|

市场调查报告书

商品编码

1388504

生成式人工智慧席捲电信产业:网路优化和差异化客户体验是一个有希望的起点,但监管不确定性是主要障碍Gen AI Hype Grips Telecom Industry as Telcos Unravel its Potential: Network Optimization and Differentiated Customer Experience are Promising Starting Points, but Regulatory Uncertainty Will Be a Major Impediment |

|||||||

在本报告中,我们将考虑生成式人工智慧在两类电信领域进行转型的可能性,以及电信公司内部开发生成式人工智慧的努力、与引入生成式人工智慧相关的劳动力趋势,以及我们研究了电信公司实施生成式人工智慧的监管影响,以及供应商在确保成功的技术整合和实施方面的作用。

自从去年底生成式人工智慧透过公共平台(如ChatGPT)进入主流以来,其突破性的能力引起了许多人的关注。 毫不奇怪,电信业高层是渴望尝试生成式人工智慧的好奇观察者之一,儘管它仍在快速发展。 然而,电信业与人工智慧之间的联繫并不新鲜。 儘管许多电信公司在过去几年中部署了传统的人工智慧工具和应用程序,但生成式人工智慧为电信公司提供了一个创造远远超过现有人工智慧的价值的机会。 几家主要电信公司已经开始探索生成式人工智慧,并专注于 "在地化" 。 透过使用生成式人工智慧进行流程在地化,电信公司旨在消除语言障碍并提高客户参与度,特别是在英语口语不占主导地位的各自销售市场中。

虽然电信公司可以在各种不同的功能中利用生成式人工智慧的力量,但网路和客户服务可能会看到生成式人工智慧变革潜力的两个关键电信业务领域。 这两个领域都至关重要,随着复杂性的增加,网路需求以前所未有的速度成长,提供差异化的客户体验仍然是电信公司无法实现的目标。 这两个电信业务领域正在出现一些生成式人工智慧的用例来应对这些挑战。 在网路领域,范例包括拓扑最佳化、网路容量规划和预测性维护。 在客户支援领域,这些包括本地化的虚拟助理、个人化支援和联络中心文件。

利用生成式人工智慧应用程式的大多数用例都涉及处理敏感数据,无论是与网路相关还是与客户相关。 从监管角度来看,这也具有重大影响,监管问题限制了电信公司的生成式人工智慧采用和部署策略。 一个主要挑战是不同市场中普遍存在的复杂而严格的法规,电信公司在这些市场中实施生成式人工智慧用例时必须了解并遵守这些法规。 在这个领域,第三方供应商希望透过提供符合各自市场法规的生成式人工智慧解决方案来受益。 供应商还透过消除缺乏技术专业知识、硬体/软体资源和熟练人员的限制,并透过减轻营运支出成本的负担,帮助中小型电信公司实施生成式人工智慧,似乎发挥了作用。 生成式 AI 领域值得关注的主要供应商提供了训练大规模语言模型 (LLM) 所需的云端运算资源与透过预训练模型提供的生成式 AI 专业知识的理想组合。

文中提到的公司

|

|

目录

- 摘要

- 电信公司乘着生成式人工智慧浪潮

- 网路营运和客户支援将成为转型的关键领域

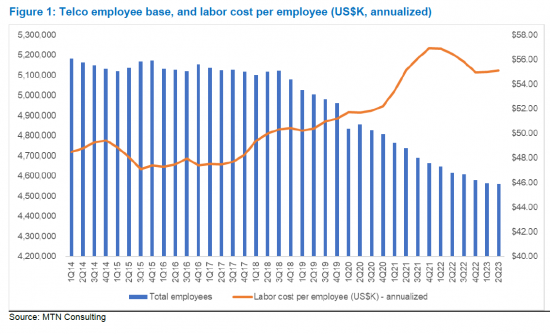

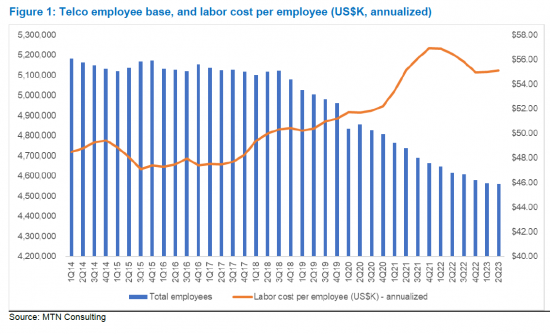

- 在生成式人工智慧时代,电信员工将变得更精简、更聪明

- 严格的监管对电信公司构成重大障碍

- 生成式人工智慧整合的主要供应商:网路规模供应商旨在进一步使电信公司受益

- 锁定风险和增加的软体成本:选择供应商时的关键考虑因素

- 附录

This brief report explores the transformative potential of generative artificial intelligence (Gen AI) in two specific telco domains. The report also discusses the in-house Gen AI development efforts of telcos, workforce trends arising from Gen AI implementation, regulatory impact of telcos deploying Gen AI, and the role of vendors in successful integration and adoption of the technology.

VISUALS

Ever since Gen AI burst into the mainstream through public-facing platforms (e.g. ChatGPT) late last year, its groundbreaking capabilities have caught the attention of many. Not surprisingly, telecom industry execs are among the curious observers wanting to try Gen AI even as it continues to evolve at a rapid pace. The telecom industry's bond with AI is not new though. Many telcos have deployed conventional AI tools and applications in the past several years, but Gen AI presents opportunities for telcos to deliver significant incremental value over existing AI. A few large telcos have kickstarted their quest for Gen AI by focusing on "localization". Through localization of processes using Gen AI, telcos vow to eliminate language barriers and improve customer engagement in their respective operating markets, especially where English as a spoken language is not dominant.

Telcos can harness the power of Gen AI across a wide range of different functions, but the two vital telco domains likely to witness transformative potential of Gen AI are networks and customer service. Both these domains are crucial: network demands are rising at an unprecedented pace with increased complexity, and delivering differentiated customer experiences remains an unrealized ambition for telcos. Several Gen AI use cases are emerging within these two telco domains to address these challenges. In the network domain, these include topology optimization, network capacity planning, and predictive maintenance, for example. In the customer support domain, they include localized virtual assistants, personalized support, and contact center documentation.

Most of the use cases leveraging Gen AI applications involve dealing with sensitive data, be it network-related or customer-related. This will have major implications from the regulatory point of view, and regulatory concerns will constrain telcos' Gen AI adoption and deployment strategies. The big challenge is the mosaic of complex and strict regulations prevalent in different markets that telcos will have to understand and adhere to when implementing Gen AI use cases in such markets. This is an area where third-party vendors will try to cash in by offering Gen AI solutions that are compliant with regulations in the respective markets. Vendors will also play a key role for small- and medium-sized telcos in Gen AI implementation, by eliminating constraints due to the lack of technical expertise and HW/SW resources, skilled manpower, along with opex costs burden. Key vendors to watch out for in the Gen AI space are webscale providers who possess the ideal combination of providing cloud computing resources required to train large language models (LLM) coupled with their Gen AI expertise offered through pre-trained models.

Companies Mentioned:

|

|

Table of Contents

- Summary

- Telcos surf the Gen AI wave

- Network operations and customer support will be key transformative areas

- Telco workforce will become leaner but smarter in the Gen AI era

- Strict regulations will be a major barrier for telcos

- Vendors key to Gen AI integration; webscale providers set for more telco gains

- Lock-in risks and rising software costs are key considerations in choosing vendors

- Appendix

Figures:

- Figure 1: Telco employee base, and labor cost per employee (US$K, annualized)

Tables:

- Table 1: Self-developed Gen AI-based tools of select telcos

- Table 2: Gen AI-based tools of select telco vendors