|

市场调查报告书

商品编码

1737050

层析法消耗品及层析法设备市场:产品类别,层析法类别设备,消耗品形态别,各终端用户,各主要地区Chromatography Consumables and Chromatography Instrumentation Market Distribution by Type of Product, Type of Chromatography Instruments, Type of Consumable Formats, End Users and Key Geographical Regions |

||||||

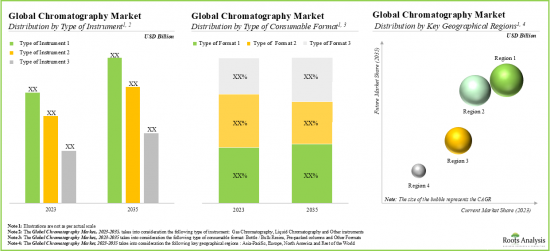

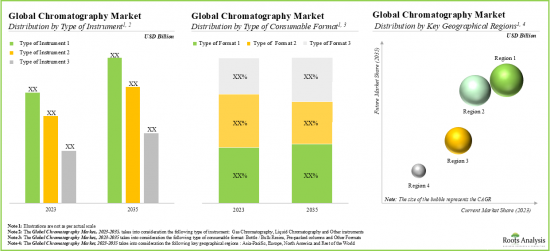

全球色谱耗材和色谱设备市场规模预计将从 2025 年的 115 亿美元增长到 2035 年的 202 亿美元,预测期内复合年增长率为 5.74%。

市场区隔与机会分析依下列参数细分:

依产品类型

- 器具

- 消耗品

- 其他

层析法类别设备

- 液体层析法

- 气相层析

- 其他

消耗品形态别

- 预装柱

- 瓶装/散装树脂

- 其他

各终端用户

- 製药/生物科技产业

- 学术·研究机关

- 其他

各主要地区

- 北美

- 欧洲

- 亚太地区

- 其他地区

色谱耗材与色谱设备市场:成长与趋势

色谱法是一种用途广泛的技术,已成为生物医学和药物分析中一种有价值的纯化工具。色谱法的原理是将分析物混合物在流动的流体流(即流动相(液体或气体))和固定相(固体或液体)之间分配。

近年来,色谱耗材和色谱设备的进步备受关注,旨在使多种物质的纯化和分离更加轻鬆和高效。色谱耗材和色谱仪器广泛应用于製药、生物技术、化工、环境、食品和石化等各行业。此外,HPLC、UPLC、LC-MS 和 GC-MS 等色谱仪器具有高灵敏度、高准确度、快速週转率和先进的检测能力,使研究人员和产业能够应对和解决各种製程的复杂问题。

色谱法在各种研究方法和工业过程中的应用,促使对各种色谱耗材的需求不断增长,包括树脂、填充柱和板。因此,色谱树脂被认为是满足新型疫苗和复杂生物分析物纯化需求的有效解决方案。随着生物製品复杂性的增加,其纯化需求预计也将随之成长,而色谱公司预计将在开发适用于製药业的先进色谱设备和便捷耗材方面发挥关键作用。

色谱耗材和色谱仪器市场:关键洞察

本报告分析了色谱耗材和色谱仪器市场的现状,并揭示了该行业的潜在成长机会。主要发现包括:

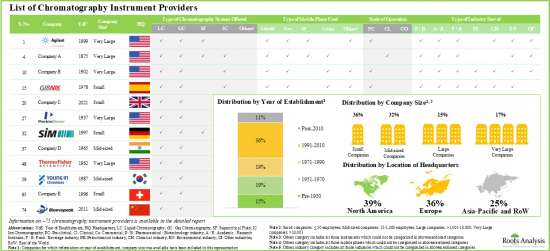

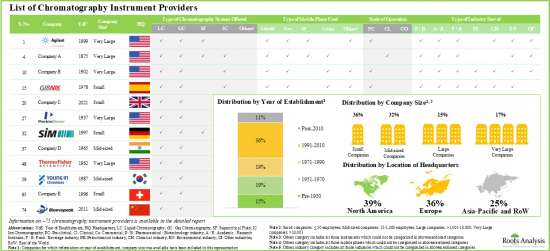

- 目前,约有 75 家公司声称提供用于检测、分离和纯化各行业各类分析物的色谱仪器。

- 70% 的仪器专为液相层析设计,该技术可以分离从大型生物聚合物到小型有机化合物等各种化合物。

- 为了提升竞争力,各公司正积极升级现有能力,并强化各自的色谱仪器产品组合。

- 目前,超过 80 家公司为各行各业提供各种色谱耗材,包括色谱树脂、色谱柱、介质和薄膜。

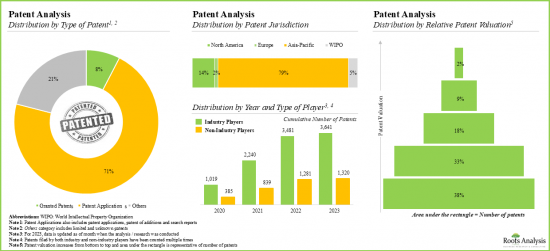

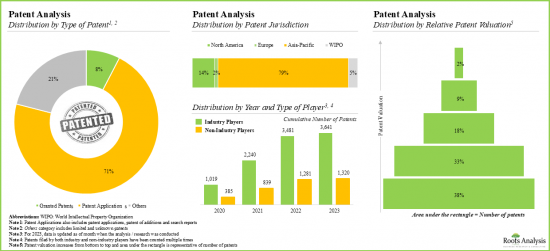

- 过去四年,已有超过 4,700 项色谱相关专利获得申请/授权,彰显了该领域研究人员的辛勤付出。

- 色谱领域的利害关係人提供各种类型的耗材,用于对复杂材料进行定性和定量分析,其中约 55% 的公司提供基于聚合物的固相。

- 为了满足日益增长的需求,色谱耗材和仪器供应商正在积极扩展其产品组合。

- 受复杂分子高效检测、分离和纯化需求日益增长的推动,色谱仪器和耗材市场预计未来十年将以 5.74% 的复合年增长率增长。

- 预计未来机会将均匀分布在各个细分市场,其中亚太地区预计在预测期内成长速度更快。

- 色谱技术的持续进步已被证明有助于满足多个行业的分析需求,预计未来这些进步将推动色谱市场稳步发展。

色谱耗材和色谱设备市场:主要细分市场

依产品类型,市场细分为仪器、耗材和其他配件。目前,设备细分市场占据色谱耗材和色谱设备市场的最高占有率。此外,值得注意的是,色谱耗材细分市场很可能会以相对较高的复合年增长率成长。

根据色谱设备的类型,全球色谱耗材和色谱设备市场细分为液相层析、气相层析和其他仪器。目前,液相层析仪器占据色谱耗材和色谱设备市场的大部分占有率。值得注意的是,新冠疫情期间研究活动的增加增加了製药/生技产业对液相层析技术的需求。预计上述细分市场在预测期内将以更高的复合年增长率成长。

根据耗材类型,市场细分为预装柱、瓶装/散装树脂和其他类型。目前,瓶装/散装树脂在全球色谱耗材和色谱设备市场中占据最大占有率(按耗材类型划分)。值得注意的是,预装柱市场的复合年增长率可能相对较高。

根据最终用户,全球色谱耗材和色谱设备市场分布于製药/生物技术产业、学术/研究机构和其他产业。由于人们越来越重视开发用于治疗各种危及生命的疾病的新化合物和生物製剂,预计製药/生物技术行业的色谱耗材和色谱设备将成为整个市场的主要驱动力。

根据主要地区,市场细分为北美、欧洲、亚太地区和世界其他地区。目前,北美占据最大市场占有率,而亚太市场预计在预测期内将呈现良好成长。

本报告提供全球层析法消耗品及层析法设备市场相关调查,提供市场概要,以及产品类别,层析法类别设备,消耗品形态别,各终端用户,各主要地区的趋势,及加入此市场的主要企业简介等资讯。

目录

第1章 序文

第2章 调查手法

第3章 经济以及其他的计划特有的考虑事项

第4章 摘要整理

第5章 简介

- 章概要

- 层析法概要

- 层析法的原理

- 层析法的种类

- 层析法的应用

- 未来展望

- 结论

第6章 层析法设备供应商的市场形势

- 章概要

- 层析法设备供应商:市场形势

第7章 层析法设备供应商:企业竞争力分析

- 章概要

- 前提主要的参数

- 调查手法

- 层析法设备供应商:企业竞争力分析

第8章 层析法消耗品供应商的市场形势

- 章概要

- 层析法消耗品供应商:市场形势

第9章 企业简介

- 章概要

- Agilent Technologies

- Bio-Rad Laboratories

- PerkinElmer

- Sartorius

- Shimadzu

- Thermo Fisher Scientific

第10章 专利分析

- 章概要

- 范围与调查手法

- 层析法设备及消耗品:专利分析

- 层析法设备及消耗品:专利基准分析

- 层析法设备及消耗品:专利评估

- 引用数前几名的专利

第11章 合併和收购

- 章概要

- 合併和收购模式

- 层析法设备及消耗品:合併和收购

第12章 市场影响分析:促进因素,阻碍因素,机会,课题

第13章 全球层析法市场

- 章概要

- 前提调查手法

- 全球层析法市场,历史的趋势(2017年以后)波及未来预测(到2035年)

- 主要的市场区隔

- 动态仪表板

第14章 层析法市场:产品类别,2023年及2035年

第15章 层析法市场:层析法类别设备,2023年及2035年

第16章 层析法市场:消耗品形态别,2023年及2035年

第17章 层析法市场:各终端用户,2023年及2035年

第18章 层析法市场:各地区

- 章概要

- 主要的前提与调查手法

- 北美

- 欧洲

- 亚太地区

- 其他地区

第19章 结论

第20章 执行洞察

第21章 附录1:表格形式资料

第22章 附录2:企业·团体一览

CHROMATOGRAPHY CONSUMABLES AND CHROMATOGRAPHY INSTRUMENTATION MARKET: OVERVIEW

As per Roots Analysis, the global chromatography consumables and chromatography instrumentation market is estimated to grow from USD 11.5 billion in 2025 to USD 20.2 billion by 2035, at a CAGR of 5.74% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Product

- Instruments

- Consumables

- Other accessories

Type of Chromatography Instruments

- Liquid chromatography

- Gas chromatography

- Other Instruments

Type of Consumable Formats

- Prepacked Columns

- Bottles / Bulk resins

- Other formats

End Users

- Pharmaceutical / Biotechnology Industries

- Academic and Research Institutes

- Other Industries

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

CHROMATOGRAPHY CONSUMABLES AND CHROMATOGRAPHY INSTRUMENTATION MARKET: GROWTH AND TRENDS

Chromatography is a versatile technique that has become a valuable purification tool for biomedical and pharmaceutical analysis. The principle of chromatography involves the distribution of a mixture of analytes between a moving fluid stream, namely the mobile phase (which can be either a liquid or a gas), and a stationary phase (which can be either a solid or a liquid).

In recent years, there has been a growing focus on the advancement of chromatography consumables and chromatography instrumentation to make the purification and separation of several substances easy and efficient. Chromatography consumables and chromatography instrumentation are used in various industries, including pharmaceutical, biotechnology, chemical, environmental, food, and petrochemical industries, for multiple applications. Further, chromatography instrumentation, such as HPLC, UPLC, LC-MS and GC-MS, have high sensitivity, precision, rapid turnover rate and advanced detection capabilities that allow researchers and industries to tackle and solve complex problems across various processes, thereby leading to increased adoption of such techniques.

Increased use of chromatography across various research and industry processes has led to the increased demand for different types of chromatography consumables, such as resins, packed columns, plates and others. As a result, chromatography resins have been considered an efficient solution to address the purification needs of novel COVID-19 vaccines as well as complex biologic analytes. With the increase in complexity of biologics, their purification needs are anticipated to increase, and chromatography companies are expected to play an important role in developing advanced chromatography instrumentation and convenient consumable formats suitable to the pharmaceutical industry.

CHROMATOGRAPHY CONSUMABLES AND CHROMATOGRAPHY INSTRUMENTATION MARKET: KEY INSIGHTS

The report delves into the current state of the chromatography consumables and chromatography instrumentation market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Presently, around 75 companies claim to offer chromatography instruments for the detection, separation and purification of different types of analytes across various industries.

- 70% of the instruments are designed for liquid chromatography in order to separate a diverse range of compounds from large biomacromolecules to small organic compounds.

- In pursuit of building a competitive edge, companies are actively upgrading their existing capabilities to enhance their respective chromatography instrument portfolios.

- Currently, over 80 companies offer different types of chromatography consumables, including chromatography resins, columns, media and membranes for a wide range of industries.

- Over 4,700 patents related to chromatography have been filed / granted in the past four years, indicating the substantial efforts made by researchers engaged in this domain.

- Stakeholders engaged in the chromatography domain offer different types of consumables for qualitative and quantitative analysis of complex entities; close to 55% of the companies provide polymer-based solid phases.

- To keep pace with the growing demand, chromatography consumables and instruments providers are actively expanding their product portfolio; the domain has witnessed around 40 mergers / acquisitions.

- With growing demand for efficient detection, separation and purification of complex molecules, the market for chromatography instruments and consumables is likely to grow at a CAGR of 5.74% over the next decade.

- The projected opportunity is anticipated to be well distributed across different segments; Asia Pacific is likely to grow at a faster pace during the forecasted period.

- Ongoing advancements in chromatography techniques have proven useful in meeting the analytical demands across several industries; these are anticipated to drive the chromatography market at a steady pace in the future.

CHROMATOGRAPHY CONSUMABLES AND CHROMATOGRAPHY INSTRUMENTATION MARKET: KEY SEGMENTS

By Type of Product Instruments, Chromatography Consumables Segment is the Fastest Growing Segment of the Global Chromatography Consumables and Chromatography Instrumentation Market During the Forecast Period

Based on the type of product, the market is segmented into instruments, consumables and other accessories. Currently, the market is dominated by instruments segment, capturing the highest proportion of the chromatography consumables and chromatography instrumentation market. Further, it is worth highlighting that the chromatography consumables segment is likely to grow at a relatively higher CAGR.

Liquid Chromatography is the Fastest Growing Segment of the Chromatography Consumables and Chromatography Instrumentation Market

Based on the type of chromatography instruments, the global market for chromatography consumables and chromatography instrumentation is segmented into liquid chromatography, gas chromatography and other instruments. Currently, the majority share of the chromatography consumables and chromatography instrumentation market is captured by liquid chromatography instruments. It is worth mentioning that the rise in research activities during the COVID-19 pandemic led to an increased demand for liquid chromatography techniques in the pharma / biotech industry. The aforementioned segment is anticipated to grow at a higher CAGR during the forecast period.

Bottles / Bulk Resins Segment Holds the Largest Share of the Chromatography Consumables and Chromatography Instrumentation Market

Based on the type of consumable formats, the market is segmented into prepacked columns, bottles / bulk resins and other formats. At present, bottles / bulk resins segment by type of consumable format holds the maximum share of the global chromatography consumables and chromatography instrumentation market. Notably, prepacked columns segment is likely to grow at a relatively higher CAGR.

By End Users, Pharmaceutical / Biopharmaceutical Industries Segment is Likely to Dominate the Market During the Forecast Period

Based on the end users, the global market for chromatography consumables and chromatography instrumentation is distributed across pharmaceutical / biotechnology industries, academic and research institutes and other industries. Chromatography consumables and chromatography instrumentation for pharmaceutical / biotechnology industries will be the primary driver of the overall market due to the growing focus on the advancement of new entities and biologics for the treatment of different life-threatening disorders and diseases.

North America Accounts for the Largest Share of the Market

Based on the key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. In the current scenario, North America is likely to capture the largest market share while the market in Asia-Pacific is anticipated to demonstrate lucrative growth during the forecast period.

Example Players in the Chromatography Consumables and Chromatography Instrumentation Market

- Agilent Technologies

- Bio-Rad Laboratories

- PerkinElmer

- Sartorius

- Shimadzu

- Thermo Fisher Scientific

CHROMATOGRAPHY CONSUMABLES AND CHROMATOGRAPHY INSTRUMENTATION MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global chromatography consumables and chromatography instrumentation market, focusing on key market segments, including [A] type of product, [B] type of chromatography instruments, [C] type of consumable formats, [D] end users and [E] key geographical regions.

- Chromatography Instrument Providers Market Landscape: A comprehensive evaluation of chromatography instrument providers, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] chromatography instrument offered, [E] type of mobile phases used, [F] type of chromatography consumables offered, [G] scale of operation and [H] type of industry served.

- Company Competitiveness Analysis: A comprehensive competitive analysis of chromatography instrument providers, examining factors, such as [A] supplier strength and [B] company competitiveness.

- Chromatography Consumable Providers Market Landscape: A comprehensive evaluation of chromatography consumable providers, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of separation technique offered, [E] type of solid phase offered, [F] type of consumable format offered, [G] type of analyte separated and [H] application area.

- Company Profiles: In-depth profiles of key players engaged in the chromatography domain, focusing on [A] overview of the company, [B] product portfolio, and [C] recent developments and an informed future outlook.

- Patent Analysis: An in-depth analysis of patents filed / granted till date in the chromatography domain, based on various relevant parameters, such as [A] type of patent, [B] publication year, [C] patent application year, [D] geographical location, [E] type of players, [F] assigned CPC symbol, [G] type of organization, [H] leading industry / academic players, [I] patent benchmarking analysis and [J] patent valuation.

- Mergers and Acquisitions: An in-depth analysis of the mergers and acquisitions undertaken in this domain, based on relevant parameters, such as [A] year of agreement, [B] type of deal, [C] geographical location, [D] size, [E] type of company ownership, [F] key value drivers and [G] acquisition deal multiples.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Project Objectives

- 1.3. Scope of the Report

- 1.4. Inclusions and Exclusions

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Chromatography

- 5.3. Principle of Chromatography

- 5.4. Types of Chromatography

- 5.5. Applications of Chromatography

- 5.6. Future Perspectives

- 5.7. Concluding Remarks

6. CHROMATOGRAPHY INSTRUMENTS PROVIDERS MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Chromatography Instrument Providers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Company Size and Location of Headquarters

- 6.2.5. Analysis by Chromatography Instrument Offered

- 6.2.6. Analysis by Type of Mobile Phase Used

- 6.2.7. Analysis by Type of Chromatography Consumables Offered

- 6.2.8. Analysis by Scale of Operation

- 6.2.9. Analysis by Type of Industry Served

7. CHROMATOGRAPHY INSTRUMENTS PROVIDERS: COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Parameters

- 7.3. Methodology

- 7.4. Chromatography Instrument Providers: Company Competitiveness Analysis

- 7.4.1. Small Companies Providing Chromatography Instruments

- 7.4.2. Mid-sized Companies Providing Chromatography Instruments

- 7.4.3. Large Companies Providing Chromatography Instruments

- 7.4.4. Very Large Companies Providing Chromatography Instruments

8. CHROMATOGRAPHY CONSUMABLES PROVIDERS MARKET LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Chromatography Consumables Providers: Overall Market Landscape

- 8.2.1. Analysis by Year of Establishment

- 8.2.2. Analysis by Company Size

- 8.2.3. Analysis by Location of Headquarters

- 8.2.4. Analysis by Company Size and Location of Headquarters

- 8.2.5. Analysis by Type of Separation Technique Used

- 8.2.6. Analysis by Type of Solid Phase Offered

- 8.2.7. Analysis by Type of Consumable Format Offered

- 8.2.8. Analysis by Type of Analyte

- 8.2.9. Analysis by Application Area of Chromatography Consumables

9. COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Agilent Technologies

- 9.2.1. Company Overview

- 9.2.2. Chromatography Product Portfolio

- 9.2.3. Recent Developments and Future Outlook

- 9.3. Bio-Rad Laboratories

- 9.3.1. Company Overview

- 9.3.2. Chromatography Product Portfolio

- 9.3.3. Recent Developments and Future Outlook

- 9.4. PerkinElmer

- 9.4.1. Company Overview

- 9.4.2. Chromatography Product Portfolio

- 9.4.3. Recent Developments and Future Outlook

- 9.5. Sartorius

- 9.5.1. Company Overview

- 9.5.2. Chromatography Product Portfolio

- 9.5.3. Recent Developments and Future Outlook

- 9.6. Shimadzu

- 9.6.1. Company Overview

- 9.6.2. Chromatography Product Portfolio

- 9.6.3. Recent Developments and Future Outlook

- 9.7. Thermo Fisher Scientific

- 9.7.1. Company Overview

- 9.7.2. Chromatography Product Portfolio

- 9.7.3. Recent Developments and Future Outlook

10. PATENT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. Chromatography Instruments and Consumables: Patent Analysis

- 10.3.1. Analysis by Patent Publication Year

- 10.3.2. Analysis by Patent Application Year

- 10.3.3. Analysis of Granted Patents and Patent Applications by Publication Year

- 10.3.4. Analysis by Patent Jurisdiction

- 10.3.5. Analysis by CPC Symbols

- 10.3.6. Analysis by Type of Applicant

- 10.3.7. Leading Industry Players: Analysis by Number of Patents

- 10.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 10.3.9. Leading Individual Patent Assignees: Analysis by Number of Patents

- 10.4. Chromatography Instruments and Consumables: Patent Benchmarking Analysis

- 10.4.1. Analysis by Patent Characteristics

- 10.5. Chromatography Instruments and Consumables: Patent Valuation

- 10.6. Leading Patents by Number of Citations

11. MERGERS AND ACQUISITIONS

- 11.1. Chapter Overview

- 11.2. Merger and Acquisition Models

- 11.3. Chromatography Instruments and Consumables: Mergers and Acquisitions

- 11.3.1. Analysis by Type of Deal

- 11.3.2. Analysis by Year of Deal

- 11.3.3. Analysis by Company Ownership

- 11.3.4. Analysis by Geography

- 11.3.4.1. Intercontinental and Intracontinental Deals

- 11.3.4.2. Local and International Deals

- 11.3.5. Most Active Players: Analysis by Number of Mergers and Acquisitions

- 11.3.6. Analysis by Key Value Drivers

- 11.3.7. Key Acquisitions: Deal Multiples

12. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 12.1. Chapter Overview

- 12.2. Market Drivers

- 12.3. Market Restraints

- 12.4. Market Opportunities

- 12.5. Market Challenges

- 12.6. Conclusion

13. GLOBAL CHROMATOGRAPHY MARKET

- 13.1. Chapter Overview

- 13.2. Assumptions and Methodology

- 13.3. Global Chromatography Market, Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 13.3.1. Scenario Analysis

- 13.4. Key Market Segmentations

- 13.5. Dynamic Dashboard

14. CHROMATOGRAPHY MARKET: DISTRIBUTION BY TYPE OF PRODUCT, 2023 AND 2035

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Chromatography Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 14.4. Chromatography Consumables: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 14.5. Other Accessories: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 14.6. Data Triangulation

- 14.6.1. Insights from Primary Research

- 14.6.2. Insights from Secondary Research

- 14.6.3. Insights from In-house Repository

15. CHROMATOGRAPHY MARKET: DISTRIBUTION BY TYPE OF CHROMATOGRAPHY INSTRUMENT

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Liquid Chromatography Instrument: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 15.4. Gas Chromatography Instrument: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 15.5. Other Instruments: Historical Trends (Since 2018) and Future Estimates (Till 2035)

- 15.6. Data Triangulation

- 15.6.1. Insights based on Primary Research

- 15.6.2. Insights based on Secondary Research

- 15.6.3. Insights from In-house Repository

16. CHROMATOGRAPHY MARKET: DISTRIBUTION BY TYPE OF CONSUMABLE FORMAT OFFERED, 2023 AND 2035

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Pre-Packed Columns: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 16.4. Bottles / Bulk Resins: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 16.5. Other Formats: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 16.6. Data Triangulation

- 16.6.1. Insights based on Primary Research

- 16.6.2. Insights based on Secondary Research

- 16.6.3. Insights from In-house Repository

17. CHROMATOGRAPHY MARKET: DISTRIBUTION BY END USER

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Pharmaceutical and Biopharmaceutical Companies: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 17.4. Academic / Research Institutes: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 17.5. Other Industries: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 17.4. Data Triangulation

- 17.4.1. Insights based on Primary Research

- 17.4.2. Insights based on Secondary Research

- 17.4.3. Insights from In-house Repository

18. CHROMATOGRAPHY MARKET: DISTRIBUTION BY GEOGRAPHY

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 18.3.1. Chromatography Market for Chromatography Instruments

- 18.3.2. Chromatography Market for Chromatography Consumables

- 18.3.3. Chromatography Market for Other Accessories

- 18.4. Europe: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 18.4.1. Chromatography Market for Chromatography Instruments

- 18.4.2. Chromatography Market for Chromatography Consumables

- 18.4.3. Chromatography Market for Other Accessories

- 18.5. Asia-Pacific: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 18.5.1. Chromatography Market for Chromatography Instruments

- 18.5.2. Chromatography Market for Chromatography Consumables

- 18.5.3. Chromatography Market for Other Accessories

- 18.6. Rest of the World: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- 18.6.1. Chromatography Market for Chromatography Instruments

- 18.6.2. Chromatography Market for Chromatography Consumables

- 18.6.3. Chromatography Market for Other Accessories

- 18.7. Data Triangulation

- 18.7.1. Insights based on Primary Research

- 18.7.2. Insights based on Secondary Research

- 18.7.3. Insights from In-house Repository

19. CONCLUSION

20. EXECUTIVE INSIGHTS

21. APPENDIX 1: TABULATED DATA

22. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Chromatography Instrument Providers: Information on Year of Establishment, Company Size, Location of Headquarters, Type of Chromatography Instrument Offered, Type of Mobile Phase Offered, and Type of Chromatography Consumable Offered

- Table 6.2 Chromatography Instrument Providers: Information on Scale of Operation and Type of Industry Served

- Table 8.1 Chromatography Consumable Providers: Information on Chromatography Consumables Providers and Type of Separation Technique Offered

- Table 8.2 Chromatography Consumable Providers: Information of Type of Separation Technique Offered, Type of Solid Phase Offered and Type of Format Offered

- Table 8.3 Chromatography Consumable Providers: Information of Type of Separation Technique Offered and Type of Analyte Separated

- Table 8.4 Chromatography Consumable Providers: Information of Type of Separation Technique Offered and Application Areas

- Table 9.1 Leading Chromatography Instrument and Consumable Providers

- Table 9.2 Agilent Technologies: Company Overview

- Table 9.3 Agilent Technologies: Chromatography Instruments Portfolio

- Table 9.4 Agilent Technologies: Chromatography Consumables Portfolio

- Table 9.5 Agilent Technologies: Recent Developments and Future Outlook

- Table 9.6 Bio-Rad Laboratories: Company Overview

- Table 9.7 Bio-Rad Laboratories: Chromatography Instruments Portfolio

- Table 9.8 Bio-Rad Laboratories: Chromatography Consumables Portfolio

- Table 9.9 PerkinElmer: Company Overview

- Table 9.10 PerkinElmer: Chromatography Instruments Portfolio

- Table 9.11 PerkinElmer: Chromatography Consumables Portfolio

- Table 9.12 PerkinElmer: Recent Developments and Future Outlook

- Table 9.13 Sartorius: Company Overview

- Table 9.14 Sartorius: Chromatography Instruments Portfolio

- Table 9.15 Sartorius: Chromatography Consumables Portfolio

- Table 9.16 Sartorius: Recent Developments and Future Outlook

- Table 9.17 Shimadzu: Company Overview

- Table 9.18 Shimadzu: Chromatography Instruments Portfolio

- Table 9.19 Shimadzu: Chromatography Consumables Portfolio

- Table 9.20 Shimadzu: Recent Developments and Future Outlook

- Table 9.21 Thermo Fisher Scientific: Company Overview

- Table 9.22 Thermo Fisher Scientific: Chromatography Instruments Portfolio

- Table 9.23 Thermo Fisher Scientific: Chromatography Consumables Portfolio

- Table 9.24 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 10.1 Patent Analysis: Top CPC Symbols

- Table 10.2 Patent Analysis: Top CPC Codes

- Table 10.3 Patent Analysis: Summary of Benchmarking Analysis

- Table 10.4 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 10.5 Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 10.6 Patent Portfolio: List of Leading Patents (by Number of Citations)

- Table 11.1 Chromatography Instruments and Consumables: List of Mergers and Acquisitions, Since 2015

- Table 11.2 Acquisitions: Information on Key Value Drivers

- Table 11.3 Key Acquisitions: Information on Deal Multiples, Since 2015

- Table 20.1 Hemochrom: Company Snapshot

- Table 20.2 SRI Instruments: Company Snapshot

- Table 21.1 Chromatography Instrument Providers: Distribution by Year of Establishment

- Table 21.2 Chromatography Instrument Providers: Distribution by Company Size

- Table 21.3 Chromatography Instrument Providers: Distribution by Location of Headquarters

- Table 21.4 Chromatography Instrument Providers: Distribution by Company Size and Location of Headquarters

- Table 21.5 Chromatography Instrument Providers: Distribution by Chromatography Instrument Offered

- Table 21.6 Chromatography Instrument Providers: Distribution by Type of Mobile Phase Used

- Table 21.7 Chromatography Instrument Providers: Distribution by Type of Consumables Offered

- Table 21.8 Chromatography Instrument Providers: Distribution by Scale of Operation

- Table 21.9 Chromatography Instrument Providers: Distribution by Type of Industry Served

- Table 21.10 Chromatography Consumables Providers: Distribution by Year of Establishment

- Table 21.11 Chromatography Consumable Providers: Distribution by Company Size

- Table 21.12 Chromatography Consumable Providers: Distribution by Location of Headquarters

- Table 21.13 Chromatography Consumable Providers: Distribution by Company Size and Location of Headquarters

- Table 21.14 Chromatography Consumable Providers: Distribution by Type of Separation Technique Used

- Table 21.15 Chromatography Consumable Providers: Distribution by Type of Solid Phase Used

- Table 21.16 Chromatography Consumable Providers: Distribution by Type of Consumable Formats Offered

- Table 21.17 Chromatography Consumable Providers: Distribution by Scale of Operation

- Table 21.18 Chromatography Consumable Providers: Distribution by Application Area

- Table 21.19 Patent Analysis: Distribution by Type of Patent

- Table 21.20 Patent Analysis: Distribution by Patent Publication Year, Since 2020

- Table 21.21 Patent Analysis: Distribution by Patent Application Year, Since Pre-2019

- Table 21.22 Patent Analysis: Distribution of Granted Patents and Patent Applications by Publication Year, Since 2020

- Table 21.23 Patent Analysis: Distribution by Patent Jurisdiction (Region-wise)

- Table 21.24 Patent Analysis: Distribution by Patent Jurisdiction (Country-wise)

- Table 21.25 Patent Analysis: Distribution by CPC Symbols

- Table 21.26 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant, Since 2020

- Table 21.27 Leading Industry Players: Distribution by Number of Patents

- Table 21.28 Leading Non-Industry Players: Distribution by Number of Patents

- Table 21.29 Leading Individual Patent Assignees: Distribution by Number of Patents

- Table 21.30 Patent Analysis: Distribution by Patent Age

- Table 21.31 Chromatography Instruments and Consumables: Patent Valuation

- Table 21.32 Mergers and Acquisitions: Distribution by Type of Deal

- Table 21.33 Mergers and Acquisitions: Cumulative Year-Wise Distribution

- Table 21.34 Acquisitions: Distribution by Company Ownership

- Table 21.35 Acquisitions and Mergers: Intercontinental and Intracontinental Deals

- Table 21.36 Mergers and Acquisitions: Distribution by Local and International Deals

- Table 21.37 Most Active Players: Distribution by Number of Mergers and Acquisitions

- Table 21.38 Acquisitions: Key Value Drivers

- Table 21.39 Global Chromatography Market, Historical Trends (Since 2018) and Future Estimates (Till 2035)

- Table 21.40 Global Chromatography Market, Till 2035: Optimistic Scenario

- Table 21.41 Global Chromatography Market, Till 2035: Conservative Scenario

- Table 21.43 Chromatography Market for Chromatography Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.44 Chromatography Market for Chromatography Consumables: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.45 Chromatography Market for Other Accessories: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.46 Chromatography Market for Liquid Chromatography Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.47 Chromatography Market for Gas Chromatography Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.48 Chromatography Market for Other Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.49 Chromatography Market for Pre-packed columns: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.50 Chromatography Market for Bottles / Bulk Resins: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.51 Chromatography Market for Other Formats: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.52 Chromatography Market for Pharmaceutical and Biotechnology Companies: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.53 Chromatography Market for Academic and Research Institutes: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.54 Chromatography Market for Other Industries: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.55 Chromatography Market in North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.56 Chromatography Market for Chromatography Instruments in North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.57 Chromatography Market for Chromatography Consumables in North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.58 Chromatography Market for Other Accessories in North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.59 Chromatography Market in Europe: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Table 21.60 Chromatography Market for Chromatography Instruments in Europe: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.61 Chromatography Market for Chromatography Consumables in Europe: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.62 Chromatography Market for Other Accessories in Europe: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.63 Chromatography Market in Asia-Pacific: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.64 Chromatography Market for Chromatography Instruments in Asia-Pacific: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.65 Chromatography Market for Chromatography Consumables in Asia-Pacific: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.66 Chromatography Market for Other Accessories in Asia-Pacific: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.67 Chromatography Market in Rest of the World: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.68 Chromatography Market for Chromatography Instruments in Rest of the World: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.69 Chromatography Market for Chromatography Consumables in Rest of the World: Historical Trends (Since 2016) and Future Estimates (Till 2035)

- Table 21.70 Chromatography Market for Other Accessories in Rest of the World: Historical Trends (Since 2017) and Future Estimates (Till 2035)

List of Figures

- Figure 2.1 Research Methodology: Research Assumptions

- Figure 2.2 Research Methodology: Project Methodology

- Figure 2.3 Research Methodology: Forecast Methodology

- Figure 2.4 Research Methodology: Robust Quality Control

- Figure 2.5 Research Methodology: Key Market Segmentations

- Figure 4.1 Executive Summary: Chromatography Instrument Providers Market Landscape

- Figure 4.2 Executive Summary: Chromatography Consumables Market Landscape

- Figure 4.3 Executive Summary: Patent Analysis

- Figure 4.4 Executive Summary: Mergers and Acquisitions

- Figure 4.5 Executive Summary: Market Sizing and Opportunity Analysis

- Figure 5.1 Components of Chromatography

- Figure 5.2 Types of Chromatography

- Figure 5.3 Applications of Chromatography

- Figure 6.1 Chromatography Instrument Providers: Distribution by Year of Establishment

- Figure 6.2 Chromatography Instrument Providers: Distribution by Company Size

- Figure 6.3 Chromatography Instrument Providers: Distribution by Location of Headquarters

- Figure 6.4 Chromatography Instrument Providers: Distribution by Company Size and Location of Headquarters

- Figure 6.5 Chromatography Instrument Providers: Distribution by Chromatography Instrument Offered

- Figure 6.6 Chromatography Instrument Providers: Distribution by Type of Mobile Phase Used

- Figure 6.7 Chromatography Instrument Providers: Distribution by Type of Consumables Offered

- Figure 6.8 Chromatography Instrument Providers: Distribution by Scale of Operation

- Figure 6.9 Chromatography Instrument Providers: Distribution by Type of Industry Served

- Figure 7.1 Small Companies Providing Chromatography Instruments

- Figure 7.2 Company Competitiveness Analysis: Leading Small Companies

- Figure 7.3 Mid-sized Companies Providing Chromatography Instruments

- Figure 7.4 Company Competitiveness Analysis: Leading Mid-sized Companies

- Figure 7.5 Large Companies Providing Chromatography Instruments

- Figure 7.6 Company Competitiveness Analysis: Leading Large Companies

- Figure 7.7 Very Large Companies Providing Chromatography Instruments

- Figure 7.8 Company Competitiveness Analysis: Leading Very Large Companies

- Figure 8.1 Chromatography Consumables Providers: Distribution by Year of Establishment

- Figure 8.2 Chromatography Consumable Providers: Distribution by Company Size

- Figure 8.3 Chromatography Consumable Providers: Distribution by Location of Headquarters

- Figure 8.4 Chromatography Consumable Providers: Distribution by Company Size and Location of Headquarters

- Figure 8.5 Chromatography Consumable Providers: Distribution by Type of Separation Technique Used

- Figure 8.6 Chromatography Consumable Providers: Distribution by Type of Solid Phase Used

- Figure 8.7 Chromatography Consumable Providers: Distribution by Type of Consumable Formats Offered

- Figure 8.8 Chromatography Consumable Providers: Distribution by Scale of Operation

- Figure 8.9 Chromatography Consumable Providers: Distribution by Application Area

- Figure 10.1 Patent Analysis: Distribution by Type of Patent

- Figure 10.2 Patent Analysis: Distribution by Patent Publication Year, Since 2020

- Figure 10.3 Patent Analysis: Distribution by Patent Application Year, Since Pre-2019

- Figure 10.4 Patent Analysis: Distribution of Granted Patents and Patent Applications by Publication Year, Since 2020

- Figure 10.5 Patent Analysis: Distribution by Patent Jurisdiction (Region-wise)

- Figure 10.6 Patent Analysis: Distribution by Patent Jurisdiction (Country-wise)

- Figure 10.7 Patent Analysis: Distribution by CPC Symbols

- Figure 10.8 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant, Since 2020

- Figure 10.9 Leading Industry Players: Distribution by Number of Patents

- Figure 10.10 Leading Non-Industry Players: Distribution by Number of Patents

- Figure 10.11 Leading Individual Patent Assignees: Distribution by Number of Patents

- Figure 10.12 Patent Benchmarking Analysis: Distribution of Leading Industry Player by Patent Characteristics (CPC Codes)

- Figure 10.13 Patent Analysis: Distribution by Patent Age

- Figure 10.14 Chromatography Instruments and Consumables: Patent Valuation

- Figure 11.1 Mergers and Acquisitions: Distribution by Type of Deal

- Figure 11.2 Mergers and Acquisitions: Cumulative Year-Wise Distribution, Since Pre-2017

- Figure 11.3 Acquisitions: Distribution by Company Ownership

- Figure 11.4 Acquisitions and Mergers: Intercontinental and Intracontinental Deals

- Figure 11.5 Mergers and Acquisitions: Distribution by Local and International Deals

- Figure 11.6 Most Active Players: Distribution by Number of Mergers and Acquisitions

- Figure 11.7 Acquisitions: Key Value Drivers

- Figure 13.1 Global Chromatography Market, Historical Trends (Since 2018) and Future Estimates (Till 2035)

- Figure 13.2 Global Chromatography Market, Till 2035: Optimistic Scenario

- Figure 13.3 Global Chromatography Market, Till 2035: Conservative Scenario

- Figure 14.1 Chromatography Market for Chromatography Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 14.2 Chromatography Market for Chromatography Consumables: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 14.3 Chromatography Market for Other Accessories: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 15.1 Chromatography Market for Liquid Chromatography Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 15.2 Chromatography Market for Gas Chromatography Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 15.3 Chromatography Market for Other Instruments: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 16.1 Chromatography Market for Pre-packed columns: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 16.2 Chromatography Market for Bottles / Bulk Resins: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 16.3 Chromatography Market for Other Formats: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 17.1 Chromatography Market for Pharmaceutical and Biotechnology Companies: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 17.2 Chromatography Market for Academic and Research Institutes: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 17.3 Chromatography Market for Other Industries: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.1 Chromatography Market in North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.2 Chromatography Market for Chromatography Instruments in North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.3 Chromatography Market for Chromatography Consumables in North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.4 Chromatography Market for Other Accessories in North America: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.5 Chromatography Market in Europe: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.6 Chromatography Market for Chromatography Instruments in Europe: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.7 Chromatography Market for Chromatography Consumables in Europe: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.8 Chromatography Market for Other Accessories in Europe: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.9 Chromatography Market in Asia-Pacific: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.10 Chromatography Market for Chromatography Instruments in Asia-Pacific: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.11 Chromatography Market for Chromatography Consumables in Asia-Pacific: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.12 Chromatography Market for Other Accessories in Asia-Pacific: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.13 Chromatography Market in Rest of the World: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.14 Chromatography Market for Chromatography Instruments in Rest of the World: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.15 Chromatography Market for Chromatography Consumables in Rest of the World: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 18.16 Chromatography Market for Other Accessories in Rest of the World: Historical Trends (Since 2017) and Future Estimates (Till 2035)

- Figure 19.1 Concluding Remarks: Chromatography Instrument Providers Market Landscape

- Figure 23.2 Concluding Remarks: Chromatography Consumables Providers Market Landscape

- Figure 23.3 Concluding Remarks: Patent Analysis

- Figure 23.4 Concluding Remarks: Mergers and Acquisitions

- Figure 23.5 Concluding Remarks: Market Sizing and Opportunity Analysis