|

市场调查报告书

商品编码

1762546

药用小瓶市场:产业趋势及全球预测 - 按所用製造材料类型、灭菌状态和主要地区划分Pharmaceutical Vials Market: Industry Trends and Global Forecasts - Distribution by Type of Fabrication Material Used, Sterilization Status and Key Geographies |

||||||

药用小瓶市场:概览

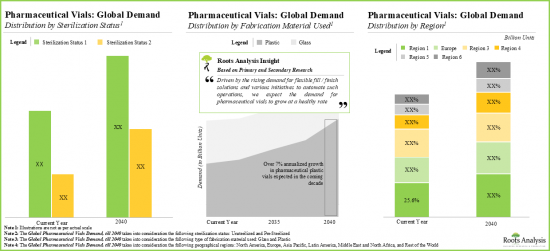

今年全球药用小瓶市场规模达110.3亿美元。预计预测期内,该市场的年复合成长率将达到6%。

市场规模与机会分析依下列参数细分:

使用的製造材料种类

- 玻璃

- 塑胶

无菌状态

- 预无菌

- 非无菌

主要地区

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和北非

- 世界其他地区

药用玻璃瓶市场:成长与趋势

药用玻璃瓶等初级包装材料在维持药品的稳定性、有效性和安全性方面发挥着非常重要的作用,因为它们与包装中的治疗药物直接接触。此外,药品内包装材料有助于保持药品的无菌性和品质,同时提供与其身份相关的资讯,在某些情况下还提供给药说明。此外,对肠外製剂的需求旺盛以及疫苗接种活动的日益增多,迫切需要安全优质的药瓶来大量储存此类製剂并在全球范围内分销。

儘管传统药瓶是最受欢迎的包装系统,但它也经常面临一些挑战,例如在恶劣条件下可能破损、包装上缺少相关资讯(序号和批号)以及可能出现分层。因此,一些药瓶製造商探索新技术,以克服传统药瓶面临的上述挑战,并提出更好的包装解决方案。事实上,药瓶製造商不断创新,推出更新、更优的包装解决方案,以满足下一代药物不断变化的需求。该领域的进步包括预灭菌药瓶的使用、多种涂层材料的开发以及智慧药物传输技术的采用。

药瓶市场:关键洞察

本报告分析了全球药瓶市场的现状,并探讨了产业内的潜在成长机会。报告的主要调查结果包括:

- 目前,近 95 家製造商销售/开发了 240 多种药瓶,其中大多数位于北美和欧洲等已开发国家。

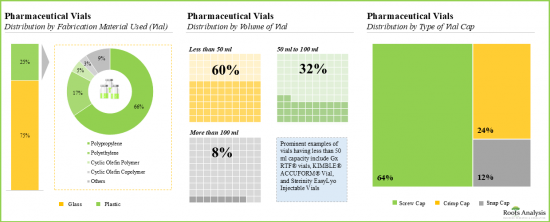

- 大多数药瓶由玻璃製成,容量各异。

- 由于玻璃具有多种优势,已成为药瓶製造的首选材料。常用的玻璃类型包括I型硼硅酸盐玻璃(65%)和III型钠钙玻璃(16%)。

- 大多数药瓶(60%)的容量小于50毫升,只有少数(8%)的容量超过100毫升。

- 超过 60%的药用小瓶设计为与螺旋盖配合使用,此类小瓶包括 1-Clic® 小瓶系统、CryoClear™ 小瓶、NextGen™ V-Vial®、Pyrofree 小瓶、无菌 CryoSure® 小瓶等。

- 为了打造竞争优势,业内企业积极升级现有产能并增加新功能,以增强各自的产品组合。

- 多年来,业内企业进一步开发了自己的药用小瓶,并达成了多项协议以实现改进。

- 过去几年,该领域的合作活动以超过 30%的年复合成长率成长。

- 现有企业和新进者过去都建立了策略伙伴关係。

- 当前的行业趋势证实了对创新包装解决方案日益成长的需求,主要是为了满足日益复杂的药品大规模、专业化的生产和包装要求。

- 近40家公司声称提供各种具有不同自由度的机器人,为提高生产力和最佳化成本提供了显着的机会。

- 在COVID-19疫情期间,药瓶的需求量很大,用于大量储存和包装新型疫苗和实验性疗法。

- 预计药瓶的市场机会将均匀分布在各种製造材料、无菌条件和地理区域。

药用小瓶市场参与者

- Chongqing Zhengchuan Pharmaceutical Packaging

- Corning

- DANYANG XIANGHE PHARMACEUTICAL PACKAGING

- DWK Life Sciences

- Gerresheimer

- Ningbo Zhengli Pharmaceutical Packaging

- Nipro

- Origin Pharma Packaging

- Pacific Vial Manufacturing

- SCHOTT

- SGD Pharma

- Shandong Pharmaceutical Glass

- Stevanato Group

- Thermo Fisher Scientific

- Worldwide Glass Resources

目录

第1章 简介

第2章 执行摘要

第3章 导论

- 章节概述

- 药品包装

- 药瓶

- 药瓶的创新

第4章 市场格局

- 章节概述

- 药瓶:市场版图

- 药瓶:製造商列表

第5章 公司竞争力分析

- 章节概述

- 假设和关键参数

- 研究方法

- 药瓶:公司竞争力分析

第6章 公司简介:北美药瓶製造商

- 章节概述

- Corning

- DWK Life Sciences

- Pacific Vial Manufacturing

- Thermo Fischer Scientific

- Worldwide Glass Resources

第7章 公司简介:欧洲药瓶製造商

- 章节概述

- Gerresheimer

- Origin Pharma Packaging

- SCHOTT

- SGD Pharma

- Stevanato Group

第8章 公司简介:亚太地区药瓶製造商

- Chongqing Zhengchuan Pharmaceutical Packaging

- Danyang Xianghe Pharmaceutical Packaging

- Ningbo Zhengli Pharmaceutical Packaging

- Nipro

- Shandong Pharmaceutical Glass

章节9 合作与合作

- 章节概述

- 合作模式

- 药瓶:合作伙伴关係与合作列表

第10章 药品包装的未来趋势

- 章节概述

- 使用现代给药装置进行自我用药的偏好

- 努力开发改进的包装组件并最佳化製造成本

- 模组化设施的可用性

- 对个人化治疗的需求和偏好不断成长

- 填充和封口製程自动化的配置不断增加

- 合作关係活动激增

- 发展中地区产业利害关係人的参与度不断提高

- 结论

第11章 需求分析

- 章节概述

- 范围与研究方法论

- 2035年全球药用瓶需求

- 结论

第12章 市场预测与机会分析

- 章节概述

- 预测研究方法与关键假设

- 全球药用瓶市场(~2035年)

第13章 案例研究:药品包装中的机器人技术

- 章节概述

- 机器人在製药业中的作用

- 选择机器人系统时需要考虑的关键点

- 机器人系统的优势

- 机器人系统的劣势

- 为製药业提供机器人的公司

- 为药品包装提供整合机器人系统的设备的公司

- Aseptic Technologies

- AST

- Bosch Packaging Technology

- Dara Pharmaceutical Packaging

- Fedegari Group

- IMA

- Steriline

- Vanrx Pharmasystems

第14章 案例研究:无菌/即用型药瓶

- 章节概述

- 药品包装与填充

- 传统内包装的局限性

- 即用型内包装

- 结论

第15章 结论

第16章 高层洞察

第17章 附录1:表格资料

第18章 附录2:公司与组织清单

PHARMACEUTICAL VIALS MARKET: OVERVIEW

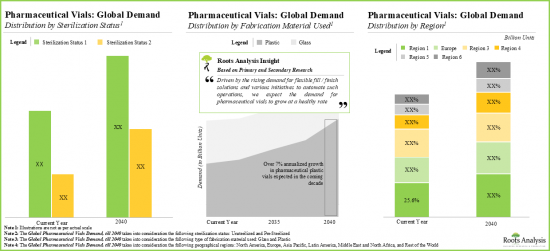

As per Roots Analysis, the global pharmaceutical vials market valued at USD 11.03 billion in the current year is anticipated to grow at a CAGR of 6% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Fabrication Material Used

- Glass

- Plastic

Sterilization Status

- Pre-sterilized

- Unsterilized

Key Geographies

- North America

- Europe

- Asia- Pacific

- Latin America

- Middle East and North Africa

- Rest of the World

PHARMACEUTICAL VIALS MARKET: GROWTH AND TRENDS

Primary packaging material such as pharmaceutical glass vials play a crucial role in preserving the stability, efficacy and safety of the drug as it is in direct contact with the packaged therapeutic. Additionally, pharmaceutical primary packaging material assists in maintaining the sterility and quality of a drug product, while also providing information related to its identity and, in certain cases, dosing instructions. Moreover, given the high demand for parenteral formulations and rising vaccination campaigns, there is an urgent need for safe and high-quality pharmaceutical vials, for storing and distributing such formulations in large quantities, across the world.

Despite being the most preferred packaging system, traditional vials are often associated with certain challenges, including chances of breakage under extreme conditions, absence of relevant information (serial or batch number) on the package and potential to delaminate. As a result, several pharmaceutical vials manufacturers are exploring novel techniques to overcome the aforementioned challenges associated with conventional pharmaceutical vials in order to create better packaging solutions. In fact, pharmaceutical vial manufacturers are constantly innovating and creating newer and better packaging solutions in order to meet the changing demands of next generation drug products. Examples of some advancements in this domain include the use of pre-sterilized vials, development of numerous coating materials and adoption of smart drug delivery technologies.

PHARMACEUTICAL VIALS MARKET: KEY INSIGHTS

The report delves into the current state of the global pharmaceutical vials market and identifies potential growth opportunities within industry. Some key findings from the report include:

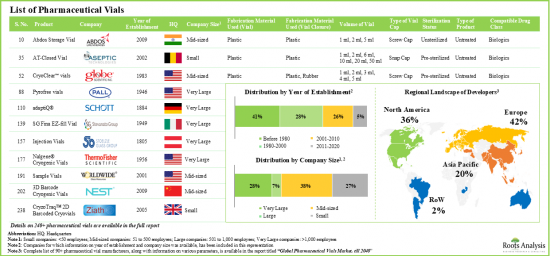

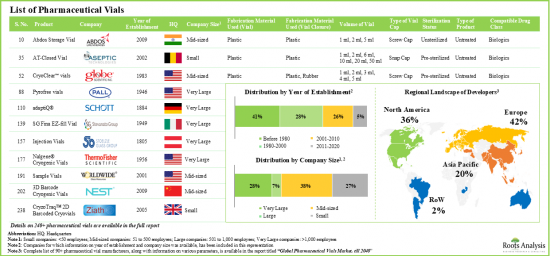

- Presently, more than 240 pharmaceutical vials are available / being developed by close to 95 manufacturers; most of these players are based in the developed such as North America and Europe.

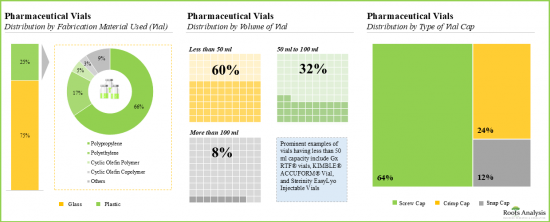

- Majority of the pharmaceutical vials are fabricated using glass and are available in a variety of volumes; screw caps are amongst the preferred type of vial caps used for such containers.

- Owing to the various benefits, glass emerged as the most preferred fabrication material used for pharmaceutical vials; common types of glass used include type I borosilicate glass (65%) and type III soda-lime glass (16%).

- Majority (60%) of the pharmaceutical vials have a capacity to hold less than 50 ml of drug product; however, very few (8%) vials are capable of storing more than 100 ml of therapeutic products.

- More than 60% of the pharmaceutical vials are designed to be used with screw caps; examples of such vials include 1-Clic(R) Vial System, CryoClear(TM) vials, NextGen(TM) V-Vial(R), Pyrofree vials and Sterile CryoSure(R) Vial.

- In pursuit of building a competitive edge, industry stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective product portfolios.

- Over the years, industry players have established several deals to further advance the development / enable the improvement of their proprietary pharmaceutical vials.

- The partnership activity in this domain has increased at a CAGR of over 30% in the past few years.

- Both established players and new entrants have forged strategic partnerships in the recent past; acquisitions emerged as the prominent type of partnership model.

- Current industry trends support the growing need for innovative packaging solutions, primarily to accommodate large scale and specialized production / packaging requirements of increasingly complex drug products.

- Close to 40 players claim to provide a wide range of robotic machinery, having different degrees of freedom, offering notable productivity and cost optimization opportunities.

- Pharmaceutical vials have been in high demand during the COVID-19 pandemic to store and package the novel vaccines and experimental therapies in large quantities.

- The estimated market opportunity for pharmaceutical vials is expected to be well distributed across different types of fabrication material, sterilization status and geographical regions.

Example Players in the Pharmaceutical Vials Market

- Chongqing Zhengchuan Pharmaceutical Packaging

- Corning

- DANYANG XIANGHE PHARMACEUTICAL PACKAGING

- DWK Life Sciences

- Gerresheimer

- Ningbo Zhengli Pharmaceutical Packaging

- Nipro

- Origin Pharma Packaging

- Pacific Vial Manufacturing

- SCHOTT

- SGD Pharma

- Shandong Pharmaceutical Glass

- Stevanato Group

- Thermo Fisher Scientific

- Worldwide Glass Resources

PHARMACEUTICAL VIALS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the pharmaceutical vials market, focusing on key market segments, including [A] type of fabrication material used, [B] sterilization status and [C] key geographies.

- Market Landscape: A comprehensive evaluation of pharmaceutical vials, based on several relevant parameters, such as [A] type of fabrication material used for container, [B] type of fabrication material used for closure, [C] volume of vial, [D] type of vial cap, [D] sterilization status, [E] type of product, [F] compatible drug class and [G] type of formulation stored. Additionally, a comprehensive evaluation of pharmaceutical vial manufacturers based on several relevant parameters, including [A] year of establishment, [B] company size, [C] location of headquarters and [D] key players (in terms of number of products).

- Company Competitiveness Analysis: A comprehensive competitive analysis of pharmaceutical vial manufacturers, examining factors, such as [A] supplier power and [B] key product specifications.

- Company Profiles: In-depth profiles of the players engaged in the development of pharmaceutical vials, focusing on [A] overview of the company, [B] financial information (if available), [C] product portfolio and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the pharmaceutical vial domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of fabrication material involved, [D] sterilization status, [E] type of partners and [F] regional distribution of the partnerships.

- Upcoming Trends in Pharmaceutical Packaging: An in-depth analysis of key trends that are likely to impact the future adoption of novel primary packaging systems. Further, a Harvey ball analysis, focusing on the relative effect of each trend on the overall pharmaceutical packaging industry.

- Demand Analysis: A detailed analysis of the current and future demand for pharmaceutical vials, based on various parameters, such as [A] type of fabrication material used, [B] sterilization status and [C] regions.

- Case Study: A detailed discussion on the use of robotic machinery in pharmaceutical manufacturing and fill / finish operations, describing the advantages of using automation / automated technologies in such processes.

- Case Study: A detailed discussion on pre-sterilized / RTU pharmaceutical vials that are currently available. Additionally, the section discusses various sterilization techniques used for primary packaging materials and the advantages of RTU container-closure systems.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Pharmaceutical Packaging

- 3.2.1. Need for Pharmaceutical Packaging

- 3.2.2. Types of Pharmaceutical Packaging

- 3.3. Pharmaceutical Vials

- 3.3.1. Types of Fabrication Materials Used for Vials

- 3.3.1.1. Glass Vials

- 3.3.1.2. Plastic Vials

- 3.3.2. Vial Caps

- 3.3.1. Types of Fabrication Materials Used for Vials

- 3.4. Innovation in Pharmaceutical Vials

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Pharmaceutical Vials: Overall Market Landscape

- 4.2.1. Analysis by Type of Fabrication Material Used (Container)

- 4.2.2. Analysis by Type of Fabrication Material Used (Closure)

- 4.2.3. Analysis by Volume of Vial

- 4.2.4. Analysis by Type of Vial Cap

- 4.2.5. Analysis by Sterilization Status

- 4.2.6. Analysis by Type of Product

- 4.2.7. Analysis by Compatible Drug Class

- 4.2.8. Analysis by Type of Formulation Stored

- 4.3. Pharmaceutical Vials: List of Manufacturers

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.3. Analysis by Location of Headquarters

- 4.3.4. Leading Manufacturers: Analysis by Number of Products

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions and Key Parameters

- 5.3. Methodology

- 5.4. Pharmaceutical Vials: Company Competitiveness Analysis

- 5.4.1. Company Competitiveness: Small Manufacturers

- 5.4.2. Company Competitiveness: Mid-sized Manufacturers

- 5.4.3. Company Competitiveness: Large Manufacturers

- 5.4.4. Company Competitiveness: Very Large Manufacturers

6. COMPANY PROFILES: PHARMACEUTICAL VIAL MANUFACTURERS IN NORTH AMERICA

- 6.1. Chapter Overview

- 6.2. Corning

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Pharmaceutical Vials Portfolio

- 6.2.4. Recent Developments and Future Outlook

- 6.3. DWK Life Sciences

- 6.3.1. Company Overview

- 6.3.2. Pharmaceutical Vials Portfolio

- 6.3.3. Recent Developments and Future Outlook

- 6.4. Pacific Vial Manufacturing

- 6.4.1. Company Overview

- 6.4.2. Pharmaceutical Vials Portfolio

- 6.4.3. Recent Developments and Future Outlook

- 6.5. Thermo Fischer Scientific

- 6.5.1. Company Overview

- 6.5.2. Financial Information

- 6.5.3. Pharmaceutical Vials Portfolio

- 6.5.4. Recent Developments and Future Outlook

- 6.6. Worldwide Glass Resources

- 6.6.1. Company Overview

- 6.6.2. Pharmaceutical Vials Portfolio

- 6.6.3. Recent Developments and Future Outlook

7. COMPANY PROFILES: PHARMACEUTICAL VIAL MANUFACTURERS IN EUROPE

- 7.1. Chapter Overview

- 7.2. Gerresheimer

- 7.2.1. Company Overview

- 7.2.2. Financial Information

- 7.2.3. Pharmaceutical Vials Portfolio

- 7.2.4. Recent Developments and Future Outlook

- 7.3. Origin Pharma Packaging

- 7.3.1. Company Overview

- 7.3.2. Pharmaceutical Vials Portfolio

- 7.3.3. Recent Developments and Future Outlook

- 7.4. SCHOTT

- 7.4.1. Company Overview

- 7.4.2. Financial Information

- 7.4.3. Pharmaceutical Vials Portfolio

- 7.4.4. Recent Developments and Future Outlook

- 7.5. SGD Pharma

- 7.5.1. Company Overview

- 7.5.2. Financial Information

- 7.5.3. Pharmaceutical Vials Portfolio

- 7.5.4. Recent Developments and Future Outlook

- 7.6. Stevanato Group

- 7.6.1. Company Overview

- 7.6.2. Pharmaceutical Vials Portfolio

- 7.6.3. Recent Developments and Future Outlook

8. COMPANY PROFILES: PHARMACEUTICAL VIAL MANUFACTURERS IN ASIA PACIFIC

- 8.1. Chongqing Zhengchuan Pharmaceutical Packaging

- 8.1.1. Company Overview

- 8.1.2. Pharmaceutical Vials Portfolio

- 8.1.3. Recent Developments and Future Outlook

- 8.2. Danyang Xianghe Pharmaceutical Packaging

- 8.2.1. Company Overview

- 8.2.2. Pharmaceutical Vials Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Ningbo Zhengli Pharmaceutical Packaging

- 8.3.1. Company Overview

- 8.3.2. Pharmaceutical Vials Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. Nipro

- 8.4.1. Company Overview

- 8.4.2. Financial Information

- 8.4.3. Pharmaceutical Vials Portfolio

- 8.4.4. Recent Developments and Future Outlook

- 8.5. Shandong Pharmaceutical Glass

- 8.5.1. Company Overview

- 8.5.2. Pharmaceutical Vials Portfolio

- 8.5.3. Recent Developments and Future Outlook

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. Pharmaceutical Vials: List of Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnership

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Year and Type of Partnership

- 9.3.4. Analysis by Type of Fabrication Material Used

- 9.3.5. Analysis by Sterilization Status

- 9.3.6. Analysis by Type of Partner

- 9.3.7. Most Active Players: Analysis by Number of Partnerships

- 9.3.8. Analysis by Geography

- 9.3.8.1. Region-wise Distribution

- 9.3.8.2. Country-wise Distribution

10. UPCOMING TRENDS IN PHARMACEUTICAL PACKAGING

- 10.1. Chapter Overview

- 10.2. Preference for Self-medication of Drugs, Through the Use of Modern Drug Delivery Devices

- 10.3. Development of Improved Packaging Components and Efforts to Optimize Manufacturing Costs

- 10.4. Availability of Modular Facilities

- 10.5. Growing Demand and Preference for Personalized Therapies

- 10.6. Rise in Provisions for Automating Fill / Finish Operations

- 10.7. Surge in Partnership Activity

- 10.8. Increase in Initiatives Undertaken by Industry Stakeholders in Developing Regions

- 10.9. Concluding Remarks

11. DEMAND ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Global Demand for Pharmaceutical Vials, Till 2035

- 11.3.1. Analysis by Type of Fabrication Material Used

- 11.3.1.1. Global Demand for Pharmaceutical Glass Vials, Till 2035

- 11.3.1.2. Global Demand for Pharmaceutical Plastic Vials, Till 2035

- 11.3.2. Analysis by Sterilization Status

- 11.3.2.1. Global Demand for Unsterilized Pharmaceutical Vials, Till 2035

- 11.3.2.2. Global Demand for Pre-sterilized Pharmaceutical Vials, Till 2035

- 11.3.3. Analysis by Geography

- 11.3.3.1. Demand for Pharmaceutical Vials in North America, Till 2035

- 11.3.3.2. Demand for Pharmaceutical Vials in Europe, Till 2035

- 11.3.3.3. Demand for Pharmaceutical Vials in Asia Pacific, Till 2035

- 11.3.3.4. Demand for Pharmaceutical Vials in Middle East and North Africa, Till 2035

- 11.3.3.5. Demand for Pharmaceutical Vials in Latin America, Till 2035

- 11.3.3.6. Demand for Pharmaceutical Vials in Rest of the World, Till 2035

- 11.3.1. Analysis by Type of Fabrication Material Used

- 11.4. Concluding Remarks

12. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 12.1. Chapter Overview

- 12.2. Forecast Methodology and Key Assumptions

- 12.3. Global Pharmaceutical Vials Market, Till 2035

- 12.3.1. Pharmaceutical Vials Market : Distribution by Type of Fabrication Material Used

- 12.3.1.1. Pharmaceutical Glass Vials Market, Till 2035

- 12.3.1.2. Pharmaceutical Plastic Vials Market, Till 2035

- 12.3.2. Pharmaceutical Vials Market : Distribution by Sterilization Status

- 12.3.2.1. Unsterilized Pharmaceutical Vials Market, Till 2035

- 12.3.2.2. Pre-sterilized Pharmaceutical Vials Market, Till 2035

- 12.3.3. Pharmaceutical Vials Market : Distribution by Geography

- 12.3.3.1. Pharmaceutical Vials Market in North America, Till 2035

- 12.3.3.2. Pharmaceutical Vials Market in Europe, Till 2035

- 12.3.3.3. Pharmaceutical Vials Market in Asia Pacific, Till 2035

- 12.3.3.4. Pharmaceutical Vials Market in Middle East and North Africa, Till 2035

- 12.3.3.5. Pharmaceutical Vials Market in Latin America, Till 2035

- 12.3.3.6. Pharmaceutical Vials Market in Rest of the World, Till 2035

- 12.3.1. Pharmaceutical Vials Market : Distribution by Type of Fabrication Material Used

13. CASE STUDY: ROBOTS IN PHARMACEUTICAL PACKAGING

- 13.1. Chapter Overview

- 13.2. Role of Robots in the Pharmaceutical Industry

- 13.2.1. Key Considerations for Selecting a Robotic System

- 13.2.2. Advantages of Robotic Systems

- 13.2.3. Disadvantages of Robotic Systems

- 13.3. Companies Providing Robots for Use in the Pharmaceutical Industry

- 13.4. Companies Providing Equipment Integrated with Robotic Systems for Pharmaceutical Packaging

- 13.4.1. Aseptic Technologies

- 13.4.2. AST

- 13.4.3. Bosch Packaging Technology

- 13.4.4. Dara Pharmaceutical Packaging

- 13.4.5. Fedegari Group

- 13.4.6. IMA

- 13.4.7. Steriline

- 13.4.8. Vanrx Pharmasystems

14. CASE STUDY: PRE-STERILIZED / READY-TO-USE PHARMACEUTICAL VIALS

- 14.1. Chapter Overview

- 14.2. Pharmaceutical Packaging and Filling

- 14.3. Limitations of Traditional Primary Packaging

- 14.4. Ready-to-Use Primary Packaging

- 14.4.1. Sterilization of Primary Packaging Material

- 14.4.1.1. Sterilization Techniques

- 14.4.2. Advantages of Ready-to-Use Primary Packaging

- 14.4.3. Cost Saving Opportunities associated with Ready-To-Use Primary Packaging

- 14.4.4. Current Demand for Ready-To-Use Primary Packaging and Key Enablers

- 14.4.5. List of Pre-Sterilized / Ready-to-Use Pharmaceutical Vials

- 14.4.1. Sterilization of Primary Packaging Material

- 14.5. Concluding Remarks

15. CONCLUDING REMARKS

16. EXECUTIVE INSIGHTS

- 16.1. Chapter Overview

- 16.2. Company A

- 16.2.1. Company Snapshot

- 16.2.2. Interview Transcript: Business Development and Technology Director

- 16.3. Company B

- 16.3.1. Company Snapshot

- 16.3.2. Interview Transcript: Former Project Manager of Business Development

- 16.4. Company C

- 16.4.1. Company Snapshot

- 16.4.2. Interview Transcript: SiO2 Materials Science

17. APPENDIX 1: TABULATED DATA

18. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 3.1 Difference between Tubular and Moulded Glass Vials

- Table 4.1 Pharmaceutical Vials: List of Products

- Table 4.2 Pharmaceutical Vials: List of Manufacturers

- Table 6.1 Leading Manufacturers of Pharmaceutical Vials in North America

- Table 6.2 Corning: Company Snapshot

- Table 6.3 Corning: Pharmaceutical Vials

- Table 6.4 Corning: Recent Developments and Future Outlook

- Table 6.5 DWK Life Sciences: Company Snapshot

- Table 6.6 DWK Life Sciences: Pharmaceutical Vials

- Table 6.7 DWK Life Sciences: Recent Developments and Future Outlook

- Table 6.8 Pacific Vial Manufacturing: Company Snapshot

- Table 6.9 Pacific Vial Manufacturing: Pharmaceutical Vials

- Table 6.10 Thermo Fisher Scientific: Company Snapshot

- Table 6.11 Thermo Fisher Scientific: Pharmaceutical Vials

- Table 6.12 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 6.13 Worldwide Glass Resources: Company Snapshot

- Table 6.14 Worldwide Glass Resources: Pharmaceutical Vials

- Table 7.1 Leading Manufacturers of Pharmaceutical Vials in Europe

- Table 7.2 Gerresheimer: Company Snapshot

- Table 7.3 Gerresheimer: Pharmaceutical Vials

- Table 7.4 Gerresheimer: Recent Developments and Future Outlook

- Table 7.5 Origin Pharma Packaging: Company Snapshot

- Table 7.6 Origin Pharma Packaging: Pharmaceutical Vials

- Table 7.7 SCHOTT: Company Snapshot

- Table 7.8 SCHOTT: Pharmaceutical Vials

- Table 7.9 SCHOTT: Recent Developments and Future Outlook

- Table 7.10 SGD Pharma: Company Snapshot

- Table 7.11 SGD Pharma: Pharmaceutical Vials

- Table 7.12 SGD Pharma: Recent Developments and Future Outlook

- Table 7.13 Stevanato Group: Company Snapshot

- Table 7.14 Stevanato Group: Pharmaceutical Vials

- Table 7.15 Stevanato Group: Recent Developments and Future Outlook

- Table 8.1 Leading Manufacturers of Pharmaceutical Vials in Asia Pacific

- Table 8.2 Chongqing Zhengchuan Pharmaceutical Packaging: Company Snapshot

- Table 8.3 Chongqing Zhengchuan Pharmaceutical Packaging: Pharmaceutical Vials

- Table 8.4 DANYANG XIANGHE PHARMACEUTICAL PACKAGING: Company Snapshot

- Table 8.5 DANYANG XIANGHE PHARMACEUTICAL PACKAGING: Pharmaceutical Vials

- Table 8.6 Ningbo Zhengli Pharmaceutical Packaging: Company Snapshot

- Table 8.7 Ningbo Zhengli Pharmaceutical Packaging: Pharmaceutical Vials

- Table 8.8 Ningbo Zhengli Pharmaceutical Packaging: Recent Developments and Future Outlook

- Table 8.9 Nipro: Company Snapshot

- Table 8.10 Nipro: Pharmaceutical Vials

- Table 8.11 Nipro: Recent Developments and Future Outlook

- Table 8.12 Shandong Pharmaceutical Glass: Company Snapshot

- Table 8.13 Shandong Pharmaceutical Glass: Pharmaceutical Vials

- Table 9.1 Pharmaceutical Vials: Partnerships and Collaborations, Since 2015

- Table 12.1 Tiered Pricing Structure of Prices of Pharmaceutical Vials across Different Geographies

- Table 13.1 List of Pharmaceutical Robotics Manufacturers

- Table 13.2 Aseptic Technologies: Company Overview

- Table 13.3 Aseptic Technologies: Key Specifications of Crystal L1 Robot Line

- Table 13.4 Aseptic Technologies: Key Specifications of Crystal SL1 Robot Line

- Table 13.5 AST: Company Overview

- Table 13.6 AST: Key Specifications of ASEPTiCell

- Table 13.7 AST: Key Specifications of GENiSYS R

- Table 13.8 AST: Key Specifications of GENiSYS C

- Table 13.9 AST: Key Specifications of GENiSYS Lab

- Table 13.10 Bosch Packaging Technology: Company Overview

- Table 13.11 Bosch Packaging Technology: Key Specifications of ATO

- Table 13.12 Dara Pharmaceutical Equipment: Company Overview

- Table 13.13 Dara Pharmaceutical Equipment: Key Specifications of SYX-E Cartridge + RABS

- Table 13.14 Fedegari Group: Company Overview

- Table 13.15 Fedegari Group: Key Specifications of Fedegari Isolator

- Table 13.16 IMA: Company Overview

- Table 13.17 IMA: Key Specifications of INJECTA

- Table 13.18 IMA: Key Specifications of STERI LIF3

- Table 13.19 Steriline: Company Overview

- Table 13.20 Steriline: Key Specifications of Robotic Nest Filling Machine

- Table 13.21 Steriline: Key Specifications of Robotic Vial Filling Machine

- Table 13.22 Steriline: Key Specifications of Robotic Vial Capping Machine

- Table 13.23 Vanrx Pharmasystems: Company Overview

- Table 13.24 Vanrx Pharmasystems: Key Specifications of Microcell Vial Filler

- Table 13.25 Vanrx Pharmasystems: Key Specifications of SA25 Aseptic Filling Workcell

- Table 14.1 Compatibility of Polymers with Ethylene Oxide Sterilization

- Table 14.2 Advantages and Disadvantages of Different Sterilization Techniques

- Table 14.3 List of Pre-sterilized / Ready-to-Use Pharmaceutical Vials

- Table 16.1 Aseptic Technologies: Company Snapshot

- Table 16.2 PYRAMID Laboratories: Company Snapshot

- Table 16.3 SiO2 Materials Science: Company Snapshot

- Table 17.1 Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Container)

- Table 17.2 Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Closure)

- Table 17.3 Pharmaceutical Vials: Distribution by Volume of Vial

- Table 17.4 Pharmaceutical Vials: Distribution by Type of Vial Cap

- Table 17.5 Pharmaceutical Vials: Distribution by Sterilization Status

- Table 17.6 Pharmaceutical Vials: Distribution by Type of Product

- Table 17.7 Pharmaceutical Vials: Distribution by Compatible Drug Class

- Table 17.8 Pharmaceutical Vials: Distribution by Type of Formulation Stored

- Table 17.9 Pharmaceutical Vials Manufacturers: Distribution by Year of Establishment

- Table 17.10 Pharmaceutical Vials Manufacturers: Distribution by Company Size

- Table 17.11 Pharmaceutical Vials Manufacturers: Distribution by Location of Headquarters

- Table 17.12 Leading Manufacturers: Distribution by Number of Products

- Table 17.13 Corning: Annual Revenues, Since 2016 (USD Billion)

- Table 17.14 Thermo Fisher Scientific: Annual Revenues, Since 2016 (USD Billion)

- Table 17.15 Gerresheimer: Annual Revenues, Since 2016 (EUR Billion)

- Table 17.16 SCHOTT: Annual Revenues, Since 2016 (EUR Billion)

- Table 17.17 Nipro: Annual Revenues, Since 2016 (JPY Billion)

- Table 17.18 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2015

- Table 17.19 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 17.20 Partnerships and Collaborations: Year-wise Trend by Type of Partnership

- Table 17.21 Partnerships and Collaborations: Distribution by Type of Fabrication Material Used

- Table 17.22 Partnerships and Collaborations: Year-wise Trend by Type of Fabrication Material Used

- Table 17.23 Partnerships and Collaborations: Distribution by Sterilization Status

- Table 17.24 Partnerships and Collaborations: Year-wise Trend by Sterilization Status

- Table 17.25 Partnerships and Collaborations: Distribution by Analysis by Type of Partner

- Table 17.26 Partnerships and Collaborations: Year-wise Trend by Analysis by Type of Partner

- Table 17.27 Most Active Players: Distribution by Number of Partnerships

- Table 17.28 Partnerships and Collaborations: Distribution by Region (Continent-wise)

- Table 17.29 Partnerships and Collaborations: Distribution by Region (Country-wise)

- Table 17.30 Global Demand for Pharmaceutical Vials, Till 2035 (Billion Units)

- Table 17.31 Global Demand for Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Billion Units)

- Table 17.32 Global Demand for Pharmaceutical Glass Vials, Till 2035 (Billion Units)

- Table 17.33 Global Demand for Pharmaceutical Plastic Vials, Till 2035 (Billion Units)

- Table 17.34 Global Demand for Pharmaceutical Vials: Distribution by Sterilization Status (Billion Units)

- Table 17.35 Global Demand for Unsterilized Pharmaceutical Vials, Till 2035 (Billion Units)

- Table 17.36 Global Demand for Pre-sterilized Pharmaceutical Vials, Till 2035 (Billion Units)

- Table 17.37 Global Demand for Pharmaceutical Vials: Distribution by Geography

- Table 17.38 Demand for Pharmaceutical Vials in North America, Till 2035 (Billion Units)

- Table 17.39 Demand for Pharmaceutical Vials in Europe, Till 2035 (Billion Units)

- Table 17.40 Demand for Pharmaceutical Vials in Asia Pacific, Till 2035 (Billion Units)

- Table 17.41 Demand for Pharmaceutical Vials in Middle East and North Africa, Till 2035 (Billion Units)

- Table 17.42 Demand for Pharmaceutical Vials in Latin America, Till 2035 (Billion Units)

- Table 17.43 Demand for Pharmaceutical Vials in Rest of the World, Till 2035 (Billion Units)

- Table 17.44 Global Pharmaceutical Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.45 Pharmaceutical Vials: Likely Growth Scenarios

- Table 17.46 Pharmaceutical Vials Market: Distribution by Type of Fabrication Material Used, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.47 Pharmaceutical Glass Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.48 Pharmaceutical Plastic Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.49 Pharmaceutical Vials Market: Distribution by Sterilization Status, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.50 Unsterilized Pharmaceutical Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.51 Pre-sterilized Pharmaceutical Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.52 Pharmaceutical Vials Market: Distribution by Geography, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.53 Pharmaceutical Vials Market in North America, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.54 Pharmaceutical Vials Market in Europe, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.55 Pharmaceutical Vials Market in Asia-Pacific, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.56 Pharmaceutical Vials Market in Middle East and North Africa, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.57 Pharmaceutical Vials Market in Latin America, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.58 Pharmaceutical Vials Market in Rest of the World, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 3.1 Advantages of Pharmaceutical Packaging

- Figure 3.2 Types of Pharmaceutical Packaging

- Figure 3.3 Advantages of Glass Vials

- Figure 3.4 Innovation in Pharmaceutical Packaging and Value Chain

- Figure 4.1 Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Container)

- Figure 4.2 Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Closure)

- Figure 4.3 Pharmaceutical Vials: Distribution by Volume of Vial

- Figure 4.4 Pharmaceutical Vials: Distribution by Type of Vial Cap

- Figure 4.5 Pharmaceutical Vials: Distribution by Sterilization Status

- Figure 4.6 Pharmaceutical Vials: Distribution by Type of Product

- Figure 4.7 Pharmaceutical Vials: Distribution by Compatible Drug Class

- Figure 4.8 Pharmaceutical Vials: Distribution by Type of Formulation Stored

- Figure 4.9 Pharmaceutical Vials Manufacturers: Distribution by Year of Establishment

- Figure 4.10 Pharmaceutical Vials Manufacturers: Distribution by Company Size

- Figure 4.11 Pharmaceutical Vials Manufacturers: Distribution by Location of Headquarters

- Figure 4.12 Leading Manufacturers: Distribution by Number of Products

- Figure 5.1 Company Competitiveness Analysis: Small Manufacturers

- Figure 5.2 Company Competitiveness Analysis: Mid-sized Manufacturers

- Figure 5.3 Company Competitiveness Analysis: Large Manufacturers

- Figure 5.4 Company Competitiveness Analysis: Very Large Manufacturers

- Figure 6.1 Corning: Annual Revenues, Since 2016 (USD Billion)

- Figure 6.2 Thermo Fisher Scientific: Annual Revenues, Since 2016 (USD Billion)

- Figure 7.1 Gerresheimer: Annual Revenues, Since 2016 (EUR Billion)

- Figure 7.2 SCHOTT: Annual Revenues, Since 2016 (EUR Billion)

- Figure 8.1 Nipro: Annual Revenues, Since 2016 (JPY Billion)

- Figure 9.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2015

- Figure 9.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 9.3 Partnerships and Collaborations: Year-wise Trend by Type of Partnership

- Figure 9.4 Partnerships and Collaborations: Distribution by Type of Fabrication Material Used

- Figure 9.5 Partnerships and Collaborations: Year-wise Trend by Type of Fabrication Material Used

- Figure 9.6 Partnerships and Collaborations: Distribution by Sterilization Status

- Figure 9.7 Partnerships and Collaborations: Year-wise Trend by Sterilization Status

- Figure 9.8 Partnerships and Collaborations: Distribution by Analysis by Type of Partner

- Figure 9.9 Partnerships and Collaborations: Year-wise Trend by Analysis by Type of Partner

- Figure 9.10 Most Active Players: Distribution by Number of Partnerships

- Figure 9.11 Partnerships and Collaborations: Distribution by Region (Continent-wise)

- Figure 9.12 Partnerships and Collaborations: Distribution by Region (Country-wise)

- Figure 10.1 Upcoming Trends Related to Pharmaceutical Packaging

- Figure 10.2 Future Growth Opportunities of Innovative Pharmaceutical Packaging based on Recent Trends

- Figure 11.1 Global Demand for Pharmaceutical Vials, Till 2035 (Billion Units)

- Figure 11.2 Global Demand for Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Billion Units)

- Figure 11.3 Global Demand for Pharmaceutical Glass Vials, Till 2035 (Billion Units)

- Figure 11.4 Global Demand for Pharmaceutical Plastic Vials, Till 2035 (Billion Units)

- Figure 11.5 Global Demand for Pharmaceutical Vials: Distribution by Sterilization Status (Billion Units)

- Figure 11.6 Global Demand for Unsterilized Pharmaceutical Vials, Till 2035 (Billion Units)

- Figure 11.7 Global Demand for Pre-sterilized Pharmaceutical Vials, Till 2035 (Billion Units)

- Figure 11.8 Global Demand for Pharmaceutical Vials: Distribution by Geography

- Figure 11.9 Demand for Pharmaceutical Vials in North America, Till 2035 (Billion Units)

- Figure 11.10 Demand for Pharmaceutical Vials in Europe, Till 2035 (Billion Units)

- Figure 11.11 Demand for Pharmaceutical Vials in Asia Pacific, Till 2035 (Billion Units)

- Figure 11.12 Demand for Pharmaceutical Vials in Middle East and North Africa, Till 2035 (Billion Units)

- Figure 11.13 Demand for Pharmaceutical Vials in Latin America, Till 2035 (Billion Units)

- Figure 11.14 Demand for Pharmaceutical Vials in Rest of the World, Till 2035 (Billion Units)

- Figure 12.1 Global Pharmaceutical Vials Market, Till 2035 (USD Billion)

- Figure 12.2 Pharmaceutical Vials: Likely Growth Scenarios

- Figure 12.3 Pharmaceutical Vials Market : Distribution by Type of Fabrication Material Used (USD Billion)

- Figure 12.4 Pharmaceutical Glass Vials Market, Till 2035 (USD Billion)

- Figure 12.5 Pharmaceutical Plastic Vials Market, Till 2035 (USD Billion)

- Figure 12.6 Pharmaceutical Vials Market : Distribution by Sterilization Status (USD Billion)

- Figure 12.7 Unsterilized Pharmaceutical Vials Market, Till 2035 (USD Billion)

- Figure 12.8 Pre-sterilized Pharmaceutical Vials Market, Till 2035 (USD Billion)

- Figure 12.9 Pharmaceutical Vials Market : Distribution by Geography (USD Billion)

- Figure 12.10 Pharmaceutical Vials Market in North America, Till 2035 (USD Billion)

- Figure 12.11 Pharmaceutical Vials Market in Europe, Till 2035 (USD Billion)

- Figure 12.12 Pharmaceutical Vials Market in Asia-Pacific, Till 2035 (USD Billion)

- Figure 12.13 Pharmaceutical Vials Market in Middle East and North Africa, Till 2035 (USD Billion)

- Figure 12.14 Pharmaceutical Vials Market in Latin America, Till 2035 (USD Billion)

- Figure 12.15 Pharmaceutical Vials Market in Rest of the World, Till 2035 (USD Billion)

- Figure 13.1 Key Considerations for Selecting a Robotic System

- Figure 13.2 Advantages Associated with Use of Robotic Systems in Pharmaceutical Manufacturing

- Figure 14.1 Traditional Aseptic Pharmaceutical Filling

- Figure 14.2 Ready-to-Use Enabled Flexible, Aseptic Processing

- Figure 14.3 Advantages of Ready-to-Use Platform

- Figure 14.4 Cost Comparison of Ready-to-Use and Conventional Container Systems

- Figure 14.5 Drivers of Ready-to-Use Platform

- Figure 16.1 Concluding Remarks: Overall Market Landscape

- Figure 16.2 Concluding Remarks: Partnerships and Collaborations

- Figure 16.3 Concluding Remarks: Global Demand for Pharmaceutical Vials

- Figure 16.4 Concluding Remarks: Market Forecast