|

市场调查报告书

商品编码

1407723

电信业主要厂商(2023年第三季版):支出疲软,电信网路基础设施收入下降,儘管美国监管,Huawei仍保持领先;两家云端供应商进入前20名Telecom's Biggest Vendors - 3Q23 Edition: Telco NI Revenues Collapse in 3Q23 Amid Spending Slump, Huawei Leads Despite US Curbs, Two Cloud Providers in Top 20 |

||||||

本报告基于对134家顶级电信厂商的追踪调查,分析了全球主要电信厂商对电信网路基础设施(Telco NI)的投资趋势和前景。我们调查了每家电信厂商的收入金额和市场份额公司(3个季度),按公司类型和地区划分的详细趋势,以及主要公司的概况和业务发展状况。

分析概述:

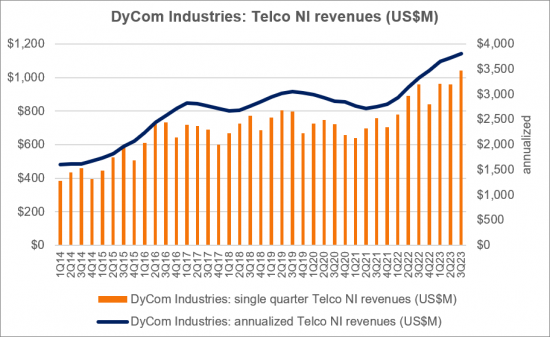

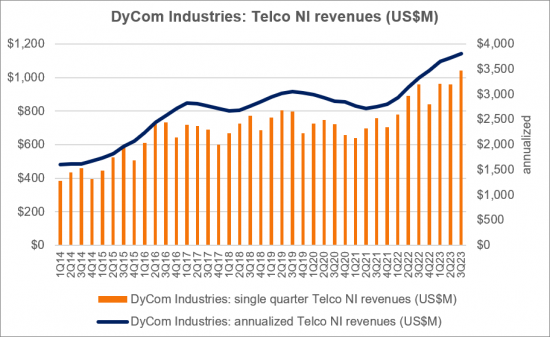

营收: 2023 年第三季度,电信网路基础设施(Telco NI) 供应商营收将达到492 亿美元(年减14.2%),即每年2,178 亿美元(下降7.6% ) 。 不包括Huawei在内的整个市场最近一个季度下降了13.4%,按年化计算年减了6.4%。

顶级供应商:通讯网路基础设施排名前三的供应商仍然是Huawei□Ericsson□Nokia。 以年计算,这些供应商占整个市场的 37.4%,仅 2023 年第三季就占 35.5%。 自2019年初以来,ZTE和China Comservice一直在争夺第四和第五名。

主要供应商的收入成长率(同比):排名前五的供应商中的三个- Alphabet、Microsoft和Tejas Networks - 报告了截至2023 年第三季的收入成长率(同比)。(比较与去年同期相比)季度率和年化率均相同。

支出展望:根据最新官方预测,作为电信网路基础设施市场主要驱动力的营运商资本支出将在2023年降至3130亿美元,并在2024年降至3130亿美元我们预计到 2020 年这一数字将进一步下降至 3,090 亿美元。 同时,预计2025年资本投资将进一步小幅下降,然后在2028年再次小幅上升,达到3,310亿美元。 全球营运商资本密集度平均将从2022年的18.4%增加到2028年的17.1%。

待分析公司

|

|

目录

第一章分析概论

第2章总结:分析结果说明

第三章电信业者NI市场:最新结果

第 4 章前 25 名供应商:可列印的剪纸

第 5 章图表:各供应商公司概论

第6章图表:5家供应商的比较

第 7 章研发成本:依供应商划分

第8章原始资料:利润金额估算(按公司)

第九章研究方法与前提

第 10 章 MTN 咨询:概述

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 134 Telco NI vendors, providing revenue and market share estimates for the 1Q13-3Q23 period. Of these 134 vendors, 110 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

Revenues: Telco NI vendor revenues were $49.2B in 3Q23 and $217.8B for the annualized 3Q23 period overall, down 14.2% and 7.6% on a YoY basis, respectively. Excluding Huawei, the total market declined by 13.4% in the latest single quarter and by 6.4% in annualized 3Q23 on a YoY baisis.

Top vendors: The top three Telco NI vendors continue to be the usual trio: Huawei, Ericsson, and Nokia. They account for 37.4% of the total market in annualized 3Q23, or 35.5% in 3Q23 alone. ZTE and China Comservice have been jostling for the 4th and 5th positions since early 2019.

Key vendors by YoY revenue growth: Three out of the top five vendors are common, in terms of YoY revenue growth, for both single quarter and annualized 3Q23: Alphabet, Microsoft, and Tejas Networks.

Spending outlook: Per our latest official forecast, we expect telco capex - the main driver of the Telco NI market - to dip to $313B in 2023, and decline a bit more to $309B in 2024. Capex will decline slightly further in 2025, though, and then rise modestly again to reach $331B in 2028. Global telco capital intensity will average out to 17.1% in 2028, from 18.4% in 2022.

COVERAGE:

|

|

Table of Contents

1. Report Highlights

2. SUMMARY - Results commentary

3. Telco NI Market - Latest Results

4. TOP 25 VENDORS - Printable tearsheets

5. CHARTS - Single vendor snapshot

6. CHARTS - 5 vendor comparisons

7. R&D spending by vendors

8. RAW DATA - revenue estimates by company

9. Methodology & Assumptions

10. ABOUT - MTN Consulting

FIGURES (Partial list):

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 3Q23 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 3Q23 ($B)

- Top 25 vendors based on Telco NI revenues in 3Q23 ($B)

- Key vendors' annualized share of Telco NI market

- Telco NI market share changes, 3Q23 TTM vs. 3Q22 TTM

- Telco NI annualized revenue changes, 3Q23 vs. 3Q22

- YoY growth in Telco NI revenues (3Q23)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 2Q23 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 3Q23 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (3Q21-3Q23)