|

市场调查报告书

商品编码

1259078

星链可行性:商业模式和投资回报率分析Starlink Feasibility: Business Model and ROI Analysis |

||||||

本报告对 Starlink 进行了研究,并对其业务模式和未来成功潜力以及成本和收入预测进行了全面分析。

报告摘要

本报告审视 Starlink 业务的健康状况并评估其业务模式的可持续性。

星链卫星发射和宽带用户获取的快速步伐扰乱了卫星通信行业。 因此,行业利益相关者必须了解影响星链价值主张的因素并评估其商业模式的可持续性。

本报告利用 NSR 在各种卫星通信应用(包括製造、发射和地面运营)方面的丰富专业知识,探讨了 Starlink 当前和未来的优先事项。 它预测了多种成本和收入情景,并全面分析了星链的商业模式和未来成功的潜力。

>本报告深入探讨了影响星链价值主张的因素,包括近地轨道 (LEO) 卫星星座对行业和最终用户的影响。 我们的分析考察了星链的潜在市场份额及其宽带用户群的增长潜力。

我们还研究了有助于 Starlink 业务模式可持续性的因素,包括成本控制策略、收入机会以及抵御潜在行业逆风的能力。

NSR 致力于提供准确、全面的市场分析,帮助我们的客户做出明智的决策。 这份星链可行性报告为卫星通信行业利益相关者提供了评估星链商业模式的可持续性和未来计划所需的信息。

本报告将回答关键问题。

- 构建不同星座尺寸的星链星座的总成本是多少?

- 在不同的市场场景下,Starlink 的总收入是多少?

- 未来几年,Starlink 在各个目标市场将如何发展?

- Starlink 的商业模式是否可持续且有利可图?

此报告的购买者

Starlink 是影响整个连接市场的主要参与者。 行业利益相关者推荐该报告来了解星链在不同案例和场景下的未来计划、收入和可持续性。 以下是价值链中各个参与者的主要收穫:

- 投资者 -了解收入机会、成本、利润、IRR、现金流等。

- 服务提供商和设备製造商 - Starlink 的商业模式是否可持续? 还了解对竞争的影响

- 卫星运营商和航天机构 - 星链未来的发射和收入预测、星座建设成本

- 运营商和移动网络运营商 - 评估 Starlink 带来的市场目标、收入潜力、机遇和威胁

与 NSR 的区别

NSR 以其预测卫星行业市场动态并保持领先地位的能力而闻名。 在这个巨大变革的时代,NSR 是一个有价值的合作伙伴,可以帮助塑造卫星通信生态系统中非 GEO 和 GEO 市场的愿景。 这份有价值的报告是对星链价值主张和相关成本的公正分析。 了解星链对于希望在卫星通信生态系统中有效定位的公司至关重要。

主要功能

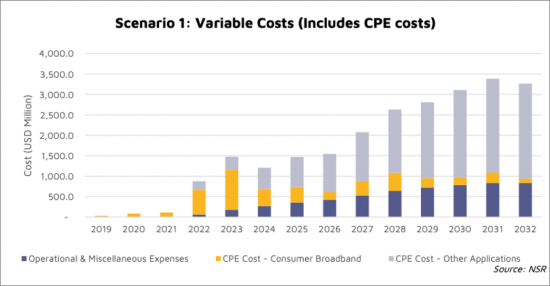

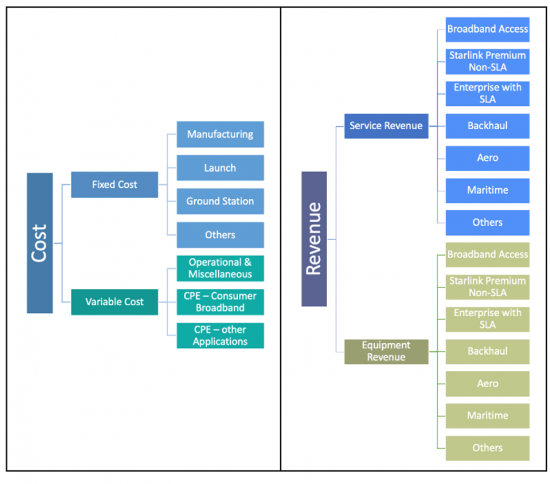

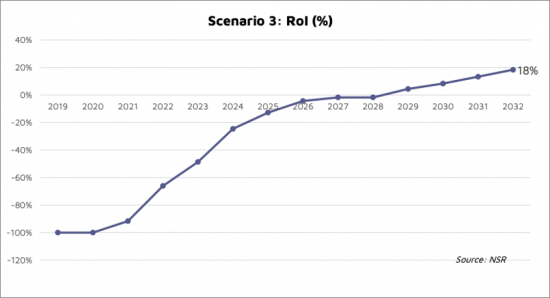

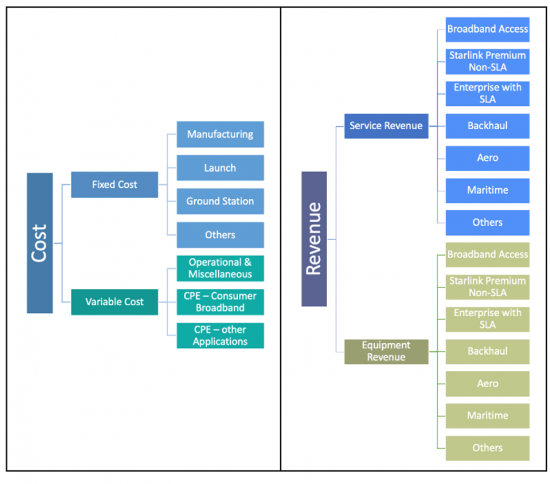

本报告通过考虑不同场景下的成本和收入,对星链的业务案例和盈利能力进行了公正的评估。 该报告估计并分析了关键变量,例如按部门划分的固定成本、按部门划分的可变成本、按应用划分的服务收入、按应用划分的设备收入、损益、现金流、内部收益率和投资回报率。

本研究的范围

- 此新功能 - 业界首个基于场景的 Starlink 业务案例评估

- 基于场景的固定和可变成本估算

- 按应用划分的 Starlink 服务和设备收入

- 按场景划分的投资回报率、内部收益率、损益预测

报告细分:

内容

简介

情景定义和研究方法

执行摘要

第1章:星炼是否有利可图?

- 场景 1 - 损益、盈亏平衡点、现金流、IRR

- 场景 2 - 利润/亏损、盈亏平衡点、现金流、IRR

- 场景 3 - 利润/亏损、盈亏平衡点、现金流、IRR

第2章星链成本评估

- 场景 1 - 发射预测和星座规模

- 场景 1 - 固定成本和可变成本

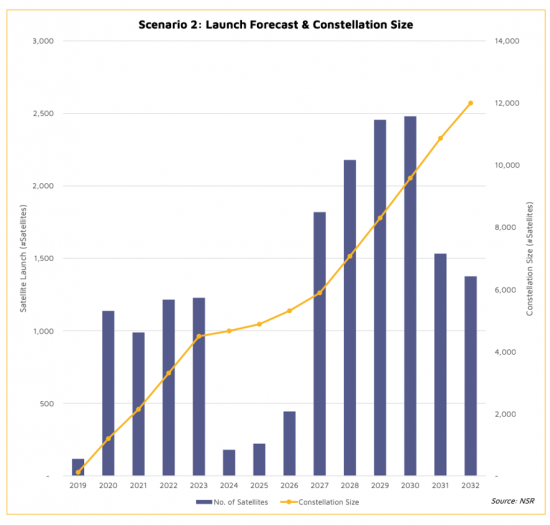

- 场景 2 - 发射预测和星座规模

- 场景 2 - 固定成本和可变成本

- 场景 3 - 发射预测和星座规模

- 场景 3 - 固定成本和可变成本

第3章星链盈利预测

- 情景 1 - 服务和设备收入

- 情景 2 - 服务和设备收入

- 情景 3 - 服务和设备收入

第4章结论

Report Summary:

Our latest report, NSR's “Starlink Feasibility: Business Model and ROI Analysis” examines the health of Starlink's business and assesses the sustainability of its business model.

Starlink's rapid pace of satellite launches, and broadband subscriber acquisition has caused disruption in the Satellite Communications industry. As a result, it's essential for industry stakeholders to understand the factors that affect Starlink's value proposition and assess the sustainability of its business model.

Leveraging NSR's extensive expertise across various Satcom applications, including manufacturing and launch, as well as ground segment operations, our report scrutinizes Starlink's current and future priorities. We have forecasted multiple cost and revenue scenarios to provide a comprehensive analysis of Starlink's business model and its potential for success in the future.

“Starlink Feasibility: Business Model and ROI Analysis” delves deep into the factors that affect Starlink's value proposition, including the impact of its low Earth orbit (LEO) satellite constellation on the industry and the end-users. Our analysis examines the potential market share that Starlink could capture and the growth potential of its broadband subscriber base.

Our report also provides insights into the factors that contribute to Starlink's business model's sustainability, including cost management strategies, revenue generation opportunities, and its ability to withstand potential industry headwinds.

At NSR, we are committed to providing accurate and comprehensive market analysis to enable our clients to make informed decisions. Our report on Starlink's feasibility provides stakeholders in the Satellite Communications industry with the information they need to assess the sustainability of Starlink's business model and plan for the future.

Key questions are answered in this report?

- What is the total cost to build the Starlink constellation for different Constellation Sizes?

- What will be the total revenue capture by Starlink, under different market scenarios?

- How will Starlink progress across different target markets in the coming years?

- Will the Starlink business model be sustainable and profitable?

Who Should Purchase this Report:

Starlink is a major player impacting the overall connectivity market. Industry stakeholders should read the report to understand Starlink's future plan, revenue and sustainability for different cases or scenarios. Below are the key takeaways for different players in the value chain:

- Investors - to understand the revenue opportunities, Costs, Profits, IRR, Cash Flow, etc.

- Service Providers & Equipment Manufacturers - whether the Starlink business model is sustainable or not? Also, to understand the competitive impact.

- Satellite Operators & Space Agencies - Starlink future launch and revenue projections, costs to build the constellation.

- Telcos and MNOs - to assess market targets, revenue potential and opportunities & threats posed by Starlink.

The NSR Difference

NSR is renowned for its ability to anticipate market dynamics and stay ahead of the curve in the satellite industry. In the midst of a profound transformation, NSR is a valued partner in helping shape the vision of both Non-GEO and GEO markets in the Satellite Communication ecosystem. This valuable report provides an unbiased analysis of Starlink's value propositions and associated costs. Understanding Starlink is crucial for any company looking to position itself effectively within the Satcom ecosystem.

Key Features:

NSR's “Starlink Feasibility: Business Model and ROI Analysis” offers an unbiased assessment of Starlink's business case and profitability, considering various scenario-based costs and revenues. The report estimates and analyzes key variables, such as Segmented Fixed Costs, Segmented Variable Costs, Service Revenues by Application, Equipment Revenues by Application, Profits/Losses, Cash Flow, IRR, and RoI.

Covered in this Report:

- NEW in this Edition - Industry's first Scenario-based evaluation of Starlink Business Case.

- Scenario based Fixed and Variable Cost estimations.

- Starlink's Service and Equipment revenues by Applications

- RoI, IRR and Profit / Loss estimations by scenarios.

Report Segmentation:

Companies mentioned in this Report:

Starlink, SpaceX, Viasat, OneWeb, Hughes, Kuiper, Telesat, SES.

Table of Contents

Introduction

Scenario Definitions & Methodology

Executive Summary

1. Will Starlink be Profitable?

- 1.1. Scenario 1 - Profit/Loss, Break-Even, Cash Flow and IRR

- 1.2. Scenario 2 - Profit/Loss, Break-Even, Cash Flow and IRR

- 1.3. Scenario 3 - Profit/Loss, Break-Even, Cash Flow and IRR

2. Starlink Cost Assessment

- 2.1. Scenario 1 - Launch Forecast and Constellation Size

- 2.2. Scenario 1 - Fixed and Variable Costs

- 2.3. Scenario 2 - Launch Forecast and Constellation Size

- 2.4. Scenario 2 - Fixed and Variable Costs

- 2.5. Scenario 3 - Launch Forecast and Constellation Size

- 2.6. Scenario 3 - Fixed and Variable Costs

3. Starlink Revenue Projections

- 3.1. Scenario 1 - Service & Equipment Revenues

- 3.2. Scenario 2 - Service & Equipment Revenues

- 3.3. Scenario 3 - Service & Equipment Revenues

4. Bottom Line

List of Exhibits

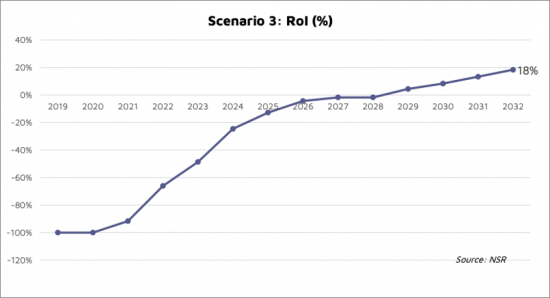

- 1. RoI by Scenario

- 2. Annual Cost by Scenario

- 3. Annual Revenue by Scenario

- 4. Annual Profit / Loss by Scenario

- 5. Scenario 1: Cost Versus Revenue

- 6. Scenario 1: Cash Flow & IRR

- 7. Scenario 1: RoI (%)

- 8. Scenario 2: Cost Versus Revenue

- 9. Scenario 2: Cash Flow & IRR

- 10. Scenario 2: RoI (%)

- 11. Scenario 3: Cost Versus Revenue

- 12. Scenario 3: Cash Flow & IRR

- 13. Scenario 3: RoI (%)

- 14. Scenario 1: Launch Forecast and Constellation Size

- 15. Scenario 1: Fixed Cost (Includes Manufacturing & Launch)

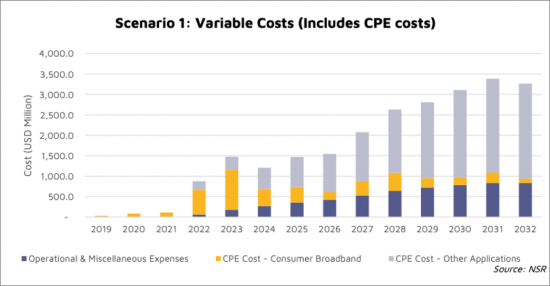

- 16. Scenario 1: Variable Cost (Includes CPE Cost)

- 17. Scenario 1: Total Cost

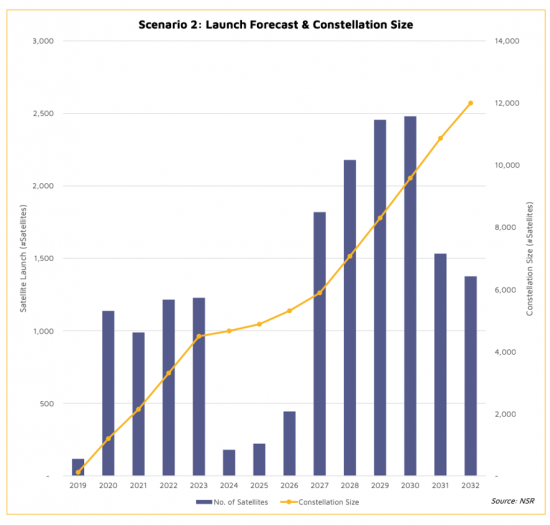

- 18. Scenario 2: Launch Forecast and Constellation Size

- 19. Scenario 2: Fixed Cost (Includes Manufacturing & Launch)

- 20. Scenario 2: Variable Cost (Includes CPE Cost)

- 21. Scenario 2: Total Cost

- 22. Scenario 3: Launch Forecast and Constellation Size

- 23. Scenario 3: Fixed Cost (Includes Manufacturing & Launch)

- 24. Scenario 3: Variable Cost (Includes CPE Cost)

- 25. Scenario 3: Total Cost

- 26. Scenario 1: Service Revenues by Application

- 27. Scenario 1: Equipment Revenues by Application

- 28. Scenario 1: Total Revenues

- 29. Scenario 2: Service Revenues by Application

- 30. Scenario 2: Equipment Revenues by Application

- 31. Scenario 2: Total Revenues

- 32. Scenario 3: Service Revenues by Application

- 33. Scenario 3: Equipment Revenues by Application

- 34. Scenario 3: Total Revenues