|

市场调查报告书

商品编码

1771288

生物性保存技术市场:产业趋势和全球预测 - 保存状态,血清类别,生物学的样品类别,各应用领域,包装形态类别,各终端用户,各地区Biopreservation Market: Industry Trends and Global Forecasts - Distribution by Preservation Condition, Type of Serum, Type of Biological Sample, Area of Application, Type of Packaging Format, End Users, and Geographical Region : |

||||||

全球生物性保存技术市场:概要

预计2035年,生物保存市场规模将从目前的19亿美元成长至155亿美元,预测期内复合年增长率为23.6%。

市场区隔包括以下参数的市场规模和机会分析:

保存状态

- 冷藏

- 冷冻/冷链

- 冷冻(超低温冷冻)/深层冷冻

- 低温/液态氮蒸气储存

血清类型

- 牛胎儿血清含有培养基

- 小牛胎儿血清含有培养基

- 人血清含有培养基

- 无血清培养基

生物学的样品类型

- 生殖细胞/干细胞

- 内臟器官

- 体细胞

- 组织

应用领域

- 诊断

- 研究开发

- 治疗

包装形态类型

- 袋

- 瓶

- 管瓶

- 其他

终端用户

- 学术研究机关

- 生物银行/基因库

- 医院

- 製药·生物科技企业

- 其他

地区

- 北美

- 欧洲

- 亚洲

- 中东·北非

- 南美

- 其他地区

全球生物保存市场:成长与趋势

近年来,受对有效治疗方案日益增长的需求的推动,细胞类产品的开发显着增长。然而,这些产品对温度变化高度敏感,通常需要冷冻或低温条件才能安全运输和储存。根据美国食品药物管理局 (USFDA) 的一项调查,超过 80% 的间质细胞治疗申请表明需要冷冻保存。这凸显了对先进保存策略的迫切需求,这些策略既要最大限度地减少压力诱导的遗传选择,又要保护基因组和蛋白质组的完整性(而目前大多数保存方法都存在不足)。

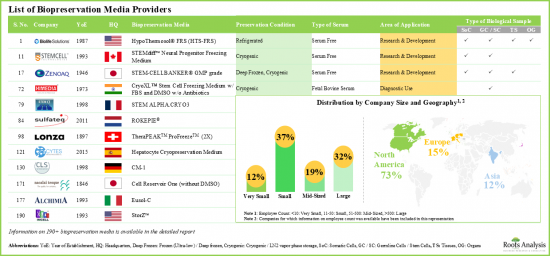

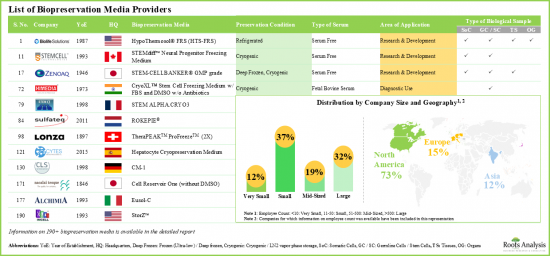

生物保存是唯一一种用于离体保存细胞、组织和器官以供保存、装运和运输的生物学方法。此外,生物保存透过将细胞和分子生物学的突破与工程理念相结合,为各种产品相关的课题提供了解决方案。因此,行业利益相关者越来越多地转向预配製和市售的生物保存介质。生物保存介质是有效保存生物样本最重要的因素之一。培养基类型的选择取决于所需的保存时长、待保存的生物样本类型以及生物保存的目的。目前,多家公司提供 190 种生物保存和生物样本库解决方案,用于保存和储存各种类型的生物样本。

全球生物保存市场:关键洞察

本报告深入探讨了全球生物保存市场的现状,并识别了该行业的潜在成长机会。报告的主要发现包括:

- 全球有 60 多家公司提供用于在不同保存条件下保存生物样本的生物保存培养基。

- 生物保存培养基有多种包装类型,适用于各种生物样本。

- 近 45% 用于保存体细胞的生物保存培养基不含血清。

- 大多数生物保存培养基(约 90%)支持低温储存,代表性产品包括 C80EZ 2X、C80EZ 标准培养基、C80EZ-Neuron 和 C80EZ-TISSUE。

- 提供多种包装类型培养基的知名公司包括 Akron Biotech、BioLife Solutions、Fuji Film、Protide Pharmaceuticals 和 ScienCell Research Laboratories。

- 为了获得竞争优势,各公司正致力于稳定提升其所提供培养基的性能。

- 合作活动的增加显示了利害关係人的兴趣。

- 近期,现有企业和新进业者已签署多项合作协议。

- 但预计中长期内将与知名学术机构签署协议。

- 成本是决定此类生物保存介质被接受和采用的关键因素。定价策略矩阵将有助于进入者评估其产品的市场竞争力。

- 受温度敏感产品日益普及的推动,预计到2035年,生物保存介质供应商市场将以每年超过23.6%的速度成长。

- 预期的市场机会在各种最终用户、生物样本、包装类型和主要地理区域内分布均匀。

生物性保存技术市场参与企业案例

- BioLife Solutions

- Cell Applications

- HiMedia Laboratories

- Merck

- Thermo Fisher Scientific

- United States Biological

- ZenBio

本报告概述了全球生物保存市场,包括按保存状态、血清类型、生物样本类型、应用领域、包装类型、最终用户趋势、区域趋势和公司概况划分的市场占有率。

目录

第1章 序文

第2章 摘要整理

第3章 简介

- 章概要

- 生物性保存技术简介

- 生物性保存技术的类型

- 生物性保存技术媒体的应用

- 生物性保存技术培养基的优点与限制

- 结论

第4章 市场形势

- 章概要

- 生物性保存技术培养基供应商:服务供应商的形势

- 生物性保存技术培养基:市场形势

第5章 重要的洞察

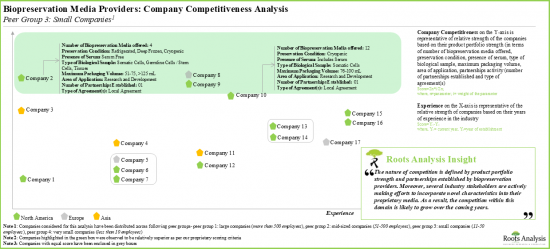

第6章 企业的竞争力

- 章概要

- 前提主要的参数

- 调查手法

- 产品系列的强度的基准

- 伙伴关係活动的基准

- 生物性保存技术培养基供应商:企业竞争力分析

第7章 企业简介

- 章概要

- BioLife Solutions

- Cell Applications

- HiMedia Laboratories

- Merck

- Thermo Fischer Scientific

- United States Biological

- ZenBio

第8章 伙伴关係和合作

- 章概要

- 伙伴关係模式

- 生物性保存技术培养基供应商:伙伴关係和合作

第9章 Bowman Clock的价格策略

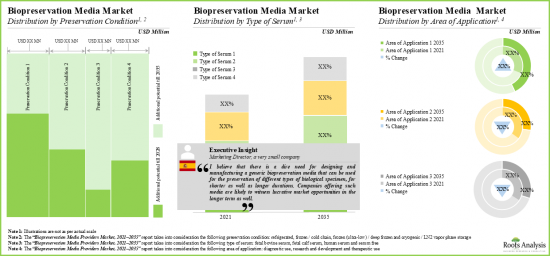

第10章 市场规模的评估与机会分析

- 章概要

- 预测调查手法主要的前提条件

- 生物性保存技术培养基供应商市场,2035年

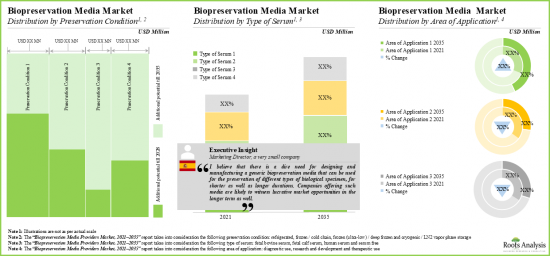

- 生物性保存技术培养基供应商市场:保存状态

- 生物性保存技术培养基供应商市场:血清类别

- 生物性保存技术媒体供应商市场:生物学的样品类别

- 生物性保存技术培养基供应商市场:各应用领域

- 生物性保存技术培养基供应商市场:包装形态类别

- 生物性保存技术培养基供应商市场:各终端用户

- 生物性保存技术培养基供应商市场:各地区

- 结论

第11章 结论

第12章 执行洞察

第13章 附录I:表格形式资料

第14章 附录II:企业及组织一览

GLOBAL BIOPRESERVATION MARKET: OVERVIEW

As per Roots Analysis, the biopreservation market is estimated to grow from USD 1.9 billion in the current year to USD 15.5 billion by 2035, at a CAGR of 23.6% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Preservation Condition

- Refrigerated

- Frozen / Cold Chain

- Frozen (Ultra-low) / DeeAp Frozen

- Cryogenic / LN2 Vapor Phase Storage

Type of Serum

- Fetal Bovine Serum Containing Media

- Fetal Calf Serum Containing Media

- Human Serum Containing Media

- Serum Free Media

Type of Biological Sample

- Germline Cells / Stem Cells

- Organs

- Somatic Cells

- Tissues

Area of Application

- Diagnostic Use

- Research and Development

- Therapeutic Use

Type of Packaging Format

- Bags

- Bottles

- Vials

- Others

End Users

- Academic and Research Institutes

- Biobanks / Genebanks

- Hospitals

- Pharmaceutical and Biotechnology Companies

- Other End Users

Geographical Region

- North America

- Europe

- Asia

- Middle East and North Africa

- Latin America

- Rest of the World

GLOBAL BIOPRESERVATION MARKET: GROWTH AND TRENDS

In recent years, there has been a noticeable increase in the development of cell-based products, driven by the rising demand for effective therapeutic solutions. However, these products are highly sensitive to temperature fluctuations and often require freezing or cryogenic conditions for safe transport and storage. According to a study by the USFDA, over 80% of submissions for mesenchymal cell-based therapies indicated a need for cryopreservation. This highlights the urgent need for advanced preservation strategies that can safeguard both genomic and proteomic integrity, while minimizing stress-induced genetic selection (an aspect where most current preservation methods fall short).

Biopreservation is the exclusive biological approach designated for the preservation of cells, tissues and organs ex-vivo for the purpose of storage, shipment and transportation. Further, biopreservation offers solutions to various product-related challenges by integrating engineering concepts with breakthroughs in cellular and molecular biology. Consequently, industry stakeholders are increasingly turning to pre-formulated, commercially available biopreservation media. Biopreservation media is one of the most crucial entities in conferring effectiveness in preservation of biological samples. The selection of the type of media depends upon the considerable time duration desired for the storage, type of biological material to be preserved and the purpose of biopreservation. Currently, various companies are engaged in providing 190 biopreservation and biobanking solutions designed for the storage and preservation of various types of biological samples.

GLOBAL BIOPRESERVATION MARKET: KEY INSIGHTS

The report delves into the current state of global biopreservation market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Globally, over 60 companies provide biopreservation media, intended for the preservation of biological samples at different preservation conditions.

- Biopreservation media is available in different packaging formats that are compatible with a variety of biological samples.

- Amongst the biopreservation media intended for preservation of somatic cells, nearly 45% are serum free; of these, majority are being used for storage at cryogenic conditions.

- Largely, the biopreservation media support preservation at cryogenic conditions (~90%), prominent examples include C80EZ 2X, C80EZ Standard Medium, C80EZ-Neuron, and C80EZ-TISSUE.

- Prominent examples of companies offering media in multiple packaging formats include Akron Biotech, BioLife Solutions, Fujifilm, Protide Pharmaceuticals, and ScienCell Research Laboratories.

- In order to build a competitive advantage, companies are focused on steadily improving the characteristics of their media offerings.

- The growing interest of stakeholders is also evident from the rise in partnership activity; a relatively larger proportion of the deals were signed by companies based in the US.

- Both established players and new entrants have signed several partnerships in the recent past; most of the companies (~45%) are actively signing manufacturing and supply agreements.

- Industry players have emerged as preferred choice of partner for companies of variable employee strength; however, in mid-to-long term, we expect firms to ink agreements with renowned academic institutes as well.

- Cost is a key determinant of the acceptance and adoption of such biopreservation media; pricing strategy matrix is likely to assist players in evaluating the competitive market prices for their offerings.

- Driven by the rising approval of temperature sensitive products, the market for biopreservation media providers is poised to grow at an annualized rate of over 23.6%, till 2035.

- The projected market opportunity is likely to be well distributed across different end users, biological samples, packaging formats and key geographical regions.

Example Players in the Biopreservation Market

- BioLife Solutions

- Cell Applications

- HiMedia Laboratories

- Merck

- Thermo Fisher Scientific

- United States Biological

- ZenBio

GLOBAL BIOPRESERVATION MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global biopreservation market, focusing on key market segments, including [A] preservation condition, [B] type of serum, [C] type of biological sample, [D] area of application, [E] type of packaging format, [F] end users and [E] geographical regions.

- Market Landscape: A comprehensive evaluation of the current biopreservation media providers' landscape, considering various parameters, such as [A] year of establishment, [B] company size, [C] type of company and [D] location of headquarters. Additionally, a comprehensive evaluation of biopreservation media based on several relevant parameters, such as [A] preservation condition, [B] type of serum, [C] type of biological sample, [D] area of application, [E] type of packaging format, [F] packaging volume and [G] product price.

- Key Insights: In-depth analysis of market trends, focusing on location of headquarters and leading players engaged in offering biopreservation media based on the parameters, such as [A] year of establishment, [B] company size, [C] number of biopreservation media offered and [D] region. Further, an insightful representation of biopreservation media, distributed based on [A] preservation condition and [B] area of application, a grid representation illustrating the distribution of biopreservation media based on [A] company size, [B] region, preservation condition, [C] type of serum and type of biological sample, and a heat map representation of biopreservation media, distributed on the basis of [A] minimum packaging volume and [B] minimum price.

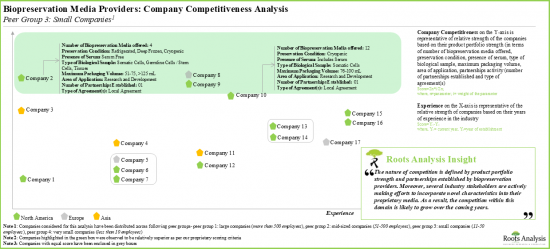

- Company Competitiveness Analysis: A comprehensive competitive analysis of biopreservation media providers, examining factors, such as [A] years of experience, [B] product portfolio strength and [C] partnership activity.

- Company Profiles: In-depth profiles of companies engaged in this domain, focusing on [A] company overview, and [B] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the biopreservation market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] most active players (in terms of the number of partnerships signed) and [E] geography.

- Bowman Clock Pricing Strategy: In-depth analysis of a framework to understand the pricing strategy of the biopreservation media provided by the company along with its competitive position.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

- 2.1. Chapter Overview

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Introduction to Biopreservation

- 3.3. Type of Biopreservation

- 3.3.1. Hypothermic Preservation

- 3.3.2. Cryopreservation

- 3.4. Applications of Biopreservation Media

- 3.5. Benefits and Limitations of Biopreservation Media

- 3.6. Concluding Remarks

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Biopreservation Media Providers: Service Providers Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Type of Company

- 4.2.4. Analysis by Location of Headquarters

- 4.3. Biopreservation Media: Market Landscape

- 4.3.1. Analysis by Preservation Condition

- 4.3.2. Analysis by Type of Serum

- 4.3.3. Analysis by Type of Biological Sample

- 4.3.4. Analysis by Area of Application

- 4.3.5. Analysis by Type of Packaging Format

- 4.3.6. Analysis by Packaging Volume

- 4.3.7. Analysis by Product Price

5. KEY INSIGHTS

- 5.1. Chapter Overview

- 5.2. Analysis by Location of Headquarters (World Map Representation)

- 5.3. Analysis by Year of Establishment, Company Size, Number of Biopreservation Media Offered and Region (4D Bubble Chart)

- 5.4. Analysis by Preservation Condition and Area of Application (Treemap Representation)

- 5.5. Analysis by Company Size, Region, Preservation Condition, Type of Serum and Type of Biological Sample (Grid Representation)

- 5.6. Analysis by Minimum Packaging Volume and Minimum Price (Heat Map Representation)

6. COMPANY COMPETITIVENESS

- 6.1. Chapter Overview

- 6.2. Assumptions and Key Parameters

- 6.3. Methodology

- 6.4. Benchmarking of Product Portfolio Strength

- 6.5. Benchmarking of Partnership Activity

- 6.6. Biopreservation Media Providers: Company Competitiveness Analysis

- 6.6.1. Company Competitiveness Analysis: Very Small Companies

- 6.6.2. Company Competitiveness Analysis: Small Companies

- 6.6.3. Company Competitiveness Analysis: Mid-Sized Companies

- 6.6.4. Company Competitiveness Analysis: Large Companies

7. COMPANY PROFILES

- 7.1. Chapter Overview

- 7.2. BioLife Solutions

- 7.2.1. Company Overview

- 7.2.2. Recent Developments and Future Outlook

- 7.3. Cell Applications

- 7.3.1. Company Overview

- 7.3.2. Recent Developments and Future Outlook

- 7.4. HiMedia Laboratories

- 7.4.1. Company Overview

- 7.4.2. Recent Developments and Future Outlook

- 7.5. Merck

- 7.5.1. Company Overview

- 7.5.2. Recent Developments and Future Outlook

- 7.6. Thermo Fischer Scientific

- 7.6.1. Company Overview

- 7.6.2. Recent Developments and Future Outlook

- 7.7. United States Biological

- 7.7.1. Company Overview

- 7.7.2. Recent Developments and Future Outlook

- 7.8. ZenBio

- 7.8.1. Company Overview

- 7.8.2. Recent Developments and Future Outlook

8. PARTNERSHIPS AND COLLABORATIONS

- 8.1. Chapter Overview

- 8.2. Partnership Models

- 8.3. Biopreservation Media Providers: Partnerships and Collaborations

- 8.3.1. Analysis by Year of Partnership

- 8.3.2. Analysis by Type of Partnership

- 8.3.2.1. Analysis by Year and Type of Partnership

- 8.3.2.2. Analysis by Type of Partnership and Company Size

- 8.3.3. Analysis by Type of Partner

- 8.3.3.1. Analysis by Year of Partnership and Type of Partner

- 8.3.3.2. Analysis by Type of Partner and Type of Partnership

- 8.3.3.3. Analysis by Type of Partner and Company Size

- 8.3.4. Most Active Players: Analysis by Number of Partnerships

- 8.3.5. Regional Analysis

- 8.3.5.1. Local and International Deals

- 8.3.5.2. Intercontinental and Intracontinental Deals

- 8.3.5.3. Analysis by Location of Headquarters of Partner

- 8.3.5.4. Analysis by Location of Headquarters of Partner and Type of Partnership

9. BOWMAN CLOCK PRICING STRATEGY

- 9.1. Chapter Overview

- 9.2. Bowman Strategy Clock

- 9.2.1. Two Dimensions of Bowman Strategy Clock

- 9.2.2. Eight Positions on Bowman Strategy Clock

- 9.3. Roots Analysis Framework

- 9.3.1. Methodology

- 9.3.2. Theoretical Framework and Price Evaluation Hypothesis

- 9.3.3. Results and Interpretation

- 9.3.3.1. Product Price Evaluation Matrix: Information on Preservation Condition

- 9.3.3.2. Product Price Evaluation Matrix: Information on Type of Serum

- 9.3.3.3. Product Price Evaluation Matrix: Information on Type of Biological Sample

- 9.3.3.4. Product Price Evaluation Matrix: Information on Minimum Packaging Volume

- 9.3.3.5. Product Price Evaluation Matrix: Information on Maximum Packaging Volume

- 9.3.3.6. Product Price Evaluation Matrix: Information on Packaging Format

- 9.3.3.7. Product Price Evaluation Matrix: Information on Area of Application

- 9.3.4. Concluding Remarks

10. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 10.1. Chapter Overview

- 10.2. Forecast Methodology and Key Assumptions

- 10.3. Biopreservation Media Providers Market, Till 2035

- 10.4. Biopreservation Media Providers Market: Distribution by Preservation Condition

- 10.4.1. Biopreservation Media Providers Market for Cryogenic / LN2 Vapor Phase, Till 2035

- 10.4.2. Biopreservation Media Providers Market for Frozen (Ultra-low) / Deep Frozen, Till 2035

- 10.4.3. Biopreservation Media Providers Market for Frozen / Cold Chain, Till 2035

- 10.4.4. Biopreservation Media Providers Market for Refrigerated, Till 2035

- 10.5. Biopreservation Media Providers Market: Distribution by Type of Serum

- 10.5.1. Biopreservation Media Providers Market for Fetal Bovine Serum Containing Media, Till 2035

- 10.5.2. Biopreservation Media Providers Market for Fetal Calf Serum Containing Media, Till 2035

- 10.5.3. Biopreservation Media Providers Market for Human Serum Containing Media, Till 2035

- 10.5.4. Biopreservation Media Providers Market for Serum Free Media, Till 2035

- 10.6. Biopreservation Media Providers Market: Distribution by Type of Biological Sample

- 10.6.1. Biopreservation Media Providers Market for Germline Cells / Stem Cells, Till 2035

- 10.6.2. Biopreservation Media Providers Market for Organs, Till 2035

- 10.6.3. Biopreservation Media Providers Market for Somatic Cells, Till 2035

- 10.6.4. Biopreservation Media Providers Market for Tissues, Till 2035

- 10.7. Biopreservation Media Providers Market: Distribution by Area of Application

- 10.7.1. Biopreservation Media Providers Market for Diagnostic Use, Till 2035

- 10.7.2. Biopreservation Media Providers Market for Research and Development, Till 2035

- 10.7.3. Biopreservation Media Providers Market for Therapeutic Use, Till 2035

- 10.8. Biopreservation Media Providers Market: Distribution by Type of Packaging Format

- 10.8.1. Biopreservation Media Providers Market for Bags, Till 2035

- 10.8.2. Biopreservation Media Providers Market for Bottles, Till 2035

- 10.8.3. Biopreservation Media Providers Market for Vials, Till 2035

- 10.8.4. Biopreservation Media Providers Market for Others, Till 2035

- 10.9. Biopreservation Media Providers Market: Distribution by End Users

- 10.9.1. Biopreservation Media Providers Market for Academic and Research Institutes, Till 2035

- 10.9.2. Biopreservation Media Providers Market for Biobanks / Genebanks, Till 2035

- 10.9.3. Biopreservation Media Providers Market for Hospitals, Till 2035

- 10.9.4. Biopreservation Media Providers Market for Pharmaceutical and Biotechnology Companies, Till 2035

- 10.9.5. Biopreservation Media Providers Market for Other End Users, Till 2035

- 10.10. Biopreservation Media Providers Market: Distribution by Region

- 10.10.1. Biopreservation Media Providers Market in North America, Till 2035

- 10.10.2. Biopreservation Media Providers Market in Europe, Till 2035

- 10.10.3. Biopreservation Media Providers Market in Asia, Till 2035

- 10.10.4. Biopreservation Media Providers Market in MENA, Till 2035

- 10.10.5. Biopreservation Media Providers Market in Latin America, Till 2035

- 10.10.6. Biopreservation Media Providers Market in Rest of the World, Till 2035

- 10.11. Concluding Remarks

11. CONCLUSION

- 11.1. Chapter Overview

12. EXECUTIVE INSIGHTS

- 12.1. Chapter Overview

- 12.2. Company A

- 12.2.1. Company Snapshot

- 12.2.2. Interview Transcript: Marketing Director

13. APPENDIX I: TABULATED DATA

14. APPENDIX II: LIST OF COMPANIES AND ORGANIZATION

List of Tables

- Table 4.1 Biopreservation Media Providers: Information on Year of Establishment, Company Size, Location of Headquarters (Country-wise and Region-wise) and Company Type

- Table 4.2 Biopreservation Media: Information on Preservation Condition

- Table 4.3 Biopreservation Media: Information on Type of Serum

- Table 4.4 Biopreservation Media: Information on Type of Biological Sample

- Table 4.5 Biopreservation Media: Information on Area of Application

- Table 4.6 Biopreservation Media: Information on Type of Packaging Format

- Table 4.7 Biopreservation Media: Information on Packaging Volume and Product Price

- Table 6.1 Company Competitiveness Analysis: Benchmarking of Product Portfolio Strength

- Table 6.2 Company Competitiveness Analysis: Benchmarking of Partnership Activity

- Table 6.3 Company Competitiveness Analysis: List of Very Small Players

- Table 6.4 Company Competitiveness Analysis: List of Small Players

- Table 6.5 Company Competitiveness Analysis: List of Mid-Sized Players

- Table 6.6 Company Competitiveness Analysis: List of Large Players

- Table 7.1 List of Companies Profiled

- Table 7.2 BioLife Solutions: Company Overview

- Table 7.3 BioLife Solutions: Recent Developments and Future Outlook

- Table 7.4 Cell Applications: Company Overview

- Table 7.5 HiMedia Laboratories: Company Overview

- Table 7.6 HiMedia Laboratories: Recent Developments and Future Outlook

- Table 7.7 Merck: Company Overview

- Table 7.8 Merck: Recent Developments and Future Outlook

- Table 7.9 Thermo Fischer Scientific: Company Overview

- Table 7.10 Thermo Fischer Scientific: Recent Developments and Future Outlook

- Table 7.11 United States Biological: Company Overview

- Table 7.12 ZenBio: Company Overview

- Table 7.13 ZenBio: Recent Developments and Future Outlook

- Table 8.1 Biopreservation Media: List of Collaborations, Since 2015

- Table 8.2 Biopreservation Media Providers: Partnerships and Collaborations, Information on Type of Agreement (Local and International Deals) and (Intercontinental and Intracontinental Deals), Since 2015

- Table 9.1 Product Price Evaluation Matrix: Information on Preservation Condition (USD)

- Table 9.2 Product Price Evaluation Matrix: Information on Type of Serum (USD)

- Table 9.3 Product Price Evaluation Matrix: Information on Type of Biological Sample (USD)

- Table 9.4 Product Price Evaluation Matrix: Information on Minimum Packaging Volume (USD)

- Table 9.5 Product Price Evaluation Matrix: Information on Maximum Packaging Volume (USD)

- Table 9.6 Product Price Evaluation Matrix: Information on Packaging Format (USD)

- Table 9.7 Product Price Evaluation Matrix: Information on Area of Application (USD)

- Table 12.1 Cytes Biotechnologies: Company Snapshot

- Table 13.1 Biopreservation Media Providers: Distribution by Year of Establishment

- Table 13.2 Biopreservation Media Providers: Distribution by Company Size

- Table 13.3 Biopreservation Media Providers: Distribution by Type of Company

- Table 13.4 Biopreservation Media Providers: Distribution by Location of Headquarters

- Table 13.5 Biopreservation Media: Distribution by Preservation Condition

- Table 13.6 Biopreservation Media: Distribution by Type of Serum

- Table 13.7 Biopreservation Media: Distribution by Type of Biological Sample

- Table 13.8 Biopreservation Media: Distribution by Area of Application

- Table 13.9 Biopreservation Media: Distribution by Type of Packaging Format

- Table 13.10 Biopreservation Media: Distribution by Minimum Packaging Volume (mL)

- Table 13.11 Biopreservation Media: Distribution by Maximum Packaging Volume (mL)

- Table 13.12 Biopreservation Media: Distribution by Minimum Price (USD)

- Table 13.13 Biopreservation Media: Distribution by Maximum Price (USD)

- Table 13.14 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2015

- Table 13.15 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 13.16 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 13.17 Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Table 13.18 Partnerships and Collaborations: Distribution by Type of Partner

- Table 13.19 Partnerships and Collaborations: Year-wise Distribution by Type of Partner

- Table 13.20 Partnerships and Collaborations: Distribution by Type of Partner and Type of Partnership

- Table 13.21 Partnerships and Collaborations: Distribution by Type of Partner and Company Size

- Table 13.22 Partnerships and Collaborations: Distribution by Number of Partnerships

- Table 13.23 Partnerships and Collaborations: Local and International Deals

- Table 13.24 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Table 13.25 Partnerships and Collaborations: Distribution by Location of Headquarters of Partner

- Table 13.26 Partnerships and Collaborations: Distribution by Location of Headquarters of Partner and Type of Partnership

- Table 13.27 Biopreservation Media Providers Market, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.28 Biopreservation Media Providers Market: Distribution by Preservation Condition

- Table 13.29 Biopreservation Media Providers Market for Cryogenic / LN2 Vapor Phase, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.30 Biopreservation Media Providers Market for Frozen (Ultra-low) / Deep Frozen, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.31 Biopreservation Media Providers Market for Frozen / Cold Chain, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.32 Biopreservation Media Providers Market for Refrigerated, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.33 Biopreservation Media Providers Market: Distribution by Type of Serum

- Table 13.34 Biopreservation Media Providers Market for Fetal Bovine Serum Containing Media, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.35 Biopreservation Media Providers Market for Fetal Calf Serum Containing Media, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.36 Biopreservation Media Providers Market for Human Serum Containing Media, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.37 Biopreservation Media Providers Market for Serum Free Media, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.38 Biopreservation Media Providers Market: Distribution by Type of Biological Sample

- Table 13.39 Biopreservation Media Providers Market for Germline Cells / Stem Cells, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.40 Biopreservation Media Providers Market for Organs, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.41 Biopreservation Media Providers Market for Somatic Cells, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.42 Biopreservation Media Providers Market for Tissues, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.43 Biopreservation Media Providers Market: Distribution by Area of Application

- Table 13.44 Biopreservation Media Providers Market for Diagnostic Use, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.45 Biopreservation Media Providers Market for Research and Development, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.46 Biopreservation Media Providers Market for Therapeutic Use, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.47 Biopreservation Media Providers Market: Distribution by Type of Packaging Format

- Table 13.48 Biopreservation Media Providers Market for Bags, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.49 Biopreservation Media Providers Market for Bottles, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.50 Biopreservation Media Providers Market for Vials, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.51 Biopreservation Media Providers Market for Others, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.52 Biopreservation Media Providers Market: Distribution by End Users

- Table 13.53 Biopreservation Media Providers Market for Academic and Research Institutes, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.54 Biopreservation Media Providers Market for Biobanks / Genebanks, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.55 Biopreservation Media Providers Market for Hospitals, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.56 Biopreservation Media Providers Market for Pharmaceutical and Biotechnology Companies, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.57 Biopreservation Media Providers Market for Other End Users, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.58 Biopreservation Media Providers Market: Distribution by Region

- Table 13.59 Biopreservation Media Providers Market in North America, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.60 Biopreservation Media Providers Market in Europe, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.61 Biopreservation Media Providers Market in Asia, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.62 Biopreservation Media Providers Market in MENA, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.63 Biopreservation Media Providers Market in Latin America, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

- Table 13.64 Biopreservation Media Providers Market in Rest of the World, Till 2035, Conservative, Base and Optimistic Scenarios (USD Million)

List of Figures

- Figure 2.1 Executive Summary: Service Providers Landscape

- Figure 2.2 Executive Summary: Market Landscape

- Figure 2.3 Executive Summary: Partnerships and Collaborations

- Figure 2.4 Executive Summary: Current and Future Market Potential

- Figure 3.1 Applications of Biopreservation Media

- Figure 3.2 Key Benefits and Limitations of Hypothermic Biopreservation Media

- Figure 3.3 Key Benefits and Limitations of Cryopreservation Media

- Figure 4.1 Biopreservation Media Providers: Distribution by Year of Establishment

- Figure 4.2 Biopreservation Media Providers: Distribution by Company Size

- Figure 4.3 Biopreservation Media Providers: Distribution by Type of Company

- Figure 4.4 Biopreservation Media Providers: Distribution by Location of Headquarters

- Figure 4.5 Biopreservation Media: Distribution by Preservation Condition

- Figure 4.6 Biopreservation Media: Distribution by Type of Serum

- Figure 4.7 Biopreservation Media: Distribution by Type of Biological Sample

- Figure 4.8 Biopreservation Media: Distribution by Area of Application

- Figure 4.9 Biopreservation Media: Distribution by Type of Packaging Format

- Figure 4.10 Biopreservation Media: Distribution by Minimum Packaging Volume (mL)

- Figure 4.11 Biopreservation Media: Distribution by Maximum Packaging Volume (mL)

- Figure 4.12 Biopreservation Media: Distribution by Minimum Price (USD)

- Figure 4.13 Biopreservation Media: Distribution by Maximum Price (USD)

- Figure 5.1 Biopreservation Media Providers: Distribution by Location of Headquarters (World Map Representation)

- Figure 5.2 Biopreservation Media Providers: Distribution by Year of Establishment, Company Size, Number of Biopreservation Media Offered and Region (4D Bubble Chart)

- Figure 5.3 Biopreservation Media: Distribution by Preservation Condition and Area of Application (Treemap Representation)

- Figure 5.4 Biopreservation Media: Distribution by Company Size, Region, Preservation Condition, Type of Serum and Type of Biological Sample (Grid Representation)

- Figure 5.5 Biopreservation Media: Distribution by Minimum Packaging Volume and Minimum Price (Heat Map Representation)

- Figure 6.1 Company Competitiveness Analysis: Benchmarking of Product Portfolio Strength

- Figure 6.2 Company Competitiveness Analysis: Benchmarking of Partnership Activity

- Figure 6.3 Company Competitiveness Analysis: Very Small Companies

- Figure 6.4 Company Competitiveness Analysis: Small Companies

- Figure 6.5 Company Competitiveness Analysis: Mid-Sized Companies

- Figure 6.6 Company Competitiveness Analysis: Large Companies

- Figure 8.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2015

- Figure 8.2 Partnerships and Collaborations: Logo Landscape

- Figure 8.3 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 8.4 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 8.5 Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Figure 8.6 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 8.7 Partnerships and Collaborations: Year-wise Distribution by Type of Partner

- Figure 8.8 Partnerships and Collaborations: Distribution by Type of Partner and Type of Partnership

- Figure 8.9 Partnerships and Collaborations: Distribution by Type of Partner and Company Size

- Figure 8.10 Partnerships and Collaborations: Distribution by Number of Partnerships

- Figure 8.11 Partnerships and Collaborations: Local and International Deals

- Figure 8.12 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Figure 8.13 Partnerships and Collaborations: Distribution by Location of Headquarters of Partner

- Figure 8.14 Partnerships and Collaborations: Distribution by Location of Headquarters of Partner and Type of Partnership

- Figure 9.1 Biopreservation Media: Bowman Clock Pricing Strategy Matrix

- Figure 9.2 Biopreservation Media: Bowman Clock Pricing Strategy Graphical Interpretation

- Figure 10.1 Biopreservation Media Providers Market, Till 2035 (USD Million)

- Figure 10.2 Biopreservation Media Providers Market: Distribution by Preservation Condition

- Figure 10.3 Biopreservation Media Providers Market for Cryogenic / LN2 Vapor Phase, Till 2035 (USD Million)

- Figure 10.4 Biopreservation Media Providers Market for Frozen (Ultra-low) / Deep Frozen, Till 2035 (USD Million)

- Figure 10.5 Biopreservation Media Providers Market for Frozen / Cold Chain, Till 2035 (USD Million)

- Figure 10.6 Biopreservation Media Providers Market for Refrigerated, Till 2035 (USD Million)

- Figure 10.7 Biopreservation Media Providers Market: Distribution by Type of Serum

- Figure 10.8 Biopreservation Media Providers Market for Fetal Bovine Serum Containing Media, Till 2035 (USD Million)

- Figure 10.9 Biopreservation Media Providers Market for Fetal Calf Serum Containing Media, Till 2035 (USD Million)

- Figure 10.10 Biopreservation Media Providers Market for Human Serum Containing Media, Till 2035 (USD Million)

- Figure 10.11 Biopreservation Media Providers Market for Serum Free Media, Till 2035 (USD Million)

- Figure 10.12 Biopreservation Media Providers Market: Distribution by Type of Biological Sample

- Figure 10.13 Biopreservation Media Providers Market for Germline Cells / Stem Cells, Till 2035 (USD Million)

- Figure 10.14 Biopreservation Media Providers Market for Organs, Till 2035 (USD Million)

- Figure 10.15 Biopreservation Media Providers Market for Somatic Cells, Till 2035 (USD Million)

- Figure 10.16 Biopreservation Media Providers Market for Tissues, Till 2035 (USD Million)

- Figure 10.17 Biopreservation Media Providers Market: Distribution by Area of Application

- Figure 10.18 Biopreservation Media Providers Market for Diagnostic Use, Till 2035 (USD Million)

- Figure 10.19 Biopreservation Media Providers Market for Research and Development, Till 2035 (USD Million)

- Figure 10.20 Biopreservation Media Providers Market for Therapeutic Use, Till 2035 (USD Million)

- Figure 10.21 Biopreservation Media Providers Market: Distribution by Type of Packaging Format

- Figure 10.22 Biopreservation Media Providers Market for Bags, Till 2035 (USD Million)

- Figure 10.23 Biopreservation Media Providers Market for Bottles, Till 2035 (USD Million)

- Figure 10.24 Biopreservation Media Providers Market for Vials, Till 2035 (USD Million)

- Figure 10.25 Biopreservation Media Providers Market for Others, Till 2035 (USD Million)

- Figure 10.26 Biopreservation Media Providers Market: Distribution by End Users

- Figure 10.27 Biopreservation Media Providers Market for Academic and Research Institutes, Till 2035 (USD Million)

- Figure 10.28 Biopreservation Media Providers Market for Biobanks / Genebanks, Till 2035 (USD Million)

- Figure 10.29 Biopreservation Media Providers Market for Hospitals, Till 2035 (USD Million)

- Figure 10.30 Biopreservation Media Providers Market for Pharmaceutical and Biotechnology Companies, Till 2035 (USD Million)

- Figure 10.31 Biopreservation Media Providers Market for Other End Users, Till 2035 (USD Million)

- Figure 10.32 Biopreservation Media Providers Market: Distribution by Region

- Figure 10.33 Biopreservation Media Providers Market in North America, Till 2035 (USD Million)

- Figure 10.34 Biopreservation Media Providers Market in Europe, Till 2035 (USD Million)

- Figure 10.35 Biopreservation Media Providers Market in Asia, Till 2035 (USD Million)

- Figure 10.36 Biopreservation Media Providers Market in MENA, Till 2035 (USD Million)

- Figure 10.37 Biopreservation Media Providers Market in Latin America, Till 2035 (USD Million)

- Figure 10.38 Biopreservation Media Providers Market in Rest of the World, Till 2035 (USD Million)

- Figure 10.39 Biopreservation Media Providers Market, Conservative, Base and Optimistic Scenarios (USD Million)

- Figure 11.1 Concluding Remarks: Current Market Landscape

- Figure 11.2 Concluding Remarks: Company Competitiveness Analysis

- Figure 11.3 Concluding Remarks: Partnerships and Collaborations

- Figure 11.4 Concluding Remarks: Market Sizing and Opportunity Analysis