|

市场调查报告书

商品编码

1723658

非病毒药物递输系统市场(第3版):递送分子类型,递送生技药品类别,所使用的赋形剂类别,标靶治疗各领域,主要各地区,各主要企业:2035年前的产业趋势与全球预测Non-Viral Drug Delivery Systems Market:3rd Edition by Type of Molecule Delivered, Type of Biologic Delivered, Type of Vehicle Used, Target Therapeutic Area, Key Geographical Regions and Leading Players: Industry Trends and Global Forecasts, till 2035 |

||||||

非病毒药物递送系统市场

全球非病毒药物递送系统市场目前价值 86 亿美元。预计到 2035 年,该市场将达到 204 亿美元,预测期内复合年增长率为 9.0%。

非病毒药物递送系统市场机会分布在以下细分领域:

递送分子类型

- 生技药品

- 低分子

递送生技药品类别

- RNA

- DNA

- 蛋白质/胜肽

- 抗体

所使用的赋形剂类别

- 奈米粒子

- 细胞外小胞

- 聚合物

- 寡核甘酸

- 细胞贯通胜肽

标靶治疗各领域

- 肿瘤疾病

- 感染疾病

- 心血管疾病

- 遗传基因疾病

- 肝损伤

- 代谢疾病

- 神经疾病

- 肺部疾病

- 罕见疾病

- 其他的疾病

付款方式

- 契约退职金

- 里程碑

主要各地区

- 北美(美国及加拿大)

- 欧洲(英国,德国,比利时,爱尔兰,丹麦,其他欧洲整个地区)

- 亚太地区(韩国,澳洲,中国)

非病毒药物递送系统市场:成长与趋势

非病毒药物递送是一种创新方法,它为将遗传物质和生物治疗药物递送至细胞、组织和器官提供了一种有前景的病毒载体替代方案。近年来,多种细胞内非病毒药物递送方法因其高效的药物递送效率而获得了广泛支持。利害关係人对细胞内非病毒药物递送方法日益增长的兴趣,很可能源于非病毒载体相比病毒载体的诸多优势,包括更高的安全性、对靶细胞的高特异性以及更低的激活免疫反应的风险。此外,非病毒载体降低了诱变的可能性,使其成为基因转移的首选方案。与病毒载体(例如腺相关病毒载体)相比,它们还可以携带更大的有效载荷,从而拓宽了其在标靶药物递送中的应用。非病毒载体的典型例子包括奈米颗粒(尤其是脂质奈米颗粒)、细胞穿透胜肽 (CPP) 和基于外泌体的药物递送系统。这些非病毒载体利用特殊的机制来靶向细胞内的蛋白质和酶,通常利用结合和包封技术将 RNA、胜肽、抗体、蛋白质和 DNA 递送到细胞内。标靶药物输送可确保治疗药物以适当的浓度到达预期的生理作用部位,从而最大限度地提高临床疗效,同时最大限度地减少脱靶效应和全身毒性。重要的是,细胞生物学和药物输送系统的进步发现了几个潜在的治疗靶点,这些靶点先前由于位于细胞膜内而被认为无法治疗。

2024年9月,NanoSyrinx获得1,300万美元的种子轮融资,用于推进其细胞内奈米註射器技术,该技术旨在将生物製剂输送到细胞内难以到达的部位。 NanoSyrinx 董事会主席 Edwin Moses 博士就此进展表示: "NanoSyrinx 的技术有望为细胞内药物递送领域现有的课题带来积极变化。我很高兴加入董事会,进一步推动本轮融资,并支持公司及其领导团队进一步开发这一独特的平台,该平台有望创造巨大的价值,并真正改善患者的生活。"

研究表明,超过 20% 的人类蛋白质组位于细胞膜内,包括致癌蛋白、细胞代谢调节剂和关键信号通路的组成部分。鑑于小分子药物仅能有效标靶10%的人类基因组,业内专家认为,细胞内疗法,尤其是基因递送,将成为传统疗法的可行替代方案。针对非病毒药物递送的需求日益增长,加上非病毒药物递送系统开发技术创新的持续推进,预计将在预测期内推动市场显着成长。

非病毒药物递送系统市场:关键洞察

本报告深入探讨了非病毒药物递送系统市场的现状,并识别了该行业的潜在成长机会。报告的主要内容包括:

- 超过45%的系统/技术采用载体来包裹药物并促进其递送至细胞质。

- 显然,各利害关係人对非病毒药物递送系统日益增长的兴趣,已促使相关知识资本的扩张。

- 超过 50% 的利害关係人已建立合作伙伴关係,旨在授权、整合和评估各种非病毒药物输送系统/技术。

- 由于对有效非病毒疗法的需求不断增长,预计未来十年非病毒药物输送系统整体市场将成长 9%。

非病毒药物递送系统市场:主要细分市场

依分子类型划分,全球市场分为小分子和生物製剂。其中,生物製剂占据了目前整体市场的最大占有率。这归功于它们能够靶向特定的复杂生物途径,并提供更高的精准度和疗效。

依生物製剂递送方式划分,全球非病毒药物递送系统市场分为RNA、DNA、蛋白质/胜肽及抗体。目前,RNA占据了整体市场的最大占有率。然而,值得注意的是,抗体领域预计在预测期内将以相对较高的复合年增长率成长。

根据所用辅料的类型,全球非病毒药物递送系统市场细分为奈米颗粒、细胞外囊泡、聚合物、寡核苷酸和细胞穿透胜肽。目前,奈米颗粒领域在非病毒药物递送系统市场中占据领先地位。需要强调的是,这一趋势未来不太可能改变。这是由于奈米颗粒具有独特的尺寸和较大的表面积与体积比,与其他药物递送载体相比,奈米颗粒可以精确设计以靶向特定组织并实现药物的可控释放。

根据目标治疗领域,全球非病毒药物递送系统市场细分为肿瘤、传染病、心血管疾病、遗传疾病、肝病、代谢性疾病、神经系统疾病、肺部疾病、罕见疾病和其他疾病。目前,市场主要由肿瘤治疗系统的收入主导。然而,由于迫切需要针对快速进化的病原体的有效标靶治疗,预计传染病市场在预测期内将呈现高成长率。

全球非病毒药物输送系统市场依据采用的付款方式,分为一次性付款和里程碑付款。目前,首付款部分在非病毒药物输送系统市场中占有最高占有率。此外,我们想强调的是,这种趋势在未来不太可能改变。

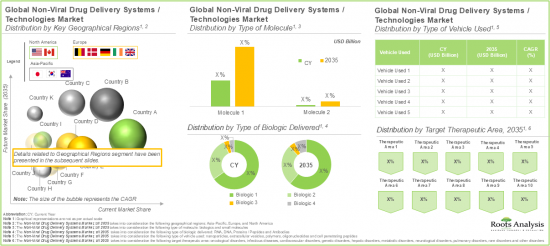

市场按主要地区细分为北美、欧洲和亚太地区。目前,北美占据最大的市场占有率。此外,值得注意的是,预计亚太地区在预测期内将以相对较高的复合年增长率成长。

报告解答的关键问题

- 目前有多少家公司进入这个市场?

- 该市场中的关键公司

- 可能影响该市场发展的因素

- 当前与未来的市场规模

- 该市场的复合年增长率

- 当前和未来的市场机会在主要细分市场中如何分配?

为何购买此报告?

- 本报告提供全面的市场分析,并针对整体市场和特定细分市场提供详细的收入预测。这些资讯对于成熟的市场领导者和新进入者都极具价值。

- 利害关係人可以利用本报告深入了解市场中的竞争动态。透过分析竞争格局,企业可以做出明智的决策,优化市场定位并制定有效的市场进入策略。

- 本报告为利害关係人提供了全面的市场概述,包括关键推动因素、阻碍因素和课题。这些资讯使利害关係人能够掌握市场趋势,并做出基于数据的决策,从而掌握成长前景。

更多优势

- PPT Insights 套件

- 免费赠送包含报告 Q 中所有分析模组的 Excel 资料包

- 10% 免费内容客製化

- 由我们的研究团队提供详细的报告讲解

- 如果报告超过 6-12 个月,可免费更新报告

本报告提供全球非病毒药物递输系统市场相关调查,提供市场概要,以及通知的各分子类型,送交的生技药品类别,所使用的赋形剂类别,标靶治疗各领域,主要各地区,各主要企业趋势,及加入此市场的主要企业简介等资讯。

目录

章节I:报告概要

第1章 序文

第2章 调查手法

第3章 市场动态

第4章 宏观经济指标

章节II:定性性的洞察

第5章 摘要整理

第6章 简介

章节III:市场概要

第7章 技术的形势

- 章概要

- 非病毒性药物输送:系统/技术的全体形势

- 非病毒性药物输送:系统/技术供应商的整体形势

第8章 技术竞争力分析

- 章概要

- 前提主要的参数

- 调查手法

- 非病毒药物递输系统/技术:技术竞争力分析

章节IV:企业简介

第9章 企业简介

- 章概要

- Arcturus Therapeutics

- Bio-Path Holdings

- CureVac

- Entos Pharmaceuticals

- etherna

- Matinas Biopharma

- MDimune

- PCI Biotech

章节V:市场趋势

第10章 专利分析

- 章概要

- 范围调查手法

- 非病毒药物递输系统/技术:专利分析

- 专利评估分析

第11章 伙伴关係和合作

第12章 机会评估组成架构:KALBACH革新模式,竞争评估

组成架构和BCG矩阵

- 章概要

- KALBACH革新模式

- 竞争评估组成架构

- BCG矩阵

章节VI:市场机会分析

第13章 全球非病毒药物递输系统市场

- 章概要

- 主要的前提调查手法

- 全球非病毒药物递输系统市场,2035年前的预测

- 主要的市场区隔

第14章 被非病毒药物递输系统市场(通知的各分子类型)

第15章 被非病毒药物递输系统市场(通知的生技药品类别)

第16章 非病毒药物递输系统市场(所使用的赋形剂类别)

第17章 非病毒药物递输系统市场(各对象治疗领域)

第18章 非病毒药物递输系统市场(付款方式)

第19章 非病毒药物递输系统市场(主要各地区)

第20章 非病毒药物递输系统市场(各主要企业)

章节VII:其他的垄断的洞察

第21章 结论

第22章 执行洞察

第23章 附录1:表格形式资料

第24章 附录2:企业·团体一览

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET

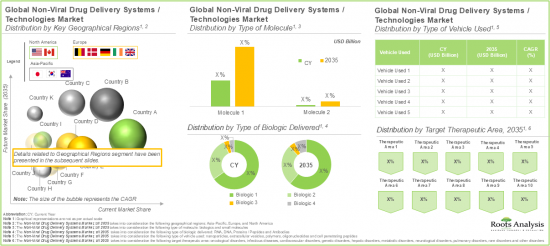

As per Roots Analysis, the global non-viral drug delivery systems market size is valued at $8.6 billion in the current year and is projected to reach $20.4 billion by 2035, growing at a CAGR of 9.0% during the forecast period.

The opportunity for non-viral drug delivery systems market has been distributed across the following segments:

Type of Molecule Delivered

- Biologics

- Small Molecules

Type of Biologics Delivered

- RNA

- DNA

- Proteins / Peptides

- Antibodies

Type of Vehicle Used

- Nanoparticles

- Extracellular Vesicles

- Polymers

- Oligonucleotides

- Cell Penetrating Peptides

Target Therapeutic Area

- Oncological Disorders

- Infectious Diseases

- Cardiovascular Disorders

- Genetic Disorders

- Hepatic Disorders

- Metabolic Disorders

- Neurological Disorders

- Pulmonary Disorders

- Rare Disorders

- Other Disorders

Type of Payment Employed

- Upfront Payments

- Milestone Payments

Key Geographical Regions

- North America (US and Canada)

- Europe (UK, Germany, Belgium, Ireland, Denmark and Rest of Europe)

- Asia-Pacific (South Korea, Australia and China)

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: GROWTH AND TRENDS

Non-viral drug delivery represents an innovative approach that serves as a promising alternative to viral vectors for delivering genetic material or biotherapeutics to cells, tissues or organs. Notably, in recent years, several intracellular non-viral drug delivery methods have gained significant traction owing to their efficiency in delivering drugs. This growing interest of stakeholders in intracellular non-viral drug delivery methods can be attributed to the various advantages associated with non-viral vectors over viral vectors, including enhanced safety, higher specificity towards the target cells and a reduced risk of activating immune responses. Moreover, non-viral vectors lower the likelihood of mutagenesis, making them a preferred option for gene delivery. They can also carry larger payloads compared to the viral vectors, such as adeno-associated viral vectors, increasing their applications in targeted drug delivery. Notable examples of non-viral vectors include nanoparticles (particularly lipid nanoparticles), cell penetrating peptides (CPPs) and exosome-based drug delivery systems. These non-viral vectors leverage specialized mechanisms to target intracellular proteins and enzymes, typically employing conjugation and / or encapsulation techniques to deliver RNA, peptides, antibodies, proteins and DNA into cells. Targeted drug delivery ensures that an adequate concentration of therapeutic agents reaches the intended physiological site of action, maximizing the clinical benefits while minimizing off-targets effects and systemic toxicity. Additionally, it is important to highlight that the ongoing advancements in cell biology and drug delivery systems have uncovered several potential therapeutic targets that were previously considered incurable owing to their localization within the cell membrane.

In September 2024, NanoSyrinx secured $13 million in seed funding to advance its intracellular nanosyringe technology, designed to target biologics in hard-to-reach sites within cells. Reflecting on the development, Dr. Edwin Moses (Chairman of Board of Directors, NanoSyrinx), quoted that "NanoSyrinx's technology promises to make a positive difference to the existing challenges associated with intracellular delivery of therapeutics. I am delighted to join the Board and help build on the momentum of this latest fundraise, to support the company and its leadership team in the further development of this unique platform which has the potential to create enormous value and make a real difference to patients' lives".

Research suggests that over 20% of the human proteome, including oncogenic proteins, cell metabolism regulators, and components of key signaling pathways are localized within the cell membrane. Given that only 10% of the human genome can be effectively targeted with small molecule drugs, industry experts see intracellular therapies, particularly gene delivery, as a compelling alternative to conventional treatments. Given the increasing demand for targeted non-viral drug delivery coupled with the ongoing pace of innovation in the development of non-viral drug delivery systems, the overall market is anticipated to witness substantial market growth during the forecast period.

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: KEY INSIGHTS

The report delves into the current state of the non-viral drug delivery systems market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

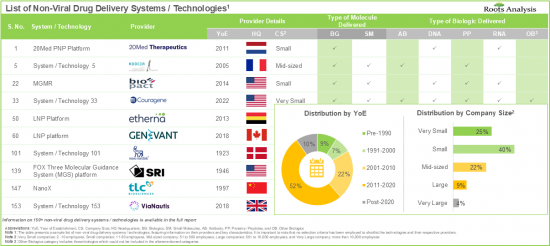

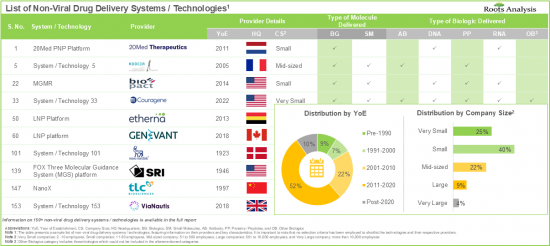

- More than 45% of the systems / technologies employ vehicles that encapsulate the drug payloads and facilitate their delivery into the cytosol of the cell.

- The rising interest of various stakeholders in non-viral drug delivery systems has evidently led to the expansion of associated intellectual capital; notably, most (54%) of the patents were filed in the North American jurisdiction.

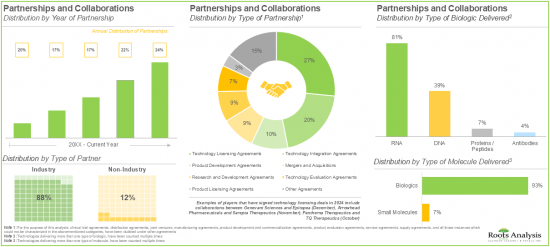

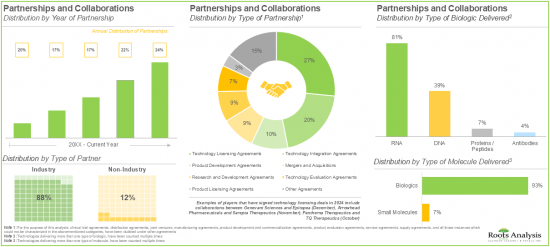

- More than 50% of the partnerships were signed by the stakeholders to license, integrate and evaluate different non-viral drug delivery systems / technologies; most of the inked deals focused on biologics, particularly RNA.

- Owing to the rising demand for effective non-viral therapeutics, the overall non-viral drug delivery systems market is anticipated to witness a growth of 9% over the next decade.

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: KEY SEGMENTS

Biologics are Likely to Hold the Largest Share of the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of molecule, the global market is segmented into small molecules and biologics. Amongst these types, the biologics segment occupies the largest share of the current overall market. This can be attributed to their ability to target specific, complex biological pathways, offering greater precision and efficacy.

Based on the Type of Biologic Delivered, RNA Segment Captures the Majority of the Current Market Share

Based on the type of biologic delivered, the global non-viral drug delivery systems market is segmented into RNA, DNA, proteins / peptides and antibodies. Presently, the RNA segment occupies the highest share of the overall market. However, it is important to note that the antibodies' segment is anticipated to grow at a relatively higher CAGR during the forecast period.

Nanoparticles Segment is Likely to Hold the Largest Share in the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of vehicle used, the global non-viral drug delivery systems market is segmented into nanoparticles, extracellular vesicles, polymers, oligonucleotides and cell penetrating peptides. Currently, nanoparticles segment leads the non-viral drug delivery systems market. It is important to highlight that this trend is unlikely to change in the future as well. This is due to the unique size and large surface area-to-volume ratio of nanoparticles which enables them to be precisely engineered in order to target specific tissues, allowing for controlled drug release as compared to other drug delivery vehicles.

Non-Viral Drug Delivery Systems Market for Oncological Disorders is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the target therapeutic area, the global non-viral drug delivery systems market is segmented across oncological disorders, infectious diseases, cardiovascular disorders, genetic disorders, hepatic disorders, metabolic disorders, neurological disorders, pulmonary disorders, rare disorders and other disorders. Presently, the market is dominated by the revenues generated through the systems intended for the treatment of oncological disorders. However, the market for infectious disease is anticipated to witness a higher growth rate during the forecast period owing to the pressing need for effective targeted treatments against rapidly evolving pathogens.

Upfront Payments are Likely to Dominate the Non-Viral Drug Delivery Systems Market During the Forecast Period

Based on the type of payment employed, the global non-viral delivery systems market is distributed across upfront payments and milestone payments. Presently, the upfront segment occupies the highest share in the non-viral drug delivery systems market. Further, it is important to highlight that this trend is unlikely to change in the future as well.

North America Accounts for the Largest Share in the Market

Based on key geographical regions, the market is segmented into North America, Europe, and Asia Pacific. In the current scenario, North America is likely to capture the largest market share. Further, it is worth highlighting that Asia-Pacific is expected to grow at a relatively high CAGR during the forecast period.

Example Players in the Non-Viral Drug Delivery Systems Market

- Arcturus Therapeutics

- Bio-Path Holdings

- CureVac

- Entos Pharmaceuticals

- etherna

- Matinas Biopharma

- MDimune

- PCI Biotech

NON-VIRAL DRUG DELIVERY SYSTEMS MARKET: RESEARCH COVERAGE

The report on non-viral drug delivery systems market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of non-viral drug delivery systems market, focusing on key market segments, including [A] type of molecule delivered, [B] type of biologic delivered, [C] type of vehicle used, [D] target therapeutic area, [E] type of payment employed, [F] key geographical regions, and [G] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Technology Market Landscape: A comprehensive evaluation of non-viral drug delivery systems / technologies, based on several relevant parameters, such as [A] type of molecule delivered, [B] type of biologic delivered, [C] type of drug interaction, and [D] type of vehicle used.

- Non-Viral Drug Delivery Systems / Technology Providers Landscape: The report features a list of systems / technology providers engaged in the non-viral drug delivery domain, along with analyses based on [A] year of establishment, [B] company size [C] location of headquarters, and [D] most active players.

- Technology Competitiveness Analysis: An insightful competitiveness analysis of the non-viral drug delivery systems / technologies, based on various relevant parameters, such as [A] company strength, and [B] technology strength.

- Company Profiles: Comprehensive profiles of key industry players in the non-viral drug delivery systems domain, featuring information on [A] company overview, [B] financial information (if available), [C] technology portfolio, [D] recent developments, and [E] future outlook statements.

- Patent Analysis: An in-depth analysis of various patents that have been filed / granted by various systems / technology providers related to non-viral drug delivery, based on various relevant parameters, such as [A] type of patent, [B] publication year, [C] application year, [D] issuing authority, [E] type of player, [F] top sections, [G] leading industry players (in terms of number of patents), [H] leading non-industry players (in terms of number of patents), [I] leading inventors, [J] patent benchmarking analysis, and [K] patent valuation.

- Partnerships and Collaborations: A detailed analysis of partnerships inked between stakeholders in the non-viral drug delivery market, since 2020, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] type of molecule delivered, [E] type of biologic delivered, [F] therapeutic area, [G] most active players (in terms of number of partnerships), and [H] geography.

- Opportunity Assessment Framework, Kalbach Innovation Model, Competitive Assessment Framework and BCG Matrix: An insightful framework which provides Kalbach, Ansoff and BCG matrix for respective non-viral drug delivery technologies currently employed by stakeholders across four zones of evaluation and product portfolio matrix based on various parameters, such as [A] number of drugs in the pipeline, [B] number of companies, [C] deal amount, [D] partnership activity, [E] trends related to grants, [F] number of publications, [G] google hits and qualitative scoring. It also provides Kalbach, Ansoff and BCG matrix for respective non-viral drug delivery technologies currently employed by stakeholders.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Need for Targeted Drug Delivery

- 6.3. Advanced Approaches for Delivery of Drug Payloads

- 6.3.1. Nanoparticular Delivery Systems

- 6.3.1.1. Liposomes

- 6.3.1.2. Nanoparticles / Microparticles

- 6.3.1.3. Poly-ethylene Glycol (PEG)

- 6.3.1.4. Cell Penetrating Peptides (CPPs)

- 6.3.2. Other Drug Delivery Technologies

- 6.3.1. Nanoparticular Delivery Systems

- 6.4. Future Perspectives

SECTION III: MARKET OVERVIEW

7. TECHNOLOGY LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Non-Viral Drug Delivery: Overall Systems / Technology Landscape

- 7.2.1. Analysis by Type of Molecule Delivered

- 7.2.2. Analysis by Type of Biologic Delivered

- 7.2.3. Analysis by Type of Drug Interaction

- 7.2.4. Analysis by Type of Vehicle Used

- 7.2.5. Analysis by Most Active Players

- 7.3. Non-Viral Drug Delivery: Overall Systems / Technology Providers Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Analysis by Company Size and Location of Headquarters

- 7.3.5. Analysis by Company Size and Type of Molecule Delivered

8. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Non-Viral Drug Delivery Systems / Technologies: Technology Competitiveness Analysis

- 8.4.1. Non-Viral Drug Delivery Systems / Technologies of Players based in North America

- 8.4.2. Non-Viral Drug Delivery Systems / Technologies of Players based in Europe

- 8.4.3. Non-Viral Drug Delivery Systems / Technologies of Players based in Asia-Pacific and Rest of the World

SECTION IV: COMPANY PROFILES

9. COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Arcturus Therapeutics

- 9.2.1. Company Overview

- 9.2.2. Technology Portfolio

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Bio-Path Holdings

- 9.4. CureVac

- 9.5. Entos Pharmaceuticals

- 9.6. etherna

- 9.7. Matinas Biopharma

- 9.8. MDimune

- 9.9. PCI Biotech

SECTION V: MARKET TRENDS

10. PATENT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. Non-Viral Drug Delivery Systems / Technologies: Patent Analysis

- 10.3.1. Analysis by Type of Patent

- 10.3.2. Analysis by Publication Year

- 10.3.3. Analysis by Application Year

- 10.3.4. Analysis by Cumulative Number of Annual Granted Patents

- 10.3.5. Analysis by Cumulative Number of Patent Applications

- 10.3.6. Analysis by Issuing Authority

- 10.3.7. Analysis by Type of Player

- 10.3.8. Analysis by Top Sections

- 10.3.9. Leading Industry Players: Analysis by Number of Patents

- 10.3.10. Leading Non-Industry Players: Analysis by Number of Patents

- 10.3.11. Leading Inventors: Analysis by Number of Patents

- 10.3.12. Non-Viral Drug Delivery Systems / Technologies: Patent Benchmarking Analysis

- 10.4. Analysis by Patent Valuation

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Partnerships and Collaborations

- 11.3. Partnership Models

- 11.4. Non-Viral Drug Delivery Systems / Technologie: List of Partnerships and Collaborations

- 11.4.1. Analysis by Year of Partnership

- 11.4.2. Analysis by Type of Partnership

- 11.4.3. Analysis by Year and Type of Partnership

- 11.4.4. Analysis by Type of Partner

- 11.4.5. Analysis by Type of Molecule Delivered

- 11.4.6. Analysis by Type of Biologic Delivered

- 11.4.7. Analysis by Therapeutic Area

- 11.4.8. Most Active Players: Analysis by Number of Partnerships

- 11.4.9. Analysis by Geography

- 11.4.9.1. Local and International Agreements

- 11.4.9.2. Intracontinental and Intercontinental Agreements

12. OPPORTUNITY ASSESSMENT FRAMEWORK: KALBACH INNOVATION MODEL, COMPETITIVE ASSESSMENT

FRAMEWORK AND BCG MATRIX

- 12.1 Chapter Overview

- 12.2. Kalbach Innovation Model

- 12.2.1. Key Assumptions and Methodologies

- 12.2.2. Analysis by Trends in Research Activity

- 12.2.3. Analysis by Trends in Investment Activity

- 12.2.4. Analysis by Trends in Partnership Activity

- 12.2.5. Analysis by Number of Technologies

- 12.2.6. Analysis by Trends in Deal Amount

- 12.2.7. Analysis by Number of Google Hits

- 12.2.8. Qualitative and Quantitative Assessment based on Secondary and Primary Research

- 12.2.9. Kalbach Innovation Model: Analysis Output

- 12.3. Competitive Assessment Framework

- 12.3.1. Key Assumptions and Methodology

- 12.3.2. Competitive Assessment Framework: Analysis Output

- 12.4. BCG Matrix

- 12.4.1. Key Assumptions and Methodology

- 12.4.2. BCG Matrix: Output Analysis

SECTION VI: MARKET OPPORTUNITY ANALYSIS

13. GLOBAL NON-VIRAL DRUG DELIVERY SYSTEMS MARKET

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Non-Viral Drug Delivery Systems Market, Forecasted Estimates, Till 2035

- 13.3.1. Multivariate Scenario Analysis

- 13.3.1.1. Conservative Scenario

- 13.3.1.2. Optimistic Scenario

- 13.3.1. Multivariate Scenario Analysis

- 13.4. Key Market Segmentations

14. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF MOLECULE DELIVERED

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Molecule Delivered

- 14.3.1. Non-Viral Drug Delivery Systems Market for Biologics, Forecasted Estimates, Till 2035

- 14.3.2. Non-Viral Drug Delivery Systems Market for Small Molecules, Forecasted Estimates, Till 2035

- 14.4. Data Triangulation and Validation

15. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF BIOLOGIC DELIVERED

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Biologic Delivered

- 15.3.1. Non-Viral Drug Delivery Systems Market for RNA, Forecasted Estimates, Till 2035

- 15.3.2. Non-Viral Drug Delivery Systems Market for DNA, Forecasted Estimates, Till 2035

- 15.3.3. Non-Viral Drug Delivery Systems Market for Proteins / Peptides, Forecasted Estimates, Till 2035

- 15.3.4. Non-Viral Drug Delivery Systems Market for Antibodies, Forecasted Estimates, Till 2035

- 15.4. Data Triangulation and Validation

16. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF VEHICLE USED

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Non-Viral Drug Delivery Systems Market: Distribution by Type of Vehicle Used

- 16.3.1. Non-Viral Drug Delivery Systems Market for Nanoparticles, Forecasted Estimates, Till 2035

- 16.3.2. Non-Viral Drug Delivery Systems Market for Extracellular Vesicles, Forecasted Estimates, Till 2035

- 16.3.3. Non-Viral Drug Delivery Systems Market for Polymers, Forecasted Estimates, Till 2035

- 16.3.4. Non-Viral Drug Delivery Systems Market for Oligonucleotides, Forecasted Estimates, Till 2035

- 16.3.5. Non-Viral Drug Delivery Systems Market for Cell Penetrating Peptides, Forecasted Estimates, Till 2035

- 16.4. Data Triangulation and Validation

17. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TARGET THERAPEUTIC AREA

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Non-Viral Drug Delivery Systems Market: Distribution by Target Therapeutic Area

- 17.3.1. Non-Viral Drug Delivery Systems Market for Oncological Diseases, Forecasted Estimates, Till 2035

- 17.3.2. Non-Viral Drug Delivery Systems Market for Infectious Disorders, Forecasted Estimates, Till 2035

- 17.3.3. Non-Viral Drug Delivery Systems Market for Cardiovascular Disorders, Forecasted Estimates, Till 2035

- 17.3.4. Non-Viral Drug Delivery Systems Market for Genetic Diseases, Forecasted Estimates, Till 2035

- 17.3.5. Non-Viral Drug Delivery Systems Market for Hepatic Disorders, Forecasted Estimates, Till 2035

- 17.3.6. Non-Viral Drug Delivery Systems Market for Metabolic Disorders, Forecasted Estimates, Till 2035

- 17.3.7. Non-Viral Drug Delivery Systems Market for Neurological Disorders, Forecasted Estimates, Till 2035

- 17.3.8. Non-Viral Drug Delivery Systems Market for Pulmonary Disorders, Forecasted Estimates, Till 2035

- 17.3.9. Non-Viral Drug Delivery Systems Market for Rare Disorders, Forecasted Estimates, Till 2035

- 17.3.10. Non-Viral Drug Delivery Systems Market for Other Disorders, Forecasted Estimates, Till 2035

- 17.4. Data Triangulation and Validation

18. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY TYPE OF PAYMENT EMPLOYED

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Non-Viral Drug Delivery Systems Market: Distribution by Type of Payment Employed

- 18.4.1. Non-Viral Drug Delivery Systems Market for Upfront Payments, Forecasted Estimates, Till 2035

- 18.4.2. Non-Viral Drug Delivery Systems Market for Milestone Payments, Forecasted Estimates, Till 2035

- 18.5. Data Triangulation and Validation

19. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY KEY GEOGRAPHICAL REGIONS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Non-Viral Drug Delivery Systems Market: Distribution by Key Geographical Regions

- 19.3.1. Non-Viral Drug Delivery Systems Market in North America, Forecasted Estimates, Till 2035

- 19.3.2. Non-Viral Drug Delivery Systems Market in Europe, Forecasted Estimates, Till 2035

- 19.3.3. Non-Viral Drug Delivery Systems Market in Asia-Pacific, Forecasted Estimates, Till 2035

- 19.4. Penetration-Growth (P-G) Matrix

- 19.5. Data Triangulation and Validation

20. NON-VIRAL DRUG DELIVERY SYSTEMS MARKET, BY LEADING PLAYERS

SECTION VII: OTHER EXCLUSIVE INSIGHTS

21. CONCLUDING REMARKS

22. EXECUTIVE INSIGHTS

- 22.1. Chapter Overview

- 22.2. Small Company, Israel

- 22.2.1. Company Snapshot

- 22.2.2. Interview Transcript

- 22.3. Small Company, US

- 22.3.1. Company Snapshot

- 22.3.2. Interview Transcript

- 22.4. Small Company, France

- 22.4.1. Company Snapshot

- 22.4.2. Interview Transcript

- 22.5. Mid-sized Company, US

- 22.5.1. Company Snapshot

- 22.5.2. Interview Transcript

- 22.6. Small Company, Norway

- 22.6.1. Company Snapshot

- 22.6.2. Interview Transcript

- 22.7. Large Company, US

- 22.7.1. Company Snapshot

- 22.7.2. Interview Transcript

23. APPENDIX 1: TABULATED DATA

24. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 7.1 Non-Viral Drug Delivery Systems / Technologies: Information on Type of Molecule Delivered and Type of Biologic Delivered

- Table 7.2 Non-Viral Drug Delivery Systems / Technologies: Information on Type of Interaction, Type of Vehicle Used and Number of Approved Drugs

- Table 7.3 Non-Viral Drug Delivery Systems / Technologies: List of Providers

- Table 9.1 Non-Viral Drug Delivery Systems / Technology Domain: List of Companies Profiled

- Table 9.2 Arcturus Therapeutics: Company Overview

- Table 9.3 Arcturus Therapeutics: Technology Portfolio

- Table 9.4 Arcturus Therapeutics: Recent Developments and Future Outlook

- Table 9.5 Bio-Path Holdings: Company Overview

- Table 9.6 Bio-Path Holdings: Technology Portfolio

- Table 9.7 Bio-Path Holdings: Recent Developments and Future Outlook

- Table 9.8 CureVac: Company Overview

- Table 9.9 CureVac: Technology Portfolio

- Table 9.10 CureVac: Recent Developments and Future Outlook

- Table 9.11 Entos Pharmaceuticals: Company Overview

- Table 9.12 Entos Pharmaceuticals: Technology Portfolio

- Table 9.13 Entos Pharmaceuticals: Recent Developments and Future Outlook

- Table 9.14 etherna: Company Overview

- Table 9.15 etherna: Technology Portfolio

- Table 9.16 etherna: Recent Developments and Future Outlook

- Table 9.17 Matinas Biopharma: Company Overview

- Table 9.18 Matinas Biopharma: Technology Portfolio

- Table 9.19 Matinas Biopharma: Recent Developments and Future Outlook

- Table 9.20 MDimune: Company Overview

- Table 9.21 MDimune: Technology Portfolio

- Table 9.22 MDimune: Recent Developments and Future Outlook

- Table 9.23 PCI Biotech: Company Overview

- Table 9.24 PCI Biotech: Technology Portfolio

- Table 9.25 PCI Biotech: Recent Developments and Future Outlook

- Table 10.1 Patent Analysis: Top Sections

- Table 10.2 Patent Analysis: Top Symbols

- Table 10.3 Patent Analysis: Top Codes

- Table 10.4 Patent Portfolio: Summary of Benchmarking Analysis

- Table 10.5 Patent Analysis: Categorization Based on Weighted Valuation Score

- Table 10.6 Patent Analysis: List of Relatively Higher Value Patents

- Table 11.1 Non-Viral Drug Delivery Systems / Technologies: List of Partnerships and Collaborations, Since 2020

- Table 11.2 Partnerships and Collaborations: Information on Type of Agreement

- Table 13.1 Non-Viral Drug Delivery Systems / Technologies: Average Upfront and Milestone Payments, Since 2020 (USD Million)

- Table 13.2 Leading Industry Players: Based on Number of Technology Licensing and Integration Deals

- Table 13.3 Leading Industry Players: Based on Number of Partnership Deals

- Table 23.1 Biond Biologics: Company Snapshot

- Table 23.2 Carmine Therapeutics: Company Snapshot

- Table 23.3 Eyevensys: Company Snapshot

- Table 23.4 Generation Bio: Company Snapshot

- Table 23.5 PCI Biotech: Company Snapshot

- Table 23.6 SRI International: Company Snapshot

- Table 24.1 Non-Viral Intracellular Drug Delivery Systems / Technologies: Distribution by Type of Molecule Delivered

- Table 24.2 Non-Viral Intracellular Drug Delivery Systems / Technologies: Distribution by Type of Biologic Delivered

- Table 24.3 Non-Viral Intracellular Drug Delivery Systems / Technologies: Distribution by Type of Drug Interaction

- Table 24.4 Non-Viral Intracellular Drug Delivery Systems / Technologies: Distribution by Type of Vehicle Used

- Table 24.5 Most Active Players: Distribution by Number of Approved Drugs

- Table 24.6 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Year of Establishment

- Table 24.7 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Company Size

- Table 24.8 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Location of Headquarters

- Table 24.9 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Company Size and Location of Headquarters

- Table 24.10 Non-Viral Intracellular Drug Delivery Technology Providers: Distribution by Company Size and Type of Molecule Delivered

- Table 24.11 Patent Analysis: Distribution by Type of Patent

- Table 24.12 Patent Analysis: Distribution by Publication Year

- Table 24.13 Patent Analysis: Distribution by Application Year

- Table 24.14 Patent Analysis: Distribution by Cumulative Number of Granted Patents

- Table 24.15 Patent Analysis: Distribution by Cumulative Number of Patent Applications

- Table 24.16 Patent Analysis: Distribution by Issuing Authority

- Table 24.17 Patent Analysis: Distribution by Cumulative Number of Patent Applications

- Table 24.18 Leading Industry Players: Distribution by Number of Patents

- Table 24.19 Leading Non-Industry Players: Distribution by Number of Patents

- Table 24.20 Leading Inventors: Distribution by Number of Patents

- Table 24.21 Patent Analysis: Distribution by Patent Age

- Table 24.22 Non-Viral Drug Delivery Technologies: Patent Valuation Analysis

- Table 24.23 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2020

- Table 24.24 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 24.25 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2020

- Table 24.26 Partnerships and Collaborations: Distribution by Type of Partner

- Table 24.27 Partnerships and Collaborations: Distribution by Type of Molecule Delivered

- Table 24.28 Partnerships and Collaborations: Distribution by Type of Biologic Delivered

- Table 24.29 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 24.30 Most Active Players: Distribution by Number of Partnerships

- Table 24.31 Partnerships and Collaborations: Distribution by Local and International Agreements

- Table 24.32 Partnerships and Collaborations: Distribution by Intracontinental and Intercontinental Agreements

- Table 24.33 Opportunity Assessment Framework: Kalbach Innovation Model

- Table 24.34 Opportunity Assessment Framework: Competitive Assessment Model

- Table 24.35 Opportunity Assessment Framework: BCG Matrix

- Table 24.36 Global Non-Viral Drug Delivery Systems / Technologies Market, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.37 Global Non-Viral Drug Delivery Systems / Technologies Market, Forecasted Estimates, Till 2035: Conservative Case (USD Billion)

- Table 24.38 Global Non-Viral Drug Delivery Systems / Technologies Market, Forecasted Estimates, Till 2035: Optimistic Case (USD Billion)

- Table 24.39 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Molecule Delivered

- Table 24.40 Non-Viral Drug Delivery Systems / Technologies Market for Biologics, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.41 Non-Viral Drug Delivery Systems / Technologies Market for Small Molecules, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.42 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Biologic Delivered

- Table 24.43 Non-Viral Drug Delivery Systems / Technologies Market for RNA, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.44 Non-Viral Drug Delivery Systems / Technologies Market for DNA, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.45 Non-Viral Drug Delivery Systems / Technologies Market for Proteins / Peptides, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.46 Non-Viral Drug Delivery Systems / Technologies Market for Antibodies, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.47 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Vehicle Used

- Table 24.48 Non-Viral Drug Delivery Systems / Technologies Market for Nanoparticles, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.49 Non-Viral Drug Delivery Systems / Technologies Market for Extracellular Vehicles, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.50 Non-Viral Drug Delivery Systems / Technologies Market for Polymers, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.51 Non-Viral Drug Delivery Systems / Technologies Market for Oligonucleotides, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.52 Non-Viral Drug Delivery Systems / Technologies Market for Cell Penetrating Peptides, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.53 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Target Therapeutic Area

- Table 24.54 Non-Viral Drug Delivery Systems / Technologies Market for Oncological Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.55 Non-Viral Drug Delivery Systems / Technologies Market for Infectious Diseases, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.56 Non-Viral Drug Delivery Systems / Technologies Market for Cardiovascular Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.57 Non-Viral Drug Delivery Systems / Technologies Market for Genetic Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.58 Non-Viral Drug Delivery Systems / Technologies Market for Hepatic Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.59 Non-Viral Drug Delivery Systems / Technologies Market for Metabolic Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.60 Non-Viral Drug Delivery Systems / Technologies Market for Neurological Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.61 Non-Viral Drug Delivery Systems / Technologies Market for Pulmonary Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.62 Non-Viral Drug Delivery Systems / Technologies Market for Rare Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.63 Non-Viral Drug Delivery Systems / Technologies Market for Other Disorders, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.64 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Type of Payment Employed

- Table 24.65 Non-Viral Drug Delivery Systems / Technologies Market for Upfront Payments, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.66 Non-Viral Drug Delivery Systems / Technologies Market for Milestone Payments, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.67 Non-Viral Drug Delivery Systems / Technologies Market: Distribution by Key Geographical Regions

- Table 24.68 Non-Viral Drug Delivery Systems / Technologies Market in North America, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.69 Non-Viral Drug Delivery Systems / Technologies Market in the US, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.70 Non-Viral Drug Delivery Systems / Technologies Market in Canada, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.71 Non-Viral Drug Delivery Systems / Technologies Market n Europe, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.72 Non-Viral Drug Delivery Systems / Technologies Market in the UK, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.73 Non-Viral Drug Delivery Systems / Technologies Market in Germany, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.74 Non-Viral Drug Delivery Systems / Technologies Market in Belgium, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.75 Non-Viral Drug Delivery Systems / Technologies Market in Ireland, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.76 Non-Viral Drug Delivery Systems / Technologies Market in Denmark, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.77 Non-Viral Drug Delivery Systems / Technologies Market in Rest of Europe, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.78 Non-Viral Drug Delivery Systems / Technologies Market in Asia-Pacific, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.79 Non-Viral Drug Delivery Systems / Technologies Market in South Korea, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.80 Non-Viral Drug Delivery Systems / Technologies Market in Australia, Forecasted Estimates, Till 2035 (USD Billion)

- Table 24.81 Non-Viral Drug Delivery Systems / Technologies Market in China, Forecasted Estimates, Till 2035 (USD Billion)