|

市场调查报告书

商品编码

1435899

稀释剂:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Viscosity Reducing Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

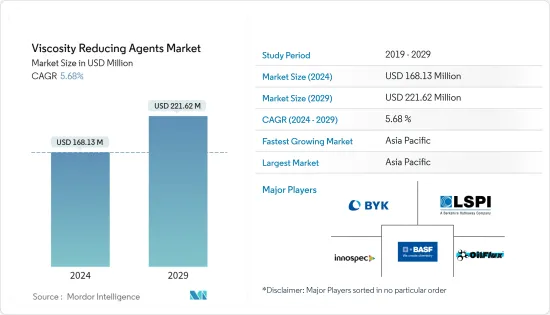

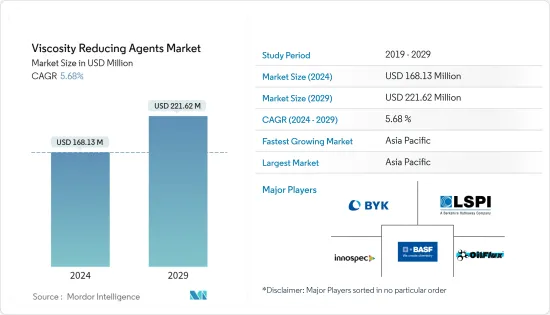

稀释剂市场规模预计到 2024 年为 1.6813 亿美元,预计到 2029 年将达到 2.2162 亿美元,预测期内(2024-2029 年)复合年增长率为 5.68%。

石油和天然气行业需求的增加以及其他驱动力正在推动市场。另一方面,严格的环境法规和冠状病毒感染疾病(COVID-19)爆发带来的不利条件正在阻碍市场成长。

主要亮点

- 由于石油和天然气行业需求的增加,预计在预测期内,薄板市场将成长

- 亚太地区将主导全球市场,其中中国和印度等国家的消费量最大

稀释剂市场趋势

石油和天然气产业需求不断成长

- 稀释剂广泛应用于石油和天然气行业,预计在预测期内将快速成长。

- 降黏剂在石油和天然气工业中通常被称为减阻剂,可以减少原油运输和加工过程中管道的湍流,减少摩擦能量损失并改善流动。

- 此外,这些是长链碳氢化合物,可以降低相同流量的压力降,从而使用相同的能量增加管道流量。

- 稀释剂有助于原油产品、最终产品、沥青原油、水性系统和多相繫统的自由流动。全球石油和其他石油基液体从2018年的9997万桶/日增加到2019年的10075万桶/日,预计在预测期内每年增加约2.847亿桶。

- 然而,由于COVID-19感染疾病造成的前所未有的情况,各国封锁和暂停旅行、旅游、电子商务和其他活动,导致石油和天然气消耗量每天减少至少500万桶。减少。餐厅可能会影响 2020 年的支出。

- 都市化的不断加快和对石油产品需求的增加预计将在预测期内推动稀释剂市场的发展。

亚太地区主导市场

- 由于中国和印度等国家的需求不断增加,预计亚太地区将在预测期内主导稀释剂市场。

- 印度和中国等国家原油消费量的增加预计将在预测期内推动市场。从全球来看,印度是仅次于中国和美国的第二大原油和石油产品消费国,拥有仅次于中国的亚洲第二大炼油厂数量。 2019年印度石油进口额约1,120亿美元,较2018财年成长27%。运输部门的消费量成长以及住宅和商业机构的液化石油气消费预计将推动市场。

- 中国的原油消费量从2018年的约1,350万桶/日增加到2019年的1,450万桶/日。除此之外,2019年中国炼油产能每天增加100万桶。中国消费量的增加预计将推动市场。

- 在油漆和涂料中,分散剂使固体溶,从而降低分散体的黏度并增加分散粉末材料的负载量。分散阶段是能耗最高的阶段,分散剂有助于提高稳定性并优化能耗。不断增长的油漆和涂料预计将推动市场发展。

- 上述因素加上政府的支持,导致预测期内亚太地区稀释剂市场的需求增加。

稀释剂产业概况

全球稀释剂市场部分分散,参与者只占市场一小部分。少数公司包括 BYK-CHEMIE GMBH、LiquidPower Specialty Products Inc.、Innospec、Oil Flux 和BASF SE。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 石油和天然气产业需求不断成长

- 其他司机

- 抑制因素

- 严格的环境法规

- 由于COVID-19感染疾病的爆发,情况不利

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场区隔

- 类型

- 减阻剂

- 表面活性剂和添加剂

- 分散剂

- 其他的

- 最终用户产业

- 石油天然气

- 油漆和涂料

- 塑胶

- 其他製造业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、合作与协议

- 市场占有率分析

- 主要企业采取的策略

- 公司简介

- Alberta Treating Chemicals LTD.

- ARKEMA Group

- Baker Hughes Company

- BASF SE

- BYK-CHEMIE GMBH

- CHINAFLOC

- Ecolab

- Innospec

- LiquidPower Specialty Products Inc.

- NuGenTecx

- Oil Flux

- Qflo

- The Lubrizol Corporation

第七章市场机会与未来趋势

- 新兴国家的需求不断增加

The Viscosity Reducing Agents Market size is estimated at USD 168.13 million in 2024, and is expected to reach USD 221.62 million by 2029, growing at a CAGR of 5.68% during the forecast period (2024-2029).

Growing demand from the oil & gas industry along with other drives are driving the market. On the flip side, stringent environmental regulations coupled with unfavorable conditions arising due to the COVID-19 outbreak are hindering the market growth.

Key Highlights

- The Viscosity Reducing Agents market is expected to grow during the forecast period owing to the growing demand from the oil & gas industry.

- Asia-Pacific region to dominate the market across the globe with the largest consumption from countries such as China and India.

Viscosity Reducing Agents Market Trends

Growing Demand from the Oil & Gas Industry

- Viscosity reducing agents are widely used in oil & gas industries and is expected to grow rapidly during the forecast period.

- Viscosity reducing agents are often referred to as drag reducing agents in oil & gas industries, they improve the flow by reducing the frictional energy losses by decreasing the turbulence in the pipeline during crude oil transportation, and processing.

- Moreover, they are long-chain hydrocarbons that decrease the pressure drop for the same flow rate and thereby increase the pipeline flow using the same amount of energy.

- Viscosity reducing agents help in the free-flowing of crude oil products, finished products, asphalt-crude, aqueous systems, and multiphase systems. The global petroleum and other petroleum-based liquids are at 100.75 million barrels per day in 2019 from 99.97 million barrels per day in 2018, which shows an increase of about 284.7 million barrels per year and is expected to grow during the forecast period.

- However, due to unprecedented conditions arisen due to the COVID-19 outbreak the consumption of oil & gas will be down by at least 5 million barrels per day due to lockdown in various countries and shut down of travel, tourism, e-commerce, and restaurants are likely to affect the consumption in 2020.

- The growing urbanization and increasing demand for petroleum-based products are expected to drive the market for the viscosity reducing agents during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for viscosity reducing agents during the forecast period due to an increase in demand from countries like China and India.

- The growing crude-oil consumption in countries like India and China is expected to drive the market during the forecast period. Globally, India is the third-largest consumer of crude oil and petroleum products after China and the United States, with the second-largest refinery in Asia after China. The Indian petroleum import value is about USD 112 billion in 2019 with a 27% growth from the financial year 2018. The growing consumption from the transportation sector, and liquified petroleum gas from residential and commercial complexes are expected to drive the market.

- In China, crude oil consumption is at 14.5 million barrels per day in 2019 from about 13.5 million barrels per day in 2018. In addition to that, China's refinery capacity is increased by 1 million barrels per day in 2019. The growing consumption in China is expected to drive the market.

- In paints & coatings, the dispersing agents deflocculates solids, thereby reducing the viscosity of dispersion and increasing the loading of dispersed powder material. The dispersing phase is the most energy consuming stage and dispersing agents help in increasing stability and optimize energy consumption. The growing paints and coatings are expected to drive the market.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for viscosity reducing agents market in the Asia-Pacific during the forecast period.

Viscosity Reducing Agents Industry Overview

The global viscosity reducing agents market is partially fragmented with players accounting for a marginal share of the market. Few companies include BYK-CHEMIE GMBH, LiquidPower Specialty Products Inc., Innospec, Oil Flux, and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand From the Oil & Gas Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Unfavourable Conditions Arising Due to the COVID-19 Outbreak

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Drag Reducing Agents

- 5.1.2 Surfactants & Additives

- 5.1.3 Dispersing Agents

- 5.1.4 Others

- 5.2 End-user Industry

- 5.2.1 Oil & Gas

- 5.2.2 Paints & Coatings

- 5.2.3 Plastics

- 5.2.4 Other Manufacturing Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alberta Treating Chemicals LTD.

- 6.4.2 ARKEMA Group

- 6.4.3 Baker Hughes Company

- 6.4.4 BASF SE

- 6.4.5 BYK-CHEMIE GMBH

- 6.4.6 CHINAFLOC

- 6.4.7 Ecolab

- 6.4.8 Innospec

- 6.4.9 LiquidPower Specialty Products Inc.

- 6.4.10 NuGenTecx

- 6.4.11 Oil Flux

- 6.4.12 Qflo

- 6.4.13 The Lubrizol Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand Due from Emerging Economies