|

市场调查报告书

商品编码

1585174

全球生物相似药市场 - 按药物类别、治疗领域、製造商类型、分销管道、地区、主要参与者:行业趋势和全球预测(~2035 年)Global Biosimilars Market - Distribution by Drug Class, Therapeutic Area, Type of Manufacturer, Distribution Channel, Geographical Regions and Leading Players: Industry Trends and Global Forecasts, till 2035 |

||||||

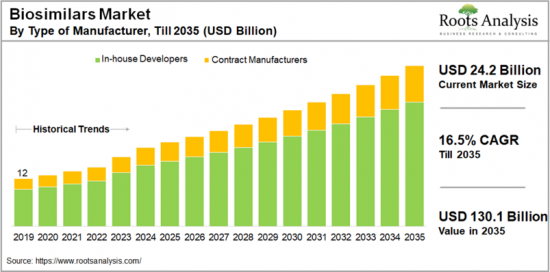

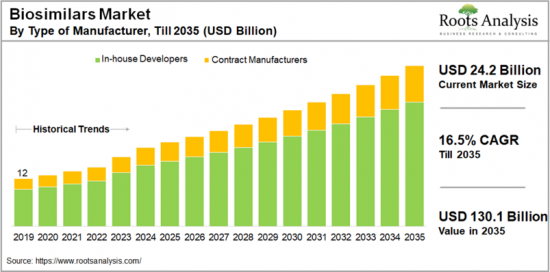

全球生物相似药市场规模预计在 2024 年达到 242 亿美元,并预计在 2035 年预测期内复合年增长率为 16.5%。

近年来,由于管理慢性病的有效性提高,生物製品市场经历了显着成长。然而,与生物製剂相关的高成本带来了重大的经济和医疗保健课题。随着对生物製剂的需求不断增加,开发公司正在寻求创新策略以提高投资回报,同时寻求具有类似安全性和功效的更实惠的替代品。随着专利到期、药品管道萎缩以及降低治疗成本的压力,生物相似药预计将在生物製药产业占据很大占有率。过去几年生物相似药开发商之间的投资和合作伙伴关係的激增也支持了这一趋势。

此外,简化审批流程和製定明确的生物相似药开发指南等监管进步正在促进生物相似药的开发。此外,相容性研究评估了具有相似安全性和有效性的参考生物製品替代生物相似药的潜力,在促进生物相似药的开发中也发挥着重要作用。此外,对生物相似药作为具有成本效益的替代品的需求不断增长,增加了对内部开发和外包的需求,为生物相似药开发公司创造了巨大的成长机会。

本报告检视了全球生物相似药市场,并按药物类别、治疗领域、製造商类型、分销管道、地区和进入市场的公司提供了市场概况、趋势等。

目录

第1章前言

第2章研究方法

第3章市场动态

第 4 章经济与其他专案特定考量

第 5 章执行摘要

第 6 章简介

第7章市场状况

- 章节概述

- 生物相似药:开发商情况

- 生物相似药:市场情势

第 8 章公司简介:总部位于北美的生物相似药开发公司

- 章节概述

- 安进

- Coherus 生物科学

- 礼来公司

- 辉瑞

第 9 章公司简介:总部位于欧洲的生物相似药开发公司

- 章节概述

- BIOCAD

- 费森尤斯‧卡比

- 山德士

- 斯塔达

第 10 章公司简介:亚太地区和其他地区的生物相似药开发商

- 章节概述

- 百康

- 雷迪博士的实验室

- Celltrion

- Intas 药厂

- 梯瓦製药

第 11 章监理状况

- 章节概述

- 北美生物相似药监管指南

- 欧洲生物相似药监管指南

- 亚太地区生物相似药监管指南

- 未来展望

第12章成本分析

- 章节概述

- 导致新生物製剂价格上涨的因素

- 生物相似药定价

- 结论

第 13 章案例研究:生物相似药外包

第14章市场影响分析

第15章全球生物相似药市场

第 16 章生物相似药市场(依药物类别)

第17章生物相似药市场(依治疗领域)

第 18 章生物相似药市场(按製造商类型)

第19章生物相似药市场(依通路)

第 20 章生物相似药市场(按地区)

第 21 章生物相似药市场(主要公司)

第22章结论

第 23 章附录一:表格资料

第 24 章附录二:公司与组织名单

The global biosimilars market is valued at USD 24.2 billion in 2024, growing at a CAGR of 16.5% during the forecast period, till 2035.

In recent years, the biologics market has experienced significant growth, owing to its improved effectiveness in managing chronic diseases. However, the high costs associated with biologics pose considerable economic and healthcare challenges. As the demand for biologics continues to increase, developers are exploring innovative strategies to enhance returns on investment while addressing the need for more affordable alternative biological products that encompass similar safety and efficacy profiles. Amidst patent expirations, shrinking drug pipelines, and pressure to reduce the treatment costs, biosimilars are expected to occupy a significant share within the biopharmaceutical industry. This trend is further supported by surge in investments and collaborations among biosimilar developers in the past few years. Further, regulatory advancements, such as streamlining approval processes and establishing clearer guidelines for biosimilar development have facilitated the development of biosimilars. Moreover, studies on interchangeability, which assess the feasibility of substituting biosimilars with reference biologics with similar safety or efficacy, have also played a critical role in advancing biosimilar development. In addition, the rising demand for biosimilars as a cost-effective alternative has promoted the need for increased in-house development and outsourcing operations, thereby creating significant growth opportunities for biosimilar developers.

Key Market Segments

Drug Class

- Monoclonal Antibodies

- Proteins

- Peptides

- Others

Therapeutic Area

- Oncological Disorders

- Autoimmune and Inflammatory Disorders

- Hematological Disorders

- Metabolic Disorders

- Other Disorders

Type of Manufacturer

- Contract Manufacturers

- In-house Developers

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Geographical Regions

- North America (US and Canada)

- Europe (Germany, UK, France, Spain, Italy, Switzerland, Belgium, Denmark and Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea and Australia)

- Middle East and North Africa (Saudi Arabia, Egypt and UAE)

- Latin America (Brazil, Mexico and Argentina)

Research Coverage:

- A preface providing an overview of the report, Global Biosimilars Market (2nd Edition), till 2035.

- An overview of the systematic research methodology adopted in this study, which includes research assumptions, forecasting methodologies, primary and secondary research techniques, as well as the various analytical frameworks integrated into the report.

- A summary of the comprehensive methodologies and frameworks used to forecast and analyze market trends, examining key factors that influence market dynamics while emphasizing the rigorous quality control measures implemented to ensure transparency and credibility in the insights presented throughout the report.

- A brief overview of the economic factors affecting the biosimilars market, including currency fluctuations, foreign exchange rates, and existing trade barriers. Additionally, it assesses the impact of global recession and inflation on market growth, drawing insights from significant historical events to inform future decision-making.

- An executive summary of the insights obtained during our research, featuring key takeaways from the current state of the biosimilars industry and its likely evolution in the short to mid-to-long term.

- A general overview of biosimilars, highlighting the key differences between innovator biologics, biosimilars, and generics. Further, it also provides information on the need for biosimilars, the manufacturing process, development timelines, and future perspectives related to the evolution of the biosimilar industry.

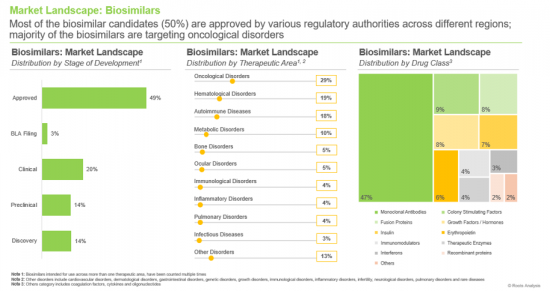

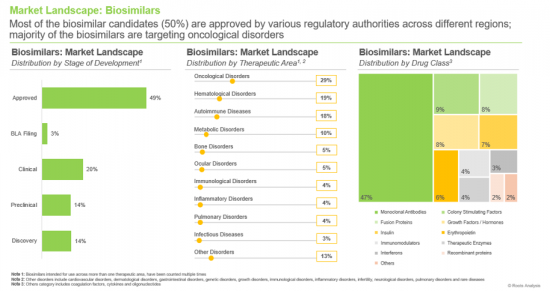

- A comprehensive evaluation of marketed and clinical-stage biosimilars based on several parameters, including the stage of development (approved, BLA registration, clinical, preclinical and discovery), therapeutic area (autoimmune diseases, bone disorders, cardiovascular disorders, growth disorders, hematological disorders, immunological disorders, infectious diseases, infertility, inflammatory disorders, metabolic disorders, neurological disorders, ocular disorders, oncological disorders, pulmonary disorders, rare diseases and other disorders), drug class (coagulation factors, colony stimulating factors, cytokines, erythropoietin, fusion proteins, growth hormones / factors, immunomodulators, insulin, interferons, monoclonal antibodies, oligonucleotides, recombinant proteins, therapeutic enzymes, vaccines and unspecified). Additionally, it includes detailed analyses of biosimilar developers based on parameters, such as year of establishment, company size, headquarters location, and the most active players (in terms of number of biosimilars developed).

- Detailed profiles of prominent companies in North America, Europe, Asia-Pacific, and the rest of the world. Each profile includes an overview of the company (year of establishment, headquarters location, employee count, leadership team, business segments), financial information (if available), biosimilar pipeline details, recent developments and future outlook.

- A brief overview of the regulatory guidelines established by regulatory bodies across different regions, such as North America, Europe, and Asia-Pacific. It also presents details on regulatory approval pathways issued by authorities in these regions.

- An analysis of the factors contributing to the high pricing of novel biologics, including factors influencing biosimilar pricing. This section also presents a price comparison between various biosimilars and their reference biologics.

- A case study focused on the growing global biosimilars market and associated opportunities for biologics CMOs and CDMOs. It discusses the need for outsourcing manufacturing operations for biosimilar drugs and examines the impact of biosimilars on the global contract manufacturing market, along with the associated challenges and future perspectives.

- An in-depth analysis of factors impacting the growth of the biosimilars industry. This includes information on key drivers, potential restraints, emerging opportunities, and existing challenges within the sector.

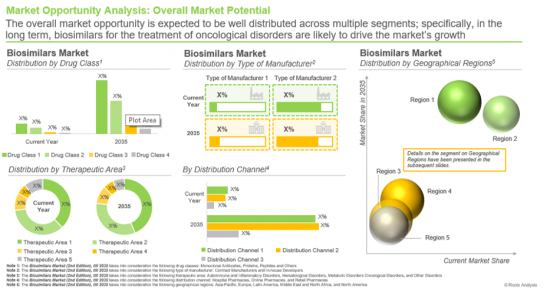

- A detailed estimation of the current market size and future growth potential within the biosimilars market over the next decade. Based on various parameters and validations from reliable secondary and primary sources, we've provided informed estimates on market evolution till 2035. The report also features the likely distribution of the current and forecasted opportunities along with three forecast scenarios, namely conservative, base, and optimistic, representing different growth trajectories.

- A detailed estimation of the current market size and future opportunities in the biosimilars market across various drug classes, such as monoclonal antibodies, proteins, peptides, and others.

- A detailed projection of current market size and future opportunities in the biosimilar market across different therapeutic areas, including oncological disorders, autoimmune and inflammatory disorders, hematological disorders, metabolic disorders, and others.

- A detailed projection of current market size and future opportunities in the biosimilars market across different types of manufacturers, such as contract manufacturers and in-house developers.

- A detailed projection of the current market size and future opportunities in the biosimilars market across different distribution channels, such as hospital pharmacies, retail pharmacies and online pharmacies.

- A detailed projection of current market size and future opportunities in the biosimilars market across different geographical regions such as North America, Europe, Asia-Pacific, Middle East and North Africa (MENA), and Latin America.

- Detailed information on leading players engaged in the development of biosimilars.

Key Benefits of Buying this Report

- The report offers valuable insights into revenue estimation for both the overall market and its sub-segments, in order to empower market leaders and newcomers with critical information requisite for establishing their footprint in the industry.

- Stakeholders can utilize the report to enhance their understanding of the competitive landscape, allowing for improved business positioning and more effective go-to-market strategies.

- The report provides stakeholders with an overview of the global biosimilars market, furnishing them with essential information on significant market drivers, barriers, opportunities, and challenges.

Example Companies Profiled

- Amgen Inc

BIOCAD

- Biocon

- Celltrion

- Coherus BioSciences

- Dr. Reddy's Laboratories

- Eli Lilly

- Fresenius Kabi

- Intas Pharmaceuticals

- Pfizer Inc

- Sandoz

STADA

- Teva Pharmaceuticals

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Key Market Segmentation

- 3.7. Robust Quality Control

- 3.8. Limitations

4. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Future Estimates

- 4.2.2. Currency Coverage and Foreign Exchange Rate

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 4.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.2.4. Strategies for Mitigating Foreign Exchange Risk

- 4.2.3. Trade Policies

- 4.2.3.1. Impact of Trade Barriers on the Market

- 4.2.3.2. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Biologics

- 6.3. Overview of Biosimilars and Biobetters

- 6.4. Difference between Innovator Biologics, Biosimilars and Generics

- 6.5. Advantages of Biosimilars

- 6.6. Manufacturing of Biosimilars

- 6.7. Development Timeline of Biosimilars

- 6.8. Future Perspectives

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Biosimilars: Developers Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.3. Biosimilars: Overall Market Landscape

- 7.3.1. Analysis by Stage of Development

- 7.3.2. Analysis by Therapeutic Area

- 7.3.3. Analysis by Drug Class

8. COMPANY PROFILES: BIOSIMILAR DEVELOPERS BASED IN NORTH AMERICA

- 8.1. Chapter Overview

- 8.2. Amgen

- 8.2.1. Company Overview

- 8.2.2. Financial Information

- 8.2.3. Biosimilar Pipeline

- 8.2.4. Recent Developments and Future Outlook

- 8.3. Coherus BioSciences

- 8.3.1. Company Overview

- 8.3.2. Financial Information

- 8.3.3. Biosimilar Pipeline

- 8.3.4. Recent Developments and Future Outlook

- 8.4. Eli Lilly

- 8.4.1. Company Overview

- 8.4.2. Financial Information

- 8.4.3. Biosimilar Pipeline

- 8.4.4. Recent Developments and Future Outlook

- 8.5. Pfizer

- 8.5.1. Company Overview

- 8.5.2. Financial Information

- 8.5.3. Biosimilar Pipeline

- 8.5.4. Recent Developments and Future Outlook

9. COMPANY PROFILES: BIOSIMILAR DEVELOPERS BASED IN EUROPE

- 9.1 Chapter Overview

- 9.2. BIOCAD

- 9.2.1. Company Overview

- 9.2.2. Biosimilar Pipeline

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Fresenius Kabi

- 9.3.1. Company Overview

- 9.3.2. Financial Information

- 9.3.3. Biosimilar Pipeline

- 9.3.4. Recent Developments and Future Outlook

- 9.4. Sandoz

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Biosimilar Pipeline

- 9.4.4. Recent Developments and Future Outlook

- 9.5. STADA

- 9.5.1. Company Overview

- 9.5.2. Financial Information

- 9.5.3. Biosimilar Pipeline

- 9.5.4. Recent Developments and Future Outlook

10. COMPANY PROFILES: BIOSIMILAR DEVELOPERS BASED IN ASIA-PACIFIC AND REST OF THE WORLD

- 10.1 Chapter Overview

- 10.2. Biocon

- 10.2.1. Company Overview

- 10.2.2. Financial Information

- 10.2.3. Biosimilar Pipeline

- 10.2.4. Recent Developments and Future Outlook

- 10.3. Dr. Reddy's Laboratories

- 10.3.1. Company Overview

- 10.3.2. Financial Information

- 10.3.3. Biosimilar Pipeline

- 10.3.4. Recent Developments and Future Outlook

- 10.4. Celltrion

- 10.4.1. Company Overview

- 10.4.2. Financial Information

- 10.4.3. Biosimilar Pipeline

- 10.4.4. Recent Developments and Future Outlook

- 10.5. Intas Pharmaceuticals

- 10.5.1. Company Overview

- 10.5.2. Biosimilar Pipeline

- 10.5.3. Recent Developments and Future Outlook

- 10.6. Teva Pharmaceuticals

- 10.6.1. Company Overview

- 10.6.2. Financial Information

- 10.6.3. Biosimilar Pipeline

- 10.6.4. Recent Developments and Future Outlook

11. REGULATORY LANDSCAPE

- 11.1. Chapter Overview

- 11.2. Regulatory Guidelines for Biosimilars in North America

- 11.2.1. Regulatory Guidelines for Biosimilars in the US

- 11.2.1.1. Overview

- 11.2.1.2. Regulatory Landscape in the US

- 11.2.1.3. Regulatory Approval Pathway

- 11.2.1. Regulatory Guidelines for Biosimilars in the US

- 11.3. Regulatory Guidelines for Biosimilars in Europe

- 11.3.1. Overview

- 11.3.2. Regulatory Landscape in Europe

- 11.3.3. Regulatory Approval Pathway

- 11.4. Regulatory Guidelines for Biosimilars in Asia-Pacific

- 11.4.1. Regulatory Guidelines for Biosimilars in China

- 11.4.1.1. Overview

- 11.4.1.2. Regulatory Landscape in China

- 11.4.1.3. Regulatory Approval Pathway

- 11.4.2. Regulatory Guidelines for Biosimilars in Japan

- 11.4.2.1. Overview

- 11.4.2.2. Regulatory Landscape in Japan

- 11.4.2.3. Regulatory Approval Pathway

- 11.4.3. Regulatory Guidelines for Biosimilars in Australia

- 11.4.3.1. Overview

- 11.4.3.2. Regulatory Landscape in Australia

- 11.4.3.3. Regulatory Approval Pathway

- 11.4.1. Regulatory Guidelines for Biosimilars in China

- 11.5. Future Perspectives

12. COST PRICE ANALYSIS

- 12.1. Chapter Overview

- 12.2. Factors Contributing to High Price of Novel Biologics

- 12.3. Pricing of Biosimilars

- 12.3.1. Price Comparison of Different Biosimilars with its Reference Biologic

- 12.4. Concluding Remarks

13. CASE STUDY: OUTSOURCING OF BIOSIMILARS

- 13.1. Chapter Overview

- 13.2. Need for Outsourcing Manufacturing Operations

- 13.3. Impact of Biosimilars on the Global Contract Manufacturing Market

- 13.3.1. Biosimilars: Historical Trend of FDA Approvals

- 13.4. Biosimilars Contract Manufacturing Service Providers

- 13.5. Challenges Associated with Outsourcing of Biosimilar Manufacturing Operations

- 13.6. Future Perspectives

14. MARKET IMPACT ANALYSIS

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. GLOBAL BIOSIMILARS MARKET

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Global Biosimilars Market, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.1. Scenario Analysis

- 15.3.1.1. Conservative Scenario

- 15.3.1.2. Optimistic Scenario

- 15.3.1. Scenario Analysis

- 15.4. Key Market Segmentations

16. BIOSIMILARS MARKET, BY DRUG CLASS

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Biosimilars Market: Distribution by Drug Class, 2019, 2024 and 2035

- 16.3.1. Biosimilars Market for Monoclonal Antibodies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.3.2. Biosimilars Market for Proteins, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.3.3. Biosimilars Market for Peptides, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.3.4. Biosimilars Market for Others, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.4. Data Triangulation and Validation

17. BIOSIMILARS MARKET, BY THERAPEUTIC AREAS

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Biosimilars Market: Distribution by Therapeutic Areas, 2019, 2024 and 2035

- 17.3.1. Biosimilars Market for Oncological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.2. Biosimilars Market for Autoimmune and Inflammatory Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.3. Biosimilars Market for Hematological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.4. Biosimilars Market for Metabolic Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.5. Biosimilars Market for Other Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.4. Data Triangulation and Validation

18. BIOSIMILARS MARKET, BY TYPE OF MANUFACTURER

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Biosimilars Market: Distribution by Type of Manufacturers, 2019, 2024 and 2035

- 18.3.1. Biosimilars Market for Contract Manufacturers, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 18.3.2. Biosimilars Market for In-house Developers, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 18.4. Data Triangulation and Validation

19. BIOSIMILARS MARKET, BY DISTRIBUTION CHANNELS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Biosimilars Market: Distribution by Distribution Channels, 2019, 2024 and 2035

- 19.3.1. Biosimilars Market for Hospital Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.3.2. Biosimilars Market for Retail Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.3.3. Biosimilars Market for Online Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 19.4. Data Triangulation and Validation

20. BIOSIMILARS MARKET, BY GEOGRAPHICAL REGIONS

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Biosimilars Market: Distribution by Geographical Regions, 2019, 2024 and 2035

- 20.3.1. Biosimilars Market in North America, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.1.1. Biosimilars Market in the US, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.1.2. Biosimilars Market in Canada, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2. Biosimilars Market in Europe, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.1. Biosimilars Market in Germany, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.2. Biosimilars Market in the UK, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.3. Biosimilars Market in France, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.4. Biosimilars Market in Spain, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.5. Biosimilars Market in Italy, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.6. Biosimilars Market in Switzerland, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.7. Biosimilars Market in Belgium, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.8. Biosimilars Market in Denmark, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.2.9. Biosimilars Market in Rest of Europe, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.3. Biosimilars Market in Asia-Pacific, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.3.1. Biosimilars Market in China, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.3.2. Biosimilars Market in India, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.3.3. Biosimilars Market in Japan, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.3.4. Biosimilars Market in South Korea, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.3.5. Biosimilars Market in Australia, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.4. Biosimilars Market in Middle East and North Africa, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.4.1. Biosimilars Market in Saudi Arabia, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.4.2. Biosimilars Market in Egypt, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.4.3. Biosimilars Market in UAE, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.5. Biosimilars Market in Latin America, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.5.1. Biosimilars Market in Brazil, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.5.2. Biosimilars Market in Mexico, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.5.3. Biosimilars Market in Argentina, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.3.1. Biosimilars Market in North America, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Data Triangulation and Validation

21. BIOSIMILARS MARKET, BY LEADING PLAYERS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

22. CONCLUDING REMARKS

23. APPENDIX I: TABULATED DATA

24. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Difference between Reference Biologics, Biosimilars and Generics

- Table 6.2 Steps Involved in Manufacturing of Biosimilars

- Table 7.1 Biosimilar Developers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 7.2 Biosimilars: Information on Developer, Stage of Development, Reference Biologic and Generic Name

- Table 7.3 Biosimilars: Information on Developer and Therapeutic Area

- Table 7.4 Biosimilars: Information on Developer and Drug Class

- Table 8.1 Biosimilar Developers in North America: List of Companies Profiled

- Table 8.2 Amgen: Company Overview

- Table 8.3 Amgen: Biosimilar Pipeline

- Table 8.4 Amgen: Recent Developments and Future Outlook

- Table 8.5 Coherus BioSciences: Company Overview

- Table 8.6 Coherus BioSciences: Biosimilar Pipeline

- Table 8.7 Coherus BioSciences: Recent Developments and Future Outlook

- Table 8.8 Eli Lilly: Company Overview

- Table 8.9 Eli Lilly: Biosimilar Pipeline

- Table 8.10 Eli Lilly: Recent Developments and Future Outlook

- Table 8.11 Pfizer: Company Overview

- Table 8.12 Pfizer: Biosimilar Pipeline

- Table 8.13 Pfizer: Recent Developments and Future Outlook

- Table 9.1 Biosimilar Developers in Europe: List of Companies Profiled

- Table 9.2 BIOCAD: Company Overview

- Table 9.3 BIOCAD: Biosimilar Pipeline

- Table 9.4 BIOCAD: Recent Developments and Future Outlook

- Table 9.5 Fresenius Kabi: Company Overview

- Table 9.6 Fresenius Kabi: Biosimilar Pipeline

- Table 9.7 Fresenius Kabi: Recent Developments and Future Outlook

- Table 9.8 Sandoz: Company Overview

- Table 9.9 Sandoz: Biosimilar Pipeline

- Table 9.10 Sandoz: Recent Developments and Future Outlook

- Table 9.11 STADA: Company Overview

- Table 9.12 STADA: Biosimilar Pipeline

- Table 9.13 STADA: Recent Developments and Future Outlook

- Table 10.1 Biosimilar Developers in Asia-Pacific and Rest of the World: List of Companies Profiled

- Table 10.2 Biocon: Company Overview

- Table 10.3 Biocon: Biosimilar Pipeline

- Table 10.4 Biocon: Recent Developments and Future Outlook

- Table 10.5 Dr. Reddy's Laboratories: Company Overview

- Table 10.6 Dr. Reddy's Laboratories: Biosimilar Pipeline

- Table 10.7 Dr. Reddy's Laboratories: Recent Developments and Future Outlook

- Table 10.8 Celltrion: Company Overview

- Table 10.9 Celltrion: Biosimilar Pipeline

- Table 10.10 Celltrion: Recent Developments and Future Outlook

- Table 10.11 Intas Pharmaceuticals: Company Overview

- Table 10.12 Intas Pharmaceuticals: Biosimilar Pipeline

- Table 10.13 Intas Pharmaceuticals: Recent Developments and Future Outlook

- Table 10.14 Teva Pharmaceuticals: Company Overview

- Table 10.15 Teva Pharmaceuticals: Biosimilar Pipeline

- Table 10.16 Teva Pharmaceuticals: Recent Developments and Future Outlook

- Table 12.1 Price Comparison of Different Biosimilars with their Reference Biologics

- Table 13.1 List of Biosimilars Contract Manufacturing Service Providers

- Table 21.1 Leading Industry Players: Based on the Company Size and Number of Approved Biosimilars

- Table 23.1 Biosimilar Developers: Distribution by Year of Establishment

- Table 23.2 Biosimilar Developers: Distribution by Company Size

- Table 23.3 Biosimilar Developers: Distribution by Location of Headquarters (Region)

- Table 23.4 Biosimilar Developers: Distribution by Location of Headquarters (Country)

- Table 23.5 Biosimilars: Distribution by Stage of Development

- Table 23.6 Biosimilars: Distribution by Therapeutic Area

- Table 23.7 Biosimilars: Distribution by Drug Class

- Table 23.8 Amgen: Consolidated Financial Details (USD Billion)

- Table 23.9 Coherus BioSciences: Consolidated Financial Details (USD Million)

- Table 23.10 Eli Lilly: Consolidated Financial Details (USD Billion)

- Table 23.11 Pfizer: Business Segment-wise Revenues and Consolidated Financial Details (USD Million)

- Table 23.12 Fresenius Kabi: Business Segment-wise Revenues and Consolidated Financial Details (EUR Million)

- Table 23.13 Sandoz: Consolidated Financial Details (USD Million)

- Table 23.14 STADA: Business Segment-wise Revenues and Consolidated Financial Details (EUR Million)

- Table 23.15 Biocon: Business Segment-wise Revenues and Consolidated Financial Details (INR Billion)

- Table 23.16 Dr. Reddy's Laboratories: Business Segment-wise Revenues and Consolidated Financial Details (INR Billion)

- Table 23.17 Celltrion: Consolidated Financial Details (KRW Billion)

- Table 23.18 Teva Pharmaceuticals: Consolidated Financial Details (USD Billion)

- Table 23.19 Global Biosimilars Market, Historical Trends (since 2019) and Forecasted Estimates (till 2035), (USD Billion)

- Table 23.20 Global Biosimilars Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Table 23.21 Global Biosimilars Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Table 23.22 Biosimilars Market: Distribution by Drug Class, 2019, 2024 and 2035

- Table 23.23 Biosimilars Market for Monoclonal Antibodies, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.24 Biosimilars Market for Proteins, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.25 Biosimilars Market for Peptides, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.26 Biosimilars Market for Others, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.27 Biosimilars Market: Distribution by Therapeutic Area, 2019, 2024 and 2035

- Table 23.28 Biosimilars Market for Oncological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.29 Biosimilars Market for Autoimmune and Inflammatory Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.30 Biosimilars Market for Hematological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios(USD Billion)

- Table 23.31 Biosimilars Market for Metabolic Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.32 Biosimilars Market for Other Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.33 Biosimilars Market: Distribution by Type of Manufacturer, 2019, 2024 and 2035

- Table 23.34 Biosimilars Market for Contract Manufacturers, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.35 Biosimilars Market for In-house Developers, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.36 Biosimilars Market: Distribution by Distribution Channel, 2019, 2024 and 2035

- Table 23.37 Biosimilars Market for Hospital Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.38 Biosimilars Market for Retail Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.39 Biosimilars Market for Online Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.40 Biosimilars Market: Distribution by Geographical Regions, 2019, 2024 and 2035

- Table 23.41 Biosimilars Market in North America, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.42 Biosimilars Market in the US, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.43 Biosimilars Market in Canada, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.44 Biosimilars Market in Europe, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.45 Biosimilars Market in Germany, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.46 Biosimilars Market in the UK, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.47 Biosimilars Market in France, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.48 Biosimilars Market in Spain, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.49 Biosimilars Market in Italy, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.50 Biosimilars Market in Switzerland, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.51 Biosimilars Market in Belgium, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.52 Biosimilars Market in Denmark, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.53 Biosimilars Market in Rest of Europe, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.54 Biosimilars Market in Asia-Pacific, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.55 Biosimilars Market in China, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.56 Biosimilars Market in India, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.57 Biosimilars Market in Japan, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.58 Biosimilars Market in South Korea, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.59 Biosimilars Market in Australia, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.60 Biosimilars Market in Middle East and North Africa, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.61 Biosimilars Market in Saudi Arabia, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.62 Biosimilars Market in Egypt, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.63 Biosimilars Market in UAE, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.64 Biosimilars Market in Latin America, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.65 Biosimilars Market in Brazil, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.66 Biosimilars Market in Mexico, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.67 Biosimilars Market in Argentina, Historical Trends (since 2019) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Key Market Segmentation

- Figure 3.3 Market Dynamics: Robust Quality Control

- Figure 4.1 Lessons Learnt from Past Recessions

- Figure 5.1 Executive Summary: Market Landscape

- Figure 5.2 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 Number of Biologics Approved by the USFDA, 2015-2023

- Figure 6.2 Need for Biosimilars

- Figure 6.3 Steps Involved in Upstream Processing

- Figure 6.4 Steps Involved in Downstream Processing

- Figure 6.5 Reference Biologic and Biosimilar Development Timeline

- Figure 7.1. Biosimilar Developers: Distribution by Year of Establishment

- Figure 7.2 Biosimilar Developers: Distribution by Company Size

- Figure 7.3 Biosimilar Developers: Distribution by Location of Headquarters (Region)

- Figure 7.4 Biosimilar Developers: Distribution by Location of Headquarters (Country)

- Figure 7.5 Biosimilars: Distribution by Stage of Development

- Figure 7.6 Biosimilars: Distribution by Therapeutic Area

- Figure 7.7 Biosimilars: Distribution by Drug Class

- Figure 8.1 Amgen: Consolidated Financial Details (USD Billion)

- Figure 8.2 Coherus BioSciences: Consolidated Financial Details (USD Million)

- Figure 8.3 Eli Lilly: Consolidated Financial Details (USD Billion)

- Figure 8.4 Pfizer: Business Segment-wise Revenues and Consolidated Financial Details (USD Million)

- Figure 9.1 Fresenius Kabi: Business Segment-wise Revenues and Consolidated Financial Details (EUR Million)

- Figure 9.2 Sandoz: Consolidated Financial Details (USD Million)

- Figure 9.3 STADA: Business Segment-wise Revenues and Consolidated Financial Details (EUR Million)

- Figure 10.1 Biocon: Business Segment-wise Revenues and Consolidated Financial Details (INR Billion)

- Figure 10.2 Dr. Reddy's Laboratories: Business Segment-wise Revenues and Consolidated Financial Details (INR Billion)

- Figure 10.3 Celltrion: Consolidated Financial Details (KRW Billion)

- Figure 10.4 Teva Pharmaceuticals: Consolidated Financial Details (USD Billion)

- Figure 11.1 Regulatory Approval Pathways for Biologics and Biosimilars in the US

- Figure 11.2 Comparability Study Steps for Biosimilar Development in Europe

- Figure 11.3 Guidelines and Approval Pathway for Biosimilar Development in China

- Figure 11.4 Guidelines for Approval of Biosimilars in Australia

- Figure 12.1 Potential Cost Saving Projections

- Figure 13.1 Need for Outsourcing Biosimilar Manufacturing Operations

- Figure 13.2 Biosimilars: Historical Trend of FDA Approvals, 2015-2024

- Figure 13.3 Challenges Associated with Outsourcing Biosimilar Manufacturing Operations

- Figure 15.1 Global Biosimilars Market, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.2 Global Biosimilars Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Figure 15.3 Global Biosimilars Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Figure 16.1 Biosimilars Market: Distribution by Drug Class, 2019, 2024 and 2035

- Figure 16.2 Biosimilars Market for Monoclonal Antibodies, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.3 Biosimilars Market for Proteins, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.4 Biosimilars Market for Peptides, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.5 Biosimilars Market for Others, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.1 Biosimilars Market: Distribution by Therapeutic Area, 2019, 2024 and 2035

- Figure 17.2 Biosimilars Market for Oncological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.3 Biosimilars Market for Autoimmune and Inflammatory Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.4 Biosimilars Market for Hematological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.5 Biosimilars Market for Metabolic Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 17.6 Biosimilars Market for Other Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.1 Biosimilars Market: Distribution by Type of Manufacturer, 2019, 2024 and 2035

- Figure 18.2 Biosimilars Market for Contract Manufacturers, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 18.3 Biosimilars Market for In-house Developers, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.1 Biosimilars Market: Distribution by Distribution Channel, 2019, 2024 and 2035

- Figure 19.2 Biosimilars Market for Hospital Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.3 Biosimilars Market for Retail Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 19.4 Biosimilars Market for Online Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.1 Biosimilars Market: Distribution by Geographical Regions, 2019, 2024 and 2035

- Figure 20.2 Biosimilars Market in North America, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.3 Biosimilars Market in the US, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.4 Biosimilars Market in Canada, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.5 Biosimilars Market in Europe, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.6 Biosimilars Market in Germany, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.7 Biosimilars Market in the UK, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.8 Biosimilars Market in France, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.9 Biosimilars Market in Spain, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.10 Biosimilars Market in Italy, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.11 Biosimilars Market in Switzerland, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.12 Biosimilars Market in Belgium, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.13 Biosimilars Market in Denmark, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.14 Biosimilars Market in Rest of Europe, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.15 Biosimilars Market in Asia-Pacific, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.16 Biosimilars Market in China, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.17 Biosimilars Market in India, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.18 Biosimilars Market in Japan, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.19 Biosimilars Market in South Korea, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.20 Biosimilars Market in Australia, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.21 Biosimilars Market in Middle East and North Africa, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.22 Biosimilars Market in Saudi Arabia, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.23 Biosimilars Market in Egypt, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.24 Biosimilars Market in UAE, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.25 Biosimilars Market in Latin America, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.26 Biosimilars Market in Brazil, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.27 Biosimilars Market in Mexico, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.28 Biosimilars Market in Argentina, Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.29 Market Movement Analysis

- Figure 20.30 Penetration-Growth (P-G) Matrix

- Figure 22.1 Concluding Remarks: Market Landscape

- Figure 22.2 Concluding Remarks: Market Forecast and Opportunity Analysis