|

市场调查报告书

商品编码

1911831

GPUaaS(GPU即服务):市占率分析、产业趋势与统计、成长预测(2026-2031)GPU As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

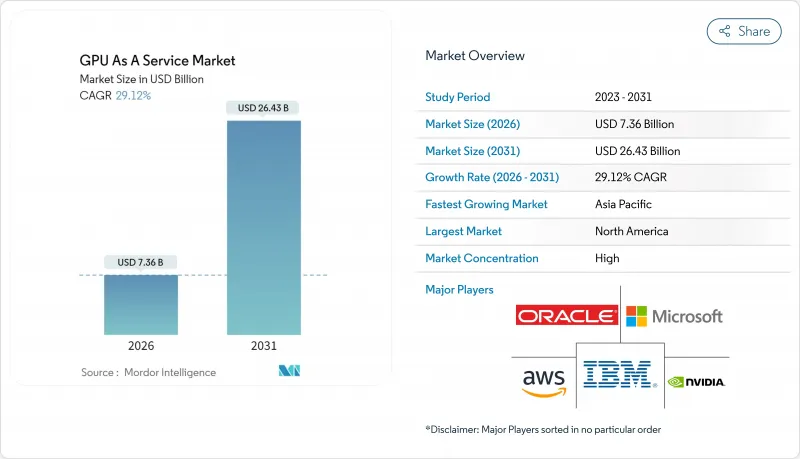

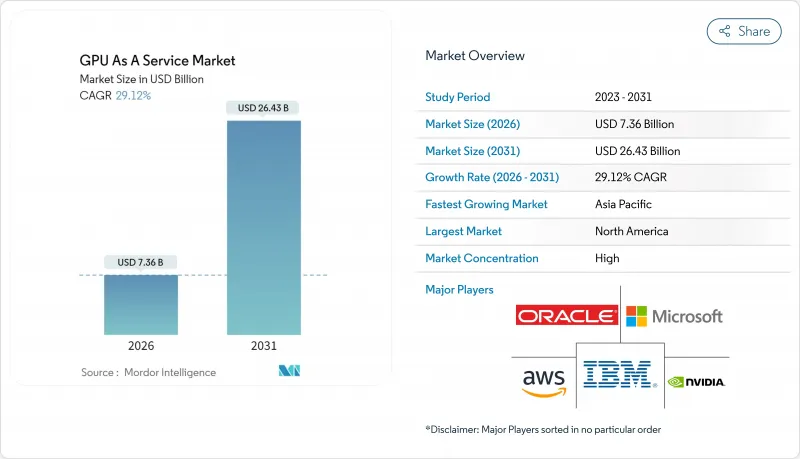

预计到 2026 年,GPUaaS(GPU 即服务)市值将达到 73.6 亿美元,高于 2025 年的 57 亿美元。

预计到 2031 年,该产业规模将达到 264.3 亿美元,2026 年至 2031 年的复合年增长率为 29.12%。

由于生成式人工智慧工作负载、云端游戏的兴起以及企业级数位转型计划对弹性高密度运算能力的需求,GPUaaS(GPU即服务)市场正蓬勃发展。计量收费模式持续推动预算从本地GPU丛集转向云端订阅,而液冷系统维修使资料中心营运商能够在保持能源效率的同时提高每个机架的加速器密度。超大规模资料中心业者在全球捍卫市场占有率的同时,专业化的「新型云端」也在价格和特定工作负载效能方面展开激烈竞争。价格从A100实例每小时0.66美元到高阶H100配置每小时4美元以上不等,为客户提供了选择不同性能等级的灵活性。

全球GPU即服务(GPUaaS)市场趋势与洞察

生成式人工智慧和LLM工作负载的日益普及

对基于变压器模型的需求正推动着前所未有的GPU丛集,单一计划就部署了数千个H100加速器,用于持续数週的训练週期。据NVIDIA称,91%的金融机构正处于人工智慧应用案例的生产或评估阶段。诸如BNY Mellon等金融服务公司已经展示了GPU超级丛集在即时诈欺分析方面的强大功能(nvidia.com)。 GPUaaS(GPU即服务)市场固有的弹性扩展能力使研究团队能够灵活地调整运算资源,以应对训练需求不可预测的峰值。配备高频宽记忆体(HBM)的H100和H200晶片尤其受欢迎,因为即使参数数量增加,它们也能保持吞吐量。Start-Ups现在可以存取与超大规模资料中心业者相同的晶片,从而创造了公平的创新环境。

AR/VR和即时渲染的需求快速成长

以每秒 90 帧的速度进行照片级渲染对消费级硬体提出了很高的要求,促使开发者从远端 GPU 串流像素级精确的帧。 NVIDIA 的 CloudXR 平台在 GPU 后端迭加了一层低延迟转码器,为精简型用户端提供身临其境型体验。像 Arcware 这样的像素流专家提供虚幻引擎即服务 (Unreal Engine as a Service),让建筑视觉化团队能够在行动装置上呈现互动式模型。製造业正在采用将实体模拟与即时视觉化相结合的数位双胞胎工作流程,从而推动了对边缘分散式 GPU 的需求。随着下一代头戴装置的到来,内容工作室更倾向于选择 GPU 即服务 (GPUaaS) 市场,而不是购买专用渲染农场,这既可以避免资本支出,又能保持柔软性。

网路安全和资料主权问题

共用加速器池正在创造新的攻击面,研究也揭示了绕过传统虚拟机器管理程式屏障的GPU侧通道攻击路径。机密运算扩充实现了记忆体加密和工作负载隔离,使多租户环境能够满足银行和政府的标准。出口管制法规使合规性变得复杂,要求超过特定TOPS阈值的GPU在跨境部署前必须获得许可。主权云端框架正推动企业转向区域节点,并影响GPUaaS(GPU即服务)市场的资料中心位置策略。服务提供者正在透过区域金钥管理系统和加密签章GPU许可强制执行措施来应对这些挑战。

细分市场分析

到2025年,人工智慧(AI)应用案例将占总营收的46.68%,占据GPU即服务(GPUaaS)市场的最大份额。 Transformer架构的参数数量现已超过一万亿,所产生的多丛集需求只能由弹性云池来满足。大规模语言模型推理涵盖即时聊天机器人、程式码产生助手和企业知识搜寻等领域,即使在训练週期结束后也能保持稳定的使用率。

云端游戏和媒体渲染是成长最快的应用领域,年复合成长率高达 30.35%,这将推动 GPU 即服务 (GPUaaS) 市场规模在 2031 年前持续成长,尤其是在娱乐工作负载方面。服务提供者正透过对晚间游戏高峰时段进行货币化,并将白天閒置的 GPU 容量出租给电影渲染管线,从而提高资产利用率。模拟自动驾驶汽车环境的混合工作负载将照片级渲染与基于物理的 AI 相结合,在单一租户中连接游戏引擎和 AI 框架。随着这些跨领域工作流程的标准化,应用边界日益模糊,每个新增计划都将为 GPUaaS 市场增添价值。

大型企业已透过预留容量协议和专属支援团队,确保了其 2025 年 55.54% 的收入。跨国银行、汽车製造商和製药巨头已预订 H100 实例,并签订多年期合同,以支援其可预测的人工智慧蓝图。他们通常会协商资料中心託管协议和製造商直接供货保证,以确保在供应链中断的情况下业务的连续性。

中小企业正以 28.95% 的复合年增长率成长,这表明付费使用制模式正在推动 GPUaaS(GPU 即服务)产业的普及化。无伺服器交付模式无需 DevOps 人员,使小规模团队能够在几天内将视觉模型和建议引擎整合到其产品中。 A100 极具竞争力的定价(每小时 0.66 美元)进一步降低了进入门槛,随着更多中小企业的参与,推动了整个 GPUaaS(GPU 即服务)市场的发展。

GPU即服务(GPUaaS)市场按应用领域(人工智慧、高效能运算等)、公司规模(中小企业、大型企业)、终端用户产业(银行、金融服务和保险、汽车及出行等)、部署模式(公共云端、私有云端、混合/多重云端)、服务模式(基础设施即服务、平台即细分服务等)及地区进行 GPU。市场预测以美元计价。

区域分析

到2025年,北美将占全球收入的30.88%,这主要得益于其成熟的超大规模资料中心业者中心基础、充满活力的Start-Ups系统以及银行、零售和娱乐产业的早期应用。服务供应商正在对传统机房维修,加装晶片级液冷系统,并将机架密度提升至120kW以上,使每个机房能够部署数万个GPU。区域出口限制制约了尖端晶片的部署,因此,合规咨询作为附加价值服务被纳入GPU即服务(GPUaaS)市场。

亚太地区预计将以29.70%的复合年增长率成长,这主要得益于政府主导的人工智慧云端和製造业数位化。新加坡正透过将每人600美元投资于英伟达硬件,并为人工智慧基础设施提供税收优惠,将自身打造成为区域运算中心。印度的国家「万GPU计划」已与国内通讯业者合作,共同推动自主云端的建设。日本和韩国正在加速采购用于语言翻译和机器人工作负载的H200丛集,这表明推动区域预算流入GPU即服务(GPUaaS)市场的因素多种多样。

欧洲在追求成长机会的同时,也严格遵守永续性和资料居住法规。服务提供者遵守欧盟碳排放上限,并投资于100%可再生能源供应和余热回收。儘管面临政策阻力,但受汽车、製药和公共部门对人工智慧应用需求的推动,使用率仍在持续上升。虽然南美和中东及非洲的绝对成长速度有所滞后,但由于宽频普及率的提高和本地人工智慧生态系统的日趋成熟,这些地区正经历两位数的成长率。预计新兴全部区域将扩大GPUaaS(GPU即服务)市场的潜在用户群,并进一步实现收入来源多元化。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 生成式人工智慧和大型语言模型(LLM)工作负载的日益普及

- AR/VR和即时渲染的需求快速成长

- 云端游戏服务的扩展

- 付费使用制的定价模式正变得越来越流行。

- 利用液冷资料中心维修GPU密度

- 可减少厂商锁定的多重云端GPU编配平台

- 市场限制

- 网路安全和资料主权问题

- 全球缺乏具备人工智慧技能的DevOps人才

- HBM记忆体和先进封装供应限制

- 资料中心用电价格上涨和更严格的碳排放法规

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 对影响市场的宏观经济因素进行评估

第五章 市场规模与成长预测

- 透过使用

- 人工智慧

- 高效能运算

- 云端游戏和媒体渲染

- 其他用途

- 按公司规模

- 小型企业

- 大公司

- 按最终用户行业划分

- BFSI

- 汽车与出行

- 医疗保健和生命科学

- 资讯科技和电信

- 媒体与娱乐

- 其他行业

- 按部署模式

- 公共云端

- 私有云端

- 混合/多重云端

- 按服务模式

- IaaS

- PaaS

- SaaS(GPU加速)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services

- Microsoft Azure

- NVIDIA DGX Cloud

- Google Cloud

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- CoreWeave

- Linode/Akamai

- Latitude.sh

- Seeweb

- Lambda Labs

- Paperspace(DigitalOcean)

- Vultr

- OVHcloud

- Scaleway

- RunPod

- Vast.ai

- Genesis Cloud

- Cirrascale

- 供应商排名分析

第七章 市场机会与未来展望

GPU as a Service market size in 2026 is estimated at USD 7.36 billion, growing from 2025 value of USD 5.70 billion with 2031 projections showing USD 26.43 billion, growing at 29.12% CAGR over 2026-2031.

The GPU as a Service market draws momentum from the collision of generative-AI workloads, cloud-gaming adoption, and companywide digital-transformation projects that require elastic, high-density compute capacity. Pay-per-use models continue to shift budgets away from on-premises GPU clusters toward cloud subscriptions, while liquid-cooling retrofits enable data-center operators to pack more accelerators per rack and maintain power efficiency. Hyperscalers protect share through global scale, yet specialist "neoclouds" compete aggressively on price and workload-specific performance. Pricing ranges from USD 0.66 per hour for A100 instances to USD 4.00 and above for premium H100 configurations, giving customers flexibility across performance tiers.

Global GPU As A Service Market Trends and Insights

Rising usage of generative-AI and LLM workloads

Demand for transformer-based models drives unprecedented GPU clustering, with single projects consuming thousands of H100 accelerators for training cycles that last weeks. NVIDIA noted that 91% of financial institutions are now in production or evaluation phases for AI use cases.Financial-services firms such as BNY Mellon demonstrated the power of GPU superclusters for real-time fraud analytics nvidia.com. Elastic scaling inherent in the GPU as a Service market allows research teams to match compute supply with unpredictable training bursts. High-bandwidth memory (HBM) equipped H100 and H200 parts are favored because they maintain throughput for expanding parameter counts. The long tail of startups can now access the same silicon that hyperscalers deploy, leveling the innovation playing field.

Surge in AR/VR and real-time rendering needs

Photorealistic rendering at 90 frames per second strains consumer hardware, motivating developers to stream pixel-perfect frames from remote GPUs. NVIDIA's CloudXR platform layers low-latency codecs onto GPU back-ends to deliver immersive experiences to thin clients. Pixel-streaming specialists such as Arcware offer Unreal-Engine-as-a-Service so that architectural-visualization teams can present interactive models on mobile devices. Manufacturing firms adopt digital-twin workflows that mix physics simulation with real-time visualization, pushing demand for distributed GPUs at the edge. As next-generation headsets arrive, content studios prefer the GPU as a Service market over purchasing bespoke render farms because they avoid capital costs and maintain flexibility.

Cyber-security and data-sovereignty concerns

Shared accelerator pools create fresh attack surfaces, with research highlighting GPU side-channel vectors that bypass traditional hypervisor barriers.Confidential-computing extensions now encrypt memory and isolate workloads so that multi-tenant environments meet bank and government standards. Export-control regimes add compliance complexity because GPUs above certain TOPS thresholds require licensing before cross-border deployment. Sovereign-cloud frameworks push enterprises toward regional nodes, influencing data-center location strategies inside the GPU as a Service market. Providers respond with per-region key-management systems and cryptographically signed GPU-license enforcement.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-gaming service expansion

- Pay-per-use pricing models gaining traction

- HBM memory and advanced packaging supply constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Artificial-intelligence use cases represented 46.68% of 2025 revenue, giving this segment the largest slice of the GPU as a Service market. Transformer architectures now exceed 1 trillion parameters, driving multi-cluster demands that only elastic cloud pools can supply. Large-language-model inference spans real-time chatbots, code-generation assistants, and enterprise knowledge retrieval, keeping utilization steady after training cycles complete.

Cloud Gaming and Media Rendering is the fastest-rising application group at a 30.35% CAGR, helping expand the GPU as a Service market size for entertainment workloads through 2031. Providers monetize evening gaming peaks and rent idle daytime capacity to film-render pipelines, elevating asset utilization. Hybrid workloads that simulate autonomous-vehicle environments blend photoreal rendering with physics-based AI, bridging gaming engines and AI frameworks in a single tenancy. As these cross-domain workflows normalize, application boundaries blur and every incremental project funnels additional value into the GPU as a Service market.

Large Enterprises secured 55.54% of 2025 revenue thanks to reserved-capacity contracts and dedicated support teams. Multinational banks, automakers, and pharmaceutical giants lock in multi-year blocks of H100 instances for predictable AI roadmaps. They often negotiate data-center colocation arrangements or direct-to-manufacturer supply guarantees, ensuring continuity during supply-chain shocks.

Small and Medium Enterprises are growing at a 28.95% CAGR, underscoring the democratization effect that consumption billing brings to the GPU as a Service industry. Serverless offerings remove the need for DevOps headcount, allowing lean teams to integrate vision models or recommendation engines into products within days. Competitive pricing at USD 0.66 per hour for A100s further lowers entry barriers, propelling the overall GPU as a Service market forward as SME participation deepens.

GPU As A Service Market is Segmented by Application (Artificial Intelligence, High-Performance Computing, and More), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, Automotive and Mobility, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid / Multi-Cloud), Service Model (IaaS, Paas, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 30.88% of global revenue in 2025 on the back of established hyperscaler footprints, vibrant startup ecosystems, and early adoption across banking, retail, and entertainment. Providers retrofit legacy halls with direct-to-chip liquid-cooling to achieve rack densities above 120 kW, enabling tens of thousands of GPUs per facility. Regional export controls shape where the most advanced silicon can be deployed, adding compliance consulting as a value-added service inside the GPU as a Service market.

Asia-Pacific is projected to post a 29.70% CAGR, reflecting government-funded AI clouds and manufacturing digitization. Singapore spends USD 600 per capita on NVIDIA hardware and offers tax incentives for AI infrastructure, positioning itself as a regional compute hub. India's national mission to install 10,000 GPUs partners NVIDIA with domestic telcos for sovereign-cloud builds. Japan and South Korea accelerate procurement of H200 clusters for language-translation and robotics workloads, illustrating diverse catalysts that funnel regional budgets into the GPU as a Service market.

Europe balances growth opportunities with stringent sustainability and data-residency regulations. Providers invest in 100% renewable energy supplies and waste-heat re-use, aligning with EU carbon caps. Demand across automotive, pharma, and public-sector AI applications keeps utilization rising despite policy headwinds. Growth in South America and the Middle East & Africa lags in absolute terms but posts double-digit gains as broadband penetration improves and local AI ecosystems mature. Collectively, emerging regions will expand the addressable user base and further diversify revenue streams for the GPU as a Service market.

- Amazon Web Services

- Microsoft Azure

- NVIDIA DGX Cloud

- Google Cloud

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- CoreWeave

- Linode / Akamai

- Latitude.sh

- Seeweb

- Lambda Labs

- Paperspace (DigitalOcean)

- Vultr

- OVHcloud

- Scaleway

- RunPod

- Vast.ai

- Genesis Cloud

- Cirrascale

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising usage of generative-AI and LLM workloads

- 4.2.2 Surge in AR/VR and real-time rendering needs

- 4.2.3 Cloud-gaming service expansion

- 4.2.4 Pay-per-use pricing models gaining traction

- 4.2.5 Liquid-cooling data-center retrofits unlocking GPU density

- 4.2.6 Multi-cloud GPU-orchestration platforms reducing vendor lock-in

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-sovereignty concerns

- 4.3.2 Global shortage of AI-skilled DevOps talent

- 4.3.3 HBM memory and advanced packaging supply constraints

- 4.3.4 Escalating data-center power tariffs and carbon regulations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Artificial Intelligence

- 5.1.2 High-Performance Computing

- 5.1.3 Cloud Gaming and Media Rendering

- 5.1.4 Other Applications

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Automotive and Mobility

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 IT and Communications

- 5.3.5 Media and Entertainment

- 5.3.6 Other Industries

- 5.4 By Deployment Model

- 5.4.1 Public Cloud

- 5.4.2 Private Cloud

- 5.4.3 Hybrid / Multi-cloud

- 5.5 By Service Model

- 5.5.1 IaaS

- 5.5.2 PaaS

- 5.5.3 SaaS (GPU-accelerated)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Microsoft Azure

- 6.4.3 NVIDIA DGX Cloud

- 6.4.4 Google Cloud

- 6.4.5 IBM Cloud

- 6.4.6 Oracle Cloud

- 6.4.7 Alibaba Cloud

- 6.4.8 CoreWeave

- 6.4.9 Linode / Akamai

- 6.4.10 Latitude.sh

- 6.4.11 Seeweb

- 6.4.12 Lambda Labs

- 6.4.13 Paperspace (DigitalOcean)

- 6.4.14 Vultr

- 6.4.15 OVHcloud

- 6.4.16 Scaleway

- 6.4.17 RunPod

- 6.4.18 Vast.ai

- 6.4.19 Genesis Cloud

- 6.4.20 Cirrascale

- 6.5 Vendor Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment