|

市场调查报告书

商品编码

1813199

水处理的全球市场(~2035年):各处理类型,各用途类型,各终端用户,各投资类型,各类型企业,各地区,产业趋势,预测Water Treatment Market, Till 2035: Distribution by Type of Treatment, Type of Application, End-User, Type of Investment, Type of Enterprise, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

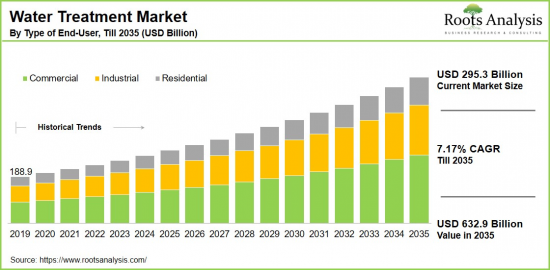

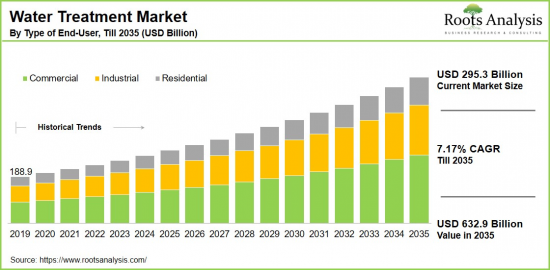

预计到 2035 年,全球水处理市场规模将从目前的 2,953 亿美元增长至 6,329 亿美元,预测期内的复合年增长率为 7.17%。

水处理市场:成长与趋势

根据联合国 "世界水资源发展报告" ,全球近一半人口每年至少面临一次缺水。这凸显了水处理的重要性,水处理已被证明是各行各业净化水质的有效方法。

水处理通常可以去除污染物和杂质,从而生产出适合饮用、工业用途和环境保护的水。对高效净化方法日益增长的需求推动了高性能吸附剂在工业和市政水处理中的应用。

为了避免过滤和脱盐系统结垢,通常使用阻垢剂来提高薄膜的耐久性和製程效率。水处理的主要优点包括改善水质、延长设备寿命、提高运作效率、符合卫生标准。重要的是,废水管理技术的快速发展和社会意识的不断增强,正在推动主要产业迅速采用水处理技术。令人惊讶的是,超过20亿人无法获得安全的饮用水。

随着数位技术的进步和全球向创新水处理解决方案的转变,水处理市场正成为增加安全用水的重要组成部分。尖端膜技术等创新技术可提高污染物去除率,同时降低能耗。此外,使用活性碳和石墨烯等材料的碳基净化技术可以有效捕捉各种污染物,包括微量污染物和有机物。因此,由于水处理技术的持续进步,例如模组化水处理系统的整合以及海水淡化市场的分析,预计预测期内水处理市场将大幅成长。

本报告研究了全球水处理市场,并提供市场规模估算、机会分析、竞争格局和公司概况等资讯。

目录

章节1 报告概要

第1章 序文

第2章 调查手法

第3章 市场动态

第4章 宏观经济指标

章节2 定性知识和见识

第5章 摘要整理

第6章 简介

第7章 法规Scenario

章节3 市场概要

第8章 主要企业整体性资料库

第9章 竞争情形

第10章 閒置频段的分析

第11章 企业的竞争力的分析

第12章 水处理市场上Start-Ups生态系统

章节IV:企业简介

第13章 企业简介

- 章概要

- 3M

- Acciona

- American Water

- Aquatech International

- ASIO

- BioMicrobics

- DuPont

- Ecolab

- Evoqua Water Technologies

- Kemira

- Kurita Water

- Pentair

- Suez

- Thermax Global

- Trojan Technologies

- Veolia

- Voltas

- Xylem

章节5 市场趋势

第14章 大趋势的分析

第15章 未满足需求的分析

第16章 专利分析

第17章 近几年的发展

章节6 市场机会分析

第18章 全球水处理市场

第19章 市场机会:各处理类型

第20章 市场机会:各用途类型

第21章 市场机会:各终端用户

第22章 市场机会:各投资类型

第23章 市场机会:各类型企业

第24章 北美的水处理市场机会

第25章 欧洲的水处理市场机会

第26章 亚洲的水处理市场机会

第27章 中东·北非(MENA)的水处理市场机会

第28章 南美的水处理市场机会

第29章 其他地区的水处理市场机会

第30章 市场集中的分析:各主要企业

第31章 邻近市场的分析

章节7 策略性工具

第32章 重要的胜利策略

第33章 波特的五力分析

第34章 SWOT的分析

第35章 价值链的分析

第36章 Roots的策略性建议

章节8 其他独家知识和见识

第37章 初步研究结果

第38章 报告的结论

章节9 附录

Water Treatment Market Overview

As per Roots Analysis, the global water treatment market size is estimated to grow from USD 295.3 billion in the current year to USD 632.9 billion by 2035, at a CAGR of 7.17% during the forecast period, till 2035.

The opportunity for water treatment market has been distributed across the following segments:

Type of Treatment

- Membrane Bioreactor (MBR)

- Micro-Filtration (MF)

- Nano / Ultra Filtration (NF/UF)

- Preliminary Treatment

- Reverse Osmosis (RO)

- Sludge treatment

- Others

Type of Application

- Waste Water Treatment

- Zero Liquid Discharge

- Others

End-Users

- Commercial

- Industrial

- Residential

Type of Investment

- Government-Funded Projects

- Private Sector Investments

- Public-Private Partnerships

Type of Enterprise

- Large

- Small and Medium Enterprise

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Water Treatment Market: Growth and Trends

According to the UN World Water Development report, almost half of the world's population faces water scarcity at least once each year. This highlights the importance of water treatment, which has proven to be an effective method for purifying water across different sectors.

Water treatment typically operates by eliminating contaminants and impurities, thereby making water suitable for drinking, industrial purposes, and environmental preservation. The rising demand for efficient purification methods is propelling the use of high-performance adsorbents in both industrial and municipal water treatment settings.

To avoid fouling in filtration and desalination systems, antiscalants are commonly utilized to improve membrane durability and process effectiveness. Some of the primary benefits of water treatment include better water quality, prolonging equipment life, boosting operational efficiency, and adhering to health standards. It's important to note that the adoption of water treatment in key industries is increasing rapidly due to the swift advancement of wastewater management technologies and heightened public awareness. Remarkably, over 2 billion individuals lack access to safe drinking water services.

The water treatment market is becoming an essential element in the global transition toward innovative water treatment solutions and digital advancements aimed at achieving greater availability of safe water. Innovations, such as cutting-edge membrane technologies, improve contaminant removal while lowering energy usage. Additionally, carbon-based purification techniques employ materials like activated carbon and graphene to efficiently capture a diverse array of pollutants, including micropollutants and organic substances. As a result, with ongoing technological progress in water treatment, including the integration of modular water treatment systems and analyses of the desalination market, the water treatment market is anticipated to experience significant growth during this forecast period.

Water Treatment Market: Key Segments

Market Share by Type of Treatment

Based on type of water treatment, the global water treatment market is segmented into membrane bioreactor (MBR), micro-filtration (MF), nano/ultra filtration (NF/UF), preliminary treatment, reverse osmosis (RO), sludge management techniques and others. According to our estimates, currently, the preliminary treatment segment captures the majority of the market share, owing to its essential function in improving the efficiency and effectiveness of subsequent treatment methods.

However, the reverse osmosis segment is expected to grow at a higher CAGR during the forecast period. This can be attributed to its efficiency in eliminating contaminants and its versatility in handling various water sources, such as seawater and wastewater.

Market Share by Type of Application

Based on type of application, the global water treatment market is segmented into wastewater treatment, zero liquid discharge and others. According to our estimates, currently, the wastewater treatment segment captures the majority of the market share. This growth can be attributed to pressing the requirement for municipalities to ensure access to safe drinking water and to address the growing amounts of biological wastewater resulting from rapid urbanization and population increases.

However, the zero liquid discharge segment is expected to grow at a higher CAGR during the forecast period. This growth can be ascribed to the rise in environmental regulations regarding water treatment and the increasing public awareness of the detrimental effects of wastewater, driving industries to implement sustainable water treatment solutions.

Market Share by End-Users

Based on end-users, the global water treatment market is segmented into commercial, industrial and residential. According to our estimates, currently, the commercial segment captures the majority of the market share. This growth can be attributed to the increasing urbanization, the development of commercial infrastructure, and a rise in corporate social responsibility initiatives.

Market Share by Type of Investment

Based on type of investment, the global water treatment market is segmented into government-funded projects, private sector investments and public-private partnerships. According to our estimates, currently, the private sector investments captures the majority of the market share. Additionally, this segment is expected to grow at a relatively higher CAGR during the forecast period. This can be attributed to the advancements in water treatment technologies that have significantly reduced costs, and the private sector tends to be more flexible and quick to adapt to market needs compared to government-funded projects.

Market Share by Type of Enterprise

Based on type of enterprise, the global water treatment market is segmented into large and small and medium enterprise. According to our estimates, currently, the large enterprise captures the majority of the market share. Additionally, this segment is expected to grow at a relatively higher CAGR during the forecast period. This can be attributed to their ability to invest in sophisticated water treatment technologies and equipment, leverage government support, achieve economies of scale, and foster business expansion.

Market Share by Geographical Regions

Based on geographical regions, the water treatment market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently North America captures the majority share of the market, owing to the rigorous environmental regulations, investments in technological innovations, and a surge in urbanization and population growth, all of which are driving the demand for clean water.

Additionally, the market in Asia is expected to grow at a higher CAGR during the forecast period. This growth can be linked to increasing urbanization and industrialization, government initiatives, investments in water treatment, rapid population growth, and rising energy needs in countries such as China and India.

Example Players in Water Treatment Market

- 3M

- Acciona

- American Water

- Aquatech International

- ASIO

- BioMicrobics

- DuPont

- Ecolab

- Evoqua Water Technologies

- Kemira

- Kurita Water

- Pentair

- Suez

- Thermax Global

- Trojan Technologies

- Veolia

- Voltas

- Xylem

Water treatment Market: Research Coverage

The report on the water treatment market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the water treatment market, focusing on key market segments, including [A] type of treatment, [B] type of application, [C] end-user, [D] type of investment, [E] type of enterprise, and [F] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the water treatment market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the water treatment market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] water treatment portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in water treatment industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the water treatment domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the water treatment market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the water treatment market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the water treatment market

Key Questions Answered in this Report

- How many companies are currently engaged in water treatment market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Water Treatment Market

- 6.2.1. Type of Water Treatment

- 6.2.2. Type of Component

- 6.2.3. Type of Capacity

- 6.2.4. Type of End-User

- 6.2.5. Type of Investment

- 6.2.6. Type of Enterprise

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Water Treatment: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE WATER TREATMENT MARKET

- 12.1. Water Treatment Market: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. 3M*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Acciona

- 13.4. American Water

- 13.5. Aquatech International

- 13.6. ASIO

- 13.7. BioMicrobics

- 13.8. DuPont

- 13.9. Ecolab

- 13.10. Evoqua Water Technologies

- 13.11. Kemira

- 13.12. Kurita Water

- 13.13. Pentair

- 13.14. Suez

- 13.15. Thermax Global

- 13.16. Trojan Technologies

- 13.17. Veolia

- 13.18. Voltas

- 13.19. Xylem

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL WATER TREATMENT MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Water Treatment Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF TREATMENT

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Water Treatment Market for Membrane Bioreactor (MBR): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Water Treatment Market for Micro-Filtration (MF): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Water Treatment Market for Nano/Ultra Filtration (NF/UF): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Water Treatment Market for Preliminary Treatment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Water Treatment Market for Reverse Osmosis (RO): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.11. Water Treatment Market for Sludge treatment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.12. Water Treatment Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.13. Data Triangulation and Validation

- 19.13.1. Secondary Sources

- 19.13.2. Primary Sources

- 19.13.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Water Treatment Market for Wastewater Treatment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Water Treatment Market for Zero Liquid Discharge: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Water Treatment Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

- 20.9.1. Secondary Sources

- 20.9.2. Primary Sources

- 20.9.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON END-USERS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Water Treatment Market for Commercial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Water Treatment Market for Industrial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Water Treatment Market for Residential: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Data Triangulation and Validation

- 21.9.1. Secondary Sources

- 21.9.2. Primary Sources

- 21.9.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF INVESTMENT

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Water Treatment Market for Government-Funded Projects: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Water Treatment Market for Private Sector Investments: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Water Treatment Market for Public-Private Partnerships: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.9. Data Triangulation and Validation

- 22.9.1. Secondary Sources

- 22.9.2. Primary Sources

- 22.9.3. Statistical Modeling

23. MARKET OPPORTUNITIES BASED ON TYPE OF ENTERPRISE

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Water Treatment Market for Large: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Water Treatment Market for Small and Medium Enterprise: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.8. Data Triangulation and Validation

- 23.8.1. Secondary Sources

- 23.8.2. Primary Sources

- 23.8.3. Statistical Modeling

24. MARKET OPPORTUNITIES WATER TREATMENT IN NORTH AMERICA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Water Treatment Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Water Treatment Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Water Treatment Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Water Treatment Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Water Treatment Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR WATER TREATMENT IN EUROPE

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Water Treatment Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Water Treatment Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Water Treatment Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Water Treatment Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Water Treatment Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Water Treatment Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Water Treatment Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. Water Treatment Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. Water Treatment Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.9. Water Treatment Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.10. Water Treatment Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.11. Water Treatment Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.12. Water Treatment Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.13. Water Treatment Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.14. Water Treatment Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.15. Water Treatment Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR WATER TREATMENT IN ASIA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Water Treatment Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Water Treatment Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Water Treatment Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Water Treatment Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Water Treatment Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Water Treatment Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Water Treatment Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR WATER TREATMENT IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Water Treatment Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Water Treatment Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 27.6.2. Water Treatment Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Water Treatment Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. Water Treatment Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. Water Treatment Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. Water Treatment Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.7. Water Treatment Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.8. Water Treatment Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR WATER TREATMENT IN LATIN AMERICA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Water Treatment Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. Water Treatment Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. Water Treatment Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. Water Treatment Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.4. Water Treatment Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.5. Water Treatment Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.6. Water Treatment Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET OPPORTUNITIES FOR WATER TREATMENT IN REST OF THE WORLD

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Revenue Shift Analysis

- 29.4. Market Movement Analysis

- 29.5. Penetration-Growth (P-G) Matrix

- 29.6. Water Treatment Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.1. Water Treatment Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.2. Water Treatment Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.3. Water Treatment Market in Other Countries

- 29.7. Data Triangulation and Validation

30. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 30.1. Leading Player 1

- 30.2. Leading Player 2

- 30.3. Leading Player 3

- 30.4. Leading Player 4

- 30.5. Leading Player 5

- 30.6. Leading Player 6

- 30.7. Leading Player 7

- 30.8. Leading Player 8

31. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

32. KEY WINNING STRATEGIES

33. PORTER'S FIVE FORCES ANALYSIS

34. SWOT ANALYSIS

35. VALUE CHAIN ANALYSIS

36. ROOTS STRATEGIC RECOMMENDATIONS

- 36.1. Chapter Overview

- 36.2. Key Business-related Strategies

- 36.2.1. Research & Development

- 36.2.2. Product Manufacturing

- 36.2.3. Commercialization / Go-to-Market

- 36.2.4. Sales and Marketing

- 36.3. Key Operations-related Strategies

- 36.3.1. Risk Management

- 36.3.2. Workforce

- 36.3.3. Finance

- 36.3.4. Others