|

市场调查报告书

商品编码

1911268

药品合约包装:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Pharmaceutical Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

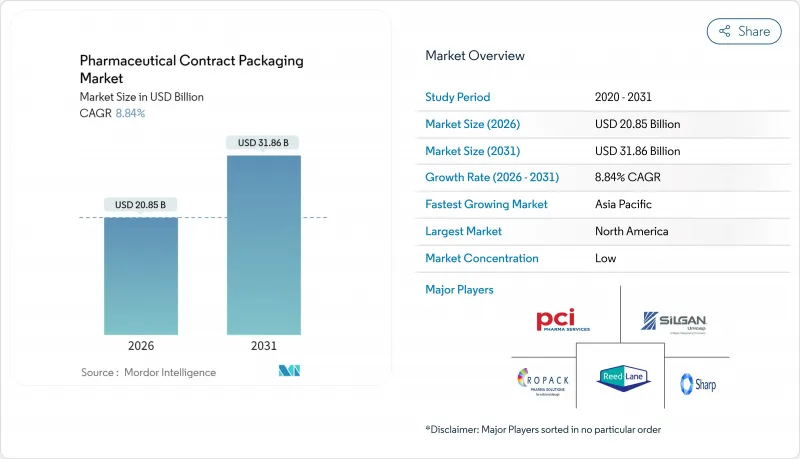

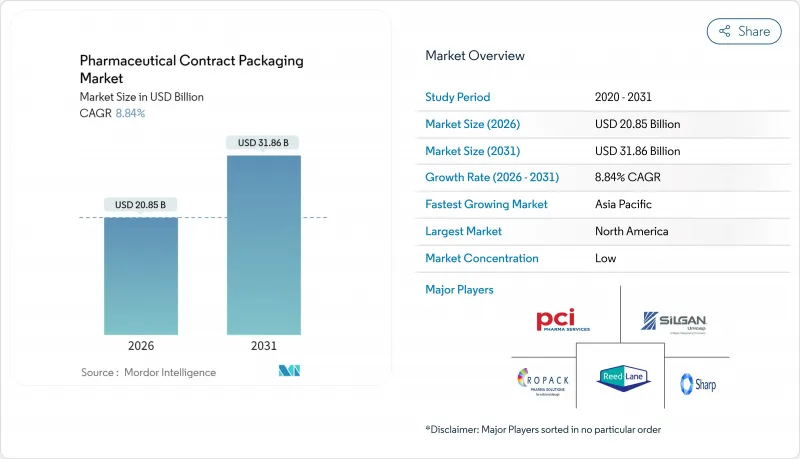

预计到 2026 年,药品合约包装市场规模将达到 208.5 亿美元,高于 2025 年的 191.6 亿美元。

预计到 2031 年,该产业规模将达到 318.6 亿美元,2026 年至 2031 年的复合年增长率为 8.84%。

日益严格的序列化要求、蓬勃发展的生物製药研发管线以及对整合式CDMO模式的日益青睐,正促使製药公司转向拥有深厚技术专长和雄厚资本实力的外部包装合作伙伴。市场对无菌初级包装容器、预填充给药装置和可追溯的二级包装的需求尤其强劲,而人工智慧赋能的切换系统正在缩短验证週期并提高生产线效率。美国和欧盟的区域近岸外包计画正在改变投资重点,亚太地区的供应商也正在扩大产能以满足出口导向学名药的成长需求。

全球医药合约包装市场趋势与洞察

序列化强制令将带来前所未有的包装变革

随着《数位供应链安全法案》(DSCSA) 于 2024 年 11 月全面实施,合约包装商将被要求在每个包装层级嵌入唯一的序号、条码和汇总数据,从而将传统的生产线转变为数据密集型操作,每天需要管理和验证数百万个序号。初期实施阶段错误率飙升 30%,凸显了采用开放式架构的「序列化 2.0」平台的重要性,这种平台能够消除对专有硬体的依赖。对边缘到云端生产线控制器的投资正在加速成长,供应商现在将即时 EPCIS 资料交换功能捆绑在一起,使下游批发商检验包装的真伪。随着义大利、加拿大和海湾国家合规宽限期的缩短,拥有统一系统的全球包装商正在获得竞争优势。

生物製药激增正在重塑无菌包装基础设施

预计到2027年,全球无菌药品生产将以15%的复合年增长率成长,修订后的附件1已将污染控制列为各公司的首要任务。即用型嵌套管瓶、安瓿瓶和聚合物注射器省去了玻璃清洗步骤,而现代化的容器密封性检测方法则以氦气质谱和真空衰减法取代了破坏性无菌取样。诸如Syntegon公司的SPC 1000之类的自动沉降板更换器可减少80%的人工操作,并加快批次放行速度。

追踪合规成本会给营业利润带来压力。

不同市场间序列资料格式的差异迫使包装商运行支援多种模式的IT架构,导致每个跨市场SKU的检验和支援预算增加高达20%。欧盟FMD聚合系统计画于2025年2月在义大利推出,这标誌着一系列日益严格的监管措施即将出台,并将推动生产线改造和仓库升级。

细分市场分析

预计到2025年,初级包装将占药品合约包装市场的45.10%,年复合成长率达10.05%,主要得益于药品接触材料中可萃取物和可浸出物的审查力度加大。为确保生物製药的化学相容性,I型硼硅酸管瓶、环烯烃聚合物药筒和阻隔性泡壳包装膜是投资计画的重点。此外,许多司法管辖区强制要求从初级包装层开始进行单元级序列化,这也推动了市场成长。

无菌容器和密封系统的创新正在重新定义竞争优势。合约包装商现在使用雷射顶空分析和氦质谱法来检验包装完整性并满足附件1的要求,同时减少破坏性测试造成的废弃物。虽然二级和三级服务透过后期客製化套件组装和专业低温运输物流继续创造价值,但监管的复杂性使得收入主要集中在初级包装层。

由于口服固体製剂占据主导地位,瓶装仍是最大的包装形式。然而,预填充式注射器和药筒是药品合约包装市场中成长最快的细分市场,预计到2031年将以11.05%的复合年增长率成长。推动这项需求成长的因素包括:生物製药自行注射的兴起、笔式註射器的普及以及医院为减少针头使用而采取的安全措施。

环烯烃聚合物筒体的创新提高了药物稳定性和窗口清晰度,而针头安全护罩和电子剂量计数器则整合了以往只有医疗器材製造商才具备的易用性功能。提供整合式活塞安装、氮气吹扫和自动注射器组装服务的合约包装商,正赢得寻求承包解决方案的专业製药客户的长期供应协议。

区域分析

2025年,北美将占总收入的39.10%,这主要得益于FDA的序列化强制规定、强大的生物製药产品线以及大规模近岸外包资本流入。例如,诺和诺德投资41亿美元的克莱顿工厂集中了灌装、包装、检验和最终组装等环节,缩短了供应链,增强了国内市场的韧性。加拿大安大略省的无菌药品走廊和墨西哥加工出口区的扩张,与美国的产能形成互补,并实现了高效的跨境,满足了当地的采购需求。

欧洲持续引领创新,这得益于PPWR永续性法规加速了材料研发,以及无菌操作指南(附件1)对无尘室性能的最高标准要求。德国的工程生态系统为高精度设备的供应奠定了基础,而义大利和法国则位置经验丰富的孤儿药填充和包装设施。英国包装商正转向先进治疗方法,并利用脱欧后MHRA的柔软性来吸引全球临床计画。

亚太地区以10.10%的复合年增长率领跑,中国和印度的合约研发生产企业(CDMO)正随着学名药的蓬勃发展和生物相似药的推出而扩大产能。日本在管瓶灌装领域率先应用高速机器人技术,韩国主导抗体药物复合体计划,新加坡则为细胞治疗设施提供税收优惠。该地区各国政府正积极推动药品生产品质管理规范(GMP)在药品资讯共享与安全框架(PIC/S)下的整合,简化多国核准流程,并促进跨境供应链网路的建设。澳洲和纽西兰提供专业的无菌製剂开发服务,这有助于提升其在区域价值链中的地位。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 序列化强制令和反假冒法规的激增

- 生物製药和特殊药物的蓬勃发展推动了对无菌包装的需求。

- CDMO对一站式服务(整合製造和包装)的需求

- 美国和欧洲大型製药企业的供应链近岸外包

- 基于人工智慧的线路切换可缩短验证时间

- 市场限制

- 全球可追溯性标准的演变正在增加合规成本。

- 复合材料永续性法规正在挤压塑胶的利润空间

- 高速无菌填充生产线技术纯熟劳工短缺

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按服务类型

- 基本的

- 瓶子

- 管瓶和安瓿

- 泡壳包装

- 次要

- 纸盒

- 标籤和插页

- 第三

- 基本的

- 按包装类型

- 瓶子

- 宝特瓶

- 玻璃瓶

- 管瓶和安瓿

- 泡壳包装

- 小袋装和条状包装

- 预填充式注射器和药筒

- 瓶子

- 按药物形式

- 固态剂型

- 药片

- 胶囊

- 口服液

- 注射

- 小体积注射

- 大容量注射剂

- 固态剂型

- 按治疗区域

- 肿瘤学

- 循环系统

- 中枢神经系统

- 感染疾病

- 其他治疗领域

- 最终用户

- 大型製药公司(收入超过100亿美元)

- 学名药/生物类似药公司

- 新兴生物技术公司和Start-Ups企业

- CRO/CDMO合作伙伴

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- PCI Pharma Services

- Catalent Inc.

- Sharp Packaging Services

- Almac Group

- Wasdell Group

- Ropack Inc.

- Reed-Lane Inc.

- Jones Healthcare Group

- Recipharm AB

- Tjoapack Netherlands BV

- AmeriPac(Veritiv Corp)

- Silgan Unicep

- Nelipak

- Aphena Pharma Solutions

- Central Pharma Contract Packing

- Quantrelle Packaging Solutions

- Variopack GmbH

- Sepha Ltd.

- Assemblies Unlimited

- DaklaPack Group

- Tripak Pharmaceuticals

- MPH Co-Packing

- Southwest Packaging

- MJS Packaging

- Jam Jams Group

- Asiapack(Elanders Group)

- Finishing Services

第七章 市场机会与未来展望

pharmaceutical contract packaging market size in 2026 is estimated at USD 20.85 billion, growing from 2025 value of USD 19.16 billion with 2031 projections showing USD 31.86 billion, growing at 8.84% CAGR over 2026-2031.

Rising serialization mandates, a booming biologics pipeline and growing preference for integrated CDMO models are steering pharmaceutical companies toward outsourced packaging partners that offer deep technical know-how and capital-intensive capabilities. Demand is particularly strong for sterile primary containers, pre-filled delivery devices and track-and-trace ready secondary packs, while AI-enabled changeover systems are trimming validation cycles and boosting line productivity. Regional near-shoring programs in the United States and the European Union are shifting investment priorities, and Asia-Pacific suppliers are scaling capacity to meet export-oriented generic drug growth.

Global Pharmaceutical Contract Packaging Market Trends and Insights

Serialization Mandates Drive Unprecedented Packaging Transformation

Full DSCSA enforcement in November 2024 forced contract packagers to embed unique serial numbers, barcodes and aggregation data at every packaging level, transforming legacy lines into data-rich operations that manage and reconcile millions of serial numbers daily. Error-rate spikes of 30% in early roll-outs underscored the need for "Serialization 2.0" platforms with open architectures that remove proprietary hardware lock-ins. Investments in edge-to-cloud line controllers accelerated, and vendors now bundle real-time EPCIS data exchange, enabling downstream wholesalers to verify pack authenticity in seconds. As compliance windows tighten in Italy, Canada and Gulf states, global packagers with harmonized systems gain a competitive edge.

Biologics Surge Reshapes Sterile Packaging Infrastructure

World-wide sterile medicinal product output is climbing at 15% CAGR to 2027, and Annex 1 revisions have elevated contamination control to an enterprise-wide priority. Ready-to-use nested vials, ampoules and polymer syringes eliminate glass washing steps, while modern container-closure integrity testing replaces destructive sterility sampling with helium mass-spectrometry and vacuum decay methods. Automated settle-plate changers, such as Syntegon's SPC 1000, cut manual interventions by 80% and drive faster batch-release timelines.

Track-and-Trace Compliance Costs Strain Operational Margins

Divergent serial data formats across markets oblige packagers to operate multi-schema IT stacks, inflating validation and support budgets by up to 20% per multi-market SKU. Italy's February 2025 go-live for EU FMD aggregation illustrates the continuing regulatory drumbeat that forces line retrofits and warehouse upgrades.

Other drivers and restraints analyzed in the detailed report include:

- CDMO Integration Accelerates End-to-End Service Adoption

- Supply-Chain Near-Shoring Transforms Geographic Manufacturing Patterns

- Skilled Labor Shortage Constrains Sterile Manufacturing Expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Primary packaging held a 45.10% share of the pharmaceutical contract packaging market in 2025 and is expanding at 10.05% CAGR as drug-contact materials face tighter leachables and extractables scrutiny.Type I borosilicate glass vials, cyclic olefin polymer cartridges and high-barrier blister films dominate investment plans because they assure chemical compatibility for biologics. Growth momentum also reflects mandatory unit-level serialization, which starts at the primary layer in many jurisdictions.

Sterile container-closure innovation is redefining competitive positioning. Contract packagers now validate package integrity using laser-based headspace analysis and helium mass-spectrometry, reducing destructive testing waste while meeting Annex 1 expectations. Secondary and tertiary services continue to add value through late-stage custom kitting and specialty cold-chain logistics, yet regulatory complexity keeps the revenue center anchored in the primary tier.

Bottles remain the largest format owing to oral solid dosage dominance. However, pre-filled syringes and cartridges show 11.05% CAGR through 2031, making them the fastest-expanding slice of the pharmaceutical contract packaging market. Demand is fuelled by self-injection biologics, pen-injector proliferation and hospital safety mandates that curb needle handling.

Technical advances in cyclic olefin polymer barrels improve drug stability and window clarity, while needle-safety shields and electronic dose counters embed usability features once reserved for device makers. Contract packagers offering integrated plunger placement, nitrogen purging and auto-injector assembly services secure long-term supply agreements with specialty-pharma clients seeking turnkey solutions.

The Pharmaceutical Contract Packaging Market Report is Segmented by Service Type (Primary, Secondary, Tertiary), Packaging Format (Bottles, Vials and Ampoules, and More), Drug Formulation (Solid Dosage, and More), Therapeutic Area (Oncology, Cardiovascular, and More), End-User (Big Pharma, Generics/Biosimilar Companies, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39.10% of 2025 revenue, supported by FDA serialization mandates, strong biologics pipelines and sizeable near-shoring capital flows. Investments such as Novo Nordisk's USD 4.1 billion Clayton complex embed fill-finish, inspection and final assembly under one roof, shortening supply lines and augmenting domestic resiliency. Canada's sterile-drug corridor in Ontario and Mexico's maquiladora expansions complement US capacity, enabling duty-efficient cross-border flows that satisfy regional content stipulations.

Europe remains an innovation hub, driven by PPWR sustainability rules that accelerate material R&D and by Annex 1 sterile guidelines demanding best-in-class cleanroom performance. Germany's engineering ecosystem anchors high-precision equipment supply, while Italy and France host seasoned fill-finish sites catering to orphan-drug runs. United Kingdom packagers pivot toward advanced therapy applications, leveraging MHRA agility post-Brexit to attract global clinical programs.

Asia-Pacific shows the fastest 10.10% CAGR as Chinese and Indian CDMOs scale capacities that align with generics booms and biosimilar roll-outs. Japan pioneers high-speed robotics in vial filling, South Korea spearheads antibody-drug conjugate projects and Singapore extends tax incentives for cell-therapy facilities. Regional governments nurture GMP convergence under PIC/S, easing multi-country approvals and encouraging cross-border supply networks. Australia and New Zealand contribute niche sterile development services, reinforcing the region's climb up the value chain.

- PCI Pharma Services

- Catalent Inc.

- Sharp Packaging Services

- Almac Group

- Wasdell Group

- Ropack Inc.

- Reed-Lane Inc.

- Jones Healthcare Group

- Recipharm AB

- Tjoapack Netherlands B.V.

- AmeriPac (Veritiv Corp)

- Silgan Unicep

- Nelipak

- Aphena Pharma Solutions

- Central Pharma Contract Packing

- Quantrelle Packaging Solutions

- Variopack GmbH

- Sepha Ltd.

- Assemblies Unlimited

- DaklaPack Group

- Tripak Pharmaceuticals

- MPH Co-Packing

- Southwest Packaging

- MJS Packaging

- Jam Jams Group

- Asiapack (Elanders Group)

- Finishing Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Serialization mandates and anti-counterfeit regulation surge

- 4.2.2 Biologic and specialty-drug boom amplifying sterile packaging demand

- 4.2.3 CDMO one-stop-shop preference (integrated manufacturing + packaging)

- 4.2.4 Supply-chain near-shoring by Big Pharma in US-EU

- 4.2.5 AI-enabled line-changeover reducing validation time

- 4.3 Market Restraints

- 4.3.1 Evolving global track-and-trace standards raise compliance costs

- 4.3.2 Poly-material sustainability rules squeeze margin on plastics

- 4.3.3 Qualified labor shortage for high-speed sterile filling lines

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Primary

- 5.1.1.1 Bottles

- 5.1.1.2 Vials and Ampoules

- 5.1.1.3 Blister Packs

- 5.1.2 Secondary

- 5.1.2.1 Cartons

- 5.1.2.2 Labels and Inserts

- 5.1.3 Tertiary

- 5.1.1 Primary

- 5.2 By Packaging Format

- 5.2.1 Bottles

- 5.2.1.1 Plastic Bottles

- 5.2.1.2 Glass Bottles

- 5.2.2 Vials and Ampoules

- 5.2.3 Blister Packs

- 5.2.4 Sachets and Stick Packs

- 5.2.5 Pre-filled Syringes and Cartridges

- 5.2.1 Bottles

- 5.3 By Drug Formulation

- 5.3.1 Solid Dosage

- 5.3.1.1 Tablets

- 5.3.1.2 Capsules

- 5.3.2 Oral Liquids

- 5.3.3 Injectable

- 5.3.3.1 Small-volume Parenterals

- 5.3.3.2 Large-volume Parenterals

- 5.3.1 Solid Dosage

- 5.4 By Therapeutic Area

- 5.4.1 Oncology

- 5.4.2 Cardiovascular

- 5.4.3 CNS

- 5.4.4 Infectious Disease

- 5.4.5 Other Therapeutic Areas

- 5.5 By End-user

- 5.5.1 Big Pharma (>USD 10 bn revenue)

- 5.5.2 Generics/Biosimilar Companies

- 5.5.3 Emerging Biotech and Start-ups

- 5.5.4 CRO/CDMO Partners

- 5.5.5 Others End-user

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PCI Pharma Services

- 6.4.2 Catalent Inc.

- 6.4.3 Sharp Packaging Services

- 6.4.4 Almac Group

- 6.4.5 Wasdell Group

- 6.4.6 Ropack Inc.

- 6.4.7 Reed-Lane Inc.

- 6.4.8 Jones Healthcare Group

- 6.4.9 Recipharm AB

- 6.4.10 Tjoapack Netherlands B.V.

- 6.4.11 AmeriPac (Veritiv Corp)

- 6.4.12 Silgan Unicep

- 6.4.13 Nelipak

- 6.4.14 Aphena Pharma Solutions

- 6.4.15 Central Pharma Contract Packing

- 6.4.16 Quantrelle Packaging Solutions

- 6.4.17 Variopack GmbH

- 6.4.18 Sepha Ltd.

- 6.4.19 Assemblies Unlimited

- 6.4.20 DaklaPack Group

- 6.4.21 Tripak Pharmaceuticals

- 6.4.22 MPH Co-Packing

- 6.4.23 Southwest Packaging

- 6.4.24 MJS Packaging

- 6.4.25 Jam Jams Group

- 6.4.26 Asiapack (Elanders Group)

- 6.4.27 Finishing Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment