|

市场调查报告书

商品编码

1597044

皮下生技药品的全球市场(第5版):2035年前的产业趋势和全球预测 - 生技药品类别,各治疗类型,各投药法,各治疗领域,各终端用户,各地区Subcutaneous Biologics Market (5th Edition), Industry Trends and Global Forecasts, till 2035 - Type of Biologic, Type of Therapy, Method of Administration, End User, Therapeutic Area, Geographical Regions, Leading Players and Sales Forecast |

||||||

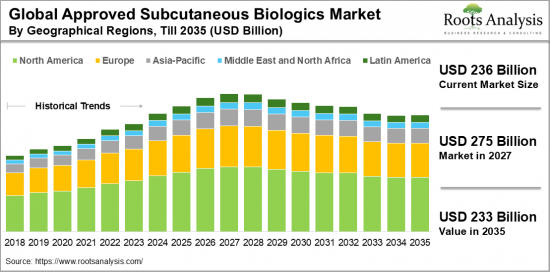

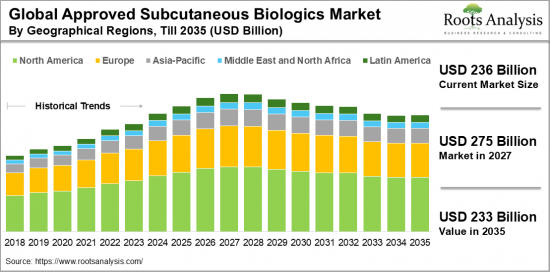

目前皮下生物製剂市场规模为2,360亿美元,预计在预测期内将稳定成长。

预计未来十年皮下生物製剂市场的成长将归因于自我给药设备的日益普及以及与生物製剂皮下输送相关的各种技术的进步。近年来,製药业的生物製品如基因治疗药物、血液製品、细胞製品、抗体和蛋白质治疗药物增加。与开发更容易、成本更低的传统化学药物不同,生物製剂在药物开发中面临独特的课题。这些包括是聚合的、具有复杂的结构、给药后容易降解以及具有复杂的製造过程。

为了克服这些课题,製药公司正在利用新技术来开发可以治疗多种疾病的生物製剂。这些创新包括利用缀合、胺基酸修饰和封装原理配製皮下生物製剂。此外,新的药物输送系统(例如自动注射器、预充式註射器和无针输送方法)正在设计用于输送高黏度製剂。近年来,该行业获得美国食品和药物管理局 (FDA) 批准的生物製剂数量有所增加,预计仅 2024 年第一季就有 9 种获得批准。人们对生物製剂的偏好不断变化,是因为它们能够最大限度地减少药物交互作用,并透过精确的结合和独特的代谢途径提供标靶治疗。

传统上,生物製剂由于其快速的体循环和强的生物利用度而通过静脉注射。静脉给药是有效的,但通常需要医疗保健专业人员定期给药,这可能会对药物依从性造成课题。然而,近年来,皮下给药方法和装置因其功效、耐受性和安全性而受到医疗保健专业人员的欢迎。此外,对自我给药疗法的需求不断增长,以及自动注射器和预充式註射器等易于使用的药物传输设备的出现,也支持了生物製剂向皮下给药的转变。

本报告提供全球皮下生技药品市场相关调查,提供市场概要,以及生技药品类别,各治疗类型,各投药法,各治疗领域,各终端用户,各地区的趋势,及加入此市场的主要企业简介等资讯。

目录

第1章 序文

第2章 调查手法

第3章 市场动态

第4章 经济以及其他的计划特有的考虑事项

第5章 摘要整理

第6章 简介

第7章 已通过核准皮下生技药品:市场形势

第8章 已通过核准皮下生技药品:成功通讯协定分析

第9章 临床阶段的皮下生技药品:市场形势

第10章 皮下製剂:技术形势

第11章 技术竞争力分析

第12章 皮下製剂技术供应商:企业简介

第13章 皮下製剂技术:伙伴关係和合作

第14章 皮下药物递输系统:市场形势

第15章 皮下药物递输系统:产品竞争力分析

第16章 SWOT分析

第17章 全球已通过核准皮下生技药品市场

第18章 已通过核准皮下生技药品市场(生物製药各类型)

第19章 已通过核准皮下生技药品市场(各治疗类型)

第20章 已通过核准皮下生技药品市场(各投药法)

第21章 已通过核准皮下生技药品市场(各治疗领域)

第22章 已通过核准皮下生技药品市场(各地区)

第23章 已通过核准皮下生技药品市场(医药品的销售额预测)

第24章 已通过核准皮下生技药品市场(各主要企业)

第25章 全球皮下生技药品製剂技术市场

第26章 皮下生技药品的製剂技术市场(基本原理)

第27章 皮下生技药品的製剂技术市场(各终端用户)

第28章 皮下生技药品的製剂技术市场(各治疗领域)

第29章 皮下生技药品的製剂技术市场(各主要地区)

第30章 皮下生技药品的所製剂技术市场(采用的付款方式)

第31章 皮下生技药品的製剂技术市场(各主要企业)

第32章 皮下药物递输系统:市场预测

第33章 结论

第34章 执行洞察

- 章概要

- Rx Bandz

- Oval Medical Technologies

- Lindy Biosciences

- Subcuject

- Qlibrium

- Intas Pharmaceuticals

- Elcam Medical

- IDEO

- Pharma Consult

- Medincell

- Xeris Biopharma

- IDT Biologika

- 其他(在美国里(上)放置据点的企业)

- 其他(欧洲放置据点的企业)

第35章 附录1:表格形式的资料

第36章 附录2:企业·团体一览

The Subcutaneous Biologics Market is valued at USD 236 billion in the current year and is poised for steady growth during the forecast period.

The subcutaneous biologics market growth over the next decade is anticipated to stem from the increased adoption of self-administration devices, coupled with various technological advancements related to subcutaneous delivery of biologic drugs. In recent years, the pharmaceutical industry has witnessed a rise in the number of biologic drugs, including gene therapies, blood products, cell products, antibodies, and protein therapeutics. Unlike traditional chemical-based medications, which are easier and affordable to develop, biologics present unique challenges during drug development. These include their high molecular weight, complex structures, susceptibility to degradation after administration, and complex manufacturing processes.

To overcome these challenges, pharmaceutical companies are leveraging new technologies to develop biologics that can treat a wide range of diseases. These technological innovations involve the formulation of subcutaneous biologics via conjugation, amino acid modification, and encapsulation principles. Additionally, novel drug delivery systems, such as autoinjectors, pre-filled syringes, and needle-free delivery methods have been designed to deliver highly viscous formulations. The industry has witnessed a rise in the number of biologic drugs approved by the US Food and Drug Administration (FDA) in recent years, with nine approvals in the first quarter of 2024 alone. The shift in preference towards biologics can be attributed to their ability to offer targeted treatment, enabling minimal drug interactions due to their precise binding and unique metabolic pathways.

Traditionally, biologics were administered intravenously due to their rapid systemic circulation and potent bioavailability. While intravenous administration is effective, it often requires regular administration by healthcare professionals, which can pose a challenge in terms of medication adherence. However, in recent years, subcutaneous administration methods and devices have gained popularity among healthcare providers owing to their effectiveness, tolerability and safety. In addition, the shift towards subcutaneous biologics is driven by the growing demand for self-administrable therapies and the availability of user-friendly drug delivery devices such as autoinjectors and pre-filled syringes.

Key Market Segments

Type of Biologic

- Antibodies

- Nucleotides

- Proteins

Type of Therapy

- Monotherapies

- Combination Therapies

- Both (Monotherapies and Combination Therapies)

Method of Administration

- Injection

- Infusion

- Both (Injection and Infusion)

Fundamental Principle

- Encapsulation

- Complex Formation

- Conjugation

- Amino acid Interaction

- Other Fundamental Principles

End User

- Pharmaceutical and Biopharmaceutical Companies

- Biotechnology Companies

- MedTech Companies

- Contract Development and Manufacturing Organizations

- Educational Institutes

- Medical Equipment Manufacturers

- Other End Users

Payment Method Employed

- Milestone Payments

- Upfront Payments

Therapeutic Area

- Autoimmune Disorders

- Bone Disorders

- Hematological Disorders

- Infectious Diseases

- Inflammatory Disorders

- Metabolic Disorders

- Neurological Disorders

- Ocular Disorders

- Oncological Disorders

- Other Disorders

Type of Drug Delivery Device

- Large Volume Wearable Injectors

- Autoinjectors

- Needle-free Injection System

- Novel Drug Reconstitution System

- Prefilled Syringes

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Research Coverage:

- A preface providing an introduction to the full report, Subcutaneous Biologics Market (5th Edition), till 2035.

- An outline of the systematic research approach used for the study of subcutaneous biologics market, featuring an overview of key assumptions, research methodologies, and quality control measures employed to ensure the accuracy and reliability of our findings.

- An overview of the diverse methodologies and frameworks used to forecast and analyze trends in the subcutaneous biologics market. Additionally, it examines the key factors that influence market dynamics and highlights the strong quality control framework implemented to ensure transparency and credibility in the insights provided in this report.

- A detailed view on the various economic factors that are expected to impact the overall market for subcutaneous biologics including currency fluctuations, foreign exchange rates, and known trade barriers. In addition, it evaluates the effects of global recession and inflation on the overall growth of the market, drawing insights from key historical events to make informed decisions in the future.

- An executive summary of the insights captured during our research, offering an insightful overview of the current subcutaneous biologics market. It presents information on the most relevant trends, challenges and opportunities shaping the industry's development.

- A general introduction to various types of therapeutic molecules (biologics and small molecules), along with a comparison of their characteristics, such as molecular size, molecular weight, molecular structure, immunogenicity, stability and manufacturing. Further, it also highlights different types of biologically derived products that are currently under development. Additionally, it highlights various challenges associated with the parenteral route of drug delivery, especially those related to the traditional intravenous (infusion) route of administration. The report further discusses subcutaneous formulations, different delivery approaches for such biologics, methods of administration, and advantages and limitations associated with subcutaneous route.

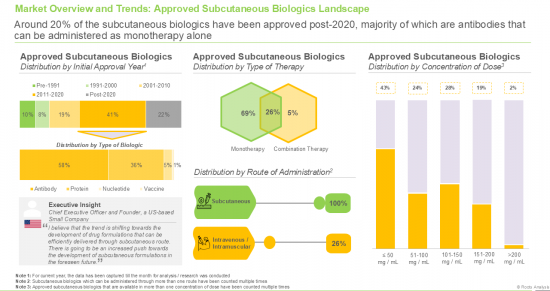

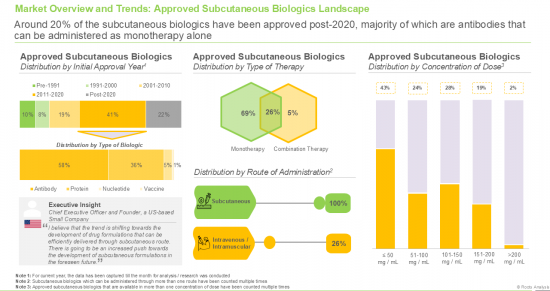

- A detailed assessment of the current overall market landscape of approved subcutaneous biologics, based on several relevant parameters, such as initial approval year, type of biologic, type of therapy, route of administration, method of administration, dosing frequency, concentration of dose, target disease indication, therapeutic area and type of drug delivery device. Further, it includes an overview of the developers in this domain, presenting a detailed analysis based on several relevant parameters, such as year of establishment, company size and location of headquarters and most active developers.

- An exhaustive success protocol analysis of the leading subcutaneous biologics (in terms of value creation), based on several relevant parameters, such as drug efficacy / success rate, target disease indication burden, global competition (with respect to industry players), therapy price, geographical reach and disease prevalence.

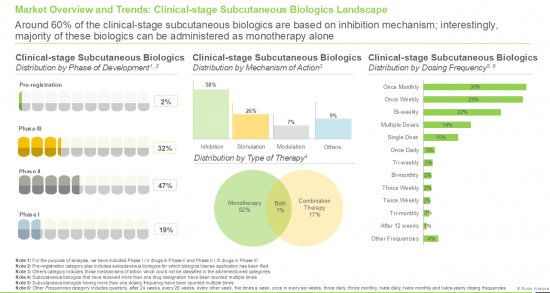

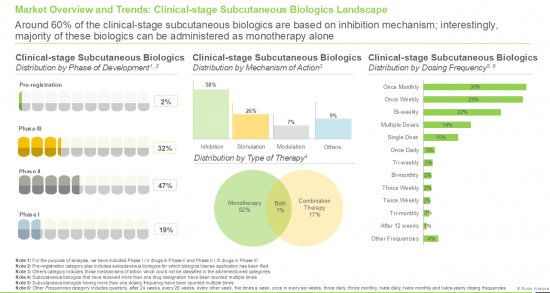

- In-depth assessment of the overall market landscape of clinical-stage subcutaneous biologics, based on several relevant parameters, such as status of development, type of biologic, type of therapy, mechanism of action, dosing frequency, target disease indication, therapeutic area and drug designation. Further, it comprises of an insightful analysis of the developers in this domain, on the basis of several parameters, such as year of establishment, company size, location of headquarters and most active developers.

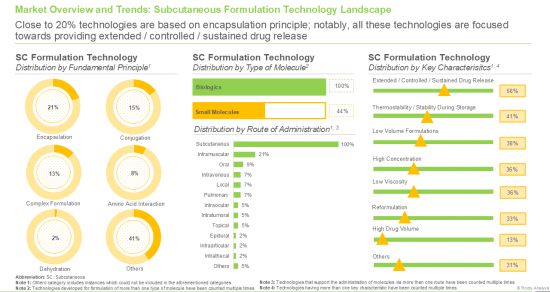

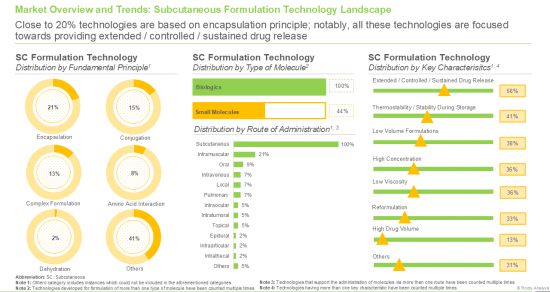

- A detailed overview of the current market landscape of subcutaneous formulation technologies, along with information on several relevant parameters, such as fundamental principle, type of molecule, route of administration, therapeutic area and key characteristics. Further, it provides a detailed assessment of subcutaneous formulation technology developers on the basis of several relevant parameters, such as their year of establishment, company size and location of headquarters.

- An informative technology competitiveness analysis of the subcutaneous formulation technologies, based on various parameters, such as company strength (in terms of years of experience) and technology strength (in terms of fundamental principle, type of molecule, route of administration, therapeutic area and key characteristics).

- Elaborate profiles of leading subcutaneous formulation technology developers based in North America, Europe and Asia-Pacific. Each company profile features a brief overview of the company, along with information on the location of headquarters, year of establishment, number of employees, leadership team, contact details, financial information (if available), technology portfolio, recent developments and an informed future outlook.

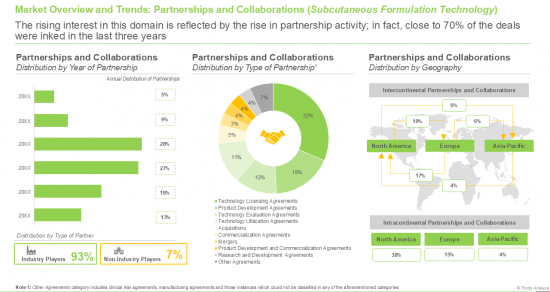

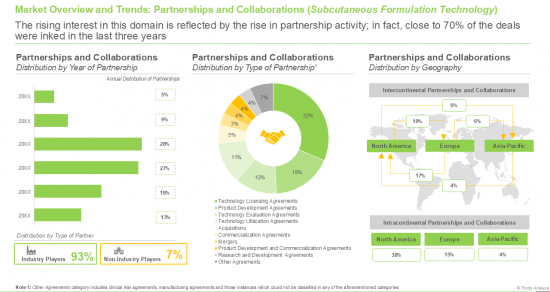

- In-depth analysis of the partnerships inked between several stakeholders in subcutaneous formulation technology domain, since 2020. Further, it covers technology licensing agreements, technology evaluation agreements, product development agreements, acquisitions and other relevant agreements.

- Detailed discussion on subcutaneous delivery systems with emphasis on the large volume wearable injectors, autoinjectors, pen injectors, needle-free injectors, novel drug reconstitution systems, prefilled syringes and implants.

- An informative product competitiveness analysis of the subcutaneous delivery systems, such as large volume wearable injectors, autoinjectors, needle-free injectors and prefilled syringes, based on various parameters, such as supplier power and product specific information.

- Deep insights on industry affiliated trends, opportunities and challenges, under SWOT analysis, which are anticipated to impact the overall evolution of the subcutaneous biologics market. It includes Harvey ball analysis, highlighting the relative impact of each SWOT parameter on the industry dynamics.

- An in-depth market forecast analysis of approved subcutaneous biologics to estimate the current market size and future opportunity associated with the subcutaneous biologics market, till 2035.

- A detailed market forecast analysis for approved subcutaneous biologics based on different types of biologics, namely antibodies, proteins and nucleotides.

- Detailed market forecast analysis for approved subcutaneous biologics across different types of therapies, namely monotherapy, combination therapy, and both monotherapy and combination therapy.

- A detailed market forecast analysis for approved subcutaneous biologics market across different methods of administration, namely injection, infusion, and both injection and infusion.

- A detailed market forecast analysis for approved subcutaneous biologics based on different therapeutic areas, namely autoimmune disorders, metabolic disorders, oncological disorders, hematological disorders, inflammatory disorders, neurological disorders, bone disorders and other disorders.

- A detailed market forecast analysis for approved subcutaneous biologics market across different geographical regions, namely North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America.

- A detailed projection of the current and anticipated future revenues from the sales of approved subcutaneous biologics.

- A detailed projection of the leading players engaged in the development of subcutaneous biologics.

- A detailed market forecast analysis to estimate the current market size and future opportunity in the subcutaneous formulation technologies market, till 2035. Based on multiple parameters, such as revenues generated from technology licensing deals and comprehensive secondary research, we have provided an informed estimate on the market evolution over the next decade. In order to account for future uncertainties and to add robustness to our model, we have provided three forecast scenarios, namely conservative, base, and optimistic scenarios, representing different tracks of the industry's growth.

- A detailed projection of the current size and future opportunity within the subcutaneous formulation technologies market across different fundamental principles, namely encapsulation, complex formation, conjugation, amino acid interaction and other fundamental principles.

- A detailed projection of the current size and future opportunity within the subcutaneous formulation technologies market across different end users, namely pharmaceutical and biopharmaceutical companies, biotechnology companies, MedTech Companies, contract development and manufacturing organizations, educational institutes, medical equipment manufacturers and other end users.

- A detailed projection of the current size and future opportunity within the subcutaneous formulation technologies market across different therapeutic areas, namely oncological disorders, metabolic disorders, ocular disorders, infectious disorders, autoimmune disorders, neurological disorders, immunological disorders and other disorders.

- A detailed projection of the current size and future opportunity within the subcutaneous formulation technologies market across different geographical regions, namely North America, Europe and Asia-Pacific.

- A detailed projection of the current size and future opportunity within the subcutaneous formulation technologies market across different payment methods employed, namely milestone payments and upfront payments.

- Detailed information on the leading players engaged in the subcutaneous biologics formulation and technology market.

- A detailed market forecast analysis in order to estimate the existing market size and future opportunity across different drug delivery systems, namely large volume wearable injectors, autoinjectors, needle-free injection systems, novel drug reconstitution systems and prefilled syringes.

Key Benefits of Buying this Report

- The report offers valuable insights into revenue estimation for both the overall market and its sub-segments in order to empower market leaders and newcomers with critical information requisite for establishing their footprint in the industry.

- The report can be utilized by stakeholders to enhance their understanding of the competitive landscape, allowing for improved business positioning and more effective go-to-market strategies.

- The report provides stakeholders with a comprehensive view on the Subcutaneous Biologics Market, covering essential information on significant market drivers, barriers, opportunities, and challenges.

Example Companies Profiled

- Adocia

- Alteogen

- Ascendis Pharma

- CD Bioparticles

- Creative Biolabs

- Creative BioMart

- Foresee Pharmaceuticals

- Pacira Biosciences

- The Wyss Institute

- Xeris Biopharma

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Key Market Segmentation

- 3.7. Robust Quality Control

- 3.8. Limitations

4. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Future Estimates

- 4.2.2. Currency Coverage and Foreign Exchange Rate

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 4.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.2.4. Strategies for Mitigating Foreign Exchange Risk

- 4.2.3. Trade Policies

- 4.2.3.1. Impact of Trade Barriers on the Market

- 4.2.3.2. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Types of Therapeutic Molecules

- 6.3. Biologically Derived Molecules

- 6.3.1. Type of Products

- 6.3.2. Routes of Administration and Formulations

- 6.3.3. Subcutaneous Formulations

- 6.3.3.1. Approaches in Subcutaneous Delivery of Biologics

- 6.3.3.1.1. Reformulation

- 6.3.3.1.2. Differing Potencies

- 6.3.3.1.3. Novel Technologies

- 6.3.3.2. Methods of Subcutaneous Administration

- 6.3.3.3. Advantages of Subcutaneous Administration

- 6.3.3.4. Limitations of Subcutaneous Administration

- 6.3.3.1. Approaches in Subcutaneous Delivery of Biologics

- 6.4. Regulatory Considerations

- 6.4.1. Medical Devices

- 6.4.2. Drug Device Combination Products

- 6.5. Future Perspectives

7. APPROVED SUBCUTANEOUS BIOLOGICS: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Approved Subcutaneous Biologics: Overall Market Overview

- 7.2.1. Analysis by Initial Approval Year

- 7.2.2. Analysis by Type of Biologic

- 7.2.3. Analysis by Type of Therapy

- 7.2.4. Analysis by Route of Administration

- 7.2.5. Analysis by Method of Administration

- 7.2.6. Analysis by Dosing Frequency

- 7.2.7. Analysis by Concentration of Dose

- 7.2.8. Analysis by Target Disease Indication

- 7.2.9. Analysis by Therapeutic Area

- 7.2.10. Analysis by Type of Drug Delivery Device

- 7.3. Approved Subcutaneous Biologics: List of Developers

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters (Region)

- 7.3.4. Analysis by Location of Headquarters (Country)

- 7.3.5. Most Active Developers: Analysis by Number of Approved Drugs

8. APPROVED SUBCUTANEOUS BIOLOGICS: SUCCESS PROTOCOL ANALYSIS

- 8.1. Chapter Overview

- 8.2. Methodology

- 8.3. Success Protocol Analysis of Top Approved Subcutaneous Biologics

- 8.3.1. BENLYSTA(R) (Human Genome Sciences)

- 8.3.1.1. Overview

- 8.3.1.2. Development History

- 8.3.1.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.1.4. Success Protocol Analysis

- 8.3.2. BESREMi(R) (PharmaEssentia)

- 8.3.2.1. Overview

- 8.3.2.2. Development History

- 8.3.2.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.2.4. Success Protocol Analysis

- 8.3.3. COSENTYX(R) (Novartis)

- 8.3.3.1. Overview

- 8.3.3.2. Development History

- 8.3.3.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.3.4. Success Protocol Analysis

- 8.3.4. DARZALEX FASPRO(R) / DARZALEX(R) SC (Halozyme)

- 8.3.4.1. Overview

- 8.3.4.2. Development History

- 8.3.4.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.4.4. Success Protocol Analysis

- 8.3.5. DUPIXENT(R) (Regeneron Pharma)

- 8.3.5.1. Overview

- 8.3.5.2. Development History

- 8.3.5.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.5.4. Success Protocol Analysis

- 8.3.6. Enbrel(R) (Amgen)

- 8.3.6.1. Overview

- 8.3.6.2. Development History

- 8.3.6.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.6.4. Success Protocol Analysis

- 8.3.7. HEMLIBRA(R) (Roche)

- 8.3.7.1. Overview

- 8.3.7.2. Development History

- 8.3.7.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.7.4. Success Protocol Analysis

- 8.3.8. Prolia(R) / Pralia(R) (Amgen)

- 8.3.8.1. Overview

- 8.3.8.2. Development History

- 8.3.8.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.8.4. Success Protocol Analysis

- 8.3.9. STELARA(R) (Janssen Biotech)

- 8.3.9.1. Overview

- 8.3.9.2. Development History

- 8.3.9.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.9.4. Success Protocol Analysis

- 8.3.10. Trulicity(R) (Eli Lilly)

- 8.3.10.1. Overview

- 8.3.10.2. Development History

- 8.3.10.3. Phase of Development, Route of Administration, and Target Disease Indication

- 8.3.10.4. Success Protocol Analysis

- 8.3.1. BENLYSTA(R) (Human Genome Sciences)

- 8.4. Conclusion

9. CLINICAL-STAGE SUBCUTANEOUS BIOLOGICS: MARKET LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Clinical-stage Subcutaneous Biologics: Overall Market Overview

- 9.2.1. Analysis by Phase of Development

- 9.2.2. Analysis by Type of Biologic

- 9.2.3. Analysis by Type of Therapy

- 9.2.4. Analysis by Mechanism of Action

- 9.2.5. Analysis by Dosing Frequency

- 9.2.6. Analysis by Drug Designation

- 9.2.7. Analysis by Target Disease Indication

- 9.2.8. Analysis by Therapeutic Area

- 9.3. Clinical-stage Subcutaneous Biologics: List of Developers

- 9.3.1. Analysis by Year of Establishment

- 9.3.2. Analysis by Company Size

- 9.3.3. Analysis by Location of Headquarters

- 9.3.4. Most Active Developers: Analysis by Number of Clinical-stage Drugs

10. SUBCUTANEOUS FORMULATION: TECHNOLOGY LANDSCAPE

- 10.1. Chapter Overview

- 10.2. Subcutaneous Formulation: Technology Landscape

- 10.2.1. Analysis by Fundamental Principle

- 10.2.2. Analysis by Type of Molecule

- 10.2.3. Analysis by Route of Administration

- 10.2.4. Analysis by Therapeutic Area

- 10.2.5. Analysis by Key Characteristics

- 10.3. Subcutaneous Formulation: Technology Developers Landscape

- 10.3.1. Analysis by Year of Establishment

- 10.3.2. Analysis by Company Size

- 10.3.3. Analysis by Location of Headquarters

11. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 11.1. Chapter Overview

- 11.2. Assumptions and Key Parameters

- 11.3. Methodology

- 11.4. Technology Competitiveness Analysis: Subcutaneous Formulation Technology

- 11.4.1. Subcutaneous Formulation Technology Developed by Companies based in North America (Peer Group I)

- 11.4.2. Subcutaneous Formulation Technology Developed by Companies based in Europe (Peer Group II)

- 11.4.3. Subcutaneous Formulation Technology Developed by Companies based in Asia-Pacific (Peer Group III)

12. SUBCUTANEOUS FORMULATION TECHNOLOGY PROVIDERS: COMPANY PROFILES

- 12.1. Chapter Overview

- 12.2. Technology Developers Based in North America

- 12.2.1. CD Bioparticles

- 12.2.1.1. Company Overview

- 12.2.1.2. Technology Portfolio

- 12.2.1.3. Recent Developments and Future Outlook

- 12.2.2. Creative Biolabs

- 12.2.2.1. Company Overview

- 12.2.2.2. Technology Portfolio

- 12.2.2.3. Recent Developments and Future Outlook

- 12.2.3. Creative BioMart

- 12.2.3.1. Company Overview

- 12.2.3.2. Technology Portfolio

- 12.2.3.3. Recent Developments and Future Outlook

- 12.2.4. Pacira BioSciences

- 12.2.4.1. Company Overview

- 12.2.4.2. Financial Information

- 12.2.4.3. Technology Portfolio

- 12.2.4.4. Recent Developments and Future Outlook

- 12.2.5. The Wyss Institute

- 12.2.5.1. Company Overview

- 12.2.5.2. Technology Portfolio

- 12.2.5.3. Recent Developments and Future Outlook

- 12.2.6. Xeris Biopharma

- 12.2.6.1. Company Overview

- 12.2.6.2. Financial Information

- 12.2.6.3. Technology Portfolio

- 12.2.6.4. Recent Developments and Future Outlook

- 12.2.1. CD Bioparticles

- 12.3. Technology Developers Based in Europe

- 12.3.1. Adocia

- 12.3.1.1. Company Overview

- 12.3.1.2. Financial Information

- 12.3.1.3. Technology Portfolio

- 12.3.1.4. Recent Developments and Future Outlook

- 12.3.2. Ascendis Pharma

- 12.3.2.1. Company Overview

- 12.3.2.2. Financial Information

- 12.3.2.3. Technology Portfolio

- 12.3.2.4. Recent Developments and Future Outlook

- 12.3.1. Adocia

- 12.4. Technology Developers Based in Asia-Pacific

- 12.4.1. Alteogen

- 12.4.1.1. Company Overview

- 12.4.1.2. Technology Portfolio

- 12.4.1.3. Recent Developments and Future Outlook

- 12.4.2. Foresee Pharmaceuticals

- 12.4.2.1. Company Overview

- 12.4.2.2. Financial Information

- 12.4.2.3. Technology Portfolio

- 12.4.2.4. Recent Developments and Future Outlook

- 12.4.1. Alteogen

13. SUBCUTANEOUS FORMULATION TECHNOLOGIES: PARTNERSHIPS AND COLLABORATIONS

- 13.1. Chapter Overview

- 13.2. Partnership Models

- 13.3. Partnerships and Collaborations: Subcutaneous Formulation Technology

- 13.3.1. Analysis by Year of Partnership

- 13.3.2. Analysis by Type of Partnership

- 13.3.3. Analysis by Year and Type of Partnership

- 13.3.4. Analysis by Type of Partner

- 13.3.5. Analysis by Location of Headquarters of Partner

- 13.3.6. Analysis by Therapeutic Area

- 13.3.7. Most Active Players: Analysis by Number of Partnerships

- 13.4. Analysis by Geography

- 13.4.1. Intracontinental and Intercontinental Agreements

- 13.4.2. International and Local Agreements

14. SUBCUTANEOUS DRUG DELIVERY SYSTEMS: MARKET LANDSCAPE

- 14.1. Chapter Overview

- 14.2. Types of Subcutaneous Drug Delivery Systems

- 14.2.1. Large Volume Wearable Injectors

- 14.2.1.1. Large Volume Wearable Injectors for Non-Insulin Drugs: Market Landscape

- 14.2.1.1.1. Analysis by Status of Development

- 14.2.1.1.2. Analysis by Type of Device

- 14.2.1.1.3. Analysis by Usability

- 14.2.1.1.4. Analysis by Type of Dose

- 14.2.1.1.5. Analysis by Type of Drug Container

- 14.2.1.1.6. Analysis by Mode of Drug Filling

- 14.2.1.1.7. Analysis by Container Volume (mL)

- 14.2.1.1.8. Analysis by Route of Administration

- 14.2.1.1.9. Analysis by Mode of Injection

- 14.2.1.1.10. Analysis by Mechanism of Action / Driving Force

- 14.2.1.1.11. Analysis by Type of Technology

- 14.2.1.1.12. Analysis by Availability of Connectivity Feature

- 14.2.1.1.13. Analysis by Type of Compatible Drug

- 14.2.1.1.14. Analysis by Compatibility with High Viscosity Drugs

- 14.2.1.1.15. Analysis by Therapeutic Area

- 14.2.1.1.16. Most Active Players: Analysis by Number of Large Volume Wearable Injectors for Non-Insulin Drugs

- 14.2.1.2. Large Volume Wearable Injectors for Insulin Drugs

- 14.2.1.2.1. Analysis by Status of Development

- 14.2.1.2.2. Analysis by Type of Device

- 14.2.1.2.3. Analysis by Usability

- 14.2.1.2.4. Analysis by Type of Dose

- 14.2.1.2.5. Analysis by Mode of Drug Filling

- 14.2.1.2.6. Analysis by Container Volume (mL)

- 14.2.1.2.7. Analysis by Type of Diabetes

- 14.2.1.2.8. Analysis by Type of Combination Insulin

- 14.2.1.2.9. Analysis by Period of Use (Days)

- 14.2.1.2.10. Analysis by Type of Device Control Feature

- 14.2.1.2.11. Analysis by Availability of Interoperable Device

- 14.2.1.2.12. Analysis by Availability of Continuous Glucose Monitoring (CGM) / Blood Glucose Meters (BGM) System

- 14.2.1.2.13. Analysis by Availability of Automatic Insulin Delivery (AID) / Artificial Pancreas

- 14.2.1.2.14. Analysis by Type of Automated Insulin Delivery (AID) Feature

- 14.2.1.2.15. Analysis by Availability of Connectivity Feature

- 14.2.1.2.16. Analysis by Waterproof Capabilities

- 14.2.1.2.17. Most Active Players: Analysis by Number of Large Volume Wearable Injectors for Insulin Drugs

- 14.2.1.3. Large Volume Drug Device Combinations for Non-Insulin Drugs: Market Landscape

- 14.2.1.3.1. Analysis by Status of Development

- 14.2.1.3.2. Analysis by Type of Device

- 14.2.1.3.3. Analysis by Usability

- 14.2.1.3.4. Analysis by Type of Dose

- 14.2.1.3.5. Analysis by Type of Drug Container

- 14.2.1.3.6. Analysis by Mode of Drug Filling

- 14.2.1.3.7. Analysis by Container Volume (mL)

- 14.2.1.3.8. Analysis by Route of Administration

- 14.2.1.3.9. Analysis by Mode of Injection

- 14.2.1.3.10. Analysis by Type of Compatible Drug

- 14.2.1.3.11. Analysis by Mechanism of Action / Driving Force

- 14.2.1.3.12. Analysis by Type of Technology

- 14.2.1.3.13. Analysis by Therapeutic Area

- 14.2.1.3.14. Leading Players: Analysis by Number of Drug Device Combinations for Non-Insulin Drugs

- 14.2.1.1. Large Volume Wearable Injectors for Non-Insulin Drugs: Market Landscape

- 14.2.2. Autoinjectors

- 14.2.2.1. Current Market Landscape

- 14.2.2.1.1. Analysis by Stage of Development

- 14.2.2.1.2. Analysis by Usability

- 14.2.2.1.3. Analysis by Type of Primary Drug Container

- 14.2.2.1.4. Analysis by Requirement of Needle

- 14.2.2.1.5. Analysis by Volume of Container

- 14.2.2.1.6. Analysis by Type of Dose Delivered

- 14.2.2.1.7. Analysis by Route of Administration

- 14.2.2.1.8. Analysis by Type of Actuation Mechanism

- 14.2.2.1.9. Analysis by Type of Feedback Mechanism

- 14.2.2.1.10. Analysis by Availability of Connectivity Feature

- 14.2.2.1.11. Analysis by Target Indication

- 14.2.2.1.12. Analysis by Type of Molecule Delivered

- 14.2.2.1.13. Analysis by End User

- 14.2.2.1.14. Most Active Players: Analysis by Number of Autoinjectors

- 14.2.2.1. Current Market Landscape

- 14.2.3. Pen Injectors

- 14.2.3.1. Current Market Landscape

- 14.2.3.1.1. Analysis by Type of Dose

- 14.2.3.1.2. Analysis by Storage Volume / Capacity

- 14.2.3.1.3. Analysis by Usability

- 14.2.3.1.4. Most Active Players: Analysis by Number of Devices

- 14.2.3.2. Drug Device Combination Products

- 14.2.3.1. Current Market Landscape

- 14.2.4. Needle Free Injection System

- 14.2.4.1. Current Market Landscape

- 14.2.4.1.1. Analysis by Actuation Mechanism

- 14.2.4.1.2. Analysis by Route of Administration

- 14.2.4.1.3. Analysis by Type of Formulation Administered

- 14.2.4.1.4. Analysis by Type of Drug Delivered

- 14.2.4.1.5. Analysis by Therapeutic Area

- 14.2.4.1.6. Analysis by Usability

- 14.2.4.1.7. Analysis by Type of Formulation Administered and Actuation Mechanism

- 14.2.4.1. Current Market Landscape

- 14.2.5. Novel Drug Reconstitution Delivery Systems

- 14.2.5.1. Current Market Landscape

- 14.2.5.1.1. Analysis by Type of Device

- 14.2.5.1.2. Analysis by Type of Chamber

- 14.2.5.1.3. Analysis by Type of Device and Type of Chamber

- 14.2.5.1.4. Analysis by Physical State of Drug

- 14.2.5.1.5. Analysis by Container Fabrication Material

- 14.2.5.1.6. Analysis by Volume of Container

- 14.2.5.1.7. Analysis by Drug Class

- 14.2.5.1.8. Analysis by Device Usability

- 14.2.5.1.9. Analysis by Container Fabrication Material and Device Usability

- 14.2.5.1.10. Analysis by Type of Pre-sterilized Devices

- 14.2.5.1.11. Analysis by Type of User-sterilized Devices

- 14.2.5.1.12. Analysis by Type of Sterilization Equipment Used

- 14.2.5.1.13. Most Active Players: Analysis by Number of Novel Drug Reconstitution Systems Manufactured

- 14.2.5.1. Current Market Landscape

- 14.2.6. Prefilled Syringes

- 14.2.6.1. Current Market Landscape

- 14.2.6.1.1. Analysis by Type of Barrel Fabrication Material

- 14.2.6.1.2. Analysis by Number of Barrel Chambers

- 14.2.6.1.3. Analysis by Type of Needle System

- 14.2.6.1.4. Analysis by Volume of Syringe

- 14.2.6.1.5. Most Active Players: Analysis by Number of Prefilled Syringes

- 14.2.6.2. Drug Device Combination Products

- 14.2.6.1. Current Market Landscape

- 14.2.7. Implants

- 14.2.7.1. Current Market Landscape

- 14.2.7.1.1. Analysis by Phase of Development

- 14.2.7.1.2. Analysis by Therapeutic Area

- 14.2.7.1.3. Analysis by Implant Material

- 14.2.7.1.4. Analysis by Treatment Duration

- 14.2.7.1.5. Analysis by Type of Delivery System

- 14.2.7.1.6. Most Active Players: Analysis by Number of Implants

- 14.2.7.2. Subcutaneous Implants Eluting Small Molecules

- 14.2.7.1. Current Market Landscape

- 14.2.1. Large Volume Wearable Injectors

15. SUBCUTANEOUS DRUG DELIVERY SYSTEMS: PRODUCT COMPETITIVENESS ANALYSIS

- 15.1. Chapter Overview

- 15.2. Large Volume Wearable Injectors

- 15.2.1. Assumptions and Key Parameters

- 15.2.2. Methodology

- 15.2.3. Product Competitiveness Analysis: Large Volume Wearable Injectors for Non-Insulin Drugs

- 15.2.3.1. Products Developed by Players in North America

- 15.2.3.2. Products Developed by Players in Europe

- 15.2.3.3. Products Developed by Players in Asia and Middle East and North Africa

- 15.2.4. Product Competitiveness Analysis: Large Volume Wearable Injectors for Insulin Drugs

- 15.2.4.1. Products Developed by Players in North America

- 15.2.4.2. Products Developed by Players in Europe

- 15.2.4.3. Products Developed by Players in Asia and Middle East and North Africa

- 15.2.5. Product Competitiveness Analysis: Large Volume Drug Device Combinations for Non-Insulin Drugs

- 15.2.5.1. Products Developed by Players in North America

- 15.2.5.2. Products Developed by Players in Europe

- 15.2.5.3. Products Developed by Players in Middle East and North Africa

- 15.3. Autoinjectors

- 15.3.1. Assumptions and Key Parameters

- 15.3.2. Methodology

- 15.3.3. Product Competitiveness Analysis: Autoinjectors

- 15.3.3.1. Disposable Autoinjectors

- 15.3.3.2. Reusable Autoinjectors

- 15.4. Needle-free Injection Systems

- 15.4.1. Assumptions and Key Parameters

- 15.4.2. Methodology

- 15.4.3. Product Competitiveness Analysis: Needle-free Injection Systems

- 15.4.3.1. Spring-based Needle-free Injection Systems

- 15.4.3.2. Gas-powered Needle-free Injection Systems

- 15.4.3.3. Other Needle-free Injection Systems

- 15.5. Prefilled Syringes

- 15.5.1. Assumptions and Key Parameters

- 15.5.2. Methodology

- 15.5.3. Product Competitiveness Analysis: Prefilled Syringes

- 15.5.3.1. Glass Barrel Prefilled Syringes

- 15.5.3.2. Plastic Barrel Prefilled Syringes

16. SWOT ANALYSIS

- 16.1. Chapter Overview

- 16.2. Comparison of SWOT Factors

- 16.2.1. Strengths

- 16.2.2. Weaknesses

- 16.2.3. Opportunities

- 16.2.4. Threats

17. GLOBAL APPROVED SUBCUTANEOUS BIOLOGICS MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Approved Subcutaneous Biologics Market, till 2035

- 17.3.1. Roots Analysis Perspective on Market Growth

- 17.3.2. Scenario Analysis

- 17.3.2.1. Conservative Scenario

- 17.3.2.2. Optimistic Scenario

- 17.4. Key Market Segmentations

18. APPROVED SUBCUTANEOUS BIOLOGICS MARKET, BY TYPE OF BIOLOGIC

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Approved Subcutaneous Biologics Market: Distribution by Type of Biologic, Current year and 2035

- 18.3.1. Approved Subcutaneous Biologics Market for Antibodies, till 2035

- 18.3.2. Approved Subcutaneous Biologics Market for Proteins, till 2035

- 18.3.3. Approved Subcutaneous Biologics Market for Nucleotides, till 2035

- 18.4. Data Triangulation and Validation

19. APPROVED SUBCUTANEOUS BIOLOGICS MARKET, BY TYPE OF THERAPY

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Approved Subcutaneous Biologics Market: Distribution by Type of Therapy, Current year and 2035

- 19.3.1. Approved Subcutaneous Biologics Market for Monotherapy, till 2035

- 19.3.2. Approved Subcutaneous Biologics Market for Combination Therapy, till 2035

- 19.3.3. Approved Subcutaneous Biologics Market for Both Monotherapy and Combination Therapies, till 2035

- 19.4. Data Triangulation and Validation

20. APPROVED SUBCUTANEOUS BIOLOGICS MARKET, BY METHOD OF ADMINISTRATION

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Approved Subcutaneous Biologics Market: Distribution by Method of Administration, Current year and 2035

- 20.3.1. Approved Subcutaneous Biologics Market for Administration via Injection, till 2035

- 20.3.2. Approved Subcutaneous Biologics Market for Administration via Infusion, till 2035

- 20.3.3. Approved Subcutaneous Biologics Market for Administration via Both Injection and Infusion, till 2035

- 20.4. Data Triangulation and Validation

21. APPROVED SUBCUTANEOUS BIOLOGICS MARKET, BY THERAPEUTIC AREA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Approved Subcutaneous Biologics Market: Distribution by Therapeutic Area, Current year and 2035

- 21.3.1. Approved Subcutaneous Biologics Market for Autoimmune Disorders, till 2035

- 21.3.2. Approved Subcutaneous Biologics Market for Metabolic Disorders, till 2035

- 21.3.3. Approved Subcutaneous Biologics Market for Oncological Disorders, till 2035

- 21.3.4. Approved Subcutaneous Biologics Market for Hematological Disorders, till 2035

- 21.3.5. Approved Subcutaneous Biologics Market for Inflammatory Disorders, till 2035

- 21.3.6. Approved Subcutaneous Biologics Market for Neurological Disorders, till 2035

- 21.3.7. Approved Subcutaneous Biologics Market for Bone Disorders, till 2035

- 21.3.8. Approved Subcutaneous Biologics Market for Other Disorders, till 2035

- 21.4. Data Triangulation and Validation

22. APPROVED SUBCUTANEOUS BIOLOGICS MARKET, BY GEOGRAPHICAL REGIONS

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Approved Subcutaneous Biologics Market: Distribution by Geographical Regions, Current year and 2035

- 22.3.1. Approved Subcutaneous Biologics Market in North America, till 2035

- 22.3.2. Approved Subcutaneous Biologics Market in Europe, till 2035

- 22.3.3. Approved Subcutaneous Biologics Market in Asia-Pacific, till 2035

- 22.3.4. Approved Subcutaneous Biologics Market in Middle East and North Africa, till 2035

- 22.3.5. Approved Subcutaneous Biologics Market in Latin America, till 2035

- 22.4. Penetration-Growth (P-G) Matrix

- 22.5. Data Triangulation and Validation

23. APPROVED SUBCUTANEOUS BIOLOGICS MARKET, SALES FORECAST OF DRUGS

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Drug-wise Sales Forecast

- 23.3.1. Actemra(R) / RoActemra(R)

- 23.3.2. Acthar(R) Gel / ACTHar

- 23.3.3. AIMOVIG(R)

- 23.3.4. AJOVY(R)

- 23.3.5. AMVUTTRA(R)

- 23.3.6. Aranesp(R) / NESP(R)

- 23.3.7. Basaglar(R) / Abasaglar

- 23.3.8. BENLYSTA(R)

- 23.3.9. Betaseron(R) / Betaferon(R) / EXTAVIA(R)

- 23.3.10. CABLIVI(R)

- 23.3.11. CIMZIA(R)

- 23.3.12. COSENTYX(R)

- 23.3.13. CRYSVITA(R)

- 23.3.14. DARZALEX FASPRO(R) / DARZALEX(R) SC

- 23.3.15. DUPIXENT(R)

- 23.3.16. EMGALITY(R)

- 23.3.17. Enbrel(R)

- 23.3.18. ENSPRYNG(R)

- 23.3.19. ENTYVIO(R)

- 23.3.20. Epogen(R) / Procrit(R) / Eprex(R)

- 23.3.21. EVENITY(R)

- 23.3.22. FASENRA(R)

- 23.3.23. FIASP(R)

- 23.3.24. Forteo(R) / Forsteo(R)

- 23.3.25. GATTEX(R) / Revestive(R)

- 23.3.26. Genotropin(R)

- 23.3.27. GIVLAARI(R)

- 23.3.28. G-LASTA(R) / Peglasta(R) / Neulasta(R) / GRAN(R)

- 23.3.29. Gonal-F(R)

- 23.3.30. HAEGARDA(R)

- 23.3.31. HEMLIBRA(R)

- 23.3.32. Herceptin(R) SC / HERCEPTIN(TM) HYLECTA

- 23.3.33. Hizentra(R)

- 23.3.34. Humalog(R)

- 23.3.35. HUMIRA(R)

- 23.3.36. Humulin(R)

- 23.3.37. ILARIS(R)

- 23.3.38. Kesimpta(R)

- 23.3.39. KEVZARA(R)

- 23.3.40. KINERET(R)

- 23.3.41. LANTUS(R)

- 23.3.42. LEQVIO(R)

- 23.3.43. Mircera(R)

- 23.3.44. MOUNJARO(R)

- 23.3.45. NPLATE(R)

- 23.3.46. Nucala(R)

- 23.3.47. ORENCIA(R)

- 23.3.48. OXLUMO(R)

- 23.3.49. PALYNZIQ(R)

- 23.3.50. Phesgo(R)

- 23.3.51. PLEGRIDY(R)

- 23.3.52. PRALUENT(R)

- 23.3.53. Prolia(R) / Pralia(R)

- 23.3.54. Rebif(R)

- 23.3.55. REBLOZYL(R)

- 23.3.56. REKOVELLE(R)

- 23.3.57. Repatha(R)

- 23.3.58. RITUXAN HYCELA(R) / MabThera(R) SC

- 23.3.59. RYZODEG(R) 70/30 SC

- 23.3.60. Saizen(R)

- 23.3.61. Saxenda(R)

- 23.3.62. SIMPONI(R)

- 23.3.63. Skyrizi(R)

- 23.3.64. SOLIQUA(R) 100/33

- 23.3.65. STELARA(R)

- 23.3.66. Strensiq(R)

- 23.3.67. TAKHZYRO(R)

- 23.3.68. Taltz(R)

- 23.3.69. Tecentriq(R)

- 23.3.70. TEGSEDI(R)

- 23.3.71. TEZSPIRE(R)

- 23.3.72. Toujeo(R)

- 23.3.73. TREMFYA(R)

- 23.3.74. TRESIBA(R)

- 23.3.75. Trulicity(R)

- 23.3.76. Tysabri(R)

- 23.3.77. Ultomiris(R)

- 23.3.78. Victoza(R)

- 23.3.79. Voxzogo(R)

- 23.3.80. VYVGART(R) Hytrulo

- 23.3.81. WAINUA(TM)

- 23.3.82. Xgeva(R) / RANMARK(R)

- 23.3.83. XOLAIR(R)

- 23.3.84. XULTOPHY(R)

- 23.3.85. ZEPBOUND(R)

24. APPROVED SUBCUTANEOUS BIOLOGICS MARKET, BY LEADING PLAYERS

25. GLOBAL SUBCUTANEOUS BIOLOGICS FORMULATION TECHNOLOGIES MARKET

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Global Subcutaneous Biologics Formulation Technologies Market, till 2035

- 25.3.1. Roots Analysis Perspective on Market Growth

- 25.3.2. Scenario Analysis

- 25.3.2.1. Conservative Scenario

- 25.3.2.2. Optimistic Scenario

- 25.4. Key Market Segmentations

26. SUBCUTANEOUS BIOLOGICS FORMULATION TECHNOLOGIES MARKET, BY FUNDAMENTAL PRINCIPLE

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Subcutaneous Biologics Formulation Technologies Market: Distribution by Fundamental Principle, Current year and 2035

- 26.3.1. Subcutaneous Biologics Formulation Technologies Market for Encapsulation Principle, till 2035

- 26.3.2. Subcutaneous Biologics Formulation Technologies Market for Complex Formation Principle, till 2035

- 26.3.3. Subcutaneous Biologics Formulation Technologies Market for Conjugation Principle, till 2035

- 26.3.4. Subcutaneous Biologics Formulation Technologies Market for Amino Acid Interaction Principle, till 2035

- 26.3.5. Subcutaneous Biologics Formulation Technologies Market for Other Principles, till 2035

- 26.4. Data Triangulation and Validation

27. SUBCUTANEOUS BIOLOGICS FORMULATION TECHNOLOGIES MARKET, BY END USER

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Subcutaneous Biologics Formulation Technologies Market: Distribution by Type of End User, Current year and 2035

- 27.3.1. Subcutaneous Biologics Formulation Technologies for Pharmaceutical and Biopharmaceutical Companies, till 2035

- 27.3.2. Subcutaneous Biologics Formulation Technologies for Biotechnology Companies, till 2035

- 27.3.3. Subcutaneous Biologics Formulation Technologies for MedTech Companies, till 2035

- 27.3.4. Subcutaneous Biologics Formulation Technologies for Contract Drug Manufacturing Organizations, till 2035

- 27.3.5. Subcutaneous Biologics Formulation Technologies for Educational Institutes, till 2035

- 27.3.6. Subcutaneous Biologics Formulation Technologies for Medical Equipment Manufacturers, till 2035

- 27.3.7. Subcutaneous Biologics Formulation Technologies for Other End Users, till 2035

- 27.4. Data Triangulation and Validation

28. SUBCUTANEOUS BIOLOGICS FORMULATION TECHNOLOGIES MARKET, BY THERAPEUTIC AREA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Subcutaneous Biologics Formulation Technologies Market: Distribution by Therapeutic Area, Current year and 2035

- 28.3.1. Subcutaneous Biologics Formulation Technologies for Oncological Disorders, till 2035

- 28.3.2. Subcutaneous Biologics Formulation Technologies for Metabolic Disorders, till 2035

- 28.3.3. Subcutaneous Biologics Formulation Technologies for Ocular Disorders, till 2035

- 28.3.4. Subcutaneous Biologics Formulation Technologies for Infectious Diseases, till 2035

- 28.3.5. Subcutaneous Biologics Formulation Technologies for Autoimmune Disorders, till 2035

- 28.3.6. Subcutaneous Biologics Formulation Technologies for Neurological Disorders, till 2035

- 28.3.7. Subcutaneous Biologics Formulation Technologies for Immunological Disorders, till 2035

- 28.3.8. Subcutaneous Biologics Formulation Technologies for Other Disorders, till 2035

- 28.4. Data Triangulation and Validation

29. SUBCUTANEOUS BIOLOGICS FORMULATION TECHNOLOGIES MARKET, BY KEY GEOGRAPHICAL REGIONS

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Subcutaneous Biologics Formulation Technologies Market: Distribution by Key Geographical Regions, Current year and 2035

- 29.3.1. Subcutaneous Biologics Formulation Technologies Market in North America, till 2035

- 29.3.2. Subcutaneous Biologics Formulation Technologies Market in Europe, till 2035

- 29.3.3. Subcutaneous Biologics Formulation Technologies Market in Asia-Pacific, till 2035

- 29.4. Penetration-Growth (P-G) Matrix

- 29.5. Data Triangulation and Validation

30. SUBCUTANEOUS BIOLOGICS FORMULATION TECHNOLOGIES MARKET, BY TYPE OF PAYMENT METHOD EMPLOYED

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Subcutaneous Biologics Formulation Technologies Market: Distribution by Type of Payment Method Employed, Current year and 2035

- 30.3.1. Subcutaneous Biologics Formulation Technologies Market based on Milestone Payments, till 2035

- 30.3.2. Subcutaneous Biologics Formulation Technologies Market based on Upfront Payments, till 2035

- 30.4. Data Triangulation and Validation

31. SUBCUTANEOUS BIOLOGICS FORMULATION TECHNOLOGIES MARKET, BY LEADING PLAYERS

32. SUBCUTANEOUS DRUG DELIVERY SYSTEM: MARKET FORECAST

- 32.1. Chapter Overview

- 32.2. Global Large Volume Wearable Injectors Market

- 32.2.1. Global Large Volume Wearable Injectors Market for Non-Insulin Drugs, till 2035 (By Value)

- 32.2.2. Global Large Volume Wearable Injectors Market for Non-Insulin Drugs, till 2035 (By Volume)

- 32.2.3. Global Large Volume Wearable Injectors Market for Insulin Drugs, till 2035 (By Value)

- 32.2.4. Global Large Volume Wearable Injectors Market for Insulin Drugs, till 2035 (By Volume)

- 32.2.5. Global Autoinjectors Market

- 32.2.6. Global Needle-free Injection Systems Market

- 32.2.7. Global Novel Drug Reconstitution Systems Market

- 32.2.8. Global Prefilled Syringes Market

33. CONCLUSION

34. EXECUTIVE INSIGHTS

- 34.1. Chapter Overview

- 34.2. Rx Bandz

- 34.2.1. Company Snapshot

- 34.2.2. Interview Transcript: Jessica Walsh, Founder and Chief Executive Officer

- 34.3. Oval Medical Technologies

- 34.3.1. Company Snapshot

- 34.3.2. Interview Transcript: Matthew Young, Founder and Chief Technology Officer

- 34.4. Lindy Biosciences

- 34.4.1. Company Snapshot

- 34.4.2. Interview Transcript: Deborah Bitterfield , Chief Executive Officer & Founder

- 34.5. Subcuject

- 34.5.1. Company Snapshot

- 34.5.2. Interview Transcript: Jesper Roested, Chief Executive Officer

- 34.6. Qlibrium

- 34.6.1. Company Snapshot

- 34.6.2. Interview Transcript: Larry Alberts, Chief Executive Officer

- 34.7. Intas Pharmaceuticals

- 34.7.1. Company Snapshot

- 34.7.2. Interview Transcript: Kirti Maheshwari, Chief Technical Officer

- 34.8. Elcam Medical

- 34.8.1. Company Snapshot

- 34.8.2. Interview Transcript: Menachem Zucker, Vice President and Chief Scientist

- 34.9. IDEO

- 34.9.1. Company Snapshot

- 34.9.2. Interview Transcript: Jesse Fourt, Senior Portfolio Director

- 34.10. Pharma Consult

- 34.10.1. Company Snapshot

- 34.10.2. Interview Transcript: Douglas Marenzi, Managing Director

- 34.11. Medincell

- 34.11.1. Company Snapshot

- 34.11.2. Interview Transcript: David Heuze , Communication Leader

- 34.12. Xeris Biopharma

- 34.12.1. Company Snapshot

- 34.12.2. Interview Transcript: Steve Prestrelski, Hong Qi and Scott Coleman, Former Founder and Chief Scientific Officer, Former Vice President (Product Development) and Former Sr. Scientist Formulation

- 34.13. IDT Biologika

- 34.13.1. Company Snapshot

- 34.13.2. Interview Transcript: Gregor Kawaletz, Former Chief Commercial Officer

- 34.14. Anonymous (a US-based company)

- 34.14.1. Company Snapshot

- 34.14.2. Interview Transcript: Anonymous

- 34.15. Anonymous (a Europe-based company)

- 34.15.1. Company Snapshot

- 34.15.2. Interview Transcript: Anonymous

35. APPENDIX 1: TABULATED DATA

36. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Comparison of Characteristics of Small Molecules and Biologics

- Table 6.2 Parenteral Routes of Administration

- Table 6.3 Parenteral Drug Formulations: Associated Physical and Chemical Instabilities

- Table 6.4 Parenteral Drug Formulations: Key Excipients

- Table 7.1 Approved Subcutaneous Biologics: Market Landscape

- Table 7.2 Approved Subcutaneous Biologics: Information on Type of Therapy, Route and Method of Administration

- Table 7.3 Approved Subcutaneous Biologics: Information on Dosing Frequency and Concentration of Dose

- Table 7.4 Approved Subcutaneous Biologics: Information on Target Disease Indication and Therapeutic Area

- Table 7.5 Approved Subcutaneous Biologics: Information on Type of Drug Delivery Device

- Table 7.6 Approved Subcutaneous Biologics: List of Developers

- Table 8.1 List of Top Approved Subcutaneous Biologics

- Table 8.2 BENLYSTA (Human Genome Sciences): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.3 BENLYSTA (Human Genome Sciences): Success Protocol Analysis Parameters

- Table 8.4 BESREMi (Pharmaessentia): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.5 BESREMi (Pharmaessentia): Success Protocol Analysis Parameters

- Table 8.6 COSENTYX (Novartis): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.7 COSENTYX (Novartis): Success Protocol Analysis Parameters

- Table 8.8 DARZALEX FASPRO (Halozyme): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.9 DARZALEX FASPRO (Halozyme): Success Protocol Analysis Parameters

- Table 8.10 DUPIXENT (Regeneron Pharma): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.11 DUPIXENT (Regeneron Pharma): Success Protocol Analysis Parameters

- Table 8.12 Enbrel (Amgen): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.13 Enbrel (Amgen): Success Protocol Analysis Parameters

- Table 8.14 HEMLIBRA (Roche): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.15 HEMLIBRA (Roche): Success Protocol Analysis Parameters

- Table 8.16 Prolia / Pralia (Amgen): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.17 Prolia / Pralia (Amgen): Success Protocol Analysis Parameters

- Table 8.18 STELARA (Janssen Biotech): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.19 STELARA (Janssen Biotech): Success Protocol Analysis Parameters

- Table 8.20 Trulicity (Eli Lilly): Phase of Development, Route of Administration, and Target Disease Indication

- Table 8.21 Trulicity (Eli Lilly): Success Protocol Analysis Parameters

- Table 9.1 Clinical-stage Subcutaneous Biologics: Market Landscape

- Table 9.2 Clinical-stage Subcutaneous Biologics: Information on Type of Therapy, Mechanism of Action and Dosing Frequency

- Table 9.3 Clinical-stage Subcutaneous Biologics: Information on Drug Designation

- Table 9.4 Clinical-stage Subcutaneous Biologics: Information on Target Disease Indication and Therapeutic Area

- Table 9.5 Clinical-stage Subcutaneous Biologics: List of Developers

- Table 10.1 Subcutaneous Formulation Technologies: Information on Fundamental Principle and Type of Molecule

- Table 10.2 Subcutaneous Formulation Technologies: Information on Route of Administration

- Table 10.3 Subcutaneous Formulation Technologies: Information on Therapeutic Area

- Table 10.4 Subcutaneous Formulation Technologies: Information on Key Characteristics

- Table 10.5 Subcutaneous Formulation Technologies: List of Developers

- Table 12.1 Subcutaneous Formulation Technologies Developers: List of Companies Profiled

- Table 12.2 CD Bioparticles: Company Snapshot

- Table 12.3 CD Bioparticles: Technology Portfolio

- Table 12.4 Creative Biolabs: Company Snapshot

- Table 12.5 Creative Biolabs: Technology Portfolio

- Table 12.6 Creative Biolabs: Recent Developments and Future Outlook

- Table 12.7 Creative BioMart: Company Snapshot

- Table 12.8 Creative BioMart: Technology Portfolio

- Table 12.9 Creative BioMart: Recent Developments and Future Outlook

- Table 12.10 Pacira BioSciences: Company Snapshot

- Table 12.11 Pacira BioSciences: Technology Portfolio

- Table 12.12 Pacira BioSciences: Recent Developments and Future Outlook

- Table 12.13 The Wyss Institute: Company Snapshot

- Table 12.14 The Wyss Institute: Technology Portfolio

- Table 12.15 Xeris Biopharma: Company Snapshot

- Table 12.16 Xeris Biopharma: Technology Portfolio

- Table 12.17 Xeris Biopharma: Recent Developments and Future Outlook

- Table 12.18 Adocia: Company Snapshot

- Table 12.19 Adocia: Technology Portfolio

- Table 12.20 Adocia: Recent Developments and Future Outlook

- Table 12.21 Ascendis Pharma: Company Snapshot

- Table 12.22 Ascendis Pharma: Technology Portfolio

- Table 12.23 Ascendis Pharma: Recent Developments and Future Outlook

- Table 12.24 Alteogen: Company Snapshot

- Table 12.25 Alteogen: Technology Portfolio

- Table 12.26 Alteogen: Recent Developments and Future Outlook

- Table 12.27 Foresee Pharmaceuticals: Company Snapshot

- Table 12.28 Foresee Pharmaceuticals: Technology Portfolio

- Table 12.29 Foresee Pharmaceuticals: Recent Developments and Future Outlook

- Table 13.1 Partnerships and Collaborations: Information on Type of Partner, Year of Agreement and Type of Partnership, since 2019

- Table 13.2 Partnerships and Collaborations: Information on Therapeutic Area and Type of Agreement (Country-wise and Continent-wise)

- Table 14.1 Large Volume Wearable Injectors for Non-Insulin Drugs: Information on Status of Development, Type of Device and Usability

- Table 14.2 Large Volume Wearable Injectors for Non-Insulin Drugs: Information on Type of Dose, Type of Drug Container and Mode of Drug Filling

- Table 14.3 Large Volume Wearable Injectors for Non-Insulin Drugs: Information on Container Volume (mL), Route of Administration and Mode of Injection

- Table 14.4 Large Volume Wearable Injectors for Non-Insulin Drugs: Information on Mechanism of Action / Driving Force and Type of Technology

- Table 14.5 Large Volume Wearable Injectors for Non-Insulin Drugs: Information on Availability of Connectivity Feature and Type of Compatible Drug

- Table 14.6 Large Volume Wearable Injectors for Non-Insulin Drugs: Information on Compatibility with High Viscosity Drugs and Therapeutic Area

- Table 14.7 Large Volume Wearable Injectors for Insulin Drugs: Information on Status of Development, Type of Device and Usability

- Table 14.8 Large Volume Wearable Injectors for Insulin Drugs: Information on Type of Dose, Mode of Drug Filling and Container Volume (mL)

- Table 14.9 Large Volume Wearable Injectors for Insulin Drugs: Information on Type of Diabetes, Type of Combination Insulin and Period of Use (days)

- Table 14.10 Large Volume Wearable Injectors for Insulin Drugs: Information on Type of Device Control Feature and Availability of Interoperable Device

- Table 14.11 Large Volume Wearable Injectors for Insulin Drugs: Information on Availability of CGM / BGM system, Availability of Automatic Insulin Delivery / Artificial Pancreases and Type of Automated Insulin Delivery Feature

- Table 14.12 Large Volume Wearable Injectors for Insulin Drugs: Information on Availability of Connectivity Feature and Waterproof Capabilities

- Table 14.13 Large Volume Drug Device Combinations for Non-Insulin Drugs: Information on Developer, Status of Development, Type of Device and Usability

- Table 14.14 Large Volume Drug Device Combinations for Non-Insulin Drugs: Information on Type of Dose, Mode of Drug Filling, Type of Drug Container and Container Volume (mL)

- Table 14.15 Large Volume Drug Device Combinations for Non-Insulin Drugs: Information on Route of Administration, Mode of Injection and Type of Compatible Drug

- Table 14.16 Large Volume Drug Device Combinations for Non-Insulin Drugs: Information on Type of Technology, Mechanism of Action / Driving Force and Therapeutic Area

- Table 14.17 Autoinjectors: Overall Market Landscape

- Table 14.18 Autoinjectors: Information on Requirement of Needle, Volume of Container, Type of Dose Delivered and Route of Administration

- Table 14.19 Autoinjectors: Information on Type of Actuation Mechanism, Type of Feedback Mechanism, Availability of Connectivity Feature and Target Indication

- Table 14.20 Autoinjectors: Information on Type of Molecule Delivered and End-user

- Table 14.21 Pen Injectors: Development Landscape

- Table 14.22 List of Smart Pen Injectors

- Table 14.23 List of Drug and Pen Injector Combination Products

- Table 14.24 List of Needle-free Injection Systems

- Table 14.25 Needle-free Injection Systems: Information on Type of Actuation Mechanism

- Table 14.26 Needle-free Injection Systems: Information on Route of Administration

- Table 14.27 Needle-free Injection Systems: Information on Type of Formulation Administered

- Table 14.28 Needle-free Injection Systems: Information on Type of Drugs Delivered

- Table 14.29 Needle-free Injection Systems: Information on Therapeutic Area

- Table 14.30 Needle-free Injection Systems: Information on Usability

- Table 14.31 Novel Drug Reconstitution Systems: Information on Manufacturer, Type of Device, Number of Chambers, Physical State of Drug and Certifications / Accreditations

- Table 14.32 Novel Drug Reconstitution Systems: Information on Container Fabrication Material, Type of Plastic, Volume, Drug Class, Device Usability and Provisions for Self-Administration

- Table 14.33 Novel Drug Reconstitution Systems: Information on Type of Pre-sterilized Device, User-sterilized Device, Sterilization Equipment Used and Type of Technology

- Table 14.34 Prefilled Syringes: List of Products

- Table 14.35 Prefilled Syringe Combination Products: List of Approved Drugs, 2013-2023

- Table 14.36 List of Other Drugs Available in Prefilled Syringe Format

- Table 14.37 Implants: Development Landscape

- Table 14.38 Implants: Information on Material Type, Treatment Duration and Type of Delivery System

- Table 14.39 Implants: Subcutaneous Implants Eluting Small Molecules

- Table 17.1 Number of Approved Subcutaneous Drugs since 2018 (not having sales information)

- Table 25.1 Subcutaneous Biologics Formulation Technologies: Average Upfront and Milestone Payment, since 2019 (USD Million)

- Table 25.2 Licensing Deals: Tranches of Milestone Payments

- Table 31.1 Leading Players: Based on Number of Technology Licensing / Utilization Deals

- Table 31.2 Leading Players: Based on Number of Partnership Deals

- Table 34.1 Rx Bandz: Company Snapshot

- Table 34.2 Oval Medical Technologies: Company Snapshot

- Table 34.3 Lindy Biosciences: Company Snapshot

- Table 34.4 Subcuject: Company Snapshot

- Table 34.5 Qlibrium: Company Snapshot

- Table 34.6 Intas Pharmaceuticals: Company Snapshot

- Table 34.7 Elcam Medical: Company Snapshot

- Table 34.8 IDEO: Company Snapshot

- Table 34.9 Pharma Consult: Company Snapshot

- Table 34.10 Medincell: Company Snapshot

- Table 34.11 Xeris Biopharma: Company Snapshot

- Table 34.12 IDT Biologika: Company Snapshot

- Table 35.1 Approved Subcutaneous Biologics: Distribution by Initial Approval Year

- Table 35.2 Approved Subcutaneous Biologics: Distribution by Type of Biologic

- Table 35.3 Approved Subcutaneous Biologics: Distribution by Initial Approval Year and Type of Biologic

- Table 35.4 Approved Subcutaneous Biologics: Distribution by Type of Therapy

- Table 35.5 Approved Subcutaneous Biologics: Distribution by Route of Administration

- Table 35.6 Approved Subcutaneous Biologics: Distribution by Method of Administration

- Table 35.7 Approved Subcutaneous Biologics: Distribution by Dosing Frequency

- Table 35.8 Approved Subcutaneous Biologics: Distribution by Concentration of Dose

- Table 35.9 Approved Subcutaneous Biologics: Distribution by Target Disease Indications

- Table 35.10 Approved Subcutaneous Biologics: Distribution by Therapeutic Area

- Table 35.11 Approved Subcutaneous Biologics: Distribution by Type of Drug Delivery Device

- Table 35.12 Approved Subcutaneous Biologic Developers: Distribution by Year of Establishment

- Table 35.13 Approved Subcutaneous Biologics Developers: Distribution by Company Size

- Table 35.14 Approved Subcutaneous Biologics Developers: Distribution by Location of Headquarters (Region)

- Table 35.15 Approved Subcutaneous Biologics Developers: Distribution by Location of Headquarters (Country)

- Table 35.16 Approved Subcutaneous Biologics Developers: Distribution by Company Size and Location of Headquarters (Region)

- Table 35.17 Most Active Developers: Distribution by Number of Approved Therapies

- Table 35.18 Clinical-stage Subcutaneous Biologics: Phase of Development

- Table 35.19 Clinical-stage Subcutaneous Biologics: Distribution by Type of Biologic

- Table 35.20 Clinical-Stage Subcutaneous Biologics: Distribution by Stage of Development and Type of Biologic

- Table 35.21 Clinical-stage Subcutaneous Biologics: Distribution by Type of Therapy

- Table 35.22 Clinical-stage Subcutaneous Biologics: Distribution by Mechanism of Action

- Table 35.23 Clinical-stage Subcutaneous Biologics: Distribution by Dosing Frequency

- Table 35.24 Clinical-stage Subcutaneous Biologics: Distribution by Drug Designation

- Table 35.25 Clinical-stage Subcutaneous Biologics: Distribution by Target Disease Indication

- Table 35.26 Clinical-stage Subcutaneous Biologics: Distribution by Therapeutics Area

- Table 35.27 Clinical-stage Subcutaneous Biologics: Distribution by Stage of Development and Therapeutics Area

- Table 35.28 Clinical-stage Subcutaneous Biologics: Distribution by Therapeutic Area and Type of Biologic

- Table 35.29 Clinical-stage Subcutaneous Biologic Developers: Distribution by Year of Establishment

- Table 35.30 Clinical-stage Subcutaneous Biologics Developers: Distribution by Company Size

- Table 35.31 Clinical-stage Subcutaneous Biologics Developers: Distribution by Location of Headquarters (Region)

- Table 35.32 Clinical-stage Subcutaneous Biologics Developers: Distribution by Company Size and Location of Headquarters (Region)

- Table 35.33 Most Active Developers: Distribution by Number of Clinical-stage Therapies

- Table 35.34 Subcutaneous Formulation Technologies: Distribution by Fundamental Principle

- Table 35.35 Subcutaneous Formulation Technologies: Distribution by Type of Molecule

- Table 35.36 Subcutaneous Formulation Technologies: Distribution by Route of Administration

- Table 35.37 Subcutaneous Formulation Technologies: Distribution by Therapeutic Area

- Table 35.38 Subcutaneous Formulation Technologies: Distribution by Type of Molecule and Route of Administration

- Table 35.39 Subcutaneous Formulation Technologies: Distribution by Key Characteristics

- Table 35.40 Subcutaneous Formulation Technology Developers: Distribution by Year of Establishment

- Table 35.41 Subcutaneous Formulation Technology Developers: Distribution by Company Size

- Table 35.42 Subcutaneous Formulation Technology Developers: Distribution by Location of Headquarters (Region)

- Table 35.43 Subcutaneous Formulation Technology Developers: Distribution by Company Size and Location of Headquarters (Region)

- Table 35.44 Pacira BioSciences: Annual Revenues, since 2020 (USD Million)

- Table 35.45 Xeris Pharmaceuticals: Annual Revenues, since 2020 (USD Million)

- Table 35.46 ADOCIA: Annual Revenues, since 2019 (EUR Million)

- Table 35.47 Ascendis Pharma: Annual Revenues, since 2020 (EUR Million)

- Table 35.48 Foresee Pharmaceuticals: Annual Revenues, since 2020 (NTD Million)

- Table 35.49 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2019

- Table 35.50 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 35.51 Partnerships and Collaborations: Distribution by Year and Type of Partnership, since 2019

- Table 35.52 Partnerships and Collaborations: Distribution by Type of Partner

- Table 35.53 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 35.54 Partnerships and Collaborations: Distribution by Location of Headquarters of Partner

- Table 35.55 Most Active Players: Distribution by Number of Partnerships

- Table 35.56 Partnerships and Collaborations: Distribution by Region

- Table 35.57 Partnerships and Collaborations: Distribution by Intercontinental and Intracontinental Agreements

- Table 35.58 Partnerships and Collaborations: Distribution by International and Local Agreements

- Table 35.59 Large Volume Wearable Injectors: Distribution by Type of Device (By Drug Administered)

- Table 35.60 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Status of Development

- Table 35.61 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Type of Device

- Table 35.62 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Usability

- Table 35.63 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Type of Dose

- Table 35.64 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Type of Drug Container

- Table 35.65 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Mode of Drug Filling

- Table 35.66 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Container Volume (mL)

- Table 35.67 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Route of Administration

- Table 35.68 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Mode of Injection

- Table 35.69 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Mechanism of Action / Driving Force

- Table 35.70 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Type of Technology

- Table 35.71 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Availability for Connectivity Feature

- Table 35.72 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Type of Compatible Drug

- Table 35.73 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Compatibility with High Viscosity Drugs

- Table 35.74 Large Volume Wearable Injectors for Non-Insulin Drugs: Distribution by Therapeutic Area

- Table 35.75 Most-Active Players: Distribution by Number of Large Volume Wearable Injectors Manufactured for Non-Insulin Drugs

- Table 35.76 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Status of Development

- Table 35.77 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Type of Device

- Table 35.78 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Usability

- Table 35.79 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Type of Dose

- Table 35.80 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Mode of Drug Filling

- Table 35.81 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Container Volume (mL)

- Table 35.82 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Type of Diabetes

- Table 35.83 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Type of Combination Insulin

- Table 35.84 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Period of use (Days)

- Table 35.85 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Type of Device Control Feature

- Table 35.86 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Availability of Interoperable Device

- Table 35.87 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Availability of Continuous Glucose Monitoring (CGM) / Blood Glucose Monitoring (BGM) System

- Table 35.88 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Availability of Automatic Insulin Delivery (AID) / Artificial Pancreas

- Table 35.89 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Type of Automated Insulin Delivery

- Table 35.90 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Availability of Connectivity Feature

- Table 35.91 Large Volume Wearable Injectors for Insulin Drugs: Distribution by Waterproof Capabilities

- Table 35.92 Most-Active Players: Large Volume Wearable Injectors for Insulin Drugs

- Table 35.93 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Status of Development

- Table 35.94 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Type of Device

- Table 35.95 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Usability

- Table 35.96 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Type of Dose

- Table 35.97 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Type of Drug Container

- Table 35.98 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Mode of Drug Filling

- Table 35.99 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Container Volume (mL)

- Table 35.100 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Route of Administration

- Table 35.101 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Mode of Injection

- Table 35.102 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Type of Compatible Drug

- Table 35.103 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Mechanism of Action / Driving Force

- Table 35.104 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Type of Technology

- Table 35.105 Large Volume Drug Device Combinations for Non-Insulin Drugs: Distribution by Therapeutic Area

- Table 35.106 Most-Active Players: Distribution by Number of Drug Device Combinations for Non-Insulin Drugs

- Table 35.107 Autoinjectors: Distribution by Stage of Development

- Table 35.108 Autoinjectors: Distribution by Usability

- Table 35.109 Autoinjectors: Distribution by Type of Primary Drug Container

- Table 35.110 Autoinjectors: Distribution by Requirement of Needle

- Table 35.111 Autoinjectors: Distribution by Volume of Container

- Table 35.112 Autoinjectors: Distribution by Type of Dose Delivered

- Table 35.113 Autoinjectors: Distribution by Route of Administration

- Table 35.114 Autoinjectors: Distribution by Type of Actuation Mechanism