|

市场调查报告书

商品编码

1911442

自动贩卖机:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Vending Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

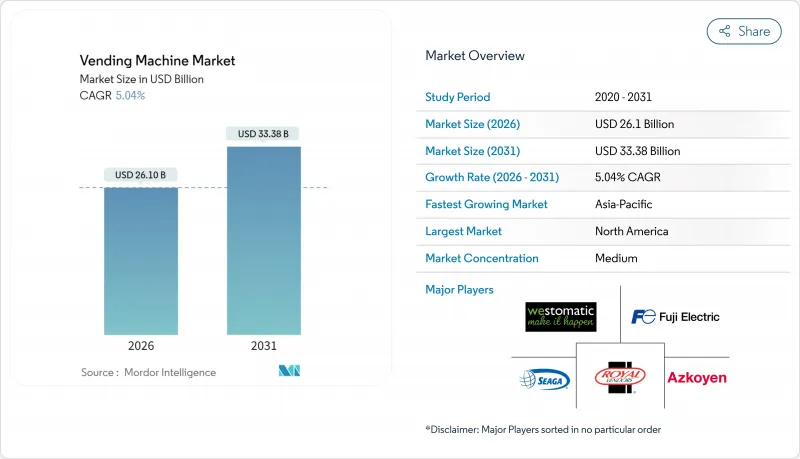

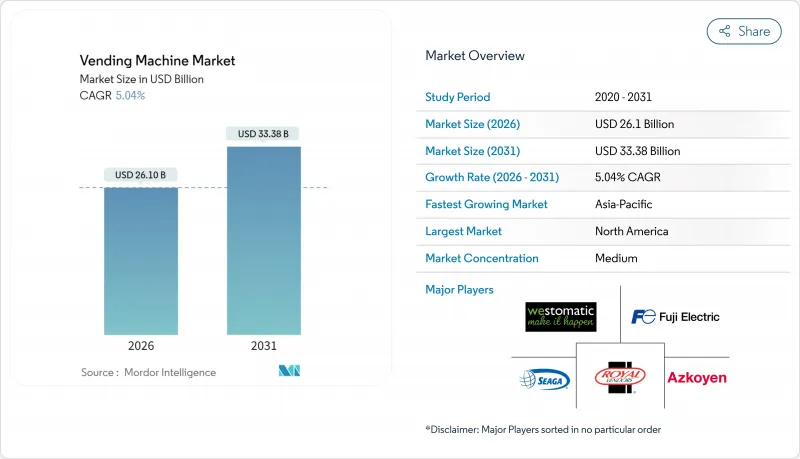

预计自动贩卖机市场将从 2025 年的 248.5 亿美元成长到 2026 年的 261 亿美元,并预计到 2031 年将达到 333.8 亿美元,2026 年至 2031 年的复合年增长率为 5.04%。

目前,全球自动贩卖机市场的扩张主要得益于人工智慧驱动的商品组合优化、预测性维护以及从投币式支付方式向无现金、非接触式支付方式的快速转变。监管因素,特别是欧洲的生产者延伸责任制(EPR)以及北美职场的环境、社会和治理(ESG)评分卡,正促使营运商推出反向自动贩卖机和健康导向产品,从而重塑竞争格局。互联设备群与数据丰富的软体层的结合,使运营商能够将数据洞察转化为利润,而不是仅仅依靠低利润的硬件,从而构建一个生态系统,使支付处理商、设备管理平台和服务集成商能够提高利润份额。亚太地区的快速都市化和行动钱包的普及带来了巨大的市场空白。同时,成熟市场人事费用的压力正促使企业在交通枢纽、医院、工业园区和其他场所实现微型零售的自动化。

全球自动贩卖机市场趋势与洞察

消费者对方便携带的包装食品和生鲜食品的需求不断增长

随着通勤者、上班族和学生将速度和便利性置于传统零售之上,食品服务的便利性持续推动全球自动贩卖机市场的发展。根据美国劳工统计局数据显示,1997年至2025年间,自动贩卖机食品价格上涨了140.66%,其中2023年涨幅尤为显着,达到14.81%,凸显了该品类强大的定价能力。在东京,由人工智慧驱动的沙拉自动贩卖机能够动态调整价格,最大限度地减少损失并提高利润率。营运商正在应用预测需求模型,根据特定位置的条件优化库存单位(SKU),从而减少废弃物并提高面积收入。与气调包装(MAP)供应商的合作,将生鲜食品的保质期延长至五天,并拓展了交通枢纽和高等院校校园的产品供应。

无现金和非接触式支付技术的快速普及

全球自动贩卖机市场的第二个利多因素是支付方式正稳步从硬币和纸币转向非接触式支付和QR码支付,预计到2030年将以12.65%的复合年增长率增长。 Cantaloupe在2024年处理了美洲和欧洲超过115万台连网终端,展现了规模经济对支付现代化的支援。日本2024年7月的纸币重新设计凸显了现有设备维修的复杂性。当时只有30%的自动贩卖机相容新设计,迫使业者谨慎权衡升级成本与销售中断风险。在印度,印度储备银行的二维码硬币试点计画正在人流量大的场所部署数位钱包,征兆着新兴市场预计将直接跳过实体现金时代。虽然2-5%的处理费会对毛利率造成压力,但业者正透过提高平均交易额和降低现金处理成本来弥补损失。

高昂的资本支出、安装和维护成本

对于全球自动贩卖机市场的新进业者而言,前期投资仍是一大障碍。配备冷冻、视觉感测器和多支付模组的现代智慧设备,其资本支出远高于传统的投币式自动贩卖机。营运商还必须为监管升级预留预算,例如软体授权、网路连线和EMV-Co认证的读卡机。原物料价格的波动也增加了额外的负担。美国财政部发布的《2024年铜成本研究报告》指出,投币式自动贩卖机的利润率面临压力,而投币式自动贩卖机的交易量占总交易量的69.5%。许多新兴国家收紧贷款标准,延长了小规模业者的投资回收期,并推迟了他们的设备升级。

细分市场分析

自动贩卖机长期以来一直是全球自动贩卖机市场的主力军,预计到2025年将占据全球市场份额的55.12%。其庞大的安装基础提供了稳定的收入来源,但成长空间有限。同时,智慧/物联网设备正以9.78%的复合年增长率快速成长,预示着市场结构正向以软体为中心的经营模式转变。受连网设备驱动,全球自动贩卖机市场规模预计将从2025年的79亿美元成长到2031年的138.4亿美元。这一成长将带来云端车队管理平台和程式化广告等辅助收入来源,进而缓解硬体利润率下降的局面。

专利申请凸显了创新日益增长的趋势。可口可乐的成分追踪管理专利实现了远端口味调整,从而减少了服务呼叫。随着行动数据流量费用的下降,基于演算法的、能够优化城区商品组合的货架陈列图正逐渐商业性化。领先采用者报告称,当人工智慧模组根据即时需求重新调整商品库存位置时,销售转换率实现了两位数的成长。这导致半自动贩卖机的需求下降,这种过渡形式的投资报酬率有限。

饮料仍将占据主导地位,预计2025年将占销售额的32.85%。然而,永续性法规的推动使得反向自动贩卖机成为成长最快的细分市场,复合年增长率将达到10.71%。随着押金制度在更多地区成为强制性规定,预计到2031年,反向自动贩卖机在全球自动贩卖机市场的份额将增加两倍。传统的零食和包装食品自动贩卖机将继续满足重要的用餐需求,但盐和糖含量法规正迫使企业重新思考产品组合。非食品必需品(例如个人防护设备和行动电话配件)不再是小众市场,因为价格弹性可以抵消销售下降的影响。

TOMRA每年收集480亿个容器的记录,充分体现了规模经济如何提升废弃物管理的经济效益。 2025年,多家欧盟零售商安装了店内压缩机,降低了退货流量成本,提高了营运商的投资收益率。同时,东京一家人工智慧驱动的生鲜食品部门证明,即使是对保质期有严格控制的商品,动态定价机制也能有效应对库存下降带来的挑战,凸显了菜单多样化的有效性。

区域分析

到2025年,北美将占全球自动贩卖机市场收入的32.74%,这得益于其广泛的宽频和卡片付款基础设施。在美国,后疫情时代的卫生重点体现在政府机构中非接触式个人防护装备分发器的普及;而在加拿大,为实现碳减排目标,节能型製冷维修进行了改造。墨西哥正在扩大反向自动贩卖试点项目,儘管规模较小,但饮料巨头们正在为即将到来的生产者责任延伸(EPR)法规做准备。人事费用的上升正在加速这三个市场自动化技术的普及,儘管面临市场成熟的压力,但仍保持着个位数的温和成长。

亚太地区预计将以9.86%的复合年增长率领跑,由于都市区化进程和行动支付的兴起,该地区将为全球自动贩卖机市场贡献显着规模。中国以QR码为主导的消费文化正在加速智慧型装置的普及,而日本货币设计变更导致70%的旧式机器暂时无法相容。泰国的陶币网路拥有6000台机器,每天售出20万瓶饮料,是劳动力替代经济的典型案例。印度储备银行的二维码硬币计画标誌着政府主导的微型零售支付现代化进程。

欧洲的进展较为稳健,但主要得益于监理推动。英国的2027年押金退还计画正在加速自助服务终端系统的安装,而德国不来梅机场于2025年6月开设了一家由人工智慧监控的无人商店。斯堪地那维亚业者已基本实现无现金支付,现在正向企业园区推广符合ESG(环境、社会和治理)标准的零食产品。南欧在行动钱包普及方面落后于其他国家,但在机场和火车站等旅游场所,行动钱包的普及率正在迎头赶上,这有助于该地区保持较高的个位数成长率。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对方便携带的包装食品和生鲜食品的需求增加

- 无现金和非接触式支付技术的快速普及

- 部署物联网智慧自动贩卖机群进行预测性维护

- 生产者延伸责任制鼓励安装自动收集机

- 职场的ESG目标推动健康且永续的自动贩卖服务交付。

- 在当地医疗网路中自动贩售药品和个人防护工具(PPE)

- 市场限制

- 高昂的资本支出、安装和维护成本

- 公共机构中的含糖饮料和卡路里限制

- 连网装置的网路安全与资料隐私风险

- 某些公共区域的卫生和破坏行为问题

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 永续性和循环经济分析

- 对宏观经济趋势的市场评估

第五章 市场规模与成长预测

- 透过技术

- 自动贩卖机

- 半自动贩卖机

- 智慧/物联网自动贩卖机

- 依产品类型

- 零食和包装食品

- 饮料

- 烟草和尼古丁产品

- 非食品必需品(个人防护装备、电子产品、个人护理用品)

- 反向自动贩卖机(回收利用)

- 按应用程式/定位

- 商业大楼和办公大楼

- 交通枢纽(机场、火车站、公车站、地铁站)

- 教育机构

- 医疗设施

- 饭店和休閒设施

- 工业和製造地

- 其他(住宅、零售商场)

- 透过付款方式

- 现金

- 以卡片为基础的非现金支付(信用卡/签帐金融卡、NFC)

- 行动钱包和QR码

- 生物识别和脸部辨识

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度分析

- 策略趋势与发展

- 市占率分析

- 公司简介

- Fuji Electric Co., Ltd.

- Crane Merchandising Systems(Crane NXT)

- Azkoyen Group

- Evoca Group

- SandenVendo GmbH

- Westomatic Vending Services Ltd.

- Royal Vendors, Inc.

- Seaga Manufacturing, Inc.

- Jofemar SA

- Selecta Group

- Cantaloupe Inc.(USA Technologies)

- 365 Retail Markets LLC

- TCN Vending Machine Co., Ltd.

- Guangzhou Baoda Intelligent Technology Co., Ltd.

- Daalchini Technologies Pvt. Ltd.

- Canteen Vending Services(Compass Group)

- Aramark Corporation

- FAS International SpA

- Vending.com(Federal Machine Corp.)

- Vendekin Technologies Pvt. Ltd.

第七章 市场机会与未来展望

The vending machine market is expected to grow from USD 24.85 billion in 2025 to USD 26.1 billion in 2026 and is forecast to reach USD 33.38 billion by 2031 at 5.04% CAGR over 2026-2031.

The current expansion of the global vending machine market is powered by AI-driven assortment optimization, predictive maintenance, and the rapid migration from coin-based mechanisms to cashless and contact-free payments. Regulatory triggers-particularly extended-producer-responsibility (EPR) mandates in Europe and workplace ESG scorecards in North America-push operators to deploy reverse-vending and healthy-product formats, reshaping the competitive playbook. Operators that marry connected fleets with data-rich software layers now monetize insights, rather than margin-squeezed hardware, catalyzing an ecosystem where payment processors, fleet-management platforms, and service integrators capture a growing share of profit pools. Asia-Pacific's urbanization boom and mobile-wallet ubiquity provide outsized white-space potential; simultaneous labor-cost pressures in mature markets lead enterprises to automate micro-retail at transit hubs, hospitals, and industrial campuses.

Global Vending Machine Market Trends and Insights

Increasing Demand for Packaged and Fresh Food for On-the-Go Consumption

Food-service convenience continues to lift the global vending machine market as commuters, office staff, and students prioritize speed and accessibility over traditional retail. The U.S. Bureau of Labor Statistics recorded a 140.66% jump in vending-food prices between 1997 and 2025, with a notable 14.81% increase in 2023, confirming the category's pricing power. Tokyo's AI-equipped salad units adjust prices dynamically to minimize shrinkage and elevate margins. Operators overlay predictive-demand models that fine-tune SKUs by micro-location, cutting waste and boosting revenue per square foot. Partnerships with controlled-atmosphere-packaging suppliers now make fresh produce viable for five-day shelf lives, broadening product scope at transportation hubs and higher-education campuses.

Rapid Adoption of Cashless and Contactless Payment Technologies

A second tailwind for the global vending machine market is the steady replacement of coins and bills with tap-and-go or QR-based options, advancing 12.65% CAGR through 2030. Cantaloupe processed more than 1.15 million connected endpoints across the Americas and Europe in 2024, underscoring scale economics behind payment modernization. Japan's July 2024 banknote redesign illustrates the retro-fit complexity: only 30% of machines were reconfigured at launch, forcing operators to weigh upgrade costs against possible sales disruption. In India, the Reserve Bank's QR-coin pilot places digital wallets at high-footfall locations, an early indication that emerging markets may leapfrog physical cash. Although processor fees of 2-5% compress gross margins, operators recoup value via higher average tickets and lower cash-handling overhead.

High Capital, Installation, and Maintenance Expenditures

Up-front investment remains a gating factor for new entrants to the global vending machine market. Modern smart units with refrigeration, vision sensing, and multi-payment modules require meaningfully higher capital outlays than legacy coil machines. Operators must also budget for software licences, connectivity, and regulatory compliance upgrades such as EMV-co-certified readers. Raw-material volatility adds further strain; the U.S. Department of the Treasury's 2024 copper cost review highlighted margin pressure on coin mechanisms that still serve 69.5% of 2024 transactions. Tight lending standards in many emerging economies elongate payback periods, causing smaller route owners to defer fleet renewal.

Other drivers and restraints analyzed in the detailed report include:

- Deployment of IoT-Enabled Smart Vending Fleets for Predictive Maintenance

- Extended-Producer-Responsibility Rules Spurring Reverse-Vending Installations

- Cyber-Security and Data-Privacy Risks for Connected Machines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automatic machines, long the workhorse of the global vending machine market, held 55.12% global vending machine market share in 2025. Their wide installed base anchors predictable revenue but offers fewer upside levers. Smart/IoT units, meanwhile, are scaling at a 9.78% CAGR, signaling a secular shift toward software-centric business models. The global vending machine market size attributed to connected machines is projected to expand from USD 7.9 billion in 2025 to USD 13.84 billion by 2031. This growth unlocks ancillary revenue for cloud-based fleet dashboards and programmatic advertising, cushioning hardware margin compression.

Patent filings corroborate the innovation runway. Coca-Cola's micro-ingredient management patents enable remote flavor tweaks, lowering service calls. Algorithmic planograms that localize assortments at street-block granularity are hitting commercial viability as cellular data prices fall. Early adopters report double-digit upticks in sales conversion when AI modules reorder the SKU face according to real-time demand. Against that backdrop, semi-automatic machines are tapering as a transitional form factor with limited ROI.

Beverages remained kingpin at 32.85% of 2025 revenues; nevertheless, sustainability legislation positions reverse-vending machines as the fastest clip at 10.71% CAGR. Their contribution to global vending machine market size is forecast to triple by 2031 as more jurisdictions introduce mandatory deposit schemes. Traditional snack and packaged-food machines continue to serve core meal occasions, yet salt- and sugar-content regulations require portfolio revamps. Non-food essentials-think PPE and phone accessories-are no longer niche, aided by price elasticity that offsets lower volume throughput.

TOMRA's 48 billion annual container capture underscores how scale addresses waste-management economics. During 2025, several EU grocers integrated on-site compactors, pulling logistics costs out of the return loop and raising operator ROI. Parallel to that, AI-driven fresh-food units in Tokyo are proving that perishables can beat shrinkage headwinds with dynamic pricing engines, validating broader menu diversification.

The Vending Machine Market Report is Segmented by Technology (Automatic, Semi-Automatic, and Smart/IoT-Enabled), Product Type (Snacks and Packaged Food, Beverages, and More), Application (Commercial Buildings and Offices, Transportation Hubs, Educational Institutions, and More), Payment Mode (Cash, Card-Based Cashless, Mobile Wallet and QR, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 32.74% of 2025 global vending machine market revenue, leveraging ubiquitous broadband and card-payments infrastructure. The United States channeled post-pandemic hygiene priorities into contact-free PPE dispensers across government buildings, while Canada's carbon-reduction targets incentivized energy-efficient refrigeration retrofits. Mexico, though smaller, is scaling reverse-vending pilots as beverage majors prepare for anticipated EPR laws. Labor-cost inflation hastens automation uptake across all three markets, sustaining mid-single-digit growth despite maturity pressures.

Asia-Pacific registered the highest 9.86% CAGR outlook, adding critical mass to the global vending machine market through urban migration and mobile money ubiquity. China's QR-first consumer culture accelerates smart-unit penetration, while Japan wrestles with currency redesigns that have rendered 70% of older machines temporarily non-compliant. Thailand's Tao Bin network sells 200,000 drinks daily via 6,000 machines, a poster child for labor substitution economics. India's Reserve Bank QR-coin initiative signals a state-sponsored push to modernize micro-retail payments.

Europe's trajectory is steadier but underpinned by regulatory catalysts. The UK's 2027 Deposit Return Scheme ramps reverse-vending installations, while Germany's Bremen Airport opened an AI-policed autonomous store in June 2025. Scandinavian operators, already largely cashless, now market ESG-compliant snack lines to corporate campuses. Southern Europe lags on mobile-wallet density yet catches up via tourism-linked deployments in airports and railway stations, ensuring the region maintains a high-single-digit growth clip.

- Fuji Electric Co., Ltd.

- Crane Merchandising Systems (Crane NXT)

- Azkoyen Group

- Evoca Group

- SandenVendo GmbH

- Westomatic Vending Services Ltd.

- Royal Vendors, Inc.

- Seaga Manufacturing, Inc.

- Jofemar S.A.

- Selecta Group

- Cantaloupe Inc. (USA Technologies)

- 365 Retail Markets LLC

- TCN Vending Machine Co., Ltd.

- Guangzhou Baoda Intelligent Technology Co., Ltd.

- Daalchini Technologies Pvt. Ltd.

- Canteen Vending Services (Compass Group)

- Aramark Corporation

- FAS International S.p.A.

- Vending.com (Federal Machine Corp.)

- Vendekin Technologies Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for packaged and fresh food for on-the-go consumption

- 4.2.2 Rapid adoption of cashless and contactless payment technologies

- 4.2.3 Deployment of IoT-enabled smart vending fleets for predictive maintenance

- 4.2.4 Extended-producer-responsibility rules spurring reverse-vending installations

- 4.2.5 Workplace ESG targets boosting healthy and sustainable vending offerings

- 4.2.6 Medicine and PPE vending in rural healthcare networks

- 4.3 Market Restraints

- 4.3.1 High capital, installation and maintenance expenditures

- 4.3.2 Sugary-drink and calorie restrictions in public institutions

- 4.3.3 Cyber-security and data-privacy risks for connected machines

- 4.3.4 Hygiene and vandalism concerns in certain public areas

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Sustainability and Circular-Economy Analysis

- 4.9 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology

- 5.1.1 Automatic Vending Machines

- 5.1.2 Semi-Automatic Vending Machines

- 5.1.3 Smart / IoT-Enabled Vending Machines

- 5.2 By Product Type

- 5.2.1 Snacks and Packaged Food

- 5.2.2 Beverages

- 5.2.3 Tobacco and Nicotine Products

- 5.2.4 Non-Food Essentials (PPE, Electronics, Personal Care)

- 5.2.5 Reverse Vending Machines (Recycling)

- 5.3 By Application / Deployment Location

- 5.3.1 Commercial Buildings and Offices

- 5.3.2 Transportation Hubs (Airports, Rail, Bus, Metro)

- 5.3.3 Educational Institutions

- 5.3.4 Healthcare Facilities

- 5.3.5 Hospitality and Leisure Venues

- 5.3.6 Industrial and Manufacturing Sites

- 5.3.7 Others (Residential, Retail Malls)

- 5.4 By Payment Mode

- 5.4.1 Cash

- 5.4.2 Card-Based Cashless (Credit/Debit, NFC)

- 5.4.3 Mobile Wallet and QR

- 5.4.4 Biometric and Facial Recognition

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 UAE

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core segments, Financials as available, Strategic info, Market rank/share, Products and services, Recent developments)

- 6.4.1 Fuji Electric Co., Ltd.

- 6.4.2 Crane Merchandising Systems (Crane NXT)

- 6.4.3 Azkoyen Group

- 6.4.4 Evoca Group

- 6.4.5 SandenVendo GmbH

- 6.4.6 Westomatic Vending Services Ltd.

- 6.4.7 Royal Vendors, Inc.

- 6.4.8 Seaga Manufacturing, Inc.

- 6.4.9 Jofemar S.A.

- 6.4.10 Selecta Group

- 6.4.11 Cantaloupe Inc. (USA Technologies)

- 6.4.12 365 Retail Markets LLC

- 6.4.13 TCN Vending Machine Co., Ltd.

- 6.4.14 Guangzhou Baoda Intelligent Technology Co., Ltd.

- 6.4.15 Daalchini Technologies Pvt. Ltd.

- 6.4.16 Canteen Vending Services (Compass Group)

- 6.4.17 Aramark Corporation

- 6.4.18 FAS International S.p.A.

- 6.4.19 Vending.com (Federal Machine Corp.)

- 6.4.20 Vendekin Technologies Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Forecast of Technology Convergence and New Business Models