|

市场调查报告书

商品编码

1648560

GLP-1 市场:依分子类型、所用活性化合物、GLP-1 促效剂药物类型、促效剂类型、给药途径、目标适应症和关键区域分:至2035年的行业趋势和全球预测GLP-1 Market by Type of Molecule, Active Compound Used, Type of GLP-1 Agonist Drugs, Type of Agonist Route of Administration, Target indication and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035 |

||||||

全球 GLP-1 市场规模预计将从目前的493亿美元成长到2035年的1,575亿美元,预测期内的年复合成长率为 11.1%。

根据世界卫生组织(WHO)统计,全球有超过10亿人患有肥胖症,其中6.5亿是成年人。据估计,肥胖每年造成400万人死亡。此外,最近的研究表明,全球有近 5.3亿成年人患有糖尿病,其中预计 98%患有第2 型糖尿病。由于肥胖和糖尿病负担日益加重,对安全有效的药物的需求也日益增加。因此,各公司已开始开发和评估针对这些适应症的候选药物。

最近,GLP-1 药物已成为一种有希望的选择。值得注意的是,目前已有15种GLP-1药物针对不同适应症实现商业化。此外,目前有超过 135 种新候选药物接受不同开发阶段的评估。在各种新药核准(针对各种适应症)和企业大量研发投入(增强 GLP-1 药物的输送机制)的推动下,预计市场将在未来十年实现稳步成长。

目前约有60%的GLP-1候选药物处于临床开发阶段,其中大部分针对第二型糖尿病和肥胖症等代谢疾病。目前,GLP-1 药物的市场格局较为分散,既有新进者,也有现有企业,其中大多数位于中国(36%)和美国(28%)。最近有关 GLP-1 药物的活动一直在稳步扩大,尤其是其中近 50%的交易包括药物开发和商业化。生活方式的改变、社群媒体的影响、名人代言和直接面向消费者的广告推动 GLP-1 药物需求的激增。预测期内,GLP-1 市场预计将以 11.1%的年复合成长率成长,到2035年,生物製剂领域预计将占据市场的大部分占有率(超过 65%)。

本报告概述了全球 GLP-1 市场,提供了关键地理位置、细分市场和关键地区以及公司简介,以及市场概况、按分子类型细分、使用的活性化合物、GLP-1 促效剂药物类型、促效剂类型、给药途径、目标适应症、趋势和公司简介。

目录

第1章 背景

第2章 研究方法

第3章 经济及其他专案具体考量

第4章 执行摘要

第5章 简介

第6章 市场模式:GLP-1 药物

第7章 GLP-1 药物:详细公司概况

第8章 GLP-1 药物:公司简介

第9章 伙伴关係与协作

第10章 市场影响分析:驱动因素、限制因素、机会与挑战

第11章 全球GLP-1市场

- 假设与研究方法

- 全球 GLP-1 市场、表现及2035年预测

第12章 GLP-1 市场:依分子类型

第13章 GLP-1 市场:依所使用活性化合物

第14章 GLP-1 市场:依 GLP-1 促效剂药物类型

第15章 GLP-1 市场:依促效剂类型

第16章 GLP-1 市场:依给药途径

第17章 GLP-1 市场:依目标适应症

第18章 GLP-1 市场:依主要区域

第19章 GLP-1市场及GLP-1药物销售预测

第20章 GLP-1 市场:依主要药物开发商

第21章 附录1:表格资料

第22章 附录2:公司与组织名单

GLP-1 MARKET: OVERVIEW

As per Roots Analysis, the global GLP-1 market is estimated to grow from USD 49.3 billion in the current year to USD 157.5 billion by 2035, at a CAGR of 11.1% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Molecule

- Biologics

- Small Molecules

Active Compound Used

- Dulaglutide

- Liraglutide

- Orforglipron

- Retatrutide

- Semaglutide

- Survodutide

- Tirzepatide

- Other Active Compounds

Type of GLP-1 Agonist Drugs

- Long-acting GLP-1 Agonist

- Short-acting GLP-1 Agonist

Type of Agonist

- Single agonist

- Dual agonist

- Tri-agonist

Route of Administration

- Oral

- Parenteral

Target Indication

- Alzheimer's Disease

- Non-Alcoholic Steatohepatitis

- Obesity

- Sleep Apnea

- Type 2 Diabetes

Key Geographical Regions

- North America (US, Canada)

- Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe)

- Asia-Pacific

- Latin America

GLP-1 MARKET: GROWTH AND TRENDS

According to the World Health Organization (WHO), more than 1 billion individuals are suffering from obesity, worldwide; of these, 650 million individuals are adults. It is estimated that 4 million people die annually due to obesity. In addition, a recent study indicates that close to 530 million adult population suffers from diabetes globally; of these, 98% of the population is expected to have type 2 diabetes. Considering the growing burden of obesity and diabetes, there has been a rise in the need for safe and effective medications. As a result, various companies have started developing and evaluating potential candidates targeting these indications.

In the recent past, GLP-1 drugs have emerged as a promising option. It is worth highlighting that 15 GLP-1 drugs have been commercialized for targeting various indications. Additionally, more than 135 drug candidates are currently being evaluated across various phases of development. Driven by the new drug approvals (for different applications), and extensive R&D efforts of the companies (to enhance delivery mechanisms of GLP-1 drugs), the market is anticipated to witness steady growth in the coming decade.

GLP-1 MARKET: KEY INSIGHTS

The report delves into the current state of the GLP-1 market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- More than 150 GLP-1 drug candidates, intended for the treatment of multiple indications, are currently either approved or being investigated by pharmaceutical companies.

- ~60% of the GLP-1 drug candidates are currently being evaluated in clinical stages of development; of these, most of the candidates target metabolic disorders, such as Type 2 diabetes and obesity.

- The current market landscape of GLP-1 drugs is fragmented, featuring the presence of both new entrants and established players; majority of these firms are based in China (36%) and the US (28%).

- Partnerships related to GLP-1 drugs have steadily grown in the recent past; notably, close to 50% of these deals were signed for drug development and commercialization.

- Lifestyle changes, influence of social media, celebrity endorsements and direct to consumer advertisements have led to a surge in the demand for GLP-1 drugs.

- The GLP-1 market is anticipated to grow at a CAGR of 11.1%, during the forecasted period; biologics segment is expected to capture the majority share (over 65%) of the market by 2035.

GLP-1 MARKET: KEY SEGMENTS

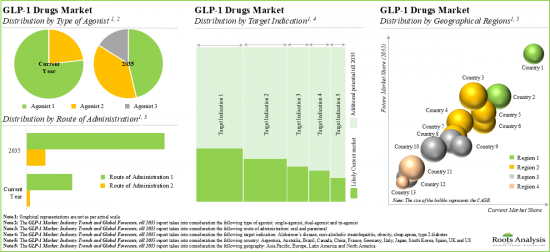

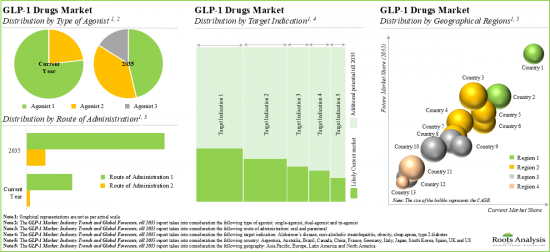

Currently, Small Molecules Occupy the Largest Share of the GLP-1 Market

Based on the type of molecule, the market is segmented into biologics and small molecules. At present, the small molecules segment holds the maximum share of the GLP-1 market. It is worth highlighting that owing to the unique physiological properties of biologics, including stability, specificity, selectivity and ability to block specific protein-protein interactions, the biologics segment is likely to grow at a relatively higher CAGR.

Survodutide Active Compound is the Fastest Growing Segment of the GLP-1 Market During the Forecast Period

Based on the active compound, the market is segmented into dulaglutide, liraglutide, orforglipron, retatrutide, semaglutide, survodutide, tirzepatide and other active compounds. At present, semaglutide holds the maximum share of the GLP-1 market. Further, it is worth highlighting that survodutide is likely to drive the market in the near future.

Currently, Long-Acting GLP-1 Agonists Occupy the Largest Share of the GLP-1 Market

Based on the type of GLP-1 agonists drugs, the market is segmented into short-acting GLP-1 agonist and long-acting GLP-1 agonist. At present, long-acting GLP-1 agonist holds the maximum share of the GLP-1 market and this trend is likely to remain the same in the forthcoming years. This can be attributed to the fact that the effect of the long-acting drug lasts longer than that of short-acting agonists. It is worth highlighting that short-acting GLP-1 agonist segment is likely to grow at a relatively higher CAGR.

At Present, Single-agonist Segment Occupies the Largest Share of the GLP-1 Market

Based on the type of GLP-1 agonist, the market is segmented into single-agonist, dual-agonist and tri-agonist. Currently, the single-agonist segment holds the maximum share of the GLP-1 market. It is worth highlighting that tri-agonist segment is likely to grow at a relatively higher CAGR.

Oral Route of Administration is the Fastest Growing Segment in the GLP-1 Market During the Forecast Period

Based on the route of administration, the market is segmented into oral route and parenteral route. At present, the parenteral route holds a larger share of the GLP-1 market. This trend is likely to remain the same in the coming decade. Further, it is worth noting that oral route of administration is likely to grow at a relatively higher CAGR.

Type 2 Diabetes Accounts for the Largest Share of the GLP-1 Market

Based on the target indication, the market is segmented into Alzheimer's Disease, non-alcoholic steatohepatitis, obesity, sleep apnea, and type 2 diabetes. While type 2 diabetes account for a relatively higher market share, it is worth highlighting that the non-alcoholic steatohepatitis segment is expected to witness substantial market growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Latin America. It is worth highlighting that, over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the GLP-1 Market

- AstraZeneca

- Biolingus

- Boehringer Ingelheim

- D&D Pharmatech

- Eli Lilly

- Gmax Biopharm

- Hanmi Pharmaceutical

- Innogen

- Novo Nordisk

- PegBio

- Pfizer

- QL Biopharma

- Roche

- Sanofi

- Sciwind Biosciences

- Tonghua Dongbao Pharmaceutical

- Viking Therapeutics

- Vivani

- vTv Therapeutic

GLP-1 MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the GLP-1 market, focusing on key market segments, including [A] type of molecule, [B] active compound used, [C] type of glp-1 agonist drugs, [D] type of agonist, [E] target indication and [F] geographical regions.

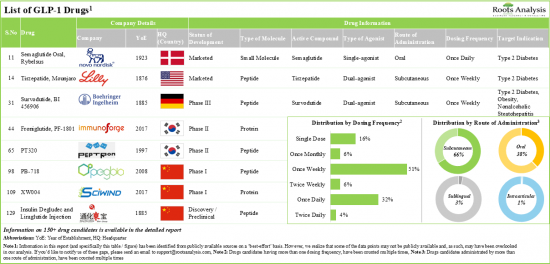

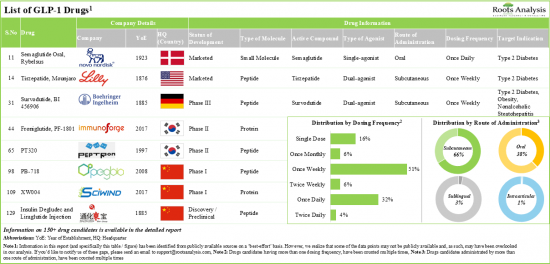

- Market Landscape: A comprehensive evaluation of GLP-1 drugs, considering various parameters, such as [A] stage of development, [B] type of molecule, [C] active compound used, [D] GLP-1 agonist, [E] route of administration, [F] dosing frequency, [G] type of therapy, [H] target indication and [I] therapeutic area. Additionally, it provides a detailed list of developers engaged in developing GLP-1 drugs, along with information on various parameters, such as [J] year of establishment, [K] company size (in terms of employee count) and [L] location of headquarters.

- Company Profiles: In-depth profiles of key industry players engaged in the development of GLP-1 drugs, focusing on [A] company overviews, [B] financial information, [C] drug portfolio, [D] recent developments and [E] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2020, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of molecule, [D] type of partner, [E] most active players (in terms of the number of partnerships signed) and [F] regional distribution of partnership activity in this domain.

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on Market

- 3.2.2.4. Strategies For Mitigating Foreign Exchange Risk

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks Associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Overview of the GLP-1 Drug

- 5.1.1. Challenges Associated with GLP-1 Drugs

- 5.1.2. Mechanism of Action of GLP-1 Drugs

- 5.2. Important Facts in GLP-1 Domain

- 5.3. Future Perspectives

6. MARKET LANDSCAPE: GLP-1 DRUGS

- 6.1. GLP-1 Drugs: Market Landscape

- 6.1.1. Analysis by Status of Development

- 6.1.2. Analysis by Type of Molecule

- 6.1.3. Analysis by Active Compound Used

- 6.1.4. Analysis by Type of Agonist

- 6.1.5. Analysis by Route of Administration

- 6.1.6. Analysis by Dosing Frequency

- 6.1.7. Analysis by Type of Therapy

- 6.1.8. Analysis by Target Indication

- 6.1.9. Analysis by Therapeutic Area

- 6.2. GLP-1 Drugs: Developer Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.3. Analysis by Location of Headquarters (Country) and Status of Development

- 6.2.4. Most Active Developers: Analysis by Number of Therapies

7. GLP-1 DRUGS: DETAILED COMPANY PROFILES

- 7.1. Chapter Overview

- 7.2.1. AstraZeneca

- 7.1.1.1. Company Overview

- 7.1.1.2. Pipeline Portfolio

- 7.1.1.3. Financial Details

- 7.1.1.4. Recent Developments and Future Outlook

- 7.1.2. D&D Pharmatech

- 7.1.2.1. Company Overview

- 7.1.2.2. Pipeline Portfolio

- 7.1.2.3. Financial Details

- 7.1.2.4. Recent Developments and Future Outlook

- 7.1.3. Eli Lilly

- 7.1.3.1. Company Overview

- 7.1.3.2. Pipeline Portfolio

- 7.1.3.3. Financial Details

- 7.1.3.4. Recent Developments and Future Outlook

- 7.1.4. Novo Nordisk

- 7.1.4.1. Company Overview

- 7.1.4.2. Pipeline Portfolio

- 7.1.4.3. Financial Details

- 7.1.4.4. Recent Developments and Future Outlook

- 7.1.5. Pfizer

- 7.1.5.1. Company Overview

- 7.1.5.2. Pipeline Portfolio

- 7.1.5.3. Financial Details

- 7.1.5.4. Recent Developments and Future Outlook

- 7.1.6. Sanofi

- 7.1.6.1. Company Overview

- 7.1.6.2. Pipeline Portfolio

- 7.1.6.3. Financial Details

- 7.1.6.4. Recent Developments and Future Outlook

- 7.1.7. Tonghua Dongbao Pharmaceutical

- 7.1.7.1. Company Overview

- 7.1.7.2. Pipeline Portfolio

- 7.1.7.3. Financial Details

- 7.1.7.4. Recent Developments and Future Outlook

- 7.1.8. Vivani

- 7.1.8.1. Company Overview

- 7.1.8.2. Pipeline Portfolio

- 7.1.8.3. Financial Details

- 7.2.8.4. Recent Developments and Future Outlook

- 7.2.1. AstraZeneca

8. GLP-1 DRUGS: BRIEF COMPANY PROFILES

- 8.1. Chapter Overview

- 8.1.1. Biolingus

- 8.1.1.1. Company Overview

- 8.1.1.2. Pipeline Portfolio

- 8.1.2. Boehringer Ingelheim

- 8.1.2.1. Company Overview

- 8.1.2.2. Pipeline Portfolio

- 8.1.3. Gmax Biopharm

- 8.1.3.1. Company Overview

- 8.1.3.2. Pipeline Portfolio

- 8.1.4. Hanmi Pharmaceutical

- 8.1.4.1. Company Overview

- 8.1.4.2. Pipeline Portfolio

- 8.1.5. Innogen

- 8.1.5.1. Company Overview

- 8.1.5.2. Pipeline Portfolio

- 8.1.6. PegBio

- 8.1.6.1. Company Overview

- 8.1.6.2. Pipeline Portfolio

- 8.1.7. QL Biopharma

- 8.1.7.1. Company Overview

- 8.1.7.2. Pipeline Portfolio

- 8.1.8. Roche

- 8.1.8.1. Company Overview

- 8.1.8.2. Pipeline Portfolio

- 8.1.9. Sciwind Biosciences

- 8.1.9.1. Company Overview

- 8.1.9.2. Pipeline Portfolio

- 8.1.10. Viking Therapeutics

- 8.1.10.1. Company Overview

- 8.1.10.2. Pipeline Portfolio

- 8.1.11. vTv Therapeutics

- 8.1.11.1. Company Overview

- 8.1.11.2. Pipeline Portfolio

- 8.1.1. Biolingus

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. GLP-1 Market: Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnership

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Focus Area

- 9.3.4. Analysis by Year and Type of Partnership

- 9.3.5. Most Active Players: Analysis by Number of Partnerships

- 9.3.7. Analysis by Geography

- 9.3.7.1. Intercontinental and Intracontinental Deals

- 9.3.7.2. Local and International Deals

10. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 10.1. Chapter Overview

- 10.2. Market Drivers

- 10.3. Market Restraints

- 10.4. Market Opportunities

- 10.5. Market Challenges

- 10.6. Conclusion

11. GLOBAL GLP-1 MARKET

- 11.1. Assumptions and Methodology

- 11.2. Global GLP-1 Market, Historical Trends and Forecasted Estimates, till 2035

- 11.2.1. Scenario Analysis

- 11.2.1.1. Conservative Scenario

- 11.2.1.2. Optimistic Scenario

- 11.2.2. Key Market Segmentations

- 11.2.1. Scenario Analysis

12. GLP-1 MARKET, BY TYPE OF MOLECULE

- 12.1. Assumptions and Methodology

- 12.2. GLP-1 Market: Distribution by Type of Molecule, 2020, 2024 and 2035

- 12.2.1. GLP-1 Market for Biologics, till 2035

- 12.2.2. GLP-1 Market for Small Molecules, till 2035

- 12.3. Data Triangulation and Validation

13. GLP-1 MARKET, BY ACTIVE COMPOUND USED

- 13.1. Assumptions and Methodology

- 13.2. GLP-1 Market: Distribution by Active Compound Used, 2020, 2024 and 2035

- 13.2.1. GLP-1 Market for Dulaglutide, till 2035

- 13.2.2. GLP-1 Market for liraglutide, till 2035

- 13.2.3. GLP-1 Market for Orforglipron, till 2035

- 13.2.4. GLP-1 Market for Retatrutide, till 2035

- 13.2.5. GLP-1 Market for Semaglutide, till 2035

- 13.2.6. GLP-1 Market for Survodutide, till 2035

- 13.2.7. GLP-1 Market for Tirzepatide, till 2035

- 13.2.8. GLP-1 Market for Other Active Compounds, till 2035

- 13.3 Data Triangulation and Validation

14. GLP-1 MARKET, BY TYPE OF GLP-1 AGONIST DRUGS

- 14.1. Assumptions and Methodology

- 14.2. GLP-1 Market: Distribution by Type Of GLP-1 Agonist Drugs, 2020, 2024 and 2035

- 14.2.1. GLP-1 Market for Long-acting GLP-1 Agonist, till 2035

- 14.2.2. GLP-1 Market for Short-acting GLP-1 Agonist, till 2035

- 14.3. Data Triangulation and Validation

15. GLP-1 MARKET, BY GLP-1 AGONIST

- 15.1. Assumptions and Methodology

- 15.2. GLP-1 Market: Distribution by GLP-1 Agonist, 2020, 2024 and 2035

- 15.2.1. GLP-1 Market for Single-agonist, till 2035

- 15.2.2. GLP-1 Market for Dual-agonist, till 2035

- 15.2.3. GLP-1 Market for Tri-agonist, till 2035

- 15.3. Data Triangulation and Validation

16. GLP-1 MARKET, BY ROUTE OF ADMINISTRATION

- 16.1. Assumptions and Methodology

- 16.2. GLP-1 Market: Distribution by Route of Administration, 2020, 2024 and 2035

- 16.2.1. GLP-1 Market for Oral Route, till 2035

- 16.2.2. GLP-1 Market for Parenteral Route, till 2035

- 16.3. Data Triangulation and Validation

17. GLP-1 MARKET, BY TARGET INDICATION

- 17.1. Assumptions and Methodology

- 17.2. GLP-1 Market: Distribution by Target Indication, 2020, 2024 and 2035

- 17.2.1. GLP-1 Market for Alzheimer's Disease, till 2035

- 17.2.2. GLP-1 Market for Non-Alcoholic Steatohepatitis, till 2035

- 17.2.3. GLP-1 Market for Obesity, till 2035

- 17.2.4. GLP-1 Market for Sleep Apnea, till 2035

- 17.2.5. GLP-1 Market for Type 2 Diabetes, till 2035

- 17.3. Data Triangulation and Validation

18. GLP-1 MARKET, BY GEOGRAPHY

- 18.1. Assumptions and Methodology

- 18.2. GLP-1 Market: Distribution by Geography, 2020, 2024 and 2035

- 18.2.1. GLP-1 Market in North America, till 2035

- 18.2.2. GLP-1 Market in Europe, till 2035

- 18.2.3. GLP-1 Market in Asia-Pacific, till 2035

- 18.2.4. GLP-1 Market in Latin America, till 2035

- 18.3. Data Triangulation and Validation

19. GLP-1 MARKET, SALES FORECAST OF GLP-1 DRUGS

- 19.1. Chapter Overview

- 19.2. Approved GLP-1 Drugs: Sales Forecast

- 19.2.1. Feisumei (Benaglutide) Sales Forecast

- 19.2.2. Fu Laimei (Polyethylene Glycol Loxenatide) Sales Forecast

- 19.2.3. Mounjaro (Tirzepatide) Sales Forecast

- 19.2.4. Ozempic (Semaglutide Subcutaneous) Sales Forecast

- 19.2.5. Rybelsus (Semaglutide Oral) Sales Forecast

- 19.2.6. Saxenda (Liraglutide) Sales Forecast

- 19.2.7. Trulicity (Dulaglutide) Sales Forecast

- 19.2.8. Victoza (Liraglutide) Sales Forecast

- 19.2.9. Wegovy (Semaglutide Subcutaneous) Sales Forecast

- 19.2.10. XULTOPHY (Insulin Degludec / Liraglutide) Sales Forecast

- 19.2.11. Zepbound (Tirzepatide) Sales Forecast

- 19.3. Phase III GLP-1 Drugs: Sales Forecast

- 19.3.1. GMA102 / Glutazumab Sales Forecast

- 19.3.2. JY09 Sales Forecast

- 19.3.3. LY3298176 / Tirzepatide Sales Forecast

- 19.3.4. Mazdutide / LY3305677/ IBI-362 Sales Forecast

- 19.3.5. Orforglipron / LY3502970 Sales Forecast

- 19.3.6. PB-119 / PEG-exenatide / Polyethylene glycol exenatide Sales Forecast

- 19.3.7. Retatrutide / LY3437943 Sales Forecast

- 19.3.8. Semaglutide Oral Sales Forecast

- 19.3.9. Semaglutide Subcutaneous Sales Forecast

- 19.3.10. Survodutide / BI 456906 Sales Forecast

- 19.3.11. XW003 / Ecnoglutide Sales Forecast

- 19.3.12. YN011-isupaglutide Sales Forecast

20. GLP-1 MARKET, BY LEADING DRUG DEVELOPERS

- 20.1. Chapter Overview

- 20.2. GLP-1 Market: Distribution by Leading Drug Developers, 2020 (USD Million)

- 20.3. GLP-1 Market: Distribution by Leading Drug Developers, 2024 (USD Million)

- 20.4. GLP-1 Market: Distribution by Leading Drug Developers, 2035 (USD Million)

21. APPENDIX 1: TABULATED DATA

22. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 List of GLP-1 Drugs

- Table 6.2 List of GLP-1 Drug Developers

- Table 7.1 AstraZeneca: Pipeline Portfolio

- Table 7.2 AstraZeneca: Recent Developments and Future Outlook

- Table 7.3 D&D Pharmatech: Pipeline Portfolio

- Table 7.4 D&D Pharmatech: Recent Developments and Future Outlook

- Table 7.5 Eli Lilly: Pipeline Portfolio

- Table 7.6 Eli Lilly: Recent Developments and Future Outlook

- Table 7.7 Novo Nordisk: Pipeline Portfolio

- Table 7.8 Novo Nordisk: Recent Developments and Future Outlook

- Table 7.9 Pfizer: Pipeline Portfolio

- Table 7.1 Pfizer: Recent Developments and Future Outlook

- Table 7.11 Sanofi: Pipeline Portfolio

- Table 7.12 Sanofi: Recent Developments and Future Outlook

- Table 7.13 Tonghua Dongbao Pharmaceutical: Pipeline Portfolio

- Table 7.14 Tonghua Dongbao Pharmaceutical: Recent Developments and Future Outlook

- Table 7.15 Vivani: Pipeline Portfolio

- Table 7.16 Vivani: Recent Developments and Future Outlook

- Table 8.1 Biolingus: Pipeline Portfolio

- Table 8.2 Boehringer Ingelheim: Pipeline Portfolio

- Table 8.3 Gmax Biopharm: Pipeline Portfolio

- Table 8.4 Hanmi Pharmaceutical: Pipeline Portfolio

- Table 8.5 PegBio: Pipeline Portfolio

- Table 8.6 QL Biopharma: Pipeline Portfolio

- Table 8.7 Roche: Pipeline Portfolio

- Table 8.8 Sciwind Biosciences: Pipeline Portfolio

- Table 8.9 Viking Therapeutics: Pipeline Portfolio

- Table 8.10 vTv Therapeutics: Pipeline Portfolio

- Table 9.1 GLP-1 Drug Market: List of Partnerships and Collaborations, Since 2020

- Table 11.1 List of GLP-1 Drugs Forecasted

- Table 21.1 GLP-1 Drugs: Distribution by Status of Development

- Table 21.2 GLP-1 Drugs: Distribution by Type of Molecule

- Table 21.3 GLP-1 Drugs: Distribution by Active Compound Used

- Table 21.4 GLP-1 Drugs: Distribution by Type of Agonist

- Table 21.5 GLP-1 Drugs: Distribution by Route of Administration

- Table 21.6 GLP-1 Drugs: Distribution by Dosing Frequency

- Table 21.7 GLP-1 Drugs: Distribution by Type of Therapy

- Table 21.8 GLP-1 Drugs: Distribution by Target Indication

- Table 21.9 GLP-1 Drugs: Therapeutic Area

- Table 21.10 GLP-1 Drugs Developer: Distribution by Year of Establishment

- Table 21.11 GLP-1 Drugs Developer: Distribution by Company Size

- Table 21.12 GLP-1 Drugs Developer: Distribution by Location of Headquarters

- Table 21.13 GLP-1 Drugs Developer: Distribution by Location of Headquarters (Country) and Status of Development

- Table 21.14 Most Active Developers: Distribution by Number of Drugs

- Table 21.15 AstraZeneca: Annual Revenues, FY 2021 Onwards (USD Billion)

- Table 21.16 D&D Pharmatech: Annual Revenues, FY 2021 Onwards (KRW Billion)

- Table 21.17 Eli Lilly: Annual Revenues, FY 2021 Onwards (USD Billion)

- Table 21.18 Novo Nordisk: Annual Revenues, FY 2021 Onwards (DKK Billion)

- Table 21.19 Pfizer: Annual Revenues, FY 2021 Onwards (USD Billion)

- Table 21.20 Sanofi: Annual Revenues, FY 2021 Onwards (EUR Billion)

- Table 21.21 Tonghua Dongbao Pharmaceutical: Annual Revenues, FY 2021 Onwards (RMB Billion)

- Table 21.22 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 21.23 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 21.24 Partnerships and Collaborations: Distribution by Focus Area

- Table 21.25 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partnership

- Table 21.26 Most Active Players: Distribution by Number of Partnerships

- Table 21.27 Partnerships and Collaborations: Distribution by Intracontinental and Intercontinental Deals

- Table 21.28 Partnerships and Collaborations: Distribution by Local and International Deals

- Table 21.29 Global GLP-1 Market, Historical Trends (since 2020) (USD Billion)

- Table 21.30 Global GLP-1 Market, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario, (USD Billion)

- Table 21.31 GLP-1 Market: Distribution by Type of Molecule

- Table 21.32 GLP-1 Market for Biologics, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.33 GLP-1 Market for Small Molecule, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.34 GLP-1 Market: Distribution by Active Compound Used

- Table 21.35 GLP-1 Market for Dulaglutide, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.36 GLP-1 Market for Liraglutide, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.37 GLP-1 Market for Orforglipron, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.38 GLP-1 Market for Retatrutide, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.39 GLP-1 Market for Semaglutide, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.40 GLP-1 Market for Survodutide, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.41 GLP-1 Market for Tirzepatide, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.42 GLP-1 Market for Other Active Compounds, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.43 GLP-1 Market: Distribution by Type of GLP-1 Agonist Drug

- Table 21.44 GLP-1 Market for Long-acting GLP-1 Agonist, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.45 GLP-1 Market for Short-acting GLP-1 Agonist, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.46 GLP-1 Market: Distribution by GLP-1 Agonist

- Table 21.47 GLP-1 Market for Single-agonist, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.48 GLP-1 Market for Dual-agonist, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.49 GLP-1 Market for Tri-agonist, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.50 GLP-1 Market: Distribution by Route of Administration

- Table 21.51 GLP-1 Market for Oral Route, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.52 GLP-1 Market for Parenteral Route, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.53 GLP-1 Market: Distribution by Target Indication

- Table 21.54 GLP-1 Market for Alzheimer's Disease, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.55 GLP-1 Market for Non-alcoholic Steatohepatitis, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.56 GLP-1 Market for Obesity, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.57 GLP-1 Market for Sleep Apnea, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.58 GLP-1 Market for Type 2 Diabetes, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.59 GLP-1 Market: Distribution by Geography

- Table 21.60 GLP-1 Market in North America, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.61 GLP-1 Market in US, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.62 GLP-1 Market in Canada, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.63 GLP-1 Market in Europe, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.64 GLP-1 Market in Germany, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.65 GLP-1 Market in UK, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.66 GLP-1 Market in France, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.67 GLP-1 Market in Italy, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.68 GLP-1 Market in Spain, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.69 GLP-1 Market in Asia Pacific, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.70 GLP-1 Market in China, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.71 GLP-1 Market in Japan, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.72 GLP-1 Market in Australia, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.73 GLP-1 Market in South Korea, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.74 GLP-1 Market in Latin America, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.75 GLP-1 Market in Brazil, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.76 GLP-1 Market in Argentina, Forecasted Estimates, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.77 Approved GLP-1 Drug, Feisumei (Benaglutide) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.78 Approved GLP-1 Drug, Fu Laimei (Polyethylene Glycol Loxenatide) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.79 Approved GLP-1 Drug, Mounjaro (Tirzepatide) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.80 Approved GLP-1 Drug, Ozempic (Semaglutide Subcutaneous) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.81 Approved GLP-1 Drug, Rybelsus (Semaglutide Oral) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.82 Approved GLP-1 Drug, Saxenda (Liraglutide) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.83 Approved GLP-1 Drug, Trulicity (Dulaglutide) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.84 Approved GLP-1 Drug, Victoza (Liraglutide) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.85 Approved GLP-1 Drug, Wegovy (Semaglutide Subcutaneous) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.86 Approved GLP-1 Drug, XULTOPHY (Insulin Degludec / Liraglutide) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.87 Approved GLP-1 Drug, Zepbound (Tirzepatide) Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.88 Phase III GLP-1 Drug, GMA102 / Glutazumab Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.89 Phase III GLP-1 Drug, JY09 Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.90 Phase III GLP-1 Drug, LY3298176 / Tirzepatide Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.91 Phase III GLP-1 Drug, Mazdutide / LY3305677/ IBI-362 Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.92 Phase III GLP-1 Drug, Orforglipron / LY3502970 Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.93 Phase III GLP-1 Drug, PB-119 / PEG-exenatide / Polyethylene glycol exenatide Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.94 Phase III GLP-1 Drug, Retatrutide / LY3437943 Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.95 Phase III GLP-1 Drug, Semaglutide Oral Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.96 Phase III GLP-1 Drug, Semaglutide Subcutaneous Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.97 Phase III GLP-1 Drug, Survodutide / BI 456906 Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.98 Phase III GLP-1 Drug, XW003 / Ecnoglutide Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.99 Phase III GLP-1 Drug, YN011-isupaglutide Sales Forecast, till 2035, Conservative, Base and Optimistic Scenario (USD Billion)

- Table 21.100 GLP-1 Market: Distribution by Leading Drug Developers (in terms of GLP-1 drug sales in 2020, Conservative, Base and Optimistic Scenario (USD Billion))

- Table 21.101 GLP-1 Market: Distribution by Leading Drug Developers (in terms of GLP-1 drug sales in the Current Year, Conservative, Base and Optimistic Scenario (USD Billion))

- Table 21.102 GLP-1 Market: Distribution by Leading Drug Developers (in terms of GLP-1 drug sales estimated in 2035, Conservative, Base and Optimistic Scenario (USD Billion))

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 3.1 Lessons Learnt from Past Recessions

- Figure 4.1 Executive Summary: Market Landscape

- Figure 4.2 Executive Summary: Partnerships and Collaborations

- Figure 4.3 Executive Summary: Market Sizing and Opportunity Analysis

- Figure 5.1 Advantage of GLP-1 Drugs

- Figure 5.2 Challenges Associated with GLP-1 Drugs

- Figure 5.3 Mechanisms of Action of GLP-1 Drugs

- Figure 6.1 GLP-1 Drugs: Distribution by Status of Development

- Figure 6.2 GLP-1 Drugs: Distribution by Type of Molecule

- Figure 6.3 GLP-1 Drugs: Distribution by Active Compound Used

- Figure 6.4 GLP-1 Drugs: Distribution by Type of Agonist

- Figure 6.5 GLP-1 Drugs: Distribution by Route of Administration

- Figure 6.6 GLP-1 Drugs: Distribution by Dosing Frequency

- Figure 6.7 GLP-1 Drugs: Distribution by Type of Therapy

- Figure 6.8 GLP-1 Drugs: Distribution by Target Indication

- Figure 6.9 GLP-1 Drugs: Distribution by Therapeutic Area

- Figure 6.10 GLP-1 Drugs Developer: Distribution by Year of Establishment

- Figure 6.11 GLP-1 Drugs Developer: Distribution by Company Size

- Figure 6.12 GLP-1 Drugs Developer: Distribution by Location of Headquarters

- Figure 6.13 GLP-1 Drugs Developer: Distribution by Location of Headquarters (Country) and Status of Development

- Figure 6.14 Most Active Developers: Distribution by Number of Drugs

- Figure 7.1 AstraZeneca: Annual Revenues, FY 2021 Onwards (USD Billion)

- Figure 7.2 D&D Pharmatech: Annual Revenues, FY 2021 Onwards (Korean Won Billion)

- Figure 7.3 Eli Lilly: Annual Revenues, FY 2021 Onwards (USD Billion)

- Figure 7.4 Novo Nordisk: Annual Revenues, FY 2021 Onwards (DKK Billion)

- Figure 7.5 Pfizer: Annual Revenues, FY 2021 Onwards (USD Billion)

- Figure 7.6 Sanofi: Annual Revenues, FY 2021 Onwards (EUR Billion)

- Figure 7.7 Tonghua Dongbao Pharmaceutical: Annual Revenues, FY 2021 Onwards (RMB Billion)

- Figure 9.1 Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 9.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 9.3 Partnerships and Collaborations: Distribution by Focus Area

- Figure 9.4 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partnership

- Figure 9.5 Most Active Players: Distribution by Number of Partnerships

- Figure 9.6 Partnerships and Collaborations: Distribution by Intracontinental and Intercontinental Deals

- Figure 9.7 Partnerships and Collaborations: Distribution by Local and International Deals

- Figure 10.1 GLP-1 Drugs: Market Drivers

- Figure 10.2 GLP-1 Drugs: Market Restraints

- Figure 10.3 GLP-1 Drugs: Market Opportunities

- Figure 10.4 GLP-1 Drugs: Market Challenges

- Figure 11.1 Global GLP-1 Market, Historical Trends and Forecasted Estimates, till 2035

- Figure 11.2 Global GLP-1 Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Figure 11.3 Global GLP-1 Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Figure 12.1 GLP-1 Market: Distribution by Type of Molecule

- Figure 12.2 GLP-1 Market for Biologics, till 2035 (USD Billion)

- Figure 12.3 GLP-1 Market for Small Molecule, till 2035 (USD Billion)

- Figure 13.1 GLP-1 Market: Distribution by Active Compound Used

- Figure 13.2 GLP-1 Market for Dulaglutide, till 2035 (USD Billion)

- Figure 13.3 GLP-1 Market for Liraglutide, till 2035 (USD Billion)

- Figure 13.4 GLP-1 Market for Orforglipron, till 2035 (USD Billion)

- Figure 13.5 GLP-1 Market for Retatrutide, till 2035 (USD Billion)

- Figure 13.6 GLP-1 Market for Semaglutide, till 2035 (USD Billion)

- Figure 13.7 GLP-1 Market for Survodutide, till 2035 (USD Billion)

- Figure 13.8 GLP-1 Market for Tirzepatide, till 2035 (USD Billion)

- Figure 13.9 GLP-1 Market for Other Active Compounds, till 2035 (USD Billion)

- Figure 14.1 GLP-1 Market: Distribution by Type of GLP-1 Agonist Drug

- Figure 14.2 GLP-1 Market for Long-acting GLP-1 Agonist, till 2035 (USD Billion)

- Figure 14.3 GLP-1 Market for Short-acting GLP-1 Agonist, till 2035 (USD Billion)

- Figure 15.1 GLP-1 Market: Distribution by GLP-1 Agonist

- Figure 15.2 GLP-1 Market for Single-agonist, till 2035 (USD Billion)

- Figure 15.3 GLP-1 Market for Dual-agonist, till 2035 (USD Billion)

- Figure 15.4 GLP-1 Market for Tri-agonist, till 2035 (USD Billion)

- Figure 16.1 GLP-1 Market: Distribution by Route of Administration

- Figure 16.2 GLP-1 Market for Oral, till 2035 (USD Billion)

- Figure 16.3 GLP-1 Market for Parenteral, till 2035 (USD Billion)

- Figure 17.1 GLP-1 Market: Distribution by Target Indication

- Figure 17.2 GLP-1 Market for Alzheimer's Disease, till 2035 (USD Billion)

- Figure 17.3 GLP-1 Market for Non-alcoholic Steatohepatitis, till 2035 (USD Billion)

- Figure 17.4 GLP-1 Market for Obesity, till 2035 (USD Billion)

- Figure 17.5 GLP-1 Market for Sleep Apnea, till 2035 (USD Billion)

- Figure 17.6 GLP-1 Market for Type 2 Diabetes, till 2035 (USD Billion)

- Figure 18.1 GLP-1 Market: Distribution by Geography

- Figure 18.2 GLP-1 Market in North America, till 2035 (USD Billion)

- Figure 18.3 GLP-1 Market in Europe, till 2035 (USD Billion)

- Figure 18.4 GLP-1 Market in Asia Pacific, till 2035 (USD Billion)

- Figure 18.5 GLP-1 Market in Latin America, till 2035 (USD Billion)

- Figure 19.1 Approved GLP-1 Drug, Feisumei (Benaglutide) Sales Forecast, till 2035 (USD Billion)

- Figure 19.2 Approved GLP-1 Drug, Fu Laimei (Polyethylene Glycol Loxenatide) Sales Forecast, till 2035 (USD Billion)

- Figure 19.3 Approved GLP-1 Drug, Mounjaro (Tirzepatide) Sales Forecast, till 2035 (USD Billion)

- Figure 19.4 Approved GLP-1 Drug, Ozempic (Semaglutide Subcutaneous) Sales Forecast, till 2035 (USD Billion)

- Figure 19.5 Approved GLP-1 Drug, Rybelsus (Semaglutide Oral) Sales Forecast, till 2035 (USD Billion)

- Figure 19.6 Approved GLP-1 Drug, Saxenda (Liraglutide) Sales Forecast, till 2035 (USD Billion)

- Figure 19.7 Approved GLP-1 Drug, Trulicity (Dulaglutide) Sales Forecast, till 2035 (USD Billion)

- Figure 19.8 Approved GLP-1 Drug, Victoza (Liraglutide) Sales Forecast, till 2035 (USD Billion)

- Figure 19.9 Approved GLP-1 Drug, Wegovy (Semaglutide Subcutaneous) Sales Forecast, till 2035 (USD Billion)

- Figure 19.10 Approved GLP-1 Drug, XULTOPHY (Insulin Degludec / Liraglutide) Sales Forecast, till 2035 (USD Billion)

- Figure 19.11 Approved GLP-1 Drug, Zepbound (Tirzepatide) Sales Forecast, till 2035 (USD Billion)

- Figure 19.12 Phase III GLP-1 Drug, GMA102 / Glutazumab Sales Forecast, till 2035 (USD Billion)

- Figure 19.13 Phase III GLP-1 Drug, JY09 Sales Forecast, till 2035 (USD Billion)

- Figure 19.14 Phase III GLP-1 Drug, LY3298176 / Tirzepatide Sales Forecast, till 2035 (USD Billion)

- Figure 19.15 Phase III GLP-1 Drug, Mazdutide / LY3305677/ IBI-362 Sales Forecast, till 2035 (USD Billion)

- Figure 19.16 Phase III GLP-1 Drug, Orforglipron / LY3502970 Sales Forecast, till 2035 (USD Billion)

- Figure 19.17 Phase III GLP-1 Drug, PB-119 / PEG-exenatide / Polyethylene glycol exenatide Sales Forecast, till 2035 (USD Billion)

- Figure 19.18 Phase III GLP-1 Drug, Retatrutide / LY3437943 Sales Forecast, till 2035 (USD Billion)

- Figure 19.19 Phase III GLP-1 Drug, Semaglutide Oral Sales Forecast, till 2035 (USD Billion)

- Figure 19.20 Phase III GLP-1 Drug, Semaglutide Subcutaneous Sales Forecast, till 2035 (USD Billion)

- Figure 19.21 Phase III GLP-1 Drug, Survodutide / BI 456906 Sales Forecast, till 2035 (USD Billion)

- Figure 19.22 Phase III GLP-1 Drug, XW003 / Ecnoglutide Sales Forecast, till 2035 (USD Billion)

- Figure 19.23 Phase III GLP-1 Drug, YN011-isupaglutide Sales Forecast, till 2035 (USD Billion)

- Figure 20.1 GLP-1 Market: Distribution by Leading Drug Developers (in terms of GLP-1 drug sales in 2020 (USD Billion))

- Figure 20.2 GLP-1 Market: Distribution by Leading Drug Developers (in terms of GLP-1 drug sales in the Current Year (USD Billion))

- Figure 20.3 GLP-1 Market: Distribution by Leading Drug Developers (in terms of GLP-1 drug sales estimated in 2035 (USD Billion))