|

市场调查报告书

商品编码

1771287

自动液体处理系统市场:产业趋势和全球预测 - 各移液技术,各清洗技术,各种模式,类别设备,各用途,各终端用户,主要各地区Automated Liquid Handling Systems Market: Industry Trends and Global Forecasts - Distribution by Pipetting Technology, Washing Technology, Modality, Type of Instrument, Application, End User and Key Geographical Regions |

||||||

全球自动液体处理系统市场:概要

预计2035年,全球自动化液体处理系统市场规模将从目前的32.6亿美元成长至63.5亿美元,预测期间内复合年增长率为6.9%。

市场区隔包括以下参数的市场规模和机会分析:

移液技术

- 接触技术

- 空气置换技术

- 活塞/容量式技术

- 音响技术

- 自由喷射技术

清洗技术

- 超音波技术

- 音响技术

- 离心技术

模式

- 固定晶片

- 抛弃式晶片

设备类型

- 独立的

- 桌面式型工作站

- 多设备系统

- 其他

用途

- 连续稀释

- 板复製

- PCR/qPCR安装

- 孔板重组

- 高通量筛检

- 全基因放大

- 细胞培养

- ELISA

- 细胞化验分析

- 珠清洗

- 其他

终端用户

- 生物科技及製药公司

- 学术机构及政府研究机关

- 医院及诊断中心

- 其他

主要地区

- 北美

- 欧洲

- 亚太地区

- 中东·北非

- 南美

全球自动化液体处理系统市场:成长与趋势

近年来,生物製药产业见证了实验室科学领域的多项进步,包括自动化系统的出现。自动化液体处理系统在製药业的应用彻底改变了现代实验室的运作方式。自动化液体处理系统相对于手动方法的优势是推动该市场成长的主要动力。此外,由于工作流程的改进,可以实现更高的通量、更高的准确性并显着节省时间,越来越多的实验室正在采用这些系统。过去二十年来,这些系统的应用提高了实验室的竞争力。然而,为了充分发挥自动化液体处理系统的潜力并维持未来成长,必须克服各种障碍和现有课题。

许多利害关係人特别关注实验室自动化领域的进步,例如开发具有液体分配功能的自动化液体处理系统。目前,超过 125 家公司参与自动化液体处理系统的製造,包括自动分配系统/自动微孔板洗板机。

全球自动化液体处理系统市场:关键洞察

本研究报告探讨了全球自动化液体处理系统市场的现状,并识别了产业内的潜在成长机会。报告的主要发现包括:

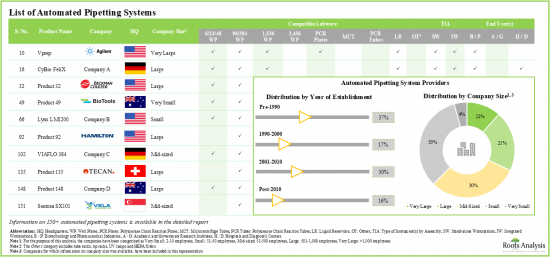

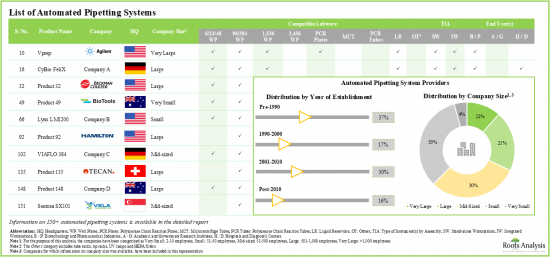

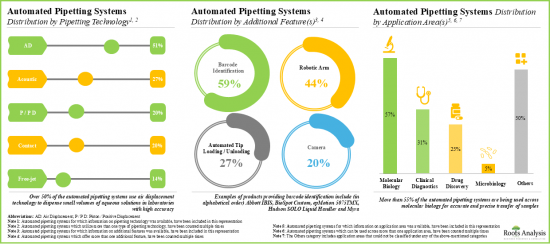

- 目前,全球 70 家知名公司声称提供 150 多种自动移液系统,其中 70% 以上的系统可用作整合工作站。

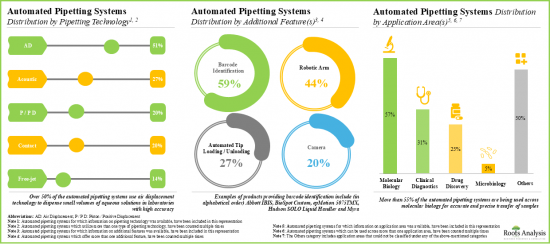

- 自动移液系统具有先进的功能,可提高可重复性和工作流程的准确性。近 60% 的系统具有条码识别功能,可轻鬆追踪样本试剂。

- 为了在该行业中建立竞争优势,利害关係人正在积极升级现有的自动分配系统,以丰富其产品组合。

- 在我们的研究中,我们发现超过 100 台自动化微孔板洗板机正用于生物製药和製药行业的各种应用。

- 近 80% 的自动化微孔板洗板机用作独立工作站,以提供样品製备的灵活性,并且超过 95% 的此类系统与平板微孔板相容。

- 值得注意的是,各公司正致力于在自动化微孔板洗板机中整合高级功能,以符合不断发展的行业基准。

- 该领域的合作活动正以超过 30% 的复合年增长率增长,事实上,过去三年签署的与自动化液体处理系统相关的交易数量最多。

- 最近,各利害关係人已提交/授予近 500 项与自动化液体处理系统相关的专利,这表明该领域的创新步伐正在加快。

- 随着自动化液体处理系统需求的不断增长,预计到 2035 年,市场复合年增长率将超过 6.9%。

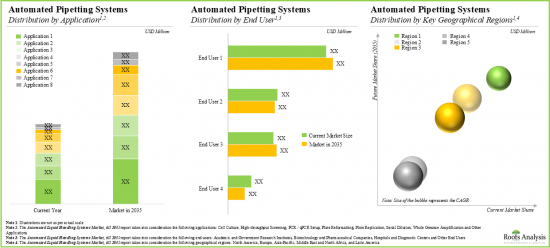

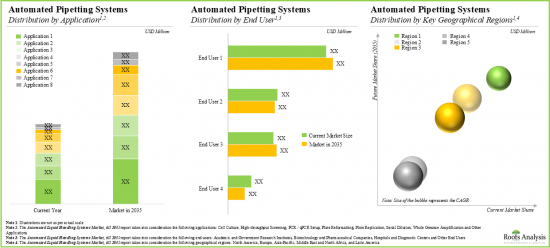

- 自动化液体处理设备市场目前和未来的机会广泛分布于各种应用、最终用户和主要地区。

- 预计自动化微孔板洗板机市场的成长主要受声波技术需求成长的推动,预计到2035年北美将占据主要市场占有率(35%)。

全球自动化液体处理系统市场:主要细分市场

空气置换技术占据自动化液体处理系统市场的最大占有率。

根据移液技术,市场细分为接触式技术、空气置换技术、活塞/容积式技术、声波技术和自由喷射技术。目前,空气置换技术占据全球自动化液体处理系统市场的大部分占有率(约30%)。此外,与其他细分市场相比,声学技术领域的成长速度可能更快。

按类型划分,一次性吸头是全球自动化液体处理系统市场中成长最快的细分市场。

依类型划分,市场分为固定吸头和一次性吸头。目前,一次性吸头在全球自动化液体处理系统市场中占有最高占有率(约75%)。值得注意的是,自动化液体处理系统市场的一次性吸头细分市场很可能会以相对较高的复合年增长率成长。

依仪器类型划分,独立式细分市场在自动化液体处理系统市场中占有最大占有率

依仪器类型划分,市场分为独立式、单一桌上型工作站、多仪器系统及其他类型。目前,独立式在自动化液体处理系统市场中占有最大占有率(约35%)。此外,多仪器系统细分市场很可能会以相对较高的复合年增长率成长。

按应用划分,高通量筛选细分市场是预测期内自动化液体处理系统市场中成长最快的细分市场。

依应用划分,市场分为连续稀释、孔板复製、PCR/qPCR 建构、孔板重新格式化、高通量筛选、全基因组扩增、细胞培养、ELISA、基于细胞的检测、珠子清洗和其他应用。目前,连续稀释细分市场在自动化液体处理系统市场中占有最高占有率(超过 30%)。此外,值得注意的是,用于高通量筛选的自动化液体处理系统市场很可能会以相对较高的复合年增长率成长。

生技与製药公司细分市场在全球自动化液体处理系统市场中占有最大占有率

根据最终用户,市场细分为生物技术和製药公司、学术和政府研究机构、医院和诊断中心等。目前,生物技术和製药公司占据全球自动化液体处理系统市场的最大占有率(约45%)。预计未来这一趋势将保持不变。

北美占最大市场占有率。

依主要地区划分,市场分为北美、欧洲、亚太地区、拉丁美洲以及中东和北非。目前,北美(约45%)在自动化液体处理系统市场占据主导地位,拥有最大的收入占有率。然而,预计亚太地区的市场将以更高的复合年增长率成长。

自动液体处理系统市场参与企业案例

- Agilent Technologies

- Beckman Coulter Life Sciences

- Eppendorf

- Hamilton Robotics

- MyGenostics

- Tecan

- Thermo Fisher Scientific

本报告概述了全球自动化液体处理系统市场,包括按移液技术、清洁技术、模式、设备类型、应用、最终用户趋势、区域趋势和公司概况进行的市场概述。

目录

第1章 序文

第2章 摘要整理

第3章 简介

- 章概要

- 自动液体处理系统概要

- 手动和自动的液体处理

- 自动移液系统

- 自动微量盘洗涤仪

- 自动液体处理系统的用途

- 自动液体处理系统的引进的课题

- 未来展望

第4章 自动移液系统:市场形势

- 章概要

- 自动移液系统:市场形势

- 自动移液系统供应商的形势

第5章 自动移液系统供应商:竞争力分析

- 章概要

- 前提主要的参数

- 调查手法

- 企业竞争力分析:自动移液系统供应商

- 北美公司(同类公司第一组)

- 欧洲公司(同类公司第二组)

- 亚太地区及世界其他地区公司(同类公司第三组)

第6章 自动移液系统供应商:企业简介

- 章概要

- Beckman Coulter Life Sciences

- Eppendorf

- Hamilton Robotics

- MyGenostics

第7章 自动微量盘洗涤仪:市场形势

- 章概要

- 自动微量盘洗涤仪:市场形势

- 自动微量盘洗涤仪供应商的形势

第8章 自动微量盘洗涤仪供应商:竞争力分析

- 章概要

- 前提主要的参数

- 调查手法

- 企业竞争力分析:自动微量盘洗涤仪供应商

- 北美公司(同类公司第一组)

- 欧洲公司(同类公司第二组)

- 亚太地区及世界其他地区公司(同类公司第三组)

第9章 自动微量盘洗涤仪供应商:企业简介

- 章概要

- Agilent Technologies

- Tecan

- Thermo Fisher Scientific

第10章 伙伴关係和合作

- 章概要

- 伙伴关係模式

- 自动液体处理系统:伙伴关係和合作

第11章 专利分析

- 章概要

- 范围与调查手法

- 自动液体处理系统:专利分析

- 自动液体处理系统:专利基准分析

- 自动液体处理系统:专利评估分析

- 主要专利:引用数分析

第12章 市场规模的评估与机会分析

- 章概要

- 调查手法主要的前提

- 全球自动液体处理系统市场(到2035年)

第13章 SWOT分析

- 章概要

- 自动液体处理系统:SWOT分析

- SWOT要素的比较

- 结论

第14章 结论

第15章 附录I:表格形式资料

第16章 附录II:企业及组织一览

GLOBAL AUTOMATED LIQUID HANDLING SYSTEMS MARKET: OVERVIEW

As per Roots Analysis, the global automated liquid handling systems market is estimated to grow from USD 3.26 billion in the current year to USD 6.35 billion by 2035, at a CAGR of 6.9% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Pipetting Technology

- Contact Technology

- Air Displacement Technology

- Piston / Positive Displacement Technology

- Acoustic Technology

- Free-jet Technology

Washing Technology

- Ultrasonic Technology

- Acoustic Technology

- Centrifugal Technology

Modality

- Fixed Tips

- Disposable Tips

Type of Instrument

- Standalone

- Individual Benchtop Workstation

- Multi Instrument Systems

- Others

Application

- Serial Dilution

- Plate Replication

- PCR / qPCR Setup

- Plate Reformatting

- High-throughput Screening

- Whole Genome Amplification

- Cell Culture

- ELISA

- Cell-based Assays

- Bead Washing

- Other Applications

End User

- Biotechnology and Pharmaceutical Companies

- Academics and Government Research Institutes

- Hospitals and Diagnostic Centers

- Other End Users

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

GLOBAL AUTOMATED LIQUID HANDLING SYSTEMS MARKET: GROWTH AND TRENDS

In recent years, the biopharmaceutical domain has witnessed several advancements in the field of laboratory sciences, including the emergence of automated systems. The use of automated liquid handling systems in the pharmaceutical industry has revolutionized the way modern laboratories operate. The advantages offered by automated liquid handling systems over manual methods primarily drive the growth of this market. Moreover, due to the increased throughput, greater precision and improved workflows that allow significant time saving, more and more laboratories are now adopting these systems. This is being done in order to give laboratories a competitive edge in the past two decades. However, to leverage the full potential of automated liquid handlers and sustain growth in the future, it is important to address the various hurdles and existing challenges.

Notably, many stakeholders are focused on incorporating advancements in lab automation such as the development of automated liquid handling systems with the capability to dispense liquid volumes. Presently, over 125 companies are engaged in the manufacturing of automated liquid handlers including automated pipetting systems / automated microplate washers.

GLOBAL AUTOMATED LIQUID HANDLING SYSTEMS MARKET: KEY INSIGHTS

The report delves into the current state of global automated liquid handling systems market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, 70 well-established players across the globe claim to offer more than 150 automated pipetting systems; more than 70% of these systems can be used as integrated workstations.

- Automated pipetting systems are equipped with advanced features to enhance reproducibility and workflow accuracy; nearly 60% of the systems offer barcode identification for tracking sample reagents conveniently.

- In pursuit of building a competitive edge in this industry, stakeholders are actively upgrading their existing automated pipetting systems in order to augment their product portfolio offerings.

- During our research, we identified more than 100 automated microplate washers that have various applications in the biopharmaceutical and pharmaceutical industries.

- Close to 80% of the automated microplate washers are used as stand-alone workstations, offering flexibility in sample preparation; over 95% of such systems are compatible with flat microplates.

- It is worth highlighting that players are focused on the integration of advanced features into their automated microplate washers to comply with the evolving industry benchmarks.

- The partnership activity in this domain has increased at a CAGR of over 30%; in fact, the maximum deals related to automated liquid handling systems have been inked in the last three years.

- Around 500 patents related to automated liquid handling systems have recently been filed / granted by various stakeholders, indicating the growing pace of innovation in this field.

- With the rising demand for automated pipetting systems, the market is expected to grow at an annualized rate of more than 6.9% till 2035.

- The current and projected future automated pipetting systems market opportunity is likely to be well distributed across various applications, end users and key geographical regions.

- Growth in the automated microplate washer's domain is anticipated to be primarily driven by the rising demand of acoustic technology; North America is expected to capture larger share (35%) of the market by 2035.

GLOBAL AUTOMATED LIQUID HANDLING SYSTEMS MARKET: KEY SEGMENTS

Air Displacement Technology Segment Occupies the Largest Share of the Automated Liquid Handling Systems Market

Based on pipetting technology, the market is segmented into contact technology, air displacement technology, piston / positive displacement technology, acoustic technology and free-jet technology. At present, air displacement technology segment holds the majority share (~30%) of the global automated liquid handling systems market. Additionally, the acoustic technology segment is likely to grow at a faster pace compared to the other segments.

By Modality, Disposable Tips is the Fastest Growing Segment of the Global Automated Liquid Handling Systems Market

Based on the modality, the market is segmented into fixed tips and disposable tips. Currently, the disposable tips segment captures the highest proportion (~75%) of the global automated liquid handling systems market. It is worth highlighting that the automated liquid handling systems market for disposable tips segment is likely to grow at a relatively higher CAGR.

Standalone Segment Occupies the Largest Share of the Automated Liquid Handling Systems Market by Type of Instrument

Based on the type of instrument, the market is segmented into standalone, individual benchtop workstation, multi-instrument systems and others. At present, the standalone segment holds the maximum share (~35%) of the automated liquid handling systems market. In addition, the multi-instrument systems segment is likely to grow at a relatively higher CAGR.

By Application, the High-throughput Screening Segment is the Fastest Growing Segment of the Automated Liquid Handling Systems Market During the Forecast Period

Based on the application, the market is segmented into serial dilution, plate replication, PCR / qPCR setup, plate reformatting, high-throughput screening, whole genome amplification, cell culture, ELISA, cell-based assays, bead washing and other applications. Currently, serial dilution segment captures the highest proportion (>30%) of the automated liquid handling systems market. Further, it is worth highlighting that the automated liquid handling systems market for high-throughput screening is likely to grow at a relatively higher CAGR.

Biotechnology and Pharmaceutical Companies Segment Account for the Largest Share of the Global Automated Liquid Handling Systems Market

Based on the end user, the market is segmented into biotechnology and pharmaceutical companies, academic and government research institutes, hospitals and diagnostic centers and other end users. Currently, biotechnology and pharmaceutical companies segment holds the maximum share (~45%) of the global automated liquid handling systems market. This trend is likely to remain the same in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East and North Africa. Currently, North America (~45%) dominates the automated liquid handling systems market and accounts for the largest revenue share. However, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Automated Liquid Handling Systems Market

- Agilent Technologies

- Beckman Coulter Life Sciences

- Eppendorf

- Hamilton Robotics

- MyGenostics

- Tecan

- Thermo Fisher Scientific

GLOBAL AUTOMATED LIQUID HANDLING SYSTEMS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global automated liquid handling systems market, focusing on key market segments, including [A] pipetting technology, [B] washing technology, [C] modality, [D] type of instrument, [E] application, [F] end user and [G] key geographical regions.

- Automated Pipetting Systems Market Landscape: A comprehensive evaluation of automated pipetting systems, considering various parameters, such as [A] pipetting technology, [B] certification(s), [C] type of instrument(s) by assembly, [D] pipetting head option(s), [E] weight of automated pipetting system (in kg), [F] compatible labware, [G] application area(s), [H] application(s), [I] additional feature(s) and [J] end user(s). Additionally, a comprehensive evaluation of automated pipetting system providers, based on parameters, such as [A] year of establishment, [B] company size (in terms of employee count) and [C] location of headquarters.

- Automated Pipetting System Providers Competitiveness Analysis: A comprehensive competitive analysis of automated pipetting system providers, examining factors, such as [A] company strength, [B] product diversity and [C] product strength.

- Automated Pipetting System Providers Company Profiles: In-depth profiles of companies engaged in the manufacturing of automated pipetting systems, focusing on [A] company overviews, [B] financial information (if available), [C] product portfolio and [D] recent developments and an informed future outlook.

- Automated Microplate Washers Market Landscape: A comprehensive evaluation of automated microplate washers, considering various parameters, such as [A] type of instrument(s), [B] compatible microplate(s), [C] weight of automated microplate washers (in Kg), [D] compatible labware, [E] application(s), and [F] end user(s). Additionally, a comprehensive evaluation of automated microplate washer providers, based on parameters, such as [A] year of establishment, [B] company size (in terms of employee count) and [C] location of headquarters.

- Automated Microplate Washer Providers Competitiveness Analysis: A comprehensive competitive analysis of automated microplate washer providers, examining factors, such as [A] company strength, [B] product diversity and [C] product strength.

- Automated Microplate Washer Providers Company Profiles: In-depth profiles of companies engaged in the manufacturing of automated microplate washers, focusing on [A] company overviews, [B] financial information (if available), [C] product portfolio and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the automated liquid handling systems market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of automated liquid handling system, [D] most popular products, [E] most active players (in terms of the number of partnerships signed) and [F] geographical distribution of partnership activity.

- Patent Analysis: An in-depth analysis of patents filed / granted till date in the automated liquid handling systems domain, based on various relevant parameters, such as [A] patent publication year, [B] type of patent, [C] patent jurisdiction, [D] CPC symbols, [F] type of applicant, [G] emerging focus areas, [H] leading players, [I] benchmarking analysis and [J] patent valuation.

- SWOT Analysis: An analysis of industry affiliated trends, opportunities and challenges, which are likely to impact the evolution of automated liquid handling systems market; it includes a Harvey ball analysis, assessing the relative impact of each SWOT parameter on industry dynamics.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Automated Liquid Handling Systems

- 3.3. Manual versus Automated Liquid Handling

- 3.4. Automated Pipetting Systems

- 3.4.1. Working Mechanism of Automated Pipetting Systems

- 3.4.2. Types of Automated Pipetting Systems

- 3.4.2.1. Tip-based Pipetting Systems

- 3.4.2.2. Non-tip based Pipetting Systems

- 3.4.3. Advantages of Automated Pipetting Systems

- 3.5. Automated Microplate Washers

- 3.5.1. Features of an Ideal Automated Microplate Washer

- 3.6. Applications of Automated Liquid Handling Systems

- 3.7. Challenges in Adoption of Automated Liquid Handling Systems

- 3.8. Future Perspectives

4. AUTOMATED PIPETTING SYSTEMS: MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Automated Pipetting Systems: Overall Market Landscape

- 4.2.1. Analysis by Type of Technology

- 4.2.2. Analysis by Pipetting Technology

- 4.2.3. Analysis by Certification(s)

- 4.2.4. Analysis by Type of Instrument(s) by Assembly

- 4.2.5. Analysis by Pipetting Head Option(s)

- 4.2.6. Analysis by Weight of Automated Pipetting System (in Kg)

- 4.2.7. Analysis by Compatible Labware

- 4.2.8. Analysis by Application Area(s)

- 4.2.9. Analysis by Application(s)

- 4.2.10. Analysis by Additional Feature(s)

- 4.2.11. Analysis by End User(s)

- 4.3. Automated Pipetting System Providers Landscape

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.3. Analysis by Location of Headquarters (Region-wise)

- 4.3.4. Analysis by Company Size and Location of Headquarters (Region-wise)

- 4.3.5. Analysis by Location of Headquarters (Country-wise)

- 4.3.6. Most Active Players: Analysis by Number of Automated Pipetting Systems Manufactured

5. AUTOMATED PIPETTING SYSTEM PROVIDERS: COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions and Key Parameters

- 5.3. Methodology

- 5.4. Company Competitiveness Analysis: Automated Pipetting System Providers

- 5.4.1. Companies based in North America (Peer Group I)

- 5.4.2. Companies based in Europe (Peer Group II)

- 5.4.3. Companies based in Asia-Pacific and Rest of the World (Peer Group III)

6. AUTOMATED PIPETTING SYSTEM PROVIDERS: COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Beckman Coulter Life Sciences

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Product Portfolio

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Eppendorf

- 6.3.1. Company Overview

- 6.3.2. Financial Information

- 6.3.3. Product Portfolio

- 6.3.4. Recent Developments and Future Outlook

- 6.4. Hamilton Robotics

- 6.4.1. Company Overview

- 6.4.2. Product Portfolio

- 6.4.3. Recent Developments and Future Outlook

- 6.5. MyGenostics

- 6.5.1. Company Overview

- 6.5.2. Product Portfolio

- 6.5.3. Recent Developments and Future Outlook

7. AUTOMATED MICROPLATE WASHERS: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Automated Microplate Washers: Overall Market Landscape

- 7.2.1. Analysis by Type of Instrument(s) by Assembly

- 7.2.2. Analysis by Compatible Microplate(s)

- 7.2.3. Analysis by Weight of Automated Microplate Washer (in Kg)

- 7.2.4. Analysis by Compatible Software

- 7.2.5. Analysis by Compatible Labware

- 7.2.6. Analysis by Application Area(s)

- 7.2.7. Analysis by Application(s)

- 7.2.8. Analysis by End User(s)

- 7.3. Automated Microplate Washer Providers Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters (Region-wise)

- 7.3.4. Analysis by Company Size and Location of Headquarters (Region-wise)

- 7.3.5. Analysis by Location of Headquarters (Country-wise)

- 7.3.6. Most Active Players: Analysis by Number of Automated Microplate Washers Manufactured

8. AUTOMATED MICROPLATE WASHER PROVIDERS: COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Company Competitiveness Analysis: Automated Microplate Washer Providers

- 8.4.1. Companies based in North America (Peer Group I)

- 8.4.2. Companies based in Europe (Peer Group II)

- 8.4.3. Companies based in Asia-Pacific and Rest of the World (Peer Group III)

9. AUTOMATED MICROPLATE WASHER PROVIDERS: COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Agilent Technologies

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Product Portfolio

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Tecan

- 9.3.1. Company Overview

- 9.3.2. Financial Information

- 9.3.3. Product Portfolio

- 9.3.4. Recent Developments and Future Outlook

- 9.4. Thermo Fisher Scientific

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Product Portfolio

- 9.4.4. Recent Developments and Future Outlook

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. Automated Liquid Handling Systems: Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Analysis by Year and Type of Partnership

- 10.3.4. Analysis by Type of Automated Liquid Handling System(s)

- 10.3.5. Analysis by Product and Type of Partnership

- 10.3.6. Most Popular Products: Distribution by Number of Partnerships

- 10.3.7. Most Active Players: Analysis by Type of Partnership

- 10.3.8. Analysis by Geography

- 10.3.8.1. Local and International Agreements

- 10.3.8.2. Intracontinental and Intercontinental Agreements

11. PATENT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Automated Liquid Handling Systems: Patent Analysis

- 11.3.1. Analysis by Patent Publication Year

- 11.3.2. Analysis by Annual Number of Granted Patents and Patent Applications

- 11.3.3. Analysis by Geography

- 11.3.4. Analysis by CPC Sections

- 11.3.5. Word Cloud Analysis: Emerging Focus Areas

- 11.3.6. Analysis by Type of Organization

- 11.3.7. Leading Industry Players: Analysis by Number of Patents

- 11.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 11.3.9. Leading Individual Assignees: Analysis by Number of Patents

- 11.4. Automated Liquid Handling Systems: Patent Benchmarking Analysis

- 11.4.1. Analysis by Patent Characteristics

- 11.5. Automated Liquid Handling Systems: Patent Valuation Analysis

- 11.6. Leading Patents: Analysis by Number of Citations

12. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 12.1. Chapter Overview

- 12.2. Methodology and Key Assumptions

- 12.3. Global Automated Liquid Handling Systems Market, Till 2035

- 12.3.1. Automated Liquid Handling Systems Market: Distribution by Type of Automated Liquid Handling System

- 12.3.1.1. Automated Pipetting Systems Market: Till 2035

- 12.3.1.1.1. Automated Pipetting Systems Market: Distribution by Pipetting Technology

- 12.3.1.1.1.1. Automated Pipetting Systems Market for Contact Technology, Till 2035

- 12.3.1.1.1.2. Automated Pipetting Systems Market for Air Displacement Technology, Till 2035

- 12.3.1.1.1.3. Automated Pipetting Systems Market for Piston / Positive Displacement Technology, Till 2035

- 12.3.1.1.1.4. Automated Pipetting Systems Market for Acoustic Technology, Till 2035

- 12.3.1.1.1.5. Automated Pipetting Systems Market for Free-jet Technology, Till 2035

- 12.3.1.1.2. Automated Pipetting Systems Market: Distribution by Modality

- 12.3.1.1.2.1. Automated Pipetting Systems Market for Fixed Tips, Till 2035

- 12.3.1.1.2.2. Automated Pipetting Systems Market for Disposable Tips, Till 2035

- 12.3.1.1.3. Automated Pipetting Systems Market: Distribution by Type of Instrument

- 12.3.1.1.3.1. Automated Pipetting Systems Market for Standalone, Till 2035

- 12.3.1.1.3.2. Automated Pipetting Systems Market for Individual Benchtop Workstation, Till 2035

- 12.3.1.1.3.1. Automated Pipetting Systems Market for Multi Instrument System, Till 2035

- 12.3.1.1.3.2. Automated Pipetting Systems Market for Others, Till 2035

- 12.3.1.1.4. Automated Pipetting Systems Market: Distribution by Application

- 12.3.1.1.4.1. Automated Pipetting Systems Market for Serial Dilution, Till 2035

- 12.3.1.1.4.2. Automated Pipetting Systems Market for Plate Replication, Till 2035

- 12.3.1.1.4.3. Automated Pipetting Systems Market for PCR / qPCR Setup, Till 2035

- 12.3.1.1.4.4. Automated Pipetting Systems Market for Plate Reformatting, Till 2035

- 12.3.1.1.4.5. Automated Pipetting Systems Market for High-throughput Screening, Till 2035

- 12.3.1.1.4.6. Automated Pipetting Systems Market for Whole Genome Amplification, Till 2035

- 12.3.1.1.4.7. Automated Pipetting Systems Market for Cell Culture, Till 2035

- 12.3.1.1.4.8. Automated Pipetting Systems Market for Other Applications, Till 2035

- 12.3.1.1.5. Automated Pipetting Systems Market: Distribution by End User

- 12.3.1.1.5.1. Automated Pipetting Systems Market for Biotechnology and Pharmaceutical Companies, Till 2035

- 12.3.1.1.5.2. Automated Pipetting Systems Market for Academic and Government Research Institutes, Till 2035

- 12.3.1.1.5.3. Automated Pipetting Systems Market for Hospitals and Diagnostic Centers, Till 2035

- 12.3.1.1.5.4. Automated Pipetting Systems Market for Other End Users, Till 2035

- 12.3.1.1.6. Automated Pipetting Systems Market: Distribution by Key Geographical Regions

- 12.3.1.1.6.1 Automated Pipetting Systems Market in North America, Till 2035

- 12.3.1.1.6.2. Automated Pipetting Systems Market in Europe, Till 2035

- 12.3.1.1.6.3. Automated Pipetting Systems Market in Asia-Pacific, Till 2035

- 12.3.1.1.6.4. Automated Pipetting Systems Market in Middle East and North Africa, Till 2035

- 12.3.1.1.6.5. Automated Pipetting Systems Market in Latin America, Till 2035

- 12.3.1.1.1. Automated Pipetting Systems Market: Distribution by Pipetting Technology

- 12.3.1.2. Automated Microplate Washers Market: Till 2035

- 12.3.1.2.1. Automated Microplate Washers Market: Distribution by Washing Technology

- 12.3.1.2.1.1. Automated Microplate Washers Market for Ultrasonic Technology, Till 2035

- 12.3.1.2.1.2. Automated Microplate Washers Market for Acoustic Technology, Till 2035

- 12.3.1.2.1.3. Automated Microplate Washers Market for Centrifugal Technology, Till 2035

- 12.3.1.2.2. Automated Microplate Washers Market: Distribution by Application

- 12.3.1.2.2.1. Automated Microplate Washers Market for ELISA, Till 2035

- 12.3.1.2.2.2. Automated Microplate Washers Market for Cell-based Assays, Till 2035

- 12.3.1.2.2.3. Automated Microplate Washers Market for Bead Washing, Till 2035

- 12.3.1.2.2.4. Automated Microplate Washers Market for Other Applications, Till 2035

- 12.3.1.2.3. Automated Microplate Washers Market: Distribution by End User

- 12.3.1.2.3.1. Automated Microplate Washers Market for Biotechnology and Pharmaceutical Companies, Till 2035

- 12.3.1.2.3.2. Automated Microplate Washers Market for Academic and Government Research Institutes, Till 2035

- 12.3.1.2.3.3. Automated Microplate Washers Market for Hospitals and Diagnostic Centers, Till 2035

- 12.3.1.2.3.4. Automated Microplate Washers Market for Other End Users, Till 2035

- 12.3.1.2.4. Automated Microplate Washers Market: Distribution by Key Geographical Regions

- 12.3.1.2.4.1. Automated Microplate Washers Market in North America, Till 2035

- 12.3.1.2.4.2. Automated Microplate Washers Market in Europe, Till 2035

- 12.3.1.2.4.3. Automated Microplate Washers Market in Asia-Pacific, Till 2035

- 12.3.1.2.4.4. Automated Microplate Washers Market in Middle East and North Africa, Till 2035

- 12.3.1.2.4.5. Automated Microplate Washers Market in Latin America, Till 2035

- 12.3.1.2.1. Automated Microplate Washers Market: Distribution by Washing Technology

- 12.3.1.1. Automated Pipetting Systems Market: Till 2035

- 12.3.1. Automated Liquid Handling Systems Market: Distribution by Type of Automated Liquid Handling System

13. SWOT ANALYSIS

- 13.1. Chapter Overview

- 13.2. Automated Liquid Handling Systems: SWOT Analysis

- 13.3. Comparison of SWOT Factors

- 13.3.1. Weaknesses

- 13.3.2. Opportunities

- 13.3.3. Threats

- 13.4. Concluding Remarks

14. CONCLUDING REMARKS

15. APPENDIX I: TABULATED DATA

16. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 3.1 Manual, Semi-automated and Automated Pipetting Systems

- Table 4.1 Automated Pipetting Systems: Information on Type of Technology, Pipetting Technology, Certification(s) and Type of Instrument(s) by Assembly

- Table 4.2 Automated Pipetting Systems: Information on Pipetting Head Option(s), Weight of Automated Pipetting System (in Kg), Compatible Labware and Application Area(s)

- Table 4.3 Automated Pipetting Systems: Information on Application(s), Additional Feature(s) and End User(s)

- Table 4.4 Automated Pipetting System Providers: Information on Year of Establishment, Employee Count, Company Size, Location and Region of Headquarters

- Table 6.1 Automated Pipetting System Manufacturers: List of Companies Profiled

- Table 6.2 Beckman Coulter Life Sciences: Company Snapshot

- Table 6.3 Beckman Coulter Life Sciences: Echo 525

- Table 6.4 Beckman Coulter Life Sciences: Echo 550

- Table 6.5 Beckman Coulter Life Sciences: Echo 650

- Table 6.6 Beckman Coulter Life Sciences: Echo 655

- Table 6.7 Beckman Coulter Life Sciences: Biomek 3000

- Table 6.8 Beckman Coulter Life Sciences: Biomek i5

- Table 6.9 Beckman Coulter Life Sciences: Biomek i7

- Table 6.10 Beckman Coulter Life Sciences: Biomek NGeniuS

- Table 6.11 Beckman Coulter Life Sciences: Sagian Multipette Automated Liquid Handler

- Table 6.12 Beckman Coulter Life Sciences: Biomek 4000

- Table 6.13 Beckman Coulter Life Sciences: Recent Developments and Future Outlook

- Table 6.14 Eppendorf: Company Snapshot

- Table 6.15 Eppendorf: epMotion 5075v

- Table 6.16 Eppendorf: epMotion 5075t

- Table 6.17 Eppendorf: epMotion 5075l

- Table 6.18 Eppendorf: epMotion 5075m

- Table 6.19 Eppendorf: epMotion 5075vt

- Table 6.20 Eppendorf: epMotion 5075MC

- Table 6.21 Eppendorf: epMotion 5075TMX

- Table 6.22 Eppendorf: epMotion 5075VAC

- Table 6.23 Eppendorf: epMotion 5075LH

- Table 6.24 Eppendorf: epMotion 5073t NGS solution

- Table 6.25 Eppendorf: epMotion 96/96xl

- Table 6.26 Eppendorf: epMotion 5070

- Table 6.27 Eppendorf: Recent Developments and Future Outlook

- Table 6.28 Hamilton Robotics: Company Snapshot

- Table 6.29 Hamilton Robotics: Microlab STAR

- Table 6.30 Hamilton Robotics: Microlab VANTAGE

- Table 6.31 Hamilton Robotics: NIMBUS384

- Table 6.32 Hamilton Robotics: NIMBUS4

- Table 6.33 Hamilton Robotics: NIMBUS96

- Table 6.34 Hamilton Robotics: Recent Developments and Future Outlook

- Table 6.35 MyGenostics: Company Snapshot

- Table 6.36 MyGenostics: MGS-96

- Table 6.37 MyGenostics: MGN-H200/H1000

- Table 6.38 MyGenostics: MGN-SIRO-4000

- Table 6.39 MyGenostics: SIRO-3000

- Table 7.1 Automated Microplate Washers: Information on Type of Instrument(s) by Assembly and Compatible Microplate(s)

- Table 7.2 Automated Microplate Washers: Information on Weight of Automated Microplate Washer (in Kg), Compatible Software and Compatible Labware

- Table 7.3 Automated Microplate Washers: Information on Application Area(s), Application(s) and End User(s)

- Table 7.4 Automated Microplate Washer Providers: Information on Year of Establishment, Employee Count, Company Size, Location and Region of Headquarters

- Table 9.1 Automated Microplate Washer Manufacturers: List of Companies Profiled

- Table 9.2 Agilent Technologies: Company Snapshot

- Table 9.3 Agilent Technologies: BioTek ELX405s

- Table 9.4 Agilent Technologies: BioTek ELx405 Select

- Table 9.5 Agilent Technologies: ELx405 HT

- Table 9.6 Agilent Technologies: ELx405 Magna

- Table 9.7 Agilent Technologies: Biotek 405TS

- Table 9.8 Agilent Technologies: BioTek 50 TS

- Table 9.9 Agilent Technologies: EL406 Microplate Washer Dispenser

- Table 9.10 Agilent Technologies: 405 LS

- Table 9.11 Agilent Technologies: Recent Developments and Future Outlook

- Table 9.12 Tecan: Company Snapshot

- Table 9.13 Tecan: HydroFlex

- Table 9.14 Tecan: 96 PW

- Table 9.15 Tecan: HydroFlex Plus

- Table 9.16 Tecan: HydroSpeed

- Table 9.17 Tecan: Recent Developments and Future Outlook

- Table 9.18 Thermo Fisher Scientific: Company Snapshot

- Table 9.19 Thermo Fisher Scientific: Wellwash Versa

- Table 9.20 Thermo Fisher Scientific: Wellwash

- Table 9.21 Thermo Fisher Scientific: accuWash

- Table 9.22 Thermo Fisher Scientific: accuWash Versa

- Table 9.23 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 10.1 Automated liquid Handling Systems: List of Partnerships and Collaborations

- Table 11.1 Patent Analysis: Top CPC Sections

- Table 11.2 Patent Analysis: Top Five CPC Symbols

- Table 11.3 Patent Analysis: Top Seven CPC Codes

- Table 11.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 11.5 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 11.6 Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 11.7 Patent Portfolio: List of Leading Patents (by Number of Citations)

- Table 15.1 Automated Pipetting Systems: Distribution by Type of Technology

- Table 15.2 Automated Pipetting Systems: Distribution by Pipetting Technology

- Table 15.3 Automated Pipetting Systems: Distribution by Certification(s)

- Table 15.4 Automated Pipetting Systems: Distribution by Type of Instrument(s) by Assembly

- Table 15.5 Automated Pipetting Systems: Distribution by Pipetting Head Option(s)

- Table 15.6 Automated Pipetting Systems: Distribution by Weight of Automated Pipetting Systems (in Kg)

- Table 15.7 Automated Pipetting Systems: Distribution by Compatible Labware

- Table 15.8 Automated Pipetting Systems: Distribution by Application Area(s)

- Table 15.9 Automated Pipetting Systems: Distribution by Application(s)

- Table 15.10 Automated Pipetting Systems: Distribution by Additional Feature(s)

- Table 15.11 Automated Pipetting Systems: Distribution by End User(s)

- Table 15.12 Automated Pipetting System Providers: Distribution by Year of Establishment

- Table 15.13 Automated Pipetting System Providers: Distribution by Company Size

- Table 15.14 Automated Pipetting System Providers: Distribution by Location of Headquarters (Region-wise)

- Table 15.15 Automated Pipetting System Providers: Distribution by Company Size and Location of Headquarters (Region-wise)

- Table 15.16 Automated Pipetting System Providers: Distribution by Location of Headquarters (Country-wise)

- Table 15.17 Most Active Players: Distribution by Number of Automated Pipetting Systems Manufactured

- Table 15.18 Beckman Coulter Life Sciences: Annual Revenues, Since 2018 (USD Billion)

- Table 15.19 Eppendorf: Annual Revenues, Since 2018 (USD Billion)

- Table 15.20 Automated Microplate Washers: Distribution by Type of Instrument(s) by Assembly

- Table 15.21 Automated Microplate Washers: Distribution by Compatible Microplate(s)

- Table 15.22 Automated Microplate Washers: Distribution by Weight of Automated Microplate Washer (in Kg)

- Table 15.23 Automated Microplate Washers: Distribution by Compatible Labware

- Table 15.24 Automated Microplate Washers: Distribution by Application Area(s)

- Table 15.25 Automated Microplate Washers: Distribution by Application(s)

- Table 15.26 Automated Microplate Washers: Distribution by End User(s)

- Table 15.27 Automated Microplate Washer Providers: Distribution by Year of Establishment

- Table 15.28 Automated Microplate Washer Providers: Distribution by Company Size

- Table 15.29 Automated Microplate Washer Providers: Distribution by Location of Headquarters (Region-wise)

- Table 15.30 Automated Microplate Washer Providers: Distribution by Company Size and Location of Headquarters (Region-wise)

- Table 15.31 Automated Microplate Washer Providers: Distribution by Location of Headquarters (Country-wise)

- Table 15.32 Most Active Players: Distribution by Number of Compatible Software

- Table 15.33 Most Active Players: Distribution by Number of Automated Microplate Washers Manufactured

- Table 15.34 Agilent Technologies: Annual Revenues, Since 2018 (USD Billion)

- Table 15.35 Tecan: Annual Revenues, Since 2018 (CHF Million)

- Table 15.36 Thermo Fisher Scientific: Annual Revenues, Since 2018 (USD Billion)

- Table 15.37 Partnerships and Collaborations: Distribution by Year of Partnership, Since 2018

- Table 15.38 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 15.39 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2018

- Table 15.40 Partnerships and Collaborations: Distribution by Type of Automated Liquid Handling System(s)

- Table 15.41 Partnerships and Collaborations: Distribution by Product and Type of Partnership

- Table 15.42 Most Popular Products: Distribution by Number of Partnerships

- Table 15.43 Most Active Players: Distribution by Type of Partnership

- Table 15.44 Partnerships and Collaborations: Local and International Agreements

- Table 15.45 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 15.46 Patent Analysis: Distribution by Type of Patent

- Table 15.47 Patent Analysis: Cumulative Distribution by Patent Publication Year, Since 2017

- Table 15.48 Patent Analysis: Year-wise Distribution by Granted Patents and Patent Applications, Since 2017

- Table 15.49 Patent Analysis: Distribution by Geography

- Table 15.50 Patent Analysis: Distribution by CPC Sections

- Table 15.51 Patent Analysis: Cumulative Year-wise Distribution by Type of Organization, Since 2017

- Table 15.52 Leading Industry Players: Distribution by Number of Patents

- Table 15.53 Leading Non-Industry Players: Distribution by Number of Patents

- Table 15.54 Leading Individual Assignees: Distribution by Number of Patents

- Table 15.55 Patent Analysis: Distribution by Patent Age

- Table 15.56 Automated Liquid Handling Systems: Patent Valuation Analysis

- Table 15.57 Global Automated Liquid Handling Systems Market, Till 2035

- Table 15.58 Automated Liquid Handling Systems Market: Distribution by Type of Automated Liquid Handling System

- Table 15.59 Automated Pipetting Systems Market: Till 2035

- Table 15.60 Automated Pipetting Systems Market: Distribution by Pipetting Technology

- Table 15.61 Automated Pipetting Systems Market for Contact Technology: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.62 Automated Pipetting Systems Market for Air Displacement Technology: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.63 Automated Pipetting Systems Market for Piston / Positive Displacement Technology: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.64 Automated Pipetting Systems Market for Acoustic Technology: Conservative, Base and Optimistic Scenarios: Till 2035

- Table 15.65 Automated Pipetting Systems Market for Free-jet Technology: Conservative, Base and Optimistic Scenarios: Till 2035

- Table 15.66 Automated Pipetting Systems Market: Distribution by Modality

- Table 15.67 Automated Pipetting Systems Market for Fixed Tips: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.68 Automated Pipetting Systems Market for Disposable Tips: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.69 Automated Pipetting Systems Market: Distribution by Type of Instrument

- Table 15.70 Automated Pipetting Systems Market for Standalone: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.71 Automated Pipetting Systems Market for Individual Benchtop Workstation: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.72 Automated Pipetting Systems Market for Multi Instrument System: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.73 Automated Pipetting Systems Market for Others: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.74 Automated Pipetting Systems Market: Distribution by Application

- Table 15.75 Automated Pipetting Systems Market for Serial Dilution: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.76 Automated Pipetting Systems Market for Plate Replication: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.77 Automated Pipetting Systems Market for PCR / qPCR Setup: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.78 Automated Pipetting Systems Market for Plate Reformatting: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.79 Automated Pipetting Systems Market for High-throughput Screening: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.80 Automated Pipetting Systems Market for Whole Genome Amplification: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.81 Automated Pipetting Systems Market for Cell Culture: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.82 Automated Pipetting Systems Market for Other Applications: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.83 Automated Pipetting Systems Market: Distribution by End User

- Table 15.84 Automated Pipetting Systems Market for Biotechnology and Pharmaceutical Companies: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.85 Automated Pipetting Systems Market for Academic and Government Research Institutes: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.86 Automated Pipetting Systems Market for Hospitals and Diagnostic Centers: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.87 Automated Pipetting Systems Market for Other End Users: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.88 Automated Pipetting Systems Market: Distribution by Key Geographical Regions

- Table 15.89 Automated Pipetting Systems Market in North America: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.90 Automated Pipetting Systems Market in Europe: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.91 Automated Pipetting Systems Market in Asia-Pacific: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.92 Automated Pipetting Systems Market in Middle East and North Africa: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.93 Automated Pipetting Systems Market in Latin America: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.94 Automated Microplate Washers Market: Till 2035

- Table 15.95 Automated Microplate Washers Market: Distribution by Washing Technology

- Table 15.96 Automated Microplate Washers Market for Ultrasonic Technology: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.97 Automated Microplate Washers Market for Acoustic Technology: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.98 Automated Microplate Washers Market for Centrifugal Technology: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.99 Automated Microplate Washers Market: Distribution by Application

- Table 15.100 Automated Microplate Washers Market for ELISA: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.101 Automated Microplate Washers Market for Cell-based Assays: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.102 Automated Microplate Washers Market for Bead Washing: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.103 Automated Microplate Washers Market for Other Applications: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.104 Automated Microplate Washers Market: Distribution by End User

- Table 15.105 Automated Microplate Washers Market for Biotechnology and Pharmaceutical Companies: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.106 Automated Microplate Washers Market for Academic and Government Research Institutes: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.107 Automated Microplate Washers Market for Hospitals and Diagnostic Centers: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.108 Automated Microplate Washers Market for Other End Users: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.109 Automated Microplate Washers Market: Distribution by Key Geographical Regions

- Table 15.110 Automated Microplate Washers Market in North America: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.111 Automated Microplate Washers Market in Europe: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.112 Automated Microplate Washers Market in Asia-Pacific: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.113 Automated Microplate Washers Market in Middle East and North Africa: Conservative, Base and Optimistic Scenarios, Till 2035

- Table 15.114 Automated Microplate Washers Market in Latin America: Conservative, Base and Optimistic Scenarios, Till 2035

List of Figures

- Figure 2.1. Executive Summary: Current Market Landscape of Automated Pipetting Systems

- Figure 2.2. Executive Summary: Current Market Landscape of Automated Microplate Washers

- Figure 2.3. Executive Summary: Partnerships and Collaborations

- Figure 2.4. Executive Summary: Patent Analysis

- Figure 2.5. Executive Summary: Market Sizing and Opportunity Analysis

- Figure 3.1. Manual versus Automated Liquid Handling

- Figure 3.2. Working Mechanism of Automated Pipetting Systems

- Figure 3.3. Advantages of Automated Pipetting Systems

- Figure 3.4. Features of an Ideal Automated Microplate Washer

- Figure 3.5. Applications of Automated Liquid Handling Systems

- Figure 4.1. Automated Pipetting Systems: Distribution by Type of Technology

- Figure 4.2. Automated Pipetting Systems: Distribution by Pipetting Technology

- Figure 4.3. Automated Pipetting Systems: Distribution by Certification(s)

- Figure 4.4. Automated Pipetting Systems: Distribution by Type of Instrument(s) by Assembly

- Figure 4.5. Automated Pipetting Systems: Distribution by Pipetting Head Option(s)

- Figure 4.6. Automated Pipetting Systems: Distribution of Weight of Automated Pipetting Systems (in Kg)

- Figure 4.7. Automated Pipetting Systems: Distribution by Compatible Labware

- Figure 4.8. Automated Pipetting Systems: Distribution by Application Area(s)

- Figure 4.9. Automated Pipetting Systems: Distribution by Application(s)

- Figure 4.10. Automated Pipetting Systems: Distribution by Additional Feature (s)

- Figure 4.11. Automated Pipetting Systems: Distribution by End User(s)

- Figure 4.12. Automated Pipetting System Providers: Distribution by Year of Establishment

- Figure 4.13. Automated Pipetting System Providers: Distribution by Company Size

- Figure 4.14. Automated Pipetting System Providers: Distribution by Location of Headquarters (Region-wise)

- Figure 4.15. Automated Pipetting System Providers: Distribution by Company Size and Location of Headquarters (Region-wise)

- Figure 4.16. Automated Pipetting System Providers: Distribution by Location of Headquarters (Country-wise)

- Figure 4.17. Most Active Players: Distribution by Number of Automated Pipetting Systems Manufactured

- Figure 5.1. Company Competitiveness Analysis: Automated Pipetting System Providers based in North America (Peer Group I)

- Figure 5.2. Company Competitiveness Analysis: Automated Pipetting System Providers based in Europe (Peer Group II)

- Figure 5.3. Company Competitiveness Analysis: Automated Pipetting System Providers based in Asia-Pacific and Rest of the World (Peer Group III)

- Figure 6.1. Beckman Coulter Life Sciences: Annual Revenues, Since 2018 (USD Billion)

- Figure 6.2. Eppendorf: Annual Revenues, Since 2018 (USD Billion)

- Figure 7.1. Automated Microplate Washers: Distribution by Type of Instrument(s) by Assembly

- Figure 7.2. Automated Microplate Washers: Distribution by Compatible Microplate(s)

- Figure 7.3. Automated Microplate Washers: Distribution by Weight of Automated Microplate Washer (in Kg)

- Figure 7.4. Automated Microplate Washers: Distribution by Compatible Labware

- Figure 7.5. Automated Microplate Washers: Distribution by Application Area(s)

- Figure 7.6. Automated Microplate Washers: Distribution by Application(s)

- Figure 7.7. Automated Microplate Washers: Distribution by End User(s)

- Figure 7.8. Automated Microplate Washer Providers: Distribution by Year of Establishment

- Figure 7.9. Automated Microplate Washer Providers: Distribution by Company Size

- Figure 7.10. Automated Microplate Washer Providers: Distribution by Location of Headquarters (Region-wise)

- Figure 7.11. Automated Microplate Washer Providers: Distribution by Company Size and Location of Headquarters (Region-wise)

- Figure 7.12. Automated Microplate Washer Providers: Distribution by Location Headquarters (Country-wise)

- Figure 7.13. Most Active Players: Distribution by Number of Compatible Software

- Figure 7.14. Most Active Players: Distribution by Number of Automated Microplate Washers Manufactured

- Figure 8.1. Company Competitiveness Analysis: Automated Microplate Washer Providers based in North America (Peer Group I)

- Figure 8.2. Company Competitiveness Analysis: Automated Microplate Washer Providers based in Europe (Peer Group II)

- Figure 8.3. Company Competitiveness Analysis: Automated Microplate Washer Providers based in Asia-Pacific and Rest of the World (Peer Group III)

- Figure 9.1. Agilent Technologies: Annual Revenues, Since 2018 (USD Billion)

- Figure 9.2. Tecan: Annual Revenues, Since 2018 (CHF Million)

- Figure 9.3. Thermo Fisher Scientific: Annual Revenues, Since 2018 (USD Billion)

- Figure 10.1. Partnerships and Collaborations: Distribution by Year of Partnership, Since 2018

- Figure 10.2. Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 10.3. Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2018

- Figure 10.4. Partnerships and Collaborations: Distribution by Type of Automated Liquid Handling System(s)

- Figure 10.5. Partnerships and Collaborations: Distribution by Product and Type of Partnership

- Figure 10.6. Most Popular Products: Distribution by Number of Partnerships

- Figure 10.7. Most Active Players: Distribution by Type of Partnership

- Figure 10.8. Partnerships and Collaborations: Local and International Agreements

- Figure 10.9. Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Figure 11.1. Patent Analysis: Distribution by Type of Patent

- Figure 11.2. Patent Analysis: Cumulative Distribution by Patent Publication Year, Since 2017

- Figure 11.3. Patent Analysis: Year-wise Distribution of Granted Patents and Patent Applications, Since 2017

- Figure 11.4. Patent Analysis: Distribution by Geography

- Figure 11.5. Patent Analysis: Distribution by CPC Sections

- Figure 11.6. Word Cloud Analysis: Emerging Focus Areas

- Figure 11.7. Patent Analysis: Cumulative Year-wise Distribution by Type of Organization, Since 2017

- Figure 11.8. Leading Industry Players: Distribution by Number of Patents

- Figure 11.9. Leading Non-Industry Players: Distribution by Number of Patents

- Figure 11.10. Leading Individual Assignees: Distribution by Number of Patents

- Figure 11.11. Leading Players: Benchmarking by Patent Characteristics (CPC Codes)

- Figure 11.12. Patent Analysis: Distribution by Patent Age

- Figure 11.13. Automated Liquid Handling Systems: Patent Valuation Analysis

- Figure 12.1. Global Automated Liquid Handling Systems Market, Till 2035

- Figure 12.2. Automated Liquid Handling Systems Market: Distribution by Type of Automated Liquid Handling System

- Figure 12.3. Automated Pipetting Systems Market: Till 2035

- Figure 12.4. Automated Pipetting Systems Market: Distribution by Pipetting Technology

- Figure 12.5. Automated Pipetting Systems Market for Contact Technology, Till 2035

- Figure 12.6. Automated Pipetting Systems Market for Air Displacement Technology, Till 2035

- Figure 12.7. Automated Pipetting Systems Market for Piston / Positive Displacement Technology, Till 2035

- Figure 12.8. Automated Pipetting Systems Market for Acoustic Technology, Till 2035

- Figure 12.9. Automated Pipetting Systems Market for Free-jet Technology, Till 2035

- Figure 12.10. Automated Pipetting Systems Market: Distribution by Modality

- Figure 12.11. Automated Pipetting Systems Market for Fixed Tips, Till 2035

- Figure 12.12. Automated Pipetting Systems Market for Disposable Tips, Till 2035

- Figure 12.13. Automated Pipetting Systems Market: Distribution by Type of Instrument

- Figure 12.14. Automated Pipetting Systems Market for Standalone, Till 2035

- Figure 12.15. Automated Pipetting Systems Market for Individual Benchtop Workstation, Till 2035

- Figure 12.16. Automated Pipetting Systems Market for Multi Instrument System, Till 2035

- Figure 12.17. Automated Pipetting Systems Market for Others, Till 2035

- Figure 12.18. Automated Pipetting Systems Market: Distribution by Application

- Figure 12.19. Automated Pipetting Systems Market for Serial Dilution, Till 2035

- Figure 12.20. Automated Pipetting Systems Market for Plate Replication, Till 2035

- Figure 12.21. Automated Pipetting Systems Market for PCR / qPCR Setup, Till 2035

- Figure 12.22. Automated Pipetting Systems Market for Plate Reformatting, Till 2035

- Figure 12.23. Automated Pipetting Systems Market for High-throughput Screening, Till 2035

- Figure 12.24. Automated Pipetting Systems Market for Whole Genome Amplification, Till 2035

- Figure 12.25. Automated Pipetting Systems Market for Cell Culture, Till 2035

- Figure 12.26. Automated Pipetting Systems Market for Other Applications, Till 2035

- Figure 12.27. Automated Pipetting Systems Market: Distribution by End User

- Figure 12.28. Automated Pipetting Systems Market for Biotechnology and Pharmaceutical Companies, Till 2035

- Figure 12.29. Automated Pipetting Systems Market for Academic and Government Research Institutes, Till 2035

- Figure 12.30. Automated Pipetting Systems Market for Hospitals and Diagnostic Centers, Till 2035

- Figure 12.31. Automated Pipetting Systems Market for Other End Users, Till 2035

- Figure 12.32. Automated Pipetting Systems Market: Distribution by Key Geographical Regions

- Figure 12.33. Automated Pipetting Systems Market in North America, Till 2035

- Figure 12.34. Automated Pipetting Systems Market in Europe, Till 2035

- Figure 12.35. Automated Pipetting Systems Market in Asia-Pacific, Till 2035

- Figure 12.36. Automated Pipetting Systems Market in Middle East and North Africa, Till 2035

- Figure 12.37. Automated Pipetting Systems Market in Latin America, Till 2035

- Figure 12.38. Automated Microplate Washers Market: Till 2035

- Figure 12.39. Automated Microplate Washers Market: Distribution by Washing Technology

- Figure 12.40. Automated Microplate Washers Market for Ultrasonic Technology

- Figure 12.41. Automated Microplate Washers Market for Acoustic Technology

- Figure 12.42. Automated Microplate Washers Market for Centrifugal Technology

- Figure 12.43. Automated Microplate Washers Market: Distribution by Application

- Figure 12.44. Automated Microplate Washers Market for ELISA, Till 2035

- Figure 12.45. Automated Microplate Washers Market for Cell-based Assays, Till 2035

- Figure 12.46. Automated Microplate Washers Market for Bead Washing, Till 2035

- Figure 12.47. Automated Microplate Washers Market for Other Applications, Till 2035

- Figure 12.48. Automated Microplate Washers Market: Distribution by End User

- Figure 12.49. Automated Microplate Washers Market for Biotechnology and Pharmaceutical Companies, Till 2035

- Figure 12.50. Automated Microplate Washers Market for Academic and Government Research Institutes, Till 2035

- Figure 12.51. Automated Microplate Washers Market for Hospitals and Diagnostic Centers, Till 2035

- Figure 12.52. Automated Microplate Washers Market for Other End Users, Till 2035

- Figure 12.53. Automated Microplate Washers Market: Distribution by Key Geographical Regions

- Figure 12.54. Automated Microplate Washers Market in North America, Till 2035

- Figure 12.55. Automated Microplate Washers Market in Europe, Till 2035

- Figure 12.56. Automated Microplate Washers Market in Asia-Pacific, Till 2035

- Figure 12.57. Automated Microplate Washers Market in Middle East and North Africa, Till 2035

- Figure 12.58. Automated Microplate Washers Market in Latin America, Till 2035

- Figure 13.1. Automated Liquid Handling Systems: SWOT Analysis

- Figure 13.2. Comparison of SWOT Factors: Harvey Ball Analysis

- Figure 14.1. Concluding Remarks: Current Market Landscape of Automated Pipetting Systems

- Figure 14.2. Concluding Remarks: Current Market Landscape of Automated Microplate Washers

- Figure 14.3. Concluding Remarks: Partnerships and Collaborations

- Figure 14.4. Concluding Remarks: Patent Analysis

- Figure 14.5. Concluding Remarks: Market Sizing and Opportunity Analysis