|

市场调查报告书

商品编码

1469334

NTC 热敏电阻:全球市场、技术与机会 (2023-2028)NTC Thermistors: World Markets, Technologies & Opportunities: 2023-2028 |

||||||

NTC(负温度係数)型热敏电阻因其作为温度感测器和电路保护元件的双重用途,在汽车、消费性电子、数位电子、工业和高可靠性终端市场等主要终端市场中得到消费。预计2023年将有大量需求。

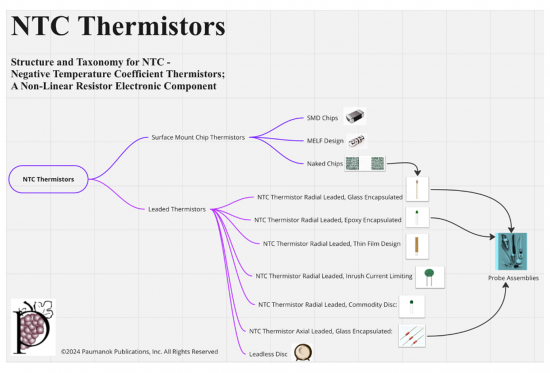

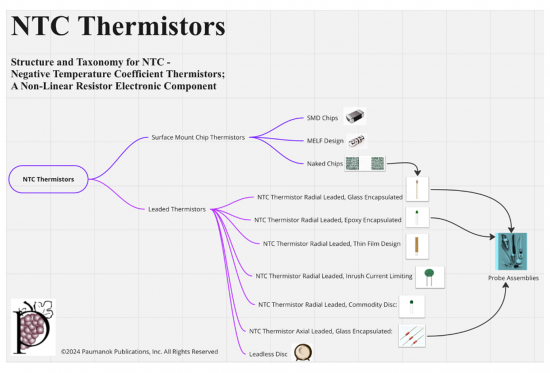

本报告涵盖的 NTC 热敏电阻产品

本报告涵盖以下 NTC 热敏电阻产品配置:

- NTC热敏电阻:径向引线型/玻璃密封型

- NTC热敏电阻:径向引线型/环氧树脂密封型

- NTC热敏电阻:径向引线型/突波电流限制型

- NTC热敏电阻:径向引线型/薄膜设计型

- NTC热敏电阻:径向引线型、通用盘型

- NTC热敏电阻:轴向引线型/玻璃密封型

- NTC 表面黏着 (SMD) 片式热敏电阻:超小型到大型 EIA 外壳尺寸

- NTC热敏电阻:MELF设计

- NTC热敏电阻:无引线裸晶片

- NTC热敏电阻:无引线磁碟

- NTC热敏电阻:探头组件

NTC热敏电阻最终市场(2023-2028)

本研究探讨了 NTC 热敏电阻元件转换为探针组件的趋势,以及相关市场(汽车、家用电器、数位电子、工业、特殊应用等)的详细趋势。

汽车电子NTC热敏电阻市场(2023-2028)

这项研究详细研究了用于各种汽车组件(例如引擎盖下、防火墙外)温度感测和补偿的 NTC 热敏电阻的使用和终端市场。

家电NTC热敏电阻市场(2023-2028)

这项研究考察了大小家电的NTC热敏电阻市场-包括大小家电(冰箱、空调等大小家电)中主要检测和补偿应用的市场。

数位电子产品的NTC热敏电阻市场(2023-2028)

在本部分中,我们将分析电源 NTC 热敏电阻(片式/盘式)在突波电流限制方面的应用。 电脑、电视、照明镇流器、直流马达、物联网和关键通讯基础设施设备进一步消耗电力。

高可靠性NTC热敏电阻市场(2023-2028)

这项研究也聚焦于工业、国防、太空、医疗、再生能源以及石油和天然气电子市场中的热敏电阻市场,特别关注电池电气系统中热感测的新兴机会。

NTC 热敏电阻市场与竞争:依技术划分(2024 年)

本报告的 "技术竞争" 分析NTC 我们分析了前33名热敏电阻供应商的竞争状况。

NTC热敏电阻供应商与经销商之间的关係(2024年)

本版块我们将重点介绍全球电子元件主要经销商的NTC热敏电阻和线路卡的产品阵容,特别关注主要经销商和专业经销商之间的差异,并对销售方式进行比较和对比。

NTC 热敏电阻供应商市占率:

本研究调查了全球 NTC 热敏电阻供应商的销售额和市场份额。

NTC热敏电阻市场预测(2023-2028)

在此预测部分,我们预测了NTC热敏电阻的消费趋势(2023-2028年,基于数量和数量)和2023年至2028年的价格趋势,以及按地区预测的全球需求趋势(截至2028年)。

区域市场:亚太地区、欧洲、北美和南美。

关于NTC热敏电阻

NTC热敏电阻的阻值随着温度的升高而降低。 因此,与其他电子元件相比,它们具有独特的功能。 它们的独特之处还在于它们是针对特定终端市场的产品,例如汽车和消费性电子市场。 该分析按类型、组成、应用、地区和竞争对全球 NTC 热敏电阻市场进行了研究,并提供了截至 2028 年的预测。

Because of the dual use of NTC (Negative Temperature Coefficient) type thermistors as temperature sensors and circuit protection devices the component has found itself in significant demand in 2023 through year end with consumption in key end markets such as automotive, home appliances, digital electronics, industrial, and high-reliability end markets.

NTC Thermistor Products Covered:

The following NTC Thermistor product configurations are discussed in this report:

- NTC Thermistor Radial Leaded, Glass Encapsulated

- NTC Thermistor Radial Leaded, Epoxy Encapsulated

- NTC Thermistor Radial Leaded, Inrush Current Limiting

- NTC Thermistor Radial Leaded, Thin Film Design

- NTC Thermistor Radial Leaded, Commodity Disc

- NTC Thermistor Axial Leaded, Glass Encapsulated

- NTC SMD Surface Mount Chip Thermistors in Ultra-Small to Large EIA Case Sizes

- NTC Thermistor MELF Designs

- NTC Thermistor Leadless Naked Chip

- NTC Thermistor Leadless Discs

- NTC Thermistor Probe Assemblies

NTC Thermistor End-Markets Covered: 2023-2028

The study also looks at the conversion of NTC thermistor components into probe assemblies and related markets in automotive, home appliance, digital electronics, industrial and specialty end-use market segments.

NTC Thermistor Markets In Automotive Electronics: 2023-2028

The study takes a detailed look at applications and end-markets for NTC thermistors in various automotive sub-assemblies including under-the-hood and beyond the firewall environments for temperature sensing and compensation.

NTC Thermistor Markets in Home Appliances: 2023-2028

The study also looks at the large and small home appliance business segment for NTC thermistors, including key sensing and compensation market applications in refrigerators and air conditioners as well as other large and small home appliances.

NTC Thermistor Markets In Digital Electronics: 2023-2028

This part of the study focuses on inrush current limiting applications for NTC thermistors (chip and disc) in power supplies. Power supplies are further consumed in computers, TV sets, lighting ballasts, DC Motors and IOT and backbone telecommunications infrastructure equipment.

NTC Thermistor Markets for High Reliability: 2023-2028

The study also focuses on thermistor markets in industrial, defense, space, medical, renewable and oil & gas electronics markets and focuses specifically on emerging opportunities for thermal sensing of battery electric systems.

NTC Thermistor Markets and Competition By Technology:2024

The "Competition by Technology" segment of the report analyzes competition among the top 33 NTC thermistor vendors based upon NTC thermistor sub-type and component configuration, NTC chip case size, and competition by end-use product market segment.

NTC Thermistor Vendor and Distributor Relationships: 2024

This section of the report notes the product lines for NTC thermistor line cards for the world's top electronic component distributors. The study compares and contrasts the differences between major and specialty distributors and how they market NTC thermistors.

NTC Thermistor Vendor Market Shares:

The study shows global sales and market share for NTC thermistor Vendors.

NTC Thermistor MARKET FORECASTS: 2023-2028:

The forecast segment offers estimated for consumption of NTC thermistors between 2023 and 2028 in terms of value, volume and pricing as well as demand by world region and end-use market segment to 2028.

The study is 148 Pages; 35 Tables and Graphs, 33 Producer Profiles.

Regional Markets: Asia-Pacific, Europe, Americas.

ABOUT NTC THERMISTORS

NTC thermistors demonstrate a decrease in resistance when subjected to an increase in temperature. This makes them unique in their functionality compared to other electronic components. It also makes them unique in their exposure to specific end-markets such as automotive and home appliance market segments. This study addresses the global market for NTC thermistors by type, configuration, application, world region, competition, and contains forecasts to 2028.

SAMPLE VIEW