|

市场调查报告书

商品编码

1394230

证券交易商的观点:来自第一线的观点Security Dealer Perspectives: Views from the Front Line |

||||||

安全经销商正在向新领域拓展,以提高利润并开发需要或重视专业安装和监控的应用程式。

这项研究已进入第 11 个年头,探讨了证券交易商目前对市场的看法以及提供成长机会的策略。 我们评估了当今安全经销商住宅业务面临的最重要的业务驱动因素和挑战,量化了智慧家庭设备初始销售和售后升级期间的需求变化,并确定了人工智慧,并揭示了经销商对Matter 标准将如何影响其业务的看法。

目录

关于 2023 年调查对象的证券交易商

- 前 5 个业务区域

- 经销商销售占总销售额的百分比:住宅与非住宅

主要发现/建议

- 获利预测/年比变动率

- 商业领域销售/年成长率

- 有兴趣与供应商合作以获得新的服务机会

- 经销商如何回报安全系统销售情况

- 有关该事项倡议的知识

- 经销商期望 Matter 带来的三大业务影响

- 人工智慧对业务的影响

2023 年产业基准与趋势

- 年收入/年比比较

- 2022 年年收入

- 预计收入变化:2023 年与 2022 年

- 住房部门收入趋势

- 经销商报告的每月平均安装量

- 消费者报告的家庭安全系统拥有率与去年相比

- 所售家庭安全系统的类型

- 公司的策略定位

业务促进与限制因素

- 证券经销商业务驱动因素

- 阻碍证券经销商业务发展的因素

- 用来克服人员配置挑战的方法

- 经销商如何回报安全系统销售状况

监控、系统定价、互动服务

- 专业监控服务合约期间/年比较

- 占住宅安全系统销售额的百分比

- 销售特殊服务的公司占百分比

- 专业监控经销商报告的 ARPU

- 根据消费者报告,家庭安全服务的平均每月费用与去年相比

- 各种专业监控服务的平均月费

- 高度重视为专业监控提供附加服务

- 有可能在未来 12 个月内提供专业监控的附加服务

- 有兴趣与供应商合作以获得新的服务机会

- 阻碍新加值服务的因素

- 分包给其他公司

安全经销商与智慧家庭设备

- 安装安全系统,包括智慧家庭设备

- 智慧家庭设备安装

- 安全系统与客户拥有的智慧家庭设备整合/同比比较

- 平均预付费用:依安全系统类型划分

- 整合智慧家庭设备和安全系统方面有困难

物质和人工智慧的预期影响

- 有关该事项倡议的知识

- 家庭自动化标准:从 X10 到 Matter

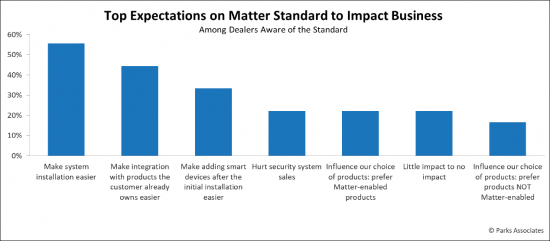

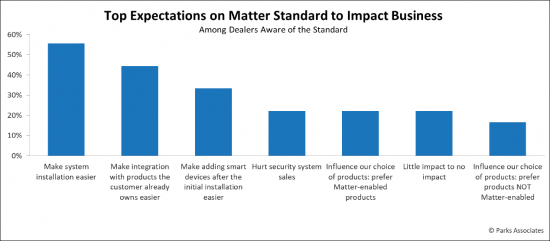

- 对影响业务的事项标准的期望

- 人工智慧对业务的影响

- 人工智慧作为智慧家庭设备解决方案的卖点

基础设施与生态系

- 如何提供专业的监控服务

- 提供专业监控系统的公司

- 选择中央监控站时的重要注意事项

- 安全系统的主要通讯路径

- 各控制面板品牌的安装率与去年相比

- 控制面板功能的重要性

您可以自行安装的DIY/安全系统

- 销售自行安装系统的经销商所占百分比

- 施工方式:DIY系统经销商销售住宅安防

- 如何安装所有家庭安全系统

- 如何安装过去 12 个月内购买的家庭安全系统

- 销售 DIY 安全系统的原因:最重要原因排名 (%)

- 自装系统售后新增专业监控服务的平均百分比

- DIY 系统对家庭安全经销商的影响

- 经销商报告 DIY 安全系统和设备的销售下降

经销商业务策略:商业成长与连续性

- 营业期限

- 企业主

- 商业销售额年成长率

- 为什么要增加商业销售?

- 企业连续性计划

- 企业连续性声明

附录

SYNOPSIS:

Dealers are branching out into new areas to bolster revenues and to find applications that require or value professional installation and monitoring.

The 11th annual release of this survey investigates how dealers see the market today and the strategies that show opportunity for growth. It assesses the most important business drivers for dealers' residential business and the challenges that dealers face today. It quantifies shifting demand for smart home devices during the initial sale and as an aftermarket upgrade, and it highlights dealer perspectives on how artificial intelligence (AI) and the Matter standard will impact their businesses.

SAMPLE VIEW

Table of Contents

About the 2023 Surveyed Security Dealers

- Top Five Business Regions

- Average Residential Sales vs. Non-Residential Sales as a Percentage of the Dealers' Total Sales Units

Key Findings and Implications

- Revenue Expectations - % Change Over Prior Year

- Commercial Sales Growth, YoY

- Interest in Partnership with Vendors for New Service Opportunities

- Dealer-Reported Methods of Selling Security System

- Familiarity with Matter Initiative

- Top Three Business Impacts Dealers Expect from Matter

- Impact of AI on Business

2023 Industry Benchmarks and Trends

- Annual Revenues, YoY

- 2022 Annual Revenues

- Expected Changes in Revenues: 2023 vs. 2022

- Changes in Residential Revenues

- Dealer-Reported Average Installations Per Month

- Consumer-Reported Home Security System Ownership, YoY

- Type of Residential Security System Sold

- Company's Strategic Positioning

Business Drivers and Inhibitors

- Business Driver for Security Dealers

- Business Inhibitors for Security Dealers

- Approaches Used to Overcome Staffing Challenges

- Dealer-Reported Methods of Selling Security System

Monitoring, System Pricing, and Interactive Services

- Contract Term of Professional Monitoring Services, YoY

- Percentage of Residential Security System Sales

- Percentage of Firms Selling Specified Service

- Dealer Reported ARPU for Professional Monitoring

- Average Monthly Fee for Home Security Service, YoY reported by Consumers

- Average Monthly Fees for Various Professional Monitoring Services

- High Intention of Offering Add-On Services to Professional Monitoring

- Likelihood of Offering Add-On Services to Professional Monitoring in the Next 12 Months

- Interest in Partnership with Vendors for New Service Opportunities

- Inhibitors for New Value-added Service

- Subcontract Work to Others

Security Dealers & Smart Home Devices

- Security System Installations Including Smart Home Devices

- Installation of Smart Home Devices

- Security System Integration with Customer Owned Smart Home Devices, YoY

- Average Upfront Price by Type of Security Systems

- Difficulty of Integrating Smart Home Devices with Security System

Expected Impact of Matter and AI

- Familiarity with Matter Initiative

- Home Automation Standards, X10 to Matter

- Expectations on Matter Standard to Impact Business

- Impact of AI on Business

- AI as Selling Point for Smart Home Device Solution

Infrastructure & Ecosystem

- Method of Providing Professional Monitoring Services

- Companies Providing Professional Monitoring System

- Top Ranked Considerations in Selecting a Central Monitoring Station

- Primary Communication Path for Security Systems

- Installation % for Various Control Panel Brands, YoY

- High Importance of Control Panel Features

DIY/Self-Installed Security Systems

- % of Dealers Selling Self-Install Systems

- Method of Installation: Residential Security Sales by DIY System Dealers

- Installation Method for All Home Security Systems

- Installation Method for Home Security Systems Acquired within the Past 12 Months

- Reasons for Selling DIY Security Systems - % Ranking Reason Most Important

- Average % Professional Monitoring Service Adding After Self-Install System Sale

- Impact of DIY Systems on Residential Security Dealers

- Dealers Reporting Losing Sales to DIY Security Systems & Devices

Dealer Business Strategies: Commercial Growth & Succession

- Business Operating Length

- Business Owner

- Commercial Sales Growth, YoY

- Reasons to Increase Commercial Sales

- Succession Plan of Company

- Company Succession Statement