|

市场调查报告书

商品编码

1911772

中东卫星通讯市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Middle East Satellite Communications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

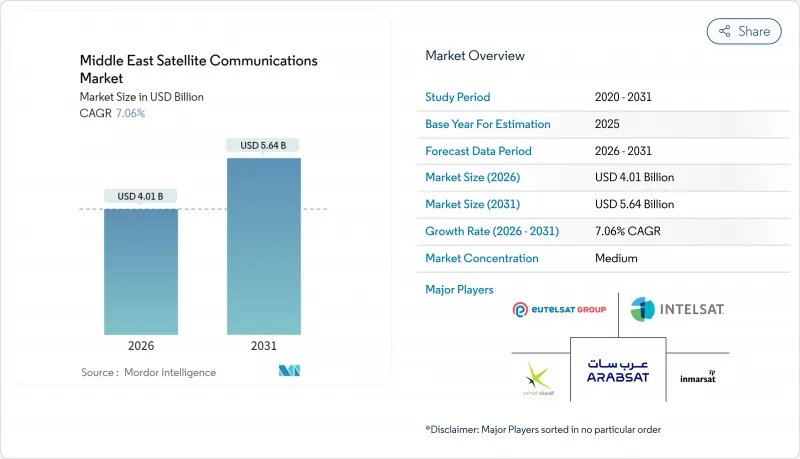

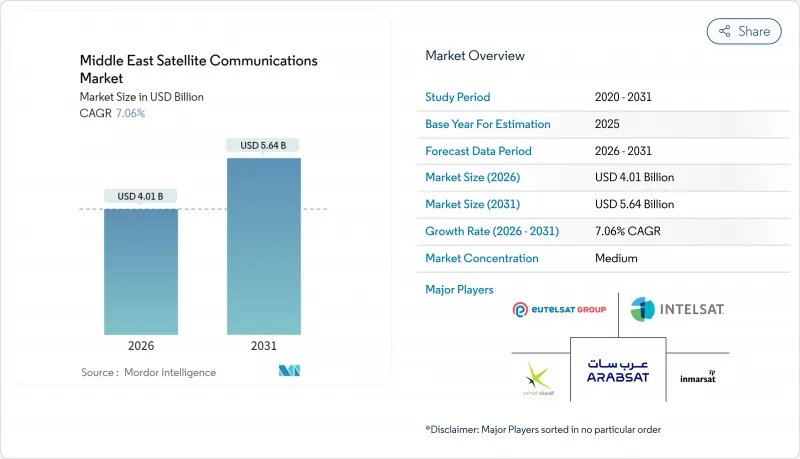

预计到2026年,中东卫星通讯市场规模将达到40.1亿美元,高于2025年的37.4亿美元。预计到2031年,该市场规模将达到56.4亿美元,2026年至2031年的复合年增长率为7.06%。

地缘政治的复杂性、政府主导的宽频政策以及物联网在油田、港口和航空领域的快速应用,都在推动市场需求。营运商正优先投资高吞吐量卫星(HTS),以满足企业和国防领域对频宽的迫切需求。同时,频谱协调方面的挑战也推高了新卫星发射的成本。竞争优势越来越依赖垂直整合的服务组合,这些组合融合了云端网关、託管连接和边缘分析能力。海事和航空连接、5G专用网路回程传输以及直接到设备(D2D)倡议正在成为利润丰厚的细分市场,并将引领中东卫星通讯市场的下一波成长浪潮。

中东卫星通讯市场趋势与洞察

物联网赋能的油田设备应用日益广泛

数千个卫星连接的感测器监测偏远油井的压力、流量和排放,从而实现预测性维护并减少非计画性停机。沙特阿美公司的即时油井监测网路就是一个典型的例子,它展现了能源巨头如何在光纤无法覆盖的地区利用太空通讯技术。 Space42 的人工智慧分析技术进一步提高了钻井效率,而 Globalstar 的储槽监测工具则减少了沿岸地区终端的供应中断。这些部署降低了营运成本,并创造了持续的频宽需求,从而支撑了中东卫星通讯市场的发展。

快速采用基于VSAT的海上通讯技术

杜拜、吉达和多哈的主要港口正在利用VSAT进行船舶交通管理和货物分析,推动航运公司进行全船队升级。 Marlink与区域营运商签订的合约表明,高通量卫星(HTS)容量可以提供影像串流、物联网遥测和船员福利服务。随着无人水面载具监管规定的不断推进,与自主导航平台的整合正在开闢新的收入来源。

频宽拥塞和跨境频率纠纷

卫星数量的快速成长加剧了干扰风险,并给国际电信联盟(ITU)的协调程序带来了压力。 Quadsat和Arabsat的频率监测合约正在扩大,业界也逐渐意识到自动化工具的重要性。然而,C波段和Ku波段重迭问题尚未解决,导致发射延迟、保险成本上升,并在中东卫星通讯市场引发摩擦。

细分市场分析

到2025年,地面设备将维持中东卫星通讯市场58.05%的份额,主要得益于沙乌地阿拉伯和阿联酋的地面站、闸道和VSAT部署。然而,业务收益的成长速度将超过硬件,年复合成长率将达到7.85%,这主要得益于託管频宽套餐、云端网关和卫星物联网平台的普及。

服务领域的成长反映了企业对计量收费模式的需求,这种模式可以减轻网路管理的负担。 EshailSat 和 Nexat 的 OSS/BSS 合作就是一个很好的例子,它展示了自动化如何帮助降低营运成本并推动技术应用。随着高通量卫星 (HTS) 有效载荷的日益普及,营运商正在将网路安全、边缘分析和基于 SLA 的运作保证打包在一起,以在中东卫星通讯市场中占据更大的客户份额。

到 2025 年,海上应用将占中东卫星通讯市场份额的 40.30%,这主要得益于苏伊士运河和霍尔木兹海峡繁忙的航道;而航空连接预计将以 8.22% 的复合年增长率实现最快增长,因为航空公司为了满足乘客扩张流动需求而加剧竞争,以及国防无人机(无人驾驶飞行器)队的飞行器。

区域航空公司正在部署Ka波段机上 Wi-Fi 以提升客户体验,阿联酋的城市空中运输示范项目正在利用低延迟卫星链路进行指挥和控制,而陆基平台对于油田 SCADA 备份和灾害復原网络仍然至关重要,这增强了支撑中东卫星通信市场的多样化需求基础。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 物联网赋能的油田设备应用日益广泛

- 快速采用基于VSAT的海上连接

- 沙乌地阿拉伯、阿拉伯联合大公国的全民宽频政府计划

- 民用卫星间资料中继网路的发展。

- 5G专用网路对卫星回程传输的需求不断成长

- 透过GCC联盟扩大合作深空探勘任务

- 市场限制

- 频宽拥塞和跨境频率纠纷

- 高通量发射机队升级的高昂资本成本

- 某些国家的地缘政治发射服务限制

- 卫星级抗辐射晶片区域性短缺

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 地面设施

- 卫星门户

- VSAT设备

- 网路营运中心(NOC)

- 卫星新闻采集(SNG)设备

- 服务

- 行动卫星业务(MSS)

- 地球观测服务

- 地面设施

- 按平台

- 携带式的

- 土地

- 海

- 机载

- 按频段

- L波段

- C波段

- Ku波段

- Ka波段

- 按最终用户行业划分

- 海

- 国防和政府机构

- 对于企业

- 媒体与娱乐

- 石油和天然气

- 其他终端用户产业

- 透过使用

- 语音通讯

- 资料通讯

- pod送

- 遥感探测

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 阿曼

- 科威特

- 土耳其

- 其他中东地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Al Yah Satellite Communications Company PJSC(Yahsat)

- Inmarsat Global Limited(now Viasat Inc.)

- Arab Satellite Communications Organization

- Intelsat SA

- Eutelsat Communications SA

- SES SA

- Thuraya Telecommunications Company PJSC

- Gulfsat Communications Company KSCC

- Saudi Telecom Company(Saudi Telecom Co.)

- Etisalat and(Emirates Telecommunications Group Co. PJSC)

- Telesat Canada

- L3Harris Technologies Inc.

- Raytheon Technologies Corporation

- Kratos Defense and Security Solutions Inc.

- Cobham Limited

- Huawei Technologies Co. Ltd.

- Anuvu Operations LLC

- SatADSL SA

- OneWeb Holdings Ltd.

- Taqnia Space Co.

第七章 市场机会与未来展望

Middle East satellite communications market size in 2026 is estimated at USD 4.01 billion, growing from 2025 value of USD 3.74 billion with 2031 projections showing USD 5.64 billion, growing at 7.06% CAGR over 2026-2031.

Geopolitical complexities, government-backed broadband mandates, and a surge of IoT deployments across oilfields, ports, and aircraft are collectively amplifying demand. Operators are prioritizing high-throughput satellite (HTS) investments to meet bandwidth-intensive enterprise and defense needs, even as spectrum coordination challenges raise the cost of new launches. Competitive positioning increasingly hinges on vertically integrated service bundles that blend cloud gateways, managed connectivity, and edge analytics capabilities. Maritime and airborne connectivity, 5G private-network backhaul, and direct-to-device (D2D) initiatives are emerging as high-margin niches that will shape the next growth wave of the Middle East satellite communications market.

Middle East Satellite Communications Market Trends and Insights

Increasing Uptake of IoT-Enabled Oilfield Equipment

Thousands of satellite-connected sensors now track pressure, flow, and emissions in remote wells, enabling predictive maintenance and lowering unplanned downtime. Saudi Aramco's real-time well-monitoring network exemplifies how energy majors leverage space-borne links where fiber is impractical. Space42's AI-powered analytics further enhance extraction efficiency, while Globalstar's tank-monitoring tools reduce supply interruptions across Gulf terminals. These deployments cut operating expenses and create recurring bandwidth demand that sustains the Middle East satellite communications market.

Rapid Adoption of VSAT-Based Maritime Connectivity

Major ports in Dubai, Jeddah, and Doha rely on VSAT for vessel traffic management and cargo analytics, driving fleet-wide upgrades by shipping lines. Marlink's agreements with regional operators showcase how HTS capacity delivers video, IoT telemetry, and crew welfare services. Integration with autonomous navigation platforms opens fresh revenue streams as unmanned surface vessels gain regulatory traction.

Spectrum Congestion and Cross-Border Frequency Disputes

Rapid satellite proliferation has exacerbated interference risks, and ITU coordination procedures struggle to keep pace. Quadsat's spectrum-monitoring deal with Arabsat signals is growing, and industry recognition that automated tools are vital. Still, unresolved C- and Ku-band overlaps can delay launches and elevate insurance premiums, adding friction to the Middle East satellite communications market.

Other drivers and restraints analyzed in the detailed report include:

- Government Programs for Universal Broadband (KSA, UAE)

- Growth of Private Inter-Satellite Data Relay Networks

- High CAPEX of HTS Fleet Upgrades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground equipment retained a 58.05% share of the Middle East satellite communications market in 2025, anchored by teleport, gateway, and VSAT deployments across Saudi Arabia and the UAE. Yet services revenue is projected to outpace hardware at an 7.85% CAGR, buoyed by managed bandwidth packages, cloud gateways, and satellite-enabled IoT platforms.

Services momentum reflects enterprise appetite for pay-as-you-go models that offload network management overhead. Es'hailSat's OSS/BSS partnership with neXat exemplifies how automation trims operating costs and accelerates onboarding. As HTS payloads proliferate, operators bundle cybersecurity, edge analytics, and SLA-backed uptime guarantees, expanding wallet share within the Middle East satellite communications market.

Maritime applications accounted for 40.30% of the Middle East satellite communications market share in 2025, due to dense shipping lanes through the Suez Canal and Strait of Hormuz. Airborne connectivity, however, is forecast to post the quickest 8.22% CAGR as airlines race to satisfy passenger streaming expectations and defense UAV fleets scale up.

Regional carriers adopt Ka-Band inflight Wi-Fi to differentiate customer experience, while the UAE's urban-air-mobility pilots lean on low-latency satellite links for command and control. Land platforms remain critical for oilfield SCADA backups and disaster-recovery networks, reinforcing diverse demand pillars that underpin the Middle East satellite communications market.

The Middle East Satellite Communications Market Report is Segmented by Type (Ground Equipment and Services), Platform (Portable, Land, Maritime, and Airborne), Frequency Band (L-Band, C-Band, Ku-Band, and Ka-Band), End-User Vertical (Maritime, Defense and Government, Enterprises, and More), Application (Voice Communications, Data Communications, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Al Yah Satellite Communications Company PJSC (Yahsat)

- Inmarsat Global Limited (now Viasat Inc.)

- Arab Satellite Communications Organization

- Intelsat S.A.

- Eutelsat Communications S.A.

- SES S.A.

- Thuraya Telecommunications Company PJSC

- Gulfsat Communications Company K.S.C.C.

- Saudi Telecom Company (Saudi Telecom Co.)

- Etisalat and (Emirates Telecommunications Group Co. PJSC)

- Telesat Canada

- L3Harris Technologies Inc.

- Raytheon Technologies Corporation

- Kratos Defense and Security Solutions Inc.

- Cobham Limited

- Huawei Technologies Co. Ltd.

- Anuvu Operations LLC

- SatADSL S.A.

- OneWeb Holdings Ltd.

- Taqnia Space Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing uptake of IoT-enabled oilfield equipment

- 4.2.2 Rapid adoption of VSAT-based maritime connectivity

- 4.2.3 Government programs for universal broadband (KSA, UAE)

- 4.2.4 Growth of private inter-satellite data relay networks

- 4.2.5 Rising demand for satellite back-haul of 5G private networks

- 4.2.6 Expansion of cooperative deep-space missions via GCC consortiums

- 4.3 Market Restraints

- 4.3.1 Spectrum congestion and cross-border frequency disputes

- 4.3.2 High CAPEX of HTS fleet upgrades

- 4.3.3 Geopolitical launch-service restrictions on select states

- 4.3.4 Shortage of SatCom-grade radiation-hardened chips in region

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Ground Equipment

- 5.1.1.1 Satellite Gateway

- 5.1.1.2 VSAT Equipment

- 5.1.1.3 Network Operation Center (NOC)

- 5.1.1.4 Satellite News Gathering (SNG) Equipment

- 5.1.2 Services

- 5.1.2.1 Mobile Satellite Services (MSS)

- 5.1.2.2 Earth Observation Services

- 5.1.1 Ground Equipment

- 5.2 By Platform

- 5.2.1 Portable

- 5.2.2 Land

- 5.2.3 Maritime

- 5.2.4 Airborne

- 5.3 By Frequency Band

- 5.3.1 L-Band

- 5.3.2 C-Band

- 5.3.3 Ku-Band

- 5.3.4 Ka-Band

- 5.4 By End-User Vertical

- 5.4.1 Maritime

- 5.4.2 Defense and Government

- 5.4.3 Enterprises

- 5.4.4 Media and Entertainment

- 5.4.5 Oil and Gas

- 5.4.6 Other End-User Verticals

- 5.5 By Application

- 5.5.1 Voice Communications

- 5.5.2 Data Communications

- 5.5.3 Broadcasting

- 5.5.4 Remote Sensing

- 5.6 By Country

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Qatar

- 5.6.4 Oman

- 5.6.5 Kuwait

- 5.6.6 Turkey

- 5.6.7 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Al Yah Satellite Communications Company PJSC (Yahsat)

- 6.4.2 Inmarsat Global Limited (now Viasat Inc.)

- 6.4.3 Arab Satellite Communications Organization

- 6.4.4 Intelsat S.A.

- 6.4.5 Eutelsat Communications S.A.

- 6.4.6 SES S.A.

- 6.4.7 Thuraya Telecommunications Company PJSC

- 6.4.8 Gulfsat Communications Company K.S.C.C.

- 6.4.9 Saudi Telecom Company (Saudi Telecom Co.)

- 6.4.10 Etisalat and (Emirates Telecommunications Group Co. PJSC)

- 6.4.11 Telesat Canada

- 6.4.12 L3Harris Technologies Inc.

- 6.4.13 Raytheon Technologies Corporation

- 6.4.14 Kratos Defense and Security Solutions Inc.

- 6.4.15 Cobham Limited

- 6.4.16 Huawei Technologies Co. Ltd.

- 6.4.17 Anuvu Operations LLC

- 6.4.18 SatADSL S.A.

- 6.4.19 OneWeb Holdings Ltd.

- 6.4.20 Taqnia Space Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need assessment