|

市场调查报告书

商品编码

1348940

卫星 D2D(Direct-to-Device)市场:第四版Satellite Direct-to-Device Market, 4th Edition |

||||||

报告概述

卫星 D2D(Direct-to-Device)市场:第四版全面介绍了卫星 D2D 市场机会、市场驱动因素、限制因素、关键用例、战略见解等。

市场机会与概述:

- 本报告探讨了卫星 D2D 市场,这是卫星产业的关键成长领域。

- NSR 是最早发现此市场机会的市场研究公司之一,本报告是第四次更新。

优先领域:

- "D2D4" 目的是全面了解卫星 D2D 市场的趋势和战略选择。

- 依地区和细分市场预测服务收入和流量。

- 向卫星营运商、行动网路营运商(MNO)以及设备和基础设施供应商提供有关如何占领这一不断成长的市场的建议。

主要问题:

- 新兴卫星 D2D 市场存在哪些收入机会?

- 除地面无线电之外,行动网路业者还可以使用卫星 D2D 瞄准哪些用例?

- 卫星 D2D 的限制与优点是什么?

- 将塑造市场未来的关键技术发展是什么?

- 主要参与者及其各种策略(频率、供应和产能、标准、商业模式等)

目标受众

卫星Direct-to-Device市场本报告针对卫星和通讯行业的各个利益相关者,例如:

- 卫星营运商寻求了解收入潜力、流量预测、市场动态。

- MNO 和 CSP对卫星 D2D 作为成长和差异化来源感兴趣。

- 想要评估频段、标准和业务模式的策略选择的晶片组和组件供应商、OEM 和基础设施供应商(太空和地面)。

- 监管机构和行业机构希望利用 D2D 促进创新并弥合数位落差。

差异化因子

- 卫星Direct-to-Device市场是 NSR 在卫星行业的专业知识与 Analysys Mason 对通讯趋势的了解的独特结合所带来的。

- "D2D4" 充分利用了 Analysys Mason 对航太产业的了解以及对营运商趋势和消费者需求的洞察。

- 第四版基于广泛的初步研究,包括对主要行业参与者的采访,以及坚实的二次研究基础。

- 第四版作为未来策略决策的路线图,将提供读者了解动态卫星 D2D 领域的各个细分市场、区域和策略选择的协助。

卫星Direct-to-Device市场:第四版为有兴趣利用新兴卫星 D2D 市场机会的产业利害关係人提供宝贵的见解。本报告利用 NSR 和 Analysys Mason 的专业知识,对不断发展的卫星 D2D 市场提供全面、公正的分析。

主要功能

本报告的目标

- 参与卫星 D2D 生态系的主要建议

- 依地区和细分市场划分的服务收入预测

- 依地区和细分市场划分的流量预测

- 目标市场的定义

- 卫星 D2D 功能的主要优点和限制回顾

- 技术演进的时机及其对市场发展的影响

- 关键策略选择的评估与影响:频率、标准、商业模式

报告细分

- 消费者

- 交通

- 服务收入

- 物联网

- 交通

- 服务收入

- 政府和军队

- 交通

- 服务收入

此报告中包含的公司

Airbus、Apple、AST SpaceMobile、AT&T、Bullitt、Echostar、Ericsson、Globalstar、Honor、Huawei、Inmarsat、Iridium、Lynk、Mediatek、Motorola、Nokia、Nothing、OmniSpace、Oppo、PNCC、Qualcomm、Rakuten、Sateliot、SCT、Skylo、SMART、Starlink、Telefónica、Thales Alenia Space、T-Mobile、vivo、Vodafone、Xiaomi。

目录

关于此报告

执行摘要

调查概述

- 挑战:行动网路营运商的收入来源和社会影响受到地面网路覆盖范围的限制

- 解决方案:卫星 D2D 透过提高用户参与度、支援新服务和降低农村网路部署成本,为 MNO 带来更多机会

建议

- 1.D2D 作为 MNO 差异化和成长的新来源

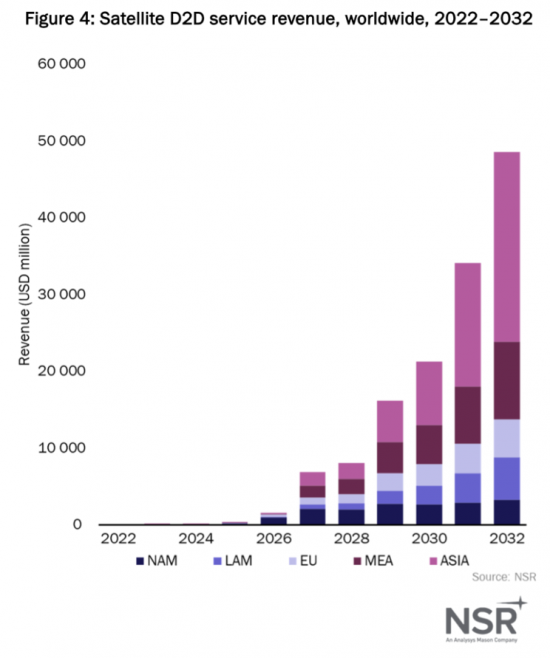

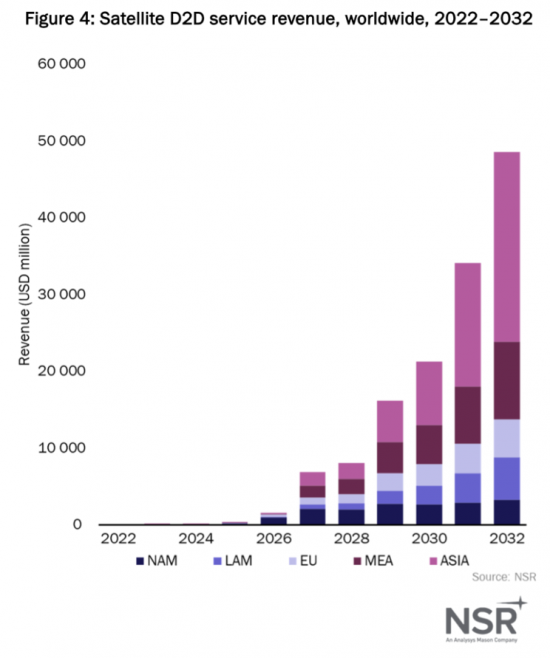

- 1.到2032年,卫星 D2D 服务收入将飙升至 486亿美元

- 2.D2D 吸引了来自三个主要领域的市场兴趣:消费者、物联网和政府/军事

- 3.消费者领域在收入领域占据主导地位,但物联网和政府/军队提供了专门的机会

- 4.卫星 D2D 对 MNO 来说不构成竞争风险,因此该技术应被视为实现新收入来源的一种手段。

- 2.适合快速发展的技术和业务

- 1.该产业的利害关係人必须继续适应技术和业务快速发展。

- 2.供应时机对于平衡市场准备和竞争优势非常重要。频谱是一种重要的资源。需要指数级供应量增加

- 3.价值链调整

- 1.建构合适的合作伙伴生态系统是提供复杂的D2D 解决方案的关键

- 2.由于向后相容性,使用 MNO 频谱可以实现更快的启动。监管的确定性和绩效的提高为 MSS 创造了长期利益。

- 3.专有协定提供了更快的商业化途径,但应优先考虑基于标准的解决方案以促进可扩展性。

- 4.卫星服务应着重于对行动网路业者有吸引力的批发模式。

附录:研究方法

关于作者和 Analysys Mason

Report Summary:

“Satellite Direct to Device Markets, 4th Edition (D2D4) ” report provides a comprehensive analysis of the satellite D2D (Direct-to-Device) market opportunity, including market drivers and restraints, key use cases, and strategic insights.

Market Opportunity and Overview:

- The report describes the satellite D2D market opportunity, which represents a significant growth area within the satellite industry.

- NSR was one of the first market research firms to identify this opportunity, and this report represents the 4th annual update with a high level of maturity and in-depth analysis.

Key Focus Areas:

- “D2D4” aims to build a complete picture of trends and strategic choices within the satellite D2D market.

- It provides forecasts for service revenues and traffic broken down by region and market segment.

- Recommendations are offered for satellite operators, mobile network operators (MNOs), and equipment and infrastructure vendors on how to capture a portion of this growing market.

Key Questions Addressed:

- What is the revenue opportunity for the emerging satellite D2D market?

- What use cases can MNOs target beyond their terrestrial coverage leveraging satellite D2D?

- What are the limitations and strength of satellite D2D?

- Which are the key technology developments that will shape the future of the market and how should players stay adaptive to this evolution?

- Who are the main players and which are the different strategies (spectrum, supply and capabilities, standards, business models, etc.)?

Target Audience

“Satellite Direct to Device Markets” report is intended for various stakeholders in the satellite and telecommunications industries, including:

- Satellite operators seeking to understand revenue potential, traffic forecasts, and market dynamics.

- MNOs and CSPs interested in satellite D2D as a source of growth and differentiation.

- Chipset and parts vendors, OEMs, and infrastructure vendors (both space and terrestrial) looking to assess strategic choices in terms of spectrum, standards, and business models.

- Regulators and industry agencies seeking to leverage D2D to foster innovation and bridge the digital divide.

Differentiating Factors:

- “Satellite Direct to Device Markets” stands out due to the unique combination of expertise from NSR in the satellite industry and Analysys Mason's knowledge of telecommunications trends.

- “D2D4” leverages understanding of the space industry and Analysys Mason's insights into telco trends and consumer needs.

- “Satellite Direct to Device 4” draws from extensive primary research, including interviews with key industry players, and is based on a solid foundation of secondary research.

- “D2D4” serves as a roadmap for future strategic decisions, helping readers navigate various market segments, regions, and strategic options in the dynamic satellite D2D landscape.

“Satellite Direct to Device Markets, 4th Edition” report offers valuable insights and recommendations for industry stakeholders interested in capitalizing on the emerging satellite D2D market opportunity. It leverages the expertise of NSR and Analysys Mason to provide a comprehensive and unbiased analysis of this evolving landscape.

Key Features:

Covered in this Report:

- Key recommendations for participating in the satellite D2D ecosystem

- Service revenues forecast by region and segment

- Traffic forecast by region and segment

- Addressable market definition

- Review of the key strength and limitations of the satellite D2D capabilities

- Timing of the technology evolution and implications for the development of the market

- Assessment and implications of key strategic choices: spectrum, standards and business models

Report Segmentation:

- Consumer

- Traffic

- Service Revenues

- IoT

- Traffic

- Service Revenues

- Government and Military

- Traffic

- Service Revenues

Companies included in this Report:

Airbus, Apple, AST SpaceMobile, AT&T, Bullitt, Echostar, Ericsson, Globalstar, Honor, Huawei, Inmarsat, Iridium, Lynk, Mediatek, Motorola, Nokia, Nothing, OmniSpace, Oppo, PNCC, Qualcomm, Rakuten, Sateliot, SCT, Skylo, SMART, Starlink, Telefónica, Thales Alenia Space, T-Mobile, vivo, Vodafone, Xiaomi.

Table of Contents

About this report

Executive summary

Research overview

- Challenge: MNOs' revenue sources and social impact are limited by the reach of terrestrial networks

- Solution: Satellite D2D extends MNOs' opportunities by boosting subscriber engagement, enabling new services and reducing rural network deployment costs

Recommendations

- 1. D2D as MNOs' new source of differentiation and growth

- 1. Satellite D2D service revenues to skyrocket to 48.6USD billion by 2032

- 2. D2D will attract market interest from 3 main segments: consumer, IoT and Gov/Mil

- 3. Consumer segment to dominate the revenue scene, but IoT and Gov/Mil present specialized opportunities

- 4. Satellite D2D does not represent a competitive risk for MNOs. The technology should be regarded as an enabler for new revenue streams

- 2. Fit for the fast-paced technology and business evolution

- 1. Actors in the field should stay adaptative to the extraordinarily fast evolution in technology and business

- 2. Timing of supply is critical to balance market readiness and competitive advantage. Spectrum is the key resource. Exponential supply growth needed

- 3. Aligning the value chain

- 1. Building the right ecosystem of partners is critical to deliver D2D's complex solution

- 2. Using MNOs' spectrum offers faster ramp-up thanks to backward compatibility. MSS long-term advantages due to regulatory certainty and enhanced performances

- 3. Standards-based solutions should be the preferred approach to facilitate scalability, albeit proprietary protocols offer a faster path to commercialization

- 4. Satellite offerings should focus on wholesale models that are attractive for MNOs

Appendix Methodology

About the authors and Analysys Mason

List of Exhibits

- Figure 1: Evolving Space enablers unlocking the opportunities in the satellite D2D market

- Figure 2: MNOs' limitations to create and capture value beyond their coverage

- Figure 3: Key segments enabled by satellite D2D

- Figure 4: Satellite D2D service revenues worldwide, 2022-2032

- Figure 5: share of service revenues per vertical worldwide

- Figure 6: satellite D2D cumulative service revenues (USD million) worldwide, 2022 to 2032

- Figure 7: Satellite D2D traffic with technology phases worldwide, 2022 to 2032

- Figure 8: generic legacy constellation supply case study