|

市场调查报告书

商品编码

1568994

最大电信厂商(2024年第2季版):随着华为的復苏,厂商市场降幅温和,为3.4%-对下半年成长持谨慎态度Telecom's Biggest Vendors - 2Q24 edition: Vendor Market Decline Moderates to 3.4% in 2Q24 as Huawei's Recovery Gains Momentum, Cautious Optimism for 2H24 Growth |

||||||

本报告系列的目的是让电信业决策者全面了解每个产业的支出趋势和供应商市场力量。因此,我们评估了电信业各种公司类型和技术领域的技术供应商的收入。这个市场被称为通讯网路基础设施,这项研究追踪了 134 家通讯网路基础设施供应商,并估计了他们从 2013 年第一季到 2024 年第二季的收入和市场占有率。

视觉

本报告的主要亮点:

- 营收:2024 年第二季度,电信网路基础设施供应商的收入总计为 533 亿美元,年化收入为 2057 亿美元,年比分别下降 3.4% 和 8.9%。华为提振市场:剔除华为后,整体市场最近一个季度年减7.3%,年化下降11.2%。华为经历了一系列疲软的季度,但在过去三个季度似乎已经出现转机。

- 主要供应商:前三名的电信网路基础设施供应商通常是华为、爱立信和诺基亚三巨头。以年化计算,这些占 2024 年第二季总数的 37.7%,单期占 40.3%。自2019年初以来,中国通讯服务和中兴通讯一直在争夺第四名和第五名。

- 主要供应商年收入成长:按季度和年度收入同比增长排名前三的供应商是 Tejas Networks、Broadcom 和 Alphabet。

- 支出预测:我们最新的官方预测要求营运商资本支出(电信网路基础设施市场的主要驱动力)将从2023 年的3,150 亿美元增长到2,950 亿美元至3,050 亿美元。预计未来几年资本投资将再次回升,2028年将达到3,310亿美元。

调查范围

|

|

目录

第1章 报告亮点

第2章 摘要:结果的说明

第3章 通讯网路基础设施市场:最新的结果

第4章 首位25供应商:印刷可能的层级薄板

第5章 表(图表):个别供应商的概述

第6章 表(图表):供应商5公司的比较

第7章 R&D费:各供应商

第8章 原始数据- 各企业的收益预测

第9章 调查手法·前提

第10章 关于MTN Consulting

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 134 Telco NI vendors, providing revenue and market share estimates for the 1Q13-2Q24 period. Of these 134 vendors, 108 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

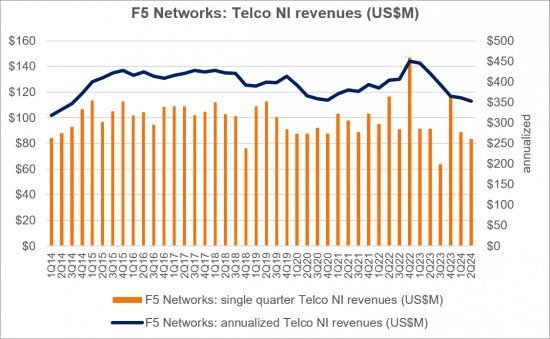

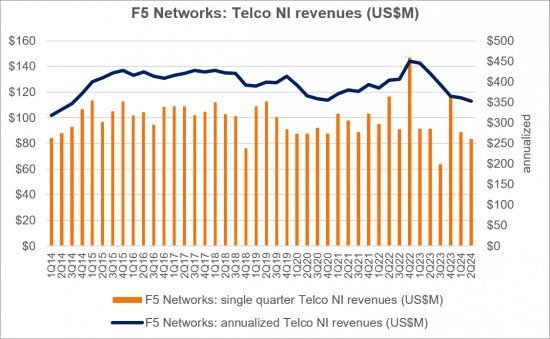

- Revenues: Telco NI vendor revenues were $53.3B in 2Q24 and $205.7B for the annualized 2Q24 period overall, down 3.4% and 8.9% on a YoY basis, respectively. Huawei lifted the market: excluding Huawei, the total market declined by 7.3% in the latest single quarter and by 11.2% in annualized 2Q24 on a YoY basis. After many disappointing quarters, Huawei appears to have turned a corner in the latest three quarters.

- Top vendors: The top three Telco NI vendors remain the usual trio: Huawei, Ericsson, and Nokia. They account for 37.7% of the total market in annualized 2Q24, or 40.3% in 2Q24 alone. China Comservice and ZTE have been jostling for the 4th and 5th positions since early 2019.

- Key vendors by YoY revenue growth: The top three vendors, in terms of YoY revenue growth, are common to both single quarter and annualized 2Q24: Tejas Networks, Broadcom, and Alphabet. Respectively, their jumps were due to BSNL's 4G rollout in India (Tejas), acquisition of VMWare in Nov 2023 (Broadcom), and improved penetration of the telecom vertical with cloud services (Alphabet).

- Spending outlook: Per our latest official forecast, we expect telco capex -the main driver of the Telco NI market -to dip from $315B in 2023 to between $295B-$305B. Capex will start to rise again in a couple of years, reaching $331B in 2028. The spending outlook for the US market is appealing in the short-term due to government funding (BEAD and RDOF).

COVERAGE:

|

|

Table of Contents

1. Report Highlights

2. SUMMARY - Results commentary

3. Telco NI Market - Latest Results

4. TOP 25 VENDORS - Printable tearsheets

5. CHARTS - Single vendor snapshot

6. CHARTS - 5 vendor comparisons

7. R&D spending by vendors

8. RAW DATA - revenue estimates by company

9. Methodology & Assumptions

10. ABOUT - MTN Consulting

FIGURES(Partial list):

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 2Q24 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 2Q24 ($B)

- Top 25 vendors based on Telco NI revenues in 2Q24 ($B)

- Key vendors' annualized share of Telco NI market

- Telco NI market share changes, 2Q24 TTM vs. 2Q23 TTM

- Telco NI annualized revenue changes, 2Q24 vs. 2Q23

- YoY growth in Telco NI revenues (2Q24)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 2Q24 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 2Q24 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (2Q22-2Q24)