|

市场调查报告书

商品编码

1737052

伴随式诊断开发市场:各提供服务形式,各使用分析技术,各对象治疗领域,各终端用户,主要的各地区Companion Diagnostics Development Market Distribution By Type of Services Offered, Analytical Techniques Used, Target Therapeutic Area, End User and Key Geographical Regions |

||||||

全球伴随诊断 (CDx) 开发市场规模预计将从目前的 8.92 亿美元增长到 2035 年的 17.96 亿美元,预测期内的复合年增长率为 7.3%。

市场区隔包括按以下参数对市场规模和机会进行细分:

依服务类型划分

- 可行性调查

- 化验开发

- 分析验证

- 临床验证

- 製造

各使用分析技术

- NGS

- PCR

- IHC

- 流式细胞技术

- 其他

各对象治疗领域

- 肿瘤性疾病

- 非肿瘤性疾病

各终端用户

- 产业参与企业

- 非前世的业缘界参与企业

各主要地区

- 北美

- 欧洲

- 亚太地区

伴随诊断 (CDX) 发展市场:成长与趋势

伴随诊断是一种体外诊断 (IVD) 产品,可用于收集重要讯息,以确保安全有效地使用相容的药物和生物製品。近期趋势逐渐转向理解疾病发展的分子机制,而从伴随诊断中收集的资讯有助于开发针对这些疾病的标靶疗法。因此,伴随诊断已成为医疗保健领域的关键,它能为临床医生提供患者独特基因图谱讯息,帮助他们制定治疗方案。截至 2022 年,FDA 已批准 44 种伴随诊断 (CDx) 诊断方法。其中,三种针对 CDx 的标靶药物已获准用于治疗晚期卵巢癌、乳癌和非小细胞肺癌。

利用这些伴随诊断收集疾病特异性资讯有助于提高标靶治疗的成功率,并改善患者的整体预后。然而,开发此类检测方法是一个漫长的过程,首先要识别合适的生物标记(针对特定疾病),最后要验证能够准确检测和量化生物样本中生物标记含量的方法。由于开发此类诊断方法的复杂性,药物开发人员更倾向于将此流程外包给具备所需专业知识的合约服务提供者。

目前,许多公司声称提供各种诊断开发服务,例如生物标记识别和发现、生物标记选择和验证、检测方法开发、分析验证、临床验证、商业化、生产、伴随诊断试剂盒相关服务、试剂开发和法规支援。

伴随诊断 (CDX) 开发市场:关键考虑因素

本报告探讨了伴随诊断 (CDx) 开发市场的现状,并重点介绍了该行业的潜在成长机会。报告的主要发现包括:

- 目前,超过 155 家服务提供者声称拥有支援伴随诊断开发中涉及的多个步骤所需的专业知识。

- 各公司提供开发分析测试以识别疾病特异性生物标记的服务,其中肿瘤学是开发人员探索个人化诊断方案的热门领域之一。

- 为了在该领域建立竞争优势,利害关係人正在积极升级现有能力并增加新功能,以增强各自的服务组合。

- 目前已有近300种基于各种分析平台的伴随诊断产品可供使用或正在开发中,以促进从各种生物样本中检测生物标记。

- 超过80%的伴随诊断产品已获准用于治疗肿瘤疾病,其中95%旨在与针对实体肿瘤的药物合併使用。

- 利害关係人日益增长的兴趣也反映在合作活动的增加。事实上,过去两年已签署了80多笔与伴随诊断开发服务相关的交易。

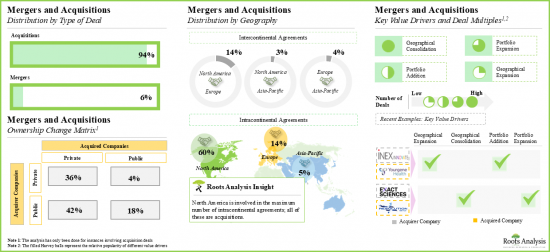

- 併购交易的激增源于对伴随诊断(CDx)需求的不断增长,65%的收购交易是为了将新功能整合到现有产品组合中而签署的。

- 药物开发公司持续建立基于生物标记的标靶治疗产品组合,并积极寻求与伴随诊断服务提供者建立合作关係。

- 多年来,多家大型製药公司赞助了多项以生物标记为重点的临床试验。在这些临床试验中使用伴随诊断测试对患者族群进行分层,可显着节省成本(约 60%)。

- 随着生物资讯学和人工智慧工具的出现,已有超过 125 个软体应用程式被开发出来,这些应用程式整合了临床和诊断数据,并为患者提供个人化体验。

- 目前,超过 115 家公司提供用于诊断、治疗和分析的软体应用程序,这些解决方案还可以处理各个治疗领域的各种数据类型。

- 伴随诊断开发价值链涉及多个药物和诊断开发商、服务提供者以及其他关键利益相关者,每个利害关係人都有不同的优先事项和要求。

- 预计到2035年,伴随诊断开发服务市场将以7.3%的复合年增长率成长,其中北美市场预计将占据大部分市场占有率(超过65%)。

伴随诊断 (CDX) 开发市场:主要细分市场

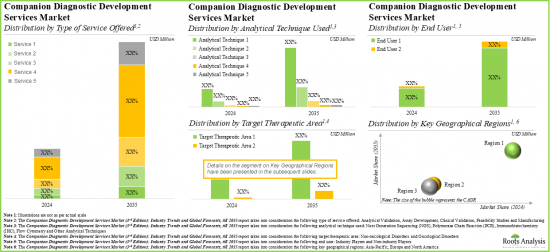

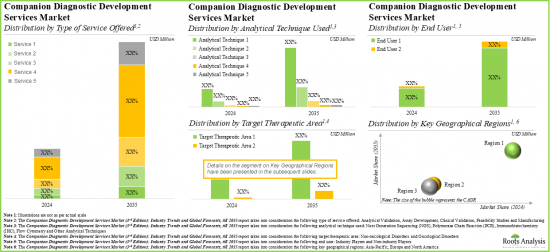

根据所提供的服务类型,市场细分为可行性研究、检测开发、分析验证、临床验证和生产。目前,临床验证服务在全球伴随诊断 (CDx) 开发市场中占有最大占有率。此外,预计分析验证服务细分市场在预测期内将以更快的速度成长。

根据所使用的分析技术,市场细分为NGS、PCR、IHC、流式细胞仪等。目前,次世代定序 (NGS) 领域在全球伴随诊断 (CDx) 开发市场中占有最高占有率,这得益于此分析技术提供的诸多优势,例如样本投入量低、通量高、灵敏度高。此外,IHC 领域的伴随诊断 (CDx) 开发市场可能以相对更高的复合年增长率成长。

根据目标治疗领域,市场细分为肿瘤学和非肿瘤学。目前,肿瘤学伴随诊断在伴随诊断 (CDx) 开发市场中占有最大占有率。预计这一趋势在预测期内将保持不变。此外,值得注意的是,非肿瘤疾病的伴随诊断 (CDx) 开发市场可能以相对更高的复合年增长率成长。

依最终用户划分,全球市场分为产业参与者和非产业参与者。目前,行业参与者占据最大市场占有率。然而,预计未来几年,伴随诊断 (CDx) 开发市场的非产业参与者将迎来显着成长。

依主要地区划分,市场分为北美、欧洲和亚太地区。目前,全球伴随诊断 (CDx) 开发市场以北美为主,占据最大收入占有率。然而,预计未来几年欧洲市场的复合年增长率将更高。

本报告提供全球伴随式诊断开发市场相关调查,提供市场概要,以及各提供服务形式,各使用分析技术,各对象治疗领域,各终端用户,主要的各地区的趋势,及加入此市场的主要企业简介等资讯。

目录

第1章 序文

第2章 调查手法

第3章 经济以及其他的计划特有的考虑事项

第4章 摘要整理

第5章 简介

- 章概要

- 个人化医疗的演变

- 伴随诊断概述

- 伴随诊断在各治疗领域的应用

- 伴随诊断的监管审查和审批流程

- 现有挑战及外包需求

- 选择合约诊断机构 (CDO) 的基本指南

- 未来展望

第6章 伴随式诊断开发服务供应商:市场形势

- 章概要

- 伴随式诊断开发服务供应商:参与企业一览

第7章 企业竞争力分析

第8章 伴随式诊断开发服务供应商:详细的企业简介

- 章概要

- 北美的主要企业

- Geneuity Clinical Research Services

- Labcorp

- Q2 Solutions

- Quest Diagnostics

- ResearchDx

- 欧洲的主要企业

- Almac Diagnostic Services

- Eurofins

- QIAGEN

- 亚太地区的主要企业

- BGI Genomics

- MEDICAL &BIOLOGICAL LABORATORIES(MBL)

第9章 伴随式诊断开发服务供应商:企业简介

- 章概要

- 北美的主要企业

- Agilent Technologies

- Creative Biolabs

- ICON Specialty Laboratories

- NeoGenomics Laboratories

- 欧洲的主要企业

- Cerba Research

- Randox Biosciences

- Roche

- Siemens Healthineers

- Unilabs

- 亚太地区的主要企业

- Abnova

- Celemics

- MEDx Translational Medicine

- Novogene

- Shuwen Biotech

第10章 伴随式诊断产品:市场形势

- 章概要

- 伴随式诊断:市售/临床实验药一览

- 伴随式诊断:开发商清单

第11章 伙伴关係和合作

第12章 有可能性的合作伙伴的分析

- 章概要

- 评分数标准主要的前提

- 范围与调查手法

- 有伴随式诊断服务供应商的可能性的合作伙伴:阿兹海默症

- 有伴随式诊断服务供应商的可能性的合作伙伴:乳癌

- 有伴随式诊断服务供应商的可能性的合作伙伴:大肠癌症

- 有伴随式诊断服务供应商的可能性的合作伙伴:肺癌症

- 有伴随式诊断服务供应商的可能性的合作伙伴:HIV

- 有伴随式诊断服务供应商的可能性的合作伙伴:卵巢癌症

- 有伴随式诊断服务供应商的可能性的合作伙伴:前列腺癌症

第13章 合併和收购

第14章 相关利益者需求分析

第15章 价值链分析

第16章 癌症生物标记临床调查:大型製药公司的配合措施

第17章 精密医疗软体解决方案的案例研究

第18章 市场影响分析:促进因素,阻碍因素,机会,课题

第19章 全球伴随式诊断开发服务市场

第20章 伴随式诊断开发服务市场(各提供服务形式)

第21章 伴随式诊断开发服务市场(各使用分析技术)

第22章 伴随式诊断开发服务市场(各对象治疗领域)

第23章 伴随式诊断开发服务市场(各终端用户)

第24章 伴随式诊断开发服务市场(各主要地区)

- 章概要

- 主要的前提与调查手法

- 北美

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 比利时

- 瑞士

- 其他

- 亚太地区

- 中国

- 其他

- 资料的三角测量检验

第25章 结论

第26章 执行洞察

第27章 附录1:表格形式资料

第28章 附录2:企业·团体一览

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: OVERVIEW

As per Roots Analysis, the global companion diagnostics (CDx) development market is estimated to grow from USD 892 million in current year to USD 1,796 million by 2035, at a CAGR of 7.3% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Services Offered

- Feasibility Studies

- Assay Development

- Analytical Validation

- Clinical Validation

- Manufacturing

Analytical Techniques Used

- NGS

- PCR

- IHC

- Flow Cytometry

- Others

Target Therapeutic Area

- Oncological Disorders

- Non-oncological Disorders

End User

- Industry Players

- Non-industry Players

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: GROWTH AND TRENDS

A companion diagnostic is a type of in-vitro diagnostic (IVD) device / test that enables researchers to collect crucial information for the safe and efficient use of a compatible drug or biological product. Recently, there has been a gradual shift towards understanding the molecular mechanisms involved in disease pathogenesis, and the information collected from companion diagnostic tools aids in the development of targeted therapies to treat these diseases. As a result, companion diagnostics have become an integral part of the healthcare sector to provide information about the unique genetic profiles of patients that further allow clinicians to develop treatment plans. It is worth noting that, since 2022, the FDA has approved close to 44 CDx diagnostics. Of these, three CDx-targeted therapies have received approval for advanced ovarian cancer, breast cancer, and non-small cell lung cancer.

Using these companion diagnostics to collect disease-specific information helps increase the success rate of target-specific therapies and improve overall patient outcomes. However, the development of such tests is a long process that starts from the identification of a suitable biomarker (specific to a particular disease indication) and extends to validating a precise method for detecting and quantifying its presence in biological samples. Given the complexities involved in the development of such diagnostic tests, drug developers prefer outsourcing this process to contract service providers having the necessary expertise.

Presently, numerous companies claim to offer a variety of services for diagnostic development, including biomarker identification and discovery, biomarker selection and validation, assay development, analytical validation, clinical validation, commercialization, manufacturing, services related to companion diagnostic kits, reagent development and regulatory assistance.

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: KEY INSIGHTS

The report delves into the current state of the companion diagnostics (CDx) development market and identifies potential growth opportunities within the industry. Some key findings from the report include:

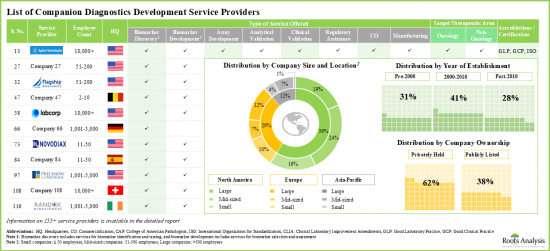

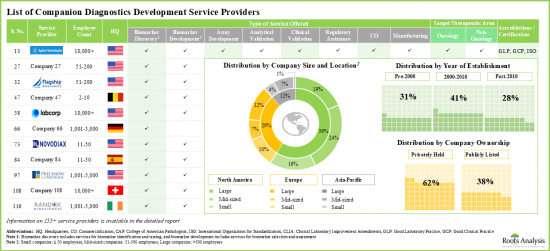

- Over 155 service providers presently claim to have the required expertise to support multiple steps involved in companion diagnostic development; ~30% of these are established players with more than 500 employees.

- Companies offer services to develop analytical tests to identify disease specific biomarkers; oncology is the more popular area wherein developers are exploring personalized diagnostic regimens.

- In pursuit of building a competitive edge in this field, stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective service portfolios.

- Close to 300 companion diagnostic products, based on various analytical platforms, are available / under development to facilitate biomarker detection from different types of biological specimens.

- More than 80% of the companion diagnostic products have received approval for the treatment of oncological disorders; of these, 95% of the products are currently intended for use with drugs targeting solid tumors.

- The rising interest of stakeholders is evident from the rise in partnership activity; in fact, more than 80 agreements related to companion diagnostic development services were inked in the last two years.

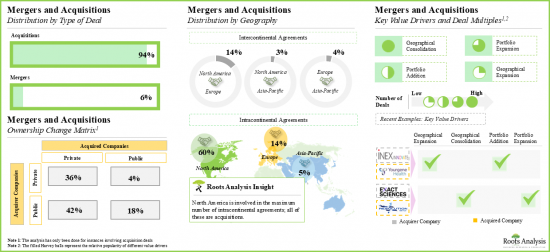

- The surge in mergers and acquisitions is driven by the increasing demand for CDx; 65% of acquisition agreements were signed to incorporate additional capabilities into their existing portfolio offerings.

- As drug developers continue to build a robust portfolio of biomarker-based targeted therapies, they are actively seeking partnerships with CDx service providers, in order to leverage the latter's expertise in this domain.

- Over the years, several big pharma players have sponsored multiple biomarker focused clinical trials; the use of companion diagnostic tests to stratify patient population in these trials offers significant cost reduction (~60%).

- The advent of bioinformatics and artificial intelligence tools has led to the development of over 125 software applications that integrate clinical and diagnostic data to deliver personalized experiences to patients.

- Over 115 players currently offer software applications for diagnostic, therapeutic and analytical purposes; these solutions are also capable of handling variable data types across a range of therapeutic areas.

- The companion diagnostic development value chain involves several drug and diagnostics developers, service providers, along with other key stakeholders, each having a discrete set of priorities and requirements.

- The companion diagnostic development services market is anticipated to grow at a CAGR of 7.3%, till 2035; North America is expected to capture the majority share (over 65%) of the market by 2035.

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: KEY SEGMENTS

Clinical Validation Service Segment Occupies the Largest Share of the Companion Diagnostics (CDx) Development Market

Based on the type of services offered, the market is segmented into feasibility studies, assay development, analytical validation, clinical validation and manufacturing. At present, the clinical validation service segment holds the maximum share of the global companion diagnostics (CDx) development market. Additionally, the analytical validation service segment is likely to grow at a faster pace during the forecasted period.

By Analytical Techniques Used, IHC (Immunohistochemistry) is the Fastest Growing Segment of the Global Companion Diagnostics (CDx) Development Market

Based on the analytical techniques used, the market is segmented into NGS, PCR, IHC, flow cytometry and others. Currently, the next generation sequencing (NGS) segment captures the highest proportion of the global companion diagnostics (CDx) development market owing to the various benefits offered by this analytical technique, such as lower sample input, higher throughput and greater sensitivity. Further, the companion diagnostics (CDx) development market for the IHC segment is likely to grow at a relatively higher CAGR.

Oncological Disorders Segment Occupies the Largest Share of the Companion Diagnostics (CDx) Development Market by Target Therapeutic Area

Based on the target therapeutic area, the market is segmented into oncological disorders and non-oncological disorders. At present, companion diagnostics for oncological disorders hold the maximum share of the companion diagnostics (CDx) development market. This trend is likely to remain the same during the forecasted period. Further, it is worth highlighting that the companion diagnostics (CDx) development market for non-oncological disorders segment is likely to grow at a relatively higher CAGR.

Currently, the Industry Players Segment Holds the Largest Share of the Companion Diagnostics (CDx) Development Market

Based on end user, the global market is segmented into industry players and non-industry players. Currently, the industry players segment holds the largest market share. However, the companion diagnostics (CDx) development market for non-industry players segment is expected to witness substantial growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe and Asia-Pacific. Currently, North America dominates the global companion diagnostics (CDx) development market and accounts for the largest revenue share. However, the market in Europe is expected to grow at a higher CAGR in the coming years.

Example Players in the Companion Diagnostics (CDx) Development Market

- Almac Diagnostics

- BGI Genomics

- Eurofins

- Geneuity Clinical Research Services

- Labcorp

- MEDICAL & BIOLOGICAL LABORATORIES

- Q2 Solutions

- QIAGEN

- Quest Diagnostics

- ResearchDx

COMPANION DIAGNOSTICS (CDX) DEVELOPMENT MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global companion diagnostics (CDx) development market, focusing on key market segments, including [A] type of services offered, [B] analytical techniques used, [C] target therapeutic area, [D] end user and [E] key geographical regions.

- Service Providers Market Landscape: A comprehensive evaluation of the companion diagnostics (CDx) development industry players, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] ownership, [D] geographical location of headquarters, [E] types of services offered, [F] affiliated services, [G] AI support, [H] analytical techniques used, [I] therapeutic areas and [J] regulatory certifications / accreditations.

- Company Competitiveness Analysis: A comprehensive competitive analysis of service providers in the companion diagnostics (CDx) development industry, examining factors, such as [A] developer strength and [B] product portfolio strength.

- Detailed Company Profiles: In-depth profiles of key service providers engaged in the companion diagnostics (CDx) development market, focusing on [A] overview of the company, [B] financial information (if available), [C] service portfolio, and [D] recent developments and [E] an informed future outlook.

- Short Company Profiles: Tabulated profiles of key service providers engaged in the companion diagnostics (CDx) development market, focusing on [A] overview of the company and [B] service portfolio.

- Companion Diagnostic Products Market Landscape: A comprehensive evaluation of the companion diagnostic products, based on several relevant parameters, such as [A] analytical techniques used, [B] target disease indication, [C] therapeutic areas, [D] type of biomarker detected, [E] type of sample used, [F] regulatory authority involved, [G] expediated review designation, [H] leading companion diagnostic developers and [I] most popular companion drugs. Additionally, a comprehensive evaluation of the companion diagnostic developers, based on several relevant parameters, such as [J] year of establishment, [K] company size, [L] ownership and [M] geographical location of headquarters.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the companion diagnostics (CDx) development market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of technology, [D] target therapeutic area, [E] type of partner, [F] most active players (in terms of the number of partnerships signed) and [G] geographical distribution of partnership activity.

- Likely Partner Analysis: An in-depth analysis of 300+ drug developers sponsoring clinical trials of therapies targeting several disease-specific biomarkers, shortlisted based on relevant parameters, such as [A] number of biomarker-focused clinical trials sponsored and [B] time to market their proprietary personalized medicine products.

- Mergers and Acquisitions: An in-depth analysis of various mergers and acquisitions in this domain, based on relevant parameters, such as [A] year of agreement, [B] type of deal, [C] geographical location of headquarters, [D] company size, [E] key value drivers and [F] acquisition deal multiples (based on revenues). Additionally, an ownership change matrix provides a summary of the involvement of private and public sector companies in this domain.

- Stakeholder Needs Analysis: An insightful analysis of the current and long-term needs of different stakeholders, along with the key areas of concern associated with this industry.

- Value Chain Analysis: An in-depth analysis of the companion diagnostics value chain, based on various relevant parameters, such as [A] various steps of development operations and [B] the cost requirements across each step.

- Big Pharma Initiatives: An in-depth analysis of oncology clinical trials sponsored by prominent big pharmaceutical companies in the companion diagnostics domain, based on various relevant parameters, such as [A] trial registration year, [B] phase of development, [C] trial sponsors, [D] recruitment status, [E] therapy design, [F] enrolled patient population, [G] popularity of biomarkers and [H] popularity of target indications.

- Case Study: A detailed discussion on the current market landscape of precision medicine software solutions that offer intelligent insights to diagnostic developers, service providers, patients and healthcare experts, based on [A] type of platform utilized, [B] purpose of software solution, [C] type of data processed, [D] therapeutic area, and [E] types of end users. Additionally, a comprehensive evaluation of software solutions developers, based on several relevant parameters, such as [A] year of establishment, [B] company size, [c] ownership and [D] geographical location of headquarters.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Evolution of Personalized Medicines

- 5.3. An Overview of Companion Diagnostics

- 5.3.1. Development of Companion Diagnostics

- 5.3.2. Analytical Techniques Used in Companion Diagnostic Tests

- 5.3.2.1. Immunohistochemistry

- 5.3.2.2. In-situ Hybridization

- 5.3.2.3. Polymerase Chain Reaction

- 5.3.2.4. DNA Sequencing / Next Generation Sequencing

- 5.3.3. Advantages of Companion Diagnostics

- 5.4. Applications of Companion Diagnostics across Different Therapeutic Areas

- 5.4.1. Oncological Disorders

- 5.4.2. Infectious Diseases

- 5.4.3. Neurological Disorders

- 5.5. Regulatory Review and Approval Process for Companion Diagnostics

- 5.6. Existing Challenges and Need for Outsourcing

- 5.7. Basic Guidelines for Selecting a Contract Diagnostics Organization (CDO)

- 5.8. Future Perspectives

6. COMPANION DIAGNOSTICS DEVELOPMENT SERVICE PROVIDERS: MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Companion Diagnostics Development Service Providers: List of Players

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Company Size and Location of Headquarters (Region)

- 6.2.5. Analysis by Company Ownership

- 6.2.6. Analysis by Type of Services Offered

- 6.2.7. Analysis by Type of Affiliated Service Offered

- 6.2.8. Analysis by AI Support

- 6.2.9. Analysis by Type of Analytical Techniques Used

- 6.2.10. Analysis by Target Therapeutic Area

- 6.2.11. Analysis by Regulatory Accreditation / Certification

- 6.2.12. Analysis by Type of Services Offered, Company Size and Location of Headquarters (Region)

- 6.2.13. Analysis by Analytical Technique Used, Company Size and Location of Headquarters (Region)

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Parameters

- 7.3. Methodology

- 7.4. Companion Diagnostics Service Providers: Company Competitiveness Analysis

- 7.4.1. Companion Diagnostics Service Providers based in North America

- 7.4.2. Companion Diagnostics Service Providers based in Europe

- 7.4.3. Companion Diagnostics Service Providers based in Asia-Pacific

8. COMPANION DIAGNOSTICS DEVELOPMENT SERVICE PROVIDERS: DETAILED COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Key Players in North America

- 8.2.1. Geneuity Clinical Research Services

- 8.2.1.1. Company Overview

- 8.2.1.2. Service Portfolio

- 8.2.1.3. Recent Developments and Future Outlook

- 8.2.2. Labcorp

- 8.2.2.1. Company Overview

- 8.2.2.2. Service Portfolio

- 8.2.2.3. Recent Developments and Future Outlook

- 8.2.3. Q2 Solutions

- 8.2.3.1. Company Overview

- 8.2.3.2. Service Portfolio

- 8.2.3.3. Recent Developments and Future Outlook

- 8.2.4. Quest Diagnostics

- 8.2.4.1. Company Overview

- 8.2.4.2. Service Portfolio

- 8.2.4.3. Recent Developments and Future Outlook

- 8.2.5. ResearchDx

- 8.2.5.1. Company Overview

- 8.2.5.2. Service Portfolio

- 8.2.5.3. Recent Developments and Future Outlook

- 8.2.1. Geneuity Clinical Research Services

- 8.3. Key Players in Europe

- 8.3.1. Almac Diagnostic Services

- 8.3.1.1. Company Overview

- 8.3.1.2. Service Portfolio

- 8.3.1.3. Recent Developments and Future Outlook

- 8.3.2. Eurofins

- 8.3.2.1. Company Overview

- 8.3.2.2. Service Portfolio

- 8.3.2.3. Recent Developments and Future Outlook

- 8.3.3. QIAGEN

- 8.3.3.1. Company Overview

- 8.3.3.2. Service Portfolio

- 8.3.3.3. Recent Developments and Future Outlook

- 8.3.1. Almac Diagnostic Services

- 8.4. Key Players in Asia-Pacific

- 8.4.1. BGI Genomics

- 8.4.1.1. Company Overview

- 8.4.1.2. Service Portfolio

- 8.4.1.3. Recent Developments and Future Outlook

- 8.4.2. MEDICAL & BIOLOGICAL LABORATORIES (MBL)

- 8.4.2.1. Company Overview

- 8.4.2.2. Service Portfolio

- 8.4.2.3. Recent Developments and Future Outlook

- 8.4.1. BGI Genomics

9. COMPANION DIAGNOSTICS DEVELOPMENT SERVICE PROVIDERS: SHORT COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Key Players in North America

- 9.2.1. Agilent Technologies

- 9.2.1.1. Company Overview

- 9.2.1.2. Service Portfolio

- 9.2.2. Creative Biolabs

- 9.2.2.1. Company Overview

- 9.2.2.2. Service Portfolio

- 9.2.3. ICON Specialty Laboratories

- 9.2.3.1. Company Overview

- 9.2.3.2. Service Portfolio

- 9.2.4. NeoGenomics Laboratories

- 9.2.4.1. Company Overview

- 9.2.4.2. Service Portfolio

- 9.2.1. Agilent Technologies

- 9.3. Key Players in Europe

- 9.3.1. Cerba Research

- 9.3.1.1. Company Overview

- 9.3.1.2. Service Portfolio

- 9.3.2. Randox Biosciences

- 9.3.2.1. Company Overview

- 9.3.2.2. Service Portfolio

- 9.3.3. Roche

- 9.3.3.1. Company Overview

- 9.3.3.2. Service Portfolio

- 9.3.4. Siemens Healthineers

- 9.3.4.1. Company Overview

- 9.3.4.2. Service Portfolio

- 9.3.5. Unilabs

- 9.3.5.1. Company Overview

- 9.3.5.2. Service Portfolio

- 9.3.1. Cerba Research

- 9.4. Key Players in Asia-Pacific

- 9.4.1. Abnova

- 9.4.1.1. Company Overview

- 9.4.1.2. Service Portfolio

- 9.4.2. Celemics

- 9.4.2.1. Company Overview

- 9.4.2.2. Service Portfolio

- 9.4.3. MEDx Translational Medicine

- 9.4.3.1. Company Overview

- 9.4.3.2. Service Portfolio

- 9.4.4. Novogene

- 9.4.4.1. Company Overview

- 9.4.4.2. Service Portfolio

- 9.4.5. Shuwen Biotech

- 9.4.5.1. Company Overview

- 9.4.5.2. Service Portfolio

- 9.4.1. Abnova

10. COMPANION DIAGNOSTIC PRODUCTS: MARKET LANDSCAPE

- 10.1. Chapter Overview

- 10.2. Companion Diagnostics: List of Marketed / Investigational Products

- 10.2.1. Analysis by Type of Sample Used

- 10.2.2. Analysis by Type of Biomarker Detected

- 10.2.3. Analysis by Analytical Technique Used

- 10.2.4. Analysis by Target Disease Indication

- 10.2.5. Analysis by Target Therapeutic Area

- 10.2.6. Analysis by Commercial Availability and Target Therapeutic Area

- 10.2.7. Marketed Products: Analysis by Year of FDA Approval

- 10.2.8. Marketed Products: Analysis by Year of Other Regulatory Approval

- 10.2.9. Marketed Products: Analysis by Regulatory Authority Involved

- 10.2.10. Most Popular Companion Drugs: Analysis by Number of Companion Diagnostic Products

- 10.3. Companion Diagnostics: List of Developers

- 10.3.1. Analysis by Year of Establishment

- 10.3.2. Analysis by Company Size

- 10.3.3. Analysis by Location of Headquarters

- 10.3.4. Analysis by Company Ownership

- 10.3.5. Most Active Players: Analysis by Number of Marketed Products

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Partnership Models

- 11.3. Companion Diagnostic Development Service Providers: Partnerships and Collaborations

- 11.3.1. Analysis by Year of Partnership

- 11.3.2. Analysis by Type of Partnership

- 11.3.3. Analysis by Year and Type of Partnership

- 11.3.4. Analysis by Type of Technology

- 11.3.5. Analysis by Target Therapeutic Area

- 11.3.6. Analysis by Type of Partner

- 11.3.7. Analysis by Year of Partnership and Type of Partner

- 11.3.8. Most Active Players: Analysis by Number of Partnerships

- 11.3.9. Analysis by Geography

- 11.3.9.1. Local and International Agreements

- 11.3.9.2. Intercontinental and Intracontinental Agreements

12. LIKELY PARTNER ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scoring Criteria and Key Assumptions

- 12.3. Scope and Methodology

- 12.4. Likely Partners for Companion Diagnostics Service Providers: Alzheimer's Disease

- 12.4.1. Industry Players Focused on Amyloid Beta Biomarker

- 12.4.1.1. Regional Distribution of Amyloid Beta Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.4.2. Non-Industry Players Focused on Amyloid Beta Biomarker

- 12.4.2.1. Regional Distribution of Amyloid Beta Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.4.3. Industry Players Focused on Tau Biomarker

- 12.4.3.1. Regional Distribution of Tau Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.4.4. Non-Industry Players Focused on Tau Biomarker

- 12.4.4.1. Regional Distribution of Tau Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.4.1. Industry Players Focused on Amyloid Beta Biomarker

- 12.5. Likely Partners for Companion Diagnostics Service Providers: Breast Cancer

- 12.5.1. Industry Players Focused on BRCA Biomarker

- 12.5.1.1. Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.5.2. Non-Industry Players Focused on BRCA Biomarker

- 12.5.2.1. Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.5.3. Industry Players Focused on HER Biomarker

- 12.5.3.1. Regional Distribution of HER Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.5.4. Non-Industry Players Focused on HER Biomarker

- 12.5.4.1. Regional Distribution of HER Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.5.5. Industry Players Focused on PD-L1 Biomarker

- 12.5.5.1. Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.5.6. Non-Industry Players Focused on PD-L1 Biomarker

- 12.5.6.1. Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.5.7. Industry Players Focused on HR Biomarker

- 12.5.7.1. Regional Distribution of HR Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.5.8. Non-Industry Players Focused on HR Biomarker

- 12.5.8.1. Regional Distribution of HR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.5.1. Industry Players Focused on BRCA Biomarker

- 12.6. Likely Partners for Companion Diagnostics Service Providers: Colorectal Cancer

- 12.6.1. Industry Players Focused on BRAF Biomarker

- 12.6.1.1. Regional Distribution of BRAF Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.6.2. Non-Industry Players Focused on BRAF Biomarker

- 12.6.2.1. Regional Distribution of BRAF Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.6.3. Industry Players Focused on EGFR Biomarker

- 12.6.3.1. Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.6.4. Non-Industry Players Focused on EGFR Biomarker

- 12.6.4.1. Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.6.5. Industry Players Focused on KRAS Biomarker

- 12.6.5.1. Regional Distribution of KRAS Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.6.6. Non-Industry Players Focused on KRAS Biomarker

- 12.6.6.1. Regional Distribution of KRAS Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.6.7. Industry Players Focused on MSI / dMMR Biomarker

- 12.6.7.1. Regional Distribution of MSI / dMMR Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.6.8. Non-Industry Players Focused on MSI / dMMR Biomarker

- 12.6.8.1. Regional Distribution of MSI / dMMR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.6.1. Industry Players Focused on BRAF Biomarker

- 12.7. Likely Partners for Companion Diagnostic Service Providers: Lung Cancer

- 12.7.1. Industry Players Focused on ALK Biomarker

- 12.7.1.1. Regional Distribution of ALK Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.2. Non-Industry Players Focused on ALK Biomarker

- 12.7.2.1. Regional Distribution of ALK Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.3. Industry Players Focused on AST Biomarker

- 12.7.3.1. Regional Distribution of AST Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.4. Non-Industry Players Focused on AST Biomarker

- 12.7.4.1. Regional Distribution of AST Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.5. Industry Players Focused on EGFR Biomarker

- 12.7.5.1. Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.6. Non-Industry Players Focused on EGFR Biomarker

- 12.7.6.1. Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.7. Industry Players Focused on PD-L1 Biomarker

- 12.7.7.1. Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.8. Non-Industry Players Focused on PD-L1 Biomarker

- 12.7.8.1. Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.9. Industry Players Focused on RET Biomarker

- 12.7.9.1. Regional Distribution of RET Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.7.10. Non-Industry Players Focused on RET Biomarker

- 12.7.10.1. Regional Distribution of RET Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.7.1. Industry Players Focused on ALK Biomarker

- 12.8. Likely Partners for Companion Diagnostics Service Providers: HIV

- 12.8.1. Industry Players Focused on CCR5 Biomarker

- 12.8.1.1. Regional Distribution of CCR5 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.8.2. Non-Industry Players Focused on CCR5 Biomarker

- 12.8.2.1. Regional Distribution of CCR5 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.8.1. Industry Players Focused on CCR5 Biomarker

- 12.9. Likely Partners for Companion Diagnostics Service Providers: Ovarian Cancer

- 12.9.1. Industry Players Focused on BRCA Biomarker

- 12.9.1.1. Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.9.2. Non-Industry Players Focused on BRCA Biomarker

- 12.9.2.1. Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.9.3. Industry Players Focused on CA-125 Biomarker

- 12.9.3.1. Regional Distribution of CA-125 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.9.4. Non-Industry Players Focused on CA-125 Biomarker

- 12.9.4.1. Regional Distribution of CA-125 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.9.1. Industry Players Focused on BRCA Biomarker

- 12.10. Likely Partners for Companion Diagnostics Service Providers: Prostate Cancer

- 12.10.1. Industry Players Focused on AR-V7 Biomarker

- 12.10.1.1. Regional Distribution of AR-V7 Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.10.2. Non-Industry Players Focused on AR-V7 Biomarker

- 12.10.2.1. Regional Distribution of AR-V7 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.10.3. Industry Players Focused on PTEN Biomarker

- 12.10.3.1. Regional Distribution of PTEN Biomarker Focused Clinical Trials Sponsored by Industry Players

- 12.10.4. Non-Industry Players Focused on PTEN Biomarker

- 12.10.4.1. Regional Distribution of PTEN Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- 12.10.1. Industry Players Focused on AR-V7 Biomarker

13. MERGERS AND ACQUISITONS

- 13.1. Chapter Overview

- 13.2. Merger and Acquisition Models

- 13.3. Companion Diagnostic Development Service Providers: Mergers and Acquisitions

- 13.3.1. Analysis by Year of Deal

- 13.3.2. Analysis by Type of Deal

- 13.3.3. Analysis by Geography

- 13.3.3.1. Local and International Agreements

- 13.3.3.2. Intercontinental and Intracontinental Agreements

- 13.3.4. Ownership Change Matrix

- 13.3.5. Key Value Drivers of Acquisitions

- 13.3.6. Key Players: Analysis by Number of Mergers and Acquisitions

- 13.3.7. Key Acquisitions: Deal Multiples

14. STAKEHOLDER NEEDS ANALYSIS

- 14.1. Chapter Overview

- 14.2. Companion Diagnostics: Interests / Needs of Different Stakeholders

- 14.3. Comparison of Interests / Needs of Various Stakeholders

- 14.3.1. Interests / Needs of Drug Developers

- 14.3.2. Interests / Needs of Companion Diagnostics Developers

- 14.3.3. Interests / Needs of Regulatory Authorities

- 14.3.4. Interests / Needs of Testing Laboratories

- 14.3.5. Interests / Needs of Payers / Insurance Providers

- 14.3.6. Interests / Needs of Physicians

- 14.3.7. Interests / Needs of Patients

- 14.4. Overall Summary

15. VALUE CHAIN ANALYSIS

- 15.1. Chapter Overview

- 15.2. Companion Diagnostics Value Chain

- 15.3. Cost Distribution Across the Value Chain

- 15.3.1. Cost Associated with Research and Product Development

- 15.3.2. Cost Associated with Manufacturing and Assembly

- 15.3.3. Cost Associated with Clinical Trials, FDA Approval and Other Administrative Tasks

- 15.3.4. Cost Associated with Payer Negotiation and KOL Engagement

- 15.3.5. Cost Associated with Marketing and Sales

16. CLINICAL RESEARCH ON CANCER BIOMARKERS: BIG PHARMA INITIATIVES

- 16.1. Chapter Overview

- 16.2. Methodology

- 16.3. Clinical Trial Analysis

- 16.3.1. List of Likely Drug Candidates for IVD Developers

- 16.4. Cumulative Distribution of Biomarker-based Trials by Registration Year, Since 2016

- 16.4.1. Analysis of Biomarker-based Trials of Most Popular Biomarkers

- 16.4.2. Analysis of Biomarker-based Trials of Moderately Popular Biomarkers

- 16.4.3. Analysis of Biomarker-based Trials of Less Popular / Preliminary Stage Biomarkers

- 16.4.4. Word Cloud of Other Emerging Biomarkers

- 16.4.5. Cumulative Distribution of Trials by Registration Year and Most Popular Biomarkers

- 16.4.6. Cumulative Distribution of Trials by Registration Year and Moderately Popular Biomarkers

- 16.4.7. Cumulative Distribution of Trials by Registration Year and Less Popular Biomarkers

- 16.5. Distribution of Biomarker-based Trials by Most Popular Indications

- 16.5.1. Distribution of Biomarker-based Trials by Moderately Popular Indications

- 16.5.2. Distribution of Biomarker-based Trials by Less Popular Other Indications

- 16.5.3. Word Cloud of Other Emerging Indications in Biomarker-based Clinical Trials

- 16.5.4. Cumulative Distribution of Trials by Registration Year and Most Popular Indication

- 16.5.5. Cumulative Distribution of Trials by Registration Year and Moderately Popular Indications

- 16.5.6. Cumulative Distribution of Trials by Registration Year and Less Popular / Preliminary Stage Indications

- 16.6. Analysis of Biomarker-based Trials by Phase of Development

- 16.6.1. Analysis of Biomarker-based Trials by Phase of Development and Most Popular Biomarkers

- 16.6.2. Analysis of Biomarker-based Trials by Phase of Development and Moderately Popular Biomarkers

- 16.6.3. Analysis of Biomarker-based Trials by Phase of Development and Less Popular Other Biomarkers

- 16.6.4. Analysis of Biomarker-based Trials by Phase of Development and Most Popular Indications

- 16.6.5. Analysis of Biomarker-based Trials by Phase of Development and Moderately Popular Indications

- 16.6.6. Analysis of Biomarker-based Trials by Phase of Development and Less Popular Other Indications

- 16.7. Analysis of Biomarker-based Trials by Sponsor

- 16.7.1. Analysis of Biomarker-based Trials by Sponsor and Most Popular Biomarkers

- 16.7.2. Analysis of Biomarker-based Trials by Sponsor and Moderately Popular Biomarkers

- 16.7.3. Analysis of Biomarker-based Trials by Sponsor and Most Popular Indications

- 16.7.4. Analysis of Biomarker-based Trials by Sponsor and Moderately Popular Indications

- 16.8. Analysis of Biomarker-based Trials by Recruitment Status

- 16.9. Analysis of Biomarker-based Trials by Therapy Design

- 16.10. Analysis of Biomarker-based Trials by Geography

- 16.10.1. Analysis of Biomarker-based Trials by Trial Phase and Recruitment Status

- 16.11. Clinical Trials Summary: Analysis by Biomarker and Most Popular Indications

- 16.12. Clinical Trials Summary: Analysis by Biomarker and Moderately Popular Indications

- 16.13. Clinical Trials Summary: Analysis by Biomarker and Preliminary Stage Indications

17. CASE STUDY ON PRECISION MEDICINE SOFTWARE SOLUTIONS

- 17.1. Chapter Overview

- 17.2. Precision Medicine Software Solutions: List of Players

- 17.2.1. Analysis by Year of Establishment

- 17.2.2. Analysis by Company Size

- 17.2.3. Analysis by Location of Headquarters (Region)

- 17.2.4. Analysis by Company Size and Location of Headquarters (Region)

- 17.3. Precision Medicine Software Solutions: List of Software

- 17.3.1. Analysis by Status of Development

- 17.3.2. Analysis by Type of Platform

- 17.3.3. Analysis by Regulatory Accreditation Received

- 17.3.4. Analysis by Target Therapeutic Area

- 17.3.5. Analysis by Type of Data Handled

- 17.3.6. Analysis by Purpose of Software

- 17.3.7. Analysis by End-User

- 17.3.8. Most Active Players: Distribution by Number of Software

18. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 18.1. Chapter Overview

- 18.2. Market Drivers

- 18.3. Market Restraints

- 18.4. Market Opportunities

- 18.5. Market Challenges

- 18.6. Conclusion

19. GLOBAL COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Global Companion Diagnostics Development Services Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.1. Scenario Analysis

- 19.3.1.1. Conservative Scenario

- 19.3.1.2. Optimistic Scenario

- 19.3.1. Scenario Analysis

- 19.4. Key Market Segmentations

20. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY TYPE OF SERVICE OFFERED

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Feasibility Studies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.4. Assay Development: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.5. Analytical Validation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6. Clinical Validation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Manufacturing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

21. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY TYPE OF ANALYTICAL TECHNIQUE USED

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. NGS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.4. PCR: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.5. IHC: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6. Flow Cytometry: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Other Analytical Techniques: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Data Triangulation and Validation

22. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY TARGET THERAPEUTIC AREA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Oncological Disorders: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.4. Non-oncological Disorders: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.5. Data Triangulation and Validation

23. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY END USER

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Industry Players: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.4. Non-Industry Players: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.5. Data Triangulation and Validation

24. COMPANION DIAGNOSTICS DEVELOPMENT SERVICES MARKET, BY KEY GEOGRAPHICAL REGIONS

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.3.1. US: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.3.2. Canada: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4. Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.4.1. Germany: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4.2. UK: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4.3. Belgium: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4.4. Switzerland: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.4.5. Other European Countries: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.5. Asia-Pacific: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.5.1. China: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.5.2. Other Asia-Pacific Countries: Historical Trends (Since 2019) and Future Estimates (Till 2035)

- 24.6. Data Triangulation and Validation

25. CONCLUDING REMARKS

26. EXECUTIVE INSIGHTS

- 26.1. Chapter Overview

- 26.2. Apollo Hospital Educational and Research Foundation, and Urvogelbio

- 26.2.1. Company Snapshot

- 26.2.2. Interview Transcript: M.V. Sasidhar, Chief Scientific Officer (Apollo Hospital Educational and Research Foundation) and Founder (Urvogelbio)

- 26.3. MEDICAL & BIOLOGICAL LABORATORIES

- 26.3.1. Company Snapshot

- 26.3.2. Interview Transcript: Keita Takahashi (Manager of Sales and Marketing Division), Kyoko Fukushima (Manager of Companion Diagnostic Development Services) and Kyo Shirai (Sales and Marketing Division)

- 26.4. Genomenon

- 26.4.1. Company Snapshot

- 26.4.2. Interview Transcript: Mike Klein, Chief Executive Officer; Mark Kiel, Founder and Chief Scientific Officer; and Candace Chapman, Vice President of Marketing

- 26.5. Tymora Analytical Operations

- 26.5.1. Company Snapshot

- 26.5.2. Interview Transcript: Anton Iliuk, President and Chief Technology Officer

- 26.6. Novodiax

- 26.6.1. Company Snapshot

- 26.6.2. Interview Transcript: Paul Kortschak, Former Senior Vice President

- 26.7. OWL Metabolomics

- 26.7.1. Company Snapshot

- 26.7.2. Interview Transcript: Pablo Ortiz, Chief Executive Officer

- 26.8. NeoGenomics Laboratories

- 26.8.1. Company Snapshot

- 26.8.2. Interview Transcript: Lawrence M. Weiss, Former Chief Scientific Officer

27. APPENDIX 1: TABULATED DATA

28. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Companion Diagnostics Service Providers: List of Players

- Table 6.2 Companion Diagnostics Development Service Providers: Information on Type of Services Offered

- Table 6.3 Companion Diagnostics Development Service Providers: Information on Type of Affiliated Services Offered and AI Support

- Table 6.4 Companion Diagnostics Development Service Providers: Information on Analytical Techniques Used

- Table 6.5 Companion Diagnostics Development Service Providers: Information on Target Therapeutic Area

- Table 6.6 Companion Diagnostics Development Service Providers: Information on Regulatory Certifications / Accreditations

- Table 8.1 Companion Diagnostic Development Service Providers: List of Companies Profiled

- Table 8.2 Geneuity Clinical Research Services: Company Overview

- Table 8.3 Geneuity Clinical Research Services: Service Portfolio

- Table 8.4 Labcorp: Company Overview

- Table 8.5 Labcorp: Service Portfolio

- Table 8.6 Labcorp: Recent Developments and Future Outlook

- Table 8.7 Q2 Solutions: Company Overview

- Table 8.8 Q2 Solutions: Service Portfolio

- Table 8.9 Quest Diagnostics: Company Overview

- Table 8.10 Quest Diagnostics: Service Portfolio

- Table 8.11 Quest Diagnostics: Recent Developments and Future Outlook

- Table 8.12 ResearchDx: Company Overview

- Table 8.13 ResearchDx: Service Portfolio

- Table 8.14 ResearchDx: Recent Developments and Future Outlook

- Table 8.15 Almac Diagnostic Services: Company Overview

- Table 8.16 Almac Diagnostic Services: Service Portfolio

- Table 8.17 Almac Diagnostic Services: Recent Developments and Future Outlook

- Table 8.18 Eurofins: Company Overview

- Table 8.19 Eurofins: Service Portfolio

- Table 8.20 QIAGEN: Company Overview

- Table 8.21 QIAGEN: Service Portfolio

- Table 8.22 QIAGEN: Recent Developments and Future Outlook

- Table 8.23 BGI Genomics: Company Overview

- Table 8.24 BGI Genomics: Service Portfolio

- Table 8.25 MEDICAL & BIOLOGICAL LABORATORIES: Company Overview

- Table 8.26 MEDICAL & BIOLOGICAL LABORATORIES: Service Portfolio

- Table 9.1 Companion Diagnostic Development Service Providers: List of Companies Profiled

- Table 9.2 Agilent Technologies: Company Overview

- Table 9.3 Agilent Technologies: Service Portfolio

- Table 9.4 Creative Biolabs: Company Overview

- Table 9.5 Creative Biolabs: Service Portfolio

- Table 9.6 ICON Specialty Laboratories: Company Overview

- Table 9.7 ICON Specialty Laboratories: Service Portfolio

- Table 9.8 NeoGenomics Laboratories: Company Overview

- Table 9.9 NeoGenomics Laboratories: Service Portfolio

- Table 9.10 Cerba Research: Company Overview

- Table 9.11 Cerba Research: Service Portfolio

- Table 9.12 Randox Biosciences: Company Overview

- Table 9.13 Randox Biosciences: Service Portfolio

- Table 9.14 Roche: Company Overview

- Table 9.15 Roche: Service Portfolio

- Table 9.16 Siemens Healthineers: Company Overview

- Table 9.17 Siemens Healthineers: Service Portfolio

- Table 9.18 Unilabs: Company Overview

- Table 9.19 Unilabs: Service Portfolio

- Table 9.20 Abnova: Company Overview

- Table 9.21 Abnova: Service Portfolio

- Table 9.22 Celemics: Company Overview

- Table 9.23 Celemics: Service Portfolio

- Table 9.24 MEDx Translational Medicine: Company Overview

- Table 9.25 MEDx Translational Medicine: Service Portfolio

- Table 9.26 Novogene: Company Overview

- Table 9.27 Novogene: Service Portfolio

- Table 9.28 Shuwen Biotech: Company Overview

- Table 9.29 Shuwen Biotech: Service Portfolio

- Table 10.1 Companion Diagnostics: Information on Developer, Sample Used, Type of Biomarker, Analytical Technique Used, Target Disease Indication and Target Therapeutic Area

- Table 10.2 Companion Diagnostics: Information on Developer, Commercial Availability, FDA Approval Year, Other Regulatory Approval Year, Companion Drug (Generic Name)

- Table 10.3 Companion Diagnostics: List of Developers

- Table 11.1 Companion Diagnostics Development Service Providers: List of Partnerships and Collaborations, Since 2021

- Table 12.1 Industry Players Focused on Amyloid Beta Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.2 Non-Industry Players Focused on Amyloid Beta Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.3 Industry Players Focused on Tau Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.4 Non-Industry Players Focused on Tau Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.5 Industry Players Focused on BRCA Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.6 Non-Industry Players Focused on BRCA Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.7 Industry Players Focused on HER Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.8 Non-Industry Players Focused on HER Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.9 Industry Players Focused on PD-L1 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.10 Non-Industry Players Focused on PD-L1 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.11 Industry Players Focused on HR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.12 Non-Industry Players Focused on HR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.13 Industry Players Focused on BRAF Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.14 Non-Industry Players Focused on BRAF Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.15 Industry Players Focused on EGFR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.16 Non-Industry Players Focused on EGFR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.17 Industry Players Focused on KRAS Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.18 Non-Industry Players Focused on KRAS Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.19 Industry Players Focused on MSI / dMMR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.20 Non-Industry Players Focused on MSI / dMMR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.21 Industry Players Focused on ALK Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.22 Non-Industry Players Focused on ALK Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.23 Industry Players Focused on AST Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.24 Non-Industry Players Focused on AST Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.25 Industry Players Focused on EGFR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.26 Non-Industry Players Focused on EGFR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.27 Industry Players Focused on PD-L1 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.28 Non-Industry Players Focused on PD-L1 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.29 Industry Players Focused on RET Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.30 Non-Industry Players Focused on RET Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.31 Industry Players Focused on CCR5 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.32 Non-Industry Players Focused on CCR5 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.33 Industry Players Focused on BRCA Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.34 Non-Industry Players Focused on BRCA Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.35 Industry Players Focused on CA-125 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.36 Non-Industry Players Focused on CA-125 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.37 Industry Players Focused on AR-V7 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.38 Non-Industry Players Focused on AR-V7 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.39 Industry Players Focused on PTEN Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 12.40 Non-Industry Players Focused on PTEN Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 13.1 Companion Diagnostic Development Services: List of Mergers and Acquisitions, Since 2017

- Table 13.2 Acquisitions: Key Value Drivers

- Table 13.3 Key Acquisitions: Deal Multiples

- Table 14.1 Comparison of Relevance of Interests / Needs of Stakeholders

- Table 16.1 List of Likely Drug Candidates / Potential Collaborators for Diagnostic Developers

- Table 16.2 List of Biomarkers across Moderately Popular Indications

- Table 16.3 List of Biomarkers Across Emerging Indications

- Table 17.1 Precision Medicine Software Developers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 17.2 Precision Medicine Software: Information on Software, Developer, AI Integration, Type of Platform, Regulatory Accreditation and Status of Development

- Table 17.3 Precision Medicine Software: Information on Target Therapeutic Area, Purpose of Software and End-User

- Table 26.1 Apollo Hospital Educational and Research Foundation, and Urvogelbio: Company Snapshot

- Table 26.2 MEDICAL & BIOLOGICAL LABORATORIES: Company Snapshot

- Table 26.3 Genomenon: Company Snapshot

- Table 26.4 Tymora Analytical Operations: Company Snapshot

- Table 26.5 Novodiax: Company Snapshot

- Table 26.6 OWL Metabolomics: Company Snapshot

- Table 26.7 NeoGenomics Laboratories: Company Snapshot

- Table 27.1 Companion Diagnostics Development Service Providers: Distribution by Year of Establishment

- Table 27.2 Companion Diagnostics Development Service Providers: Distribution by Company Size

- Table 27.3 Companion Diagnostics Development Service Providers: Distribution by Location of Headquarters

- Table 27.4 Companion Diagnostics Development Service Providers: Distribution by Company Size and Location of Headquarters (Region)

- Table 27.5 Companion Diagnostics Development Service Providers: Distribution by Company Ownership

- Table 27.6 Companion Diagnostics Development Service Providers: Distribution by Type of Services Offered

- Table 27.7 Companion Diagnostics Development Service Providers: Distribution by Type of Affiliated Services Offered

- Table 27.8 Companion Diagnostics Development Service Providers: Distribution by AI Support

- Table 27.9 Companion Diagnostics Development Service Providers: Distribution by Analytical Techniques Used

- Table 27.10 Companion Diagnostics Development Service Providers: Distribution by Target Therapeutic Area

- Table 27.11 Companion Diagnostics Development Service Providers: Distribution by Regulatory Accreditations / Certifications

- Table 27.12 Companion Diagnostics: Distribution by Type of Sample Used

- Table 27.13 Companion Diagnostics: Distribution by Type of Biomarker Detected

- Table 27.14 Companion Diagnostics: Distribution by Analytical Technique Used

- Table 27.15 Companion Diagnostics: Distribution by Target Disease Indication

- Table 27.16 Companion Diagnostics: Distribution by Target Therapeutic Area

- Table 27.17 Companion Diagnostics: Distribution by Commercial Availability and Target Therapeutic Area

- Table 27.18 Companion Diagnostics: Distribution by Year of FDA Approval

- Table 27.19 Companion Diagnostics: Distribution by Year of Other Regulatory Approval

- Table 27.20 Companion Diagnostics: Distribution of Regulatory Authority Involved

- Table 27.21 Companion Diagnostics: Most Popular Companion Drugs

- Table 27.22 Companion Diagnostics Developers: Distribution by Year of Establishment

- Table 27.23 Companion Diagnostics Developers: Distribution by Company Size

- Table 27.24 Companion Diagnostics Developers: Distribution by Location of Headquarters

- Table 27.25 Companion Diagnostic Developers: Distribution by Company Ownership

- Table 27.26 Most Active Players: Distribution by Number of Marketed Products

- Table 27.27 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2017

- Table 27.28 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 27.29 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2021

- Table 27.30 Partnerships and Collaborations: Distribution by Type of Technology

- Table 27.31 Partnerships and Collaborations: Distribution by Target Therapeutic Area

- Table 27.32 Partnerships and Collaborations: Distribution by Type of Partner

- Table 27.33 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partner

- Table 27.34 Most Active Players: Distribution by Number for Partnerships

- Table 27.35 Partnerships and Collaborations: Local and International Agreements

- Table 27.36 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 27.37 Likely Partner Analysis: Distribution of Industry Players Focused on Amyloid Beta Biomarker by Likelihood of Partnership

- Table 27.38 Regional Distribution of Amyloid Beta Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.39 Likely Partner Analysis: Distribution of Non-Industry Players Focused on Amyloid Beta Biomarkers by Likelihood of Partnership

- Table 27.40 Regional Distribution of Amyloid Beta Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.41 Likely Partner Analysis: Distribution of Industry Players Focused on Tau Biomarker by Likelihood of Partnership

- Table 27.42 Regional Distribution of Tau Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.43 Likely Partner Analysis: Distribution of Non-Industry Players Focused on Tau Biomarker by Likelihood of Partnership

- Table 27.44 Regional Distribution of Tau Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.45 Likely Partner Analysis: Distribution of Industry Players Focused on BRCA Biomarker by Likelihood of Partnership

- Table 27.46 Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.47 Likely Partner Analysis: Distribution of Non-Industry Players Focused on BRCA Biomarker by Likelihood of Partnership

- Table 27.48 Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.49 Likely Partner Analysis: Distribution of Industry Players Focused on HER Biomarker by Likelihood of Partnership

- Table 27.50 Regional Distribution of HER Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.51 Likely Partner Analysis: Distribution of Non-Industry Players Focused on HER Biomarker by Likelihood of Partnership

- Table 27.52 Regional Distribution of HER Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.53 Likely Partner Analysis: Distribution of Industry Players Focused on PD-L1 Biomarker by Likelihood of Partnership

- Table 27.54 Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.55 Likely Partner Analysis: Distribution of Non-Industry Players Focused on PD-L1 Biomarker by Likelihood of Partnership

- Table 27.56 Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.57 Likely Partner Analysis: Distribution of Industry Players Focused on HR Biomarker by Likelihood of Partnership

- Table 27.58 Regional Distribution of HR Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.59 Likely Partner Analysis: Distribution of Non-Industry Players Focused on HR Biomarker by Likelihood of Partnership

- Table 27.60 Regional Distribution of HR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.61 Likely Partner Analysis: Distribution of Industry Players Focused on BRAF Biomarker by Likelihood of Partnership

- Table 27.62 Regional Distribution of BRAF Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.63 Likely Partner Analysis: Distribution of Non-Industry Players Focused on BRAF Biomarker by Likelihood of Partnership

- Table 27.64 Regional Distribution of BRAF Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.65 Likely Partner Analysis: Distribution of Industry Players Focused on EGFR Biomarker by Likelihood of Partnership

- Table 27.66 Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.67 Likely Partner Analysis: Distribution of Non-Industry Players Focused on EGFR Biomarker by Likelihood of Partnership

- Table 27.68 Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.69 Likely Partner Analysis: Distribution of Industry Players Focused on KRAS Biomarker by Likelihood of Partnership

- Table 27.70 Regional Distribution of KRAS Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.71 Likely Partner Analysis: Distribution of Non-Industry Players Focused on KRAS Biomarker by Likelihood of Partnership

- Table 27.72 Regional Distribution of KRAS Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.73 Likely Partner Analysis: Distribution of Industry Players Focused on MSI / dMMR Biomarker by Likelihood of Partnership

- Table 27.74 Regional Distribution of MSI / dMMR Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.75 Likely Partner Analysis: Distribution of Industry Players Focused on ALK Biomarker by Likelihood of Partnership

- Table 27.76 Regional Distribution of ALK Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.77 Likely Partner Analysis: Distribution of Non-Industry Players Focused on ALK Biomarker by Likelihood of Partnership

- Table 27.78 Regional Distribution of ALK Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.79 Likely Partner Analysis: Distribution of Industry Players Focused on AST Biomarker by Likelihood of Partnership

- Table 27.80 Regional Distribution of AST Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.81 Likely Partner Analysis: Distribution of Non-Industry Players Focused on AST Biomarker by Likelihood of Partnership

- Table 27.82 Regional Distribution of AST Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.83 Likely Partner Analysis: Distribution of Industry Players Focused on EGFR Biomarker by Likelihood of Partnership

- Table 27.84 Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.85 Likely Partner Analysis: Distribution of Non-Industry Players Focused on EGFR Biomarker by Likelihood of Partnership

- Table 27.86 Regional Distribution of EGFR Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.87 Likely Partner Analysis: Distribution of Industry Players Focused on PD-L1 Biomarker by Likelihood of Partnership

- Table 27.88 Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.89 Likely Partner Analysis: Distribution of Non-Industry Players Focused on PD-L1 Biomarker by Likelihood of Partnership

- Table 27.90 Regional Distribution of PD-L1 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.91 Likely Partner Analysis: Distribution of Non-Industry Players Focused on RET Biomarker by Likelihood of Partnership

- Table 27.92 Regional Distribution of RET Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.93 Likely Partner Analysis: Distribution of Industry Players Focused on CCR5 Biomarker by Likelihood of Partnership

- Table 27.94 Regional Distribution of CCR5 Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.95 Likely Partner Analysis: Distribution of Non-Industry Players Focused on CCR5 Biomarker by Likelihood of Partnership

- Table 27.96 Regional Distribution of CCR5 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.97 Likely Partner Analysis: Distribution of Industry Players Focused on BRCA Biomarker by Likelihood of Partnership

- Table 27.98 Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.99 Likely Partner Analysis: Distribution of Non-Industry Players Focused on BRCA Biomarker by Likelihood of Partnership

- Table 27.100 Regional Distribution of BRCA Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.101 Likely Partner Analysis: Distribution of Industry Players Focused on CA-125 Biomarker by Likelihood of Partnership

- Table 27.102 Regional Distribution of CA-125 Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.103 Likely Partner Analysis: Distribution of Non-Industry Players Focused on CA-125 Biomarker by Likelihood of Partnership

- Table 27.104 Regional Distribution of CA-125 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.105 Likely Partner Analysis: Distribution of Industry Players Focused on AR-V7 Biomarker by Likelihood of Partnership

- Table 27.106 Regional Distribution of AR-V7 Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.107 Regional Distribution of AR-V7 Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.108 Likely Partner Analysis: Distribution of Industry Players Focused on PTEN Biomarker by Likelihood of Partnership

- Table 27.109 Regional Distribution of PTEN Biomarker Focused Clinical Trials Sponsored by Industry Players

- Table 27.110 Likely Partner Analysis: Distribution of Non-Industry Players Focused on PTEN Biomarker by Likelihood of Partnership

- Table 27.111 Regional Distribution of PTEN Biomarker Focused Clinical Trials Sponsored by Non-Industry Players

- Table 27.112 Mergers and Acquisitions: Cumulative Year-Wise Trend, Since 2017

- Table 27.113 Mergers and Acquisitions: Distribution by Type of Deal

- Table 27.114 Mergers and Acquisitions: Local and International Agreements

- Table 27.115 Mergers and Acquisitions: Intercontinental and Intracontinental Agreements

- Table 27.116 Acquisitions: Ownership Change Matrix

- Table 27.117 Acquisitions: Distribution by Key Value Drivers

- Table 27.118 Key Players: Distribution by Number of Mergers and Acquisitions

- Table 27.119 Clinical Trial Analysis: Distribution by Trial Registration Year

- Table 27.120 Clinical Trial Analysis: Distribution of Trials of the Most Popular Biomarkers by Trial Registration Year

- Table 27.121 Clinical Trial Analysis: Distribution of Trials of the Moderately Popular Biomarkers by Trials Registration Year

- Table 27.122 Clinical Trial Analysis: Distribution of Trials of the Less Popular and Other Biomarkers by Trial Registration Year

- Table 27.123 Clinical Trial Analysis: Distribution of Trial of the Most Popular Indications by Trial Registration Year

- Table 27.124 Clinical Trial Analysis: Distribution of Trial of the Moderately Popular Indications by Trial Registration Year

- Table 27.125 Clinical Trial Analysis: Distribution of Trial of the Less Popular and Other Indications by Trial Registration Year

- Table 27.126 Clinical Trial Analysis: Distribution by Trial Phase of Development

- Table 27.127 Clinical Trial Analysis: Distribution of Trials of the Most Popular Biomarkers by Phase of Development

- Table 27.128 Clinical Trial Analysis: Distribution of Trials of the Moderately Popular Biomarkers by Phase of Development

- Table 27.129 Clinical Trial Analysis: Distribution of Trials of the Less Popular and Other Biomarkers by Phase of Development

- Table 27.130 Clinical Trial Analysis: Distribution of Trials of the Most Popular Indications by Phase of Development

- Table 27.131 Clinical Trial Analysis: Distribution of Trials of the Moderately Popular Indications by Phase of Development

- Table 27.132 Clinical Trial Analysis: Distribution of Trials of the Less Popular / Emerging Indications by Phase of Development

- Table 27.133 Clinical Trial Analysis: Distribution of Trials by Sponsor

- Table 27.134 Clinical Trial Analysis: Distribution of Trials by Recruitment Status

- Table 27.135 Clinical Trial Analysis: Distribution of Trials by Therapy Design

- Table 27.136 Precision Medicine Software Developers: Distribution by Year of Establishment

- Table 27.137 Precision Medicine Software Developers: Distribution by Company Size

- Table 27.138 Precision Medicine Software Developers: Distribution by Location of Headquarters (Region)

- Table 27.139 Precision Medicine Software Developers: Distribution by Location of Headquarters

- Table 27.140 Precision Medicine Software Developers: Distribution by Company Size and Location of Headquarters (Region)

- Table 27.141 Precision Medicine Software: Distribution by Status of Development

- Table 27.142 Precision Medicine Software: Distribution by Status of Development and Location of Developer

- Table 27.143 Precision Medicine Software Developers: Distribution by Type of Platform

- Table 27.144 Precision Medicine Software: Distribution by Regulatory Accreditation Received

- Table 27.145 Precision Medicine Software: Distribution by Target Therapeutic Area

- Table 27.146 Precision Medicine Software: Distribution by Status of Development and Target Therapeutic Area

- Table 27.147 Precision Medicine Software: Distribution by Type of Data Handled

- Table 27.148 Precision Medicine Software: Distribution by Status of Development and Type of Data Handled

- Table 27.149 Precision Medicine Software: Distribution by Type of Data Handled and Target Therapeutic Area

- Table 27.150 Precision Medicine Software: Distribution by Purpose of Software

- Table 27.151 Precision Medicine Software: Distribution by Type of End-User

- Table 27.152 Global Companion Diagnostic Development Services Market, Historical Trends (Since 2019) (USD Billion)

- Table 27.153 Global Companion Diagnostic Development Services Market, Forecasted Estimates (Till 2035): Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 27.154 Companion Diagnostic Development Services Market: Distribution by Type of Service Offered

- Table 27.155 Companion Diagnostic Development Services Market for Feasibility Studies, Historical Trends (Since 2019) (USD Million)

- Table 27.156 Companion Diagnostic Development Services Market for Feasibility Studies, Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 27.157 Companion Diagnostic Development Services Market for Assay Development, Historical Trends (Since 2019) (USD Million)