|

市场调查报告书

商品编码

1597048

隔离器无菌填充系统的全球市场:一次容器类别,各运用规模,system throughput,各终端用户,各地区 - 2035年前的产业趋势与全球预测Aseptic Filling Machine Market by Type of Compatible Primary Container, Scale of Operation, System Throughput, End-user and Key Geographical Regions: Industry Trends and Global Forecasts, Till 2035 |

||||||

根据 Roots Analysis 预测,到 2035 年,全球无菌灌装系统市场规模将从目前的 13 亿美元成长到 34 亿美元,到 2035 年的预测期内复合年增长率为 8.7%。

药品填充和精加工製造是药品製造的重要组成部分。然而,目前的药物填充过程带来了一些课题,包括污染风险、剂量分配不准确和标籤问题。产业专家估计,大约 80% 的产品召回是由于包装相关问题造成的。此外,灌装线上的手动操作对产品完整性构成威胁,因为它们增加了工人接触造成污染的风险,而且通常效率低。

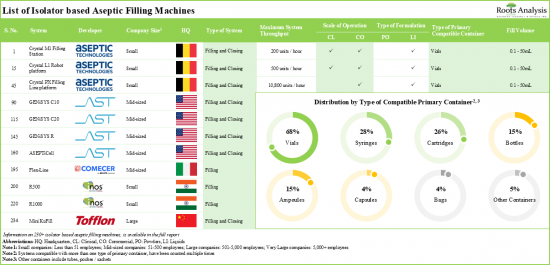

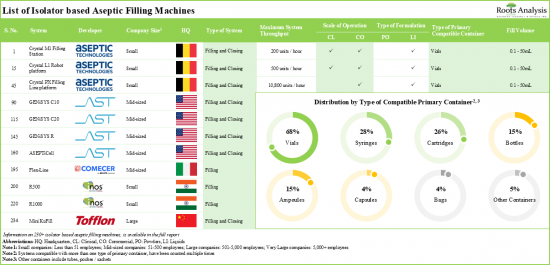

多年来,製药设备製造商已将隔离器和限制进入屏障系统 (RABS) 纳入自己的无菌填充和精加工生产线中,以创造更具成本效益、可靠且高效的机器。其中许多系统旨在透过最大限度地减少人为参与来降低操作员引起的污染风险。此外,使用具有独立设备组件的填充线可以显着节省成本。开发商不再需要为这些填充线投资大型高端无尘室。目前市场上有超过 230 种基于隔离器的填充和封闭系统,设备开发商目前正在致力于进一步改进。

随着多种生物製剂目前正在开发中,无菌填充和终止设备开发商的机会预计将进一步扩大。此外,注射药物和管道候选药物的增加正在推动对无菌填充机的需求。

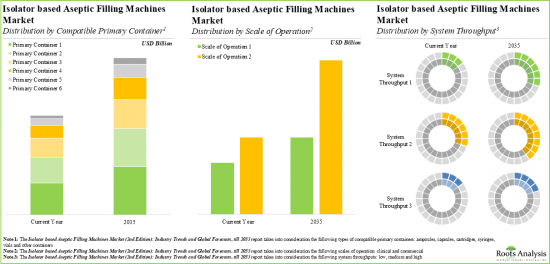

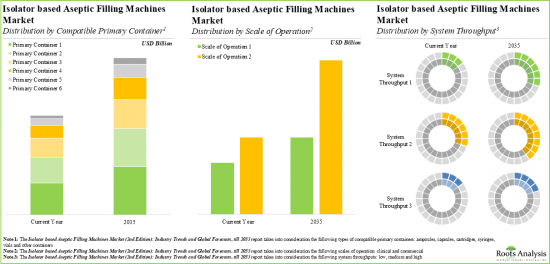

到 2035 年,隔离器无菌填充系统市场预计将以 8.7% 的复合年增长率扩张。目前,大部分市场占有率由各种相容的初级容器中的小瓶占据。

本报告提供全球隔离器无菌填充系统市场相关调查,提供市场概要,以及一次容器类别,各运用规模,system throughput,各终端用户,各地区的趋势,及加入此市场的主要企业简介等资讯。

目录

第1章 序文

第2章 摘要整理

第3章 简介

第4章 隔离器无菌填充系统:市场形势

第5章 隔离器无菌填充系统及封闭系统:产品竞争力分析

第6章 企业简介

- 章概要

- AST

- Bausch+Strobel

- Dara Pharma

- Groninger

- IMA Group

- Marchesini Group

- OPTIMA

- Syntegon

- Tofflon

第7章 最近的趋势

第8章 法规指南:无菌处理

第9章 市场预测机会分析

第10章 结论

第11章 执行洞察

第12章 附录I:表格形式资料

第13章 附录II:企业及团体一览

ASEPTIC FILLING MACHINE MARKET: OVERVIEW

As per Roots Analysis, the global aseptic filling machine market is estimated to grow from USD 1.3 billion in the current year to USD 3.4 billion by 2035, at a CAGR of 8.7% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Primary Container

- Vials

- Syringes

- Cartridges

- Ampoules

- Capsules

- Other Containers

Scale of Operation

- Clinical

- Commercial

System Throughput

- Low

- Medium

- High

End-user

- Pharma / Biotech Companies

- Contract Manufacturing Organizations

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

ASEPTIC FILLING MACHINE MARKET: GROWTH AND TRENDS

Pharmaceutical fill-finish manufacturing is a crucial element of drug production. However, several issues arise in the current drug filling process, including contamination risks, inaccuracies in dose dispensing, and labeling problems. Industry experts estimate that approximately 80% of product recalls stem from packaging-related issues. Additionally, manual interventions in filling lines pose threats to product integrity, as they increase contamination risks due to contact with workers and are often inefficient.

Over the years, pharmaceutical equipment manufacturers have introduced more cost-effective, reliable and efficient machinery, incorporating isolators and restricted access barrier systems (RABS) into their proprietary aseptic fill-finish lines. Many of these systems are intended to minimize human involvement, thereby lowering the risk of operator-related contamination. Moreover, using filling lines where equipment components are individually isolated can lead to substantial cost savings; developers can avoid investing in large, high-end cleanrooms for these filling lines. At present, over 230 isolator-based filling and closing systems are available in the market, and equipment developers are still engaged in further improvement efforts.

As several biologics are currently under development, the opportunity for aseptic fill / finish equipment developers is anticipated to expand further. Moreover, rise in a number of injectable drugs and pipeline candidates is driving the demand for aseptic filling machines.

ASEPTIC FILLING MACHINE MARKET: KEY INSIGHTS

- 1. Presently, over 230 isolator based aseptic filling machines are available in the market; majority of these isolator based aseptic filling machines use vials as compatible primary container.

- 2. 78% of isolator based aseptic filling systems can perform both filling and closing operations for liquid / powder formulations, followed by the systems capable of performing only filling operations (15%).

- 3. The current market landscape of isolator based aseptic filling machines developers is fragmented, featuring the presence of both new entrants and established players; majority of these players are based in Europe.

- 4. Leading manufacturers are revolutionizing pharmaceutical production by integrating advanced automation, real-time monitoring, and automated cleaning in aseptic filling systems.

- 5. Stakeholders are actively upgrading their existing capabilities to further enhance their respective fill / finish capabilities and comply to the evolving industry benchmarks.

- 6. From automation to sustainability, several recent mega trends are shaping the isolator-based aseptic filling machine industry, thereby driving innovation and efficiency in manufacturing processes.

- 7. In terms of recent developments, the market had witnessed a substantial partnership activity and a number of conferences related to aseptic pharmaceutical packaging were organized across the globe.

- 8. The isolator based aseptic filling machines market is likely to grow at a CAGR of 8.7%, till 2035; presently, majority of the market share is occupied by vials amongst the various compatible primary containers.

- 9. The isolator based aseptic filling machines market is anticipated to be primarily driven by the rising need for alternate sterilization methods; Europe is expected to capture larger share (40%) of the market by 2035.

The report delves into the current state of the aseptic filling machine market and identifies potential growth opportunities within the industry. Some key findings from the report include:

ASEPTIC FILLING MACHINE MARKET: KEY SEGMENTS

Cartridge Segment is the Fastest Growing Segment in the Aseptic Filling Machine Market

Based on type of primary containers, the market is segmented into vials, syringes, cartridges, ampoules, capsules, and other containers. It is worth highlighting that the majority of current aseptic filling machine market is captured by pharmaceutical vials. This trend is likely to remain the same in the coming decade. It is worth mentioning that vials offer various advantages, such as the ability to pre-sterilize the containers through various terminal sterilization techniques and minimal risk of breakage during handling and transportation and ease of filling as compared to other primary packaging containers.

By Scale of Operation, Commercial Scale is Likely to Dominate the Aseptic Filling Machine Market During the Forecast Period

Based on scales of operation, the market is segmented into clinical and commercial scale. It is worth highlighting that revenues generated from isolator based aseptic filling machines operating at commercial scale will be the primary driver of the overall market.

High System Throughputs is Expected to Capture the Highest Share in the Aseptic Filling Machine Market During the Forecast Period

Based on type of system throughput, the market is segmented into low, medium and high system throughputs. At present, the largest market share is captured by high throughput aseptic filling machines. This can be attributed to the fact that both in-house manufacturers and contract manufacturing organizations will use the high throughput isolator based filling machines for commercial scale manufacturing.

Currently, the Pharma / Biotech Companies Hold the Maximum Share of the Aseptic Filling Machines Market

Based on the end-users, the market is segmented into pharma / biotech companies and contract service providers. It is worth highlighting that, currently, pharma / biotech companies hold the largest share of isolator based aseptic filling machines market.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. At present, Europe captures the maximum share of the market opportunity, and this trend is unlikely to change in the coming years. It is worth highlighting that over the years, the market in Asia-Pacific and Rest of the World is expected to grow at a higher CAGR.

Example Players in the Aseptic Filling Machine Market

- AST

- Bausch+Strobel

- Dara Pharma

- Groninger

- IMA Group

- Marchesini

- OPTIMA

- Syntegon

- Tofflon

ASEPTIC FILLING MACHINE MARKET: RESEARCH COVERAGE

- The report features an in-depth analysis of the aseptic filling machine market, focusing on key market segments, including type of compatible primary container, scale of operation, system throughput, end-user and key geographical regions.

- The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

- A comprehensive evaluation of isolator based aseptic filling systems, considering various parameters, type of system (filling, filling and closing, and turnkey), maximum system throughput (up to 1,000 units/ hour, >1,000 to 5,000 units/ hour, >5,000 to 10,000 units/ hour, >10,000 to 20,000 units/ hour, > 20,000 to 40,000 units/ hour, >40,000 to 60,000 units/ hour, and >60,000 units/ hour), type of compatible primary container (ampoules, bags, bottles, capsules, cartridges, syringes, vials and other containers), type of formulation (liquids and powders). It also provides an assessment of the companies involved in the development of isolator based aseptic filling systems based on their year of establishment, company size (in terms of employee count), location of headquarters (North America, Europe and Asia-Pacific and Rest of the World) and leading players.

- A comprehensive competitive analysis of isolator based aseptic filling systems, examining factors such as scale of operation, system throughput, compatible primary containers, type of formulation and other important product related specifications.

- In-depth profiles of key players in aseptic filling machines market, focusing on company overviews, proprietary products, recent developments and an informed future outlook.

- A discussion on general regulatory guidelines for aseptic processing, and specific recommendations related to isolator and blow-fill-seal technologies used in the aseptic fill / finish process.

- An analysis of recent trends, covering partnerships and collaborations, and conferences held in this domain.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1 Introduction

- 1.2 Market Share Insights

- 1.3 Key Market Insights

- 1.4 Report Coverage

- 1.5 Key Questions Answered

- 1.6 Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1 Chapter Overview

- 3.2 Overview of Drug Fill / Finish Processes

- 3.3 Traditional Methods of Fill / Finish

- 3.4 Aseptic Fill / Finish Technique

- 3.5 Need for Aseptic Fill / Finish Techniques

- 3.6 Advanced Aseptic Fill / Finish Processes: Blow-Fill-Seal Aseptic Technology

- 3.6.1 Isolator Systems

- 3.6.2 Restricted Access Barrier Systems (RABS)

- 3.6.3 Comparison between Isolator Systems and RABS

- 3.7 Advantages of Advanced Aseptic Fill / Finish Techniques

- 3.8 Regulatory Guidelines for Aseptic Fill / Finish

- 3.9 Future Perspectives

4. ISOLATOR BASED ASEPTIC FILLING SYSTEMS: OVERALL MARKET LANDSCAPE

- 4.1 Chapter Overview

- 4.2 Isolator based Aseptic Filling Systems: Overall Market Landscape

- 4.2.1 Analysis by Type of System

- 4.2.2 Analysis by Maximum System Throughput

- 4.2.3 Analysis by Type of Compatible Primary Container

- 4.2.4 Analysis by Type of Formulation

- 4.3 Isolator based Aseptic Filling Systems: Developer Landscape

- 4.3.1 Analysis by Year of Establishment

- 4.3.2 Analysis by Company Size

- 4.3.3 Analysis by Location of Headquarters

- 4.3.4 Leading Players: Analysis by Number of Systems Offered

5. ISOLATOR BASED ASEPTIC FILLING AND CLOSING SYSTEMS: PRODUCT COMPETITIVENESS ANALYSIS

- 5.1 Chapter Overview

- 5.2 Methodology and Key Parameters

- 5.3 Product Competitiveness Analysis: Peer Group I

- 5.4 Product Competitiveness Analysis: Peer Group II

- 5.5 Product Competitiveness Analysis: Peer Group III

6. COMPANY PROFILES

- 6.1 Chapter Overview

- 6.2 AST

- 6.2.1 Company Overview

- 6.2.2 Isolator based Aseptic Filling Machines Portfolio

- 6.2.3 Recent Developments and Future Outlook

- 6.3 Bausch+Strobel

- 6.3.1 Company Overview

- 6.3.2 Isolator based Aseptic Filling Machines Portfolio

- 6.3.3 Recent Developments and Future Outlook

- 6.4 Dara Pharma

- 6.4.1 Company Overview

- 6.4.2 Isolator based Aseptic Filling Machines Portfolio

- 6.4.3 Recent Developments and Future Outlook

- 6.5 Groninger

- 6.5.1 Company Overview

- 6.5.2 Isolator based Aseptic Filling Machines Portfolio

- 6.5.3 Recent Developments and Future Outlook

- 6.6 IMA Group

- 6.6.1 Company Overview

- 6.6.2 Isolator based Aseptic Filling Machines Portfolio

- 6.6.3 Recent Developments and Future Outlook

- 6.7 Marchesini Group

- 6.7.1 Company Overview

- 6.7.2 Isolator based Aseptic Filling Machines Portfolio

- 6.7.3 Recent Developments and Future Outlook

- 6.8 OPTIMA

- 6.8.1 Company Overview

- 6.8.2 Isolator based Aseptic Filling Machines Portfolio

- 6.8.3 Recent Developments and Future Outlook

- 6.9 Syntegon

- 6.9.1 Company Overview

- 6.9.2 Isolator based Aseptic Filling Machines Portfolio

- 6.9.3 Recent Developments and Future Outlook

- 6.10 Tofflon

- 6.10.1 Company Overview

- 6.10.2 Isolator based Aseptic Filling Machines Portfolio

- 6.10.3 Recent Developments and Future Outlook

7. RECENT DEVELOPMENTS

- 7.1 Chapter Overview

- 7.2 Partnership Models

- 7.3 Isolator based Aseptic Filling Systems Market: Partnership Activity

- 7.3.1 List of Partnerships and Collaborations

- 7.3.1.1 Analysis by Year of Partnership

- 7.3.1.2 Analysis by Type of Partnership

- 7.3.1.3 Most Active Players: Analysis by Number of Partnerships

- 7.3.1 List of Partnerships and Collaborations

- 7.4 Isolator based Aseptic Filling Systems Market: Recent Conferences

- 7.4.1 List of Recent Conferences

- 7.4.1.1 Analysis by Year of Occurrence

- 7.4.1.2 Analysis by Geography

- 7.4.1 List of Recent Conferences

- 7.5 Concluding Remarks

8. REGULATORY GUIDELINES: ASEPTIC PROCESSING

- 8.1 Chapter Overview

- 8.2 Overview of Cleanroom Grades

- 8.3 General Guidelines for Aseptic Processing

- 8.3.1 Requirements for Buildings and Facilities

- 8.3.2 Requirements for Personnel Training, Qualification and Monitoring

- 8.3.3 Requirements for Components and Containers / Closures

- 8.4 Guidelines for Using Isolator Technology

- 8.5 Guidelines for Using Blow / Fill / Seal Technology

9. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 9.1 Chapter Overview

- 9.2 Key Assumptions and Methodology

- 9.3 Global Isolator based Aseptic Filling Systems Market: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.4 Isolator based Aseptic Filling Systems Market: Distribution by Scale of Operation, 2019, Current Year and 2035

- 9.4.1 Isolator based Aseptic Filling Systems Market for Commercial Scale Systems: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.4.2 Isolator based Aseptic Filling Systems Market for Clinical Scale Systems: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.5 Global Isolator based Aseptic Filling Systems Market: Distribution by Type of Compatible Primary Container, 2019, Current Year and 2035

- 9.5.1 Isolator based Aseptic Filling Systems Market for Vials: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.5.2 Isolator based Aseptic Filling Systems Market for Syringes: Historical Trends (2019-2023) and Forecasted Estimates (till 2035)

- 9.5.3 Isolator based Aseptic Filling Systems Market for Cartridges: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.5.4 Isolator based Aseptic Filling Systems Market for Ampoules: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.5.5 Isolator based Aseptic Filling Systems Market for Capsules: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.5.6 Isolator based Aseptic Filling Systems Market for Other Primary Containers: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.6 Global Isolator based Aseptic Filling Systems Market: Distribution by System Throughput, 2019, Current Year and 2035

- 9.6.1 Isolator based Aseptic Filling Systems Market for High Throughput Systems: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.6.2 Isolator based Aseptic Filling Systems Market for Medium Throughput Systems: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.6.3 Isolator based Aseptic Filling Systems Market for Low Throughput Systems: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.7 Global Isolator based Aseptic Filling Systems Market: Distribution by End-user, 2019, Current Year and 2035

- 9.7.1 Isolator based Aseptic Filling Systems Market for Pharma / Biotech Companies: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.7.2 Isolator based Aseptic Filling Systems Market for Contract Service Providers: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8 Isolator based Aseptic Filling Systems Market: Distribution by Key Geographical Regions, 2019, Current Year and 2035

- 9.8.1 Isolator based Aseptic Filling Systems Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.1.1 Isolator based Aseptic Filling Systems Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.1.2 Isolator based Aseptic Filling Systems Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2 Isolator based Aseptic Filling Systems Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2.1 Isolator based Aseptic Filling Systems Market in France: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2.2 Isolator based Aseptic Filling Systems Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2.3 Isolator based Aseptic Filling Systems Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2.4 Isolator based Aseptic Filling Systems Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2.5 Isolator based Aseptic Filling Systems Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2.6 Isolator based Aseptic Filling Systems Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2.7 Isolator based Aseptic Filling Systems Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.2.8 Isolator based Aseptic Filling Systems Market in Rest of Europe: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.3 Isolator based Aseptic Filling Systems Market in Asia-Pacific: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.3.1 Isolator based Aseptic Filling Systems Market in China: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.3.2 Isolator based Aseptic Filling Systems Market in India: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.3.3 Isolator based Aseptic Filling Systems Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.3.4 Isolator based Aseptic Filling Systems Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.3.5 Isolator based Aseptic Filling Systems Market in Rest of Asia-Pacific: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.4 Isolator based Aseptic Filling Systems Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.4.1 Isolator based Aseptic Filling Systems Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.4.2 Isolator based Aseptic Filling Systems Market in Brazil : Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.4.3 Isolator based Aseptic Filling Systems Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.4.4 Isolator based Aseptic Filling Systems Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.4.5 Isolator based Aseptic Filling Systems Market in Other Countries: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

- 9.8.1 Isolator based Aseptic Filling Systems Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (till 2035)

10. CONCLUSION

- 10.1 Chapter Overview

11. EXECUTIVE INSIGHTS

- 11.1 Chapter Overview

- 11.2 Automated Systems of Tacoma (AST)

- 11.3 Interview Transcript: Joe Hoff, Chairman and CEO

12. APPENDIX I: TABULATED DATA

13. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 Isolator based Aseptic Filling Systems: Information on Developer, Type of System and Scale of Operation

- Table 4.2 Isolator based Aseptic Filling Systems: Information on System Throughput

- Table 4.3 Isolator based Aseptic Filling Systems: Information on Compatible Primary Container

- Table 4.4 Isolator based Aseptic Filling Systems: Information on Fill Volume and Type of Formulation

- Table 4.5 List of Companies Providing Isolator based Aseptic Filling Systems

- Table 6.1 Isolator based Aseptic Filling Machines: List of Companies Profiled

- Table 6.2 AST: Company Snapshot

- Table 6.3 AST: Isolator based Aseptic Filling Machines Portfolio

- Table 6.4 AST: Recent Developments and Future Outlook

- Table 6.5 Bausch+Strobel: Company Snapshot

- Table 6.6 Bausch+Strobel: Isolator based Aseptic Filling Machines Portfolio

- Table 6.7 Dara Pharmaceutical Packaging: Company Snapshot

- Table 6.8 Dara Pharmaceutical Packaging: Isolator based Aseptic Filling Machines Portfolio

- Table 6.9 Dara Pharmaceutical Packaging: Recent Developments and Future Outlook

- Table 6.10 Groninger: Company Snapshot

- Table 6.11 Groninger: Isolator based Aseptic Filling Machines Portfolio

- Table 6.12 Groninger: Recent Developments and Future Outlook

- Table 6.13 IMA Group: Company Snapshot

- Table 6.14 IMA Group: Isolator based Aseptic Filling Machines Portfolio

- Table 6.15 Marchesini Group: Company Snapshot

- Table 6.16 Marchesini Group: Isolator based Aseptic Filling Machines Portfolio

- Table 6.17 Marchesini Group: Recent Developments and Future Outlook

- Table 6.18 OPTIMA Packaging Group: Company Snapshot

- Table 6.19 OPTIMA Packaging Group: Isolator based Aseptic Filling Machines Portfolio

- Table 6.20 OPTIMA Packaging Group: Recent Developments and Future Outlook

- Table 6.21 Syntegon: Company Snapshot

- Table 6.22 Syntegon: Isolator based Aseptic Filling Machines Portfolio

- Table 6.23 Syntegon: Recent Developments and Future Outlook

- Table 6.24 Tofflon Group: Company Snapshot

- Table 6.25 Tofflon Group: Isolator based Aseptic Filling Machines Portfolio

- Table 7.1 Isolator based Aseptic Filling Systems: List of Partnerships and Collaborations, Since 2017

- Table 7.2 Isolator based Aseptic Filling Systems: List of Conferences, Since 2017

- Table 12.1 Isolator based Aseptic Filling Systems: Distribution by Type of System

- Table 12.2 Isolator based Aseptic Filling Systems: Distribution by System Throughput

- Table 12.3 Isolator based Aseptic Filling Systems: Distribution by Compatible Primary Container

- Table 12.4 Isolator based Aseptic Filling Systems: Distribution by Type of Formulation

- Table 12.5 Isolator based Aseptic Filling System Providers: Distribution by Year of Establishment

- Table 12.6 Isolator based Aseptic Filling System Providers: Distribution by Company Size

- Table 12.7 Isolator based Aseptic Filling System Providers: Distribution by Location of Headquarters

- Table 12.8 Isolator based Aseptic Filling System Providers: Leading Players

- Table 12.9 Isolator based Aseptic Filling Systems Market Partnership Activity: Analysis by Year of Partnership

- Table 12.10 Isolator based Aseptic Filling Systems Market Partnership Activity: Analysis by Type of Partnership

- Table 12.11 Isolator based Aseptic Filling Systems Market Partnership: Analysis by Number of Partnerships

- Table 12.12 Isolator based Aseptic Filling Systems Market Recent Conferences: Analysis by Year of Occurrence

- Table 12.13 Isolator based Aseptic Filling Systems Market Recent Conferences: Analysis by Geographical Location

- Table 12.14 Global Isolator based Filling Systems Market: Historical Trends, Since 2019 (USD Million)

- Table 12.15 Global Isolator based Aseptic Filling Systems Market: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.16 Isolator based Aseptic Filling Systems Market: Distribution by Scale of Operation, 2019, Current Year and 2035

- Table 12.17 Isolator based Aseptic Filling Systems Market for Commercial Scale Systems: Historical Trends, Since 2019 (USD Million)

- Table 12.18 Isolator based Aseptic Filling Systems Market for Commercial Scale Systems: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.19 Isolator based Aseptic Filling Systems Market for Clinical Scale Systems: Historical Trends, Since 2019 (USD Million)

- Table 12.20 Isolator based Aseptic Filling Systems Market for Clinical Scale Systems: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.21 Isolator based Aseptic Filling Systems Market: Distribution by Type of Compatible Primary Container, 2019, Current Year and 2035

- Table 12.22 Isolator based Aseptic Filling Systems Market for Vials, Since 2019 (USD Million)

- Table 12.23 Isolator based Aseptic Filling Systems Market for Vials: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.24 Isolator based Aseptic Filling Systems Market for Syringes: Historical Trends, Since 2019 (USD Million)

- Table 12.25 Isolator based Aseptic Filling Systems Market for Syringes: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.26 Isolator based Aseptic Filling Systems Market for Cartridges: Historical Trends, Since 2019 (USD Million)

- Table 12.27 Isolator based Aseptic Filling Systems Market for Cartridges: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.28 Isolator based Aseptic Filling Systems Market for Ampoules: Historical Trends, Since 2019 (USD Million)

- Table 12.29 Isolator based Aseptic Filling Systems Market for Ampoules: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.30 Isolator based Aseptic Filling Systems Market for Capsules: Historical Trends, Since 2019 (USD Million)

- Table 12.31 Isolator based Aseptic Filling Systems Market for Capsules: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.32 Isolator based Aseptic Filling Systems Market for Other Containers: Historical Trends, Since 2019 (USD Million)

- Table 12.33 Isolator based Aseptic Filling Systems Market for Other Containers: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.34 Isolator based Aseptic Filling Systems Market: Distribution by System Throughput, 2019, Current Year and 2035

- Table 12.35 Isolator based Aseptic Filling Systems Market for Low Throughput Systems, Since 2019 (USD Million)

- Table 12.36 Isolator based Aseptic Filling Systems Market for Low Throughput Systems: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.37 Isolator based Aseptic Filling Systems Market for Medium Throughput Systems, Since 2019 (USD Million)

- Table 12.38 Isolator based Aseptic Filling Systems Market for Medium Throughput Systems: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.39 Isolator based Aseptic Filling Systems Market for High Throughput Systems, Since 2019 (USD Million)

- Table 12.40 Isolator based Aseptic Filling Systems Market for High Throughput Systems: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.41 Isolator based Aseptic Filling Systems Market: Distribution by End-User, 2019, Current Year and 2035

- Table 12.42 Isolator based Aseptic Filling Systems Market for Pharma/ Biotech Companies, Since 2019 (USD Million)

- Table 12.43 Isolator based Aseptic Filling Systems Market for Pharma/ Biotech Companies: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.44 Isolator based Aseptic Filling Systems Market for Contract Service Providers, Since 2019 (USD Million)

- Table 12.45 Isolator based Aseptic Filling Systems Market for Contract Service Providers: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.46 Isolator based Aseptic Filling Systems Market: Distribution by Key Geographical Regions, 2019, Current Year and 2035

- Table 12.47 Isolator based Aseptic Filling Systems Market in North America, Since 2019 (USD Million)

- Table 12.48 Isolator based Aseptic Filling Systems Market in North America: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.49 Isolator based Aseptic Filling Systems Market in the US, Since 2019 (USD Million)

- Table 12.50 Isolator based Aseptic Filling Systems Market in the US: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.51 Isolator based Aseptic Filling Systems Market in Canada, Since 2019 (USD Million)

- Table 12.52 Isolator based Aseptic Filling Systems Market in Canada: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.53 Isolator based Aseptic Filling Systems Market in Europe, Since 2019 (USD Million)

- Table 12.54 Isolator based Aseptic Filling Systems Market in Europe: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.55 Isolator based Aseptic Filling Systems Market in France, Since 2019 (USD Million)

- Table 12.56 Isolator based Aseptic Filling Systems Market in France: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.57 Isolator based Aseptic Filling Systems Market in Germany, Since 2019 (USD Million)

- Table 12.58 Isolator based Aseptic Filling Systems Market in Germany: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.59 Isolator based Aseptic Filling Systems Market in the UK, Since 2019 (USD Million)

- Table 12.60 Isolator based Aseptic Filling Systems Market in the UK: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.61 Isolator based Aseptic Filling Systems Market in Italy, Since 2019 (USD Million)

- Table 12.62 Isolator based Aseptic Filling Systems Market in Italy: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.63 Isolator based Aseptic Filling Systems Market in Spain, Since 2019 (USD Million)

- Table 12.64 Isolator based Aseptic Filling Systems Market in Spain: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.65 Isolator based Aseptic Filling Systems Market in Austria, Since 2019 (USD Million)

- Table 12.66 Isolator based Aseptic Filling Systems Market in Austria: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.67 Isolator based Aseptic Filling Systems Market in Switzerland, Since 2019 (USD Million)

- Table 12.68 Isolator based Aseptic Filling Systems Market in Switzerland: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.69 Isolator based Aseptic Filling Systems Market in Rest of Europe, Since 2019 (USD Million)

- Table 12.70 Isolator based Aseptic Filling Systems Market in Rest of Europe: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.71 Isolator based Aseptic Filling Systems Market in Asia-Pacific, Since 2019 (USD Million)

- Table 12.72 Isolator based Aseptic Filling Systems Market in Asia-Pacific: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.73 Isolator based Aseptic Filling Systems Market in China, Since 2019 (USD Million)

- Table 12.74 Isolator based Aseptic Filling Systems Market in China: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.75 Isolator based Aseptic Filling Systems Market in India, Since 2019 (USD Million)

- Table 12.76 Isolator based Aseptic Filling Systems Market in India: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.77 Isolator based Aseptic Filling Systems Market in South Korea, Since 2019 (USD Million)

- Table 12.78 Isolator based Aseptic Filling Systems Market in South Korea, Since 2019 (USD Million)

- Table 12.79 Isolator based Aseptic Filling Systems Market in Japan, Since 2019 (USD Million)

- Table 12.80 Isolator based Aseptic Filling Systems Market in Japan, Since 2019 (USD Million)

- Table 12.81 Isolator based Aseptic Filling Systems Market in Rest of Asia-Pacific, Since 2019 (USD Million)

- Table 12.82 Isolator based Aseptic Filling Systems Market in Rest of Asia-Pacific: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.83 Isolator based Aseptic Filling Systems Market in Rest of the World, Since 2019 (USD Million)

- Table 12.84 Isolator based Aseptic Filling Systems Market in Rest of the World: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.85 Isolator based Aseptic Filling Systems Market in Argentina, Since 2019 (USD Million)

- Table 12.86 Isolator based Aseptic Filling Systems Market in Argentina: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.87 Isolator based Aseptic Filling Systems Market in Brazil, Since 2019 (USD Million)

- Table 12.88 Isolator based Aseptic Filling Systems Market in Brazil: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.89 Isolator based Aseptic Filling Systems Market in Israel, Since 2019 (USD Million)

- Table 12.90 Isolator based Aseptic Filling Systems Market in Israel: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.91 Isolator based Aseptic Filling Systems Market in Iran, Since 2019 (USD Million)

- Table 12.92 Isolator based Aseptic Filling Systems Market in Iran: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 12.93 Isolator based Aseptic Filling Systems Market in Other Countries, Since 2019 (USD Million)

- Table 12.94 Isolator based Aseptic Filling Systems Market in Other Countries: Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

List of Figures

- Figure 3.1 Drug Fill / Finish Process

- Figure 3.2 Aseptic Fill / Finish Workflow

- Figure 3.3 Comparison of Traditional Filling with Blow / Fill / Seal Technologies

- Figure 3.4 Aseptic Processing Equipment and Degrees of Sterility

- Figure 3.5 Comparison of RABS with Isolators

- Figure 4.1 Isolator based Aseptic Filling Systems: Distribution by Type of System

- Figure 4.2 Isolator based Aseptic Filling Systems: Distribution by Maximum System Throughput

- Figure 4.3 Isolator based Aseptic Filling Systems: Distribution by Compatible Primary Container

- Figure 4.4 Isolator based Aseptic Filling Systems: Distribution by Type of Formulation

- Figure 4.5 Isolator based Aseptic Filling System Providers: Distribution by Year of Establishment

- Figure 4.6 Isolator based Aseptic Filling System Providers: Distribution by Company Size

- Figure 4.7 Isolator based Aseptic Filling System Providers: Distribution by Location of Headquarters

- Figure 4.8 Most Active Players: Distribution by Number of Systems Offered

- Figure 5.1 Competitiveness Analysis: Products in Peer Group I

- Figure 5.2 Competitiveness Analysis: Products in Peer Group II

- Figure 5.3 Competitiveness Analysis: Products in Peer Group III

- Figure 7.1 Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 7.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 7.3 Partnerships and Collaborations: Distribution by Focus Area

- Figure 7.4 Most Active Players: Distribution by Number of Partnerships

- Figure 7.5 Recent Conferences: Distribution by Year of Occurrence

- Figure 7.6 Recent Conferences: Distribution by Geographical Location

- Figure 8.1 Airborne Particulate Classification for Different Cleanroom Grades

- Figure 9.1 Global Isolator based Filling Systems Market, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.2 Isolator based Aseptic Filling Systems Market, Distribution by Scale of Operation, 2019, Current YEar and 2035

- Figure 9.3 Isolator based Aseptic Filling Systems Market for Commercial Scale Systems, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.4 Isolator based Aseptic Filling Systems Market for Clinical Scale Systems, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.5 Isolator based Aseptic Filling Systems Market, Distribution by Type of Compatible Primary Container, 2019, Current Year and 2035

- Figure 9.6 Isolator based Aseptic Filling Systems Market for Vials, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.7 Isolator based Aseptic Filling Systems Market for Syringes, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.8 Isolator based Aseptic Filling Systems Market for Cartridges, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.9 Isolator based Aseptic Filling Systems Market for Ampoules, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.10 Isolator based Aseptic Filling Systems Market for Capsules, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.11 Isolator based Aseptic Filling Systems Market for Other Primary Containers, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.12 Global Isolator based Aseptic Filling Systems, Market Distribution by System Throughput, 2019, Current Year and 2035

- Figure 9.13 Isolator based Aseptic Filling Systems Market for High Throughput Systems, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.14 Isolator based Aseptic Filling Systems Market for Medium Throughput Systems, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.15 Isolator based Aseptic Filling Systems Market for Low Throughput Systems, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.16 Global Isolator based Aseptic Filling Systems Market, Distribution by End-user, 2019, Current Year and 2035

- Figure 9.17 Isolator based Aseptic Filling Systems Market for Pharma/ Biotech Companies, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.18 Isolator based Aseptic Filling Systems Market for Contract Service Providers, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.19 Isolator based Aseptic Filling Systems Market, Distribution by Key Geographical Regions, 2019, Current Year and 2035

- Figure 9.20 Isolator based Aseptic Filling Systems Market in North America, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.21 Isolator based Aseptic Filling Systems Market in the US, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.22 Isolator based Aseptic Filling Systems Market in Canada, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.23 Isolator based Aseptic Filling Systems Market in Europe, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.24 Isolator based Aseptic Filling Systems Market in France, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.25 Isolator based Aseptic Filling Systems Market in Germany, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.26 Isolator based Aseptic Filling Systems Market in the UK, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.27 Isolator based Aseptic Filling Systems Market in Italy, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.28 Isolator based Aseptic Filling Systems Market in Spain, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.29 Isolator based Aseptic Filling Systems Market in Austria, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.30 Isolator based Aseptic Filling Systems Market in Switzerland, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.31 Isolator based Aseptic Filling Systems Market in Rest of Europe, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.32 Isolator based Aseptic Filling Systems Market in Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.33 Isolator based Aseptic Filling Systems Market in China, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.34 Isolator based Aseptic Filling Systems Market in India, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.35 Isolator based Aseptic Filling Systems Market in Japan, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.36 Isolator based Aseptic Filling Systems Market in South Korea, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.37 Isolator based Aseptic Filling Systems Market in Rest of Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.38 Isolator based Aseptic Filling Systems Market in Rest of the World, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.39 Isolator based Aseptic Filling Systems Market in Argentina, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.40 Isolator based Aseptic Filling Systems Market in Brazil, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.41 Isolator based Aseptic Filling Systems Market in Israel, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.42 Isolator based Aseptic Filling Systems Market in Iran, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 9.43 Isolator based Aseptic Filling Systems Market in Other Countries, Historical Trends (Since 2019) and Forecasted Estimates (till 2035) (USD Million)

- Figure 10.1 Concluding Remarks: Current Market Landscape of Isolator based Aseptic Filling Systems

- Figure 10.2 Concluding Remarks: Current Developer Landscape of Isolator based Aseptic Filling Systems

- Figure 10.3 Concluding Remarks: Market Sizing and Opportunity Analysis (I/II)

- Figure 10.4 Concluding Remarks: Market Sizing and Opportunity Analysis (II/II)