|

市场调查报告书

商品编码

1584145

家庭安全和监控:订阅者取消和保留Home Security & Monitoring: Subscriber Churn and Retention |

||||||

安防市场不断发展以满足消费者对系统和设备、安装方法、购买方法和监控服务的多种选择的需求。经常性收入流(包括专业监控和视讯储存)对于安全系统和设备业务的可持续性至关重要。安全提供者必须吸引并留住用户,同时透过提供可带来真正价值的新功能和服务来最大化 ARPU。

资讯图表

本报告调查了 2024 年第四季度的家庭安全和监控市场,并概述了安全系统和服务、用户模型、功能、实施状态、安装人员选择/偏好/意见以及提供者的变更/取消。趋势、策略来帮助您留住订阅者等等。

目录

执行摘要

安全解决方案:招募/市场分类

- 部署安全解决方案

- 推出有偿保全服务

- 拥有家庭安全系统

- 过去一年购买的家庭安全系统

- 在所有安全系统拥有者之间采用互动系统

- 最近的安全系统购买者采用互动系统

- 拥有智慧安全保障设备

- 引进家庭安全系统和服务

- 家庭安全系统安装

- 安装方法

安防系统采购流程

- 安防系统采购状况及购买意向

- 智慧摄影机及智慧型可视门铃采购状况及购买意愿

- 现代系统买家正在考虑替代安全解决方案

- 获得的安全系统目前未使用

- 目前未使用的自装系统

- 安防系统采购管道

- 如何购买安全系统

- 如何购买安全系统所有者

- 家庭安全系统的平均初始成本(年比)

- 所有购买家庭安全系统的业主所使用的付款方式

- 购买家庭安全系统的付款方式:依安装方式

- 作为安全系统一部分获得的设备

- 作为系统一部分获得的设备(按安装方法)

- 初始安装后新增至安全系统的设备

- 初始安装后新增至安全系统的设备(依安装方法)

- 新增到现有安全系统的设备

- 购买安全系统的原因

- 引进安全系统的原因:DIY/专业

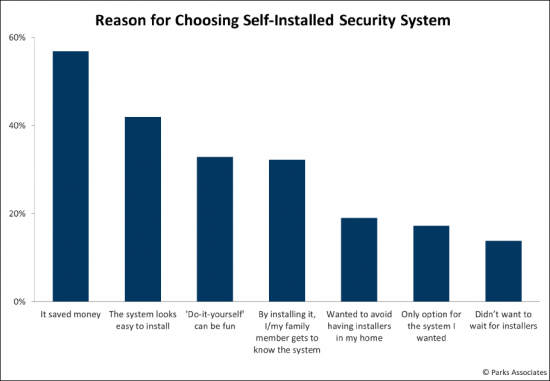

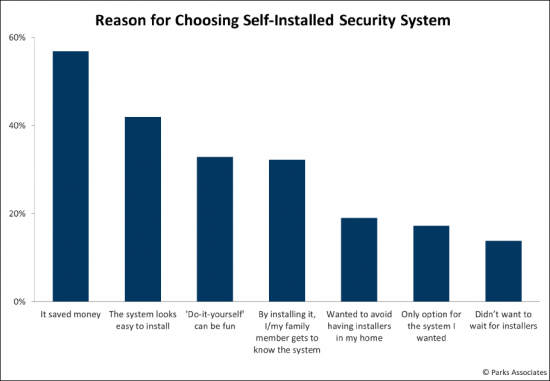

- 为什么选择DIY安装安全系统?

- 安装 DIY 系统的困难

竞争格局

- 拥有的安全系统品牌:所有系统拥有者

- 拥有的安全系统品牌:过去一年购买的系统的所有者

- 安防系统品牌: DIY/专业

- 可视门铃品牌购买

- 智慧相机品牌选购

- 付费家庭安全服务:依安全系统品牌分类

- 领先的安防系统专业监控服务供应商

- 安全服务提供者净推荐值 (NPS)

- 主要安全系统服务商NPS趋势

安全服务类别: 专业自助设备监控

- 安全服务细分市场:监控系统/设备

- 订阅家庭安全系统付费服务的家庭数量(同比变化)

- 安全系统服务介绍

- 安防监控服务:依安装方式

- 安装专业安防系统的家庭中订阅有偿安防服务的家庭数

- 安装了自我安全系统的家庭中订阅有偿保全服务的家庭数量

- 安全系统服务提供者 NPS:按监控和安装类别

- 拥有智慧型视讯设备的家庭中视讯门铃和智慧摄影机的 NPS

- 可视门铃付费服务

- 智慧相机付费服务

- 智慧摄影机:安装区域

- 付费服务连线率:依摄影机安装位置划分(2024年第2季)

- 智慧型烟雾/一氧化碳侦测器所有者的安全系统所有权状况

- 订阅安全系统的付费检测服务

- 独立探测器方案

- 智慧型烟雾/一氧化碳侦测器订阅方案的每月费用

- 烟雾/一氧化碳侦测器服务功能

系统服务详细分析:ARPU、流失率、留存率

- 引进家庭安全系统和服务

- 家庭安全系统的平均每月服务费

- 2024 年第二季平均月价:依主要品牌划分

- 专业监控服务连续订阅期

- 过去 12 个月对安全系统服务所做的更改

- 专业监控系统家庭转投其他专业提供者的比例

- 从自我监测转向专业监测的家庭百分比

- 为什么安全系统拥有者取消专业监控安全服务

- 取消或切换的人之前订阅过的供应商

- 更换监控提供者的原因

- 转专业监听可能性大

- 专业监控系统服务合约剩余期限及拟取消人数

- 合约条款如何影响取消

- 维护激励对专业监控系统服务取消计画的影响

- 服务价格折扣作为专业监控系统服务维护工具的影响

系统服务详细分析:自我监控

- 为什么拥有安全系统的家庭选择自助服务而不是专业安全系统

- 对自我监控安全系统的看法

- 邻居、急救人员及其对误报的看法:依服务类型

- 专业监控服务订阅促销

- 为什么要从自我监控转向专业监控?

- 高意愿加盟专业监控服务

下一代服务

- 除入侵防御功能外的前 3 项必需功能

- 采用个人、车辆和穿戴式安全解决方案

- 使用至少一种经过测试的安全解决方案的百分比

- 使用个人、车辆和穿戴式安全解决方案的家庭

- 对安全系统附加服务感兴趣

- 事件验证方法的吸引力:影片、人工智慧和对每个系统所有者的个人化安全

- 事件验证方法的吸引力:影片、人工智慧和使用安全服务的个人安全

安全买家简介

- 服务使用者概况:人口统计

- 服务使用者概况:住房特征

- 服务使用者概况:就业、种族/民族

- 人口统计:依系统实施状态

- 外壳因素:依系统安装

- 就业/种族/民族:依系统实施

附录

SYNOPSIS:

The security market has evolved to meet consumer demand for choice in systems, devices, installation methods, purchase methods, and monitoring services. Professional monitoring, video storage, and other recurring sources of revenue are critical to the sustainability of a security system or device business. Security providers must attract and retain subscribers, while maximizing ARPU through the delivery of new feature and services that provide real value.

INFOGRAPHICS

This Q4 2024 study assesses security subscription models, features, and pricing as well as strategies that can aid in subscriber retention.

Key questions addressed:

- 1. How are security segments shifting, between systems and devices and between installation and monitoring methods?

- 2. How are the competitive dynamics shifting between leading brands and service providers?

- 3. What are the most impactful triggers for purchasing security solutions?

- 4. What is the take rate of professional monitoring and other recurring revenue security services?

- 5. What are average attrition rates, and what incentives pose the greatest opportunity to retain subscribers?

- 6. What new security solutions show promise to attract new subscribers and increase ARPU?

ANALYST INSIGHT:

"Security providers have held down churn and increased customer spending in these recent lean years. Prepare for a rebound in demand with an expanded portfolio of solutions and a choice in installation and monitoring options that meet the needs of diverse customer segments." - Jennifer Kent , VP, Research, Parks Associates.

Table of Contents

Executive Summary

- Security Service Market Segments: Monitoring, Systems, and Devices

- Residential Security Solution Market

- Security Market Customer Profiles

- Security System Market Segments

- Paid Security System Services among Pro-Installed Security System HHs

- Paid Security System Services among Self-Installed Security System HHs

- Security System Service Provider NPS

- High Intention of Subscribing to Professional Monitoring for Security System in Next 6 Months

- Security System-attached Devices

- Opportunities to Expand Security Offerings

- Competitors Vie for Leadership Across Key Industry Metrics

Security Solutions: Adoption & Market Segments

- Security Solution Adoption

- Paid Security Service Adoption

- Home Security System Ownership

- Home Security Systems Acquired in Past Year

- Interactive Systems Adoption among all Security System Owners

- Interactive Systems Adoption among Recent Security System Buyers

- Smart Safety & Security Device Ownership

- Home Security System & Service Adoption

- Home Security System Installation

- Installation Method

Security System Purchase Journey

- Security System Purchase and Intention to Buy

- Smart Camera & Smart Video Doorbell Purchase and Intention to Buy

- Alternative Security Solutions Considered, Among Recent System Buyers

- Security System Acquired Not Currently In Use

- Self-Installed System Not Currently In Use

- Security System Purchase Channel

- Security System Purchase Method

- Purchase Method for Security Systems Owners

- Average Upfront Fees for Home Security Systems, YoY

- Payment Method Used to Acquire a Home Security System among All System Owners Who Purchased Their Systems

- Payment Method Used to Acquire a Home Security System by Install Method

- Devices Acquired as Part of Security System

- Devices Acquired as Part of System, by Installation Method

- Devices Added to Security System After Initial Installation among all Security System Owners

- Devices Added to Security System After Initial Installation by Installation Method

- Devices Added to Existing Security System

- Triggers for Security System Acquisition

- Triggers of Security System Acquisition by DIY vs. Pro Installation

- Reason for Choosing Self-Installed Security System

- Difficulty with DIY System Install

Competitive Landscape

- Security System Brand Owned among all System Owners

- Security System Brand Owned among Owners of Systems Acquired in the Past Year

- Security System Brand Owned by DIY Installed vs Pro Installed

- Video Doorbell Brand Purchased

- Smart Camera Brand Purchased

- Paid Home Security Service by Security System Brand

- Top Professional Monitoring Service Providers for Security Systems

- Security Service Provider Net Promoter Score (NPS)

- NPS of Top Security System Service Providers, Trending

Security Service Segments: Pro, Self, and Device-based Monitoring

- Security Service Market Segments: Monitoring, Systems, and Devices

- Households with Paid Service Attached to Home Security System, YoY

- Adoption of Security System Services

- Security Monitoring Service by Installation Method

- Paid Security Services among Pro-Installed Security System HHs

- Paid Security Services among Self-Installed Security System HHs

- Security System Service Provider NPS by Monitoring & Installation Segments

- NPS of Video Doorbell and Smart Camera among All Smart Video Device Owning Households

- Paid Services for Video Doorbells

- Paid Services for Smart Cameras

- Smart Camera: Area of Installation

- Paid Service Attach Rate by Camera Location - Q2 2024

- Security System Ownership Among Smart Smoke/CO Detector Owners

- Paid Detector Service with Security System Subscription

- Stand-Alone Detector Plan

- Smart Smoke/CO Detector Subscription Plan Monthly Cost

- Features of Smoke/CO Detector Service

System Services Deep Dive: ARPU, Churn, Retention

- Home Security System & Service Adoption

- Average Monthly Service Fees for Home Security Systems

- Avg Monthly Fee by Top Brands, Q2 2024

- Length of Continuous Subscription to Professional Monitoring Service

- Changes Made to Security System Service in Past 12 Months

- % of Pro Monitoring Systems HHs that Switched Pro Monitoring Providers

- % of Pro Monitoring Systems HHs that Switched from Self-Monitoring to Pro

- Reasons for Security Systems Owners Cancelling Professional Monitoring Security Service

- Previous Professional Monitoring Service Providers for Security System, Among Cancellers/Switchers

- Reason for Switching Between Professional Monitoring Providers of Security System

- High Likelihood of Making Changes to Pro-Monitored Security System

- Pro-Monitored System Service Contract Length Remaining, Among Intended Cancellers

- Impact of Contract Terms on Cancellation Plans

- Impact of Retention Incentive on Pro-Monitoring System Service Cancellation Plans

- Impact of Service Pricing Discount as Retention Tool for Pro-Monitored System Services

System Services Deep Dive: Self Monitoring

- Reason Security System Households Choose Self over Pro Monitoring Service

- Attitudes toward Self-Monitored Security System

- Attitudes towards Neighborhood, First Responders, False Alarms by Type of Service

- Promotion to Boost Professional Monitoring Service Subscription

- Reason for Switching from Self to Pro Monitoring of a Security System

- High Intention of Subscribing to Professional Monitoring for Security System

Next Wave of Services

- Top Three Desired Features Beyond Intrusion Protection

- Adoption of Personal, Vehicle, and Wearable Safety Solutions

- % Using at Least One Tested Safety Solution

- Householders Using Personal, Vehicle, and Wearables Safety Solutions

- Interest in Security System Add-on Service

- Appeal of Event Verification Methods: Video, AI, Private Guard among All System Owners

- Appeal of Event Verification Methods: Video, AI, Private Guard by Security Service Use

Security Buyer Profiles

- Service Subscriber Profile: Demographics

- Service Subscriber Profile: Housing Characteristics

- Service Subscriber Profile: Employment, Race/Ethnicity

- Demographics by System Installation

- Housing Factors by System Installation

- Employment, Race/Ethnicity by System Installation