|

市场调查报告书

商品编码

1597046

抗体药物复合体市场:各适应疾病,各治疗领域,连接试剂,有效负载,标的抗原,与各主要地区:2035年前的产业趋势与全球预测Antibody Drug Conjugate Market by Target Disease Indication,Therapeutic Area, Linker, Payload, Target Antigens And Key Geographical Regions: Industry Trends and Global Forecasts, Till 2035 |

||||||

全球抗体药物偶联物市场规模预计将从目前的 77.2 亿美元增长到 2035 年的 233 亿美元,到 2035 年的预测期间复合年增长率为 9.63%。

多年来,随着药物动力学和药效学特性的提高以及抗体工程等各种技术的发展,抗体药物偶联物已被认为是治疗实体瘤和血液恶性肿瘤的可行治疗工具。迄今为止,已有超过 280 种抗体药物偶联物获得批准或正在进行临床试验,超过 250 种候选药物处于早期开发阶段。美国食品药物管理局 (USFDA) 批准的药物包括 Zinronta、Acarax 和 Agekisi。抗体-药物偶联物已成为选择性消除肿瘤群体且副作用最小的潜在选择。迄今为止,多项临床试验已经证明了抗体药物偶联物的治疗优势(相对于传统癌症治疗方案)和功效。因此,患有各种癌症疾病的患者数量不断增加已成为抗体药物偶联物市场的主要驱动因素之一。在创新技术平台的可用性、有利的融资机会和有希望的临床试验结果的推动下,抗体药物偶联物预计将在未来十年获得上市批准,预计市场将长期成长。

本报告提供全球抗体药物复合体市场相关调查,提供市场概要,以及各适应疾病,各治疗领域,连接试剂,有效负载,标的抗原,各地区的趋势,及加入此市场的主要企业简介等资讯。

目录

第1章 序文

第2章 摘要整理

第3章 简介

第4章 市场概要

第5章 目标竞争力分析

第6章 企业和药物简介

- 章概要

- ADC Therapeutics

- Astellas Pharma

- AstraZeneca

- Byondis

- Daiichi Sankyo

- Genentech

- Gilead Sciences

- ImmunoGen

- Pfizer

- RemeGen

- Seagen

第7章 临床试验的分析

第8章 主要意见领袖

第9章 联合治疗

第10章 伙伴关係和合作

第11章 资金筹措投资分析

第12章 专利分析

第13章 学术津贴的分析

第14章 主要商业化策略

第15章 推销分析

第16章 成功通讯协定分析

第17章 新结合和连接试剂技术平台

第18章 对人的给药的非临床资料的评估

第19章 原价分析

第20章 案例研究1:抗体药物复合体的受託製造

第21章 案例研究2:抗体药物复合体治疗的伴随式诊断

第22章 SWOT分析

第23章 市场预测机会分析

第24章 执行洞察

- 章概要

- Oxford Biotherapeutics

- Angiex

- Syndivia

- BSP Pharmaceuticals

- PolyTherics (an Abzena company)

- CureMeta

- CytomX Therapeutics

- NBE-Therapeutics

- Cerbios-Pharma

- Eisai

- AbTis

- AmbrX

- Synaffix

- Pierre Fabre

- Catalent Pharma Solutions

- Lonza

- Piramal Healthcare

- Ajinomoto Bio-Pharma Services

- Cardiff University

- 其他

第25章 结论

第26章 附录1:表格形式的资料

第27章 附录2:企业·团体一览

ANTIBODY DRUG CONJUGATE MARKET: OVERVIEW

As per Roots Analysis, the global antibody drug conjugate market is estimated to grow from USD 7.72 billion in the current year to USD 23.3 billion by 2035, at a CAGR of 9.63% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Target Disease Indication

- Breast Cancer

- B-cell Lymphoma

- Lung Cancer

- Multiple Myeloma

- Acute Lymphoblastic Leukemia

- Gastric Cancer

- Renal Cancer

- Cervical Cancer

- Other Target Disease Indications

Therapeutic Area

- Hematological Cancer

- Solid Tumor

Linker

- Valine-Citrulline

- Succinimidyl-4-(N-Maleimidomethyl) Cyclohexane-1-Carboxylate

- Tetrapeptide-based Linker

- Maleimide, Maleimidocaproyl

- Valine-Alanine

- Hydrazone (4-(4-Acetylphenoxy) Butanoic Acid (AcBut)

- Other Linkers

Payload

- Monomethyl Auristatin E

- DM1

- Duocarmycin

- SN-38 / Irinotecan

- Monomethyl Auristatin F

- SG3199

- Ozogamicin

- DM4

- Other Payloads

Target Antigens

- HER-2 (ERBB2)

- CD79b

- Trop-2

- BCMA (TNFRSF17 / BCM)

- CD19

- CD22

- Tissue Factor

- CD30

- CEACAM5

- Nectin 4

- Others

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

ANTIBODY DRUG CONJUGATE MARKET: GROWTH AND TRENDS

Over the years, various technical developments, such as enhanced pharmacokinetic and pharmacodynamic properties and antibody engineering have paved the way for antibody drug conjugates to be considered as a viable therapeutic modality for the treatment of solid tumors and hematological malignancies. Till date, over 280 antibody drug conjugates have been either approved or being investigated in clinical studies, whereas more than 250 candidates are in the early stages of development. Examples of the USFDA approved drugs include Zynlonta, Akalux, Aidixi.

Antibody drug conjugates have emerged as a potential option to selectively eliminate the tumor population, with minimal side effects. Till date, several clinical trials have shown the therapeutic superiority (over conventional cancer treatment options) and efficacy of antibody-drug conjugates. Therefore, the rising population of various oncological disorders is one of the key drivers for the antibody drug conjugate market. Driven by the availability of innovative technology platforms, lucrative funding opportunities and encouraging clinical trial results, the antibody drug conjugates market is poised to grow in the long-run, as multiple product candidates are expected to receive marketing approval in the coming decade.

ANTIBODY DRUG CONJUGATE MARKET: KEY INSIGHTS

The report delves into the current state of the antibody drug conjugate market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- 1. The landscape of ADCs has steadily evolved over the past decade; more than 530 ADC therapy programs are being evaluated by over 140 drug developers, worldwide.

- 2. Currently, 47% of the ADCs are in discovery / preclinical stages of development; of these, close to 160 ADCs utilize auristatin and maytansinoid payloads.

- 3. In order to gain a competitive edge, ADC developers are actively exploring novel targets for the treatment of a wide array of indications.

- 4. Since 2010, 560+ clinical trials have been registered to evaluate the safety and efficacy of various ADCs; majority of these studies have been conducted across various sites in the US.

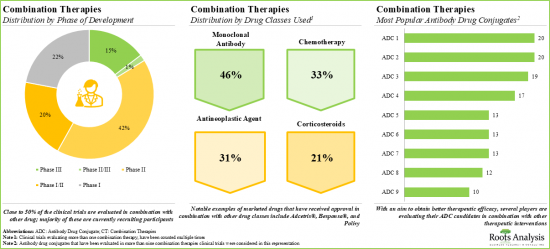

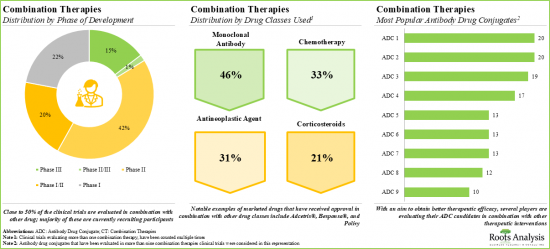

- 5. Developers have already evaluated more than 190 ADCs in combination with other therapeutic modalities for the treatment of various oncological disorders.

- 6. The growing interest in this field is evident from the rise in partnership activity over the years; in fact, the maximum partnerships, till date, were inked recently.

- 7. Considering the enormous opportunities associated with ADCs for the treatment of cancer, investors have readily extended funds, worth nearly USD 30 billion, in the last decade.

- 8. Several researchers from renowned universities, currently involved in evaluating efficacy and safety of ADCs, have emerged as prominent KOLs.

- 9. Over the years, the intellectual capital related to the therapeutic applications of ADCs has grown at a commendable pace; more than 3,330 patents have been filed by both industry and non-industry players.

- 10. A number of grants, worth over USD 135 million, have been awarded for research activity related to ADCs; nearly 90% of these grants extend a support period of up to 10 years.

- 11. Stakeholders are exploring diverse commercialization strategies across different stages of a drug's launch cycle; for drugs nearing patent expiry, these developers are expected to adopt lifecycle management strategies.

- 12. Presently, around 35 players, across the globe, claim to have the required capabilities to offer contract manufacturing / conjugation services for ADCs; of these, over 10 players claim to be one-stop-shops.

- 13. With a promising developmental pipeline, the global market is anticipated to witness an annualized growth of nearly 10% over the next decade.

ANTIBODY DRUG CONJUGATE MARKET: KEY SEGMENTS

Breast Cancer is Likely to Dominate the Antibody Drug Conjugate Market During the Forecast Period

Based on the target disease indication, the market is segmented into breast cancer, b-cell lymphoma, lung cancer, multiple myeloma, acute lymphoblastic leukemia, gastric cancer, renal cancer, cervical cancer and other target disease indications. Currently, a number of antibody drug conjugates have been approved for the treatment of breast cancer patients. This segment is expected to capture the largest share as more drug candidates receive approvals in the future.

Currently, Solid Tumor Holds Maximum Share within the Antibody Drug Conjugate Market

Based on the therapeutic area, the market is segmented into hematological cancer and solid tumor. It is worth highlighting that antibody drug conjugate market for solid tumor is likely to grow at a relatively higher CAGR, during the forecast period.

Maleimidocaproyl is the Fastest Growing Segment in the Antibody Conjugate Market During the Forecast Period

Based on the type of linker, the market is segmented into valine-citrulline, succinimidyl-4-(n-maleimidomethyl) cyclohexane-1-carboxylate, tetrapeptide-based linker, maleimidocaproyl, valine-alanine, hydrazone (4-(4-acetylphenoxy) butanoic acid (acbut) and other linkers. It is worth highlighting that the current antibody drug conjugate market is dominated by valine-citrulline linkers.

Monomethyl auristatin E (MMAE) Payload is Likely to Dominate the Antibody Drug Conjugate Market During the Forecast Period

Based on the type of payload, the market is segmented into Monomethyl Auristatin E, DM1, Duocarmycin, SN-38 / Irinotecan, Monomethyl Auristatin F, SG3199, Ozogamicin, DM4 and other Payloads. The current market is expected to be driven by MMAE payload used in antibody drug conjugates, followed by DM1; a similar trend is anticipated in the long term.

Currently, HER-2 (ERBB2) Target Antigen Holds the Maximum Share within the Antibody Drug Conjugate Market

Based on the target antigen, the market is segmented into HER-2 (ERBB2), CD79b, Trop-2, BCMA (TNFRSF17 / BCM), CD19, CD22, tissue factor, CD30, CEACAM5, Nectin 4 and others.

The market is expected to be driven by HER-2 (ERBB2) antigen, CD79b target antigen and TROP-2 antigen in mid-long term. It is worth highlighting that the antibody drug conjugate market for tissue factor is likely to grow at a relatively higher CAGR during the forecast period.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe and Asia-Pacific. Majority share is expected to be captured by drug developers based in North America and Europe. It is worth highlighting that over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Antibody Drug Conjugates Market

- ADC Therapeutics

- Astellas Pharma

- AstraZeneca

- Byondis

- Daiichi Sankyo

- Genentech

- Gilead Sciences

- ImmunoGen

- Pfizer

- RemeGen

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Founder and Chief Executive Officer, Oxford Biotherapeutics

- Founder and Chief Operating Officer, Angiex

- Co-Founder and Chief Executive Officer, Syndivia

- President and Chief Executive Officer, BSP Pharmaceuticals

- Former Chief Executive Officer, PolyTherics (an Abzena company)

- Founder and Chief Executive Officer, CureMeta

- Chief Business Officer and Head of Strategy, CytomX Therapeutics

- Former Chief Business Officer, NBE-Therapeutics

- Chief Commercial Officer, Cerbios-Pharma

- Senior Vice President and Chief Scientific Officer, Eisai

- Chief Business Officer, AbTis

- Former Vice President and Head of Chemistry, AmbrX

- Vice President, Business Development, Synaffix

- Former Director, Pierre Fabre

- Former Group Product Manager, Catalent Pharma Solutions

- Former Head of Bioconjugates Commercial Development, Lonza

- Former Site Head, Piramal Healthcare

- General Manager, Business Development, CDMO Business, Ajinomoto Bio-Pharma Services

- Professor, Cardiff University

ANTIBODY DRUG CONJUGATE MARKET: RESEARCH COVERAGE

- The report features an in-depth analysis of the antibody drug conjugate market, focusing on key market segments, including target disease indication, therapeutic area, linker, payload, target antigens and key geographical regions.

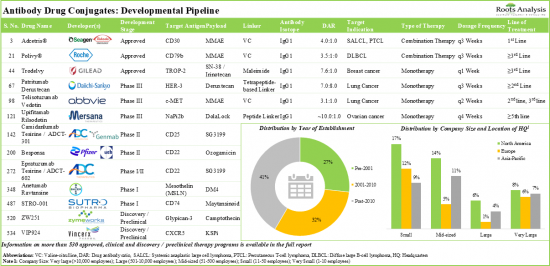

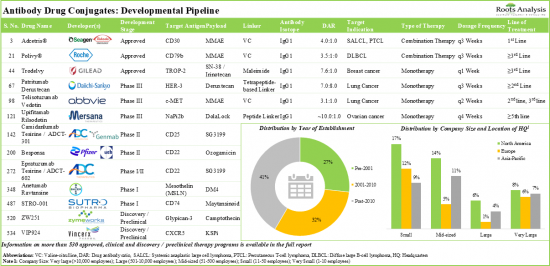

- A comprehensive evaluation of close to 400 antibody drug conjugates / ADC therapeutics that have been either approved or being evaluated in different stages of development, considering various parameters, such as status of development (Approved, Phase III, Phase II, Phase I and Discovery / Preclinical), target disease indication (breast cancer, lung cancer, gastric cancer, ovarian cancer, non-Hodgkin's lymphoma, hepatic cancer, b-cell lymphoma, acute myeloid leukemia, brain cancer and renal cancer), therapeutic area (solid tumors, hematological cancers, autoimmune disorders / inflammatory disorders and others), line of treatment (1st line, >=1st line, 2nd line, >=2nd line, 3rd line, >=3rd line, <=4th line, Last line and others), dosing frequency (q3 weeks, q2 weeks, q1 weeks, q4 weeks, once and q6 weeks), type of therapy (combination therapy and monotherapy), target antigen (HER-2 (ERBB2), Trop-2, EGFR, FOLR1 (folate receptor alpha), CD30, B7-H3 (CD276), Nectin 4 and c-MET), antibody isotype (IgG1, IgG2 and IgG4), payload / cytotoxin / warhead (monomethyl auristatin E (MMAE), DM4, DM1, SG3199, SN-38 / irinotecan, duocarmycin and monomethyl auristatin F (MMAF)), type of payload (auristatin, Maytansinoid, camptothecin, exatecan derivative topoisomerase I inhibitor, pyrrolobenzodiazepine dimer, topoisomerase I inhibitor (unspecified), DNA topoisomerase I inhibitor, Seco-DUBA, calicheamicin (ozogamicin), glucocorticoid and pyrrolobenzodiazepine (PBD)), linkers (valine-citrulline, peptide linker, tetrapeptide-based linker, N-succinimidyl 4-(2-pyridyldithio) -butanoate (SPDB), valine-alanine, succinimidyl-4-(N-maleimidomethyl) cyclohexane-1-carboxylate and maleimide linker) and type of linkers (cleavable and non-cleavable). In addition, it includes information on various antibody drug conjugate developers, based on their year of establishment, company size, location of headquarters and most active players (in terms of number of therapies).

- A comprehensive competitive analysis of biological targets, examining factors, such as number of antibody drug conjugates being developed against them, number of unique target disease indications and number of companies developing antibody-drug conjugates for the target. In addition, it includes a six-dimensional spider-web analysis, featuring the most popular biological targets based on a number of relevant parameters, including number of publications, number of grants received to support research on a particular target, number of companies involved in drug development based on a singular target, highest phase of development for the singular target, number of therapies and number of indications.

- In-depth profiles of key industry players in antibody drug conjugate market, focusing on company overviews, financial information (if available), product portfolio, recent developments, and an informed future outlook.

- Detailed profiles of marketed ADC therapeutics, focusing on overview of the therapy, its mechanism of action, target antigen, linker, payload, type of therapy and details related to sales generated (wherever available).

- Examination of completed, ongoing, and planned clinical studies of various drug conjugates based on several parameters, such as trial registration year, trial status, trial phase, enrolled patient population, type of sponsor / collaborator, target population, study design, most active industry players, and non-industry players (in terms of number of trials) and key geographical regions.

- An in-depth examination that emphasizes the key opinion leaders (KOLs) within this field includes an evaluation of various principal investigators overseeing clinical trials associated with antibody drug conjugates, based on several relevant parameters, such as type of KOL, qualification(s), type of organization, affiliated organization, geographical location of KOLs and target disease indications. In addition, the chapter highlights the most prominent KOLs, based on our proprietary and third-party scoring criteria.

- An assessment of various therapeutics that are being evaluated in combination with antibody-drug conjugates. The study also presents the likely evolution of these therapeutics across different indications.

- An analysis of partnerships established in this sector, since 2014, covering product licensing agreements, technology licensing agreements, research and development agreements, clinical trial agreements, mergers / acquisitions, product development agreements, technology utilization agreements, product development and commercialization agreements, manufacturing agreements, technology integration agreements and others), purpose of partnership (research and development, product development and commercialization, product development, clinical evaluation, portfolio enhancement, product development and manufacturing, manufacturing, research and others.

- A detailed evaluation of the investments made in the ADC domain, encompassing seed financing, venture capital financing, debt financing, grants, capital raised from IPOs and subsequent offerings based on several parameters, such as number of funding instances, amount invested, type of funding, leading companies and investors, and geographical analysis.

- Detailed analysis of various patents filed / granted related to antibody drug conjugates based on type of patent, patent publication year, patent application year, geographical location, type of players, assigned CPC symbol, type of organization, and leading industry / academic players (in terms of size of intellectual property portfolio). It also includes a patent benchmarking analysis and a detailed valuation analysis.

- A comprehensive evaluation of various grants that have been awarded to research institutes engaged in conducting research related to antibody drug conjugates, since 2016, based on various important parameters, such as year of grant award, amount awarded, funding institute center, support period, type of grant application, purpose of grant award, activity code, study section involved, popular NIH departments (based on number of grants awarded), prominent program officers, leading recipient organizations and key regions.

- A detailed analysis of the commercialization strategies employed by different drug developers for their respective products, prior to launch, during / post launch. It also includes a proprietary framework to outline the essential steps and guidelines that companies can follow while developing their marketing strategies.

- An analysis of the key promotional strategies that have been adopted by the developers of marketed products, namely Adcetris, Besponsa, Enhertu, Kadcyla, Mylotarg, Polivy, and Trodelvy.

- Assessment of the success protocol model for the recently approved ADC therapeutics, based on several relevant parameters, such as dosing frequency, drug efficacy, drug exclusivity, fatality rate, geographical reach, intra-class competition, line of treatment, prevalence, price, type of therapy, and existing competition among developers.

- An overview of various conjugation and linker technologies along with the types that are presently being employed in the designing and development of antibody drug conjugates. In addition, it presents a list of the conjugation and linker technologies that are presently being employed in the designing and development of antibody drug conjugates.

- An overview of research aimed at enhancing the analysis of non-clinical data to support first-in-human (FIH) dose selection for antibody drug conjugates. It also examines the various methods employed to estimate FIH doses. Additionally, it highlights potential FIH starting doses and the estimated dose escalations necessary to achieve the maximum tolerated dose (MTD) in humans.

- A comprehensive discussion on the various factors that are likely to influence the pricing of antibody drug conjugate products. This includes an exploration of different models and approaches that pharmaceutical companies may consider while determining the prices of their lead therapy candidates that are likely to be marketed in the near future.

- A case study on manufacturing of antibody drug conjugates, highlighting the key challenges, and a list of contract service providers that are involved in the ADC market.

- A case study on companies offering companion diagnostics that can potentially be used to make treatment related decisions involving antibody-drug conjugates, providing information on the geographical location of key diagnostic developers, affiliated disease biomarkers, assay techniques involved, target indications, the type of sample required (tumor tissue, blood, bone marrow and others) and the drug candidates for which a particular test was developed.

- A SWOT analysis, focusing on key drivers and challenges that are likely to impact the industry's evolution. Further, it includes a Harvey ball analysis, highlighting the relative effect of each SWOT parameter on the overall industry.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What are the factors that are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1.PREFACE

- 1.1. Antibody Drug Conjugate Market Overview

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2.EXECUTIVE SUMMARY

3.INTRODUCTION

- 3.1.Chapter Overview

- 3.2.Pillars of Cancer Therapy

- 3.3.Overview of Antibody Drug Conjugates

- 3.3.1.History of Antibody Drug Conjugates

- 3.3.2.Difference between Small Molecule Drugs, Monoclonal Antibody Therapies and Antibody Drug Conjugates

- 3.3.3.Components of Antibody Drug Conjugates

- 3.3.3.1.Antibody

- 3.3.3.2.Cytotoxin

- 3.3.3.3.Linker

- 3.3.4.Advantages of Antibody Drug Conjugates Therapeutics over Traditional Therapeutics

- 3.3.5.Pharmacokinetic Properties of Antibody-Drug Conjugates

- 3.3.5.1. Absorption

- 3.3.5.2. Distribution

- 3.3.5.3. Metabolism and Elimination

- 3.4.Concluding Remarks

4. MARKET OVERVIEW

- 4.1.Chapter Overview

- 4.2.Antibody Drug Conjugates: Therapies Pipeline

- 4.2.1.Analysis by Status of Development

- 4.2.2.Analysis by Target Disease Indication

- 4.2.3.Analysis by Therapeutic Area

- 4.2.4.Analysis by Line of Treatment

- 4.2.5.Analysis by Dosing Frequency

- 4.2.6.Analysis by Type of Therapy

- 4.2.7.Analysis by Target Antigen

- 4.2.8.Analysis by Antibody Isotype

- 4.2.9.Analysis by Payload / Cytotoxin / Warhead

- 4.2.10.Analysis by Type of Payload

- 4.2.11.Analysis by Linker

- 4.2.12.Analysis by Type of Linker (Cleavable / Non-Cleavable)

- 4.3.Antibody Drug Conjugate: List of Therapy Developers

- 4.3.1.Analysis by Year of Establishment

- 4.3.2.Analysis by Company Size

- 4.3.3.Analysis by Location of Headquarters

- 4.3.4.Analysis by Company size and Location of Headquarters

- 4.3.5.Most Active Players: Analysis by Number of Therapies

5. TARGET COMPETITIVENESS ANALYSIS

- 5.1.Chapter Overview

- 5.2.Key Parameters

- 5.3.Methodology

- 5.4.Target Competitiveness Analysis: Key Targets of Antibody Drug Conjugates

- 5.4.1.Three-Dimensional Bubble Analysis

- 5.4.1.1.Targets of Approved / Marketed Drugs

- 5.4.1.2.Targets of Phase III Drugs

- 5.4.1.3.Targets of Phase II Drugs

- 5.4.1.4.Targets of Phase I Drugs

- 5.4.1.5.Targets of Pre-Clinical Drugs

- 5.4.2.Six-Dimensional Spider Web Analysis

- 5.4.1.Three-Dimensional Bubble Analysis

6.COMPANY AND DRUG PROFILES

- 6.1.Chapter Overview

- 6.2.ADC Therapeutics

- 6.2.1.Company Overview

- 6.2.2.Financial Information

- 6.2.3.Pipeline Overview

- 6.2.3.1.Zynlonta

- 6.2.4.Recent Developments and Future Outlook

- 6.3.Astellas Pharma

- 6.3.1.Company Overview

- 6.3.2.Financial Information

- 6.3.3.Pipeline Overview

- 6.3.3.1.Padcev

- 6.3.4.Recent Developments and Future Outlook

- 6.4.AstraZeneca

- 6.4.1.Company Overview

- 6.4.2.Financial Information

- 6.4.3.Pipeline Overview

- 6.4.3.1.Enhertu

- 6.4.4.Recent Developments and Future Outlook

- 6.5.Byondis

- 6.5.1.Company Overview

- 6.5.2.Financial Information

- 6.5.2.1.Pipeline Overview

- 6.5.3.Trastuzumab duocarmazine

- 6.5.4.Recent Developments and Future Outlook

- 6.6.Daiichi Sankyo

- 6.6.1.Company Overview

- 6.6.2.Financial Information

- 6.6.3.Pipeline Overview

- 6.6.3.1.Enhertu

- 6.6.4.Recent Developments and Future Outlook

- 6.7.Genentech (Subsidiary of Roche)

- 6.7.1.Company Overview

- 6.7.2.Financial Information

- 6.7.3.Pipeline Overview

- 6.7.3.1.Kadcyla

- 6.7.3.2.Polivy

- 6.7.4.Recent Developments and Future Outlook

- 6.8.Gilead Sciences

- 6.8.1.Company Overview

- 6.8.2.Financial Information

- 6.8.3.Pipeline Overview

- 6.8.3.1.Trodelvy

- 6.8.4.Recent Developments and Future Outlook

- 6.9.ImmunoGen

- 6.9.1.Company Overview

- 6.9.2.Financial Information

- 6.9.3.Pipeline Overview

- 6.9.3.1.Elahere

- 6.9.4.Recent Developments and Future Outlook

- 6.10.Pfizer

- 6.10.1.Company Overview

- 6.10.2.Financial Information

- 6.10.3.Pipeline Overview

- 6.10.3.1.Mylotarg

- 6.10.3.2.Besponsa

- 6.10.4.Recent Developments and Future Outlook

- 6.11.RemeGen

- 6.11.1.Company Overview

- 6.11.2.Financial Information

- 6.11.3.Pipeline Overview

- 6.11.3.1.Disitamab vedotin

- 6.11.4.Recent Developments and Future Outlook

- 6.12.Seagen

- 6.12.1.Company Overview

- 6.12.2.Financial Information

- 6.12.3.Pipeline Overview

- 6.12.3.1.Adcetris

- 6.12.3.2.Padcev

- 6.12.3.3.Tivdak

- 6.12.4.Recent Developments and Future Outlook

7.CLINICAL TRIAL ANALYSIS

- 7.1.Chapter Overview

- 7.2.Scope and Methodology

- 7.3.Antibody Drug Conjugates: Clinical Trial Analysis

- 7.3.1.Analysis by Trial Registration Year

- 7.3.2.Analysis by Trial Status

- 7.3.3.Analysis by Trial Status and Patients Enrolled

- 7.3.4.Analysis by Trial Registration Year and Trial Status

- 7.3.5.Analysis by Trial Registration Year and Patients Enrolled

- 7.3.6.Analysis by Trial Phase

- 7.3.7.Analysis by Trial Phase and Patients Enrolled

- 7.3.8.Analysis by Type of Sponsor / Collaborator

- 7.3.9.Analysis by Target Population

- 7.3.10.Analysis by Study Design

- 7.3.11.Most Active Industry Players: Analysis by Number of Trials

- 7.3.12.Most Active Non-Industry Players: Analysis by Number of Trials

- 7.3.13.Analysis of Clinical Trials by Geography

- 7.3.14.Analysis of Patients Enrolled by Geography

8. KEY OPINION LEADERS

- 8.1.Chapter Overview

- 8.2.Assumption and Key Parameters

- 8.3.Methodology

- 8.4.Antibody Drug Conjugates: Key Opinion Leaders

- 8.4.1.Analysis by Type of KOLs

- 8.4.2.Analysis by Qualification

- 8.4.3.Analysis by Affiliated Organization

- 8.4.4.Analysis by Type of Organization

- 8.4.5.Analysis by Geographical Location of KOLs

- 8.4.6.Most Prominent KOLs: Analysis by KOLs Activeness, Expertise and Strength

- 8.4.7.Most Prominent KOLs: Analysis by RA score

- 8.4.8.Most Prominent KOLs: Comparison of RA Score and Third-Party Score

9.COMBINATION THERAPIES

- 9.1.Chapter Overview

- 9.2.Combination Therapies: History of Development

- 9.3.Combination Therapies: FDA Guidelines

- 9.3.1.Combination of Marketed Drugs

- 9.3.2.Combinations of Marketed Drugs with New Molecular Entities

- 9.3.3.Combination of New Molecular Entities

- 9.4.Combination Therapies: Antibody Drug Conjugates

- 9.4.1.Completed / Ongoing Clinical Studies of Antibody Drug Conjugates

- 9.4.1.1.Analysis by Type of Therapy

- 9.4.2.Completed / Ongoing Clinical Studies of Antibody Drug Conjugate-based Combination Therapies

- 9.4.2.1.Analysis by Phase of Development

- 9.4.2.2.Analysis by Trial Status

- 9.4.2.3.Analysis by Target Disease Indication

- 9.4.2.4.Most Popular Antibody Drug Conjugates Used in Combination Therapies: Analysis by Number of Trials

- 9.4.2.5.Most Popular Drug Class Used in Combination Therapies: Analysis by Number of Trials

- 9.4.2.6.Analysis by Target Disease Indication and Drug Class Used in Antibody Drug Conjugate-based Combination Therapies

- 9.4.1.Completed / Ongoing Clinical Studies of Antibody Drug Conjugates

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1.Chapter Overview

- 10.2.Partnership Models

- 10.3.Antibody Drug Conjugates: List of Partnerships and Collaborations

- 10.3.1.Analysis by Year of Partnership

- 10.3.2.Analysis by Type of Partnership

- 10.3.3.Analysis by Year and Type of Partnership

- 10.3.4.Analysis by Purpose of Partnership

- 10.3.5.Analysis by Type of Partner

- 10.3.6.Most Active Players: Analysis by Number of Partnerships

- 10.3.7.Analysis by Geography

- 10.3.7.1.International and Local Agreements

- 10.3.7.2.Intercontinental and Intracontinental Agreements

11.FUNDING AND INVESTMENT ANALYSIS

- 11.1.Chapter Overview

- 11.2.Types of Funding

- 11.3.Antibody Drug Conjugates: List of Funding and Investment Analysis

- 11.3.1.Analysis by Year of Funding

- 11.3.2.Analysis by Amount Invested

- 11.3.3.Analysis by Type of Funding

- 11.3.4.Analysis by Year and Type of Funding

- 11.3.5.Analysis by Type of Investor

- 11.3.6.Analysis by Amount Invested by Geography

- 11.3.6.1.Analysis by Region

- 11.3.6.2.Analysis by Country

- 11.3.7. Most Active Players: Analysis by Number of Funding Instances

- 11.3.8. Most Active Players: Analysis by Amount Invested

- 11.3.9. Key Investors: Analysis by Number of Funding Instances

12.PATENT ANALYSIS

- 12.1.Chapter Overview

- 12.2.Scope and Methodology

- 12.3.Antibody Drug Conjugates: Patent Analysis

- 12.3.1.Analysis by Patent Publication Year

- 12.3.2.Analysis by Patent Application Year

- 12.3.3.Analysis by Annual Number of Granted Patents and Patent Applications

- 12.3.4.Analysis by Patent Jurisdiction

- 12.3.5.Analysis by CPC Symbols

- 12.3.6.Analysis by Type of Applicant

- 12.3.7.Leading Industry Players: Analysis by Number of Patents

- 12.3.8.Leading Non-Industry Players: Analysis by Number of Patents

- 12.3.9.Leading Individual Assignees: Analysis by Number of Patents

- 12.4.Antibody Drug Conjugate: Patent Benchmarking Analysis

- 12.4.1.Analysis by Patent Characteristics

- 12.5.Antibody Drug Conjugate: Patent Valuation

- 12.6.Leading Patents by Number of Citations

13.ACADEMIC GRANTS ANALYSIS

- 13.1.Chapter Overview

- 13.2.Scope and Methodology

- 13.3.Antibody Drug Conjugates: Grants Analysis

- 13.3.1.Analysis by Year of Grant Award

- 13.3.2.Analysis by Amount Awarded

- 13.3.3.Analysis by Funding Institute

- 13.3.4.Analysis by Support Period

- 13.3.5.Analysis by Type of Grant Application

- 13.3.6.Analysis by Purpose of Grant Award

- 13.3.7.Analysis by Activity Code

- 13.3.8.Analysis by Study Section Involved

- 13.3.9.Popular NIH Departments: Analysis by Number of Grants

- 13.3.9.1.Prominent Program Officers: Analysis by Number of Grants

- 13.3.9.2.Popular Recipient Organizations: Analysis by Number of Grants

- 13.3.9.3.Popular Recipient Organizations: Analysis by Grant Amount

- 13.3.10. Analysis by Region of Recipient Organization

14.KEY COMMMERCIALIZATION STRATEGIES

- 14.1.Chapter Overview

- 14.2.Successful Drug Launch Strategy: ROOTS Framework

- 14.3.Successful Drug Launch Strategy: Product Differentiation

- 14.4.Common Commercialization Strategies Adopted Across Different Stages of Product Development

- 14.5.Key Commercialization Strategies Adopted by the Companies Focused on Antibody Drug Conjugates

- 14.5.1.Participation in the Global Events

- 14.5.2.Collaboration with External Stakeholders and Pharmaceuticals Firms

- 14.5.3.Geographical Expansion

- 14.5.4.Awareness Through Product Website

- 14.6.Concluding Remarks

15.PROMOTIONAL ANALYSIS

- 15.1.Chapter Overview

- 15.2.Channels Used for Promotional Campaigns

- 15.3.Summary of Product Website

- 15.4.Summary of Patient Support Services and Informative Downloads

- 15.5.Adcetris: Promotional Analysis

- 15.5.1.Drug Overview

- 15.5.2.Product Website Analysis

- 15.5.2.1.Message for Healthcare Professional

- 15.5.2.2.Message for Patients

- 15.5.2.3.Informative Downloads

- 15.5.2.4.Patient Support Services

- 15.6.Besponsa: Promotional Analysis

- 15.6.1.Drug Overview

- 15.6.2.Product Website Analysis

- 15.6.2.1.Message for Healthcare Professional

- 15.6.2.2.Message for Patients

- 15.6.2.3.Informative Downloads

- 15.6.2.4.Patient Support Services

- 15.7.Enhertu: Promotional Analysis

- 15.7.1.Drug Overview

- 15.7.2.Product Website Analysis

- 15.7.2.1.Message for Healthcare Professional

- 15.7.2.2.Message for Patients

- 15.7.2.3.Informative Downloads

- 15.7.2.4.Patient Support Services

- 15.8.Kadcyla: Promotional Analysis

- 15.8.1.Drug Overview

- 15.8.2.Product Website Analysis

- 15.8.2.1.Message for Healthcare Professional

- 15.8.2.2.Message for patients

- 15.8.2.3.Informative Downloads

- 15.8.2.4.Patient Support Services

- 15.9.Mylotarg: Promotional Analysis

- 15.9.1.Drug Overview

- 15.9.2.Product Website Analysis

- 15.9.2.1.Message for Healthcare Professional

- 15.9.2.2.Message for patients

- 15.9.2.3.Informative Downloads

- 15.9.2.4.Patient Support Services

- 15.10.Polivy: Promotional Analysis

- 15.10.1.Drug Overview

- 15.10.2.Product Website Analysis

- 15.10.2.1.Message for Healthcare Professional

- 15.10.2.2.Message for Patients

- 15.10.2.3.Informative Downloads

- 15.10.2.4.Patient Support Services

- 15.11.Trodelvy: Promotional Analysis

- 15.11.1.Drug Overview

- 15.11.2.Product Website Analysis

- 15.11.2.1.Message for Healthcare Professional

- 15.11.2.2.Message for Patients

- 15.11.2.3.Informative Downloads

- 15.11.2.4.Patient Support Services

16.SUCCESS PROTOCOL ANALYSIS

- 16.1.Chapter Overview

- 16.2.Antibody Drug Conjugates: Success Protocol Analysis

- 16.3.Adcetris (Seagen / Takeda Oncology)

- 16.3.1.Overview

- 16.3.2.Approval Timeline

- 16.3.3.Success Protocol Analysis

- 16.4.Aidixi (RemeGen)

- 16.4.1.Overview

- 16.4.2.Approval Timeline

- 16.4.3.Success Protocol Analysis

- 16.5.Akalux (Rakuten Medical)

- 16.5.1.Overview

- 16.5.2.Approval Timeline

- 16.5.3.Success Protocol Analysis

- 16.6.Besponsa (Pfizer / UCB)

- 16.6.1.Overview

- 16.6.2.Approval Timeline

- 16.6.3.Success Protocol Analysis

- 16.7.Blenrep (GlaxoSmithKline)

- 16.7.1.Overview

- 16.7.2.Approval Timeline

- 16.7.3.Success Protocol Analysis

- 16.8.Elahere (ImmunoGen)

- 16.8.1.Overview

- 16.8.2.Approval Timeline

- 16.8.3.Success Protocol Analysis

- 16.9.Enhertu (Daiichi Sankyo / AstraZeneca)

- 16.9.1.Overview

- 16.9.2.Approval Timeline

- 16.9.3.Success Protocol Analysis

- 16.10.Kadcyla (Genentech / ImmunoGen)

- 16.10.1.Overview

- 16.10.2.Approval Timeline

- 16.10.3.Success Protocol Analysis

- 16.11.Padcev (Seagen / Astellas Pharma)

- 16.11.1.Overview

- 16.11.2.Approval Timeline

- 16.11.3.Success Protocol Analysis

- 16.12.Polivy (Genentech)

- 16.12.1.Overview

- 16.12.2. Approval Timeline

- 16.12.3. Success Protocol Analysis

- 16.13.Tivdak (Seagen / Genmab)

- 16.13.1.Overview

- 16.13.2.Approval Timeline

- 16.13.3.Success Protocol Analysis

- 16.14.Trodelvy (Gilead Sciences)

- 16.14.1.Overview

- 16.14.2.Approval Timeline

- 16.14.3.Success Protocol Analysis

- 16.15. Zynlonta (ADC Therapeutics)

- 16.15.1.Overview

- 16.15.2.Approval Timeline

- 16.15.3.Success Protocol Analysis

- 16.16.Concluding Remarks

17. NOVEL CONJUGATION AND LINKER TECHNOLOGY PLATFORMS

- 17.1.Chapter Overview

- 17.2.Antibody Drug Conjugates: Conjugation Technologies

- 17.2.1.Chemical Conjugation

- 17.2.2.Enzymatic Conjugation

- 17.3.Antibody Drug Conjugates: List of Conjugation Technologies

- 17.4.Antibody Drug Conjugates: Linker Technologies

- 17.4.1.Non-cleavable Linkers

- 17.4.2.Cleavable Linker

- 17.5.Antibody Drug Conjugates: List of Linker and Linker-Payload Technologies

- 17.6.Concluding Remarks

18.ASSESSMENT OF NON-CLINICAL DATA FIRST IN HUMAN DOSING

- 18.1.Chapter Overview

- 18.2.Antibody Drug Conjugates: Non-Clinical Studies

- 18.3.ICH S9 Guidelines

- 18.4.Investigational New Drug (IND)-Enabling Study Designs

- 18.4.1.Example Case: Kadcyla

- 18.5.Toxicities in Animal Models

- 18.6.Prediction of Maximum Tolerated Dosage (MTD) in Humans

- 18.7.Other Key Considerations for Study Design

19.COST PRICE ANALYSIS

- 19.1.Chapter Overview

- 19.2.Factors Contributing Towards the High Price of Antibody-Drug Conjugates

- 19.3.Antibody Drug Conjugates Market: Cost Price Analysis

- 19.3.1.On the Basis of Associated Costs

- 19.3.2.On the Basis of Competition

- 19.3.3.On the Basis of Patient Segment

- 19.4.Reimbursement Considerations for Antibody-Drug Conjugates

20.CASE STUDY 1: CONTRACT MANUFACTURING OF ANTIBODY-DRUG CONJUGATES

- 20.1.Chapter Overview

- 20.2.Key Steps in Antibody Drug Conjugate Manufacturing Process

- 20.3.Technical Challenges Related to Antibody Drug Conjugate Manufacturing

- 20.4.Challenges Associated with Supply Chain and Method Transfer

- 20.5.Limitations of In-House Manufacturing

- 20.6.Investments in Antibody Drug Conjugate Manufacturing Capability Expansions

- 20.7.Collaborations Established for Antibody-Drug Conjugate Manufacturing

- 20.8.Growing Demand for Antibody-Drug Conjugate Contract Manufacturing

- 20.9.CMOs with Linker Manufacturing Capabilities

- 20.10.CMOs with HPAPI / Cytotoxic Payload Manufacturing Capabilities

- 20.11.CMOs with Conjugation Capabilities

- 20.12.Antibody Drug Conjugate One-Stop-Shops

- 20.13.Increasing Demand for One-Stop-Shops

21.CASE STUDY 2: COMPANION DIAGNOSTICS FOR ANTIBODY DRUG CONJUGATES THERAPEUTICS

- 21.1.Chapter Overview

- 21.1.1.Advantages of Companion Diagnostics

- 21.1.2.Challenges Associated with the Development of Companion Diagnostics

- 21.2. Companion Diagnostics for Antibody Drug Conjugates

- 21.3.Companion Diagnostics For Antibody Therapeutics

- 21.3.1.Analysis by Target Antigen

- 21.3.2.Analysis by Type of Cancer

- 21.4.Most Prominent Players: Analysis by Number of Tests

22.SWOT ANALYSIS

- 22.1.Chapter Overview

- 22.2.Strengths

- 22.2.1.Improved Safety and Patient Adherence

- 22.2.2.Rise of Next-Generation Conjugation Technologies

- 22.2.3.Robust Pipeline with Multiple Late Stage Product Candidates

- 22.2.4.Growing Involvement of Academic Institutes

- 22.3.Weaknesses

- 22.3.1.Technical Complexities Associated with Product Development

- 22.3.2.Manufacturing, Logistics and Supply Chain Challenges

- 22.3.3.Batch to Batch Inconsistencies

- 22.4.Opportunities

- 22.4.1.Increasing Collaborations and VC Funding

- 22.4.2.Widening Therapeutics Reach

- 22.4.3.Life Cycle Management

- 22.4.4.Combination Therapies

- 22.4.5.Opportunities for CMOs

- 22.5.Threats

- 22.5.1.Failure of Clinical / Marketed Candidates

- 22.5.2.Increased Competition from Other Therapeutic Classes

23. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 23.1.Chapter Overview

- 23.2.Forecast Methodology and Key Assumptions

- 23.3.Global Antibody Drug Conjugates Market, till 2035

- 23.3.1.Global Antibody Drug Conjugates Market: Distribution by Target Disease Indication, 2023 and 2035

- 23.3.1.1.Antibody Drug Conjugates Market for Breast Cancer, till 2035

- 23.3.1.2.Antibody Drug Conjugates Market for B-cell Lymphoma, till 2035

- 23.3.1.3.Antibody Drug Conjugates Market for Lung Cancer, till 2035

- 23.3.1.4.Antibody Drug Conjugates Market for Multiple Myeloma, till 2035

- 23.3.1.5.Antibody Drug Conjugates Market for Renal Cancer, till 2035

- 23.3.1.6.Antibody Drug Conjugates Market for Gastric Cancer, till 2035

- 23.3.1.7.Antibody Drug Conjugates Market for Cervical Cancer, till 2035

- 23.3.1.8.Antibody Drug Conjugates Market for Acute Lymphoblastic Leukemia, till 2035

- 23.3.1.9.Antibody Drug Conjugates Market for Other Disease Indications, till 2035

- 23.3.2.Antibody Drug Conjugates Market: Distribution by Therapeutic Area, Current Year and 2035

- 23.3.2.1.Antibody Drug Conjugates Market for Solid Tumors, till 2035

- 23.3.2.2.Antibody Drug Conjugates Market for Hematological Cancer, till 2035

- 23.3.3.Global Antibody Drug Conjugates Market: Distribution by Linker, 2023 and 2035

- 23.3.3.1.Antibody Drug Conjugates Market for Valine-Citrulline Linker, till 2035

- 23.3.3.2.Antibody Drug Conjugates Market for Tetrapeptide-Based Linker, till 2035

- 23.3.3.3.Antibody Drug Conjugates Market for Succinimidyl-4-(N-maleimidomethyl) cyclohexane-1-carboxylate Linker, till 2035

- 23.3.3.4.Antibody Drug Conjugates Market for Maleimide Linker, till 2035

- 23.3.3.5.Antibody Drug Conjugates Market for Maleimidocaproyl Linker, till 2035

- 23.3.3.6.Antibody Drug Conjugates Market for Valine-Alanine Linker, till 2035

- 23.3.3.7.Antibody Drug Conjugates Market for Hydrazone (4-(4-acetylphenoxy) butanoic acid (AcBut) Linker, till 2035

- 23.3.3.8.Antibody Drug Conjugates Market for Other Linkers, till 2035

- 23.3.4.Antibody Drug Conjugates Market: Distribution by Type of Payload, Current Year and 2035

- 23.3.4.1.Antibody Drug Conjugates Market for Monomethyl Auristatin E Payloads, till 2035

- 23.3.4.2.Antibody Drug Conjugates Market for DM1 Payloads, till 2035

- 23.3.4.3.Antibody Drug Conjugates Market for SN-38 / Irinotecan Payloads, till 2035

- 23.3.4.4.Antibody Drug Conjugates Market for Monomethyl Auristatin F Payloads, till 2035

- 23.3.4.5.Antibody Drug Conjugates Market for Duocarmycin Payloads, till 2035

- 23.3.4.6.Antibody Drug Conjugates Market for SG3199 Payloads, till 2035

- 23.3.4.7.Antibody Drug Conjugates Market for Ozogamicin Payloads, till 2035

- 23.3.4.8.Antibody Drug Conjugates Market for DM4 Payloads, till 2035

- 23.3.4.9.Antibody Drug Conjugates Market for Other Payloads, till 2035

- 23.3.5.Global Antibody Drug Conjugates Market: Distribution by Target Antigen, Current Year and 2035

- 23.3.5.1.Antibody Drug Conjugates Market for HER-2 (ERBB2), till 2035

- 23.3.5.2.Antibody Drug Conjugates Market for CD79b, till 2035

- 23.3.5.3.Antibody Drug Conjugates Market for TROP-2, till 2035

- 23.3.5.4.Antibody Drug Conjugates Market for BCMA (TNFRSF17 / BCM), till 2035

- 23.3.5.5.Antibody Drug Conjugates Market for CD19, till 2035

- 23.3.5.6.Antibody Drug Conjugates Market for Nectin 4, till 2035

- 23.3.5.7.Antibody Drug Conjugates Market for Tissue Factor, till 2035

- 23.3.5.8.Antibody Drug Conjugates Market for CD22, till 2035

- 23.3.5.9.Antibody Drug Conjugates Market for CD30, till 2035

- 23.3.5.10.Antibody Drug Conjugates Market for CEACAM5, till 2035

- 23.3.5.11.Antibody Drug Conjugates Market for Other Target Antigens, till 2035

- 23.3.6.Antibody Drug Conjugates Market: Distribution by Geographical Regions, Current Year and 2035

- 23.3.6.1.Antibody Drug Conjugates Market in North America, till 2035

- 23.3.6.1.1.Antibody Drug Conjugates Market in US, till 2035

- 23.3.6.1.2.Antibody Drug Conjugates Market in Canada, till 2035

- 23.3.6.2.Antibody Drug Conjugates Market in Europe, till 2035

- 23.3.6.2.1.Antibody Drug Conjugates Market in Germany, till 2035

- 23.3.6.2.2.Antibody Drug Conjugates Market in UK, till 2035

- 23.3.6.2.3.Antibody Drug Conjugates Market in France, till 2035

- 23.3.6.2.4.Antibody Drug Conjugates Market in Italy, till 2035

- 23.3.6.2.5.Antibody Drug Conjugates Market in Spain, till 2035

- 23.3.6.3.Antibody Drug Conjugates Market in Asia-Pacific, till 2035

- 23.3.6.3.1.Antibody Drug Conjugates Market in China, till 2035

- 23.3.6.3.2.Antibody Drug Conjugates Market in Australia, till 2035

- 23.3.6.3.3.Antibody Drug Conjugates Market in Japan, till 2035

- 23.3.6.1.Antibody Drug Conjugates Market in North America, till 2035

- 23.3.1.Global Antibody Drug Conjugates Market: Distribution by Target Disease Indication, 2023 and 2035

- 23.4.Antibody Drug Conjugates Market: Product-wise Sales Forecast, till 2035

- 23.4.1.Adcetris

- 23.4.1.1.Sales Forecast (USD Billion)

- 23.4.1.2.Net Present Value (USD Billion)

- 23.4.1.3.Value Creation Analysis

- 23.4.2.Aidixi

- 23.4.2.1.Sales Forecast (USD Billion)

- 23.4.2.2.Net Present Value (USD Billion)

- 23.4.2.3.Value Creation Analysis

- 23.4.3.Besponsa

- 23.4.3.1.Sales Forecast (USD Billion)

- 23.4.3.2.Net Present Value (USD Billion)

- 23.4.3.3.Value Creation Analysis

- 23.4.4.Blenrep

- 23.4.4.1.Sales Forecast (USD Billion)

- 23.4.4.2.Net Present Value (USD Billion)

- 23.4.4.3.Value Creation Analysis

- 23.4.5.Elahere

- 23.4.5.1.Sales Forecast (USD Billion)

- 23.4.5.2.Net Present Value (USD Billion)

- 23.4.5.3.Value Creation Analysis

- 23.4.6.Enhertu

- 23.4.6.1.Sales Forecast (USD Billion)

- 23.4.6.2.Net Present Value (USD Billion)

- 23.4.6.3.Value Creation Analysis

- 23.4.7.Kadcyla

- 23.4.7.1.Sales Forecast (USD Billion)

- 23.4.7.2.Net Present Value (USD Billion)

- 23.4.7.3.Value Creation Analysis

- 23.4.8.Padcev

- 23.4.8.1.Sales Forecast (USD Billion)

- 23.4.8.2.Net Present Value (USD Billion)

- 23.4.8.3.Value Creation Analysis

- 23.4.9.Polivy

- 23.4.9.1.Sales Forecast (USD Billion)

- 23.4.9.2.Net Present Value (USD Billion)

- 23.4.9.3.Value Creation Analysis

- 23.4.10. Tivdak

- 23.4.10.1.Sales Forecast (USD Billion)

- 23.4.10.2.Net Present Value (USD Billion)

- 23.4.10.3.Value Creation Analysis

- 23.4.11. Trodelvy

- 23.4.11.1.Sales Forecast (USD Billion)

- 23.4.11.2.Net Present Value (USD Billion)

- 23.4.11.3.Value Creation Analysis

- 23.4.12. Zynlonta

- 23.4.12.1.Sales Forecast (USD Billion)

- 23.4.12.2.Net Present Value (USD Billion)

- 23.4.12.3.Value Creation Analysis

- 23.4.13. Datopotamab Deruxtecan

- 23.4.13.1.Sales Forecast (USD Billion)

- 23.4.13.2.Net Present Value (USD Billion)

- 23.4.13.3.Value Creation Analysis

- 23.4.14. Patritumab Deruxtecan

- 23.4.14.1.Sales Forecast (USD Billion)

- 23.4.14.2.Net Present Value (USD Billion)

- 23.4.14.3.Value Creation Analysis

- 23.4.15. SHR-A1811

- 23.4.15.1.Sales Forecast (USD Billion)

- 23.4.15.2.Net Present Value (USD Billion)

- 23.4.15.3.Value Creation Analysis

- 23.4.16. SKB264

- 23.4.16.1.Sales Forecast (USD Billion)

- 23.4.16.2.Net Present Value (USD Billion)

- 23.4.16.3.Value Creation Analysis

- 23.4.17. TAA013

- 23.4.17.1.Sales Forecast (USD Billion)

- 23.4.17.2.Net Present Value (USD Billion)

- 23.4.17.3.Value Creation Analysis

- 23.4.18. Telisotuzumab Vedotin

- 23.4.18.1.Sales Forecast (USD Billion)

- 23.4.18.2.Net Present Value (USD Billion)

- 23.4.18.3.Value Creation Analysis

- 23.4.19. Trastuzumab Duocarmazine

- 23.4.19.1.Sales Forecast (USD Billion)

- 23.4.19.2.Net Present Value (USD Billion)

- 23.4.19.3.Value Creation Analysis

- 23.4.20. Tusamitamab Ravtansine

- 23.4.20.1.Sales Forecast (USD Billion)

- 23.4.20.2.Net Present Value (USD Billion)

- 23.4.20.3.Value Creation Analysis

- 23.4.21. Upifitamab Rilsodotin

- 23.4.21.1.Sales Forecast (USD Billion)

- 23.4.21.2.Net Present Value (USD Billion)

- 23.4.21.3.Value Creation Analysis

- 23.4.1.Adcetris

24.EXECUTIVE INSIGHTS

- 24.1.Chapter Overview

- 24.2.Oxford Biotherapeutics

- 24.2.1.Company Snapshot

- 24.2.2.Interview Transcript: Christian Rohlff, Founder and Chief Executive Officer

- 24.3.Angiex

- 24.3.1.Company Snapshot

- 24.3.2.Interview Transcript: Paul Jaminet, Founder and Chief Operating Officer

- 24.4.Syndivia

- 24.4.1.Company Snapshot

- 24.4.2.Interview Transcript: Sasha Koniev, Co-Founder and Chief Executive Officer

- 24.5.BSP Pharmaceuticals

- 24.5.1.Company Snapshot

- 24.5.2.Interview Transcript: Aldo Braca, President and Chief Executive Officer and Giorgio Salciarini, Technical Business Development Senior Manager

- 24.6.PolyTherics (an Abzena company)

- 24.6.1.Company Snapshot

- 24.6.2.Interview Transcript: John Burt, Former Chief Executive Officer

- 24.7.CureMeta

- 24.7.1.Company Snapshot

- 24.7.2.Interview Transcript: Michael Schopperle, Founder and Chief Executive Officer

- 24.8.CytomX Therapeutics

- 24.8.1.Company Snapshot

- 24.8.2.Interview Transcript: Jeff Landau, Chief Business Officer and Head of Strategy

- 24.9.NBE-Therapeutics

- 24.9.1.Company Snapshot

- 24.9.2.Interview Transcript: Wouter Verhoeven, Former Chief Business Officer

- 24.10.Cerbios-Pharma

- 24.10.1. Company Snapshot

- 24.10.2. Interview Transcript: Denis Angioletti, Chief Commercial Officer

- 24.11.Eisai

- 24.11.1. Company Snapshot

- 24.11.2. Interview Transcript: Toshimitsu Uenaka, President and Takashi Owa, Senior Vice President and Chief Scientific Officer

- 24.12.AbTis

- 24.12.1. Company Snapshot

- 24.12.2. Interview Transcript: Justin Oh, Chief Business Officer

- 24.13.AmbrX

- 24.13.1. Company Snapshot

- 24.13.2. Interview Transcript: Sukumar Sakamuri, Former Vice President and Head of Chemistry

- 24.14.Synaffix

- 24.14.1. Company Snapshot

- 24.14.2. Interview Transcript: Anthony DeBoer, Vice President, Business Development

- 24.15.Pierre Fabre

- 24.15.1. Company Snapshot

- 24.15.2. Interview Transcript: Christian Bailly, Former Director

- 24.16.Catalent Pharma Solutions

- 24.16.1. Company Snapshot

- 24.16.2. Interview Transcript: Jennifer L. Mitcham, Former Director, SMARTag ADCs and Bioconjugates and Stacy McDonald, Former Group Product Manager

- 24.17.Lonza

- 24.17.1. Company Snapshot

- 24.17.2. Interview Transcript: Laurent Ducry, Former Head of Bioconjugates Commercial Development

- 24.18.Piramal Healthcare

- 24.18.1. Company Snapshot

- 24.18.2. Interview Transcript: Mark Wright, Former Site Head

- 24.19.Ajinomoto Bio-Pharma Services

- 24.19.1. Company Snapshot

- 24.19.2. Interview Transcript: Tatsuya Okuzumi, General Manager, Business Development, CDMO Business

- 24.20.Cardiff University

- 24.20.1. Company Snapshot

- 24.20.2. Interview Transcript: Alan Burnett, Professor, School of Medicine

- 24.21.Anonymous, Director, Business Development, Leading CMO

- 24.22.Anonymous, Chief Executive Officer, Leading CMO

25.CONCLUSION

26.APPENDIX 1: TABULATED DATA

27.APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 3.1 List of Approved Monoclonal Antibody Therapies

- Table 3.2 Characteristics of Small Molecules and Monoclonal Antibodies and Antibody Drug Conjugates

- Table 3.3 Commonly Used Cytotoxins for Antibody Drug Conjugates

- Table 3.4 Characteristics of First, Second and Third Generation Antibody Drug Conjugates

- Table 4.1 Antibody Drug Conjugates: Information on Drug Candidates, Developer(s), Status of Development, Target Disease Indication(s), and Therapeutic Area(s)

- Table 4.2 Antibody Drug Conjugates: Information on Drug Candidates, Line of Treatment, Dosing Frequency, Type of Therapy, Target Antigen and Antibody Isotype

- Table 4.3 Antibody Drug Conjugates: Information on Drug Candidates, Payload / Cytotoxin / Warhead, Type of Payload, Linker and Type of Linker (Cleavable and Non-Cleavable)

- Table 4.4 Antibody Drug Conjugate Developers: Information on Year of Establishment, Company Size, and Location of Headquarters

- Table 5.1 Target Competitiveness Analysis: Information on Novel Pre-Clinical Stage Targets, Drug Candidates, Developer(s), Target Disease Indication(s) and Therapeutics Area(s)

- Table 6.1 List of Companies Profiled

- Table 6.2 ADC Therapeutics: Company Overview

- Table 6.3 ADC Therapeutics: Antibody Drug Conjugate Pipeline

- Table 6.4 Drug Profile: Zynlonta

- Table 6.5 ADC Therapeutics: Recent Developments and Future Outlook

- Table 6.6 Astellas Pharma: Company Overview

- Table 6.7 Astellas Pharma: Antibody Drug Conjugate Pipeline

- Table 6.8 Drug Profile: Padcev

- Table 6.9 Astellas Pharma: Recent Developments and Future Outlook

- Table 6.10 AstraZeneca: Company Overview

- Table 6.11 AstraZeneca: Antibody Drug Conjugate Pipeline

- Table 6.12 Drug Profile: Enhertu

- Table 6.13 AstraZeneca: Recent Developments and Future Outlook

- Table 6.14 Byondis: Company Overview

- Table 6.15 Byondis: Antibody Drug Conjugate Pipeline

- Table 6.16 Drug Profile: Trastuzumab Duocarmazine

- Table 6.17 Byondis: Recent Developments and Future Outlook

- Table 6.18 Daiichi Sankyo: Company Overview

- Table 6.19 Daiichi Sankyo: Antibody Drug Conjugate Pipeline

- Table 6.20 Drug Profile: Enhertu

- Table 6.21 Daiichi Sankyo: Recent Development and Future Outlook

- Table 6.22 Genentech: Company Overview

- Table 6.23 Genentech: Antibody Drug Conjugate Pipeline

- Table 6.24 Drug Profile: Kadcyla

- Table 6.25 Drug Profile: Polivy

- Table 6.26 Roche / Genentech: Recent Developments and Future Outlook

- Table 6.27 Gilead Sciences: Company Overview

- Table 6.28 Gilead Sciences: Antibody Drug Conjugate Pipeline

- Table 6.29 Drug Profile: Trodelvy

- Table 6.30 Gilead Sciences: Recent Developments and Future Outlook

- Table 6.31 ImmunoGen: Company Overview

- Table 6.32 ImmunoGen: Antibody Drug Conjugate Pipeline

- Table 6.33 Drug Profile: Elahere

- Table 6.34 ImmunoGen: Recent Developments and Future Outlook

- Table 6.35 Pfizer: Company Overview

- Table 6.36 Pfizer: Antibody Drug Conjugate Pipeline

- Table 6.37 Drug Profile: Mylotarg

- Table 6.38 Drug Profile: Besponsa

- Table 6.39 Pfizer: Recent Developments and Future Outlook

- Table 6.40 RemeGen: Company Overview

- Table 6.41 RemeGen: Antibody Drug Conjugate Pipeline

- Table 6.42 Drug Profile: Disitamab vedotin

- Table 6.43 RemeGen: Recent Developments and Future Outlook

- Table 6.44 Seagen: Company Overview

- Table 6.45 Seagen: Antibody Drug Conjugate Pipeline

- Table 6.46 Drug Profile: Adcetris

- Table 6.47 Drug Profile: Padcev

- Table 6.48 Drug Profile: Tivdak

- Table 6.49 Seagen: Recent Developments and Future Outlook

- Table 8.1 Antibody Drug Conjugates: List of Principal Investigators

- Table 10.1 Antibody Drug Conjugates: List of Partnerships and Collaborations, 2014 Onwards

- Table 11.1 Antibody Drug Conjugates: List of Funding and Investments, 2014 Onwards

- Table 11.2 Funding and Investment Analysis: Summary of Investments

- Table 12.1 Patent Analysis: Top CPC Sections

- Table 12.2 Patent Analysis: Top CPC Symbols

- Table 12.3 Patent Analysis: Top CPC Codes

- Table 12.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 12.5 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 12.6 Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 12.7 Patent Portfolio: List of Leading Patents (by Number of Citations)

- Table 14.1 List of Conferences Related to Approved Antibody Drug Conjugates

- Table 14.2 Key Commercialization Strategies: Harvey Ball Analysis by Ease of Implementation, Value Addition and Current Adoption

- Table 15.1 Promotional / Marketing Strategy: Informative Downloads

- Table 15.2 Adcetris: Drug Overview

- Table 15.3 Besponsa: Drug Overview

- Table 15.4 Enhertu: Drug Overview

- Table 15.5 Kadcyla: Drug Overview

- Table 15.6 Mylotarg: Drug Overview

- Table 15.7 Polivy: Drug Overview

- Table 15.8 Trodelvy: Drug Overview

- Table 16.1 List of Top Approved Antibody Drug Conjugates

- Table 16.2 Adcetris (Seagen / Takeda Oncology): Success Protocol Analysis Parameters

- Table 16.3 Besponsa (UCB / Pfizer): Success Protocol Analysis Parameters

- Table 16.4 Elahere (ImmunoGen): Success Protocol Analysis Parameters

- Table 16.5 Enhertu (Seagen / Takeda Oncology): Success Protocol Analysis Parameters

- Table 16.6 Kadcyla (Genentech / ImmunoGen): Success Protocol Analysis Parameters

- Table 16.7 Padcev (Seagen / Astellas Pharma): Success Protocol Analysis Parameters

- Table 16.8 Polivy (Genentech): Success Protocol Analysis Parameters

- Table 16.9 Tivdak (Seagen / Genmab): Success Protocol Analysis Parameters

- Table 16.10 Trodelvy (Gilead Sciences): Success Protocol Analysis Parameters

- Table 16.11 Zynlonta (ADC Therapeutics): Success Protocol Analysis Parameters

- Table 17.1 Antibody Drug Conjugate Conjugation Technologies: Information on Generation of Technology, Type of Specificity, Type of Conjugation and Drug Antibody Ratio

- Table 17.2 Antibody Drug Conjugate Linker and Linker-Payload Technologies: Information on Manufacturer, Linker Name and Type of Linker

- Table 18.1 Antibody Drug Conjugates Non-Clinical Studies: Safety Packages Required

- Table 18.2 Kadcyla: GLP Toxicology Study Results

- Table 18.3 Antibody Drug Conjugates: Dose Limiting Toxicities in Clinical Studies

- Table 18.4 Antibody Drug Conjugates: Relationship Between Dose-Limiting Toxicities and Antibody Drug Conjugate Warhead

- Table 19.1 Antibody Drug Conjugates Components: Information on the Cost of Different Types of Linkers

- Table 19.2 Antibody Drug Conjugates Component: Information on Cost by Type of Cytotoxin

- Table 19.3 Price of Marketed Antibody Drug Conjugates

- Table 19.4 Price of Marketed Targeted Drugs

- Table 20.1 Antibody Drug Conjugates Contract Manufacturing Service Providers: List of Companies

- Table 20.2 Antibody Drug Conjugates Contract Manufacturing Service Providers: List of HPAPI and Cytotoxic Payloads Manufacturing Service Providers

- Table 20.3 Antibody Drug Conjugates Contract Manufacturing Service Providers: Information on Scale of Operation

- Table 20.4 Antibody Drug Conjugate Contract Manufacturing Service Providers: Information on Location of Dedicated Manufacturing Facilities

- Table 21.1 Companion Diagnostics: List of Available / Under Development Tests for Antibody Drug Conjugates

- Table 21.2 Companion Diagnostics: Partnerships and Collaborations, 2017 Onwards

- Table 21.3 Companion Diagnostics for Antibody Therapeutics: List of Available / Under Development Tests

- Table 23.1 Antibody Drug Conjugates: List of Forecasted Therapies

- Table 23.2 Adcetris (Seagen / Takeda Oncology): Net Present Value (USD Billion)

- Table 23.3 Adcetris (Seagen / Takeda Oncology): Value Creation Analysis (USD Billion)

- Table 23.4 Aidixi (RemeGen): Net Present Value (USD Billion)

- Table 23.5 Aidixi (RemeGen): Value Creation Analysis (USD Billion)

- Table 23.6 Besponsa (Pfizer / UCB): Net Present Value (USD Billion)

- Table 23.7 Besponsa (Pfizer / UCB): Value Creation Analysis (USD Billion)

- Table 23.8 Blenrep (GSK): Net Present Value (USD Billion)

- Table 23.9 Blenrep (GSK): Value Creation Analysis (USD Billion)

- Table 23.10 Elahere (ImmunoGen): Net Present Value (USD Billion)

- Table 23.11 Elahere (ImmunoGen): Value Creation Analysis (USD Billion)

- Table 23.12 Enhertu (Daiichi Sankyo / AstraZeneca): Net Present Value (USD Billion)

- Table 23.13 Enhertu (Daiichi Sankyo / AstraZeneca): Value Creation Analysis (USD Billion)

- Table 23.14 Kadcyla (Genentech / ImmunoGen): Net Present Value (USD Billion)

- Table 23.15 Kadcyla (Genentech / ImmunoGen): Value Creation Analysis (USD Billion)

- Table 23.16 Padcev (Seagen / Astellas Pharma): Net Present Value (USD Billion)

- Table 23.17 Padcev (Seagen / Astellas Pharma): Value Creation Analysis (USD Billion)

- Table 23.18 Polivy (Genentech): Net Present Value (USD Billion)

- Table 23.19 Polivy (Genentech): Value Creation Analysis (USD Billion)

- Table 23.20 Tivdak (Seagen / Genmab): Net Present Value (USD Billion)

- Table 23.21 Tivdak (Seagen / Genmab): Value Creation Analysis (USD Billion)

- Table 23.22 Trodelvy (Gilead Sciences): Net Present Value (USD Billion)

- Table 23.23 Trodelvy (Gilead Sciences): Value Creation Analysis (USD Billion)

- Table 23.24 Zynlonta (ADC Therapeutics): Net Present Value (USD Billion)

- Table 23.25 Zynlonta (ADC Therapeutics): Value Creation Analysis (USD Billion)

- Table 23.26 Datopotamab Deruxtecan (Daiichi Sankyo): Net Present Value (USD Billion)

- Table 23.27 Datopotamab Deruxtecan (Daiichi Sankyo): Value Creation Analysis (USD Billion)

- Table 23.28 Patritumab Deruxtecan (Daiichi Sankyo): Net Present Value (USD Billion)

- Table 23.29 Patritumab Deruxtecan (Daiichi Sankyo): Value Creation Analysis (USD Billion)

- Table 23.30 SHR-A1811 (Luzsana Biotechnology): Net Present Value (USD Billion)

- Table 23.31 SHR-A1811 (Luzsana Biotechnology): Value Creation Analysis (USD Billion)

- Table 23.32 SKB264 (Klus Pharma): Net Present Value (USD Billion)

- Table 23.33 SKB264 (Klus Pharma): Value Creation Analysis (USD Billion)

- Table 23.34 TAA013 (Tot Biopharm): Net Present Value (USD Billion)

- Table 23.35 TAA013 (Tot Biopharm): Value Creation Analysis (USD Billion)

- Table 23.36 Telisotuzumab Vedotin (Abbvie): Net Present Value (USD Billion)

- Table 23.37 Telisotuzumab Vedotin (Abbvie): Value Creation Analysis (USD Billion)

- Table 23.38 Trastuzumab Duocarmazine (Byondis): Net Present Value (USD Billion)

- Table 23.39 Trastuzumab Duocarmazine (Byondis): Value Creation Analysis (USD Billion)

- Table 23.40 Tusamitamab Ravtansine (Sanofi / ImmunoGen): Net Present Value (USD Billion)

- Table 23.41 Tusamitamab Ravtansine (Sanofi / ImmunoGen): Value Creation Analysis (USD Billion)

- Table 23.42 Upifitamab Rilsodotin (Mersana Therapeutics): Net Present Value (USD Billion)

- Table 23.43 Upifitamab Rilsodoti (Mersana Therapeutics): Value Creation Analysis (USD Billion)

- Table 24.1 Angiex: Key Highlights

- Table 24.2 Syndivia: Key Highlights

- Table 24.3 BSP Pharmaceuticals: Key Highlights

- Table 24.4 PolyTherics: Key Highlights

- Table 24.5 CureMeta: Key Highlights

- Table 24.6 CytomX: Key Highlights

- Table 24.7 NBE-Therapeutics: Key Highlights

- Table 24.8 Cerbios-Pharma: Key Highlights

- Table 24.9 Eisai: Key Highlights

- Table 24.10 AbTis: Key Highlights

- Table 24.11 AmbrX: Key Highlights

- Table 24.12 Synaffix: Key Highlights

- Table 24.13 Pierre Fabre: Key Highlights

- Table 24.14 Catalent Pharma Solutions: Key Highlights

- Table 24.15 Lonza: Key Highlights

- Table 24.16 Piramal Healthcare: Key Highlights

- Table 24.17 Ajinomoto Bio-Pharma Services: Key Highlights

- Table 24.18 Cardiff University: Key Highlights

- Table 26.1 Antibody Drug Conjugates: Distribution by Status of Development

- Table 26.2 Antibody Drug Conjugates: Distribution by Target Disease Indication

- Table 26.3 Antibody Drug Conjugates: Distribution by Therapeutic Area

- Table 26.4 Antibody Drug Conjugates: Distribution by Line of Treatment

- Table 26.5 Antibody Drug Conjugates: Distribution by Dosing Frequency

- Table 26.6 Antibody Drug Conjugates: Distribution by Type of Therapy

- Table 26.7 Antibody Drug Conjugates: Distribution by Target Antigen

- Table 26.8 Antibody Drug Conjugates: Distribution by Antibody Isotype

- Table 26.9 Antibody Drug Conjugates: Distribution by Type of Payload / Cytotoxin / Warhead

- Table 26.10 Antibody Drug Conjugates: Distribution by Type of Payload

- Table 26.11 Antibody Drug Conjugates: Distribution by Linker

- Table 26.12 Antibody Drug Conjugates: Distribution by Type of Linker

- Table 26.13 Antibody Drug Conjugate Developers: Distribution by Year of Establishment

- Table 26.14 Antibody Drug Conjugates Developers: Distribution by Company Size

- Table 26.15 Antibody Drug Conjugates Developers: Distribution by Location of Headquarters

- Table 26.16 Antibody Drug Conjugate Developers: Distribution by Company Size and Location of Headquarters

- Table 26.17 Most Active Players: Distribution by Number of Antibody Drug Conjugates

- Table 26.18 ADC Therapeutics: Annual Revenues, 2021 Onwards (USD Million)

- Table 26.19 Astellas Pharma: Annual Revenues, FY 2018 Onwards (JPY Billion)

- Table 26.20 AstraZeneca: Annual Revenues, 2018 Onwards (USD Billion)

- Table 26.21 Byondis: Annual Revenues, 2019 Onwards (EUR Million)

- Table 26.22 Daiichi Sankyo: Annual Revenues, FY 2018 Onwards (JPY Billion)

- Table 26.23 Roche (Parent Company of Genentech): Annual Revenues, 2018 Onwards (CHF Billion)

- Table 26.24 Gilead Sciences: Annual Revenues, 2018 Onwards (USD Billion)

- Table 26.25 ImmunoGen: Annual Revenues, 2018 Onwards (USD Million)

- Table 26.26 Pfizer: Annual Revenues, 2018 Onwards (USD Billion)

- Table 26.27 RemGen: Annual Revenues, 2021 Onwards (CNY Million)

- Table 26.28 Seagen: Annual Revenues, 2018 Onwards (USD Million)

- Table 26.29 Clinical Trial Analysis: Cumulative Distribution by Trial Registration Year, 2016 Onwards

- Table 26.30 Clinical Trial Analysis: Distribution by Trial Status

- Table 26.31 Clinical Trial Analysis: Distribution by Trial Status and Patients Enrolled

- Table 26.32 Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Status, 2016 Onwards

- Table 26.33 Clinical Trial Analysis: Distribution by Trial Registration Year and Patients Enrolled, 2016 Onwards

- Table 26.34 Clinical Trial Analysis: Distribution by Trial Phase

- Table 26.35 Clinical Trial Analysis: Distribution by Trial Phase and Patients Enrolled

- Table 26.36 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Table 26.37 Clinical Trial Analysis: Distribution by Target Population

- Table 26.38 Clinical Trial Analysis: Distribution by Study Design

- Table 26.39 Most Active Industry Players: Distribution by Number of Trials

- Table 26.40 Most Active Non-Industry Players: Distribution by Number of Trials

- Table 26.41 Clinical Trial Analysis: Geographical Distribution by Number of Clinical Trials

- Table 26.42 Clinical Trial Analysis: Geographical Distribution by Number of Patients Enrolled

- Table 26.43 Antibody Drug Conjugates KOL Analysis: Distribution by Type of KOLs

- Table 26.44 Antibody Drug Conjugates KOL Analysis: Distribution by Qualification(s)

- Table 26.45 Antibody Drug Conjugates KOL Analysis: Distribution by Affiliated Organization

- Table 26.46 Antibody Drug Conjugates KOL Analysis: Distribution by Type of Organization

- Table 26.47 Antibody Drug Conjugates: Geographical Distribution of KOLs

- Table 26.48 Antibody Drug Conjugates Most Prominent KOLs: Distribution by RA Score

- Table 26.49 Antibody Drug Conjugates Most Prominent KOLs: Comparison of RA Score with Third-Party Score

- Table 26.50 Antibody Drug Conjugates Clinical Studies: Distribution by Trial Registration Year and Type of Therapy

- Table 26.51 Antibody Drug Conjugate-based Combination Therapies: Distribution by Phase of Development

- Table 26.52 Antibody Drug Conjugate-based Combination Therapies: Distribution by Trial Status

- Table 26.53 Antibody Drug Conjugate-based Combination Therapies: Distribution by Target Disease Indication

- Table 26.54 Most Popular Antibody Drug Conjugates Used in Combination Therapies: Distribution by Number of Trials

- Table 26.55 Most Popular Drug Classes Used in Antibody Drug Conjugate-based Combination Therapies: Distribution by Number of Trials

- Table 26.56 Partnerships and Collaborations: Cumulative Year-wise Trend, 2014 Onwards

- Table 26.57 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 26.58 Partnerships and Collaborations: Distribution by Year and Type of Partnership, 2014-2023

- Table 26.59 Partnerships and Collaborations: Distribution by Purpose of Partnership

- Table 26.60 Partnerships and Collaborations: Distribution by Type of Partner

- Table 26.61 Most Active Players: Distribution by Number for Partnerships

- Table 26.62 Partnerships and Collaborations: International and Local Agreements

- Table 26.63 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 26.64 Funding and Investment Analysis: Cumulative Distribution of Instances, 2016 Onwards

- Table 26.65 Funding and Investment Analysis: Cumulative Distribution of Amount Invested, 2016 Onwards (USD Million)

- Table 26.66 Funding and Investment Analysis: Distribution of Instances by Type of Funding

- Table 26.67 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 26.68 Funding and Investments: Distribution of Amount Invested by Year and Type of Funding

- Table 26.69 Funding and Investment Analysis: Distribution of Instances by Type of Investor

- Table 26.70 Funding and Investment Analysis: Distribution of Funding Instances by Region

- Table 26.71 Funding and Investment Analysis: Distribution of Amount Invested by Country (USD Million)

- Table 26.72 Most Active Players: Distribution by Number of Funding Instances

- Table 26.73 Most Active Players: Distribution by Amount Invested (USD Million)

- Table 26.74 Key Investors: Distribution by Number of Instances

- Table 26.75 Patent Analysis: Distribution by Type of Patent

- Table 26.76 Patent Analysis: Cumulative Distribution by Patent Publication Year, 2019 Onwards

- Table 26.77 Patent Analysis: Cumulative Distribution by Patent Application Year, 2018 Onwards

- Table 26.78 Patent Analysis: Year-wise Distribution of Granted Patents and Patent Applications, 2019 Onwards

- Table 26.79 Patent Analysis: Distribution by Patent Jurisdiction (Region-wise)

- Table 26.80 Patent Analysis: Distribution by Patent Jurisdiction (Country-wise)

- Table 26.81 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant, 2019 Onwards

- Table 26.82 Leading Industry Players: Distribution by Number of Patents

- Table 26.83 Leading Non-Industry Players: Distribution by Number of Patents

- Table 26.84 Leading Individual Assignees: Distribution by Number of Patents

- Table 26.85 Patent Analysis: Distribution by Patent Age

- Table 26.86 Grants Analysis: Cumulative Distribution by Year of Grant, 2016 Onwards

- Table 26.87 Grants Analysis: Distribution by Cumulative Amount Awarded (USD Million), 2016- 2023

- Table 26.88 Grants Analysis: Distribution by Funding Institute Center

- Table 26.89 Grants Analysis: Distribution by Support Period

- Table 26.90 Grants Analysis: Distribution by Type of Grant Applications

- Table 26.91 Grants Analysis: Distribution by Purpose of Grant Award

- Table 26.92 Grants Analysis: Distribution by Activity Code

- Table 26.93 Grants Analysis: Distribution by Study Section Involved

- Table 26.94 Popular NIH Departments: Distribution by Number of Grants

- Table 26.95 Prominent Program Officers: Distribution by Number of Grants

- Table 26.96 Popular Recipient Organizations: Distribution by Number of Grants

- Table 26.97 Popular Recipient Organizations: Distribution by Grant Amount (USD Million)

- Table 26.98 Grants Analysis: Distribution by Region of Recipient Organization

- Table 26.99 Antibody Drug Conjugate Contract Manufacturing Service Providers: Distribution by Scale of Operation

- Table 26.100 Antibody Drug Conjugate Contract Manufacturing Service Providers: Distribution by Location of Manufacturing Facilities

Table 26.101Companion Diagnostics for Antibody Therapeutics: Distribution by Target Antigen

- Table 26.102 Companion Diagnostics for Antibody Therapeutics: Distribution by Type of Cancer

- Table 26.103 Companion Diagnostics for Antibody Therapeutics: Distribution by Key Players

- Table 26.104 Global Antibody Drug Conjugates Market, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.105 Antibody Drug Conjugates Market: Distribution by Target Disease Indication, Current Year and 2035 (USD Billion)

- Table 26.106 Antibody Drug Conjugates Market for Breast Cancer, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.107 Antibody Drug Conjugates Market for B-cell Lymphoma, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.108 Antibody Drug Conjugates Market for Lung Cancer, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.109 Antibody Drug Conjugates Market for Multiplr Myeloma, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.110 Antibody Drug Conjugates Market for Renal Cancer, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.111 Antibody Drug Conjugates Market for Gastric Cancer, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.112 Antibody Drug Conjugates Market for Cervical Cancer, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.113 Antibody Drug Conjugates Market for Acute Lymphoblastic Leukemia, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.114 Antibody Drug Conjugates Market for Other Target Disease Indication, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.115 Antibody Drug Conjugates Market: Distribution by Therapeutic Area, Current Year and 2035 (USD Billion)

- Table 26.116 Antibody Drug Conjugates Market for Solid Tumors, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.117 Antibody Drug Conjugates Market for Hematological Cancer, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.118 Antibody Drug Conjugates Market, Current Year and 2035: Distribution by Linker (USD Billion)

- Table 26.119 Antibody Drug Conjugates Market for Valine-Citrulline Linker, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.120 Antibody Drug Conjugates Market for Tetrapeptide-based Linker, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.121 Antibody Drug Conjugates Market for Succinimidyl-4-(N-maleimidomethyl) cyclohexane-1-carboxylate Linker, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 26.122 Antibody Drug Conjugates Market for Maleimide Linker, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)