|

市场调查报告书

商品编码

1911333

围篱:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Fencing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

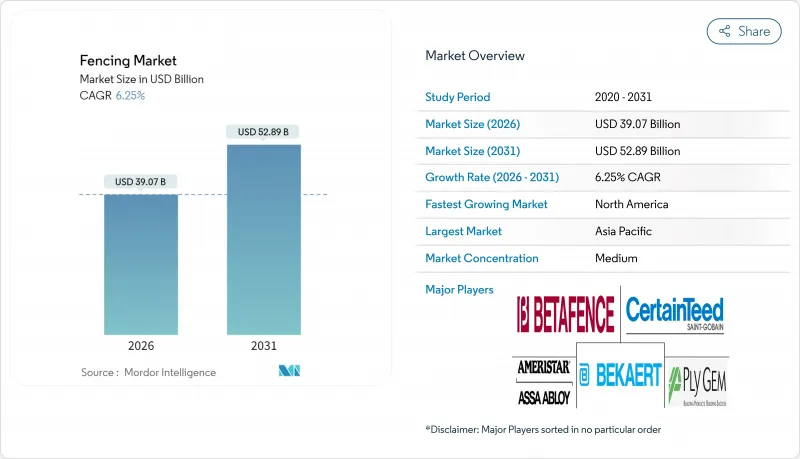

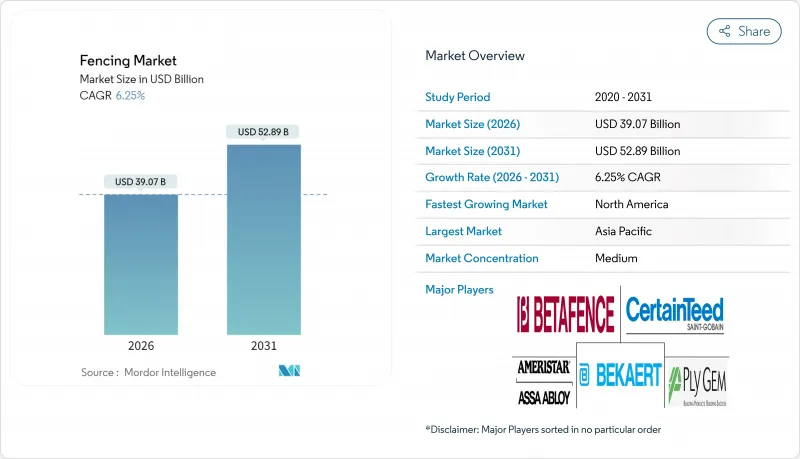

据估计,2026年围篱市场规模将达到390.7亿美元,高于2025年的367.7亿美元,预计2031年将达到528.9亿美元。

预计从 2026 年到 2031 年,其复合年增长率将达到 6.25%。

这一增长反映了电力网、资料中心和边境安全措施的强制性加强,智慧边境硬体的快速商业化,以及政府对基础设施的持续投资。金属製品因其耐用性和全生命週期成本优势,继续在大型计划占据主导地位,但由于气候适应性设计要求,复合材料和PVC替代品正迅速普及。住宅的需求依然强劲,而农业和可再生能源设施正成为成长最快的领域。由于物联网系统带来的技术挑战日益增加,专业承包商占据了大部分收入,而成熟的住宅市场对DIY套件的需求也在增加。从区域来看,北美凭藉联邦政府的支出计划保持主导地位,但亚太地区预计将在数十亿美元的边境和工业项目的推动下超越其他所有地区。

全球围篱市场趋势与洞察

政府基础设施支出推动了边境安全需求。

国家安全优先事项体现在用于边境防御和关键资产保护的巨额多年预算中。印度已拨款3,250亿卢比(约38.9亿美元),用于在敏感边境沿线建造围栏和道路,并指定采用防切割和防攀爬的钢结构设计,该拨款将持续到2034年。北美电力可靠性公司(NERC)修订的指导方针要求在高影响电网控制中心安装防撞大门,迫使电力公司维修老化的周界设施。美国联邦建筑规范现已纳入「透过环境设计预防犯罪」(CPTED)原则,该原则规定采用多层屏障和电子门禁系统。这些法规推动了对高规格设备的需求,并有利于拥有安全许可的供应商。

智慧感测器围栏系统越来越受欢迎

物联网的整合正在将被动式围栏转变为主动式威胁侦测网路。 IEEE 的研究表明,与传统光束侦测器相比,多感测器智慧围栏可将误报率降低 60%。美国近期更新了通讯标准,纳入了安全的物联网接口,这影响了商业产品蓝图。遵循美国国家安全航空联盟最佳实践的机场,现在指定采用整合影像分析、雷达和身份验证资料库的周界解决方案。国防安全保障部的检验通讯协定制定了统一的性能指标,以加快采购週期。

钢材、木材和PVC树脂价格波动

能源成本和电气化需求持续给金属和树脂市场带来压力。世界银行金属指数在2024年4月上涨了9%,预示2025年基底金属价格将进一步上涨。世纪铝业在国内减产凸显了铝供应对成本的敏感度。博伊西凯斯卡德公司2024年的收入下降表明,在住宅市场低迷时期,将木材价格上涨转嫁给消费者面临许多挑战。儘管製造商通常会收取附加费,但价格波动仍在不断挤压利润空间,并使竞标定价更加复杂。

细分市场分析

金属製品将占2025年销售额的50.05%,凭藉其久经考验的强度和生命週期价值,为围栏市场提供支撑。钢材将在国防和公共产业计划中主导,而铝材因其耐腐蚀性,在住宅应用中的使用率不断提高。木材在註重自然美的建筑法规地区仍然很受欢迎,但欧盟收紧甲醛法规带来了替代木材的风险。混凝土板虽然应用范围有限,但在需要防爆的领域至关重要。

随着设计师寻求低维护成本的替代方案并满足无铅法规的要求,复合材料和PVC系统正以8.25%的复合年增长率快速增长。采用消费后PVC回收材料和生物基稳定剂的製造商可望获得绿色采购溢价。农光互补试点计画表明,轻质复合复合材料可兼作太阳能板的支撑结构,从而拓展围栏市场,使其成为多功能资产。

第二代复合材料兼具强度重量比和回收性,为供应商带来长期优势。欧盟日益严格的铅含量限制和新的高度关注物质清单正在加速向锌稳定聚氯乙烯(PVC)和再生高密度聚乙烯(HDPE)混合物的转变。拥有挤出能力和工业废弃物回收系统的供应商可以在价格上胜过原生树脂生产商。永续性资讯揭露已成为许多公共采购的必要条件,进一步推动了这项转变。

区域分析

到2025年,北美将占全球销售额的35.10%,这主要得益于联邦政府对道路、电网和退伍军人设施维修的补贴。北美电力可靠性委员会(NERC)的规则变更要求公用事业公司加强变电站的周边防护,而「购买美国货」条款也鼓励企业在国内的辊压成型和加工企业进行消费。不断增长的住宅维修需求也支撑了该地区的近期前景。

亚太地区虽然目前规模较小,但预计到2031年将以7.05%的复合年增长率实现最快成长。印度已累计超过4亿美元用于边境围栏建设,其中包括在高风险通道沿线安装防攀爬钢格栅。在中国,儘管房地产行业面临不利因素,但基础设施奖励策略和城市更新计划仍在支撑围栏需求。日本和韩国正在推进智慧感测器的部署,而澳洲的矿业部门则继续为偏远营地采购临时屏障。

欧洲市场以严格的生态设计法规和循环经济目标为特征。无铅PVC的最后期限和欧盟2026年甲醛基准值正在推动材料替代,使创新者获得竞争优势。可再生能源的扩张,特别是陆域风电的更新,正在支撑公共产业需求。东欧受益于欧盟凝聚基金对交通走廊的津贴,这些走廊需要大距离的隔音和防盗围栏。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 政府基础设施支出推动了对边境安全措施的需求

- 配备智慧感测器的围栏系统越来越受欢迎

- 耐候性复合材料和PVC材料正变得越来越受欢迎。

- 成熟经济体中DIY住宅维修文化的快速发展

- 关键资产(公共产业、资料中心)加强的强制性法规

- 农光互补和垂直农业设施的边界安全需求

- 市场限制

- 钢铁、木材和PVC树脂的价格波动

- 来自低成本非正规製造商的竞争

- 加强对木材防腐剂和PVC添加剂的环境监管

- 增加对电子监控系统的投入,以取代实体屏障

- 价值/供应链分析

- 监管环境

- 技术展望

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 材料分析

- 地缘政治对围篱市场的影响

第五章 市场规模与成长预测

- 材料

- 金属

- 钢

- 铝

- 木头

- 塑胶和复合材料

- 具体的

- 其他材料

- 金属

- 最终用户

- 住宅

- 农业

- 军事/国防

- 政府

- 矿业

- 石油/化工产品

- 能源与电力

- 其他最终用户

- 按安装类型

- 专业承包商

- 其他 - 製造商、DIY/模组化套件

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 印尼

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- CertainTeed

- Bekaert

- Betafence

- Ameristar Perimeter Security

- Ply Gem

- Long Fence

- Gregory Industries

- A-1 Fence Products

- Specrail

- Jerith

- Trex Company

- Barrette Outdoor Living

- Master Halco

- ActiveYards

- Fortress Building Products

- Allied Tube & Conduit

- Eastern Wholesale Fence

- Merchants Metals

- ITOCHU Corporation(Sakura)

- Gentek Building Products

第七章 市场机会与未来展望

第八章附录

- 总体经济指标

- 主要生产、消费、进出口统计数据

Fencing market size in 2026 is estimated at USD 39.07 billion, growing from 2025 value of USD 36.77 billion with 2031 projections showing USD 52.89 billion, growing at 6.25% CAGR over 2026-2031.

This expansion reflects mandatory hardening of power grids, data centers and borders, the rapid commercialization of smart perimeter hardware, and steady government infrastructure outlays. Metal products continue to dominate large-scale projects because of durability and life-cycle economics, while composite and PVC alternatives are scaling quickly under climate-resilient design mandates. Residential demand remains robust, yet agriculture and renewable-energy installations are emerging as the fastest-moving opportunity set. Professional contractors capture most revenue as IoT-enabled systems raise the technical bar, although DIY kits are expanding in mature housing markets. Regionally, North America retains leadership because of federal spending packages, but Asia-Pacific is set to outpace all other regions on the back of multibillion-dollar border and industrial programs.

Global Fencing Market Trends and Insights

Government Infrastructure Spend Boosting Perimeter Safety Demand

National security priorities are translating into sizeable multiyear budgets devoted to border fortifications and critical-asset protection. India has earmarked INR 32,500 crore (USD 3.89 billion) for fencing and road construction along sensitive borders through 2034, specifying anti-cut and anti-climb steel designs. Updated North American Electric Reliability Corporation guidance requires crash-rated gates at high-impact grid control centers, prompting utilities to overhaul outdated perimeter lines. United States federal building standards now embed Crime Prevention Through Environmental Design principles that specify layered barriers and electronic access control. These mandates are fueling demand for high-specification installations and favoring suppliers with security clearances.

Rising Adoption Of Smart, Sensor-Enabled Fencing Systems

IoT integration is converting passive fences into active threat-detection networks. IEEE studies show multi-sensor smart fences cut false alarms by 60% relative to legacy beam detectors. The U.S. Department of Defense telecommunication standard, recently updated to incorporate secure IoT interfaces, is shaping commercial product roadmaps. Airports adhering to National Safe Skies Alliance best practices are now specifying perimeter solutions that merge video analytics, radar, and credential databases. Department of Homeland Security validation protocols have created uniform performance metrics that accelerate procurement cycles.

Volatile Steel, Timber & PVC Resin Prices

Metal and resin markets remain tight due to energy costs and electrification demand. The World Bank metals index rose 9% in April 2024 and indicates further upside for base metals in 2025. Century Aluminum's curtailed domestic output underscores cost sensitivity in aluminum supply. Boise Cascade's 2024 revenue dip illustrates timber price pass-through challenges during soft housing cycles. Manufacturers are issuing more frequent surcharges, but volatility still squeezes margins and complicates bid pricing.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Critical-Asset Hardening Regulations

- Climate-Resilient Composite & PVC Materials Gaining Traction

- Competition From Low-cost Unorganised Manufacturers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal products generated 50.05% of 2025 revenue, anchoring the fencing market through proven strength and lifecycle value. Steel commands defense and utility projects, while aluminum gains residential traction for corrosion resistance. Wood keeps a loyal following where planning codes favor natural aesthetics, though upcoming EU formaldehyde caps create substitution risk. Concrete panels stay niche but indispensable at blast-critical sites.

Composite and PVC systems are scaling at an 8.25% CAGR as specifiers seek low-maintenance alternatives and compliance with lead-free directives. Manufacturers pursuing post-consumer PVC recovery and bio-based stabilizers stand to secure green-procurement premiums. Agrivoltaic pilots highlight how lightweight composites double as solar-panel sub-structures, expanding the fencing market size for multifunctional assets.

Second-generation composites position vendors for long-run advantage by balancing strength-to-weight ratios and recyclability. Restrictive EU rules on lead and novel SVHC listings are accelerating the pivot to zinc-stabilized PVC and recycled HDPE blends. Suppliers with extrusion capacity and closed-loop post-industrial scrap streams can undercut virgin-resin incumbents. Sustainability disclosures are now prerequisites for many public tenders, reinforcing the shift.

The Fencing Market Report is Segmented by Material (Metal, Wood, Plastic & Composite, Concrete, Other Materials), by End-User (Residential, Agricultural, Military & Defense, Government, Mining, and More), by Installation Type (Professional Contractor, Others - Fabricators, DIY / Modular Kits), and by Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 35.10% of 2025 global sales, propelled by federal grants for road, grid, and veterans facility upgrades. Updated NERC rules obligate utilities to fortify substation perimeters, while Buy-America provisions steer spend toward domestic roll-formers and fabricators. An expanding residential remodeling base supports the region's near-term outlook.

Asia-Pacific, though smaller today, is set to post the fastest 7.05% CAGR through 2031. India has budgeted more than USD 400 million for border fencing, including anti-climb steel grating along high-risk corridors. China's infrastructure stimulus and urban renewal projects cushion fencing demand despite property-sector headwinds. Japan and South Korea champion smart-sensor adoption, while Australia's mining sector continues to procure temporary barriers for remote camps.

Europe's market is framed by stringent eco-design laws and circular-economy targets. Lead-free PVC deadlines and the 2026 EU formaldehyde threshold spur material substitution, opening a competitiveness gap for innovators. Renewables build-out, particularly onshore wind repowering, sustains utility demand. Eastern Europe benefits from EU cohesion fund grants channelled into transport corridors that require long miles of acoustic and security fencing.

- CertainTeed

- Bekaert

- Betafence

- Ameristar Perimeter Security

- Ply Gem

- Long Fence

- Gregory Industries

- A-1 Fence Products

- Specrail

- Jerith

- Trex Company

- Barrette Outdoor Living

- Master Halco

- ActiveYards

- Fortress Building Products

- Allied Tube & Conduit

- Eastern Wholesale Fence

- Merchants Metals

- ITOCHU Corporation (Sakura)

- Gentek Building Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government infrastructure spend boosting perimeter safety demand

- 4.2.2 Rising adoption of smart, sensor-enabled fencing systems

- 4.2.3 Climate-resilient composite & PVC materials gaining traction

- 4.2.4 Surging DIY home-improvement culture in mature economies

- 4.2.5 Mandatory critical-asset hardening (utilities, data-centres) regulations

- 4.2.6 Demand for perimeter security in agrivoltaics & vertical farming sites

- 4.3 Market Restraints

- 4.3.1 Volatile steel, timber & PVC resin prices

- 4.3.2 Competition from low-cost unorganised manufacturers

- 4.3.3 Stricter environmental rules on wood preservatives & PVC additives

- 4.3.4 Rising substitute spend on electronic surveillance in lieu of physical barriers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Materials Analysis

- 4.9 Impact of Geopolitics On Fencing Market

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Material

- 5.1.1 Metal

- 5.1.1.1 Steel

- 5.1.1.2 Aluminium

- 5.1.2 Wood

- 5.1.3 Plastic & Composite

- 5.1.4 Concrete

- 5.1.5 Other Materials

- 5.1.1 Metal

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Agricultural

- 5.2.3 Military & Defense

- 5.2.4 Government

- 5.2.5 Mining

- 5.2.6 Petroleum & Chemicals

- 5.2.7 Energy & Power

- 5.2.8 Other End-Users

- 5.3 By Installation Type

- 5.3.1 Professional Contractor

- 5.3.2 Others - Fabricators, DIY / Modular Kits

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Netherlands

- 5.4.3.7 Rest of Europe

- 5.4.4 Middle East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 South Africa

- 5.4.4.4 Nigeria

- 5.4.4.5 Rest of Middle East and Africa

- 5.4.5 Asia-Pacific

- 5.4.5.1 China

- 5.4.5.2 India

- 5.4.5.3 Japan

- 5.4.5.4 South Korea

- 5.4.5.5 Australia

- 5.4.5.6 Indonesia

- 5.4.5.7 Rest of Asia-Pacific

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 CertainTeed

- 6.4.2 Bekaert

- 6.4.3 Betafence

- 6.4.4 Ameristar Perimeter Security

- 6.4.5 Ply Gem

- 6.4.6 Long Fence

- 6.4.7 Gregory Industries

- 6.4.8 A-1 Fence Products

- 6.4.9 Specrail

- 6.4.10 Jerith

- 6.4.11 Trex Company

- 6.4.12 Barrette Outdoor Living

- 6.4.13 Master Halco

- 6.4.14 ActiveYards

- 6.4.15 Fortress Building Products

- 6.4.16 Allied Tube & Conduit

- 6.4.17 Eastern Wholesale Fence

- 6.4.18 Merchants Metals

- 6.4.19 ITOCHU Corporation (Sakura)

- 6.4.20 Gentek Building Products

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

8 Appendix

- 8.1 Macroeconomic Indicators

- 8.2 Key Production, Consumption, Export & Import Stats