|

市场调查报告书

商品编码

1703510

最大的电信供应商(2024 年第四季):供应商市场年增 2.2%,结束了连续九个季度的下滑,因为广泛的復苏抵消了华为的下滑Telecom's Biggest Vendors 4Q24 - Vendor Market Upturn Breaks Nine-quarter Decline: Vendor Market Climbs 2.2% YoY in 4Q24 to End Nine-quarter Slide, as Broader Recovery Offsets Huawei Dip |

|||||||

本报告追踪了 137 家通讯网路基础设施供应商,并提供了 2013 年第一季至 2024 年第一季的营收和市占率估算。在这 137 家供应商中,有 111 家正在积极向营运商销售产品,还有许多其他供应商已被资料库中的其他公司收购。例如,ADVA 现在是 Adtran 的一部分,但根据过去的销售业绩,两家公司仍保留在资料库中。

视觉

主要亮点:

营收: 预计通讯网路基础设施供应商 2024 年第四季的营收为 576 亿美元,2024 年全年的营收为 2,069 亿美元。与去年同期相比,分别成长 2.2% 和下降 3.0%。 2024年上半年领先市场的华为在最近一个季度略有放缓,而整体市场则出现復苏迹象。以年率计算,2024年第四季整体市场年减3.0%。不过,不包括华为,萎缩率为3.7%,相较之下略有改善。

顶级供应商:前三名的电信网路基础设施供应商是常见的:华为、爱立信和诺基亚。以 2024 年第四季的年化计算,这三家公司占据了整个市场的 36.7%,仅在第四季度就占据了 39.9% 的占有率。中国通讯服务与中兴通讯自2019年初以来一直在争夺第四和第五的位置。

以年收入成长排名的领先供应商:2024 年第四季同比成长率和年化率最高的两家公司是:Tejas Networks 和 Dixon Technologies。 Tejas 得益于 BSNL 在印度大规模推出 4G 服务而实现了成长。与此同时,迪克森摆脱了前一年的糟糕表现,迅速成长。 Dixon 的一个重要里程碑是其将于 2024 年第二季与诺基亚建立合作伙伴关係,共同开发和製造固定无线存取设备和路由器等通讯设备。

支出前景:根据最新的官方预测,作为电信网路基础设施市场的主要驱动力,营运商资本支出预计将从 2023 年的 3140 亿美元下降到 2024 年的略低于 3000 亿美元。预计未来几年资本支出将几乎没有成长,到 2028 年可能会降至 2,800 亿美元左右。各国市场的前景各不相同。 注意本报告是在川普总统于 2025 年 4 月初宣布征收关税之前准备的。股市已经暴跌,许多经济学家预测,这场不必要且适得其反的贸易战将导致经济衰退或更糟的情况。如果有必要,我们计划在未来更新我们的预测。

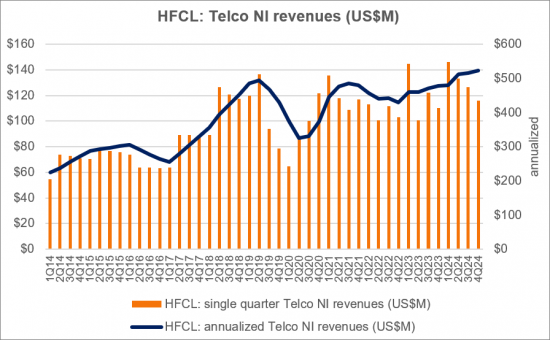

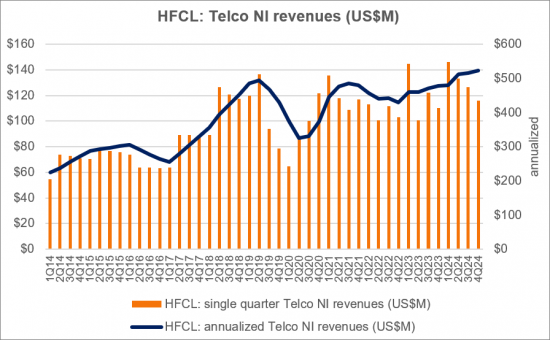

公司涵盖范围:从 2024 年第 4 季版开始,已将三家新供应商新增至覆盖范围。这三家公司均位于印度:Cyient、Dixon Technologies 和 HFCL。

调查主题

公司列表

|

|

|

目录

第1章报告要点

第 2 章摘要:调查结果说明

第3章:通讯网路基础设施市场:最新研究成果

第 4 章:前 25 名的供应商:可列印的样页

第 5 章图表:各个供应商概况

第6章 图表:五家供应商的比较

第7章:供应商研发支出

第 8 章原始资料:各公司营收预测

第9章 研究方法与假设

第 10 章 关于 MTN 咨询

The goal of this report series is to equip telecom industry decision-makers with a comprehensive view of spending trends and vendor market power in their industry. To do this we assess technology vendors' revenues in the telecom vertical, across a wide range of company types and technology segments. We call this market "telco network infrastructure", or "Telco NI." This study tracks 137 Telco NI vendors, providing revenue and market share estimates for the 1Q13-4Q24 period. Of these 137 vendors, 111 are actively selling to telcos; most others have been acquired by other companies in the database. For instance, ADVA is now part of Adtran, but both companies remain in the database because of historic sales.

VISUALS

Below are the key highlights of the report:

Revenues: Telco NI vendor revenues were $57.6B in 4Q24 and $206.9B for the 2024 year overall, up 2.2% and down 3.0% on a YoY basis, respectively. Huawei, which lifted the market in the first half of 2024, slipped slightly in the latest quarter while the broader market rebounded. The total market contracted 3.0% YoY in the annualized 4Q24, a modest improvement compared to a 3.7% decline excluding Huawei.

Top vendors: The top three Telco NI vendors remain the usual trio: Huawei, Ericsson, and Nokia. They account for 36.7% of the total market in annualized 4Q24, or 39.9% in 4Q24 alone. China Comservice and ZTE have been jostling for the 4th and 5th positions since early 2019.

Key vendors by YoY revenue growth: The top two vendors, in terms of YoY revenue growth, are common to both single quarter and annualized 4Q24: Tejas Networks and Dixon Technologies. Their growth drivers were distinct: Tejas benefited from BSNL's large-scale 4G rollout in India, while Dixon surged from a low year-ago base. A key milestone for Dixon was its 2Q24 partnership with Nokia to jointly develop and manufacture telecom equipment, including fixed wireless access points and routers.

Spending outlook: Per our latest official forecast, we expect telco capex - the main driver of the Telco NI market - to dip from $314B in 2023 to just below $300B in 2024. Capex will struggle to see any growth over the next few years, likely ending 2028 at ~$280B. The outlook for specific country markets varies. Note that this report was prepared before Trump's early April tariff announcements. Stock markets have already plummeted, and most economists now expect a recession or worse to result from this unnecessary and counterproductive trade war. We will update our forecast outlook if warranted.

Company coverage: starting with this 4Q24 edition, we have added three additional vendors to our coverage universe. They are all based in India: Cyient, Dixon Technologies, and HFCL.

Research Coverage

List of companies:

|

|

|

Table of Contents

1. Report Highlights

2. SUMMARY - Results commentary

3. Telco NI Market - Latest Results

4. TOP 25 VENDORS - Printable tearsheets

5. CHARTS - Single vendor snapshot

6. CHARTS - 5 vendor comparisons

7. R&D spending by vendors

8. RAW DATA - revenue estimates by company

9. Methodology & Assumptions

10. ABOUT - MTN Consulting

List of Figures: (Partial)

- Annualized Telco NI vendor revenues ($B) vs. YoY growth in annualized sales

- YoY growth in annualized Telco NI market, with and without Huawei figures

- All vendors, YoY growth in single quarter sales

- Telco NI vendor revenues by company type, TTM basis (US$B)

- Telco NI revenues by company type: YoY % change

- Telco NI revenue split: Services vs. HW/SW

- Telco NI sales of top 10 vendors vs. all others, 4Q24 TTM (annualized)

- Top 25 vendors based on annualized Telco NI revenues through 4Q24 ($B)

- Top 25 vendors based on Telco NI revenues in 4Q24 ($B)

- Key vendors' annualized share of Telco NI market

- Telco NI market share changes, 4Q24 TTM vs. 4Q23 TTM

- Telco NI annualized revenue changes, 4Q24 vs. 4Q23

- YoY growth in Telco NI revenues (4Q24)

- Top 25 vendors in Telco NI Hardware/Software: Annualized 4Q24 Revenues (US$B)

- Top 25 vendors in Telco NI Services: Annualized 4Q24 Revenues (US$B)

- R&D spending as a percent of revenues for key telco-focused vendors (4Q22-4Q24)