|

市场调查报告书

商品编码

1762523

分子诊断市场:产业趋势与全球预测 - 依检测类型、依产品类型、依样本类型、依技术类型、依治疗领域、依最终用户、依地区Molecular Diagnostics Market: Industry Trends and Global Forecasts - Distribution by Test Type, Type of Offering, Type of Sample, Type of Technology, Therapeutic Area, End Users, and Geographical Regions |

||||||

分子诊断市场:概览

预计2035年,全球分子诊断市场规模将从目前的159亿美元成长到309亿美元,预测期间的年复合成长率为6.2%。

市场区隔包括以下参数的市场规模和机会分析:

检测类型

- 实验室检测

- 即时侦测

产品类型

- 试剂

- 检测设备

- 服务

样本类型

- 血液、血清、血浆

- 尿液

- 其他

技术类型

- 聚合酶炼式反应(PCR)

- 原位杂交

- 恆温核酸扩增技术

- 新一代定序

- 微阵列

- 质谱

- 其他

治疗领域

- 心血管疾病

- 基因疾病

- 传染病

- 神经系统疾病

- 肿瘤疾病

- 其他

最终使用者

- 医院

- 实验室

- 其他

主要地区

- 北美(美国、加拿大)

- 欧洲(奥地利、比利时、 (例如:法国、德国、义大利、荷兰、波兰、西班牙、瑞士、英国等)

- 亚洲(中国、印度、印尼、日本、新加坡、韩国、泰国等)

- 拉丁美洲(阿根廷、巴西、墨西哥等)

- 中东和北非(埃及、以色列、沙乌地阿拉伯等)

- 世界其他地区(澳洲、纽西兰)

分子诊断市场:成长与趋势

分子诊断测试是用于分析基因组和蛋白质组中生物标记的先进技术和工具。这些诊断解决方案对于检测和监测疾病、识别基因异常以及指导个人化治疗计划非常重要。分子诊断领域使用的主要技术包括聚合酶炼式反应、新一代定序和微阵列。 PCR是一种高度特异性的技术,可以扩增和检测微量的DNA和RNA,而NGS可以对整个基因组进行高通量定序。因此,分子诊断解决方案在癌症、传染病、基因检测和个人化医疗等各个医疗领域中发挥着非常重要的作用。这些解决方案能够提高诊断的准确性,并支持个人化的治疗策略,最终目的是改善诊断结果并改善公众健康。此外,超过 70%的医疗保健决策是基于实验室检测结果,这反映了此类诊断工具在患者护理中的重要性。

此外,由于分子诊断解决方案具有快速检测、缩短週转时间和快速决策等诸多优势,预计预测期内市场将维持健康的年复合成长率。

分子诊断市场:关键洞察

本报告分析了分子诊断市场的现状,并揭示了潜在的成长机会。报告的主要调查结果包括:

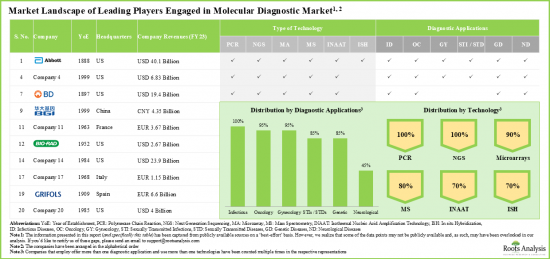

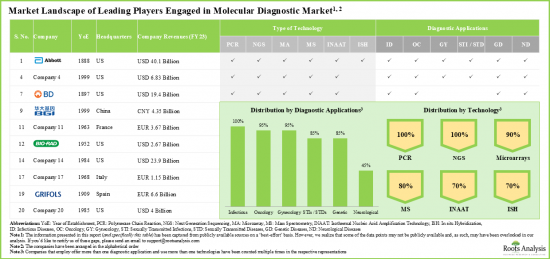

- 分子诊断领域市场格局充满活力,参与者使用各种先进技术来实现各种诊断应用。

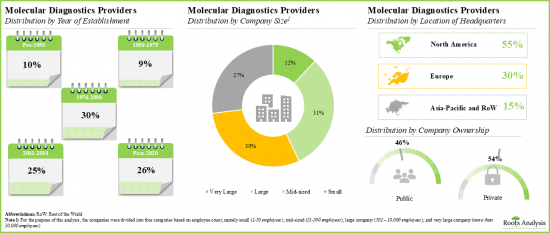

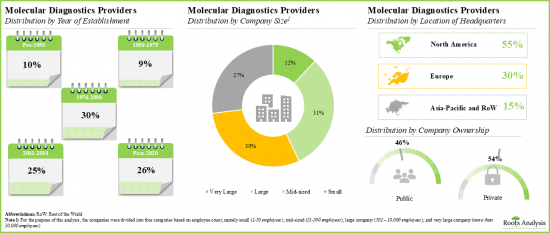

- 本分析涵盖的许多主要参与者均成立于1951年至2000年之间,其中60%位于北美。

- 凭藉其多样化的分子诊断解决方案组合以及近年来的强劲表现,Roche已成为该领域最具实力的主要参与者。

- 为了研究各种趋势对分子诊断市场的影响,开发了一种独特的研究方法,并根据波特五力模型分析了各种参数。

- 预防性医疗保健意识的不断增强推动了分子诊断市场的发展,然而,监管的复杂性仍然是该行业参与者面临的主要障碍。

- 受全球慢性病盛行率上升的推动,预计预测期内分子诊断市场将以 6.2%的健康成长率成长。

- 预期未来机会将均衡分布在检测类型、样本类型、治疗领域和最终用户等多个细分领域。

分子诊断市场:关键细分市场

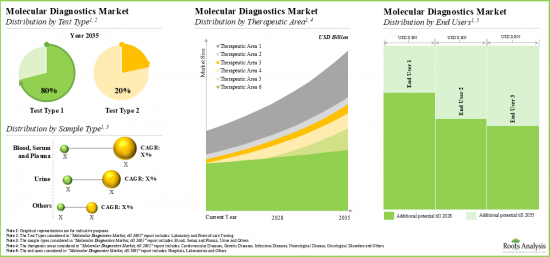

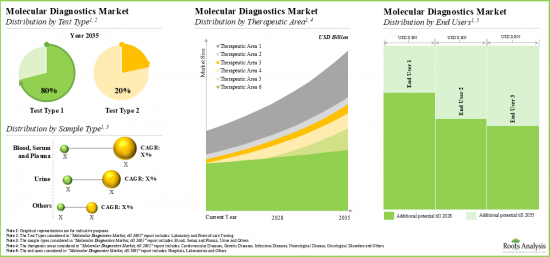

根据检测类型,市场分为实验室检测和即时检测。目前,实验室检测在分子诊断市场中占有最大占有率。预计未来这一趋势将保持不变。此外,预计在预测期内,即时检测领域的分子诊断市场将展现出最高的市场成长潜力。

依产品类型划分,试剂是全球分子诊断市场中成长最快的细分市场。

分子诊断市场细分为试剂、仪器和服务。目前,试剂在全球分子诊断市场中占有最大占有率。此外,由于试剂需要频繁补充,这有助于产生经常性收入,因此预计在预测期内,试剂市场的年复合成长率将更高。

依样本类型划分,市场细分为血液、血清/血浆、尿液和其他样本。目前,血液、血清和血浆在全球分子诊断市场中占有最大占有率。然而,预计在预测期内,尿液市场的年复合成长率将更高。

依技术类型,市场细分为聚合酶炼式反应(PCR)、原位杂交、恆温核酸扩增技术、新一代定序、微阵列、质谱等。虽然聚合酶炼式反应(PCR)细分市场预计将成为整体市场的主要驱动力,但值得注意的是,新一代定序细分市场的全球分子诊断市场很可能会以相对较高的年复合成长率成长。这可以归因于新一代定序仪提供的许多优势,例如高通量、更高的准确性以及同时对多个基因进行定序的能力。

依治疗领域,市场细分为心血管疾病、遗传疾病、传染病、神经系统疾病、肿瘤疾病等。目前,传染病细分市场占据分子诊断市场的最大占有率。此外,预计神经系统疾病细分市场在预测期内将展现最高的成长潜力,并且相比其他细分市场,其年复合成长率更高。

依最终用户划分,全球市场分为医院、实验室和其他。目前,医院占据最大的市场占有率。然而,预计未来几年实验室分子诊断市场将大幅成长。

依主要地区划分,市场分为北美、欧洲、亚洲、拉丁美洲、中东和非洲以及拉丁美洲其他地区。目前,北美在全球分子诊断市场占据主导地位,占据最大的收入占有率。此外,预计未来几年亚太地区市场将以更高的年复合成长率成长。

进入分子诊断市场的公司范例

- Abbott Laboratories

- Agilent Technologies

- Becton Dickinson

- BGI Genomics

- bioMerieux

- Bio-Rad

- Danaher

- DiaSorin

- Grifols

- Hologic

- Illumina

- Qiagen

- QuidelOrtho

- Revvity

- Roche

- Sansure

- Seegene

- Siemens Healthineers

- Sysmex

- Thermo Fisher Scientific

目录

第1章 背景

第2章 研究方法论

第3章 经济及其他专案具体考量

第4章 执行摘要

第5章 导论

- 分子诊断概述

- 分子诊断解决方案中采用的关键技术

- 分子诊断领域面临的挑战

- 分子诊断领域的最新趋势

- 分子诊断领域的未来展望

第6章 市场影响分析:驱动因素、限制因素、机会与挑战

第7章 全球分子诊断市场

- 关键假设与研究方法

- 全球分子诊断市场2035

第8章 分子诊断市场:依检测类型

- 市场动态分析

- 分子诊断市场:依检测类型

- 2035年前临床检测的分子诊断市场

- 2035年前即时检测的分子诊断市场

第9章 分子诊断市场:依产品类型

- 市场动态分析

- 分子诊断市场:依产品类型

第10章 分子诊断市场:依样本类型

- 市场动态分析

- 分子诊断市场:依样本类型

第11章 分子诊断市场:依技术类型

- 市场动态分析

- 分子诊断市场:依技术类型

第12章 分子诊断市场:依治疗领域

- 市场波动分析

- 分子诊断市场:依治疗领域

第13章 分子诊断市场:依最终用户

- 市场波动分析

- 分子诊断市场:依最终用户

第14章 分子诊断市场:依地区

- 市场波动分析

- 分子诊断市场:依地区

第15章 分子诊断市场:依主要公司

- 分子诊断市场:按年销售额的主要公司

第16章 市场概览:领先的分子诊断解决方案提供者

- 分子诊断解决方案:市场格局

- 分子诊断:解决方案提供者格局

第17章 公司竞争力分析:分子诊断解决方案提供者

- 评估研究方法和关键参数

- 分子诊断解决方案提供者:领先公司竞争力分析

- 分子诊断解决方案提供者:领先公司竞争力分析

- 基准分析:领先的分子诊断解决方案提供商

第18章 公司简介:北美分子诊断解决方案提供者

- 公司详情个人资料

- Abbott

- Agilent Technologies

- BD

- Danaher

- Thermo Fisher Scientific

- 其他公司简介

- Bio-Rad

- Illumina

- Hologic

- PerkinElmer

- QuidelOrtho

第19章 公司简介:欧洲分子诊断解决方案提供者

- 详细的公司简介

- bioMerieux

- Grifols

- Roche

- Siemens Healthineers

- 其他公司简介

- DiaSorin

- Qiagen

第20章 公司简介:亚洲分子诊断解决方案提供者

- 详细公司简介

- Sysmex

- 其他公司简介

- BGI Genomics

- Sansure

- Seegene

第21章 波特五力分析

第22章 附录1:表格资料

第23章 附录2:公司列表及组织

MOLECULAR DIAGNOSTICS MARKET: OVERVIEW

As per Roots Analysis, the global molecular diagnostics market is estimated to grow from USD 15.9 billion in the current year to USD 30.9 billion by 2035, at a CAGR of 6.2% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Test Type

- Laboratory Testing

- Point-of-Care Testing

Type of Offering

- Reagents

- Instruments

- Services

Type of Sample

- Blood, Serum and Plasma

- Urine

- Others

Type of Technology

- Polymerase Chain Reaction (PCR)

- In situ Hybridization

- Isothermal Nucleic Acid Amplification Technology

- Next Generation Sequencing

- Microarrays

- Mass Spectrometry

- Others

Therapeutic Area

- Cardiovascular Diseases

- Genetic Diseases

- Infectious Diseases

- Neurological Diseases

- Oncological Diseases

- Others

End Users

- Hospitals

- Laboratories

- Others

Key Geographical Regions

- North America (US, Canada)

- Europe (Austria, Belgium, France, Germany, Italy, Netherlands, Poland, Spain, Switzerland, UK, Rest of the Europe)

- Asia (China, India, Indonesia, Japan, Singapore, South Korea, Thailand, Rest of Asia)

- Latin America (Argentina, Brazil, Mexico, Rest of Latin America)

- Middle East and North Africa (Egypt, Israel, Saudi Arabia, Rest of Middle East and North Africa)

- Rest of the World (Australia and New Zealand)

MOLECULAR DIAGNOSTICS MARKET: GROWTH AND TRENDS

Molecular diagnostic tests are advanced techniques and tools used to analyze biological markers in the genome and proteome. These diagnostic solutions are essential for detecting and monitoring diseases, identifying genetic abnormalities, and guiding personalized treatment plans. The primary technologies used in the molecular diagnostics domain include polymerase chain reaction, next-generation sequencing and microarrays. While PCR is a highly specific technique that enables the amplification and detection of trace amounts of DNA or RNA, NGS allows for high-throughput sequencing of entire genomes. Thus, molecular diagnostic solutions are pivotal across various medical fields, including oncological disorders, infectious diseases, genetic testing, and personalized medicine. These solutions enhance the accuracy of diagnosis, enable and support tailored treatment strategies aiming to ultimately improve diagnostic outcomes and advancing public health. In addition, it is worth mentioning that more than 70% of the healthcare decisions are made based on laboratory test results, which reflects the importance of such diagnostic tools in patient care.

Further, owing to the several benefits offered by these molecular diagnostic solutions, such as providing rapid testing, reducing turnaround times and enabling quicker decision-making, the market is expected to grow at a healthy compounded annual growth rate (CAGR) during the forecast period.

MOLECULAR DIAGNOSTICS MARKET: KEY INSIGHTS

The report delves into the current state of the molecular diagnostics market and identifies potential growth opportunities within industry. Some key findings from the report include:

- The molecular diagnostic domain features a dynamic market landscape of players that utilize various types of advanced technologies in order to offer a variety of diagnostic applications.

- A number of leading players considered in this analysis were established during 1951 to 2000; 60% of such players are based in North America.

- Owing to its diverse portfolio of molecular diagnostics solutions and strong financial performance in recent fiscal year, Roche emerged as the most competent company among the leading players in this domain.

- In order to study the impact of various trends in the molecular diagnostics market, we developed our proprietary research methodology to analyze different parameters under Porter's Five Forces framework.

- The molecular diagnostics market is fueled by growing awareness towards preventive healthcare; however, factors, such as navigating through regulatory complexities remain significant hurdles for industry players.

- Driven by the increasing prevalence of chronic disorders across the globe, the global molecular diagnostics market is expected to grow at a healthy growth rate of 6.2% during the forecast period.

- The anticipated future opportunity is expected to be well distributed across multiple segments, such as test type, sample type, therapeutic area, and end users.

MOLECULAR DIAGNOSTICS MARKET: KEY SEGMENTS

Laboratory Testing Segment holds the Largest Share of the Molecular Diagnostics Market

Based on the test type, the market is segmented into laboratory testing and point-of-care testing. At present, the laboratory testing segment holds the maximum share of the molecular diagnostics market. This trend is likely to remain the same in the coming future. Further, the molecular diagnostics market for point-of-care testing segment is expected to show the highest market growth potential during the forecast period.

By Type of Offering, Reagents is the Fastest Growing Segment of the Global Molecular Diagnostics Market

Based on the type of offering, the market is segmented into reagents, instruments and services. At present, the reagents segment holds the maximum share of the global molecular diagnostics market. Further, owing to the fact that reagents are required to be replenished frequently, which contributes to the recurrent revenues, the market for reagents segment is expected to grow at a higher CAGR during the forecast period.

By Type of Sample, Blood, Serum and Plasma Segment Accounts for the Largest Share of the Global Molecular Diagnostics Market

Based on the type of sample, the market is segmented into blood, serum and plasma, urine, and other samples. Currently, the blood, serum and plasma segment capture the highest proportion of the global molecular diagnostics market. However, the urine segment is expected to grow at a higher CAGR during the forecast period.

The Polymerase Chain Reaction (PCR) Segment by Type of Technology Occupy the Largest Share of the Molecular Diagnostics Market

Based on the type of technology, the market is segmented into Polymerase Chain Reaction (PCR), in situ hybridization, isothermal nucleic acid amplification technology, next generation sequencing, microarrays, mass spectrometry and others. While the polymerase chain reaction (PCR) segment is expected to be the primary driver of the overall market, it is worth highlighting that the global molecular diagnostics market for next generation sequencing segment is likely to grow at a relatively higher CAGR. This can be attributed to the several benefits offered by next generation sequencing, such as high-throughput, improved accuracy, and the capability to simultaneously sequence multiple genes.

By Therapeutic Area, Infectious Disease Segment is Likely to Dominate the Molecular Diagnostics Market

Based on the therapeutic area, the market is segmented into cardiovascular diseases, genetic diseases, infectious diseases, neurological diseases, oncological diseases and others. At present the infectious diseases segment holds the maximum share of the molecular diagnostics market. Additionally, the neurological diseases segment is expected to show the highest growth potential during the forecast period, growing at a higher CAGR, compared to the other segments.

Currently, Hospitals Segment Holds the Largest Share of the Molecular Diagnostics Market

Based on end users, the global market is segmented into hospitals, laboratories, and others. Currently, the hospitals segment holds the largest market share. However, the molecular diagnostics market for laboratories segment is expected to witness substantial growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. Currently, North America dominates the global molecular diagnostics market and accounts for the largest revenue share. Further, the market in Asia-Pacific is likely to grow at a higher CAGR in the coming future.

Example Players in the Molecular Diagnostics Market

- Abbott Laboratories

- Agilent Technologies

- Becton Dickinson

- BGI Genomics

- bioMerieux

- Bio-Rad

- Danaher

- DiaSorin

- Grifols

- Hologic

- Illumina

- Qiagen

- QuidelOrtho

- Revvity

- Roche

- Sansure

- Seegene

- Siemens Healthineers

- Sysmex

- Thermo Fisher Scientific

MOLECULAR DIAGNOSTICS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global molecular diagnostics market, focusing on key market segments, including [A] test type, [B] type of offering, [C] type of sample, [D] type of technology, [E] therapeutic area, [F] end users and [D] key geographical regions.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

- Market Landscape: A comprehensive evaluation of the leading molecular diagnostics companies, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] company ownership and [D] location of the headquarters. Further, the section includes a comprehensive evaluation of molecular diagnostic solutions, focusing on the parameters, such as [A] type of technology used and [B] diagnostic applications.

- Company Competitiveness Analysis: A comprehensive competitive analysis of molecular diagnostic companies, examining factors, such as [A] years of experience and [B] company competitiveness.

- Regulatory Landscape for Medical Devices: A comprehensive discussion of the various guidelines established by major regulatory bodies for medical device approval across different countries. Additionally, a multi-dimensional bubble analysis was done, focusing on the comparison of contemporary regulatory scenario in key geographies across the globe.

- Company Profiles: In-depth profiles of key players that specialize in molecular diagnostic solutions, focusing on [A] overview of the company, [B] financial information, [C] molecular diagnostic offerings and [D] recent developments and an informed future outlook.

- Porter's Five Forces Analysis: A qualitative assessment of Porter's Five Forces framework based on the five competitive forces, including [A] threats to new entrants, [B] bargaining power of product providers, [C] bargaining power of buyers, [D] threat of substitute products and [E] rivalry among existing competitors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Factors

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risk

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks Associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Overview of Molecular Diagnostics

- 5.2. Key Technologies Employed in Molecular Diagnostic Solution

- 5.3. Challenges in the Molecular Diagnostics Domain

- 5.4. Recent Developments in the Molecular Diagnostics Domain

- 5.5. Future Perspective in the Molecular Diagnostics Domain

6. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 6.1. Market Drivers

- 6.2. Market Restraints

- 6.3. Market Opportunities

- 6.4. Market Challenges

7. GLOBAL MOLECULAR DIAGNOSTICS MARKET

- 7.1. Key Assumptions and Methodology

- 7.2. Global Molecular Diagnostics Market, Till 2035

- 7.2.1. Scenario Analysis

- 7.2.1.1. Conservative Scenario

- 7.2.1.2. Optimistic Scenario

- 7.2.1. Scenario Analysis

8. MOLECULAR DIAGNOSTICS MARKET, BY TEST TYPE

- 8.1. Market Movement Analysis

- 8.2. Molecular Diagnostics Market: Distribution by Test Type

- 8.2.1. Molecular Diagnostics Market for Laboratory Testing, Till 2035

- 8.2.2. Molecular Diagnostics Market for Point-of-Care Testing, Till 2035

9. MOLECULAR DIAGNOSTICS MARKET, BY TYPE OF OFFERING

- 9.1. Market Movement Analysis

- 9.2. Molecular Diagnostics Market: Distribution by Type of Offering

- 9.2.1. Molecular Diagnostics Market for Instruments, Till 2035

- 9.2.1.1. Molecular Diagnostics Market for In-house Instruments, Till 2035

- 9.2.1.2. Molecular Diagnostics Market for Outsourced Instruments, Till 2035

- 9.2.2. Molecular Diagnostics Marlet for Reagents, till 2035

- 9.2.3. Molecular Diagnostics Market for Services, till 2035

- 9.2.1. Molecular Diagnostics Market for Instruments, Till 2035

10. MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE

- 10.1. Market Movement Analysis

- 10.2. Molecular Diagnostics Market: Distribution by Sample Type

- 10.2.1. Molecular Diagnostics Market for Blood, Serum and Plasma, till 2035

- 10.2.2. Molecular Diagnostics Market for Urine, till 2035

- 10.2.3. Molecular Diagnostics Market for Other Samples, till 2035

11. MOLECULAR DIAGNOSTICS MARKET, BY TYPE OF TECHNOLOGY

- 11.1. Market Movement Analysis

- 11.2. Molecular Diagnostics Market: Distribution by Type of Technology

- 11.2.1. Molecular Diagnostics Market for PCR, till 2035

- 11.2.2. Molecular Diagnostics Market for In Situ Hybridization, till 2035

- 11.2.3. Molecular Diagnostics Market for Isothermal Nucleic Acid Amplification Technology, till 2035

- 11.2.4. Molecular Diagnostics Market for Next Generation Sequencing, till 2035

- 11.2.5. Molecular Diagnostics Market for Microarrays, till 2035

- 11.2.6. Molecular Diagnostics Market for Mass Spectrometry, till 2035

- 11.2.7. Molecular Diagnostics Market for Other Technologies, till 2035

12. MOLECULAR DIAGNOSTICS MARKET, BY THERAPEUTIC AREA

- 12.1. Market Movement Analysis

- 12.2. Molecular Diagnostics Market: Distribution by Therapeutic Area

- 12.2.1. Molecular Diagnostics Market for Infectious Diseases, till 2035

- 12.2.1.1. Molecular Diagnostics Market for COVID-19, till 2035

- 12.2.1.2. Molecular Diagnostics Market for Respiratory Infections (Excluding COVID-19), till 2035

- 12.2.1.3. Molecular Diagnostics Market for Healthcare-associated Infections, till 2035

- 12.2.1.4. Molecular Diagnostics Market for Hepatitis, till 2035

- 12.2.1.5. Molecular Diagnostics Market for HIV, till 2035

- 12.2.1.6. Molecular Diagnostics Market for Sexually Transmitted Diseases, till 2035

- 12.2.1.7. Molecular Diagnostics Market for Other Infectious Diseases, till 2035

- 12.2.2. Molecular Diagnostics Market for Oncological Disorders, till 2035

- 12.2.2.1. Molecular Diagnostics Market for Lung Cancer, till 2035

- 12.2.2.2. Molecular Diagnostics Market for Breast Cancer, till 2035

- 12.2.2.3. Molecular Diagnostics Market for Colorectal Cancer, till 2035

- 12.2.2.4. Molecular Diagnostics Market for Prostate Cancer, till 2035

- 12.2.2.5. Molecular Diagnostics Market for Gastric Cancer, till 2035

- 12.2.2.6. Molecular Diagnostics Market for Other Oncological Disorders, till 2035

- 12.2.3. Molecular Diagnostics Market for Cardiovascular Diseases, till 2035

- 12.2.4. Molecular Diagnostics Market for Neurological Diseases, till 2035

- 12.2.5. Molecular Diagnostics Market for Genetic Diseases, till 2035

- 12.2.6. Molecular Diagnostics Market for Other Therapeutic Areas, till 2035

- 12.2.1. Molecular Diagnostics Market for Infectious Diseases, till 2035

13. MOLECULAR DIAGNOSTICS MARKET, BY END USERS

- 13.1. Market Movement Analysis

- 13.2. Molecular Diagnostics Market: Distribution by End Users

- 13.2.1. Molecular Diagnostics Market for Laboratories, till 2035

- 13.2.1.1. Molecular Diagnostics Market for Large Laboratories, till 2035

- 13.2.1.2. Molecular Diagnostics Market for Small and Medium-sized Laboratories, till 2035

- 13.2.2. Molecular Diagnostics Market for Hospitals, till 2035

- 13.2.3. Molecular Diagnostics Market for Other End Users, till 2035

- 13.2.1. Molecular Diagnostics Market for Laboratories, till 2035

14. MOLECULAR DIAGNOSTICS MARKET, BY GEOGRAPHICAL REGIONS

- 14.1. Market Movement Analysis

- 14.2. Molecular Diagnostics Market: Distribution by Geographical Regions

- 14.2.1. Molecular Diagnostics Market in North America, till 2035

- 14.2.1.1. Molecular Diagnostics Market in the US, till 2035

- 14.2.1.2. Molecular Diagnostics Market in Canada, till 2035

- 14.2.2. Molecular Diagnostics Market in Europe, till 2035

- 14.2.2.1. Molecular Diagnostics Market in Austria, till 2035

- 14.2.2.2. Molecular Diagnostics Market in Belgium, till 2035

- 14.2.2.3. Molecular Diagnostics Market in France, till 2035

- 14.2.2.4. Molecular Diagnostics Market in Germany, till 2035

- 14.2.2.5. Molecular Diagnostics Market in Italy, till 2035

- 14.2.2.6. Molecular Diagnostics Market in the Netherlands, till 2035

- 14.2.2.7. Molecular Diagnostics Market in Poland, till 2035

- 14.2.2.8. Molecular Diagnostics Market in Spain, till 2035

- 14.2.2.9. Molecular Diagnostics Market in Switzerland, till 2035

- 14.2.2.10. Molecular Diagnostics Market in the UK, till 2035

- 14.2.2.11. Molecular Diagnostics Market in the Rest of Europe, till 2035

- 14.2.3. Molecular Diagnostics Market in Asia, till 2035

- 14.2.3.1. Molecular Diagnostics Market in China, till 2035

- 14.2.3.2. Molecular Diagnostics Market in India, till 2035

- 14.2.3.3. Molecular Diagnostics Market in Indonesia, till 2035

- 14.2.3.4. Molecular Diagnostics Market in Japan, till 2035

- 14.2.3.5. Molecular Diagnostics Market in Singapore, till 2035

- 14.2.3.6. Molecular Diagnostics Market in South Korea, till 2035

- 14.2.3.7. Molecular Diagnostics Market in Thailand, till 2035

- 14.2.3.8. Molecular Diagnostics Market in Rest of Asia, till 2035

- 14.2.4. Molecular Diagnostics Market in Latin America, till 2035

- 14.2.4.1. Molecular Diagnostics Market in Brazil, till 2035

- 14.2.4.2. Molecular Diagnostics Market in Argentina, till 2035

- 14.2.4.3. Molecular Diagnostics Market in Mexico, till 2035

- 14.2.4.4. Molecular Diagnostics Market in Rest of Latin America, till 2035

- 14.2.5. Molecular Diagnostics Market in Middle East and North Africa, till 2035

- 14.2.5.1. Molecular Diagnostics Market in Egypt, till 2035

- 14.2.5.2. Molecular Diagnostics Market in Israel, till 2035

- 14.2.5.3. Molecular Diagnostics Market in Saudi Arabia, till 2035

- 14.2.5.4. Molecular Diagnostics Market in the Rest of Middle East and North Africa, till 2035

- 14.2.6. Molecular Diagnostics Market in Rest of the World, till 2035

- 14.2.6.1. Molecular Diagnostics Market in Australia, till 2035

- 14.2.6.2. Molecular Diagnostics Market in New Zealand, till 2035

- 14.2.1. Molecular Diagnostics Market in North America, till 2035

15. MOLECULAR DIAGNOSTICS MARKET, BY LEADING PLAYERS

- 15.1. Molecular Diagnostics Market: Distribution of Leading Players by Annual Revenues

16. MARKET OVERVIEW: LEADING MOLECULAR DIAGNOSTIC SOLUTION PROVIDERS

- 16.1. Molecular Diagnostic Solution: Overall Market Landscape

- 16.1.1. Analysis by Type of Technology

- 16.1.2. Analysis by Diagnostic Applications

- 16.1.3. Analysis by Type of Technology and Diagnostic Applications

- 16.2. Molecular Diagnostics: Solution Providers Landscape

- 16.2.1. Analysis by Year of Establishment

- 16.2.2. Analysis by Company Size

- 16.2.3. Analysis by Location of Headquarters

- 16.2.4. Analysis by Company Ownership

17. COMPANY COMPETITIVENESS ANALYSIS: MOLECULAR DIAGNOSTIC SOLUTION PROVIDERS

- 17.1. Methodology and Key Parameters Assessed

- 17.2. Molecular Diagnostic Solution Providers: Competitiveness Analysis of Very Large Players

- 17.3. Molecular Diagnostic Solution Providers: Competitiveness Analysis of Large Players

- 17.4. Benchmarking Analysis: Leading Molecular Diagnostics Solution Providers

- 17.4.1. Benchmarking of Companies

- 17.4.1.1. Roche: Benchmarking Analysis

- 17.4.1.2. Abbott: Benchmarking Analysis

- 17.4.1.3. Thermo Fisher Scientific: Benchmarking Analysis

- 17.4.1.4. Qiagen: Benchmarking Analysis

- 17.4.1.5. bioMerieux: Benchmarking Analysis

- 17.4.1.6. DiaSorin: Benchmarking Analysis

- 17.4.1.7. Illumina: Benchmarking Analysis

- 17.4.1.8. Sysmex: Benchmarking Analysis

- 17.4.1.9. Perkin Elmer: Benchmarking Analysis

- 17.4.1.10. Bio-Rad: Benchmarking Analysis

- 17.4.2. Benchmarking of Parameters

- 17.4.2.1. Leading Molecular Diagnostics Solution Providers: Benchmarking by Competitiveness

- 17.4.2.2. Leading Molecular Diagnostic Solution Providers: Benchmarking by Type of Technology Score

- 17.4.2.3. Leading Molecular Diagnostic Solution Providers: Benchmarking by Diagnostic Applications Score

- 17.4.1. Benchmarking of Companies

18. COMPANY PROFILES: MOLECULAR DIAGNOSTICS SOLUTION PROVIDERS BASED IN NORTH AMERICA

- 18.1. Detailed Company Profiles

- 18.1.1. Abbott

- 18.1.1.1. Company Overview

- 18.1.1.2. Product Portfolio

- 18.1.1.3. Financial Information

- 18.1.1.4. Recent Developments and Future Outlook

- 18.1.2. Agilent Technologies

- 18.1.3. BD

- 18.1.4. Danaher

- 18.1.5. Thermo Fisher Scientific

- 18.1.1. Abbott

- 18.2. Short Company Profiles

- 18.2.1. Bio-Rad

- 18.2.1.1. Company Overview

- 18.2.1.2. Product Portfolio

- 18.2.2. Illumina

- 18.2.3. Hologic

- 18.2.4. PerkinElmer

- 18.2.5. QuidelOrtho

- 18.2.1. Bio-Rad

19. COMPANY PROFILES: MOLECULAR DIAGNOSTICS SOLUTION PROVIDERS BASED IN EUROPE

- 19.1. Detailed Company Profiles

- 19.1.1. bioMerieux

- 19.1.1.1. Company Overview

- 19.1.1.2. Product Portfolio

- 19.1.1.3. Financial Information

- 19.1.1.4. Recent Developments and Future Outlook

- 19.1.2. Grifols

- 19.1.3. Roche

- 19.1.4. Siemens Healthineers

- 19.1.1. bioMerieux

- 19.2. Brief Company Profiles

- 19.2.1. DiaSorin

- 19.2.1.1. Company Overview

- 19.2.1.2. Product Portfolio

- 19.2.2. Qiagen

- 19.2.1. DiaSorin

20. COMPANY PROFILES: MOLECULAR DIAGNOSTICS SOLUTION PROVIDERS BASED IN ASIA

- 20.1. Detailed Company Profiles

- 20.1.1. Sysmex

- 20.1.1.1. Company Overview

- 20.1.1.2. Product Portfolio

- 20.1.1.3. Financial Information

- 20.1.1.4. Recent Developments and Future Outlook

- 20.1.1. Sysmex

- 20.2. Brief Company Profiles

- 20.2.1. BGI Genomics

- 20.2.1.1. Company Overview

- 20.2.1.2. Product Portfolio

- 20.2.2. Sansure

- 20.2.3. Seegene

- 20.2.1. BGI Genomics

21. PORTER'S FIVE FORCES ANALYSIS

- 21.1. Methodology and Assumptions

- 21.2. Key Parameters

- 21.2.1. Threats of New Entrants

- 21.2.2. Bargaining Power of Buyers

- 21.2.3. Bargaining Power of Suppliers

- 21.2.4. Threats of Substitute Products

- 21.2.5. Rivalry among Existing Competitors

- 21.3. Porter's Five Force Analysis: Harvey Ball Analysis

- 21.4. Concluding Remarks

22. APPENDIX I: TABULATED DATA

23. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 16.1 Leading Molecular Diagnostics Solution Providers: Information on Year of Establishment, Headquarters, Company Ownership, Type of Technology and Diagnostic Applications

- Table 16.2 Other Leading Molecular Diagnostics Solution Providers: Information on Year of Establishment, Headquarters and Company Ownership

- Table 18.1 Abbott: Company Overview

- Table 18.2 Abbott: Product Portfolio

- Table 18.3 Abbott: Recent Developments and Future Outlook

- Table 18.4 Agilent Technologies: Company Overview

- Table 18.5 Agilent Technologies: Product Portfolio

- Table 18.6 Agilent Technologies: Recent Developments and Future Outlook

- Table 18.7 BD: Company Overview

- Table 18.8 BD: Product Portfolio

- Table 18.9 BD: Recent Developments and Future Outlook

- Table 18.10 Danaher: Company Overview

- Table 18.11 Danaher: Product Portfolio

- Table 18.12 Danaher: Recent Developments and Future Outlook

- Table 18.13 Roche: Company Overview

- Table 18.14 Roche: Product Portfolio

- Table 18.15 Roche: Recent Developments and Future Outlook

- Table 18.16 Thermo Fisher Scientific: Company Overview

- Table 18.17 Thermo Fisher Scientific: Product Portfolio

- Table 18.18 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 18.19 Bio-Rad: Company Overview

- Table 18.20 Bio-Rad: Product Portfolio

- Table 18.21 Illumina: Company Overview

- Table 18.22 Illumina: Product Portfolio

- Table 18.23 Hologic: Company Overview

- Table 18.24 Hologic: Product Portfolio

- Table 18.25 PerkinElmer: Company Overview

- Table 18.26 PerkinElmer: Product Portfolio

- Table 18.27 QuidelOrtho: Company Overview

- Table 18.28 QuidelOrtho: Product Portfolio

- Table 19.1 bioMerieux: Company Overview

- Table 19.2 bioMerieux: Product Portfolio

- Table 19.3 bioMerieux: Recent Developments and Future Outlook

- Table 19.4 Grifols: Company Overview

- Table 19.5 Grifols: Product Portfolio

- Table 19.6 Grifols: Recent Developments and Future Outlook

- Table 19.7 Siemens Healthineers: Company Overview

- Table 19.8 Siemens Healthineers: Product Portfolio

- Table 19.9 Siemens Healthineers: Recent Developments and Future Outlook

- Table 19.10 DiaSorin: Company Overview

- Table 19.11 DiaSorin: Product Portfolio

- Table 19.12 Qiagen: Company Overview

- Table 19.13 Qiagen: Product Portfolio

- Table 20.1 Sysmex: Company Overview

- Table 20.2 Sysmex: Product Portfolio

- Table 20.3 Sysmex: Recent Developments and Future Outlook

- Table 20.4 BGI Genomics: Company Overview

- Table 20.5 BGI Genomics: Product Portfolio

- Table 20.6 Sansure: Company Overview

- Table 20.7 Sansure: Product Portfolio

- Table 20.8 Seegene: Company Overview

- Table 20.9 Seegene: Product Portfolio

- Table 22.1 Global Molecular Diagnostics Market, Till 2035 (USD Billion)

- Table 22.2 Global Molecular Diagnostics Market, Conservative Scenario, till 2035 (USD Billion)

- Table 22.3 Global Molecular Diagnostics Market, Optimistic Scenario, till 2035 (USD Billion)

- Table 22.4 Molecular Diagnostics Market: Distribution by Test Type

- Table 22.5 Molecular Diagnostics Market for Laboratory Testing, Till 2035 (USD Billion)

- Table 22.6 Molecular Diagnostics Market for Point-of-Care Testing, Till 2035 (USD Billion)

- Table 22.7 Molecular Diagnostics Market: Distribution by Type of Offering

- Table 22.8 Molecular Diagnostics Market for Instruments, Till 2035 (USD Billion)

- Table 22.9 Molecular Diagnostics Market for In-house Instruments, Till 2035 (USD Billion)

- Table 22.10 Molecular Diagnostics Market for Outsourced Instruments, Till 2035 (USD Billion)

- Table 22.11 Molecular Diagnostics Market for Reagents, Till 2035 (USD Billion)

- Table 22.12 Molecular Diagnostics Market for Services, Till 2035 (USD Billion)

- Table 22.13 Molecular Diagnostics Market: Distribution by Sample Type

- Table 22.14 Molecular Diagnostics Market for Blood, Serum and Plasma, Till 2035 (USD Billion)

- Table 22.15 Molecular Diagnostics Market for Urine, Till 2035 (USD Billion)

- Table 22.16 Molecular Diagnostics Market for Others, Till 2035 (USD Billion)

- Table 22.17 Molecular Diagnostics Market: Distribution by Type of Technology

- Table 22.18 Molecular Diagnostics Market for PCR, Till 2035 (USD Billion)

- Table 22.19 Molecular Diagnostics Market for In situ Hybridization, Till 2035 (USD Billion)

- Table 22.20 Molecular Diagnostics Market for Isothermal Nucleic Acid Amplification Technology, Till 2035 (USD Billion)

- Table 22.21 Molecular Diagnostics Market for Next Generation Sequencing, Till 2035 (USD Billion)

- Table 22.22 Molecular Diagnostics Market for Microarrays, Till 2035 (USD Billion)

- Table 22.23 Molecular Diagnostics Market for Mass Spectrometry, Till 2035 (USD Billion)

- Table 22.24 Molecular Diagnostics Market for Other Technologies, Till 2035 (USD Billion)

- Table 22.25 Molecular Diagnostics Market: Distribution by Therapeutic Area

- Table 22.26 Molecular Diagnostics Market for Infectious Diseases, Till 2035 (USD Billion)

- Table 22.27 Molecular Diagnostics Market for COVID-19, Till 2035 (USD Billion)

- Table 22.28 Molecular Diagnostics Market for Respiratory Infections (Excluding COVID-19), Till 2035 (USD Billion)

- Table 22.29 Molecular Diagnostics Market for Healthcare-associated Infections, Till 2035 (USD Billion)

- Table 22.30 Molecular Diagnostics Market for Hepatitis, Till 2035 (USD Billion)

- Table 22.31 Molecular Diagnostics Market for HIV, Till 2035 (USD Billion)

- Table 22.32 Molecular Diagnostics Market for Sexually Transmitted Diseases, Till 2035 (USD Billion)

- Table 22.33 Molecular Diagnostics Market for Other Infectious Diseases, Till 2035 (USD Billion)

- Table 22.34 Molecular Diagnostics Market for Oncological Disorders, Till 2035 (USD Billion)

- Table 22.35 Molecular Diagnostics Market for Lung Cancer, Till 2035 (USD Billion)

- Table 22.36 Molecular Diagnostics Market for Breast Cancer, Till 2035 (USD Billion)

- Table 22.37 Molecular Diagnostics Market for Colorectal Cancer, Till 2035 (USD Billion)

- Table 22.38 Molecular Diagnostics Market for Prostate Cancer, Till 2035 (USD Billion)

- Table 22.39 Molecular Diagnostics Market for Gastric Cancer, Till 2035 (USD Billion)

- Table 22.40 Molecular Diagnostics Market for Other Oncological Disorders, Till 2035 (USD Billion)

- Table 22.41 Molecular Diagnostics Market for Cardiovascular Diseases, Till 2035 (USD Billion)

- Table 22.42 Molecular Diagnostics Market for Neurological Diseases, Till 2035 (USD Billion)

- Table 22.43 Molecular Diagnostics Market for Genetic Diseases, Till 2035 (USD Billion)

- Table 22.44 Molecular Diagnostics Market for Other Therapeutic Areas, Till 2035 (USD Billion)

- Table 22.45 Molecular Diagnostics Market: Distribution by End Users

- Table 22.46 Molecular Diagnostics Market for Laboratories, Till 2035 (USD Billion)

- Table 22.47 Molecular Diagnostics Market for Large Laboratories, Till 2035 (USD Billion)

- Table 22.48 Molecular Diagnostics Market for Small and Medium-sized Laboratories, Till 2035 (USD Billion)

- Table 22.49 Molecular Diagnostics Market for Hospitals, Till 2035 (USD Billion)

- Table 22.50 Molecular Diagnostics Market for Other End Users, Till 2035 (USD Billion)

- Table 22.51 Molecular Diagnostics Market: Distribution by Geographical Regions

- Table 22.52 Molecular Diagnostics Market in North America, Till 2035 (USD Billion)

- Table 22.53 Molecular Diagnostics Market in the US, Till 2035 (USD Billion)

- Table 22.54 Molecular Diagnostics Market in Canada, Till 2035 (USD Billion)

- Table 22.55 Molecular Diagnostics Market in Europe, Till 2035 (USD Billion)

- Table 22.56 Molecular Diagnostics Market in Austria, Till 2035 (USD Billion)

- Table 22.57 Molecular Diagnostics Market in Belgium, Till 2035 (USD Billion)

- Table 22.58 Molecular Diagnostics Market in France, Till 2035 (USD Billion)

- Table 22.59 Molecular Diagnostics Market in Germany, Till 2035 (USD Billion)

- Table 22.60 Molecular Diagnostics Market in Italy, Till 2035 (USD Billion)

- Table 22.61 Molecular Diagnostics Market in the Netherlands, Till 2035 (USD Billion)

- Table 22.62 Molecular Diagnostics Market in Poland, Till 2035 (USD Billion)

- Table 22.63 Molecular Diagnostics Market in Spain, Till 2035 (USD Billion)

- Table 22.64 Molecular Diagnostics Market in Switzerland, Till 2035 (USD Billion)

- Table 22.65 Molecular Diagnostics Market in the UK, Till 2035 (USD Billion)

- Table 22.66 Molecular Diagnostics Market in Rest of the Europe, Till 2035 (USD Billion)

- Table 22.67 Molecular Diagnostics Market in Asia, Till 2035 (USD Billion)

- Table 22.68 Molecular Diagnostics Market in China, Till 2035 (USD Billion)

- Table 22.69 Molecular Diagnostics Market in India, Till 2035 (USD Billion)

- Table 22.70 Molecular Diagnostics Market in Indonesia, Till 2035 (USD Billion)

- Table 22.71 Molecular Diagnostics Market in Japan, Till 2035 (USD Billion)

- Table 22.72 Molecular Diagnostics Market in Singapore, Till 2035 (USD Billion)

- Table 22.73 Molecular Diagnostics Market in South Korea, Till 2035 (USD Billion)

- Table 22.74 Molecular Diagnostics Market in Thailand, Till 2035 (USD Billion)

- Table 22.75 Molecular Diagnostics Market in Rest of Asia, Till 2035 (USD Billion)

- Table 22.76 Molecular Diagnostics Market in Latin America, Till 2035 (USD Billion)

- Table 22.77 Molecular Diagnostics Market in Brazil, Till 2035 (USD Billion)

- Table 22.78 Molecular Diagnostics Market in Argentina, Till 2035 (USD Billion)

- Table 22.79 Molecular Diagnostics Market in Mexico, Till 2035 (USD Billion)

- Table 22.80 Molecular Diagnostics Market in Rest of Latin America, Till 2035 (USD Billion)

- Table 22.81 Molecular Diagnostics Market in Middle East and North Africa, Till 2035 (USD Billion)

- Table 22.82 Molecular Diagnostics Market in Egypt, Till 2035 (USD Billion)

- Table 22.83 Molecular Diagnostics Market in Israel, Till 2035 (USD Billion)

- Table 22.84 Molecular Diagnostics Market in Saudi Arabia, Till 2035 (USD Billion)

- Table 22.85 Molecular Diagnostics Market in Rest of Middle East and North Africa, Till 2035 (USD Billion)

- Table 22.86 Molecular Diagnostics Market in Rest of the World, Till 2035 (USD Billion)

- Table 22.87 Molecular Diagnostics Market in Australia, Till 2035 (USD Billion)

- Table 22.88 Molecular Diagnostics Market in New Zealand, Till 2035 (USD Billion)

- Table 22.89 Molecular Diagnostics Market: Distribution of Leading Players by Annual Revenues (FY23, USD Billion

- Table 22.90 Molecular Diagnostic Solution: Distribution by Type of Technology

- Table 22.91 Molecular Diagnostic Solution: Distribution by Diagnostic Applications

- Table 22.92 Molecular Diagnostic Solution: Distribution by Type of Technology and Diagnostic Applications

- Table 22.93 Molecular Diagnostics Solution Providers: Distribution by Year of Establishment

- Table 22.94 Molecular Diagnostics Solution Providers: Distribution by Company Size

- Table 22.95 Molecular Diagnostics Solution Providers: Distribution by Location of Headquarters

- Table 22.96 Molecular Diagnostics Solution Providers: Distribution by Company Ownership

- Table 22.97 Abbott: Financial Information (USD Billion)

- Table 22.98 Agilent Technologies: Financial Information (USD Billion)

- Table 22.99 BD: Financial Information (USD Billion)

- Table 22.100 Danaher: Financial Information (USD Billion)

- Table 22.101 Thermo Fisher Scientific: Financial Information (CHF Billion)

- Table 22.102 bioMerieux: Financial Information (EUR Billion)

- Table 22.103 Grifols: Financial Information (EUR Billion)

- Table 22.104 Roche: Financial Information (CHF Billion)

- Table 22.105 Siemens Healthineers: Financial Information (EUR Billion)

- Table 22.106 Sysmex: Financial Information (JPY Billion)

List of Figures

- Figure 2.1 Research Methodology: Research Assumptions

- Figure 2.2 Research Methodology: Project Methodology

- Figure 2.3 Research Methodology: Forecast Methodology

- Figure 2.4 Research Methodology: Robust Quality Control

- Figure 2.5 Research Methodology: Key Market Segmentations

- Figure 5.1 Key Technologies Employed in Molecular Diagnostic Solution

- Figure 5.2 Challenges in the Molecular Diagnostics Domain

- Figure 6.1 Market Drivers

- Figure 6.2 Market Restraints

- Figure 6.3 Market Opportunities

- Figure 6.4 Market Challenges

- Figure 7.1 Global Molecular Diagnostics Market, Till 2035 (USD Billion)

- Figure 7.2 Global Molecular Diagnostics Market, Conservative Scenario, Till 2035 (USD Billion)

- Figure 7.3 Global Molecular Diagnostics Market, Optimistic Scenario, Till 2035 (USD Billion)

- Figure 8.1 Molecular Diagnostics Market: Distribution by Test Type

- Figure 8.2 Molecular Diagnostics Market for Laboratory Testing, Till 2035 (USD Billion)

- Figure 8.3 Molecular Diagnostics Market for Point-of-Care Testing, Till 2035 (USD Billion)

- Figure 9.1 Molecular Diagnostics Market: Distribution by Type of Offering

- Figure 9.2 Molecular Diagnostics Market for Instruments, Till 2035 (USD Billion)

- Figure 9.3 Molecular Diagnostics Market for In-house Instruments, Till 2035 (USD Billion)

- Figure 9.4 Molecular Diagnostics Market for Outsourced Instruments, Till 2035 (USD Billion)

- Figure 9.5 Molecular Diagnostics Market for Reagents, Till 2035 (USD Billion)

- Figure 9.6 Molecular Diagnostics Market for Services, Till 2035 (USD Billion)

- Figure 10.1 Molecular Diagnostics Market: Distribution by Sample Type

- Figure 10.2 Molecular Diagnostics Market for Blood, Serum and Plasma, Till 2035 (USD Billion)

- Figure 10.3 Molecular Diagnostics Market for Urine, Till 2035 (USD Billion)

- Figure 10.4 Molecular Diagnostics Market for Others, Till 2035 (USD Billion)

- Figure 11.1 Molecular Diagnostics Market: Distribution by Type of Technology

- Figure 11.2 Molecular Diagnostics Market for PCR, Till 2035 (USD Billion)

- Figure 11.3 Molecular Diagnostics Market for In Situ Hybridization, Till 2035 (USD Billion)

- Figure 11.4 Molecular Diagnostics Market for Isothermal Nucleic Acid Amplification Technology, Till 2035 (USD Billion)

- Figure 11.5 Molecular Diagnostics Market for Next Generation Sequencing, Till 2035 (USD Billion)

- Figure 11.6 Molecular Diagnostics Market for Microarrays, Till 2035 (USD Billion)

- Figure 11.7 Molecular Diagnostics Market for Mass Spectrometry, Till 2035 (USD Billion)

- Figure 11.8 Molecular Diagnostics Market for Other Technologies, Till 2035 (USD Billion)

- Figure 12.1 Molecular Diagnostics Market: Distribution by Therapeutic Area

- Figure 12.2 Molecular Diagnostics Market for Infectious Diseases, Till 2035 (USD Billion)

- Figure 12.3 Molecular Diagnostics Market for COVID-19, Till 2035 (USD Billion)

- Figure 12.4 Molecular Diagnostics Market for Respiratory Infections (Excluding COVID-19), Till 2035 (USD Billion)

- Figure 12.5 Molecular Diagnostics Market for Healthcare-associated Infections, Till 2035 (USD Billion)

- Figure 12.6 Molecular Diagnostics Market for Hepatitis, Till 2035 (USD Billion)

- Figure 12.7 Molecular Diagnostics Market for HIV, Till 2035 (USD Billion)

- Figure 12.8 Molecular Diagnostics Market for Sexually Transmitted Diseases, Till 2035 (USD Billion)

- Figure 12.9 Molecular Diagnostics Market for Other Infectious Diseases, Till 2035 (USD Billion)

- Figure 12.10 Molecular Diagnostics Market for Oncological Disorders, Till 2035 (USD Billion)

- Figure 12.11 Molecular Diagnostics Market for Lung Cancer, Till 2035 (USD Billion)

- Figure 12.12 Molecular Diagnostics Market for Breast Cancer, Till 2035 (USD Billion)

- Figure 12.13 Molecular Diagnostics Market for Colorectal Cancer, Till 2035 (USD Billion)

- Figure 12.14 Molecular Diagnostics Market for Prostate Cancer, Till 2035 (USD Billion)

- Figure 12.15 Molecular Diagnostics Market for Gastric Cancer, Till 2035 (USD Billion)

- Figure 12.16 Molecular Diagnostics Market for Other Oncological Disorders, Till 2035 (USD Billion)

- Figure 12.17 Molecular Diagnostics Market for Cardiovascular Diseases, Till 2035 (USD Billion)

- Figure 12.18 Molecular Diagnostics Market for Neurological Diseases, Till 2035 (USD Billion)

- Figure 12.19 Molecular Diagnostics Market for Genetic Diseases, Till 2035 (USD Billion)

- Figure 12.20 Molecular Diagnostics Market for Other Therapeutic Areas, Till 2035 (USD Billion)

- Figure 13.1 Molecular Diagnostics Market: Distribution by End Users

- Figure 13.2 Molecular Diagnostics Market for Laboratories, Till 2035 (USD Billion)

- Figure 13.3 Molecular Diagnostics Market for Large Laboratories, Till 2035 (USD Billion)

- Figure 13.4 Molecular Diagnostics Market for Small and Medium-sized Laboratories, Till 2035 (USD Billion)

- Figure 13.5 Molecular Diagnostics Market for Hospitals, Till 2035 (USD Billion)

- Figure 13.6 Molecular Diagnostics Market for Other End Users, Till 2035 (USD Billion)

- Figure 14.1 Molecular Diagnostics Market: Distribution by Geographical Regions

- Figure 14.2 Molecular Diagnostics Market in North America, Till 2035 (USD Billion)

- Figure 14.3 Molecular Diagnostics Market in the US, Till 2035 (USD Billion)

- Figure 14.4 Molecular Diagnostics Market in Canada, Till 2035 (USD Billion)

- Figure 14.5 Molecular Diagnostics Market in Europe, Till 2035 (USD Billion)

- Figure 14.6 Molecular Diagnostics Market in Austria, Till 2035 (USD Billion)

- Figure 14.7 Molecular Diagnostics Market in Belgium, Till 2035 (USD Billion)

- Figure 14.8 Molecular Diagnostics Market in France, Till 2035 (USD Billion)

- Figure 14.9 Molecular Diagnostics Market in Germany, Till 2035 (USD Billion)

- Figure 14.10 Molecular Diagnostics Market in Italy, Till 2035 (USD Billion)

- Figure 14.11 Molecular Diagnostics Market in the Netherlands, Till 2035 (USD Billion)

- Figure 14.12 Molecular Diagnostics Market in Poland, Till 2035 (USD Billion)

- Figure 14.13 Molecular Diagnostics Market in Spain, Till 2035 (USD Billion)

- Figure 14.14 Molecular Diagnostics Market in Switzerland, Till 2035 (USD Billion)

- Figure 14.15 Molecular Diagnostics Market in the UK, Till 2035 (USD Billion)

- Figure 14.16 Molecular Diagnostics Market in Rest of Europe, Till 2035 (USD Billion)

- Figure 14.17 Molecular Diagnostics Market in Asia, Till 2035 (USD Billion)

- Figure 14.18 Molecular Diagnostics Market in China, Till 2035 (USD Billion)

- Figure 14.19 Molecular Diagnostics Market in India, Till 2035 (USD Billion)

- Figure 14.20 Molecular Diagnostics Market in Indonesia, Till 2035 (USD Billion)

- Figure 14.21 Molecular Diagnostics Market in Japan, Till 2035 (USD Billion)

- Figure 14.22 Molecular Diagnostics Market in Singapore, Till 2035 (USD Billion)

- Figure 14.23 Molecular Diagnostics Market in South Korea, Till 2035 (USD Billion)

- Figure 14.24 Molecular Diagnostics Market in Thailand, Till 2035 (USD Billion)

- Figure 14.25 Molecular Diagnostics Market in Rest of the Asia, Till 2035 (USD Billion)

- Figure 14.26 Molecular Diagnostics Market in Latin America, Till 2035 (USD Billion)

- Figure 14.27 Molecular Diagnostics Market in Brazil, Till 2035 (USD Billion)

- Figure 14.28 Molecular Diagnostics Market in Argentina, Till 2035 (USD Billion)

- Figure 14.29 Molecular Diagnostics Market in Mexico, Till 2035 (USD Billion)

- Figure 14.30 Molecular Diagnostics Market in Rest of Latin America, Till 2035 (USD Billion)

- Figure 14.31 Molecular Diagnostics Market in Middle East and North Africa, Till 2035 (USD Billion)

- Figure 14.32 Molecular Diagnostics Market in Egypt, Till 2035 (USD Billion)

- Figure 14.33 Molecular Diagnostics Market in Israel, Till 2035 (USD Billion)

- Figure 14.34 Molecular Diagnostics Market in Saudi Arabia, Till 2035 (USD Billion)

- Figure 14.35 Molecular Diagnostics Market in Rest of Middle East and North Africa, Till 2035 (USD Billion)

- Figure 14.36 Molecular Diagnostics Market in Rest of the World, Till 2035 (USD Billion)

- Figure 14.37 Molecular Diagnostics Market in Australia, Till 2035 (USD Billion)

- Figure 14.38 Molecular Diagnostics Market in New Zealand, Till 2035 (USD Billion)

- Figure 15.1 Molecular Diagnostics Market: Distribution of Leading Players by Annual Revenue (FY23, USD Billion)

- Figure 16.1 Molecular Diagnostic Solution: Distribution by Type of Technology

- Figure 16.2 Molecular Diagnostic Solution: Distribution by Diagnostic Applications

- Figure 16.3 Molecular Diagnostic Solution: Distribution by Type of Technology and Diagnostic Applications

- Figure 16.4 Molecular Diagnostics Solution Providers: Distribution by Year of Establishment

- Figure 16.5 Molecular Diagnostics Solution Providers: Distribution by Company Size

- Figure 16.6 Molecular Diagnostics Solution Providers: Distribution by Location of Headquarters

- Figure 16.7 Molecular Diagnostics Solution Providers: Distribution by Company Ownership

- Figure 17.1 Molecular Diagnostic Solution Providers: Competitiveness Analysis of Very Large Players

- Figure 17.2 Molecular Diagnostic Solution Providers: Competitiveness Analysis of Large Players

- Figure 17.3 Roche: Benchmarking Analysis

- Figure 17.4 Abbott: Benchmarking Analysis

- Figure 17.5 Thermo Fisher Scientific: Benchmarking Analysis

- Figure 17.6 Qiagen: Benchmarking Analysis

- Figure 17.7 bioMerieux: Benchmarking Analysis

- Figure 17.8 DiaSorin: Benchmarking Analysis

- Figure 17.9 Illumina: Benchmarking Analysis

- Figure 17.10 Sysmex: Benchmarking Analysis

- Figure 17.11 Perkin Elmer: Benchmarking Analysis

- Figure 17.12 Bio-Rad: Benchmarking Analysis

- Figure 17.13 Leading Molecular Diagnostic Solution Providers: Benchmarking by Competitiveness

- Figure 17.14 Leading Molecular Diagnostic Solution Providers: Benchmarking by Type of Technology Score

- Figure 17.15 Leading Molecular Diagnostic Solution Providers: Benchmarking by Diagnostic Applications Score

- Figure 18.1 Abbott: Financial Information (USD Billion)

- Figure 18.2 Agilent Technologies: Financial Information (USD Billion)

- Figure 18.3 BD: Financial Information (USD Billion)

- Figure 18.4 Danaher: Financial Information (USD Billion)

- Figure 18.5 Thermo Fisher Scientific: Financial Information (CHF Billion)

- Figure 19.1 bioMerieux: Financial Information (EUR Billion)

- Figure 19.2 Grifols: Financial Information (EUR Billion)

- Figure 19.3 Roche: Financial Information (CHF Billion)

- Figure 19.4 Siemens Healthineers: Financial Information (EUR Billion)

- Figure 20.1 Sysmex: Financial Information (JPY Billion)

- Figure 21.1 Threats of New Entrants

- Figure 21.2 Bargaining Power of Buyers

- Figure 21.3 Bargaining Power of Suppliers

- Figure 21.4 Threats of Substitute Products

- Figure 21.5 Rivalry among Existing Competitors

- Figure 21.6 Porter's Five Force Analysis: Harvey Ball Analysis