|

市场调查报告书

商品编码

1562736

儘管缺乏收入机会和法律挑战,生成式人工智慧席捲了世界:资料中心淘金热会结束吗?这股热情将走向何方?资料中心需求将会发生什么变化?Will the Data Center Gold Rush Come to an End? Generative AI has Taken the World by Storm, despite the Lack of Proven Revenue Opportunities and Huge Legal Challenges, Where Does the Hype Head Next, and What Happens to Data Center Demand? |

|||||||

本报告为我们的资本支出预测提供了支援数据,重点关注资料中心需求以及生成式人工智慧在刺激投资增加方面的作用,特别是在网路规模领域。

视觉

生成式人工智慧的所有演变都吸引了投资界的注意。人们认为,生成式人工智慧是千载难逢的机会,早期的获胜者有可能在数十年中占据主导地位。这种情况以前在其他创新中也曾发生过,兴奋感通常会消失。生成式人工智慧现在走向何方?生成式人工智慧是一个泡沫,我们正面临着一场艰苦的战斗来普及它。生成式人工智慧工具很有趣,而且有多种应用,但它们面临严峻的法律挑战,而且还没有杀手级应用。

上週,宣布设立一支基金,将筹集和管理高达 1000 亿美元的人工智慧资料中心和相关能源投资。新基金GAIIP(全球人工智慧基础设施投资合作伙伴关係)是微软与三个专注于人工智慧基础设施的金融机构之间的合作伙伴关係:贝莱德、全球基础设施合作伙伴(GIP)和总部位于阿布达比的MGX。 这项新的合作关係增加了近年来宣布的一系列由私募股权主导的资料中心投资。自 2022 年底 ChatGPT 发布以来,这些投资激增。甚至在 2022 年底/2023 年初推出生成式人工智慧之前,旨在筹集资金和管理数位基础设施投资的新投资工具就已经出现。生成式人工智慧将于 2024 年开始流行,并且正在加速发展。

由于生成式人工智慧热潮导致资料中心支出激增并不是什么新闻。即将推出的新资料中心更大、更好、能耗更高。新的金融工具不断涌现,为这些新的基础设施提供融资。这使得人们更加意识到计算机,尤其是现在 GPU 伺服器占主导地位的网路规模资料中心中普遍存在的巨大计算机集群,实际上消耗了多少电力。自 2019 年以来,网路规模产业的能源消耗翻了一番,过去两年每年增长 15%。更重要的是,自从新冠疫情以来,网路规模产业的能源密集度变得更高,而不是更少。 2021年,每百万美元收入消耗59兆瓦时的能源,这一数字到2022年将增加到65兆瓦时,到2023年将增加到70兆瓦时。这是值得注意的,因为网路扩展者应该能够利用其规模并从规模中获得效率。由于对生成式人工智慧的大力投入,能源强度将持续上升。无法获得足够的可负担的可再生能源是产生人工智慧市场面临的众多挑战之一,但儘管存在这些挑战,资料中心支出仍将继续推动网路规模市场在几个季度内保持高位。推进这些新人工智慧模型的竞赛正在进行中,并且有一种观点认为,早期的获胜者将拥有多年的优势。因此,存在着对熟练开发商、工具、能源能力和土地的竞争。

目标范围

提及的组织

|

|

目录

摘要

简介

分析

- 2024 年上半年网路规模资本支出激增,生成式人工智慧推动强劲前景

- 四大网路缩放器引领资料中心发展

- 云端现已成为主要收入来源

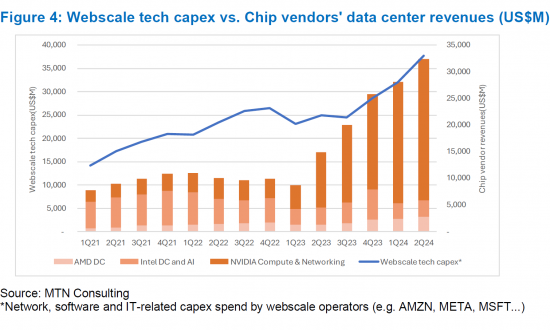

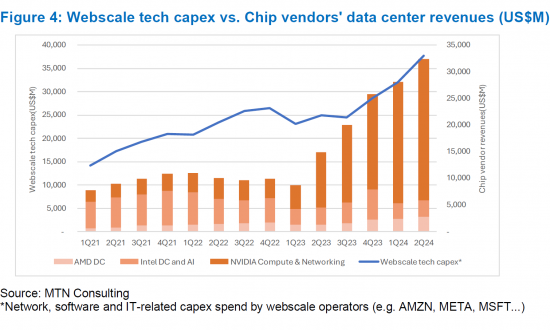

- 网路规模技术的资本支出与晶片供应商的资料中心收入密切相关

- 人们对网路规模市场的能源消耗趋势感到担忧。

- 世界政治与中美贸易战的干预

展望

附录

This short brief is focused on data center demand and the role of generative AI in spurring an uptick in investments, particularly in the webscale sector. This brief supports our pending capex forecast update.

VISUALS

Generative AI (GenAI) in all its evolving flavors has captured the attention of the 'investment community' - there is a feeling that GenAI is a once in a lifetime opportunity where the early winners have the potential to dominate for decades. This has happened before with other technology breakthroughs and the hype usually dies down. Where is it going now? There is a strong argument that GenAI is a bubble which faces an uphill battle towards widespread adoption. The tools are interesting and do have a range of applications, but they also face serious legal challenges and lack a killer app. There's also support for the idea that the "smart money" already believes this but doesn't care, due to confidence in being able to sell others on the hype.

Last week a fund was announced to raise and manage up to $100 billion (B) in funding for AI data centers and related energy investments. The new fund, Global AI Infrastructure Investment Partnership (GAIIP), is a partnership between Microsoft and three financial institutions betting big on AI infrastructure: BlackRock, Global Infrastructure Partners (GIP), and Abu Dhabi-based MGX. The new partnership adds to a long list of private equity-driven investments in data centers announced over the last few years. These investments have spiked since late 2022, when ChatGPT was released. Even prior to GenAI rolling out in late 2022/early 2023, new investment vehicles were emerging to raise capital and manage investments in digital infrastructure. With GenAI gaining steam in 2024, that has accelerated.

It's not news that data center spending is surging thanks to widespread enthusiasm for GenAI. The announcements keep on coming: new data centers, bigger and better, consuming more power. New financial vehicles arising to fund all this new infrastructure. With this, a more widespread appreciation of how power-hungry computers actually are - especially the massive clusters of computers prevailing in webscale data centers, now dominated by GPU servers. Energy consumption has doubled in the webscale sector since 2019, growing 15% per year in each of the last two years. More important, since COVID, the webscale sector has become more energy intensive, not less; in 2021, 59 MWh of energy was consumed per US$1M in revenues. That figure grew to 65 in 2022 and 70 in 2023. This is notable, as webscalers are supposed to be able to exploit their size in order to get efficiencies from scale; it's going the opposite direction with data center power consumption. And energy intensity is likely to keep rising with big commitments to GenAI. Inadequate access to affordable, renewable power is one of many challenges faced by the GenAI market. Despite these challenges, data center spend is likely to remain elevated for a few quarters, driven by the webscale market. There is a race underway to train and evolve these new AI models. There is a feeling that the early winners will be able to preserve their advantage for many years. Hence there is a land grab underway: for skilled developers, for tools, for energy capacity, and for land.

Coverage

Organizations mentioned:

|

|

Table of Contents

Summary

Introduction

Analysis

- Webscale capex surged in 1H24 and GenAI is driving strong outlook

- Top four webscalers drive data center developments

- Cloud may have started as a side business but it's now big money

- Webscale tech capex closely tied to chip vendors' data center revenues

- Energy consumption trends in webscale market are concerning

- Global politics and the US-China trade war will intervene

Outlook

Appendix

Figures:

- Figure 1: Webscale sector capex and free cash flow margin trends through 2Q24

- Figure 2: Big data center spenders (webscale and CNNO) - annualized capex and YoY % change

- Figure 3: Cloud service revenues as a percent of total for key webscalers, 2018-24

- Figure 4: Webscale tech capex vs. Chip vendors' data center revenues (US$M)

- Figure 5: Energy intensity (MWh of energy consumption per $M in revenue)