|

市场调查报告书

商品编码

1759019

电子产品製造服务 (EMS) 的全球市场 (2025年版)The Worldwide Electronics Manufacturing Services Market - 2025 Edition: The Most Comprehensive Study Available on the Worldwide EMS Market |

||||||

报告亮点

全球电子产品市场分析:2024-2029年

- 46产品市场区隔:地区·各供应商

- 集合总额 (OEM·EMS·ODM)

全球EMS市场分析:2024-2029年

- OEM 与外包(EMS/ODM 分包)对比

- EMS、ODM 和 OEM 製造占有率:按地区、细分市场和产品划分(46 种产品和超过 900 个製造地点)

- 按地区划分的製造地点分布:57 个国家/地区

- 按国家/地区划分的 EMS、ODM、OEM 和产品分析

财务基准

- 细分市场指标:收入/利润率/利润

- 每平方英尺/SMT生产线/员工收入

- 全球劳动成本比率/ROA/ROE L:表现最佳者

公司简介(价值超过1亿美元的前100家EMS和ODM公司)

概要

全球电子製造服务 (EMS) 市场是电子製造业的决定性力量,占2024年所有成品组装产品的45%。 2023年,由于电脑和通讯产业的经济衰退,外包业务较前一年负成长,导致2024年整个产业下滑约5.2%。 EMS和ODM都受到了沉重打击,尤其是那些服务顶级市场的公司。公司。

本报告研究了全球电子製造服务 (EMS) 市场,并提供了市场规模预测、按产品细分和地区划分的详细分析、主要公司的市场占有率分析、财务基准分析和概况。

目录

第1章 简介

第2章 摘要整理

- 全球市场预测

- 各地区占有率

- 各用途占有率

- EMS市场占有率

- EMS效能

第3章 全球电子产业的预测

- 概要

- 世界经济预测

- 摘要预测

- 产业预测

- 通讯(9个产品细分)

- 计算机(10个产品细分市场)

- 消费品(9 个产品细分市场)

- 工业(4 个产品细分市场)

- 医疗(3 个产品细分市场)

- 汽车(4 个产品细分市场)

- 航空航太、国防和其他运输(7 个产品细分市场)

第4章 EMS产业结构:2024年

- 全球电子 OEM 市场

- 电子产品製造商

- OEM 市场:以 7 个细分市场划分

- EMS 市场:按製造商划分(OEM 和 EMS)

- EMS 统计(依公司规模划分:大、中、小)

- 各地区製造业占有率(57 个国家)

- 南北美洲

- 欧洲·中东·非洲

- 亚太地区

- 各市场占有率的产业製造数量 (46产品)

- 通讯(9 个产品细分市场)

- 计算机(10 个产品细分市场)

- 消费(9 个产品细分市场)

- 工业(4 个产品细分市场)

- 医疗(3 个产品细分市场)

- 汽车(4 个产品细分市场)

- 民航(2 个产品细分市场)

- 军事/国防及其他运输(5 个产品细分市场)

- 全球 EMS 供应商市占率

第5章 产业预测

- 全球电子产品OEM市场

- 电子产品组装的製造原

- 按产品和细分市场划分的 OEM 市场

- 按製造商划分的 EMS 市场(OEM 和 EMS)

- 按国家和地区划分的区域製造占有率细分市场

- 产品应用预测(EMS 和 ODM)

- 按产品和国家/地区划分的全球可用材料市场

第6章 财务基准

- 财务效能基准

- 五年销售成长排名

- 按细分市场划分的平均净利润

- 按细分市场划分的毛利率

- 资产报酬率(平均和顶尖公司)

- 股本回报率(平均和顶级公司)

- 每位员工的收入(平均和顶尖公司)

- 每平方英尺製造空间的收入

- 其他绩效指标 - 每股盈余

- 成长率(平均和顶级公司)

- 平均基本工资率(57%)国家/地区

- 摘要

第7章 M&A

- 过往活动

- 收购分类及估值

- 各地区最佳OEM资产剥离机会

- OEM、EMS和ODM的併购活动

第8章 主要供应商的企业简介

|

|

|

Report Highlights:

Worldwide Electronics Market Analysis, 2024-2029

- 46 Product Segments by Region and Supplier

- Total Assembly Value (OEM, EMS and ODM)

Worldwide EMS Market Analysis, 2024-2029

- OEM vs. Outsourced (EMS and ODM Subcontractors)

- EMS, ODM, and OEM Production Market Share by

Region, Market Segment, and Product (46 products and

-

900+ manufacturing facilities)

- Regional Manufacturing Distribution by 57 Countries

- Product Analysis by EMS, ODM, OEM, and Country

Financial Benchmarks

- Market Segment Metrics - Revenue/Margin/Earnings

- Revenue per Sq. Ft./ per SMT Line/ per Employee

- WW Labor Rates, ROA/ROE L - Highest Performers

In-Depth Company Profiles (Best Performing EMS and ODM

- Companies from $100+ Million - Total 100)

Synopsis:

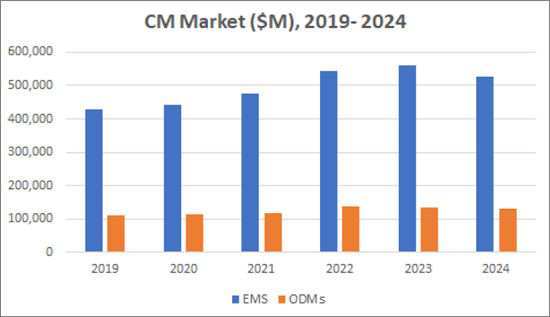

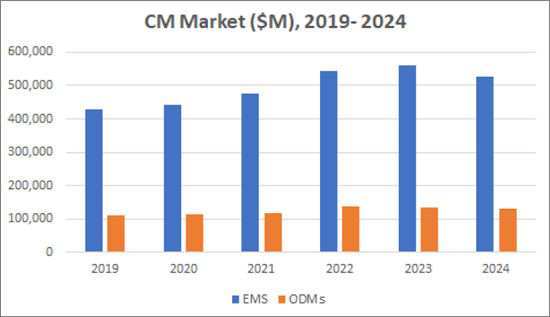

The worldwide electronics manufacturing services (EMS) market is a determining force in production of electronics products and in 2024 accounted for 45 percent of all assembly completed. Outsourcing grew negatively in 2023 from the previous year, as a result of an economic downturn in the computer and communication industries. This resulted in an industry downturn of approximately 5.2 percent in 2024. Both EMS and ODMs endured equally, particularly those serving the top tier.

New Venture Research (NVR) has followed this industry for 30 years and is pleased to offer its latest update on this continually expanding market. Our report, The Worldwide Electronics Manufacturing Services Market - 2025 Edition is the most comprehensive market research report on the EMS industry. This analysis focuses on the leading players, growing market segments, total available market (TAM), and emerging manufacturing opportunities and technologies by numerous products and countries.

The report begins with an analysis of the worldwide electronics assembly market, giving a baseline for the manufacturing value of electronics product assemblies. A forecast is checked against 46 individual product segments which make up the majority of electronics assembly (automotive, communications, computer, consumer, industrial, medical, aviation and aerospace and defense industries). Some segments such as transportation and industrial remain strong sources for outsourcing demand. NVR estimates that total electronics assembly value (OEM+EMS+ODM) was $1.6 trillion in 2024 and will grow to approximately $2.2 trillion in 2029 at a CAGR of 6.3 percent, mostly fueled by the demand for comprehensive EMS services.

To support this conclusion, the report analyzes the EMS industry in a variety of ways. First, it reviews the worldwide market for EMS and OEM electronics assembly by 46 individual products. Second, the report analyzes the EMS industry, including a breakdown of the market leaders and relative share by industry and region. Third, the market opportunity for emerging growth is presented by product and country across the 46 product segments and 900+ manufacturing sites. No other report gives such detail by country, wage rate, and regional product assembly. The data can also be purchased as an Excel file to allow for easy analysis of the hundreds of variables collected in the report.

The report also includes an EMS financial performance analysis for the best-performing companies and examines a variety of critical financial metrics. Another chapter reviews EMS mergers and acquisitions for the past few years and the impact on the growth of the industry and its competitiveness.

The report concludes with profiles of the largest EMS and ODM firms (100 companies-82 EMS and 18 ODM) from all over the world. These reviews summarize the market focus and value-proposition of each company, describing its leading customers, and each company's financial production performance statistics. The intent of these profiles is to serve as a global directory and competitive analysis tool for EMS industry participants.

The Worldwide Electronics Manufacturing Services Market, 2025 Edition is the product of hundreds of hours of research.

Table of Contents

Chapter 1: Introduction

- Objectives

- Organization

- Methodology

Chapter 2: Executive Summary

- Worldwide Market Forecast

- Regional Market Share

- Application Market Share

- EMS Market Share

- EMS Performance

Chapter 3: Worldwide Electronics Industry Forecast, 2024 - 2029

- Overview

- World Economic Outlook

- Summary Forecast

- Industry Forecasts

- Communications (9 product segments)

- Computers (10 product segments)

- Consumer (9 product segments)

- Industrial (4 product segments)

- Medical (3 product segments)

- Automotive (4 product segments)

- Aviation, Defense, Other Transportation (7 product segments)

Chapter 4: EMS Industry Structure, 2024

- The Worldwide OEM Market for Electronic Products

- Manufacturing Sources for Electronics Products

- OEM Market by Seven Market Segments

- EMS Market by Manufacturing Source (OEM, EMS)

- EMS Statistics by Company Size (large/med/small)

- Regional Production Market Share (57 Countries)

- Americas (9 countries)

- EMEA (33 countries)

- APAC (15 countries)

- Industry Production by Market Share (46 products)

- Communications (9 product segments)

- Computer (10 product segments)

- Consumer (9 product segments)

- Industrial (4 product segments)

- Medical (3 product segments)

- Automotive (4 product segments)

- Commercial Aviation (2 product segments)

- Military/Defense, Other Transportation (5 product segments)

- Worldwide EMS Supplier Market Share

Chapter 5: Industry Forecast, 2024-2029

- Worldwide OEM Market for all Electronic Products

- Manufacturing Source for Electronics Assembly

- OEM Market by Product and Market Segment

- EMS Market by Production Source (OEM, EMS)

- Regional Production Share by Country/Segment

- Product Application Forecast (EMS, ODM)

- Total WW Available Market by Product/Country

Chapter 6: Financial Benchmarks

- Financial Performance Benchmarks

- 5-Year Sales Growth Rankings

- Net Income Averages by Market Segment

- Gross Margins by Market Segment

- Return on Assets (Average plus Leaders)

- Return on Equity (Average plus Leaders)

- Revenue per Employee (Average plus Leaders)

- Revenue per Square Foot of Manufacturing Space

- Other Performance Metrics - Earnings per Share

- Growth (Average plus Leaders)

- Average Base Wage Rate by 57 Countries

- Summary Performance Rankings by Leading Supplier

Chapter 7: Mergers and Acquisitions

- Past Activity, 2019-2024 - Largest and Best Deals by Year

- Acquisition Classes and Valuations - Methods

- Best OEM Divestment Opportunities by Region

- M/A activity by OEM, EMS, and ODM

Chapter 8: Company Profiles of Leading Suppliers

|

|

|

List of Figures and Tables (Partial):

- Product Industry and Market Segments

- Nominal GDP of Major Countries and Regions

- Real GDP Growth Rates for Selected Countries

- Electronics Assembly Market, 2024-2029

- Computer Products, 2024-2029

- Communications Products, 2024-2029

- Consumer Products, 2024-2029

- Industrial Products, 2024-2029

- Medical Products, 2024-2029

- Automotive Products, 2024-2029

- Commercial Aviation, Defense, Other Transportation Products, 2024-2029

- Worldwide EMS Market, 2024-2029

- Worldwide OEM Market by Mfg. Source, 2024-2029

- Worldwide OEM Market by Industry Segment, 2024-2029

- Worldwide EMS Market by EMS Size, 2024-2029

- Key EMS Statistics by Company Size, 2024

- Worldwide EMS Market by Region, 2024

- Large EMS Manufacturing Facilities by Country, 2024

- Worldwide EMS Market by Country, 2024

- 57 Countries/Regions

- Worldwide EMS Market by Industry Segment, 2024

- 7 Market Segments, 46 Products

- EMS and ODM Rankings

- EMS Market Share, 2024

- ODM Market Share, 2024

- Top Ten CM Market Share, 2024

- Worldwide OEM Market by Industry Segment, 2024-2029

- Worldwide EMS Market by Company Size, 2024-2029

- Worldwide EMS Market by Country and CAGR - 2024-2029

- Worldwide Total Market by Country and CAGR - 2024-2029

- Worldwide EMS Market by Region and Industry Segment, 2024-2029

- Worldwide Total Market by Region and Industry Segment, 2024-2029

- Worldwide EMS and Total Market by Product

- 46 Product Segments

- Forecasts from 2024 to 2029

- Summary Financial Performance Metrics for Large Public EMS Companies, 2024

- Key Financial Performance Metrics for Large Public EMS Companies, 2024

- Worldwide EMS Margins by Industry Segment, 2024

- EMS Companies by Revenue Growth Rate, 2024-2029

- EMS Companies by Net Income, 2024

- EMS Companies by Gross Margin, 2024

- EMS Companies by Return on Assets, 2024

- EMS Companies by Return on Equity, 2024

- EMS Companies by Revenue per Employee, 2024

- EMS Companies by Revenue per Square Foot, 2024

- EMS Companies by Average Days Collection, 2024

- EMS Companies by Inventory Turns, 2024

- EMS Companies by Available Cash, 2024

- EMS Companies by Debt to Equity, 2024

- EMS Companies by 5-Year EPS Growth, 2024

- Worldwide Performance Ranking for Leading EMS Companies, 2024

- Worldwide EMS Wage Rates by Country, 2024

- Merger and Acquisition Activity, 2024-2029

- Leading Merger and Acquisition Activity by Company, 2024-2029

- Average Merger and Acquisition Valuations by Company, 2024-2029