|

市场调查报告书

商品编码

1934591

农用轮胎:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Agricultural Tires - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

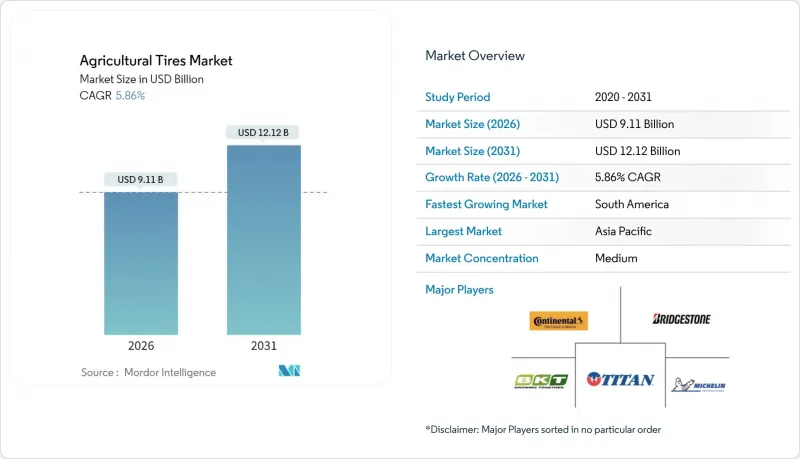

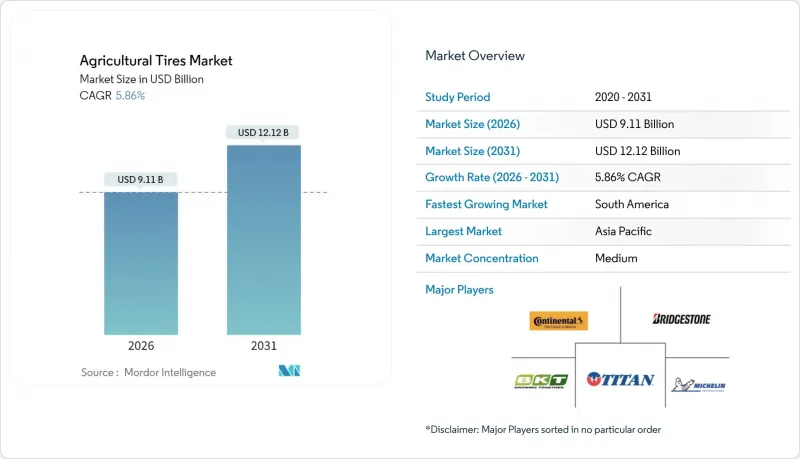

预计农业轮胎市场将从 2025 年的 86.1 亿美元成长到 2026 年的 91.1 亿美元,到 2031 年将达到 121.2 亿美元,2026 年至 2031 年的复合年增长率为 5.86%。

农业轮胎市场受益于持续的机械化需求、子午线化趋势的加速发展以及提高承载能力并降低土壤压力的IF/VF技术的商业化等因素。农民向精密农业的稳步转型、老旧拖拉机车队更新换代需求的增加以及对中央轮胎压力管理系统(CTIS)降低运营成本的日益青睐,进一步增强了市场增长势头。随着老牌企业和区域性新兴企业升级产品线、投资智慧轮胎平台并寻求垂直整合以降低原材料价格波动带来的风险,市场竞争日益激烈。供应链重组,特别是围绕天然橡胶来源的重组,仍将是影响2030年之前农业轮胎市场发展的关键因素。

全球农用轮胎市场趋势与洞察

新兴市场的快速机械化和车队更新

新兴经济体正经历显着的车辆现代化。在阿根廷,受政策支持的融资和旨在降低进口成本在地采购激励措施的推动,预计到2025年,拖拉机、收割机和喷药机的销售将持续成长。市场对30-70马力机械的需求日益增长,凸显了专用中型轮胎的市场机会;而150马力以上的设备也正在加速向VF规格轮胎的过渡。包括凯斯纽荷兰(Case IH)在内的产业相关人员正在亚洲扩张,儘管面临农村网路存取有限等基础设施瓶颈,但在这个高成长市场中依然展现出强劲的成长势头。这些趋势共同支撑了农业轮胎市场的未来前景。

从斜交轮胎过渡到子午线/IF-VF低密度轮胎

子午线化轮胎具有显着的成本效益优势。在相同的充气压力下,IF(斜交胎)设计可承受五分之一的更高负荷,而VF(垂直胎)设计则可将此优势提升五分之二。米其林为纽荷兰CR11联合收割机设计的CEREXBIB 2系列轮胎,在更大的接地面积下可承载19吨的负荷,这反映了製造商对土壤保护的承诺。轮胎与轮圈协会(T&RA)的标准化工作统一了充气通讯协定,并加速了全球的推广应用。 BKT、CEAT和Yokohama Rubber等公司迅速产品推出,进一步丰富了OEM和替换市场的VF产品选择。随着越来越多的农场将燃油效率和土壤健康放在首位,农业轮胎市场正迅速从斜交胎转向先进的子午线产品。

农产品价格波动

农产品价格週期影响农民投资资本设备的能力。在巴西,由于CELIC利率上升导致借贷成本增加,2024年农业机械销量略降至约5万台。阿根廷的农业机械註册量在2025年初环比下降,儘管以年度为基础改善,但仍保持谨慎态度。现金流紧张导致整车製造商(OEM)需求疲软和工厂生产计划不稳定,给轮胎供应商带来挑战。同时,替换需求相对稳定,缓解了收入下滑。这种两极化凸显了售后市场为何能支撑整个农业轮胎市场的基准需求。

细分市场分析

到2025年,售后市场将占农业轮胎市场份额的70.74%。农民强烈希望延长农机设备的使用寿命,尤其是在高利率时期,这进一步巩固了售后市场的优势。受乌克兰重建工作和拉丁美洲政策支持的车队更新需求的推动,预计到2031年,OEM通路将以5.91%的复合年增长率成长。

Bridgestone的VX-TRACTOR、VT-TRACTOR和VX-R TRACTOR产品线将于2024年8月在美国上市,展现了对优质化的坚定承诺,承诺更长的使用寿命和更高的40%承载能力。同时,特瑞堡与约翰迪尔达成协议,使其能够进入巴西300多家经销商通路,并为其配备中央轮胎资讯系统(CTIS)的轮胎提供新拖拉机交货,这进一步推动了OEM厂商的需求成长。强劲的售后市场需求,加上OEM订单的復苏,凸显了农业轮胎市场均衡的成长要素。

到2025年,拖拉机将占据农业轮胎市场56.12%的份额,巩固其作为日常农活核心部件的地位。撒播机虽然体积较小,但预计到2031年将以5.95%的复合年增长率成长,从而推动对高底盘设备用窄型VF轮胎的需求。联合收割机和拖车占据剩余份额,它们对轮胎性能提出了明确的要求,进而影响胎面花纹设计和汽车胎体刚度。

阿波罗的Vredestein Traxion CropCare系列轮胎可将喷药机的横向稳定性提升30%,体现了其在作物保护设备领域专注的工程研发。米其林为纽荷兰CR11联合收割机设计的VF 900/65R46 CFO轮胎,直径2.32米,负载容量荷达19吨,代表了更大、更重型解决方案的发展趋势。这些创新拓展了性能范围,并提升了其在农业轮胎市场的价值提案。

区域分析

到2025年,亚太地区将占据全球农业轮胎市场37.41%的份额,其中中国和印度将引领这一市场。这两个国家合计占全球农业机械成长的五分之二以上。许多地方政府正透过补贴来缓解劳动力短缺问题,鼓励采用配备可变胎面轮胎(VF)的拖拉机,以保护宝贵的农地。日本广泛采用子午线轮胎,反映了该地区在先进研发丛集和严格的永续性标准支持下所达到的技术成熟度。

预计南美洲将成为成长最快的地区,2026年至2031年的复合年增长率将达到6.09%。巴西农业机械销售在2024年出现下滑后,由于FROTA模式等政策的实施,以及阿根廷国内製造业份额的提升,需求正在復苏。诸如特瑞堡与约翰迪尔庞大的经销网络所进行的策略合作,正为中小农业生产者提供先进的低压轮胎。

欧洲和北美地区的轮胎更换率较高。欧盟将于2027年1月生效的机械法规将提高数位化相容性和安全性标准,有利于采用CTIS(接触式轮胎资讯系统)和配备感测器的轮胎。乌克兰的重建计画预计将提振OEM厂商的需求,因为农业机械库存将得到补充。儘管中东和非洲的机械化程度尚不成熟,但随着子午线浮动轮胎在依赖灌溉的粮食种植中的农艺优势日益凸显,需求正在逐步增长。整体而言,区域差异凸显了多种需求驱动因素,巩固了农业轮胎市场到2031年的成长动能。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 新兴市场的快速机械化与车辆更换

- 从斜交轮胎过渡到子午线/IF-VF低压缩轮胎

- 世界人口成长与粮食安全压力

- 老旧拖拉机车队的更新换代需求迅速成长

- 即时胎压监测系统和中央轮胎资讯系统(CTIS)的广泛应用将推动升级改造。

- 欧盟和乌克兰的重建计画引发了OEM需求的激增

- 市场限制

- 农产品价格波动

- 天然橡胶和石化产品成本波动

- 供应商限制了退货选项并提高了价格

- 橡胶叶病导致原料供应受限

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按销售管道

- OEM

- 替换件/售后市场

- 透过使用

- 联结机

- 结合

- 喷雾器

- 拖车

- 装载机和加长型堆高机

- 其他工具

- 轮胎结构

- 偏见

- 径向

- IF/VF径向

- 按轮圈尺寸

- 小于20英寸

- 20到30英寸

- 30到40英寸

- 40吋或以上

- 按设备马力等级

- 不到30马力

- 30-70马力

- 71-150马力

- 超过150马力

- 透过通膨技术相容性

- 标准轮胎

- 相容CTIS的智慧轮胎

- 按地区

- 北美洲

- 我们

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bridgestone Corporation

- Michelin

- Continental AG

- Balkrishna Industries Ltd(BKT)

- Titan International Inc.

- Trelleborg AB

- Yokohama Rubber Co. Ltd.(ATG)

- Nokian Tyres plc

- Apollo Tyres Ltd.

- Prometeon Tyre Group

- CEAT Ltd.

- Mitas as

- Goodyear Tire & Rubber Co.

- Hankook Tire & Technology

- GRI Tires

- Maxam Tire International

- Specialty Tires of America

- Magna Tyres Group

- Petlas Tire Industry

第七章 市场机会与未来展望

The Agricultural Tires market is expected to grow from USD 8.61 billion in 2025 to USD 9.11 billion in 2026 and is forecast to reach USD 12.12 billion by 2031 at 5.86% CAGR over 2026-2031.

The Agricultural Tires market is benefiting from sustained mechanization demand, rapid radialization, and the commercialization of IF/VF technologies that improve load capacity while reducing soil compaction. Growth momentum is further reinforced by farmers' steady shift toward precision farming, swelling replacement demand from aging tractor fleets, and a widening preference for Central Tire Inflation Systems that lower operating costs. Competitive intensity is mounting as incumbents and regional challengers upgrade product lines, invest in smart-tire platforms, and pursue vertical integration to mitigate raw-material price volatility. Supply-chain recalibration, particularly around natural rubber sources, remains an important theme shaping the Agricultural Tires market through 2030.

Global Agricultural Tires Market Trends and Insights

Rapid Mechanization & Fleet Renewal In Emerging Markets

Emerging economies are in the midst of pronounced fleet modernization. Argentina anticipates growth in tractor, harvesters, and sprayers sales during 2025, underpinned by policy-backed financing and local-content incentives that reduce import-cost exposure. Rising preference for 30-70 HP machines underscores opportunities for specialized mid-range tires, while >150 HP equipment accelerates the push toward VF specifications. Industry participants including Case IH are expanding Asian footprints, highlighting the magnetic pull of high-growth markets despite infrastructure bottlenecks such as limited rural internet. These dynamics collectively bolster the Agricultural Tires market outlook.

Shift From Bias To Radial / If-Vf Low-Compaction Tires

The cost-benefit rationale for radialization is compelling: IF designs allow one-fifth higher load at identical pressure, and VF designs expand the margin to two-fifth. Michelin's CEREXBIB 2 line for New Holland's CR11 combine, accommodating 19 ton loads with a wider footprint, illustrates manufacturers' commitment to soil preservation. Standards codified by the Tire & Rim Association have harmonized inflation protocols, accelerating global adoption. Expedited product launches from BKT, CEAT, and Yokohama further diversify VF offerings across both OEM and replacement channels. As more farms prioritize fuel efficiency and soil health, the Agricultural Tires market is witnessing rapid technology diffusion from bias to advanced radial products.

Fluctuating Agricultural Commodity Prices

Commodity price cycles shape farmers' capital-spending capacity. Brazil's agricultural machinery sales fell slightly in 2024 to close to half a lakh units amid a uptick Selic rate that inflated borrowing costs. Argentina's equipment registrations showed early-2025 month-on-month declines despite annual improvements, underlining persistent caution. When cash flows tighten, OEM demand softens and factory scheduling becomes erratic, challenging tire suppliers. Conversely, replacement needs remain steadier, cushioning revenue dips. This dichotomy reinforces why the aftermarket anchors baseline demand across the Agricultural Tires market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Global Population & Food-Security Pressure

- Surging Replacement Demand From Aging Tractor Fleet

- Natural-Rubber & Petrochemical Cost Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Agricultural Tires market size attributed to the aftermarket accounts for 70.74% of market share in 2025. Farmers' strong inclination to extend equipment lifespan, particularly during high interest-rate periods, reinforces this dominance. OEM channels are on a 5.91% CAGR path through 2031, buoyed by Ukraine reconstruction and policy-supported fleet renewal in Latin America.

Bridgestone's August 2024 U.S. introduction of VX-TRACTOR, VT-TRACTOR, and VX-R TRACTOR portfolios illustrates the pursuit of premiumization, promising longer wear life and 40% higher load capacity. Parallel OEM momentum stems from Trelleborg's agreement with John Deere, granting access to more than 300 Brazilian dealerships and positioning CTIS-ready tires for new tractor deliveries. The interplay between defensive aftermarket strength and revitalized OEM orders underscores balanced growth drivers across the Agricultural Tires market.

Tractors generated 56.12% of the Agricultural Tires market in 2025, cementing their centrality in daily farm tasks. Sprayers, although representing a smaller base, are forecast for 5.95% CAGR through 2031, sharpening demand for narrow-section VF tires compatible with high-clearance machinery. Combine harvesters and trailers capture residual shares yet set distinct performance benchmarks that shape tread design and carcass rigidity.

Apollo's Vredestein Traxion CropCare series grants 30% higher lateral stability for sprayers, reflecting an engineering push tailored to crop-protection equipment. Michelin's VF 900/65R46 CFO tire, boasting a 2.32 m diameter and 19 ton load rating for New Holland's CR11 harvester, mirrors a trend toward oversized, heavy-duty solutions. These innovations broaden performance envelopes and enlarge the value proposition of the Agricultural Tires market.

The Agricultural Tires Market Report is Segmented by Sales Channel (OEM and Replacement/Aftermarket), Application (Tractors, Combine Harvesters, and More), Tire Construction (Bias, Radial, and IF/VF Radial), Rim-Size (Less Than 20 Inch and More), Equipment Horse-Power Class (Less Than 30 HP and More), Inflation-Technology Compatibility, and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific held 37.41% of Agricultural Tires market share in 2025, propelled by China and India, which together delivered more than two-fifth of global equipment growth. Many provincial subsidies address labor scarcity by encouraging VF-equipped tractors that protect increasingly valuable arable land. Japan's radial-tire uptake underscores the region's technological maturity, supported by advanced R-&-D clusters and stringent sustainability standards.

South America is projected as the fastest-growing region with 6.09% CAGR between 2026 and 2031. Following a contraction in Brazil's machinery sales during 2024, policy steps such as Moderfrota coupled with Argentina's domestic manufacturing content are revitalizing demand. Strategic collaborations, exemplified by Trelleborg's tie-up with John Deere's extensive dealership grid, channel advanced low-compaction tires to small and mid-sized growers.

Europe and North America exhibit high replacement ratios. EU machinery regulations effective January 2027 will elevate compliance thresholds for digital readiness and safety, favoring CTIS and sensor-equipped tires. Ukraine reconstruction plans could spark an OEM spike as farming equipment stocks are replenished. Middle East and Africa remain under-mechanized yet display gradual uptake, notably in irrigation-dependent cereals where radial flotation tires provide clear agronomic benefits. Overall, regional heterogeneity accentuates multiple demand pockets, solidifying the growth arc of the Agricultural Tires market through 2031.

- Bridgestone Corporation

- Michelin

- Continental AG

- Balkrishna Industries Ltd (BKT)

- Titan International Inc.

- Trelleborg AB

- Yokohama Rubber Co. Ltd. (ATG)

- Nokian Tyres plc

- Apollo Tyres Ltd.

- Prometeon Tyre Group

- CEAT Ltd.

- Mitas a.s.

- Goodyear Tire & Rubber Co.

- Hankook Tire & Technology

- GRI Tires

- Maxam Tire International

- Specialty Tires of America

- Magna Tyres Group

- Petlas Tire Industry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Mechanization & Fleet Renewal In Emerging Markets

- 4.2.2 Shift From Bias To Radial / If-Vf Low-Compaction Tires

- 4.2.3 Growing Global Population & Food-Security Pressure

- 4.2.4 Surging Replacement Demand From Aging Tractor Fleet

- 4.2.5 Real-Time Tire-Pressure & Ctis Adoption Accelerating Upgrades

- 4.2.6 EU-Ukraine Reconstruction Triggering Oem Demand Spike

- 4.3 Market Restraints

- 4.3.1 Fluctuating Agricultural Commodity Prices

- 4.3.2 Natural-Rubber & Petrochemical Cost Volatility

- 4.3.3 Supplier Exits Limiting Choice & Raising Prices

- 4.3.4 Rubber-Leaf Disease Constraining Raw-Material Supply

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Sales Channel

- 5.1.1 OEM

- 5.1.2 Replacement / Aftermarket

- 5.2 By Application

- 5.2.1 Tractors

- 5.2.2 Combine Harvesters

- 5.2.3 Sprayers

- 5.2.4 Trailers

- 5.2.5 Loaders & Telehandlers

- 5.2.6 Other Implements

- 5.3 By Tire Construction

- 5.3.1 Bias

- 5.3.2 Radial

- 5.3.3 IF / VF Radial

- 5.4 By Rim-Size

- 5.4.1 Less than 20 inch

- 5.4.2 20 - 30 inch

- 5.4.3 30 - 40 inch

- 5.4.4 More than 40 inch

- 5.5 By Equipment Horse-Power Class

- 5.5.1 Less than 30 HP

- 5.5.2 30 - 70 HP

- 5.5.3 71 - 150 HP

- 5.5.4 More than 150 HP

- 5.6 By Inflation-Technology Compatibility

- 5.6.1 Standard Tires

- 5.6.2 CTIS-Ready / Smart Tires

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Australia

- 5.7.4.6 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 Turkey

- 5.7.5.4 Egypt

- 5.7.5.5 South Africa

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Bridgestone Corporation

- 6.4.2 Michelin

- 6.4.3 Continental AG

- 6.4.4 Balkrishna Industries Ltd (BKT)

- 6.4.5 Titan International Inc.

- 6.4.6 Trelleborg AB

- 6.4.7 Yokohama Rubber Co. Ltd. (ATG)

- 6.4.8 Nokian Tyres plc

- 6.4.9 Apollo Tyres Ltd.

- 6.4.10 Prometeon Tyre Group

- 6.4.11 CEAT Ltd.

- 6.4.12 Mitas a.s.

- 6.4.13 Goodyear Tire & Rubber Co.

- 6.4.14 Hankook Tire & Technology

- 6.4.15 GRI Tires

- 6.4.16 Maxam Tire International

- 6.4.17 Specialty Tires of America

- 6.4.18 Magna Tyres Group

- 6.4.19 Petlas Tire Industry

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment