|

市场调查报告书

商品编码

1911829

印度家具金属製品市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)India Furniture Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

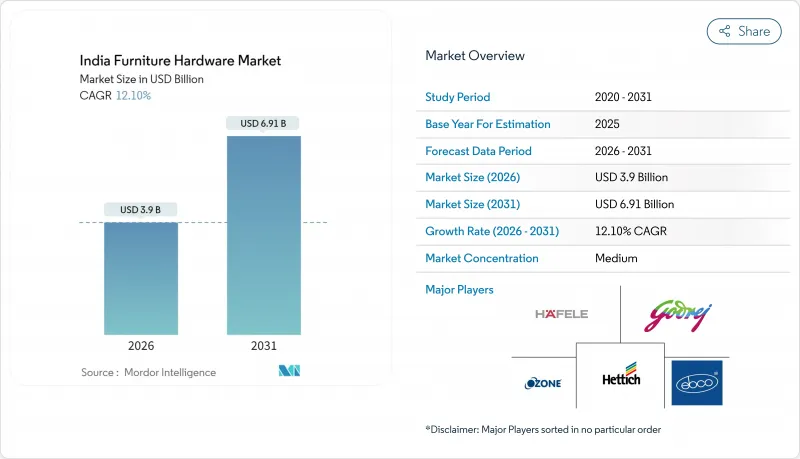

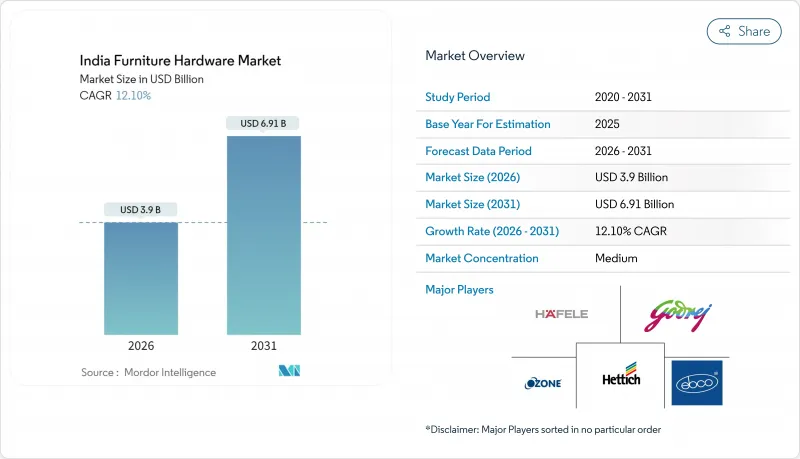

据估计,印度家具金属製品市场到 2026 年的价值将达到 39 亿美元,高于 2025 年的 34.8 亿美元。

预计到 2031 年将达到 69.1 亿美元,2026 年至 2031 年的复合年增长率为 12.1%。

受都市区住宅快速建设、零售网路扩张和数位化通路普及等因素的推动,印度家具金属製品市场保持着两位数的成长动能。可支配收入的增加带动了高端五金和缓闭系统的需求,而政府的品质标准也促进了认证产品的销售。目前市场竞争格局依然分散,全球品牌透过设计差异化来捍卫市场份额,而灵活的本土企业则在价格上竞争。近期成长要素包括强劲的住宅项目、不断扩张的商业室内装饰市场以及互联网普及率的提高,这些因素正在推动消费者和小规模承包商转向线上采购。

印度家具金属製品市场趋势与洞察

快速的住宅建设和都市化

预计未来十年印度将新增约1亿住宅,其中孟买、浦那和清奈等大都会圈的需求量最大,直接推动了铰链、铰链和建筑五金的需求。老旧住宅存量的现代化改造进一步增加了对传统铰链的需求,人们希望用缓闭式和耐腐蚀铰链来取代旧铰链。沿海地区的开发商越来越多地指定使用耐潮湿的不銹钢材质,推高了平均售价。集中在工业中心(尤其是马哈拉斯特拉邦製造业带)的建设计划创造了区域性需求,有利于附近的供应商。新计画和替换需求的结合,为印度家具金属製品市场打造了一个强大且地理多元化的基础。

加速模组化和RTA家具的电子商务

组装衣柜和厨房模组现在以平板包装形式发货,包装内包含螺丝、凸轮和导轨等组件,这些组件必须符合严格的公差要求。由于网购消费者自行安装五金件,品牌方更加重视直觉的设计、带有QR码的影片指南以及完整的紧固件套装。主要市场快速的产品更新周期要求五金供应商将产品库存单位 (SKU) 与家具製造商的更新计划同步,从而促进价值链上更深入的合作。顾客评估数据显示,铰链缺陷是产品退货的主要原因,因此品质一致性成为关键的差异化因素。数位通路 14.36% 的复合年增长率直接转化为标准化五金件销量的成长,同时也提高了印度家具五金市场的价格透明度。

来自非正规部门的价格压力和物流挑战

成千上万的小规模作坊聚集在拉杰果德和莫拉达巴德,它们规避了认证费用,直接向当地木工销售产品,从而能够以比品牌製造商低30%的价格出售产品。它们能够迅速复製热门产品,这给印度家具金属製品市场的入门级利润率带来了压力。笨重的金属滑轨和篮子重量与价值比低,而且运往偏远地区时会增加运费。东北地区落后的交通网络延长了前置作业时间,迫使经销商增加安全库存,增加了流动资金。虽然印度标准协会(BIS)的法规旨在消除不合格产品,但主要港口以外地区执法不力,导致了持续的价格战。

细分市场分析

2025年,升降系统的收入微乎其微,但预计将以12.62%的复合年增长率快速增长,这主要得益于都市区厨房对上开式橱柜以提高空间利用率的需求。铰链仍是领先产品,占印度家具金属製品市场份额的26.88%。然而,消费者价值念的转变使得隐藏式和缓闭式铰链更受青睐,因此价格也更高。滑轨系统的需求持续成长,模组化厨房需要更安静且可完全拉出的抽屉。把手、把手和旋钮的需求主要受设计主导,消费者更倾向于选择与室内主题相协调的配色系列。虽然紧固件是销量最大的SKU,但由于市场参与者分散,其利润率正在下降。然而,BIS标准的实施可能会促使注重品质的消费者转向品牌产品。诸如滑动门系统和金属丝篮等专业子类别提供了更多功能选择,从而丰富了产品种类,并提升了其在印度整体家具金属製品市场的竞争力。

次生影响力正在重塑各产品领域的竞争性投资格局。升降辅助阻尼器和伺服驱动开门器需要精确的气弹簧调节,这推动了本地工厂的自动化生产。隐藏式铰链需要微米级冲压模具,小规模工厂难以维护,这进一步扩大了正规生产商和非正规生产商之间的能力差距。高阶箱体系统的成长与衣柜模组化程度的提高一致,供应商提供导轨、支架和把手等整合套件。落地玻璃面板的滑动机构正在开拓高端住宅和办公室内市场,在这些市场中,框架厚度越薄越好。这些趋势共同作用,正在推动收入结构向工程机械领域转移,并扩大印度家具金属製品市场的价值基础。

由于钢材经久耐用且单位成本低廉,预计到2025年,钢材将占印度家具金属製品市场规模的41.88%。锌合金因其耐腐蚀性,在沿海和潮湿地区备受青睐;而铝材则因其轻巧的特性,被用于电梯系统等高端应用领域。另一方面,塑胶和其他聚合物基五金预计将以12.33%的复合年增长率快速增长,因为製造商利用射出成型的柔软性来製造复杂形状并整合阻尼功能。黄铜在豪华酒店业拥有独特的装饰应用,其独特的铜绿美感使其价格也显得合理。

如今,可回收性已成为材料选择的重要组成部分,都市区消费者在购买前也会考虑产品的环保性能。先进的玻璃纤维增强尼龙材料兼具金属般的强度和更轻的重量,从而降低了电商配送的运输成本。射出成型的投资也缩短了生产週期,使企业能够快速提升产能,以满足线上限时抢购的激增需求。同时,SS-304 和 SS-316 等优质不銹钢在高端厨房市场中占据越来越大的份额,因为易于清洁和经久耐用是高端厨房的关键特性。先进塑胶和不銹钢合金的同步发展,标誌着印度家具金属製品市场的分化,兼具轻量化和高端性能。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章:目录——印度家具金属製品市场

第二章 引言

- 研究假设和市场定义

- 调查范围

第三章调查方法

第四章执行摘要

第五章 市场情势

- 市场概览

- 市场驱动因素

- 住宅房地产快速成长与都市化

- 在网上购买的模组化/RTA家具数量激增

- 优质化和设计主导的需求促使人们对高品质金属製品产生需求。

- 拓展有组织的零售和DIY通路

- 透过BIS品管指令提高绩效标准

- 身心障碍者标准推动了人体工学硬体的发展。

- 市场限制

- 分散的非正规部门和激烈的竞争

- 钢材、锌和聚合物成本波动

- 大型重型零件的物流效率低下

- 满足新的永续性和无障碍标准所需的成本

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察市场最新趋势与创新

- 深入了解市场近期发展动态(新产品发表、策略性倡议、投资、合作、合资、扩张、併购等)

- 对硬体行业法规结构和行业标准的深入了解

第六章 市场规模及成长预测(以金额为准,2020-2030 年)

- 依产品类型

- 铰链

- 跑步系统

- 升降系统

- 箱式系统

- 金属丝篮

- 滑动门系统

- 把手、把手、旋钮

- 紧固件(螺丝、螺栓、螺帽等)

- 其他的

- 材料

- 钢

- 锌合金

- 铝

- 塑胶和聚合物基

- 黄铜和其他金属

- 最终用户

- 住宅家具

- 办公家具

- 饭店和零售设施

- 公共利益(医疗保健、教育)

- 透过分销管道

- 线下 - 经销商和零售商

- 线上 - 电子商务和品牌 D2C

- 按地区(印度)

- 印度北部

- 西印度群岛

- 南印度

- 印度东部和东北部

第七章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Hettich India Pvt. Ltd.

- Hafele India Pvt. Ltd.

- Godrej Locks & Architectural Fittings & Systems

- Ebco Pvt. Ltd.

- Ozone Overseas Pvt. Ltd.

- Dorset Industries Pvt. Ltd.

- Blum India

- Sugatsune Kogyo India

- H Hafele(Hafele brand stores)

- Hettich PODs & Studio Partners

- Kich Architectural Products

- PEGO Hardware

- Quba Group

- Vinay Wire & Polyproduct Pvt. Ltd.

- Dorset Smart Locks

- Ozone Securitas

- Evershine Appliances(Oliveworld)

- Italik Metalware Pvt. Ltd.

- DP Garg & Company(Garg Hinges)

- SIFON Hardware

第八章:市场机会与未来展望

- 有组织的零售业扩张促进了品牌五金的发展。

- 智慧机制革新模组化家具系统

India furniture hardware market size in 2026 is estimated at USD 3.90 billion, growing from 2025 value of USD 3.48 billion with 2031 projections showing USD 6.91 billion, growing at 12.1% CAGR over 2026-2031.

Demand momentum is anchored in rapid urban housing creation, swelling organized retail footprints, and digital channel adoption that keep the India furniture hardware market on a double-digit growth curve. Rising disposable incomes promote premium fittings and soft-close systems, while government quality mandates steer buyers toward certified products. Global brands safeguard share with design differentiation, whereas nimble regional firms battle on price, sustaining a fragmented competitive field. Near-term upside stems from a strong residential pipeline, expanding commercial interiors, and online penetration that moves both consumer and small-contractor purchases to click-based journeys.

India Furniture Hardware Market Trends and Insights

Rapid residential build-out and urbanization

India must add roughly 100 million homes this decade, and metros such as Mumbai, Pune and Chennai account for a large share of that pipeline, directly lifting demand for hinges, runners and architectural fittings. Modernization of aging housing stock further multiplies retrofit volumes as owners swap legacy hinges for soft-close or corrosion-resistant versions. Developers in coastal belts increasingly specify stainless-steel grades to withstand humidity, nudging average selling prices higher. Construction clusters around industrial nodes, especially Maharashtra's manufacturing belts, create localized demand pockets that favor nearby suppliers. Together, greenfield projects and replacements underpin a robust, geographically diversified base for the India furniture hardware market.

E-commerce acceleration in modular and RTA furniture

Ready-to-assemble wardrobes and kitchen modules now ship in flat-packs bundled with screws, cams and runners that must meet tight tolerances. Online buyers install fittings themselves, so brands emphasize intuitive designs, QR-code video guides and complete fastener kits. Rapid product cycles on leading marketplaces force hardware suppliers to synchronize SKUs with furniture makers' refresh calendars, deepening collaboration along the value chain. Customer-review data reveal hinge failures as a leading cause of returns, making quality consistency a vital differentiator. The 14.36% CAGR logged by digital channels thus converts directly into incremental standardized-hardware sales while injecting pricing transparency into the India furniture hardware market.

Price pressure from the unorganized sector plus logistics hurdles

Thousands of small workshops clustered in Rajkot and Moradabad undercut branded players by up to 30% because they sidestep certification costs and sell direct to local carpenters. Their agility in copying popular SKUs squeezes margins on entry-level lines within the India furniture hardware market. Bulky metal slides and baskets suffer unfavorable weight-to-value ratios, inflating freight costs when shipped to distant regions. Poor connectivity in the North-East lengthens lead times and forces distributors to hold larger safety stocks, raising working capital. Although BIS mandates aim to weed out sub-par goods, patchy enforcement outside major ports allows price-led competition to persist.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization, design focus and regulatory quality cues

- Rise of organized retail, DIY and accessibility needs

- Raw-material and compliance cost volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lift systems captured only modest revenue in 2025 but are forecast to grow at a 12.62% CAGR, the quickest pace among categories, as urban kitchens seek overhead cabinets that open upwards for space efficiency. Hinges remained the workhorse with 26.88% of the India furniture hardware market share, yet value migration favors concealed and soft-close variants that attract price premiums. Runner systems continue to gain traction in modular kitchens whose drawers require silent, full-extension slides. Handles, pulls and knobs benefit from design-led demand, supporting color-matched collections that complement interior themes. Fasteners are the highest-volume SKU yet face margin erosion from unorganized players; still, BIS standards could lift quality-conscious buyers toward branded options. Specialized sub-categories such as sliding-door systems and wire baskets broaden functionality choices, reinforcing product breadth as a competitive lever across the India furniture hardware market.

Second-order effects shape competitive investments across product verticals. Lift-assist dampers and servo-driven openers rely on precise gas-spring calibration, encouraging automation in local factories. Concealed hinges require micron-level stamping dies that smaller shops struggle to maintain, widening the capability gap between organized and informal producers. Growth in premium box systems aligns with rising wardrobe modularization, prompting suppliers to bundle runners, brackets and handles as integrated kits. Sliding mechanisms designed for floor-to-ceiling glass panels tap into premium residential and office interiors, where minimal frame thickness is prized. Together these trends shift revenue mix toward engineered mechanisms, expanding the value pool of the India furniture hardware market.

Steel delivered 41.88% of the India furniture hardware market size in 2025 thanks to its durability and low unit cost. Zinc alloy follows in coastal and high-humidity zones for its corrosion resistance, while aluminum's light weight attracts premium applications such as lift systems. Plastic and other polymer-based fittings, however, clock the fastest 12.33% CAGR as makers exploit injection-mold flexibility to create complex geometries and integrate damping functions. Brass serves niche decor roles in luxury hospitality where patina aesthetics justify higher price points.

Material selection now incorporates recyclability, with urban consumers querying environmental credentials before purchase. Advanced glass-fiber-reinforced nylon grades rival metal strength at lower weights, slashing freight costs for e-commerce shipments. Injection-molding investments also reduce per-unit cycle time, allowing rapid ramp-up to serve flash sale spikes online. Conversely, high-grade stainless variants such as SS-304 and SS-316 earn share in premium kitchens where ease of cleaning and long life matter. The simultaneous rise of advanced plastics and stainless alloys signals bifurcation toward both lightweight economy and high-end performance within the India furniture hardware market.

The India Furniture Hardware Market Report is Segmented by Product Type (Hinges, Runner Systems, Lift Systems, Box Systems, Wire Baskets, and More), Material (Steel, Zinc Alloy, Aluminium, and More), End-User (Residential, Office, Hospitality & Retail, Institutional), Distribution Channel (Offline, Online), and Geography (North, West, South, and More). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Hettich India Pvt. Ltd.

- Hafele India Pvt. Ltd.

- Godrej Locks & Architectural Fittings & Systems

- Ebco Pvt. Ltd.

- Ozone Overseas Pvt. Ltd.

- Dorset Industries Pvt. Ltd.

- Blum India

- Sugatsune Kogyo India

- H Hafele (Hafele brand stores)

- Hettich PODs & Studio Partners

- Kich Architectural Products

- PEGO Hardware

- Quba Group

- Vinay Wire & Polyproduct Pvt. Ltd.

- Dorset Smart Locks

- Ozone Securitas

- Evershine Appliances (Oliveworld)

- Italik Metalware Pvt. Ltd.

- DP Garg & Company (Garg Hinges)

- SIFON Hardware

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Table of Contents - India Furniture Hardware Market

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

3 Research Methodology

4 Executive Summary

5 Market Landscape

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Rapid growth in residential real-estate & urbanisation

- 5.2.2 Surge in modular/RTA furniture bought online

- 5.2.3 Premiumisation & design-driven demand for high-quality fittings

- 5.2.4 Expanding organised retail & DIY channels

- 5.2.5 BIS quality-control orders upgrading performance standards

- 5.2.6 Accessibility standards for PwD driving ergonomic hardware

- 5.3 Market Restraints

- 5.3.1 Fragmented unorganised sector & intense price competition

- 5.3.2 Volatile steel/zinc/polymer costs

- 5.3.3 Logistics inefficiencies for bulky, weighty fittings

- 5.3.4 Compliance costs for new sustainability & accessibility norms

- 5.4 Industry Value Chain Analysis

- 5.5 Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Suppliers

- 5.5.3 Bargaining Power of Buyers

- 5.5.4 Threat of Substitutes

- 5.5.5 Competitive Rivalry

- 5.6 Insights into the Latest Trends and Innovations in the Market

- 5.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 5.8 Insights on Regulatory Framework and Industry Standards for the Hardware Industry

6 Market Size & Growth Forecasts (Value, 2020-2030)

- 6.1 By Product Type

- 6.1.1 Hinges

- 6.1.2 Runner Systems

- 6.1.3 Lift Systems

- 6.1.4 Box Systems

- 6.1.5 Wire Baskets

- 6.1.6 Sliding Door Systems

- 6.1.7 Handles, Pulls, and Knobs

- 6.1.8 Fasteners (Screw, Bolts, Nuts, etc.)

- 6.1.9 Others

- 6.2 By Material

- 6.2.1 Steel

- 6.2.2 Zinc Alloy

- 6.2.3 Aluminium

- 6.2.4 Plastic & Polymer-based

- 6.2.5 Brass & Other Metals

- 6.3 By End-user

- 6.3.1 Residential Furniture

- 6.3.2 Office Furniture

- 6.3.3 Hospitality & Retail Fixtures

- 6.3.4 Institutional (Healthcare, Education)

- 6.4 By Distribution Channel

- 6.4.1 Offline - Dealer & Retail

- 6.4.2 Online - E-commerce & Brand D2C

- 6.5 By Region (India)

- 6.5.1 North India

- 6.5.2 West India

- 6.5.3 South India

- 6.5.4 East & North-East India

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 7.4.1 Hettich India Pvt. Ltd.

- 7.4.2 Hafele India Pvt. Ltd.

- 7.4.3 Godrej Locks & Architectural Fittings & Systems

- 7.4.4 Ebco Pvt. Ltd.

- 7.4.5 Ozone Overseas Pvt. Ltd.

- 7.4.6 Dorset Industries Pvt. Ltd.

- 7.4.7 Blum India

- 7.4.8 Sugatsune Kogyo India

- 7.4.9 H Hafele (Hafele brand stores)

- 7.4.10 Hettich PODs & Studio Partners

- 7.4.11 Kich Architectural Products

- 7.4.12 PEGO Hardware

- 7.4.13 Quba Group

- 7.4.14 Vinay Wire & Polyproduct Pvt. Ltd.

- 7.4.15 Dorset Smart Locks

- 7.4.16 Ozone Securitas

- 7.4.17 Evershine Appliances (Oliveworld)

- 7.4.18 Italik Metalware Pvt. Ltd.

- 7.4.19 DP Garg & Company (Garg Hinges)

- 7.4.20 SIFON Hardware

8 Market Opportunities & Future Outlook

- 8.1 Organized Retail Expansion Boosting Branded Hardware

- 8.2 Smart Mechanisms Transforming Modular Furniture Systems