群和偏远能源设施需要额外的节点来确保讯号饱和,这推动了基础设施投资的成长速度超过了用户成长速度。供应商正在将基于云端的管理入口网站捆绑在一起,这些入口网站可以监控网关的运作状况并自动更新韧体,从而降低现场服务成本。

在需要远距离通讯和高功率的场合,行动车载设备仍然非常有用,尤其是在运输和公共产业车队中。固定基地台是指挥中心的核心,整合了电脑辅助设计 (CAD)资料库和人工智慧 (AI) 驱动的事件分析。随着各组织机构推行单一平台策略,基于通用晶片组和模组化射频前端的硬体简化了物流,并使各种外形尺寸的设备都能从中受益。网关製造商在商用地面行动无线市场中不断增长的份额,依赖于能够连接传统网路和宽频网路的开放标准接口,而无需将买家锁定在专有中间件中。

区域分析

北美地区将继续保持领先地位,预计到2025年将占全球支出的35.90%,这主要得益于联邦津贴项目和军事现代化项目,例如大规模的州级P25系统和美国的HMS无线电采购项目。成熟的分销通路环境有利于签订多年服务合约、进行软体升级和网路安全审核,从而为现有供应商提供可预测的经常性收入。此外,对快速应对野火和飓风日益增长的需求也进一步证明了对互通语音网路持续投资的必要性。

预计到2031年,亚太地区将以13.55%的复合年增长率实现最高增长,这主要得益于中国和印度将基础设施预算重点投入智慧城市、高速铁路和工业数位化。国内主要企业正利用成本优势拓展对非洲和拉丁美洲市场的出口,从而扩大其潜在市场。东南亚国家正在重建网络,以提高其抗灾能力,并采用支援TETRA和LTE的双模无线电技术,推动了市场规模的成长。日本和韩国在能力创新方面主导,正在试验与机器人和无人机协同工作的AI驱动型指挥中心。

在欧洲,协调一致的频谱政策和跨境紧急合作倡议将推动网路稳步扩张。英国紧急服务网路(ESN)的营运寿命延长至2032年,凸显了该地区正在向宽频整合的个人行动无线电(PMR)转型,而非简单的同质化替换。北欧国家正在试行将5G网路切片应用于关键任务型一键通(PTT)通信,为其他欧盟成员国树立了可藉镜的典范。同时,东欧成员国正利用欧盟復苏基金升级模拟市政网络,以维持对陆基商用无线电市场长期秩序的清晰认知。

其他福利

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对相容 5G 的 PMR回程传输的需求快速成长

- 从类比协议过渡到数位通讯协定

- 公共网路现代化任务

- 人工智慧驱动的车辆调度管理和预测性维护

- 将专用 LTE 与 MC-X 平台集成

- 气候变迁灾害中互通性的必要性

- 市场限制

- 1 频宽以下频段短缺

- 资本密集型多技术更新周期

- 网路安全回应成本不断增加

- PMR-LTE频谱共用方面的监理不确定性

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 主要经济趋势分析

第五章 市场规模与成长预测

- 透过技术

- 模拟

- 数位的

- TETRA

- P25

- DMR

- NXDN/dPMR

- 按外形尺寸

- 手持式/可携式

- 移动(汽车)

- 固定线路/基地台

- 中继器和网关

- 按频段

- VHF(30~300MHz)

- UHF(300~1,000MHz)

- 700/800MHz

- 900MHz 或更高

- 终端用户部门

- 公共与保全

- 运输/物流

- 公共产业能源

- 製造业和工业

- 建筑和采矿

- 饭店和零售业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- GCC

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Motorola Solutions

- Hytera Communications

- JVCKenwood Corporation

- Airbus Defence and Space

- Tait Communications

- L3Harris Technologies

- BK Technologies

- Sepura PLC

- Thales Group

- Icom Incorporated

- Codan Communications

- Simoco Wireless Solutions

- DAMM Cellular Systems

- Rohill Engineering

- Kirisun Communications

- TISR(Leonardo)

- Omnitronics

- Syndico Distribution

- Siyata Mobile

- Pyramid Communications

第七章 市场机会与未来展望

The Land Professional Mobile Radio Market was valued at USD 27.10 billion in 2025 and estimated to grow from USD 30.06 billion in 2026 to reach USD 50.43 billion by 2031, at a CAGR of 10.91% during the forecast period (2026-2031).

Continued analog-to-digital migration, higher spectrum efficiencies, and 5G-enabled backhaul integration are accelerating system replacements across public safety, transport, utilities, and industrial users. Adoption momentum is reinforced by national interoperability mandates, rising climate-driven disaster response requirements, and the growing need for secure voice and data in field operations. Vendors differentiate through software-defined architectures, AI-assisted features, and multi-band capabilities that future-proof investments while easing integration with private LTE and MC-X platforms. Heightened cyber-risk awareness further pushes agencies toward encrypted digital protocols that meet evolving compliance standards.

Global Land Professional Mobile Radio Market Trends and Insights

5G-enabled PMR backhaul demand surge

Cellular operators and radio vendors now pair 5G backhaul with narrowband PMR links to extend coverage and offload peak traffic without jeopardizing mission-critical uptime. Early deployments such as the Los Angeles Regional Interoperable Communications System show how 5G pipes enable high-bandwidth applications-live video, mapping, and biometric data-while voice and signaling remain on licensed PMR channels. Broader adoption is encouraged by falling small-cell costs, shared infrastructure models, and continuing public funding for critical communications. The hybrid design keeps spectrum use efficient, ensures prioritization, and delays costly wholesale equipment swaps, positioning the Land Professional Mobile Radio market for sustained expansion.

Transition from analog to digital protocols

Retirement of legacy analog systems accelerates as agencies confront security gaps, limited channel capacity, and poor audio quality. Digital standards such as TETRA, P25, and DMR deliver encryption, better spectrum usage, and backward compatibility modes that smooth changeovers. Contracts like BK Technologies' USD 9.1 million CAL FIRE order demonstrate how public-safety buyers emphasize future-proofing when procuring new fleets. Developing economies often bypass analog altogether, stepping directly into digital platforms and thus compounding global unit growth. Because radios, repeaters, and dispatch consoles are refreshed concurrently, the replacement cycle fuels both hardware and software revenue streams within the Land Professional Mobile Radio market.

Spectrum scarcity in sub-1 GHz bands

Low-band frequencies prized for wide-area coverage face re-farm pressure from commercial broadband and IoT services. The U.S. Federal Communications Commission review of 900 MHz allocations illustrates policymaker balancing acts that inject planning risk for PMR license holders. When incumbents must migrate or accept tighter channelization, deployment timelines lengthen and radio re-tuning costs rise. Agencies increasingly hedge by adopting dual-mode radios capable of roaming onto cellular networks, adding expense and complexity to procurement decisions in the Land Professional Mobile Radio market.

Other drivers and restraints analyzed in the detailed report include:

- Public-safety network modernisation mandates

- AI-driven dispatch and predictive maintenance

- Capital-intensive multi-technology overhaul cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital platforms held 60.85% share of the Land Professional Mobile Radio market in 2025 and are set to grow at a 13.05% CAGR through 2031. This dominance is anchored in encryption, data capability, and spectral efficiency that align with stricter public-safety standards. P25 leads North America, TETRA underpins many European and Asian emergency networks, while cost-oriented DMR gains ground among commercial fleets. Convergence pressures hasten multi-standard terminals, allowing agencies to phase migration without losing backward compatibility. Analog's footprint will shrink, yet it persists in cost-sensitive and rural uses where simplicity outweighs advanced features. The Land Professional Mobile Radio market size tied to technology upgrades remains a core revenue engine, with software licenses and over-the-air encryption keys adding recurring value.

From 2025 onward, suppliers emphasize software-defined radios that load protocol stacks on demand, lowering SKUs and warehouse costs. JVCKENWOOD's NEXEDGE line exemplifies hybrid units capable of analog and digital modes, smoothing user transitions. Ecosystem openness also helps integrators plug radios into GIS, incident command, and asset-tracking suites. This interoperability heightens switching elasticity, prompting established players to nurture developer programs and API toolkits to safeguard share amid rising digital multi-vendor environments in the broader Land Professional Mobile Radio market.

Handheld and portable units accounted for 58.10% share in 2025, given their frontline utility across sectors. Yet repeaters and gateways will post a 13.95% CAGR as agencies densify coverage and link disparate voice groups over IP backbones through 2031. Urban tunnels, high-rise complexes, and remote energy sites require additional nodes to guarantee signal saturation, pushing infrastructure spending faster than subscriber additions. Vendors bundle cloud-based management portals that monitor gateway health and automate firmware patching, trimming field service costs.

Mobile vehicular sets retain relevance where extended range and higher power are needed, especially in transport and utility truck fleets. Fixed base stations anchor dispatch centers, integrating CAD databases and AI-powered incident analytics. As organizations pursue one-platform strategies, hardware built on common chipsets and modular RF front-ends streamlines logistics, benefiting every form factor. The Land Professional Mobile Radio market share expansion for gateway makers will hinge on open-standard interfaces that bridge legacy and broadband domains without locking buyers into proprietary middleware.

The Land Professional Mobile Radio Market Report is Segmented by Technology (Analog, Digital Including TETRA, and More), Form Factor (Handheld/Portable, Mobile Vehicular, and More), Frequency Band (VHF 30-300 MHz, UHF 300-1000 MHz, and More), End-User Sector (Public Safety and Security, Transportation and Logistics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35.90% of global spend in 2025, buoyed by structured federal grant programs, large statewide P25 systems, and military modernization programs such as the U.S. Army's HMS radio procurements.The mature channel landscape encourages multi-year service contracts, software upgrades, and cybersecurity audits that deliver predictable annuity revenue for incumbent vendors. Rapid wildfire and hurricane response needs further validate continuous investment in interoperable voice networks.

Asia-Pacific posts the most rapid 13.55% CAGR to 2031 as China and India funnel infrastructure budgets into smart cities, high-speed rail, and industrial digitization. Domestic champions leverage cost advantages to penetrate African and Latin American exports, widening their addressable base. Southeast Asian nations, rebuilding disaster-resilient networks, adopt dual-mode radios compatible with both TETRA and LTE, reinforcing volume growth. Japan and South Korea lead feature innovation, experimenting with AI-enabled command centers tied to robots and drones.

Europe maintains steady expansion through harmonized spectrum policies and cross-border emergency cooperation initiatives. The United Kingdom's Emergency Services Network, now extended to 2032, underscores the region's pivot toward broadband-integrated PMR rather than simple like-for-like replacements. Nordic nations pilot 5G slicing for mission-critical push-to-talk, setting frameworks other EU states may replicate. Meanwhile, Eastern European members invest EU recovery funds into upgrading analog municipal networks, preserving long-term order visibility across the Land Professional Mobile Radio market.

- Motorola Solutions

- Hytera Communications

- JVCKenwood Corporation

- Airbus Defence and Space

- Tait Communications

- L3Harris Technologies

- BK Technologies

- Sepura PLC

- Thales Group

- Icom Incorporated

- Codan Communications

- Simoco Wireless Solutions

- DAMM Cellular Systems

- Rohill Engineering

- Kirisun Communications

- TISR (Leonardo)

- Omnitronics

- Syndico Distribution

- Siyata Mobile

- Pyramid Communications

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G-enabled PMR backhaul demand surge

- 4.2.2 Transition from analog to digital protocols

- 4.2.3 Public-safety network modernisation mandates

- 4.2.4 AI-driven dispatch and predictive maintenance

- 4.2.5 Integration with private LTE and MC-X platforms

- 4.2.6 Inter-agency interoperability needs amid climate-driven disasters

- 4.3 Market Restraints

- 4.3.1 Spectrum scarcity in sub-1 GHz bands

- 4.3.2 Capital-intensive multi-technology overhaul cycles

- 4.3.3 Rising cyber-security compliance costs

- 4.3.4 Regulatory uncertainty over PMR-LTE spectrum sharing

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Analysis of Key Economic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Analog

- 5.1.2 Digital

- 5.1.2.1 TETRA

- 5.1.2.2 P25

- 5.1.2.3 DMR

- 5.1.2.4 NXDN / dPMR

- 5.2 By Form Factor

- 5.2.1 Handheld / Portable

- 5.2.2 Mobile (Vehicular)

- 5.2.3 Fixed / Base-Station

- 5.2.4 Repeaters and Gateways

- 5.3 By Frequency Band

- 5.3.1 VHF (30-300 MHz)

- 5.3.2 UHF (300-1000 MHz)

- 5.3.3 700/800 MHz

- 5.3.4 900 MHz +

- 5.4 By End-user Sector

- 5.4.1 Public Safety and Security

- 5.4.2 Transportation and Logistics

- 5.4.3 Utilities and Energy

- 5.4.4 Manufacturing and Industrial

- 5.4.5 Construction and Mining

- 5.4.6 Hospitality and Retail

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Motorola Solutions

- 6.4.2 Hytera Communications

- 6.4.3 JVCKenwood Corporation

- 6.4.4 Airbus Defence and Space

- 6.4.5 Tait Communications

- 6.4.6 L3Harris Technologies

- 6.4.7 BK Technologies

- 6.4.8 Sepura PLC

- 6.4.9 Thales Group

- 6.4.10 Icom Incorporated

- 6.4.11 Codan Communications

- 6.4.12 Simoco Wireless Solutions

- 6.4.13 DAMM Cellular Systems

- 6.4.14 Rohill Engineering

- 6.4.15 Kirisun Communications

- 6.4.16 TISR (Leonardo)

- 6.4.17 Omnitronics

- 6.4.18 Syndico Distribution

- 6.4.19 Siyata Mobile

- 6.4.20 Pyramid Communications

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment