|

市场调查报告书

商品编码

1771292

Fc融合蛋白品质市场:产业趋势和全球预测 - 各标的适应症,各融合分子类型,各给药途径,主要各地区Fc Fusion Protein Market: Industry Trends and Global Forecasts - Distribution by Target Indications, Type of Fusion Molecule, Route of Administration and Key Geographical Regions |

||||||

全球Fc融合蛋白市场:概览

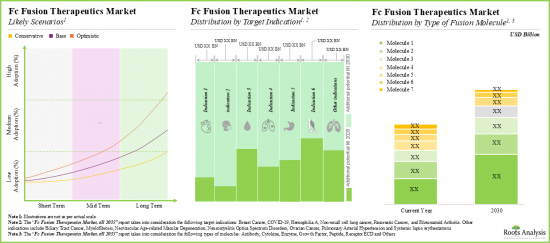

今年全球Fc融合蛋白市场规模达155亿美元。预计预测期内,市场复合年增长率为 10%。

市场区隔与机会分析依下列参数细分。

标的适应症

- 嗜中性白血球低下症

- 移植物抗宿主病

- 乳癌

- 类风湿性关节炎

- 非小细胞肺癌

- 新生血管性(wet)老龄化黄斑部病变(AMD)

- A型血友病

- 视神经脊髓炎频谱障碍

- 全身性红斑

融合分子类型

- 抗体

- 细胞激素

- 成长因素

- 受体ECD

- 其他

给药途径

- 皮下

- 静脉注射

- 玻璃体内

主要地区

- 北美

- 欧洲

- 亚太地区

- 其他地区

全球Fc融合蛋白市场:成长与趋势

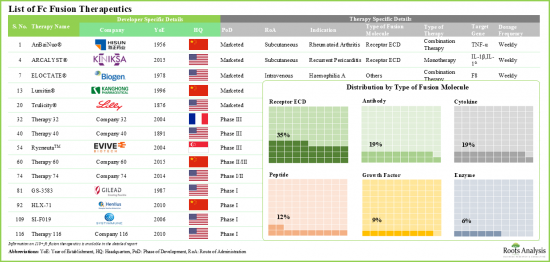

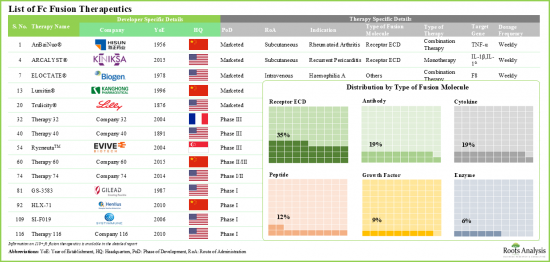

自1998年Enbrel®(CD4-Fc融合蛋白)核准用于治疗类风湿性关节炎以来,Fc融合蛋白疗法已成为一种重要的治疗药物。目前,已有13种基于Fc融合蛋白的药物上市,另有约50种分子正在开发中,用于治疗各种疾病。这些治疗药物结合了生物活性配体的良好药理特性和免疫球蛋白G (IgG) 可结晶片段 (Fc) 结构域的独特特性。此外,由于这些疾病修饰疗法能够延长生物活性蛋白的血清半衰期,因此已应用于各种治疗领域,包括肿瘤学、神经病学、呼吸系统疾病、罕见遗传疾病等等。

目前,许多药物开发商正积极致力于开发疗效较佳的新型Fc融合疗法。事实上,该领域开发商研究工作的核心是提高药理活性成分的稳定性和溶解度,最终旨在增强其治疗潜力。因此,预计Fc融合疗法市场在预测期内将呈现健康的成长动能。

全球Fc融合蛋白市场:关键洞察

本报告分析了全球Fc融合蛋白市场的现状,并揭示了该行业的潜在成长机会。报告的主要发现包括:

- 目前,全球约有40家公司正在评估Fc融合疗法在治疗多种适应症的潜在益处。

- 目前,超过115种药物疗法正在评估其作为单药或与其他疗法联合使用的疗效,这些疗法处于不同的研发阶段,其中大多数用于肠外给药。

- 大多数已核准的疗法和后期候选药物旨在治疗各种肿瘤、遗传、血液和免疫疾病。

- 鑑于Fc融合疗法的治疗益处,这些干预措施主要作为单药疗法进行评估。作为单药疗法进行研究的后期药物包括ACE-011和RC18。

- 约50%的Fc融合疗法用于皮下给药,患者可使用各种给药系统自行给药。

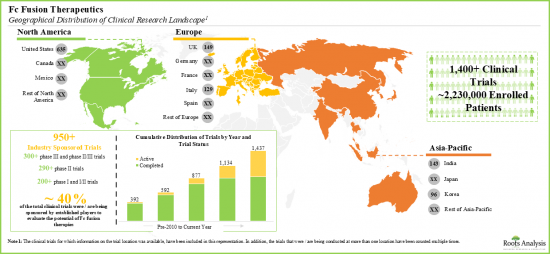

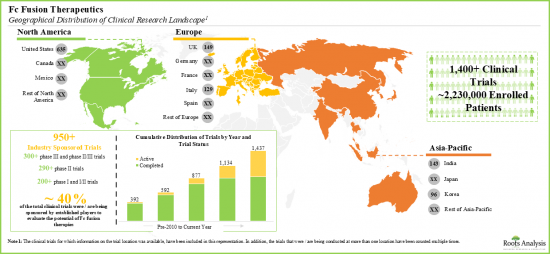

- 已有超过200万名患者参与了针对近120种Fc融合候选疗法的临床试验,这些试验遍布全球。

- 一些组织已提供资金支持该领域的研究工作。目前,资金拨付主要着重于支持SBIR/STTR以外的药物研究。

- 过去几年,授予该领域的利害关係人资助数量有所增加,其中超过60%的资助总额用于研究计画。

- 美国国立卫生研究院(NIH)的各管理机构都参与了该领域,其中NCI、NIAID和NHLBI是相对突出的参与者。

- 随着时间的推移,与Fc融合疗法相关的智慧财产权以令人瞩目的速度成长,产业和非产业参与者都提交了专利。

- 在此期间,该领域提交/授予的专利数量以17%的复合年增长率增长,其中大部分是在过去两年提交/授予的。

- 除了产业参与者之外,史丹佛大学和INSERM等学术机构也提交了与Fc融合疗法相关的专利。

- 高价值专利专注于透过各种融合分子(包括受体ECD、酵素和胜肽)修饰Fc区。

- 已发表的科学文献显示了该领域研究的进展速度。过去和正在进行的研究似乎都集中在抗癌疗法的开发上。

- 过去几年,与Fc融合疗法相关的论文数量稳步增长。这些论文中也包括关注与抗体Fc区融合的生物部分类型的论文。

- 大多数已发表的论文(约70%)都是关于评估Fc融合蛋白在各种癌症和血液疾病中的治疗潜力的研究。

- 与Fc融合疗法相关的论文已发表在几本高影响力期刊上,其中PLoS One和MAbs成为领先的期刊,发表了30多篇论文。

- 这些干预措施中,有几款候选药物处于开发的中后期阶段,主要针对肿瘤疾病,其中大多数是利用Fc蛋白进行基因工程改造的抗体。

- 许多已上市药物,例如 Fasenra、Gazyva、Margenza 和 Skyrizi,目前也正在接受其他肿瘤适应症的疗效评估。

- 大多数后期候选药物(约 60%)针对的是肿瘤适应症,包括实体肿瘤、非何杰金氏淋巴瘤和非小细胞肺癌。

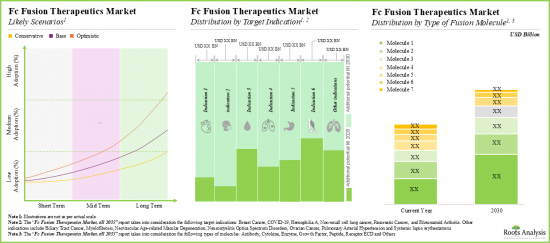

- 随着后期药物研发管线数量的不断增加,预计未来收入将以每年近 10% 的速度成长。

- 预计市场机会将涵盖不同的治疗类型、标靶适应症、融合分子类型、给药途径和主要地区,且具有良好的多元化。

药物研发平台市场参与企业案例

- Abzena

- Creative Biolabs

- Distributed Bio(Subsidiary of Charles River)

- ImmunoPrecise Antibodies

- IONTAS

- LakePharma

- Leading Biology

- Sino Biological

- XOMA

全球 Fc 融合蛋白市场

- 市场规模与机会分析:本研究报告对全球 Fc 融合蛋白市场进行了深入分析,重点关注 [A] 目标适应症、[B] 融合分子类型、[C] 给药途径和 [D] 重点地区等关键细分市场。

- 市场格局:对Fc融合疗法进行全面评估,考虑各种参数,例如:A] 先导候选药物的开发阶段,[B] 融合分子类型,[C] 目标基因,[D] 治疗领域,[E] 目标疾病适应症,[F] 治疗类型,[G] 给药途径,[H] 剂量。此外,也根据[A] 成立年份,[B] 公司规模,[C] 总部所在地,对药物开发公司进行详细评估。

- 公司简介:对参与Fc融合疗法开发的公司的详细简介,重点关注:A] 公司概况,[B] 财务资讯(如有),[C] 产品组合,[D] 最新进展及未来展望。

- 临床试验分析:基于若干相关参数对各种 Fc 融合疗法的临床试验进行详细分析,例如:A] 研究註册年份,[B] 研究阶段,[C] 研究设计,[D] 掩蔽类型,[E] 干预模式类型,[F] 新兴重点领域,[G] 主要行业赞助商/合作者,[Hi] 适应症,[Hi] 热门区域的热门措施,[Hi]。

- 资助分析:根据各种相关参数(例如A]资助年份、[B]资助金额、[C]管理机构中心、[D]支持期限、[E]资助申请类型、[F]资助目标、[G]活动代码、[H]新兴重点领域等),对授予开展Fc融合疗法相关项目的研究机构的资助进行详细分析。

- 出版品分析:根据A]出版年份、[B]新兴重点领域、[C]目标治疗领域、[D]主要作者、[E]主要期刊,对近1,135篇与Fc融合疗法相关的同行评审科学论文进行全面分析。

- 专利分析:基于各种相关参数,对与Fc融合疗法相关的已申请/已授权专利进行详细分析,例如A]出版年份、[B]地区、[C] CPC符号、[D]新兴重点领域、[E]申请人类型、[F]主要行业参与者、[G]专利估值分析等。

- 合作关係与协作:基于多个参数,对该领域利害关係人达成的交易进行深入分析,例如:A)合作年份、B)合作类型、C)重点领域、D)合作伙伴类型、E)最活跃的参与者(已达成的合作伙伴关係数量)、F)合作活动的区域分布。

- 案例研究:基于多个相关参数,对已上市和正在开发的Fc工程抗体进行详细分析,例如:A)开发阶段、B)目标疾病、C)治疗领域、D) Fc工程类型、E) Fc工程的影响、F)给药途径、G)治疗类型。

本报告研究了全球Fc融合蛋白市场,并概述了市场趋势,涵盖目标适应症、融合分子类型、给药途径、区域趋势以及市场参与者概况。

目录

第1章 序文

第2章 摘要整理

第3章 简介

- Fc融合治疗药概要

- Fc融合治疗药的成分

- 作用机制

- Fc融合治疗药的种类

- Fc融合治疗药的应用

- Fc融合治疗药对其他的生物学的分子有的优点

- 未来展望

第4章 开发平台评估:成药和临床药

- 分析调查手法和主要参数

- Fc融合治疗药:医药品开发平台(管线)

- Fc融合治疗药:开发平台分析

- Fc融合治疗药:医药品开发企业一览

第5章 企业简介

- 章概要

- Alphamab Oncology

- Amgen

- Acceleron Pharmaceuticals

- Bristol Myers Squibb

- Sanofi

第6章 临床试验的分析

- 分析调查手法和主要参数

- Fc融合治疗药:临床试验清单

第7章 学术资助分析

- 分析调查手法和主要参数

- Fc融合治疗药:学术资助的分析

第8章 出版物的分析

第9章 专利分析

- 分析调查手法和主要参数

- Fc融合治疗药:专利分析

第10章 伙伴关係和合作

- 分析调查手法和主要参数

- 伙伴关係模式

- Fc融合治疗药:伙伴关係和合作的清单

第11章 市场规模的评估与机会分析

- 预测调查手法主要的前提条件

- 全球FC融合治疗药市场(到2035年)

- 到2035年前的全球FC融合治疗药市场:各标的适应症

- 到2035年前的全球FC融合治疗药市场:各融合分子类型

- 到2035年前的全球FC融合治疗药市场:治疗类别

- 到2035年前的全球FC融合治疗药市场:各给药途径

- 到2035年前的全球FC融合治疗药市场:各地区

- Fc融合治疗药:个别产品的销售额预测

- ABP 938(安进)

- Alprolix®(赛诺菲)

- 朝日製药®(海正製药)

- Arcalyst®(Kiniska)药品)

- BIVV001(赛诺菲)

- CD24Fc(默克)

- Electate®(百健)

- Eylea™(再生元製药)

- FRSW107(郑州Gensciences)

- KN035(康宁杰瑞肿瘤)

- KN046(康宁杰瑞肿瘤)

- Lumitin®(成都康弘生物科技)

- Rebrozil®(百时美施贵宝)

- Ryzneuta™(Evive Biotech)

- Strensiq®(阿斯特捷利康)

- 泰利西普 (RemeGen)

第12章 案例研究:FC蛋白质工程及糖锁链工程抗体

- Fc蛋白质改变抗体及糖锁链改变抗体:医药品开发平台(管线)

- Fc蛋白质改变抗体及糖锁链改变抗体:开发商一览

第13章 结论

第14章 附录1:表格形式资料

第15章 附录2:企业·团体一览

GLOBAL FC FUSION PROTEIN MARKET: OVERVIEW

As per Roots Analysis, the global Fc fusion protein market valued at USD 15.5 billion in the current year is anticipated to grow at a CAGR of 10% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Target Indications

- Neutropenia

- Graft Versus Host Disease

- Breast Cancer

- Rheumatoid Arthritis

- Non-Small Cell Lung Cancer

- Neovascular (Wet) Age-related Macular Degeneration (AMD)

- Hemophilia A

- Neuromyelitis Optica Spectrum Disorders

- Systemic Lupus Erythematosus

Type of Fusion Molecule

- Antibody

- Cytokine

- Growth Factor

- Receptor ECD

- Others

Route of Administration

- Subcutaneous

- Intravenous

- Intravitreal

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

GLOBAL FC FUSION PROTEIN MARKET: GROWTH AND TRENDS

Since the approval of Enbrel(R) (a CD4-Fc fusion protein for the treatment of rheumatoid arthritis) in 1998, Fc fusion protein therapies have become a prominent class of therapeutics. At present, 13 Fc fusion protein-based drugs are commercially available, and approximately 50 additional molecules are in development for a range of disease indications. These therapies combine the advantageous pharmacological properties of biologically active ligands with the unique characteristics of the crystallizable fragment (Fc) domain of immunoglobulin G (IgG). Moreover, due to their ability to prolong the serum half-life of biologically active proteins, these disease-modifying therapies are utilized in a variety of therapeutic areas. Some of these include oncological, neurological, respiratory, and rare genetic disorders.

Currently, numerous drug developers are actively involved in the development of novel Fc fusion therapies with improved efficacy. In fact, the research efforts by developers in this area are centered on enhancing the stability and solubility of the pharmacologically active component, ultimately aiming to boost its therapeutic potential. Consequently, the Fc fusion therapies market is expected to witness healthy market growth during the forecast period.

GLOBAL FC FUSION PROTEIN MARKET: KEY INSIGHTS

The report delves into the current state of global Fc fusion protein market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, around 40 players from across the world, are engaged in evaluating the potential benefits of Fc fusion therapeutics for the treatment of a wide range of disease indications.

- The pipeline features 115+ drug therapies being evaluated either as monotherapies or in combination with other interventions across different stages of development; most of these are designed for parenteral administration.

- Majority of the approved therapies and late-stage candidates are intended for the treatment of various oncological disorders, genetic disorders, hematological disorders and immunological disorders.

- Given the therapeutic benefits of fc fusion, these interventions are primarily evaluated as monotherapies; examples of late-stage drugs being investigated as monotherapy include ACE-011 and RC18.

- Around 50% of the fc fusion therapeutics are meant for subcutaneous administration; these can be self-administered by the patients using different drug delivery systems.

- Over two million patients have been enrolled in the clinical studies being conducted for the evaluation of close to 120 fc fusion-based therapy candidates, across various geographies.

- Several organizations have extended financial support to aid research efforts in this domain; currently, the focus, in terms of funds disbursed, is primarily in support of investigations of drugs for non-SBIR / STTR purposes.

- The number of grants awarded to stakeholders in this domain have increased in the past few years; more than 60% of the total amount was awarded for research projects.

- The field has witnessed the involvement of various administering institutes of the NIH; of all the institutes, participation of the NCI, NIAID, and NHLBI has been relatively more prominent.

- Over time, the intellectual property related to Fc fusion therapeutics has grown at a commendable pace, with patents being filed by both industry and non-industry players.

- Number of patents filed / granted in this domain have increased at a CAGR of 17% during the given time period, with majority of the patents filed / granted in the past two years.

- In addition to industry players, several academic organizations, such as Stanford University and INSERM have also filed patents related to fc fusion therapeutics.

- The high value patents focus on the modification of Fc region with different fusion molecules, such as receptor ECD, enzyme and peptide.

- Published scientific literature is indicative of the ongoing pace of research in this field; the focus of past and ongoing studies seems to be fixated on the development of anti-cancer therapeutics.

- The past few years have seen a steady rise in the number of publications related to fc fusion therapeutics; these include articles highlighting the type of biological moieties fused with the Fc region of the antibodies.

- Majority (~70%) of the published articles are related to the research studies focused on evaluating the therapeutic potential of Fc fusion proteins across various oncological and blood disorders.

- Articles related to Fc fusion therapeutics have been published in several high impact journals; however, PLoS One and MAbs have emerged as the key journals with over 30 articles.

- With multiple pipeline candidates in the mid to late stages of development, these interventions are primarily targeting oncological disorders; majority of these are Fc protein engineered antibodies.

- A number of marketed drugs, such as Fasenra, Gazyva, Margenza and Skyrizi, are now being evaluated for their efficacy across other oncological indications as well.

- Majority (~60%) of the late-stage candidates are targeting oncological indications, including solid tumors, non-Hodgkin lymphoma, and non-small cell lung cancer.

- Driven by an increasing number of late-stage therapies in the pipeline, the future opportunity, in terms of revenues, is anticipated to grow at an annualized rate of nearly 10%.

- The estimated market opportunity is expected to be well-distributed across different types of therapies, target indications, type of fusion molecules, routes of administration and key geographic regions.

Example Players in the Drug Discovery Platforms Market

- Abzena

- Creative Biolabs

- Distributed Bio (Subsidiary of Charles River)

- ImmunoPrecise Antibodies

- IONTAS

- LakePharma

- Leading Biology

- Sino Biological

- XOMA

GLOBAL FC FUSION PROTEIN MARKET

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global Fc fusion protein market, focusing on key market segments, including [A] target indications, [B] type of fusion molecule, [C] route of administration and [D] key geographical regions.

- Market Landscape: A comprehensive evaluation of Fc fusion therapeutics, considering various parameters, such as [A] phase of development of lead candidates, [B] type of fusion molecule, [C] target gene, [D] therapeutic area(s), [E] target disease indication(s), [F] type of therapy, [G] route of administration and [H] dosing frequency. Additionally, a detailed evaluation of the drug developer(s), based on [A] year of establishment, [B] company size, and [C] location of headquarters.

- Company Profiles: In-depth profiles of companies engaged in the development of Fc fusion therapeutics, focusing on [A] company overview, [B financial information (if available), [C] product portfolio and [D] recent developments and an informed future outlook.

- Clinical Trial Analysis: A detailed analysis of clinical studies of various Fc fusion therapeutics, based on several relevant parameters, such as [A] trial registration year, [B] trial phase, [C] study design, [D] type of masking, [E] type of intervention model, [F] emerging focus area, [G] leading industry sponsors / collaborators, [H] popular indications, [I] popular interventions and [J] regional distribution of trials.

- Grant Analysis: An in-depth analysis of grants that have been awarded to research institutes engaged in conducting projects related to Fc fusion therapeutics, based on various relevant parameters, such as [A] year of grant award, [B] amount awarded, [C] administering institute center, [D] support period, [E] type of grant application, [F] purpose of grant award, [G] activity code and [H] emerging focus areas.

- Publication Analysis: A comprehensive analysis of close to 1,135 peer-reviewed scientific articles related to Fc fusion therapeutics, based on [A] year of publication, [B] emerging focus areas, [C] target therapeutic area, [D] leading authors and [E] key journals.

- Patent Analysis: An in-depth analysis of patents filed / granted related to Fc fusion therapeutics, based on various relevant parameters, such as [A] publication year, [B] geography, [C] CPC symbols, [D] emerging focus areas, [E] type of applicant, [F] leading industry players and [G] patent valuation analysis.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in this domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] focus area, [D] type of partner, [E] most active players (in terms of the number of partnerships signed) and [F] geographical distribution of partnership activity.

- Case Study: A detailed discussion on the Fc protein engineered and glycoengineered antibodies that are either marketed or being developed based on multiple of relevant parameters, such as [A] phase of development, [B] target disease indication, [C] therapeutic area, [D] type of Fc engineering, [E] impact of Fc engineering, [F] route of administration and [G] type of therapy.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Overview of Fc Fusion Therapeutics

- 3.2. Components of Fc Fusion Therapeutics

- 3.3. Mechanism of Action

- 3.4. Types of Fc Fusion Therapeutics

- 3.4.1. Antibody-based Fc Fusion Therapeutics

- 3.4.2. Cytokine-based Fc Fusion Therapeutics

- 3.4.3. Enzyme-based Fc Fusion Therapeutics

- 3.4.4. Peptide-based Fc Fusion Therapeutics

- 3.4.5. Receptor ECD-based Fc Fusion Therapeutics

- 3.5. Applications of Fc Fusion Therapeutics

- 3.6. Advantages of Fc Fusion Therapeutics over Other Biological Moieties

- 3.7. Future Perspectives

4. PIPELINE REVIEW: MARKETED AND CLINICAL DRUGS

- 4.1. Analysis Methodology and Key Parameters

- 4.2. Fc Fusion Therapeutics: Drug Pipeline

- 4.3. Fc Fusion Therapeutics: Pipeline Analysis

- 4.3.1. Analysis by Phase of Development

- 4.3.2. Analysis by Type of Fusion Molecule

- 4.3.3. Analysis by Target Gene

- 4.3.4. Analysis by Therapeutic Area(s)

- 4.3.5. Analysis by Target Disease Indication(s)

- 4.3.6. Analysis by Type of Therapy

- 4.3.7. Analysis by Route of Administration

- 4.3.8. Analysis by Dosing Frequency

- 4.4. Fc Fusion Therapeutics: List of Drug Developers

- 4.4.1. Analysis by Year of Establishment

- 4.4.2. Analysis by Company Size

- 4.4.3. Analysis by Location of Headquarters

- 4.4.4. Leading Developers

- 4.4.5. Grid Analysis: Distribution by Phase of Development, Company Size and Location of Headquarters

5. COMPANY PROFILES

- 5.1. Chapter Overview

- 5.2. Alphamab Oncology

- 5.2.1. Company Overview

- 5.2.2. Financial Information

- 5.2.3. Product Portfolio

- 5.2.4. Recent Developments and Future Outlook

- 5.3. Amgen

- 5.3.1. Company Overview

- 5.3.2. Financial Information

- 5.3.3. Product Portfolio

- 5.3.4. Recent Developments and Future Outlook

- 5.4. Acceleron Pharmaceuticals

- 5.4.1. Company Overview

- 5.4.2. Financial Information

- 5.4.3. Product Portfolio

- 5.4.4. Recent Developments and Future Outlook

- 5.5. Bristol Myers Squibb

- 5.5.1. Company Overview

- 5.5.2. Financial Information

- 5.5.3. Product Portfolio

- 5.5.4. Recent Developments and Future Outlook

- 5.6. Sanofi

- 5.6.1. Company Overview

- 5.6.2. Financial Information

- 5.6.3. Product Portfolio

- 5.6.4. Recent Developments and Future Outlook

6. CLINICAL TRIAL ANALYSIS

- 6.1. Analysis Methodology and Key Parameters

- 6.2. Fc Fusion Therapeutics: List of Clinical Trials

- 6.2.1. Analysis by Trial Registration Year

- 6.2.2. Analysis by Trial Phase

- 6.2.3. Analysis by Study Design

- 6.2.4. Analysis by Type of Masking

- 6.2.5. Analysis by Type of Intervention Model

- 6.2.6. World Cloud: Emerging Focus Areas

- 6.2.7. Analysis by Trial Registration Year and Geography

- 6.2.8. Analysis by Type of Sponsor

- 6.2.9. Leading Industry Players: Analysis by Number of Trials Registered

- 6.2.10. Leading Non-Industry Players: Analysis by Number of Trials Registered

- 6.2.11. Popular Indications: Analysis by Number of Registered Trials

- 6.2.12. Popular Interventions: Analysis by Number of Registered Trials

- 6.2.13. Geographical Analysis by Number of Registered Trials

- 6.2.14. Geographical Analysis by Number of Patients Enrolled

7. ACADEMIC GRANT ANALYSIS

- 7.1. Analysis Methodology and Key Parameters

- 7.2. Fc Fusion Therapeutics: Analysis of Academic Grants

- 7.2.1. Analysis by Year of Grant Award

- 7.2.2. Analysis by Amount Awarded

- 7.2.3. Analysis by Administering Institute Center

- 7.2.4. Analysis by Support Period

- 7.2.5. Analysis by Type of Grant Application

- 7.2.6. Analysis by Purpose of Grant Award

- 7.2.7. Analysis by Activity Code

- 7.2.8. Word Cloud Analysis: Emerging Focus Areas

- 7.2.9. Popular NIH Departments: Analysis by Number of Grants

- 7.2.10. Prominent Program Officers: Analysis by Number of Grants

- 7.2.11. Popular Recipient Organizations: Analysis by Number of Grants

8. PUBLICATION ANALYSIS

- 8.1. Analysis Methodology and Key Parameters

- 8.2. Fc Fusion Therapeutics: Recent Publications

- 8.3. Analysis by Year of Publication

- 8.4. Word Cloud Analysis: Emerging Focus Areas

- 8.5. Analysis by Target Therapeutic Area

- 8.6. Leading Authors: Analysis by Number of Publications

- 8.7. Key Journals: Analysis by Number of Publications

9. PATENT ANALYSIS

- 9.1. Analysis Methodology and Key Parameters

- 9.2. Fc Fusion Therapeutics: Patent Analysis

- 9.2.1. Analysis by Publication Year

- 9.2.2. Analysis by Type of Patent

- 9.2.3. Analysis by Geographical Location

- 9.2.4. Analysis by Patent Age

- 9.2.5. Analysis by CPC Symbols

- 9.2.6. Word Cloud Analysis: Emerging Focus Areas

- 9.2.7. Leading Patent Assignees: Analysis by Number of Patents

- 9.2.8. Leading Industry Players: Analysis by Number of Patents

- 9.2.9. Leading Non-Industry Players: Analysis by Number of Patents

- 9.2.10. Fc Fusion Therapeutics: Patent Benchmarking Analysis

- 9.2.11. Fc Fusion Therapeutics: Patent Valuation Analysis

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Analysis Methodology and Key Parameters

- 10.2. Partnership Models

- 10.3. Fc Fusion Therapeutics: List of Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Analysis by Type of Partnership and Type of Fusion molecule

- 10.3.4. Analysis by Year of Partnership and Type of Partner

- 10.3.5. Analysis by Type of Partnership and Type of Partner

- 10.3.6. Most Active Players: Analysis by Number of Partnerships

- 10.3.7. Regional Analysis

- 10.3.7.1. Intercontinental and Intracontinental Agreements

11. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 11.1. Forecast Methodology and Key Assumptions

- 11.2. Global Fc Fusion Therapeutics Market, Till 2035

- 11.3. Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Target Indication

- 11.4. Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Type of Fusion Molecule

- 11.5. Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Type of Therapy

- 11.6. Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Route of Administration

- 11.7. Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Geography

- 11.8. Fc Fusion Therapeutics: Individual Product Sales Forecasts

- 11.8.1. ABP 938 (Amgen)

- 11.8.2. Alprolix(R) (Sanofi)

- 11.8.3. AnBaiNuo(R) (Hisun Pharmaceuticals)

- 11.8.4. Arcalyst(R) (Kiniska Pharmaceuticals)

- 11.8.5. BIVV001 (Sanofi)

- 11.8.6. CD24Fc (Merck)

- 11.8.7. Eloctate(R) (Biogen)

- 11.8.8. Eylea(TM) (Regeneron Pharmaceuticals)

- 11.8.9. FRSW107 (Zhengzhou Gensciences)

- 11.8.10. KN035 (Alphamab Oncology)

- 11.8.11. KN046 (Alphamab Oncology)

- 11.8.12. Lumitin(R) (Chengdu Kanghong Biotech)

- 11.8.13. Reblozyl(R) (Bristol-Myers Squibb)

- 11.8.14. RyzneutaTM (Evive Biotech)

- 11.8.15. Strensiq(R) (AstraZeneca)

- 11.8.16. Telitacicept (RemeGen)

12. CASE STUDY: FC PROTEIN ENGINEERED AND GLYCOENGINEERED ANTIBODIES

- 12.1. Fc Protein Engineered and Glycoengineered Antibodies: Drug Pipeline

- 12.1.1. Analysis by Phase of Development

- 12.1.2. Analysis by Target Disease Indication

- 12.1.3. Analysis by Therapeutic Area

- 12.1.4. Analysis by Type of Fc Engineering

- 12.1.5. Analysis by Impact of Fc Engineering

- 12.1.6. Analysis by Route of Administration

- 12.1.7. Analysis by Type of Therapy

- 12.2. Fc Protein Engineered and Glycoengineered Antibodies: List of Developers

- 12.2.1. Analysis by Year of Establishment

- 12.2.2. Analysis by Company Size

- 12.2.3. Analysis by Location of Headquarters

13. CONCLUSION

14. APPENDIX 1: TABULATED DATA

15. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 Fc Fusion Therapeutics: Drug Pipeline

- Table 4.2 Fc Fusion Therapeutics: List of Drug Developers

- Table 5.1 Fc Fusion Therapeutics: List of Companies Profiled

- Table 5.2 Drug Profile: KN015

- Table 5.3 Drug Profile: KN046

- Table 5.4 Drug Profile: KN035

- Table 5.5 Drug Profile: KN058

- Table 5.6 Drug Profile: KN055

- Table 5.7 Drug Profile: KN019

- Table 5.8 Alphamab Oncology: Recent Developments and Future Outlook

- Table 5.9 Drug Profile: AMG 386

- Table 5.10 Drug Profile: AMG 592

- Table 5.11 Drug Profile: ABP 938

- Table 5.12 Drug Profile: Enbrel(R)

- Table 5.13 Drug Profile: Nplate(R)

- Table 5.14 Amgen: Recent Developments and Future Outlook

- Table 5.15 Drug Profile: ACE-1334

- Table 5.16 Drug Profile: ACE-011

- Table 5.17 Acceleron Pharmaceuticals: Recent Developments and Future Outlook

- Table 5.18 Drug Profile: AVID200

- Table 5.19 Drug Profile: Orencia(R)

- Table 5.20 Drug Profile: Nulojix(R)

- Table 5.21 Drug Profile: REBLOZYL(R)

- Table 5.22 Bristol-Myers Squibb: Recent Developments and Future Outlook

- Table 5.23 Drug Profile: Alprolix(R)

- Table 5.24 Drug Profile: BIVV001

- Table 5.25 Drug Profile: Zaltrap(R)

- Table 5.26 Sanofi: Recent Developments and Future Outlook

- Table 6.1 Fc Fusion Therapeutics: List of Clinical Trials

- Table 10.1 Fc Fusion Therapeutics: List of Partnerships and Collaborations

- Table 12.1 Fc Protein Engineered and Glycoengineered Antibodies: Drug Pipeline

- Table 12.2 Fc Protein Engineered and Glycoengineered Antibodies: List of Drug Developers

- Table 14.1 Fc Fusion Therapeutics: Distribution by Phase of Development

- Table 14.2 Fc Fusion Therapeutics: Distribution by Type of Fusion Molecule

- Table 14.3 Fc Fusion Therapeutics: Distribution by Target Gene

- Table 14.4 Fc Fusion Therapeutics: Distribution by Therapeutic Area(s)

- Table 14.5 Fc Fusion Therapeutics: Distribution by Target Disease Indication(s)

- Table 14.6 Fc Fusion Therapeutics: Distribution by Type of Therapy

- Table 14.7 Fc Fusion Therapeutics: Distribution by Route of Administration

- Table 14.8 Fc Fusion Therapeutics: Distribution by Dosing Frequency

- Table 14.9 Fc Fusion Therapeutics: Distribution by Year of Establishment

- Table 14.10 Fc Fusion Therapeutics: Distribution by Company Size

- Table 14.11 Fc Fusion Therapeutics: Distribution by Location of Headquarters

- Table 14.12 Fc Fusion Therapeutics: Distribution by Leading Developers

- Table 14.13 Amgen: Annual Revenues, Since 2016 (USD Billion)

- Table 14.14 Acceleron Pharmaceuticals: Annual Revenues, Since 2016 (USD Billion)

- Table 14.15 Bristol Myers Squibb: Annual Revenues, Since 2016 (USD Billion)

- Table 14.16 Sanofi: Annual Revenues, Since 2016 (USD Billion)

- Table 14.17 Clinical Trial Analysis: Distribution by Trial Registration Year

- Table 14.18 Clinical Trial Analysis: Distribution by Trial Phase

- Table 14.19 Clinical Trial Analysis: Distribution by Study Design

- Table 14.20 Clinical Trial Analysis: Distribution by Type of Masking

- Table 14.21 Clinical Trial Analysis: Distribution by Type of Intervention Model

- Table 14.22 Clinical Trial Analysis: Distribution by Trial Registration Year and Geography

- Table 14.23 Clinical Trial Analysis: Distribution by Type of Sponsor

- Table 14.24 Leading Industry Players: Distribution by Number of Trials Registered

- Table 14.25 Leading Non-Industry Players: Distribution by Number of Trials Registered

- Table 14.26 Popular Indications: Analysis by Number of Registered Trials

- Table 14.27 Popular Interventions: Analysis by Number of Registered Trials

- Table 14.28 Popular Indications: Distribution by Number of Registered Trials

- Table 14.29 Popular Interventions: Distribution by Number of Registered Trials

- Table 14.30 Clinical Trial Analysis: Geographical Distribution by Number of Registered Trials

- Table 14.31 Clinical Trial Analysis: Geographical Distribution by Number of Patients Enrolled

- Table 14.32 Grant Analysis: Cumulative Trend by Year of Grant Award, Since 2010

- Table 14.33 Grant Analysis: Cumulative Distribution by Amount Awarded (USD Million), Since 2010

- Table 14.34 Grant Analysis: Distribution by Administering Institute Center

- Table 14.35 Grant Analysis: Distribution by Support Period

- Table 14.36 Grant Analysis: Distribution by Type of Grant Application

- Table 14.37 Grant Analysis: Distribution by Purpose of Grant Award

- Table 14.38 Grant Analysis: Distribution by Activity Code

- Table 14.39 Popular NIH Departments: Distribution by Number of Grants

- Table 14.40 Prominent Program Officers: Distribution by Number of Grants

- Table 14.41 Popular Recipient Organizations: Distribution by Number of Grants

- Table 14.42 Publication Analysis: Cumulative Year-wise Trend, Since 2010

- Table 14.43 Publication Analysis: Distribution by Target Therapeutic Area

- Table 14.44 Leading Authors: Distribution by Number of Publications

- Table 14.45 Key Journals: Distribution by Number of Publications

- Table 14.46 Patent Analysis: Distribution by Publication Year

- Table 14.47 Patent Analysis: Distribution by Type of Patent

- Table 14.48 Patent Analysis: Distribution by Geographical Location

- Table 14.49 Patent Analysis: Distribution by Patent Age

- Table 14.50 Patent Analysis: Distribution by CPC Symbols

- Table 14.51 Leading Patent Assignees: Distribution by Number of Patents

- Table 14.52 Leading Industry Players: Distribution by Number of Patents

- Table 14.53 Patent Analysis: Distribution by Patent Benchmarking

- Table 14.54 Patent Analysis: Distribution by Patent Valuation

- Table 14.55 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2015

- Table 14.56 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 14.57 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Fusion Molecule

- Table 14.58 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partner

- Table 14.59 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Partner

- Table 14.60 Most Active Players: Distribution by Number of Partnerships

- Table 14.61 Partnerships and Collaborations: Regional Distribution

- Table 14.62 Global Fc Fusion Therapeutics Market, Till 2035 (USD Million)

- Table 14.63 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Target Indication (USD Million)

- Table 14.64 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Type of Therapy (USD Million)

- Table 14.65 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Route of Administration (USD Million

- Table 14.66 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Geography (USD Million)

- Table 14.67 ABP 938: Sales Forecast, Till 2035 (USD Million)

- Table 14.68 Alprolix(R): Sales Forecast, Till 2035 (USD Million)

- Table 14.69 AnBaiNuo(R): Sales Forecast, Till 2035 (USD Million)

- Table 14.70 Arcalyst(R): Sales Forecast, Till 2035 (USD Million)

- Table 14.71 BIVV001: Sales Forecast, Till 2035 (USD Million)

- Table 14.72 CD24Fc: Sales Forecast, Till 2035 (USD Million)

- Table 14.73 Eloctate(R): Sales Forecast, Till 2035 (USD Million)

- Table 14.74 Eylea(TM): Sales Forecast, Till 2035 (USD Million)

- Table 14.75 FRSW107: Sales Forecast, Till 2035 (USD Million)

- Table 14.76 KN035: Sales Forecast, Till 2035 (USD Million)

- Table 14.77 KN046: Sales Forecast, Till 2035 (USD Million)

- Table 14.78 Lumitin(R): Sales Forecast, Till 2035 (USD Million)

- Table 14.79 Reblozyl(R): Sales Forecast, Till 2035 (USD Million)

- Table 14.80 RyzneutaTM: Sales Forecast, Till 2035 (USD Million)

- Table 14.81 Strensiq(R): Sales Forecast, Till 2035 (USD Million)

- Table 14.82 Telitacicept: Sales Forecast, Till 2035 (USD Million)

- Table 14.83 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Phase of Development

- Table 14.84 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Target Disease Indication

- Table 14.85 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Therapeutic Area

- Table 14.86 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Type of Fc Engineering

- Table 14.87 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Impact of Fc Engineering

- Table 14.88 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Route of Administration

- Table 14.89 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Type of Therapy

- Table 14.90 Fc Protein Engineered and Glycoengineered Antibodies Developers: Analysis by Year of Establishment

- Table 14.91 Fc Protein Engineered and Glycoengineered Antibodies Developers Analysis by Company Size

- Table 14.92 Fc Protein Engineered and Glycoengineered Antibodies Developers Analysis by Location of Headquarters

List of Figures

- Figure 2.1 Executive Summary: Overall Market Landscape

- Figure 2.2 Executive Summary: Clinical Trial Analysis

- Figure 2.3 Executive Summary: Academic Grant Analysis

- Figure 2.4 Executive Summary: Publication Analysis

- Figure 2.5 Executive Summary: Patent Analysis

- Figure 2.6 Executive Summary: Partnerships and Collaborations

- Figure 2.7 Executive Summary: Market Forecast

- Figure 3.1 Components of Fc Fusion Therapeutics

- Figure 3.2 Mechanism of Action

- Figure 4.1 Fc Fusion Therapeutics: Distribution by Phase of Development

- Figure 4.2 Fc Fusion Therapeutics: Distribution by Type of Fusion Molecule

- Figure 4.3 Fc Fusion Therapeutics: Distribution by Target Gene

- Figure 4.4 Fc Fusion Therapeutics: Distribution by Therapeutic Area(s)

- Figure 4.5 Fc Fusion Therapeutics: Distribution by Target Disease Indication(s)

- Figure 4.6 Fc Fusion Therapeutics: Distribution by Type of Therapy

- Figure 4.7 Fc Fusion Therapeutics: Distribution by Route of Administration

- Figure 4.8 Fc Fusion Therapeutics: Distribution by Dosing Frequency

- Figure 4.9 Fc Fusion Therapeutics Developers: Distribution by Year of Establishment

- Figure 4.10 Fc Fusion Therapeutics Developers: Distribution by Company Size

- Figure 4.11 Fc Fusion Therapeutics Developers: Distribution by Location of Headquarters

- Figure 4.12 Leading Developers: Distribution by Number of Fc Fusion Therapeutics

- Figure 4.13 Grid Analysis: Distribution by Phase of Development, Company Size and Location of Headquarters

- Figure 5.1 Amgen: Annual Revenues, Since 2016 (USD Billion)

- Figure 5.2 Acceleron Pharmaceuticals: Annual Revenues, Since 2016 (USD Billion)

- Figure 5.3 Bristol Myers Squibb: Annual Revenues, Since 2016 (USD Billion)

- Figure 5.4 Sanofi: Annual Revenues, Since 2016 (USD Billion)

- Figure 6.1 Clinical Trial Analysis: Distribution by Trial Registration Year

- Figure 6.2 Clinical Trial Analysis: Distribution by Trial Phase

- Figure 6.3 Clinical Trial Analysis: Distribution by Study Design

- Figure 6.4 Clinical Trial Analysis: Distribution by Type of Masking

- Figure 6.5 Clinical Trial Analysis: Distribution by Type of Intervention Model

- Figure 6.6 World Cloud Analysis: Emerging Focus Areas

- Figure 6.7 Clinical Trial Analysis: Distribution by Trial Registration Year and Geography

- Figure 6.8 Clinical Trial Analysis: Distribution by Type of Sponsor

- Figure 6.9 Leading Industry Players: Distribution by Number of Trials Registered

- Figure 6.10 Leading Non-Industry Players: Distribution by Number of Trials Registered

- Figure 6.11 Popular Indications: Distribution by Number of Registered Trials

- Figure 6.12 Popular Interventions: Distribution by Number of Registered Trials

- Figure 6.13 Popular Indications: Distribution by Number of Registered Trials

- Figure 6.14 Popular Interventions: Distribution by Number of Registered Trials

- Figure 6.15 Clinical Trial Analysis: Geographical Distribution by Number of Registered Trials

- Figure 6.16 Clinical Trial Analysis: Geographical Distribution by Number of Patients Enrolled

- Figure 7.1 Grant Analysis: Cumulative Trend by Year of Grant Award, Since 2010

- Figure 7.2 Grant Analysis: Cumulative Distribution by Amount Awarded (USD Million), Since 2010

- Figure 7.3 Grant Analysis: Distribution by Administering Institute Center

- Figure 7.4 Grant Analysis: Distribution by Support Period

- Figure 7.5 Grant Analysis: Distribution by Type of Grant Application

- Figure 7.6 Grant Analysis: Distribution by Purpose of Grant Award

- Figure 7.7 Grant Analysis: Distribution by Activity Code

- Figure 7.8 Word Cloud Analysis: Emerging Focus Areas

- Figure 7.9 Popular NIH Departments: Distribution by Number of Grants

- Figure 7.10 Prominent Program Officers: Distribution by Number of Grants

- Figure 7.11 Popular Recipient Organizations: Distribution by Number of Grants

- Figure 8.1 Publication Analysis: Cumulative Year-wise Trend, Since 2010

- Figure 8.2 Word Cloud Analysis: Emerging Focus Areas

- Figure 8.3 Publication Analysis: Distribution by Target Therapeutic Area

- Figure 8.4 Leading Authors: Distribution by Number of Publications

- Figure 8.5 Key Journals: Distribution by Number of Publications

- Figure 9.1 Patent Analysis: Distribution by Publication Year

- Figure 9.2 Patent Analysis: Distribution by Type of Patent

- Figure 9.3 Patent Analysis: Distribution by Geographical Location

- Figure 9.4 Patent Analysis: Distribution by Patent Age

- Figure 9.5 Patent Analysis: Distribution by CPC Symbols

- Figure 9.6 Word Cloud Analysis: Emerging Focus Areas

- Figure 9.7 Leading Patent Assignees: Distribution by Number of Patents

- Figure 9.8 Leading Industry Players: Distribution by Number of Patents

- Figure 9.9 Leading Non-Industry Players: Distribution by Number of Patents

- Figure 9.10 Patent Analysis: Distribution by Patent Benchmarking

- Figure 9.11 Patent Analysis: Distribution by Patent Valuation

- Figure 10.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2015

- Figure 10.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 10.3 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Fusion Molecule

- Figure 10.4 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partner

- Figure 10.5 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Partner

- Figure 10.6 Most Active Players: Distribution by Number of Partnerships

- Figure 10.7 Partnerships and Collaborations: Regional Distribution

Figure 10.7.1 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 11.1 Global Fc Fusion Therapeutics Market, Till 2035 (USD Million)

- Figure 11.2 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Target Indication (USD Million)

- Figure 11.3 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Type of Fusion Molecule (USD Million)

- Figure 11.4 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Type of Therapy (USD Million)

- Figure 11.5 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Route of Administration (USD Million

- Figure 11.6 Global Fc Fusion Therapeutics Market, Till 2035: Distribution by Geography (USD Million)

- Figure 11.7 ABP 938: Sales Forecast, Till 2035 (USD Million)

- Figure 11.8 Alprolix(R): Sales Forecast, Till 2035 (USD Million)

- Figure 11.9 AnBaiNuo(R): Sales Forecast, Till 2035 (USD Million)

- Figure 11.10 Arcalyst(R): Sales Forecast, Till 2035 (USD Million)

- Figure 11.11 BIVV001: Sales Forecast, Till 2035 (USD Million)

- Figure 11.12 CD24Fc: Sales Forecast, Till 2035 (USD Million)

- Figure 11.13 Eloctate(R): Sales Forecast, Till 2035 (USD Million)

- Figure 11.14 Eylea(TM): Sales Forecast, Till 2035 (USD Million)

- Figure 11.15 FRSW107: Sales Forecast, Till 2035 (USD Million)

- Figure 11.16 KN035: Sales Forecast, Till 2035 (USD Million)

- Figure 11.17 KN046: Sales Forecast, Till 2035 (USD Million)

- Figure 11.18 Lumitin(R): Sales Forecast, Till 2035 (USD Million)

- Figure 11.19 Reblozyl(R): Sales Forecast, Till 2035 (USD Million)

- Figure 11.20 RyzneutaTM: Sales Forecast, Till 2035 (USD Million)

- Figure 11.21 Strensiq(R): Sales Forecast, Till 2035 (USD Million)

- Figure 11.21 Telitacicept: Sales Forecast, Till 2035 (USD Million)

- Figure 12.1 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Phase of Development

- Figure 12.2 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Target Disease Indication

- Figure 12.3 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Therapeutic Area

- Figure 12.4 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Type of Fc Engineering

- Figure 12.5 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Impact of Fc Engineering

- Figure 12.6 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Route of Administration

- Figure 12.7 Fc Protein Engineered and Glycoengineered Antibodies: Analysis by Type of Therapy

- Figure 12.8 Fc Protein Engineered and Glycoengineered Antibodies Developers: Analysis by Year of Establishment

- Figure 12.9 Fc Protein Engineered and Glycoengineered Antibodies Developers Analysis by Company Size

- Figure 12.10 Fc Protein Engineered and Glycoengineered Antibodies Developers Analysis by Location of Headquarters

- Figure 13.1 Concluding Remarks: Overall market Landscape

- Figure 13.2 Concluding Remarks: Clinical Trial Analysis

- Figure 13.3 Concluding Remarks: Academic Grants Analysis

- Figure 13.4 Concluding Remarks: Publication Analysis

- Figure 13.5 Concluding Remarks: Patent Analysis

- Figure 13.6 Concluding Remarks: Partnerships and Collaborations

- Figure 13.7 Concluding Remarks: Market Forecast