|

市场调查报告书

商品编码

1469329

智慧家庭:整合,自动化和控制Smart Home: Integration, Automation, and Control |

||||||

智慧家庭正走向成熟,近一半的美国网路家庭拥有核心智慧家庭设备。智慧家庭公司需要重新思考他们的产品和策略,以吸引更多的大众。 许多消费者不是体验智慧家居,而是透过一个或多个解决每个痛点的单点解决方案来体验智慧家庭。

该报告根据与智慧家庭相关的消费者研究来审视消费者的购买行为和偏好,涵盖智慧家庭设备拥有趋势,购买计划,使用方法,设备类型趋势以及 NPS(净推荐值),回报及趋势等

目录

执行摘要

- 智慧家庭设备拥有量趋势

- 不断增加的设备类别

- 智慧家庭设备拥有者的技术亲和力

- 您拥有的智慧家庭设备数量

- 价格实惠且超值的智慧家庭设备

- 智慧家庭设备购买状况与购买意向

- 智慧摄影机或智慧视讯门铃拥有量趋势

- 独立视讯产品的付费服务

- 智慧家庭设备整合的目的

- 互联设备拥有者拥有可协同工作的协调设备

- 十大有吸引力的动作/惯例

- 建议的开始例程的方法

- 采购与生态系统整合:注意事项

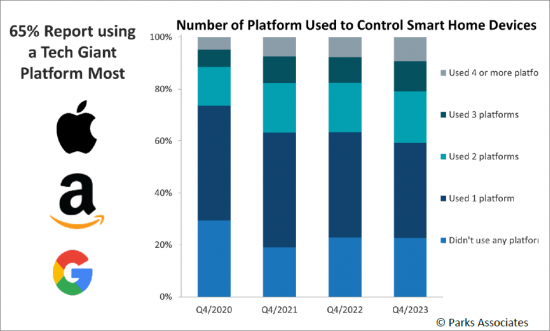

- 用于控制智慧家庭设备的平台数量

- 智慧家庭产品购买管道

- 智慧安防与安全设备:专业安装

- 智慧能源设备:由专家安装

智慧家庭简介

- 智慧家庭设备拥有量趋势

- 推出智慧家庭设备

- 平均拥有的智慧家庭设备数量

- 您拥有的智慧家庭设备数量

- 技术亲和力:以智慧家庭设备的拥有量划分

- 智慧家庭设备拥有者的技术亲和力

- 杰弗瑞·摩尔的"跨沟"理论

- 创新扩散:技术采用者分类

设备采用率:依个人和类别划分

- 智慧安全与安保设备拥有量趋势

- 智慧能源,照明和水设备的拥有量趋势

- 智慧家电拥有量趋势

- 智慧音箱或智慧显示器的拥有量趋势

视讯设备业务

- 智慧摄影机或智慧视讯门铃拥有量趋势

- 平均拥有的智慧摄影机和智慧视讯门铃数量

- 购买可视门铃品牌

- 购买的智慧相机品牌

- 可视门铃付费服务

- 网路摄影机付费服务

- 智慧型视觉门铃:每月服务费

- 智慧相机:每月服务费

公寓大楼与智慧家庭介绍

- 智慧家庭设备的采用率与意图:依居住类型划分

- 智慧家庭设备的采用与意图:依建筑类型

- 智慧家庭设备拥有者/使用者分类

智慧型装置:认知度,价值,购买能力

- Parks Associates相关性理论

- 智慧型装置:认知度,价值,购买能力

- 智慧型装置:意识

- 智慧型装置:感知的效益价值

- 智慧型装置:购买能力

设备购买与触发器

- 智慧家庭设备购买状况与购买意向

- 购买智慧安保和安全设备

- 购买智慧能源,照明和水设备

- 购买智慧电器

- 平均售价:选择智慧家庭设备

- 为什么要买智慧家庭设备?

购买意愿

- 智慧家庭设备购买意愿:安全与保全,能源,照明,水,智慧家电,智慧家庭控制

- 购买意愿:智慧安全与保全设备

- 购买意愿:智慧能源,照明和水设备

- 购买意愿:智慧家电

购买通路与替代品

- 如何取得智慧家庭设备

- 如何取得智慧家庭设备-购买

- 如何取得智慧家庭设备-礼物和预先安装

- 智慧家庭产品的购买管道

- 购买智慧家庭设备:首次购买和重复购买

- 购买智慧家庭设备:首次购买和重复购买

- 智慧安防与安全设备:专业安装

- 智慧能源设备:由专家安装

智慧家庭控制趋势

- 使用家庭控制应用

- 智慧家庭设备单元的主要控制方式

- 智慧安全防范设备的主要控制方法

- 能源,照明,供水装置的主要控制方式

智慧家庭平台配置

- 用于控制智慧家庭设备的平台

- 用于控制智慧家庭设备的平台数量

- 最常使用的智慧家庭设备控制平台

- 智慧家庭设备拥有者用于控制智慧家庭设备的平台数量

- 单一统一应用的首选提供者

- 潜在购买者的未来购买行为与生态系统整合考量因素

- 生态系统整合是未来智慧家居设备购买的关键考量因素

智慧家庭例行公事/整合

- 平衡自动化与个人偏好

- 目前的整合使多个智慧家居设备协同工作

- 智慧家庭设备整合的目的

- 有吸引力的行为/常规类别

- 有吸引力的动作/例行公事

- 入口处周围有吸引力的活动/例行公事

- "走出去"例行公事的有吸引力的行动

- "睡前"例行公事的有吸引力的动作

- 为您的"起床"例程提供有吸引力的动作

- "娱乐"日常的迷人动作

- "晚餐时间"例行公事的有吸引力的动作

- 为您的"在家工作"习惯提供有吸引力的行动

- 美国远距办公家庭

- 支持照顾亲人的有吸引力的活动

- 建议的开始例程的方法

使用者体验:NPS与回报

- NPS:2024 年智慧家庭设备

- 智慧家庭设备 NPS:有小孩的家庭

- 智慧家庭设备 NPS:技术亲和力

- NPS:智慧安全装置

- NPS:能源,照明和水设备

- NPS:智慧型设备

- 购买和退货智慧家庭设备

- 过去 12 个月智慧家庭设备退货率及过去 6个月购买率

- 退回智慧家庭设备的原因

附录

SYNOPSIS:

The smart home is at a moment of maturity, where nearly half of US internet households own a core smart home device. Smart home players need to rethink their products and strategies for a more mass market buyer. At the same time, many consumers experience the "smart home" through one or more point solutions solving unique pain points - rather than a coordinated intelligent home experience.

SAMPLE VIEW

This flagship consumer study provides the latest trending data on smart home trends influencing consumer purchase behavior and preferences that provide critical intelligence for smart home business strategies. Topics include smart product adoption and purchase intention across multiple product categories, segmentation profiles, purchase channels and installation preferences, voice and control platforms, NPS by product category, and attitudes about interoperability.

Key questions addressed:

- 1. How is smart home device adoption trending overall and among specified product categories?

- 2. How were recently added devices acquired and installed?

- 3. How has the makeup of the adopter base changed since last year?

- 4. What are the leading smart home control platforms?

- 5. Do consumers coordinate their smart home devices to work together?

- 6. What are the top smart home use cases driving device integrations and routines?

"As the market expands into the mainstream, there is more urgency than ever to deliver on the integrated, automated, intelligent vision of the smart home." - Jennifer Kent, VP, Research, Parks Associates.

ABOUT THE AUTHORS:

Elizabeth Parks , President and Chief Marketing Officer.

As the President and Chief Marketing Officer at Parks Associates, Elizabeth Parks plays a pivotal role at Parks Associates. With over two decades of dedication to the company, she has been instrumental in shaping its growth and success, along with the continued focus of delivering timely and quality industry and consumer insights on the connected home and SMB industries.

Elizabeth's leadership extends across a diverse range of responsibilities. She is a driving force behind the company's research focus and coverage areas, ensuring that Parks Associates remains at the forefront of industry trends and insights for the broadband, consumer electronics, and home service markets. Her expertise is showcased in the strategic communication plan she orchestrates, encompassing advertising, public relations, and marketing efforts.

A cornerstone of her role is as the key organizer of Parks Associates' prestigious events, including Parks Associates signature event, CONNECTIONS(TM), Smart Energy Summit, Future of Video, Connected Health Summit, and Smart Spaces.

Jennifer Kent, Vice President, Research.

INDUSTRY EXPERTISE: Connected Health, Connected Home Technologies and Services, Connected Entertainment Products and Services

Jennifer manages the research department and Parks Associates' process for producing high-quality, relevant, and meaningful research. Jennifer also leads and advises on syndicated and custom research projects across all connected consumer verticals and guides questionnaire development for Parks Associates' extensive consumer analytics survey program. Jennifer is a certified focus group moderator, with training from the Burke Institute.

Table of Contents

Executive Summary

- Smart Home Device Ownership

- Growing Device Categories

- Tech Affinity, Among Smart Home Device Owners

- Number of Smart Home Devices Owned

- Smart Home Device Affordable & Value Groups

- Smart Home Device Purchases and Intentions to Buy

- Smart Camera or Smart Video Doorbell Ownership

- Paid Services for Stand-alone Video Products

- Purpose of Smart Home Device Integration

- Connected Device Owners with Coordinated Devices Working Together

- Top 10 Appealing Actions/Routines

- Preferred Methods of Initiating a Routine

- Purchase and Ecosystem Integration Considerations

- Number of Platform Used to Control Smart Home Devices

- Smart Home Product Purchase Channel

- Smart Security & Safety Devices: Professional Installation

- Smart Energy Devices: Professional Installation

Smart Home Adoption

- Smart Home Device Ownership

- Smart Home Devices Adoption

- Average Smart Home Devices Owned

- Number of Smart Home Devices Owned

- Tech Affinity, by Smart Home Device Ownership

- Tech Affinity, Among Smart Home Device Owners

- Geoffrey Moore's "Crossing the Chasm" Theory

- Diffusion of Innovation: Tech Adopter Segments

Individual and Category Device Adoption

- Smart Safety & Security Device Ownership

- Smart Energy, Lighting, Water Device Ownership

- Smart Appliance Ownership

- Smart Speaker or Smart Display Ownership

The Business of Video Devices

- Smart Camera or Smart Video Doorbell Ownership

- Average # of Smart Cameras and Smart Video Doorbells Owned

- Video Doorbell Brand Purchased

- Smart Camera Brand Purchased

- Paid Services for Video Doorbells

- Paid Services for Network Cameras

- Smart Video Doorbell: Monthly Service Fees

- Smart Camera: Monthly Service Fees

Multifamily and Smart Home Adoption

- Smart Home Device Adoption & Intention by Type of Residents

- Smart Home Device Adoption & Intention by Type of Building

- Smart Home Device Owners/User Segments

- Smart Home Device Owners/User Segments

Smart Devices: Familiarity, Value, Affordability

- Parks Associates Theory of Relevancy

- Smart Devices: Familiarity vs. Value vs. Affordability

- Smart Devices: Familiarity

- Smart Device: Perceived Value of Benefit

- Smart Devices: Affordability

Device Purchases and Triggers

- Smart Home Device Purchases and Intentions to Buy

- Smart Security & Safety Device Purchases

- Smart Energy, Lighting, Water Device Purchases

- Smart Appliance Purchases

- Average Selling Price: Select Smart Home Devices

- Reasons for Purchasing Smart Home Devices

Purchase Intentions

- Smart Home Devices Purchase Intention: Safety & Security, Energy, Lighting, Water, Smart Appliance, Smart Home Control

- Purchase Intention: Smart Safety & Security Devices

- Purchase Intention: Smart Energy, Lighting, Water Device

- Purchase Intention: Smart Appliance

Purchase Channels and Replacements

- Smart Home Device Acquisition Method

- Smart Home Device Acquisition Method - Purchases

- Smart Home Device Acquisition Method - Gifts and Pre-installation

- Smart Home Product Purchase Channel

- Smart Home Devices Purchases: First Time vs. Repeat Purchases

- Smart Home Devices Purchase: First Time vs. Repeat Purchase

- Smart Security & Safety Devices: Professional Installation

- Smart Energy Devices: Professional Installation

Smart Home Control Trends

- Home Control App Usage

- Primary Control Method of Smart Home Devices Units

- Primary Control Method of Smart Safety & Security Device

- Primary Control Method of Energy, Lighting, Water Device

Smart Home Platform Preferences

- Platforms Used to Control Smart Home Devices

- Number of Platform Used to Control Smart Home Devices

- Most Used Platform Used to Control Smart Home Device

- Number of Platform Used to Control Smart Home Devices by Smart Home Device Ownership

- Preferred Provider for a Single Unified App

- Future Purchase and Ecosystem Integration Considerations Among Intenders

- Ecosystem Integration as Critical Consideration to Future Smart Home Device Purchase

Smart Home Routines/Integrations

- Balance of Automation & Personal Preferences

- Current Integration of Multiple Smart Home Devices Working Together

- Purpose of Smart Home Device Integration

- Appealing Actions/Routines Category

- Top Appealing Actions/Routines

- Appealing Actions/Routines Around Entrance

- Appealing Actions for a "Away" Routine

- Appealing Actions for a "Bedtime" Routine

- Appealing Actions for a "Wake-up" Routine

- Appealing Actions for a "Entertainment" Routine

- Appealing Actions for a "Dinner Time" Routine

- Appealing Actions for a "Work at Home" Routine

- US Internet HHs with a Remote Worker at Home

- Appealing Actions for Helping Care for Loved Ones

- Preferred Methods of Initiating a Routine

User Experience: NPS & Returns

- Net Promoter Score: Smart Home Devices 2024

- Smart Home Device NPS: Households with Children

- Smart Home Device NPS by Tech Affinity

- Net Promoter Score: Smart Safety & Security Devices

- Net Promoter Score: Energy, Lighting, Water Device

- Net Promoter Score: Smart Appliance

- Smart Home Device Purchases and Return

- Smart Home Device Return Rate in the Last 12 Months vs Purchase rate in the Past 6 Months

- Reasons for Returning Smart Home Devices

Appendix

- Demographic Breakdown of Tech Adopter Segments

- Housing-related Demographic Breakdown of Tech Adopter Segments

- Defining Heads of Internet Households