|

市场调查报告书

商品编码

1411021

CHC(消费者医疗保健)创新:2024Innovation in CHC 2024 |

||||||

全球消费者保健市场每年推出数千种创新产品,但为消费者带来显着新益处的剂型或配方相对较少。

样本

2023 年,美容护理、益生菌和益生元以及护髮/美容补充剂的推出迅速增加,推动了 NPD 活动。在后新冠疫情情势下,以化妆品为重点的品类是上市活动的主要动力,此外还有性健康和生育产品、镇静剂和助眠剂。展望未来,我们看到各种 Rx-to-OTC 转换候选者和创新趋势可能会在未来几年推动 CHC 市场的成长,包括个人化医疗、抗衰老补充剂等的使用增加预防产品指出。

本报告详细审视了 2023 年的消费者医疗保健 (CHC),重点介绍了消费者医疗保健行业最引人注目的交付形式和成分趋势。我们依地区、国家和主要市场研究新产品趋势,以探索 CHC 创新的未来。

目录

世界概况

创新概览

- 止痛药

- 咳嗽、感冒、过敏

- 胃肠药

- 益生菌和益生元

- 维生素、矿物质和补充剂

- 皮肤科

- 性健康和生育能力

- 生活方式CHC

- 自我诊断和医疗设备

运输格式和包装趋势

食材、口味和标籤的趋势

公司新产品开发活动

- Nestle

- Haleon

- Kenvue

- Bayer

- Taisho

- Stada

- P&G

- Sanofi

- Unilever

- Galderma

依地区/国家划分的创新

- 2023 年 NPD 活动(依地区)

- 阿根廷

- 澳大利亚

- 巴西

- 加拿大

- 中国

- 哥伦比亚

- 法国

- 德国

- 印度

- 印度尼西亚

- 义大利

- 日本

- 墨西哥

- 波兰

- 俄罗斯

- 韩国

- 西班牙

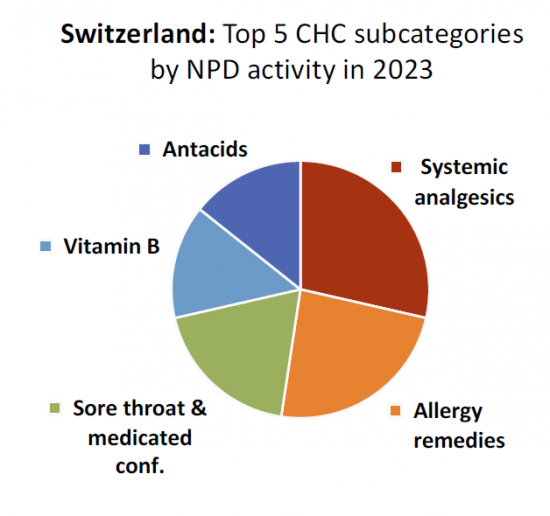

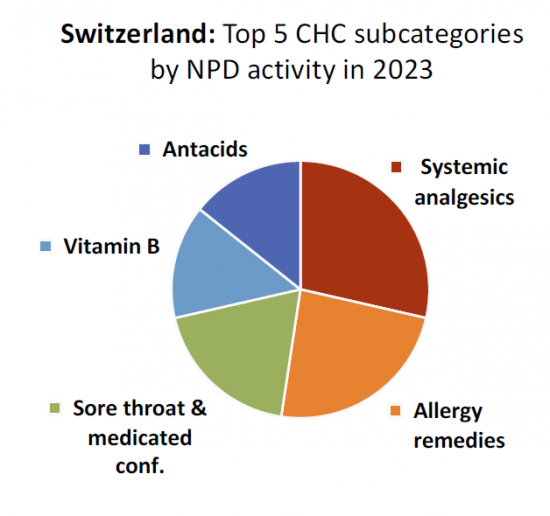

- 瑞士

- 英国

- 美国

一流的案例研究

- Pabron

- Nature Made

- Tums

总结和未来趋势

- 摘要 - 主要 NPD 趋势

- 总结 - NPD 促进因素

- 概述 - 从 Rx 转向 OTC 的趋势

- 结论 - 未来趋势

Thousands of innovations are launched every year in the global consumer healthcare market, but relatively few offer notable new benefits for consumers in terms of delivery format or formulation. Which new products are breaking through and offering a unique proposition? Where will new product development take the CHC market in future?

SAMPLE VIEW

The latest title from CHC New Products Tracker takes an in-depth look at 100 key CHC innovations in 2023, and picks out some of the most prominent delivery format and ingredient trends in the consumer healthcare industry. It examines new product activity by region, country and leading marketer, and explores what the future might hold in terms of CHC innovation.

Innovation Showcase: 100 key innovations in 2023

Showcasing the best CHC innovation of the past year, including:

- Analgesics Cough, Cold & Allergy

- Gastrointestinals

- Probiotics & Prebiotics Vitamins, Minerals & Supplements

- Hair & Beauty

- Dermatologicals

- Diagnostics Lifestyle CHC

- Sexual Health & Fertility

Delivery Format Trends

Highlighting 5 major delivery format trends in the CHC market, including:

- Straws

- Novel sleep aid formats (glasses / headphones / headsets)

- Novel VMS food formats (energy bars / honey)

Ingredient Trends

Highlighting 10 major ingredient, flavour and labelling trends in the CHC market, including:

|

|

Summary & Future Trends

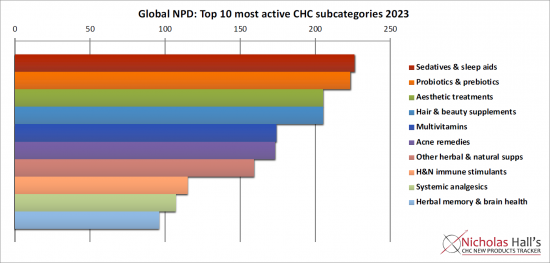

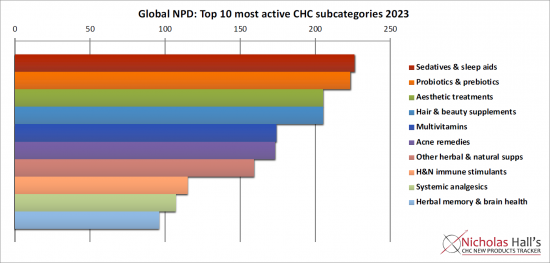

In 2023, NPD activity was driven by a surge in launches of aesthetic (beauty) treatments, probiotics & prebiotics and hair & beauty supplements. In the post-Covid landscape, cosmetic-focused categories have been an important driver of launch activity, along with sexual health & fertility products and sedatives & sleep aids. Looking to the future, we pinpoint various Rx-to-OTC switch candidates and innovation trends that will unlock CHC market growth over the coming years, including greater use of personalized medicine, anti-ageing supplements and prevention products more generally.

Innovation by Marketer

- Reviewing innovation by the leading global CHC marketers and some of the smaller companies driving new product activity in the industry

Innovation by Region & Country

- Analysing innovation trends by region (North America, Latin America, Europe and Asia-Pacific) and taking a closer look at each of the 20 countries tracked by CHC New Products Tracker

Best-in-class case studies

- Case studies of top-performing innovations from previous years

Table of Contents

Global Overview

Innovation Showcase

- Analgesics

- Cough, Cold & Allergy

- Gastrointestinals

- Probiotics & Prebiotics

- Vitamins, Minerals & Supplements

- Dermatologicals

- Sexual Health & Fertility

- Lifestyle CHC

- Self-Diagnostics & Medical Devices

Delivery Format & Packaging Trends

- 1. Straws

- 2. Crystals

- 3. Novel sleep aid formats

- 4. Novel food formats

- 5. All-in-one kits

Ingredient, Flavour & Labelling Trends

- 1. Berberine

- 2. Pro-vitamin A5

- 3. Trehalose

- 4. Chasteberry

- 5. Celery

- 6. Amla

- 7. Centella asiatica

- 8. Spirulina

- 9. Lavender

- 10. Coconut

NPD Activity by Company

- Nestle

- Haleon

- Kenvue

- Bayer

- Taisho

- Stada

- P&G

- Sanofi

- Unilever

- Galderma

Innovation by Region & Country

- NPD Activity by Region 2023

- Argentina

- Australia

- Brazil

- Canada

- China

- Colombia

- France

- Germany

- India

- Indonesia

- Italy

- Japan

- Mexico

- Poland

- Russia

- South Korea

- Spain

- Switzerland

- UK

- USA

Best-In-Class Case Studies

- Pabron

- Nature Made

- Tums

Summary & Future Trends

- Summary - Major NPD Trends

- Summary - NPD Drivers

- Summary - Rx-to-OTC Switch Trends

- Conclusion - Future Trends