|

市场调查报告书

商品编码

1771308

製造执行系统市场:行业趋势和全球预测 - 依部署类型、最终用户和主要区域Manufacturing Execution System Market: Industry Trends and Global Forecasts - Distribution by Type of Deployment, Type of End-User and Key Geographical Regions |

||||||

全球製造执行系统市场:概览

预计到2035年,全球製造执行系统市场规模将从目前的39.9亿美元成长至204.6亿美元,预测期内年复合成长率为 16.02%。

市场区隔包括按以下参数细分的市场规模和市场机会:

部署类型

- 云端

- 企业资料中心

- 混合云

- 本地部署

最终使用者

- 生命科学/生技公司

- 医疗器材供应商

- 製药公司其他

主要地区

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和北非

全球製造执行系统市场:成长与趋势

多年来,医疗保健产业取得了显着成长,製造商必须采用新技术和工具,才能在不断变化的市场格局中保持竞争力。製造执行系统在医疗保健产业获得长期竞争优势方面发挥关键作用。製造执行系统是一个动态资讯系统,可以连接、监控和同步复杂製造作业中的各种流程。 MES系统可以提高工厂的生产力和效率,同时让整个製造流程更加灵活和敏捷。它们还简化了遵守法规指南的流程,使医疗保健公司更容易在製造过程中保持高品质标准。

近年来,许多医疗保健产业的利害关係人积极致力于将製造执行系统融入其生产线。此外,该领域的公司整合物联网(IoT)和人工智慧(AI)等先进技术,以收集和分析来自各种来源的大量资料,以洞察、预测和行动的形式创造价值。随着医疗保健产业转向製造执行系统,在生产线上做出资料驱动的决策,未来的工业流程有望实现更高的效率和更好的成长机会。

全球製造执行系统市场:关键洞察

本报告深入探讨了全球製造执行系统市场的现状,并识别了该行业的潜在成长机会。主要调查结果包括:

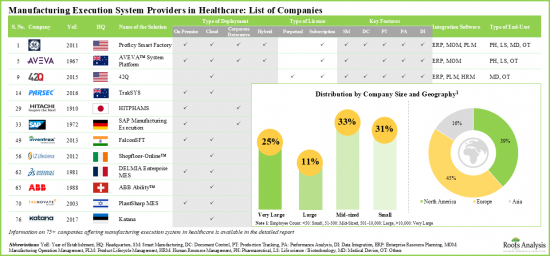

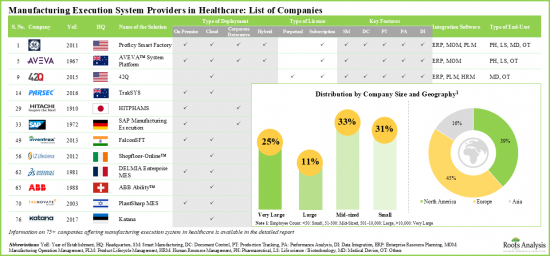

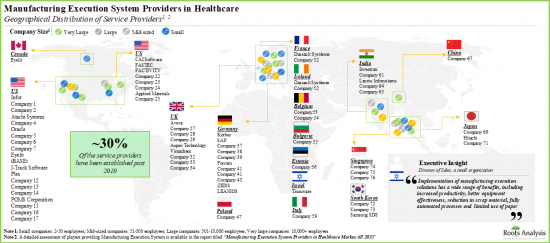

- 目前,全球超过 75 家公司声称提供製造执行系统(MES),用于监控、追踪和控制医疗保健产业的生产流程。

- 利害关係人透过各种授权模式,为製药、生命科学/生物技术和医疗器材产业提供与多种软体整合的MES。

- 超过 85%的MES 供应商以订阅模式提供服务,医疗器材产业成为此类服务的主要最终用户。

- ERP 和 PLM 已成为最突出的整合软体,近 50%的利害关係人提供与多种软体整合的MES。

- 近 15%的利害关係人声称向所有最终用户提供 MES,其中一些主要的例子包括 Atachi Systems、Dassault Systemes、Epicor、GE Digital、Infor、Tulip 等。

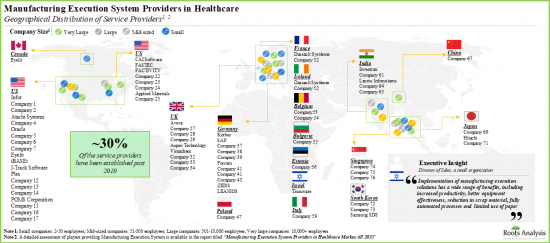

- 为了满足全球客户不断变化的需求,利害关係人向不同的地区扩张。

- 利害关係人日益成长的兴趣也体现在合作活动的增加上,事实上,过去两年联盟数量创历史新高。

- 为了建立竞争优势,製造执行系统供应商积极升级现有能力,以进一步增强各自的服务/产品。

- 专有的价值创造框架重点介绍了该领域新兴参与者必须整合的关键工具和技术,以增强其MES产品组合。

- 预计未来十年市场将以超过16%的健康速度成长,机会将遍布不同的部署类型、最终用户和不同地区。

全球製造执行系统市场:关键细分市场

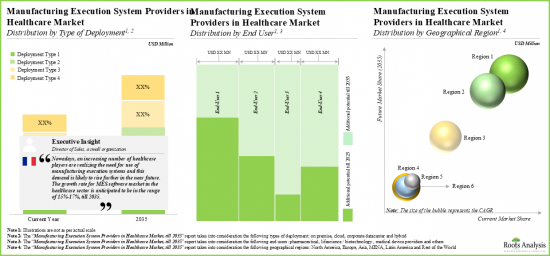

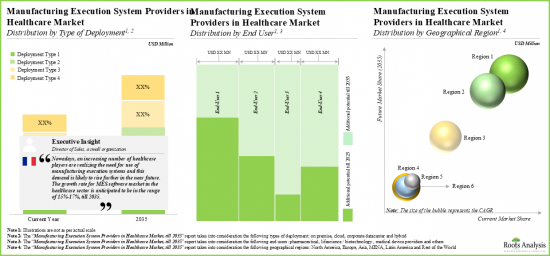

根据部署类型,市场分为云端部署、企业资料中心部署、混合部署和本地部署。目前,由于对基于云端的MES解决方案的需求不断成长,云端部署占据全球製造执行系统市场的最大占有率(约69%)。然而,预计在预测期内,混合部署市场的年复合成长率将更高。

根据最终用户类型,市场细分为生命科学/生技公司、医疗设备提供者、製药公司和其他。目前,医疗器材供应商占据製造执行系统(MES)市场最高占有率(约 51%)。此外,生命科学/生物技术公司由于高度依赖 MES 辅助批量生产管理、物料和产品的追踪和追溯,其年复合成长率可能相对较高。

根据主要地区,市场细分为北美、欧洲、亚太地区、中东和非洲、拉丁美洲以及世界其他地区。目前,欧洲(约 41%)在製造执行系统市场占据主导地位,占据最大的收入占有率。然而,亚太地区市场预计在预测期内的年复合成长率将更高,达到 16.8%。

参与製造执行系统市场的公司范例

- Andea

- Critical Manufacturing

- Dassault Systemes

- GE Digital

- Infor

- Korber

- Rockwell Automation

本报告调查製造执行系统市场,提供市场概述,以及依部署类型、最终用户和地区的趋势,和参与市场的公司简介。

目录

第1章 简介

第2章 执行摘要

第3章 简介

- 製造执行系统概述

- 製造执行系统的核心功能

- 製造执行系统的实施模型

- 製造执行系统所带来的优势

- 製造执行系统面临的挑战

- 为不同业务整合製造执行系统

- 结论

第4章 市场格局

第4章 医疗保健领域的製造执行系统提供者:市场概览

- 製造执行系统清单医疗健康领域的执行系统提供者

- 依成立年份分析

- 依公司规模分析

- 依总部位置分析

- 依部署类型分析

- 依软体整合分析

- 依许可证类型分析

- 依最终使用者类型分析

- 依关键功能分析

- 依提供的服务类型分析

- 依照所获得的品质认证分析

第5章 关键洞察

第6章 合作伙伴关係与协作

第7章 竞争分析

- 医疗健康领域的製造执行系统提供者:竞争分析

- 假设和关键参数

- 研究方法

- 投资组合实力基准测试

- 合作伙伴活动基准测试

- 竞争分析:超大型公司

- 竞争分析:大型公司

- 竞争分析:中型公司

- 竞争分析:小型公司

第8章 公司简介

- Andea

- Critical Manufacturing

- Dassault Systemes

- GE Digital

- Infor

- Korber

- Rockwell Automation

第9章 价值创造架构:解决製造执行系统未满足需求的策略指南

- 医疗保健产业对製造业执行系统的未满足需求

- 关键假设与研究方法

- 关键工具与技术

- 创新程度及相关风险

- 结论

第10章 市场预测

- 关键假设及预测研究方法

- 预测的细分市场

- 医疗保健市场的製造执行系统提供者(~2035年)

- 医疗保健市场的製造执行系统提供者:依部署类型分析(~2035年)

- 医疗保健市场的製造执行系统提供者:依最终用户分析(~2035年)

- 医疗保健市场的製造执行系统提供者:依地区分析(~2035年)

第11章 高层洞察

第12章 附录1:附加图表

第13章 附录2:表格资料

第14章 附录3:公司列表

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET: OVERVIEW

As per Roots Analysis, the global manufacturing execution system market is estimated to grow from USD 3.99 billion in the current year to USD 20.46 billion by 2035, at a CAGR of 16.02% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Deployment

- Cloud

- Corporate Data Center

- Hybrid

- On Premise

Type of End-User

- Life Science / Biotechnology Companies

- Medical Device Providers

- Pharmaceutical Companies and Others

Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North Africa

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET: GROWTH AND TRENDS

Over the years, the healthcare industry has undergone substantial growth, making it essential for manufacturers to adopt new technologies and tools in order to remain relevant and competitive in the evolving market landscape. Manufacturing execution systems play a crucial role in achieving long term competitive advantages in the healthcare industry. Manufacturing execution system is a dynamic information system that connects, monitors, and synchronizes various processes of complex manufacturing processes. MES system enables enhanced plant productivity and efficiency along with increased flexibility and agility across the manufacturing processes. It also simplifies the process of complying with regulatory guidelines and facilitates healthcare companies in maintaining high quality standards during the production process.

In recent years, several healthcare stakeholders have actively undertaken initiatives to incorporate manufacturing execution systems into their production lines. In addition, players engaged in this domain are integrating advanced technologies, including internet of thing (IOT) and artificial intelligence (AI) to collect and analyze large volume of data from various sources and to produce value in the form of insights, predictions, and actions. With the healthcare industry turning towards manufacturing execution systems to make data-driven decisions about their production lines, the future of industrial processes promises greater efficiency and better opportunities for growth.

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET: KEY INSIGHTS

The report delves into the current state of the global manufacturing execution system market and identifies potential growth opportunities within industry. Some key findings from the report include:

- At present, more than 75 companies across the globe claim to offer manufacturing execution systems (MES) in order to monitor, track and control the production process in the healthcare sector.

- Stakeholders are offering MES, integrated with numerous types of software, through different licensing models to serve the pharmaceutical, life science / biotechnology and medical device industries.

- Over 85% of the MES providers offer such services via subscription models; the medical device industry has emerged as a prominent end user for such services.

- ERP and PLM have emerged as the most prominent integration software; nearly 50% of stakeholders offer MES integrated with more than one type of software.

- Nearly 15% stakeholders claim to offer MES for all end users; prominent examples include Atachi Systems, Dassault Systemes, Epicor, GE Digital, Infor and Tulip.

- In order to cater to the evolving needs of clients across the world, stakeholders have established a presence across different regions; Europe has emerged as the key hub, featuring the highest number of MES providers.

- The growing interest of stakeholders is also evident from the rise in partnership activity; in fact, the maximum number of collaborations were inked in the last two years.

- In pursuit of building a competitive edge, manufacturing execution system providers are actively upgrading their existing capabilities to further enhance their respective service / product offerings.

- Our proprietary value creation framework highlights the key tools and technologies that emerging players in this domain must integrate in order to augment their MES portfolio.

- The market is expected to witness a healthy growth of over 16% in the coming decade; the opportunity is likely to be well distributed across various type of deployments, end users and different regions.

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET: KEY SEGMENTS

Cloud Segment Occupies the Largest Share of the Manufacturing Execution System Market

Based on the type of deployment, the market is segmented into cloud, corporate datacenter, hybrid and on-premises. At present, the cloud segment holds the maximum (~69%) share of the global manufacturing execution system market due to the growing demand for cloud-based MES solutions. However, the hybrid segment is expected to grow at a higher CAGR during the forecast period.

By Type of End-User, Life Science / Biotechnology Companies is the Fastest Growing Segment of the Global Manufacturing Execution System Market

Based on the type of end-user, the market is segmented into life science / biotechnology companies, medical device providers, pharmaceutical companies and others. Currently, the medical device providers segment captures the highest proportion (~51%) of the manufacturing execution system market. Further, the life science / biotechnology companies' segment is likely to grow at a relatively higher CAGR as the companies highly rely on MES that aid in managing batch production, tracking, and tracing materials and products.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, Latin America, and the rest of the world. Currently, Europe (~41%) dominates the manufacturing execution system market and accounts for the largest revenue share. However, the market in Asia-Pacific is expected to grow at a higher CAGR of 16.8% during the forecast period.

Example Players in the Manufacturing Execution System Market

- Andea

- Critical Manufacturing

- Dassault Systemes

- GE Digital

- Infor

- Korber

- Rockwell Automation

PRIMARY RESEARCH OVERVIEW

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews conducted with the following industry stakeholders:

- Chief Executive Officer, Company A

- Chief Marketing Officer, Company B

- Director of Sales, Company C

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global manufacturing execution system market, focusing on key market segments, including [A] type of deployment, [B] type of end-user and [C] key geographical regions.

- Market Landscape: A comprehensive evaluation of manufacturing execution system companies in the healthcare industry, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of deployment, [E] integrating MES software, [F] type of license, [G] type of end-user, [H] key features, [I] type of service(s) offered and [J] quality certifications received.

- Key Insights: An in-depth analysis of manufacturing execution system market trends using five schematic representations, including [A] a detailed analysis, based on year of establishment and region of headquarters, [B] an analysis, based on company size and type of deployment, [C] a comprehensive analysis, based on type of license and end-user, [D] an analysis, based on company size and key features, and [E] a 4D bubble chart comparing the players engaged in MES market.

- Partnerships and Collaborations: An in-depth analysis of the deals inked by stakeholders in this domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] key players (in terms of the number of partnerships signed) and [E] geographical distribution of partnership activity.

- Company Competitiveness Analysis: An insightful competitive analysis of manufacturing execution system providers in the healthcare industry, examining factors, such as [A] product portfolio strength, [B] competitive index and [C] partnership strength.

- Company Profiles: In-depth profiles of companies engaged in the manufacturing execution system industry, focusing on [A] company overview and [B] recent developments and an informed future outlook.

- Value Creation Framework: An insightful framework depicting the implementation of several advanced tools and technologies, such as [A] artificial intelligence, [B] cloud computing, [C] internet of things and [D] machine learning.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Overview of Manufacturing Execution Systems

- 3.2. Core Function of Manufacturing Execution Systems

- 3.3. Deployment Models of Manufacturing Execution Systems

- 3.4. Benefits Offered by Manufacturing Execution Systems

- 3.5. Challenges Associated with Manufacturing Execution Systems

- 3.6. Integration of Manufacturing Execution Systems for Different Operations

- 3.7. Concluding Remarks

4. MARKET LANDSCAPE

4.1. Manufacturing Execution System Providers in Healthcare: Market Overview

- 4.2. List of Manufacturing Execution System Providers in Healthcare

- 4.3. Analysis by Year of Establishment

- 4.4. Analysis by Company Size

- 4.5. Analysis by Location of Headquarters

- 4.6. Analysis by Type of Deployment

- 4.7. Analysis by Integrating Software

- 4.8. Analysis by Type of License

- 4.9. Analysis by Type of End User

- 4.10. Analysis by Key Features

- 4.11. Analysis by Type of Service(s) Offered

- 4.12. Analysis by Quality Certifications Received

5. KEY INSIGHTS

- 5.1. Analysis by Year of Establishment and Region of Headquarters

- 5.2. Analysis by Company Size and Type of Deployment

- 5.3. Analysis by Type of License and End User

- 5.4. Analysis by Company Size and Key Features

- 5.5. Analysis by Year of Establishment, Company Size, Type of Deployment and Quality Certifications Received (4D Bubble Chart)

6. PARTNERSHIPS AND COLLABORATIONS

- 6.1. Manufacturing Execution System Providers in Healthcare: Partnerships and Collaborations

- 6.2. Analysis by Year of Partnership

- 6.3. Analysis by Type of Partnership

- 6.4. Analysis by Year of Partnership and Type of Partnership

- 6.5. Analysis by Type of Partnership and Company Size

- 6.6. Key Players: Analysis by Number of Partnerships

- 6.7. Analysis by Type of Partner

- 6.8. Analysis by Country

- 6.9. Analysis by Region

- 6.10. Intercontinental and Intracontinental Deals

- 6.11. Analysis by Location of Headquarters of Partner

- 6.12. Analysis by Type of Partnership and Location of Headquarters of Partner

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Manufacturing Execution System Providers in Healthcare: Company Competitiveness Analysis

- 7.2. Assumptions and Key Parameters

- 7.3. Methodology

- 7.4. Benchmarking of Portfolio Strength

- 7.5. Benchmarking of Partnership Activity

- 7.6. Company Competitiveness Analysis: Very Large Players

- 7.7. Company Competitiveness Analysis: Large Players

- 7.8. Company Competitiveness Analysis: Mid-Sized Players

- 7.9. Company Competitiveness Analysis: Small Players

8. COMPANY PROFILES

- 8.1. Andea

- 8.1.1. Company Overview

- 8.1.2. Technology Portfolio

- 8.1.3. Recent Developments and Future Outlook

- 8.2. Critical Manufacturing

- 8.2.1. Company Overview

- 8.2.2. Technology Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Dassault Systemes

- 8.3.1. Company Overview

- 8.3.2. Technology Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. GE Digital

- 8.4.1. Company Overview

- 8.4.2. Technology Portfolio

- 8.4.3. Recent Developments and Future Outlook

- 8.5. Infor

- 8.5.1. Company Overview

- 8.5.2. Technology Portfolio

- 8.5.3. Recent Developments and Future Outlook

- 8.6. Korber

- 8.6.1. Company Overview

- 8.6.2. Technology Portfolio

- 8.6.3. Recent Developments and Future Outlook

- 8.7. Rockwell Automation

- 8.7.1. Company Overview

- 8.7.2. Technology Portfolio

- 8.7.3. Recent Developments and Future Outlook

9. VALUE CREATION FRAMEWORK: A STRATEGIC GUIDE TO ADDRESS UNMET NEED FOR MANUFACTURING EXECUTION SYSTEMS

- 9.1. Unmet Need for Manufacturing Execution Systems in the Healthcare Industry

- 9.2. Key Assumptions and Methodology

- 9.3. Key Tools and Technologies

- 9.3.1. Technology 1

- 9.3.2. Technology 2

- 9.3.3. Technology 3

- 9.3.4. Technology 4

- 9.4. Extent of Innovation versus Associated Risks

- 9.5. Concluding Remarks

10. MARKET FORECAST

- 10.1. Key Assumptions and Forecast Methodology

- 10.2. Forecasted Market Segments

- 10.3. Manufacturing Execution System Providers in Healthcare Market, Till 2035

- 10.4. Manufacturing Execution System Providers in Healthcare Market: Analysis by Type of Deployment, Till 2035

- 10.4.1. Manufacturing Execution System Providers in Healthcare Market for Cloud Solutions

- 10.4.2. Manufacturing Execution System Providers in Healthcare Market for Corporate Datacenter Solutions

- 10.4.3. Manufacturing Execution System Providers in Healthcare Market for Hybrid Solutions

- 10.4.4. Manufacturing Execution System Providers in Healthcare Market for On Premise Solutions

- 10.5. Manufacturing Execution System Providers in Healthcare Market: Analysis by Type of End User, Till 2035

- 10.5.1. Manufacturing Execution System Providers in Healthcare Market for Life science / Biotechnology Companies

- 10.5.2. Manufacturing Execution System Providers in Healthcare Market for Medical Device Providers

- 10.5.3. Manufacturing Execution System Providers in Healthcare Market for Pharmaceutical Companies

- 10.5.4. Manufacturing Execution System Providers in Healthcare Market for Other End Users

- 10.6. Manufacturing Execution System Providers in Healthcare Market: Analysis by Geography, Till 2035

- 10.6.1. Manufacturing Execution System Providers in Healthcare Market in North America, Till 2035

- 10.6.2. Manufacturing Execution System Providers in Healthcare Market in Europe, Till 2035

- 10.6.3. Manufacturing Execution System Providers in Healthcare Market in Asia, Till 2035

- 10.6.4. Manufacturing Execution System Providers in Healthcare Market in Latin America, Till 2035

- 10.6.5. Manufacturing Execution System Providers in Healthcare Market in MENA, Till 2035

- 10.6.6. Manufacturing Execution System Providers in Healthcare Market in Rest of the World, Till 2035

11. EXECUTIVE INSIGHTS

- 11.1. Company A

- 11.1.1. Company Snapshot

- 11.1.2. Interview Transcript: Chief Executive Officer

- 11.2. Company B

- 11.2.1. Company Snapshot

- 11.2.2. Interview Transcript: Chief Marketing Officer

- 11.3. Company C

- 11.3.1. Company Snapshot

- 11.3.2. Interview Transcript: Director of Sales

12. APPENDICES I: OTHER FIGURES

12.1. Market Overview

- 12.2. Key Insights

- 12.3. Partnerships and Collaborations

- 12.4. List of Figures

13. APPENDICES II: TABULATED DATA

14. APPENDICES III: LIST OF COMPANIES

List of Tables

- Table 4.1. Manufacturing Execution System Providers in Healthcare: Information on Year of Establishment, Headquarters, Company Size and Name of Solution

- Table 4.2. Manufacturing Execution System Providers in Healthcare: Information on Type of Deployment, Integrating Software, Type of License, Type of End User, Key Features, Type of Service(s) Offered and Quality Certifications Received

- Table 4.3. Manufacturing Execution System Providers in Healthcare: Key Features, Type of Service(s) Offered and Quality Certifications Received

- Table 6.1. Manufacturing Execution System Providers in Healthcare: Partnerships and Collaborations

- Table 13.1. Manufacturing Execution System Providers in Healthcare Distribution by Year of Establishment

- Table 13.2. Manufacturing Execution System Providers in Healthcare: Distribution by Company Size

- Table 13.3. Manufacturing Execution System Providers in Healthcare: Distribution by Location of Headquarters

- Table 13.4. Manufacturing Execution System Providers in Healthcare: Distribution by Type of Deployment

- Table 13.5. Manufacturing Execution System Providers in Healthcare: Distribution by Integrating Software

- Table 13.6. Manufacturing Execution System Providers in Healthcare: Distribution by Type of License

- Table 13.7. Manufacturing Execution System Providers in Healthcare: Distribution by Type of End User

- Table 13.8. Manufacturing Execution System Providers in Healthcare: Distribution by Key Features

- Table 13.9. Manufacturing Execution System Providers in Healthcare: Distribution by Type of Service(s) Offered

- Table 13.10. Partnerships and Collaborations: Distribution by Year of Partnership

- Table 13.11. Partnerships and Collaborations: Distribution by Type of Partnership

- Table 13.12. Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 13.13. Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Table 13.14. Partnerships and Collaborations: Key Players by Number of Partnerships

- Table 13.15. Partnerships and Collaborations: Distribution by Type of Partner

- Table 13.16. Partnerships and Collaborations: Distribution by Country

- Table 13.17. Partnerships and Collaborations: Distribution by Region

- Table 13.18. Intercontinental and Intracontinental Deals

- Table 13.19. Manufacturing Execution System Providers in Healthcare Market: Distribution by Type of Deployment, Till 2035

- Table 13.20. Manufacturing Execution System Providers in Healthcare Market for Cloud Solutions (USD Billion)

- Table 13.21. Manufacturing Execution System Providers in Healthcare Market for Corporate Datacenter Solutions (USD Billion)

- Table 13.22. Manufacturing Execution System Providers in Healthcare Market for Hybrid Solutions (USD Billion)

- Table 13.23. Manufacturing Execution System Providers in Healthcare Market for On Premise Solutions (USD Billion)

- Table 13.24. Manufacturing Execution System Providers in Healthcare Market: Distribution by Type of End User, Till 2035

- Table 13.25. Manufacturing Execution System Providers in Healthcare Market for Life science / Biotechnology Companies (USD Billion)

- Table 13.26. Manufacturing Execution System Providers in Healthcare Market for Medical Device Providers (USD Billion)

- Table 13.27. Manufacturing Execution System Providers in Healthcare Market for Pharmaceutical Companies (USD Billion)

- Table 13.28. Manufacturing Execution System Providers in Healthcare Market for Other End Users (USD Billion)

- Table 13.29. Manufacturing Execution System Providers in Healthcare Market: Distribution by Geography, Till 2035

- Table 13.30. Manufacturing Execution System Providers in Healthcare Market in North America, Till 2035

- Table 13.31. Manufacturing Execution System Providers in Healthcare Market in Europe, Till 2035

- Table 13.32. Manufacturing Execution System Providers in Healthcare Market in Asia, Till 2035

- Table 13.33. Manufacturing Execution System Providers in Healthcare Market in Latin America, Till 2035

- Table 13.34. Manufacturing Execution System Providers in Healthcare Market in MENA, Till 2035

- Table 13.35. Manufacturing Execution System Providers in Healthcare Market in Rest of the World, Till 2035

List of Figures

- Figure 3.4. Integration of Manufacturing Execution Systems for Different Operations

- Figure 4.1. Manufacturing Execution System Providers in Healthcare Distribution by Year of Establishment

- Figure 4.2. Manufacturing Execution System Providers in Healthcare: Distribution by Company Size

- Figure 4.3. Manufacturing Execution System Providers in Healthcare: Distribution by Location of Headquarters

- Figure 4.4. Manufacturing Execution System Providers in Healthcare: Distribution by Type of Deployment

- Figure 4.5. Manufacturing Execution System Providers in Healthcare: Distribution by Integrating Software

- Figure 4.6. Manufacturing Execution System Providers in Healthcare: Distribution by Type of License

- Figure 4.7. Manufacturing Execution System Providers in Healthcare: Distribution by Type of End User

- Figure 4.8. Manufacturing Execution System Providers in Healthcare: Distribution by Key Features

- Figure 4.9. Manufacturing Execution System Providers in Healthcare: Distribution by Type of Service(s) Offered

- Figure 5.1. Key Insights: Distribution by Year of Establishment and Region of Headquarters

- Figure 5.2. Key Insights: Distribution by Company Size and Type of Deployment

- Figure 5.3. Key Insights: Distribution by Type of License and End User

- Figure 5.4. Key Insights: Distribution by Company Size and Key Features

- Figure 5.5. Key Insights: Distribution by Year of Establishment, Company Size, Type of Deployment and Quality Certifications Received

- Figure 6.1. Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 6.2. Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 6.3. Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 6.4. Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Figure 6.5. Partnerships and Collaborations: Key Players by Number of Partnerships

- Figure 6.6. Partnerships and Collaborations: Distribution by Type of Partner

- Figure 6.7. Partnerships and Collaborations: Distribution by Country

- Figure 6.8. Partnerships and Collaborations: Distribution by Region

- Figure 6.9. Intercontinental and Intracontinental Deals

- Figure 7.1. Company Competitiveness Analysis: Benchmarking of Portfolio Strength

- Figure 7.2. Company Competitiveness Analysis: Benchmarking of Partnership Activity

- Figure 7.3. Company Competitiveness Analysis: Very Large Players

- Figure 7.4. Company Competitiveness Analysis: Large Players

- Figure 7.5. Company Competitiveness Analysis: Mid-Sized Players

- Figure 7.6. Company Competitiveness Analysis: Small Players

- Figure 9.1. Value Creation Framework: Trends in Research Activity related to Integration of Key Tools and Technologies with Manufacturing Execution System

- Figure 9.2. Value Creation Framework: Trends in Intellectual Property related to Integration of Key Tools and Technologies with Manufacturing Execution System

- Figure 9.3. Value Creation Framework: Extent of Innovation versus Associated Risk Matrix

- Figure 9.4. Value Creation Framework: Comparison of Key Tools / Technologies

- Figure 10.1. Manufacturing Execution System Providers in Healthcare Market: Distribution by Type of Deployment, Till 2035

- Figure 10.2. Manufacturing Execution System Providers in Healthcare Market for Cloud Solutions (USD Billion)

- Figure 10.3. Manufacturing Execution System Providers in Healthcare Market for Corporate Datacenter Solutions (USD Billion)

- Figure 10.4. Manufacturing Execution System Providers in Healthcare Market for Hybrid Solutions (USD Billion)

- Figure 10.5. Manufacturing Execution System Providers in Healthcare Market for On Premise Solutions (USD Billion)

- Figure 10.6. Manufacturing Execution System Providers in Healthcare Market: Distribution by Type of End User, Till 2035

- Figure 10.7. Manufacturing Execution System Providers in Healthcare Market for Life science / Biotechnology Companies (USD Billion)

- Figure 10.8. Manufacturing Execution System Providers in Healthcare Market for Medical Device Providers (USD Billion)

- Figure 10.9. Manufacturing Execution System Providers in Healthcare Market for Pharmaceutical Companies (USD Billion)

- Figure 10.10. Manufacturing Execution System Providers in Healthcare Market for Other End Users (USD Billion)

- Figure 10.11. Manufacturing Execution System Providers in Healthcare Market: Distribution by Geography, Till 2035

- Figure 10.12. Manufacturing Execution System Providers in Healthcare Market in North America, Till 2035

- Figure 10.13. Manufacturing Execution System Providers in Healthcare Market in Europe, Till 2035

- Figure 10.14. Manufacturing Execution System Providers in Healthcare Market in Asia, Till 2035

- Figure 10.15. Manufacturing Execution System Providers in Healthcare Market in Latin America, Till 2035

- Figure 10.16. Manufacturing Execution System Providers in Healthcare Market in MENA, Till 2035

- Figure 10.17. Manufacturing Execution System Providers in Healthcare Market in Rest of the World, Till 2035