|

市场调查报告书

商品编码

1934703

石材地板材料:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Stone Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

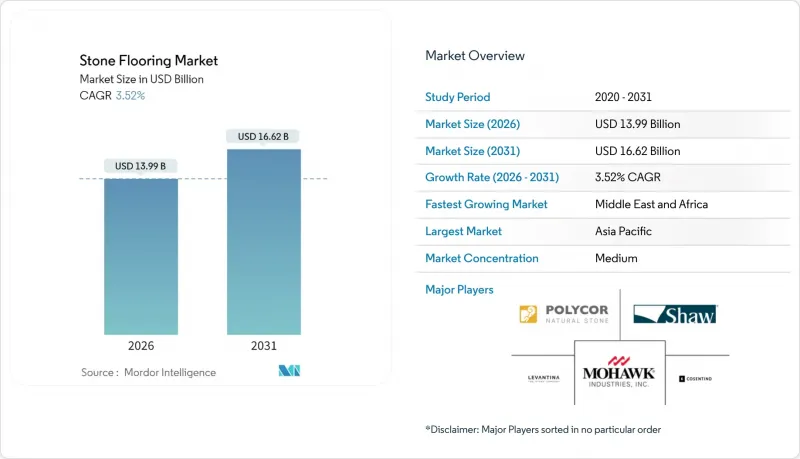

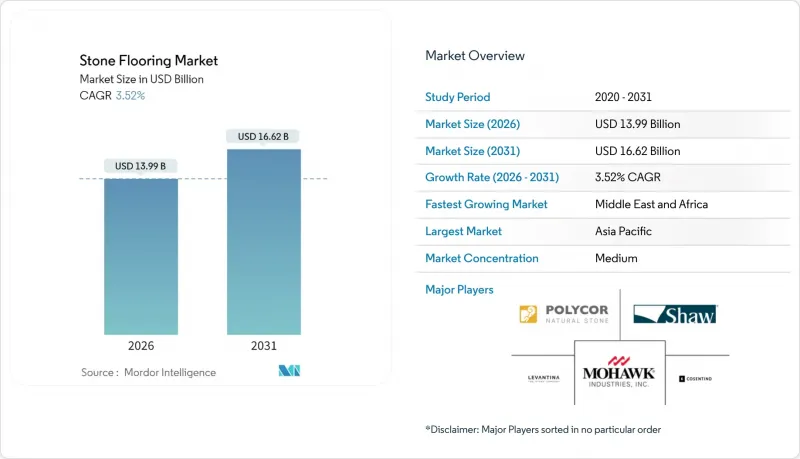

2025年石材地板材料市场价值为135.1亿美元,预计到2031年将达到166.2亿美元,而2026年为139.9亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.52%。

这一成长反映了成熟的市场环境,在这个环境中,高端定位、永续采购和技术驱动的加工方式优于大规模生产的竞争对手。供应商利用切割和表面处理工程的自动化,在满足大型板材严格公差要求的同时,持续扩大成本优势。欧洲对历史建筑维修的政策支持、全球饭店建筑需求的復苏以及美国住宅市场供不应求,共同构成了一个需求基础,从而缓衝了经济放缓的影响。然而,中国石材关税的波动、安装人员的严重短缺以及石材复合材料(SPC)地板的快速普及,都对传统的获利模式构成了挑战。儘管竞争强度仍然适中,但主要企业正在将资金重新投入到永续性、在地化生产和数数位化服务中,以捍卫市场份额并提高利润率。

全球石材地板材料市场趋势与洞察

美国二线都会区豪华住宅竣工量激增

奥斯汀、纳许维尔和夏洛特等美国二线都市区正吸引着传统上专注于沿海城市的开发商的目光。儘管奥斯汀的新建房屋交易量预计到2024年将下降40%,但全国约450万套的住宅缺口表明,长期需求仍然强劲。这些市场的建筑商倾向于选择石材地板材料作为高端饰面,以实现差异化,尤其是在开放式厨房和户外生活区等对耐用性要求极高的区域。拥有灵活物流能力的供应商可以利用投机性计划在景气衰退清理库存的机会,并在审批流程恢復后迅速扩大规模。与固守主要市场的知名品牌相比,区域性企业透过根据当地设计标准和气候条件调整产品,获得了先发优势。随着一线城市土地资源日益紧张,投资正向内陆转移,从而在更广泛的基本客群中维持石材地板材料市场的需求。

欧盟为历史建筑维修提供税收抵免

欧盟成员国正日益推出财政奖励来保护其建筑遗产,从而为符合历史还原度要求的天然石材创造了专门的需求管道。英国对受保护建筑的维修免征增值税,就是一个很好的例子,它表明法规结构如何刺激对优质石材的需求,尤其是在那些需要使用特定采石场材料和传统加工工艺的计划上。这些规定通常强制要求使用天然石材种类和传统施工方法,提高了人造石材的进入门槛,同时也支撑了人造石材相对于天然石材的溢价。遗产保护需求的复杂性有利于那些拥有悠久历史和修復技术经验的成熟石材供应商。

中国石材关税波动

预计到2025年,美国对部分中国石材征收的关税将高达145%,而对印度和欧盟石材的关税则在20%至26%之间,这将扭曲全球贸易流动。儘管莫霍克工业公司(Mohawk Industries)在美国国内拥有庞大的业务,但在2025年第一季仍报告了5,000万美元的关税成本。大规模经销商在关税减免期间进行累计,导致库存和仓储成本增加。同时,小规模进口商在价格飙升的情况下面临破产风险,加速了产业整合。如果材料成本飙升,预算固定的计划可能会因变更订单而产生纠纷。在土耳其、西班牙或美国拥有采石场的公司拥有更大的议价能力,但仍面临货柜短缺和国内运输成本上涨的问题。由于贸易谈判悬而未决,石材地板材料市场所有相关人员的交付价格和交货时间仍然难以预测。

细分市场分析

大理石凭藉其永恆的奢华感,将在2025年之前保持32.20%的石材地板材料市场份额。然而,人造复合复合材料的复合年增长率高达5.26%,明显高于石材地板材料市场的整体成长速度。花岗岩在对耐磨性要求极高的领域依然占据优势,而石灰石和洞石则深受地中海风格住宅的青睐。板岩和砂岩则占据着一个细分市场,因其防滑性和质朴的美感而备受青睐。人造石英和烧结石材产品能够以近乎零孔隙率复製天然石材的纹理,因此越来越多地应用于饭店浴室和多用户住宅厨房。低硅配方技术的进步正在降低美国多个机构所指出的职业健康风险,并缓解监管方面的阻力。随着加工厂采用自动化和封闭回路型水循环系统,生产效率不断提高,废弃物减少,从而能够在不损害利润率的情况下实现具有竞争力的价格。

人造石材的成长前景取决于持续的设计创新,以超越仿层压板。供应商将扩增实境视觉化与快速样品交付结合,在设计阶段,甚至在现场测量之前,就能影响并锁定订单。作为回应,大理石矿场正大力宣传其可追溯的产地资讯和碳足迹揭露,以证明其高价的合理性。他们也正在合作开发薄片大理石增强铝蜂窝复合材料,这种材料在重量和安装速度方面具有竞争优势。虽然从长远来看,这两种产品将共存,但随着无硅化学技术在色彩深度和边缘抛光品质方面达到与人造石材相同的水平,复合材料的市场份额转移速度将会加快。

儘管2025年住宅占石材地板材料市场57.40%的份额,但商业需求仍将领先,到2031年将以6.03%的复合年增长率成长。饭店、办公大楼大厅和高等教育机构因其提升品牌价值和经久耐用的使用寿命而选择石材。老旧医疗设施的维修着重于低孔隙率的花岗岩和石英石,以满足卫生要求。同时,持续高企的房屋抵押贷款利率和谨慎的消费者抑制了新建独栋住宅的数量,在可预见的未来将放缓住宅需求。虽然地板材料支出80%的翻新需求仍然低迷,但其潜在需求预计在利率下降后得到释放。

商业买家需要大规模的地块面积和更紧迫的交货期限,因此优先考虑拥有内部设计能力和准时交货的供应商。十年或更长时间的产品保固和售后服务合约相结合,能够带来持续的收入来源。住宅通路,尤其是DIY用户的家居装潢商店,正越来越多地转向卡扣式工程石材面板,这种面板可以最大限度地减少对专业的需求。与建筑商在设计中心展厅建立策略伙伴关係,能够让天然石材始终保持在住宅的视野中,并吸引那些原本可能选择SPC或豪华乙烯基瓷砖的消费者群体。

区域分析

亚太地区将持续维持市场主导地位,到2025年将占41.05%的市场。这主要得益于中国垂直整合的石材丛集和印度的特种花岗岩出口,而这两者都面临美国高达145%和26%的关税(参见[4])。亚太地区的人事费用优势抵销了不断上涨的运输成本,而在地化的电商平台正在开拓东南亚等新兴市场。同时,中东和非洲地区的石材地板材料市场规模预计将以4.47%的复合年增长率快速增长,这主要得益于创纪录的饭店建筑规划以及沙乌地阿拉伯政府支持的采石场许可证发放。非洲基础设施投资的增加(预计到2030年,非洲的水泥需求将从2024年的350亿美元成长到420亿美元)将进一步扩大潜在市场规模。

北美面临复杂的情况。不断上涨的房屋抵押贷款利率抑制了住宅开工,而450万套的供不应求又造成了被压抑的需求。儘管法院和学校等公共部门的维修预算仍在源源不绝地涌入,但美国的住宅维修市场却趋于谨慎。在欧洲,维修税收抵免和对碳足迹日益增长的关注促使设计师选择当地采石场的石材,从而减少运输排放。获得环境产品声明(EPD)认证的公司在竞标欧盟气候法目标时获得了优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 美国二线都会区豪华住宅竣工量激增

- 欧盟历史建筑维修税收返还计划

- 海湾合作委员会国家酒店开发计划快速扩张

- 大型标准石材板材的应用日益广泛

- 消费者偏好耐用、高品质且美观的材质。

- 切割和精加工技术的技术进步

- 市场限制

- 中国石材进口关税波动

- 熟练石材人手不足

- SPC/LVT替代品日益普及

- 限制天然石材的蕴藏量排放法规(未受到太多关注)

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察市场最新趋势与创新

- 深入了解市场近期发展动态(新产品发表、策略性倡议、投资、合作、合资、扩张、併购等)

第五章 市场规模及成长预测(金额:美元)

- 依产品类型

- 大理石

- 花岗岩

- 石灰石和洞石

- 石板

- 砂岩

- 人造/复合石材

- 最终用户

- 住宅

- 商业的

- 饭店及休閒

- 零售和购物中心

- 医疗设施

- 教育

- 总公司

- 公共设施和政府机构

- 其他商业用户

- 依建筑类型

- 新房产

- 改造/维修

- 透过分销管道

- B2C/零售消费者

- 家居建材商店

- 专业地板商店

- 在线的

- 其他分销管道

- B2B/承包商/建筑商

- B2C/零售消费者

- 按地区

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Antolini Luigi & CSpA

- Arizona Tile, LLC

- Aro Granite Industries Ltd.

- Bedrosians Tile & Stone

- Caesarstone Ltd.

- Cambria Company LLC

- Cosentino SA

- Dal-Tile Corporation

- Dimpomar

- Finstone Group

- Florim SpA

- Fox Marble Holdings plc

- Johnson Tiles

- Laticrete International, Inc.

- Levantina y Asociados de Minerales, SA

- Mohawk Industries

- MSI Surfaces

- Polycor Inc.

- Porcelanosa Grupo

- RED Graniti SpA

- Shaw Industries

- Santucci Group

- Temmer

- Topalidis

- Universal Marble & Granite Group

第七章 市场机会与未来展望

The stone flooring market was valued at USD 13.51 billion in 2025 and estimated to grow from USD 13.99 billion in 2026 to reach USD 16.62 billion by 2031, at a CAGR of 3.52% during the forecast period (2026-2031).

Growth reflects a maturing landscape in which premium positioning, sustainable sourcing, and technology-enabled fabrication outweigh volume-driven competition. Suppliers that leverage automation in cutting and finishing operations are widening cost advantages while meeting stricter tolerance requirements for large-format panels. Policy incentives for heritage renovation in Europe, a resurgent global hotel pipeline, and an under-supplied United States housing market together form a demand backbone that cushions cyclical slowdowns. However, tariff volatility on Chinese dimensional stone, an acute installer labor shortage, and fast-rising adoption of stone-plastic-composite (SPC) flooring challenge traditional revenue models. Competitive intensity remains moderate; leading firms are reallocating capital toward sustainability, regional production, and digitally enabled services to defend share and lift margins.

Global Stone Flooring Market Trends and Insights

Surging Luxury Housing Completions in Tier-2 United States Metros

Secondary United States metros such as Austin, Nashville, and Charlotte are attracting developers that once focused on coastal cities. Even after a 40% dip in Austin's new-build transactions during 2024, the national housing shortage of about 4.5 million units points to resilient long-run demand. Builders in these markets favor stone flooring for upscale finishes that differentiate their offerings, particularly in open-plan kitchens and outdoor living areas where durability matters. Suppliers with flexible logistics can capture margin when speculative projects liquidate inventory during down cycles, then scale up rapidly when permits rebound. Regional players gain first-mover advantages by tailoring assortments to local design codes and climate demands while larger brands remain fixated on primary markets. As land constraints tighten in Tier-1 cities, investment migrates inland, sustaining the stone flooring market across a broader customer base.

Tax-Rebate Programs for Historic-Building Renovations in EU

European Union member states increasingly deploy fiscal incentives to preserve architectural heritage, creating specialized demand channels for authentic stone materials that comply with historical accuracy requirements. The zero VAT rate applicable to approved alterations of protected buildings in the UK exemplifies how regulatory frameworks can stimulate premium stone demand, particularly for projects requiring specific quarry sources or traditional finishing techniques. These programs often mandate the use of original stone types and traditional installation methods, creating barriers to entry for engineered alternatives while supporting premium pricing for authentic materials. The complexity of heritage compliance requirements favors established stone suppliers with documented provenance and technical expertise in historical restoration techniques.

Volatile Import Tariffs on Chinese Dimensional Stone

United States tariffs on some Chinese stone grades escalated to 145% in 2025, while duties on Indian and EU stone range between 20% and 26%, distorting global trade flows. Mohawk Industries cited USD 50 million in tariff costs for Q1 2025 despite its sizable domestic footprint. Large distributors pre-buy during tariff lulls, lifting inventories and warehousing costs, whereas smaller importers risk bankruptcy amid price spikes, accelerating consolidation. Projects with locked construction budgets face change-order disputes when material costs surge. Companies that own quarries in Turkey, Spain, or inside the United States have more bargaining power, but they still face a shortage of shipping containers and higher domestic transport costs. Because trade negotiations are still unsettled, delivered prices and delivery schedules remain unpredictable for everyone in the stone flooring market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Hotel Pipeline Expansion Across GCC States

- Rising Adoption of Large-Format Gauged Stone Panels

- Labor Shortages in Qualified Stone Installers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Marble retained 32.20% of stone flooring market share in 2025 on the back of its timeless luxury appeal, yet engineered composites are accelerating at a 5.26% CAGR, notably above the stone flooring market growth trajectory. Granite stays resilient where foot-traffic durability is paramount, while limestone and travertine appeal to Mediterranean-inspired residences. Slate and sandstone remain niche, valued for slip resistance and rustic aesthetics. Engineered quartz and sintered-stone products replicate veining with near-zero porosity, winning specification in hospitality bathrooms and multifamily kitchens. Advances in low-silica formulations reduce occupational health risks flagged by several United States agencies, easing regulatory headwinds. As fabrication plants integrate automation and closed-loop water recycling, production yields rise and waste declines, allowing competitive pricing without compromising margins.

Growth prospects for engineered stone hinge on continuous design innovation that stays ahead of counterfeit laminates. Suppliers coupling augmented-reality visualization with speedy sample fulfillment influence early design decisions, locking in orders before site measurement. Marble quarries, in response, promote traceable origin stories and carbon-footprint disclosures to justify premium pricing. They also co-develop hybrid assemblies-thin-cut marble reinforced with aluminum honeycomb-to compete on weight and installation speed. Long term, the two categories will coexist, but share shifts toward composites will intensify if silica-free chemistries achieve parity in color depth and edge polish quality.

Residential buyers represented 57.40% of the stone flooring market size in 2025, yet commercial demand is pacing ahead at a 6.03% CAGR through 2031. Hotels, office lobbies, and higher-education facilities specify natural stone for brand elevation and lifecycle durability. Renovations across aging healthcare campuses underscore hygiene imperatives met by low-porosity granite and quartz. Conversely, high mortgage rates and consumer caution curb new single-family starts, muting near-term residential volume. Remodeling, which accounts for 80% of flooring spend, remains subdued but stores latent demand that should unlock once interest rates soften.

Commercial buyers offer larger lot sizes and tighter schedule adherence, favoring suppliers with in-house drafting and just-in-time delivery. Product warranties exceeding 10 years, coupled with service contracts, open annuity revenue streams. Residential channels, especially DIY-oriented home centers, pivot toward click-together engineered stone panels that minimize professional labor needs. Strategic partnerships with builders for design-center displays keep natural stone visible to homebuyers who might otherwise default to SPC or luxury vinyl tile.

The Stone Flooring Market Report is Segmented by Product Type (Marble, Granite, Slate, Sandstone, and More), End User (Residential, Commercial), Construction Type (New Construction, Remodeling/Retrofit), Distribution Channel (B2C/Retail Consumers, B2B/Contractors/Builders), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific preserved a commanding 41.05% share in 2025, buoyed by China's vertically integrated stone cluster and India's specialty granite exports, though both contend with United States tariffs of up to 145% and 26% respectively. [4]. Regional labor-cost advantages offset shipping premiums, and localized e-commerce portals are opening emerging Southeast Asian markets. Meanwhile, the stone flooring market size for the Middle East and Africa is forecast to rise fastest at 4.47% CAGR, underpinned by a record hotel construction pipeline and government-backed quarry licensing in Saudi Arabia. African infrastructure outlays, evidenced by cement demand climbing from USD 35.0 billion in 2024 to USD 42.0 billion by 2030, further expand addressable volumes.

North America faces mixed conditions: elevated mortgage rates dampen housing starts, but pent-up demand remains due to a 4.5 million-unit shortage. The United States remodel sector turns cautious, yet public-sector renovation budgets continue flowing into courthouses and schools. Europe benefits from renovation tax rebates and growing carbon-footprint scrutiny that nudges specifiers toward locally quarried stone, reducing transport emissions. Firms that certify Environmental Product Declarations gain an edge in tenders bound by EU Climate Law targets.

- Antolini Luigi & C. S.p.A.

- Arizona Tile, LLC

- Aro Granite Industries Ltd.

- Bedrosians Tile & Stone

- Caesarstone Ltd.

- Cambria Company LLC

- Cosentino S.A.

- Dal-Tile Corporation

- Dimpomar

- Finstone Group

- Florim S.p.A.

- Fox Marble Holdings plc

- Johnson Tiles

- Laticrete International, Inc.

- Levantina y Asociados de Minerales, S.A.

- Mohawk Industries

- MSI Surfaces

- Polycor Inc.

- Porcelanosa Grupo

- R.E.D. Graniti S.p.A.

- Shaw Industries

- Santucci Group

- Temmer

- Topalidis

- Universal Marble & Granite Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging luxury-housing completions in Tier-2 United States metros

- 4.2.2 Tax-rebate programs for historic-building renovations in EU

- 4.2.3 Rapid hotel pipeline expansion across GCC states

- 4.2.4 Rising adoption of large-format gauged stone panels

- 4.2.5 Consumer Preference for Durable and Premium Aesthetic Materials

- 4.2.6 Technological Advancements in Cutting and Finishing Techniques

- 4.3 Market Restraints

- 4.3.1 Volatile import tariffs on Chinese dimensional stone

- 4.3.2 Labor shortages in qualified stone installers

- 4.3.3 Increasing popularity of SPC/LVT alternatives

- 4.3.4 Embodied-carbon regulations restricting natural stone (under-the-radar)

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Marble

- 5.1.2 Granite

- 5.1.3 Limestone and Travertine

- 5.1.4 Slate

- 5.1.5 Sandstone

- 5.1.6 Engineered/Composite Stone

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.2.1 Hospitality and Leisure

- 5.2.2.2 Retail and Shopping Centers

- 5.2.2.3 Healthcare Facilities

- 5.2.2.4 Education

- 5.2.2.5 Corporate Offices

- 5.2.2.6 Public and Government Buildings

- 5.2.2.7 Other Commercial Users

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Remodeling/Retrofit

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail Consumers

- 5.4.1.1 Home Centers

- 5.4.1.2 Specialty Flooring Stores

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Contractors/Builders

- 5.4.1 B2C/Retail Consumers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX

- 5.5.3.7 NORDICS

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Antolini Luigi & C. S.p.A.

- 6.4.2 Arizona Tile, LLC

- 6.4.3 Aro Granite Industries Ltd.

- 6.4.4 Bedrosians Tile & Stone

- 6.4.5 Caesarstone Ltd.

- 6.4.6 Cambria Company LLC

- 6.4.7 Cosentino S.A.

- 6.4.8 Dal-Tile Corporation

- 6.4.9 Dimpomar

- 6.4.10 Finstone Group

- 6.4.11 Florim S.p.A.

- 6.4.12 Fox Marble Holdings plc

- 6.4.13 Johnson Tiles

- 6.4.14 Laticrete International, Inc.

- 6.4.15 Levantina y Asociados de Minerales, S.A.

- 6.4.16 Mohawk Industries

- 6.4.17 MSI Surfaces

- 6.4.18 Polycor Inc.

- 6.4.19 Porcelanosa Grupo

- 6.4.20 R.E.D. Graniti S.p.A.

- 6.4.21 Shaw Industries

- 6.4.22 Santucci Group

- 6.4.23 Temmer

- 6.4.24 Topalidis

- 6.4.25 Universal Marble & Granite Group

7 Market Opportunities and Future Outlook

- 7.1 Shift Toward Sustainable and Recycled Stone Materials

- 7.2 Adoption of Advanced Surface Treatments and Finishes