|

市场调查报告书

商品编码

1821507

抗体发现市场 - 服务和平台:2035年前的产业趋势和全球预测 - 抗体发现阶段,各方法,性质,各抗体类型,各治疗领域,各终端用户,各地区Antibody Discovery Market - Focus on Services and Platforms: Industry Trends and Global Forecasts, till 2035 - Distribution by Antibody Discovery Step, Method, Nature of, Type of Antibody, Therapeutic Area, End-user and Geographical Regions |

||||||

抗体发现市场:概览

预计到 2035 年,抗体发现市场规模将从目前的 24 亿美元增长至 66 亿美元,预测期内复合年增长率达 10.5%。

本市场细分按以下参数细分了市场规模与机会:

抗体发现步骤

- 标靶药物生成

- 先导化合物筛选

- 先导化合物优化

抗体发现方法

- 基于杂交瘤的方法

- 噬菌体展示文库方法

- 基因改造动物方法

- 基于酵母展示的方法方法

- 基于单细胞的方法

- 其他

抗体的性质

- 人抗体

- 人体化抗体

- 嵌合抗体

- 鼠标抗体

治疗领域

- 肿瘤学的疾病

- 免疫疾病

- 感染疾病领域

- 循环系统疾病

- 神经疾病

- 其他的疾病

抗体类型

- 单株抗体

- 二特异性抗体

- 抗体药物复合体

- 免疫复合体

- 其他的抗体

终端用户

- 公司内部部门

- 受託研究机构

地区

- 北美

- 欧洲

- 亚太地区

- 中东·北非

- 南美

抗体发现服务市场成长与趋势

抗体在辨识和中和外来物质方面发挥着至关重要的作用。由于其特异性高、安全性好等诸多优势,这些分子已成为极具前景的选择,尤其是在治疗癌症、自体免疫疾病和传染病方面。抗体目前是最大的生物製剂类别,迄今已有超过80个分子获得批准,超过200个分子处于临床前/发现阶段。

儘管已获得多项批准,但在设计、生产和临床应用的多个阶段仍存在各种尚未解决的挑战。鑑于现代药物开发的复杂性,许多公司正将外包作为优化研究工作的策略解决方案。这种预期转变的原因多种多样,包括缩短研发週期、降低与试验失败相关的财务风险以及加速工作流程。目前,约有 125 家公司提供各种抗体发现服务。

人工智慧和机器学习的进步是该领域的关键,它们有助于预测抗体-抗原相互作用,并提高先导化合物的鑑定效率。

在这些发展的推动下,抗体发现市场预计将在未来几年蓬勃发展,惠及众多持续推动该领域创新的利害关係人。

本报告深入探讨了抗体发现市场的现状,并识别了该行业的潜在成长机会。报告的主要发现包括:

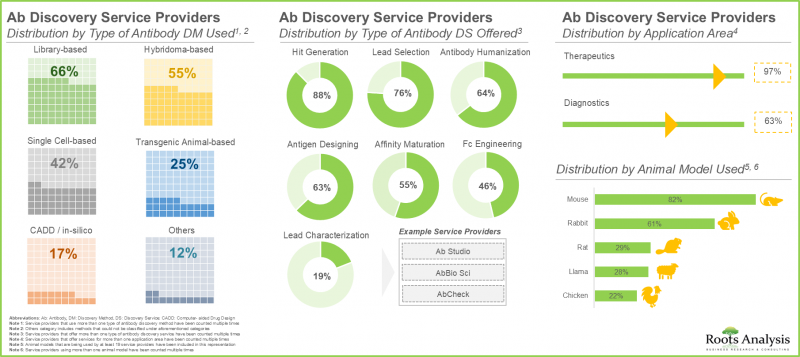

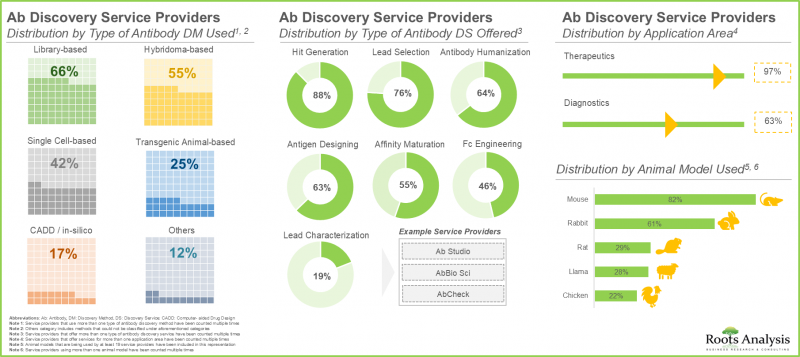

- 目前,全球近 125 家公司声称提供客製化服务以支援抗体发现相关活动,其中大多数公司位于北美。

- 相当大比例的服务提供者(88%)提供抗体发现服务,其中57%采用基于文库的方法来支持治疗性抗体的发现。

- 目前,市面上有近265种抗体发现技术,透过加速高特异性抗体的鑑定和开发,彻底改变了抗体发现领域。

- 其中45%支持单株抗体的发现。

- 利害关係人正积极增强现有能力,提升竞争力,以在抗体发现服务领域取得优势。

- 为了获得竞争优势,利害关係人正在积极创新和开发新的抗体发现技术/平台,以支持多种类型抗体的发现。

- 60% 的合作协议是在 2021 年之后签署的,其中技术/产品授权协议成为最主要的合作模式。

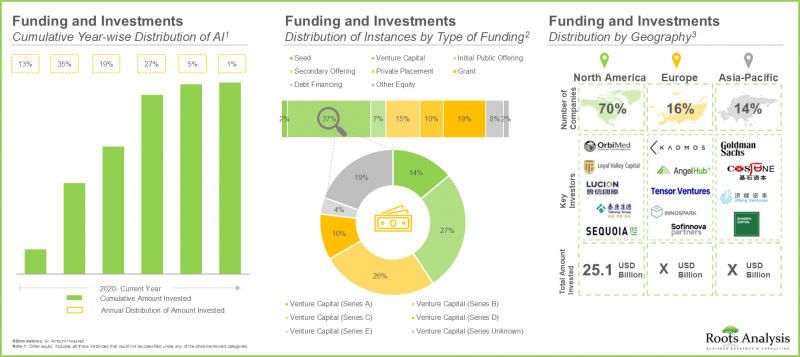

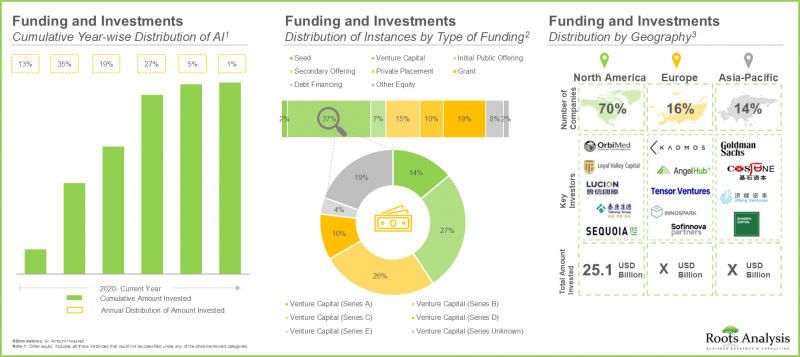

- 由于预期获得丰厚回报,许多公私投资者自 2020 年以来已投资了相当于 360 亿美元的资金。

- 由于对标靶生物製剂和个人化医疗的需求不断增长,预计到 2035 年,抗体发现市场将以 10.1% 的复合年增长率 (CAGR) 增长。

- 预计采用基于杂交瘤方法的服务提供者将获得最大的市场机会。按抗体类型划分,单株抗体细分市场预计将显着成长。

- 从长远来看,单株抗体发现平台有望成为主要贡献者,预计亚太地区将经历最快的成长。

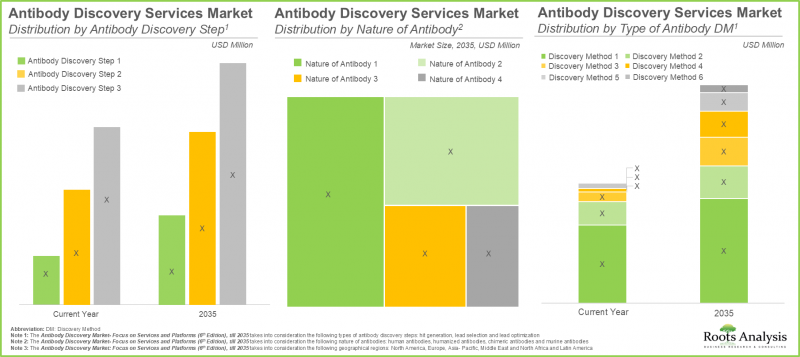

抗体发现服务市场的主要细分市场

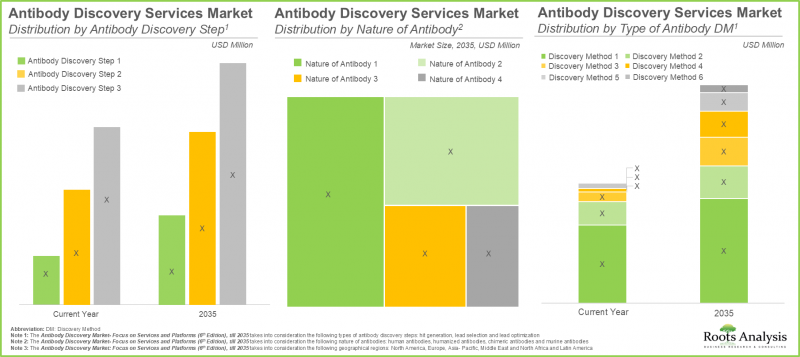

根据抗体发现步骤,抗体发现市场的服务细分市场分为先导化合物优化、先导化合物筛选和标靶化合物发现。目前,先导化合物优化细分市场占了整体市场占有率的大部分(61%)。值得注意的是,先导化合物优化能够筛选出在亲和力、稳定性和特异性方面均表现优异的高品质候选抗体,从而提高临床成功的可能性。

抗体发现服务市场依发现方法分为:基于杂交瘤、基于噬菌体展示文库、基于基因改造动物、基于酵母展示、单细胞和其他。

目前,基于杂交瘤的方法占市场主导地位(35%)。其高效性和低复杂度使其在抗体发现领域越来越受欢迎。此外,基于杂交瘤的方法对于开髮用于治疗癌症、自体免疫疾病和传染病的治疗性单株抗体至关重要。

依据抗体特性,抗体发现市场服务区隔市场分为人源抗体、人源化抗体、嵌合抗体和鼠源抗体。人源抗体细分市场目前占全球服务市场的最大占有率(53%)。人源抗体的诸多优势,例如较低的免疫原性和单株抗体在人体内的血清半衰期延长,使其占了较高的市场占有率。

全球抗体发现服务市场规模依治疗领域细分,包括肿瘤学、免疫学、传染病、心血管疾病、神经系统疾病和其他疾病。目前,肿瘤学细分市场占市场主导地位(48%)。这是由于全球肿瘤疾病发生率不断上升,迫切需要开发和生产有效的治疗方法,包括基于抗体的治疗方法。

依抗体类型细分,全球抗体发现服务市场细分为单株抗体、双特异性抗体和免疫偶联物。目前,单株抗体(60%)占市场主导地位,这一趋势在未来不太可能改变。这是因为单株抗体具有高度的特异性、一致性和可重复性,使其成为标靶治疗的理想选择。此外,单株抗体已被证明在治疗多种疾病方面非常有效,包括癌症、自体免疫疾病和传染病。

同样,依抗体类型,全球技术/平台市场细分为单株抗体、双特异性抗体、抗体-药物偶联物和其他抗体。

技术/平台市场将成为预测期内成长最快的细分市场。

依最终用户细分,抗体发现市场的技术/平台市场细分为两大不同的终端用户:内部参与者和合约研究组织。内部製造商细分市场 (98%) 占最大市场占有率。这是因为内部公司拥有专业团队、丰富的内部资源以及对智慧财产权的控制,这使得他们能够简化药物发现流程并保持竞争优势。

此细分市场揭示了全球服务市场规模按地区分布的情况,包括北美、欧洲、亚太地区、中东和北非以及拉丁美洲。我们估计,由于大型製药公司的存在、完善的监管框架以及各种技术进步,北美(50%)今年将占大部分市场占有率。同时,亚太地区预计在预测期内将实现13.3%的复合年增长率的健康成长。

同样,技术/平台市场细分为多个区域,包括北美、欧洲和亚太地区。我们的预测表明,鑑于总部位于北美的技术和平台提供商签署的技术许可和整合协议数量最多,北美将占整个市场的大多数占有率。

此外,预计亚太市场在未来将以更快的速度成长(复合年增长率为9.30%)。

初步研究概述

本研究中提出的观点和见解受到与市场中多个利害关係人讨论的影响。本研究报告也包含与产业利害关係人(按资历排序)的详细访谈记录。

- 美国,小规模企业,执行长兼最高科学负责人

- 德国,小规模企业,执行长兼总经理

- 美国,小规模企业,执行长

- 美国,大企业,原执行长

- 美国,中坚企业,执行长

- 美国,中坚企业,执行长

- 美国,中坚企业,原执行长

- 美国,大企业,原最高科学负责人

- 美国,中坚企业,社长兼最高执行负责人

- 美国,中坚企业,创业者兼技术长

- 美国,中坚企业,创业者兼社长

- 美国,中坚企业,商业服务部门副总统

- 美国,中坚企业,上级副社长

- 加拿大,大企业,共同创立者兼新兴科学技术担当董事

- 印度,小企业,共同成立者兼董事

- 美国,大企业,原网站董事

- 美国,小企业,事业开发管理者

抗体发现服务市场上参与企业案例

- Ablexis

- Abwiz Bio

- Abzena

- Aragen Life Sciences

- BIOTEM

- ChemPartner

- Creative Biolabs

- DetaiBio

- FairJourney Biologics

- Fusion Antibodies

- Genmab

- Harbour BioMed

- Immunome

- ImmunoPrecise Antibodies

- Integral Molecular

- Isogenica

- ProteoGenix

- Syd Labs

- Viva Biotech

- WuXi Biologics

抗体发现服务市场研究报告

- 抗体发现服务市场规模及机会分析:本报告按主要细分市场深入分析了全球抗体发现市场:[A] 抗体发现步骤,[B] 抗体发现方法,[C] 抗体特性,[D] 治疗领域,[E] 抗体类型,[F] 地区。

- 抗体发现技术/平台市场:本报告按主要细分市场深入分析了全球抗体发现市场:[A] 抗体类型,[B] 最终用户类型,[C] 地区。

- 市场模式:基于若干相关参数对参与抗体发现市场的公司进行深入评估,例如 A] 成立年份、[B] 公司规模、[C] 总部位置、[D] 提供的抗体发现服务类型、[E] 支援的抗体发现类型、[F] 抗体发现方法的类型、[G] 使用的动物模型以及 [H] 应用领域。

- 竞争分析:对抗体药物合约製造商进行全面的竞争分析,考虑因素包括 A] 开发商实力、[B] 产品组合实力和 [C] 产品组合多样性。

- 技术竞争分析:对抗体发现技术/平台进行全面的竞争分析,考察因素包括 A] 开发商实力、[B] 产品组合实力和 [C] 产品组合多样性。

- 公司简介:抗体发现市场主要开发商的详细简介,重点关注 A] 公司概况、[B] 财务资讯(如有)、[C] 抗体发现服务组合以及 [D] 近期发展和未来展望。

- 合作关係与合作:基于各种参数,例如 A) 合作年份、[B] 合作类型、[C] 抗体类型、[D] 地区等,对抗体发现市场中达成的各种合作关係与合作进行深入分析。

- 资金与投资分析:基于各种参数,例如 A) 融资年份、[B] 融资类型、[C] 地区等,对该领域报告的总体资金和投资进行深入分析。

目录

章节I:报告概要

第1章 序文

第2章 调查手法

第3章 市场动态

- 章概要

- 预测调查手法

- 市场评估组成架构

- 预测工具和技巧

- 重要的考虑事项

- 限制事项

第4章 宏观经济指标

- 章概要

- 市场动态

- 结论

章节II:定性洞察

第5章 摘要整理

第6章 简介

- 章概要

- 抗体结构

- 抗体发现的历史

- 抗体的同型

- 抗体的作用机制

- 抗体的分类

- 单株抗体

- 多株抗体

- 双特异性抗体

- 抗体的应用

- 结论

第7章 抗体发现:流程与方法

- 章概要

- 抗体发现流程

- 抗体发现方法

- 现有的抗体发现方法的优点和缺点

- 单株抗体的演进

- 结论

章节III:竞争情形

第8章 市场形势:抗体发现服务供应商

- 章概要

- 抗体发现服务供应商:市场形势

第9章 市场形势:抗体发现技术/平台

- 章概要

- 抗体发现技术/平台:市场形势

- 抗体发现技术/平台供应商的形势

第10章 企业竞争力分析

- 章概要

- 前提主要的参数

- 调查手法

- Pierre群组概要

- 企业竞争力分析

- 北美设立总公司抗体发现服务供应商

- 欧洲为本部的抗体发现服务供应商

- 亚太地区设立总公司抗体发现服务供应商

第11章 技术竞争力分析

- 章概要

- 前提主要的参数

- 调查手法

- Pierre群组概要

- 技术竞争力分析

- 北美设立总公司企业所提供的抗体发现技术·平台

- 欧洲为本部的企业所提供的抗体发现技术·平台

- 亚太地区设立总公司企业所提供的抗体发现技术/平台

章节IV:企业简介

第12章 抗体发现服务提供者:北美公司简介

- 章概要

- Abwiz Bio

- Abzena

- Creative Biolabs

- DetaiBio

- ImmunoPrecise Antibodies

- Integral Molecular

- Syd Labs

第13章

- 章概要

- BIOTEM

- FairJourney Biologics

- Fusion Antibodies

- Proteogenix

第14章 抗体发现服务提供者:亚太地区公司简介

- 章概要

- Aragen Life Sciences

- ChemPartner

- Viva Biotech

- WuXi Biologics

第15章 抗体发现技术/平台供应商:北美企业简介

- 章概要

- Ablexis

- Harbour BioMed

- Immunome

第16章 抗体发现技术/平台供应商:欧洲企业简介

- 章概要

- Genmab

- Isogenica

章节V:市场趋势

第17章 伙伴关係和合作

- 章概要

- 伙伴关係模式

- 抗体发现服务和平台:伙伴关係和合作

第18章 资金筹措投资分析

- 章概要

- 资金筹措的种类

- 抗体发现服务及平台供应商:资金筹措和投资分析

- 投资摘要

章节VI:市场机会分析

第19章 市场影响分析:促进因素,阻碍因素,机会,课题

第20章 全球抗体发现服务市场

第21章 抗体发现服务市场(抗体发现阶段)

第22章 抗体发现服务市场(各抗体发现方法)

第23章 抗体发现服务市场(抗体的性质)

第24章 抗体发现服务市场(各治疗领域)

第25章 抗体发现服务市场(各抗体类型)

第26章 抗体发现服务市场(各地区)

第27章 全球抗体发现技术/平台市场

第28章 抗体发现技术/平台市场(各抗体类型)

第29章 抗体发现技术/平台市场(各终端用户)

第30章 抗体发现技术/平台市场(各地区)

第31章 授权契约结构

第32章 案例:热门抗体药物研发流程

- 章概要

- Humira(Adalimumab)

- KEYTRUDA(Pembrolizumab)

- Stelara(Ustekinumab)

- Opdivo(Nivolumab)

- daruzarekkusu(Daratumumab)

第33章 抗体发现的未来的成长机会

章节VII:其他独家洞察

第34章 结论

第35章 执行洞察

章节VIII:附录

第36章 附录I:表资料

第37章 附录II:企业及组织的一览

Antibody Discovery Market: Overview

As per Roots Analysis, the antibody discovery market is estimated to grow from USD 2.4 billion in the current year to USD 6.6 billion by 2035, representing a higher CAGR of 10.5% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Antibody Discovery Step

- Hit Generation

- Lead Selection

- Lead Optimization

Antibody Discovery Method

- Hybridoma-based Methods

- Phage Display Library-based Methods

- Transgenic Animal-based Methods

- Yeast Display-based Methods

- Single Cell-based Methods

- Other Methods

Nature of Antibody

- Human Antibodies

- Humanized Antibodies

- Chimeric Antibodies

- Murine Antibodies

Therapeutic Area

- Oncological Disorders

- Immunological Disorders

- Infectious Diseases

- Cardiovascular Disorders

- Neurological Disorders

- Other Disorders

Type of Antibody

- Monoclonal Antibodies

- Bispecific Antibodies

- Antibody Drug Conjugates

- Immunoconjugates

- Other Antibodies

End-user

- In-house Players

- Contract Research Organizations

Geographical Regions

- North America

- Europe

- Asia Pacific

- Middle East and North Africa

- Latin America

Antibody Discovery Services Market: Growth and Trends

Antibodies play a pivotal role in the identification and neutralization of foreign substances. Owing to several beneficial features, such as high specificity, and a favorable safety profile, these molecules have emerged as a promising alternative, particularly for the treatment of cancer, autoimmune diseases, and infectious diseases. It is worth highlighting that, at present, antibodies represent the largest class of biologics, with over 80 molecules approved till date and over 200 molecules in the preclinical / discovery stages.

Despite multiple approvals, various challenges in the domain remain unaddressed across several stages of design, production, and clinical application. Therefore, given the complexities of modern drug development, several companies prefer to outsource as a strategic solution to optimize their research efforts. This expected shift can be attributed to various reasons, such as reduced timelines, lessened financial risks associated with failed trials and accelerated workflows. At present, around 125 players are offering a wide array of antibody discovery services.

This field possesses significant promise for future breakthroughs, wherein advances in artificial intelligence and machine learning is expected to be crucial, facilitating the prediction of antibody-antigen interactions and enhancing the efficiency of lead identification.

Fueled by these developments, the antibody discovery market is expected to progress in the coming years, benefiting multiple stakeholders who have consistently fostered innovation in this field

Antibody discovery market: Key Insights

The report delves into the current state of the antibody discovery market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, close to 125 players across the globe claim to offer customized services in order to support the operations related to antibody discovery; majority of these firms are based in North America.

- A relatively large proportion (88%) of the service providers offer hit generation services; of these, 57% employ library-based methods in order to support the discovery of antibodies for different therapeutic purposes.

- Close to 265 antibody discovery technologies are currently available in the market; these have revolutionized the field of antibody discovery by accelerating the identification and development of highly specific antibodies.

- Nearly 60% of the technologies employ library-based methods for antibody discovery; of these, 45% of the technologies support the discovery of monoclonal antibodies.

- Stakeholders are actively enhancing their existing capabilities and strengthening their competencies in order to gain an edge in the antibody discovery services domain.

- In pursuit of gaining a competitive edge, industry stakeholders are actively innovating and developing novel antibody discovery technologies / platforms that can support the discovery of multiple type of antibodies.

- 60% of the partnership deals have been inked post-2021; technology / product licensing agreements have emerged as the most prominent types of partnership models

- Foreseeing lucrative returns, many public and private investors have made investments worth USD 36 billion since 2020; of this, 70% of the total amount was raised by players based in North America.

- Given the rising demand for targeted biologics and personalized medicine, the antibody discovery market is anticipated to grow at an annualized rate (CAGR) of 10.1% till 2035

- The market opportunity for service providers using hybridoma-based methods is likely to be the highest; in terms of type of antibody, monoclonal antibodies sub-segment is anticipated to grow substantially.

- In the long term, the antibody discovery platforms for monoclonal antibodies are likely to emerge as the key contributor; Asia-Pacific is anticipated to be the fastest growing region.

Antibody Discovery Services Market: Key Segments

Lead Optimization Segment Captures that Majority of the Market Share

Based on the antibody discovery step, the services segment of antibody discovery market is distributed across lead optimization, lead selection and hit generation. Currently, the lead optimization sub-segment occupies the majority (61%) of the share in the overall market. It is worth highlighting that lead optimization ensures the selection of high-quality antibody candidates in terms of affinity, stability, and specificity, thereby increasing their likelihood of clinical success.

Antibody Discovery Services Segment is leading the Antibody Discovery Market

Based on the discovery method, the services segment of antibody discovery market is segmented into hybridoma-based methods, phage display library-based methods, transgenic animal-based methods, yeast display-based methods, single cell-based methods and other methods.

Presently, the market is dominated by hybridoma-based methods (35%) since the popularity of hybridoma-based methods for the discovery of antibodies has risen, owing to its efficiency and low complexity. Moreover, hybridoma-based methods have been crucial in developing therapeutic monoclonal antibodies used in treatment of diseases, including cancer, autoimmune disorders, and infections.

Based on Nature of Antibody, Human Antibodies Sub-Segment Occupies the Highest Share

Based on the nature of antibody, the services segment of antibody discovery market is segmented into human antibodies, humanized antibodies, chimeric antibodies and murine antibodies. The human antibodies sub-segment occupies the highest share (53%) in the current global services market. Several benefits associated with human antibodies, including reduced immunogenicity and the increased serum half-life of the monoclonal antibodies in humans, contribute to the high market share.

Oncological Disorders Dominate the Current Antibody Discovery Market

The global market value for services segment of antibody discovery market, based on different therapeutic areas, is segmented into oncological disorders, immunological disorders, infectious diseases, cardiovascular disorders, neurological disorders and other disorders. Currently, the market is dominated by oncological disorders sub-segment (48%). This can be attributed to the fact that incidence of oncological disorders has been on the rise globally, necessitating the development and production of effective treatments, including antibody-based therapeutics.

By Type of Antibody, Monoclonal Antibodies are Likely to Dominate the Market During the Forecast Period

Based on the type of antibody, the global services segment of antibody discovery market is segmented into monoclonal antibodies, bispecific antibodies and immunoconjugates. In the current year, the market is dominated by monoclonal antibodies (60%) and the trend is unlikely to change in the future as well. This can be attributed to the fact that monoclonal antibodies offer high specificity, consistency, and reproducibility, which makes them ideal for targeted therapies. In addition, mAbs have proven to be highly effective in treating a range of diseases, including cancer, autoimmune disorders, and infectious diseases.

Similarly, based on the type of antibody, the global technologies / platforms market is segmented into monoclonal antibodies, bispecific antibodies, antibody drug conjugates and other antibodies.

The Technologies / Platforms Market is the Fastest Growing Segment of the During the Forecast Period

In terms of end-user, the global technologies / platforms market segment of antibody discovery market is segmented across different end-users, namely in-house players and contract research organizations. In-house players' sub-segment (98%) occupies the highest market share. This can be attributed to the fact that in-house players mostly have dedicated teams, access to extensive in-house resources, and control over intellectual property, which enables them to streamline the discovery process and maintain competitive advantages.

North America Accounts for the Largest Share of the Market

This segment highlights the distribution of global services market size across geographical regions, such as North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. Our estimates suggest that the majority share in the current year is captured by North America (50%) owing to the presence of big pharma players, well-established regulatory framework, and various technological advancements in this region. On the contrary, Asia-Pacific is poised for the healthy growth rate (with a CAGR of 13.3%) during the forecast period.

Likewise, technologies / platforms market is segmented across various geographies, including North America, Europe and Asia-Pacific. Our estimates suggest that, North America is likely to capture the majority of the overall market share driven by maximum number of technology licensing / integration deals inked by technology / platform providers headquartered in this region.

Further, the market in Asia-Pacific is anticipated to increase at a faster pace (CAGR of 9.30%) in the foreseen future.

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders in the market. In addition, the research report features detailed transcripts of interviews held with the industry stakeholders (arranged in decreasing order of seniority level):

- Chief Executive Officer and Chief Scientific Officer, Small Company, US

- Chief Executive Officer and General Manager, Small Company, Germany

- Chief Executive Officer, Small Company, US

- Former Chief Executive Officer, Large Company, US

- Chief Business Officer, Mid-sized Company, US

- Chief Business Officer, Mid-sized Company, US

- Former Chief Business Officer, Small Company, US

- Former Chief Scientific Officer, Large Company, US

- President and Chief Operating Officer, Small Company, US

- Founder and Chief Technology Officer, Small Company, US

- Founder and President, Small Company, US

- Vice President of Commercial Services, Mid-sized Company, US

- Senior Vice President, Small Company, US

- Co-founder and Director of Emerging Science and Technology, Large Company, Canada

- Co-founder and Director, Small Company, India

- Former Site Director, Large Company, US

- Business Development Manager, Small Company, US

Example Players in the Antibody Discovery Services Market

- Ablexis

- Abwiz Bio

- Abzena

- Aragen Life Sciences

- BIOTEM

- ChemPartner

- Creative Biolabs

- DetaiBio

- FairJourney Biologics

- Fusion Antibodies

- Genmab

- Harbour BioMed

- Immunome

- ImmunoPrecise Antibodies

- Integral Molecular

- Isogenica

- ProteoGenix

- Syd Labs

- Viva Biotech

- WuXi Biologics

Antibody Discovery Services Market: Research Coverage

- Antibody Discovery Services Market Sizing and Opportunity Analysis: The report features a thorough analysis of the global antibody discovery market, in terms of the key market segments, namely [A] antibody discovery step [B] type of antibody discovery method, [C] and nature of antibody [D] therapeutic area [E] type of antibody and [F] geographical regions.

- Antibody Discovery Technologies / Platforms Market: The report features a thorough analysis of the global antibody discovery market, in terms of the key market segments, namely [A] type of antibody [B] type of end-user, [C] and geographical regions.

- Market Landscape: An in-depth assessment of the companies involved in antibody discovery market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of antibody discovery service offered, [E] type of antibody discovery supported, [F] type of antibody discovery method, [G] animal model used, [H] application area.

- Company Competitiveness Analysis: A comprehensive competitive analysis of antibody contract manufacturers, examining factors, such as [A] developer strength and [B] portfolio strength and [C] portfolio diversity.

- Technology Competitiveness Analysis: A comprehensive competitive analysis of antibody discovery technologies / platforms, examining factors, such as [A] developer strength and [B] portfolio strength and [C] portfolio diversity.

- Company Profiles: Detailed profiles of key developers engaged in the antibody discovery market, focused on [A] overview of the company, [B] financial information (if available), [C] antibody discovery service portfolio, and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the various partnerships and collaborations signed in the antibody discovery market, based on various parameters, such as [A] year of partnership [B] type of partnership [C] type of antibody and [D] geography.

- Funding and Investment Analysis: An insightful analysis of the overall funding and investments reported in this domain, based on various parameters, such as [A] year of funding [B] type of funding and [C] geography.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Structure of Antibodies

- 6.3. History of Antibody Discovery

- 6.4. Antibody Isotypes

- 6.5. Mechanism of Action of Antibodies

- 6.6. Classification of Antibodies

- 6.6.1. Monoclonal Antibodies

- 6.6.2. Polyclonal Antibodies

- 6.6.3. Bispecific Antibodies

- 6.7. Applications of Antibodies

- 6.8. Concluding Remarks

7. ANTIBODY DISCOVERY: PROCESSES AND METHODS

- 7.1. Chapter Overview

- 7.2. Antibody Discovery Process

- 7.2.1. Target Selection and Validation

- 7.2.2. Hit Generation

- 7.2.3. Lead Selection

- 7.2.4. Lead Optimization

- 7.2.4.1. Humanization

- 7.2.4.2. Affinity Maturation

- 7.2.4.3. Fc Engineering

- 7.2.5. Lead Characterization

- 7.2.6. Candidate Selection

- 7.3. Antibody Discovery Methods

- 7.3.1. Hybridoma Method

- 7.3.2. In Vitro Display Method

- 7.3.2.1. Phage Display Method

- 7.3.2.2. Yeast Display Method

- 7.3.2.3. Ribosomal Display Method

- 7.3.3. Transgenic Animal-based Method

- 7.3.4. Single B Cell Based Method

- 7.4. Advantages and Disadvantages of Existing Antibody Discovery Methods

- 7.5. Evolution of Monoclonal Antibodies

- 7.5.1. Fully Human Monoclonal Antibodies

- 7.6. Concluding Remarks

SECTION III: COMPETITIVE LANDSCAPE

8. MARKET LANDSCAPE: ANTIBODY DISCOVERY SERVICE PROVIDERS

- 8.1. Chapter Overview

- 8.2. Antibody Discovery Service Providers: Market Landscape

- 8.2.1. Analysis by Year of Establishment

- 8.2.2. Analysis by Company Size

- 8.2.3. Analysis by Location of Headquarters

- 8.2.4. Analysis by Type of Antibody Discovery Service Offered

- 8.2.5. Analysis by Type of Antibody Discovery Supported

- 8.2.6. Analysis by Type of Antibody Discovery Method

- 8.2.7. Analysis by Animal Model Used

- 8.2.8. Analysis by Type of Antibody Discovery Method and Type of Antibody Discovery Supported

- 8.2.9. Analysis by Type of Antibody Discovery Service Offered and Location of Headquarters

- 8.2.10. Analysis by Application Area

9. MARKET LANDSCAPE: ANTIBODY DISCOVERY TECHNOLOGIES / PLATFORMS

- 9.1. Chapter Overview

- 9.2. Antibody Discovery Technologies / Platforms: Market Landscape

- 9.2.1. Analysis by Type of Antibody Discovery Method Used

- 9.2.2. Analysis by Type of Antibody Discovery Supported

- 9.2.3. Analysis by Animal Model Used

- 9.2.4. Analysis by Type of Antibody Discovery Method Used and Type of Antibody Discovery Supported

- 9.2.5. Analysis by Type of Antibody Discovery Method and Location of Headquarters of Technology / Platform Providers

- 9.3. Antibody Discovery Technology / Platform Providers Landscape

- 9.3.1. Analysis by Year of Establishment

- 9.3.2. Analysis by Company Size

- 9.3.3. Analysis by Location of Headquarters

- 9.3.4. Most Active Players: Analysis by Number of Technologies

10. COMPANY COMPETITIVENESS ANALYSIS

- 10.1. Chapter Overview

- 10.2. Assumptions and Key Parameters

- 10.3. Methodology

- 10.4. Overview of Peer Groups

- 10.5. Company Competitiveness Analysis

- 10.5.1. Antibody Discovery Service Providers Headquartered in North America

- 10.5.2. Antibody Discovery Service Providers Headquartered in Europe

- 10.5.3. Antibody Discovery Service Providers Headquartered in Asia-Pacific

11. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 11.1. Chapter Overview

- 11.2. Assumptions and Key Parameters

- 11.3. Methodology

- 11.4. Overview of Peer Groups

- 11.5. Technology Competitiveness Analysis

- 11.5.1. Antibody Discovery Technologies / Platforms Provided by Players Headquartered in North America

- 11.5.2. Antibody Discovery Technologies / Platforms Provided by Players Headquartered in Europe

- 11.5.3. Antibody Discovery Technologies / Platforms Provided by Players Headquartered in Asia-Pacific

SECTION IV: COMPANY PROFILES

12. ANTIBODY DISCOVERY SERVICE PROVIDERS: COMPANY PROFILES OF PLAYERS BASED IN NORTH AMERICA

- 12.1. Chapter Overview

- 12.2. Abwiz Bio

- 12.2.1. Company Overview

- 12.2.2. Antibody Discovery Service Portfolio

- 12.2.3. Recent Developments and Future Outlook

- 12.3. Abzena

- 12.3.1. Company Overview

- 12.3.2. Antibody Discovery Service Portfolio

- 12.3.3. Recent Developments and Future Outlook

- 12.4. Creative Biolabs

- 12.4.1. Company Overview

- 12.4.2. Antibody Discovery Service Portfolio

- 12.4.3. Recent Developments and Future Outlook

- 12.5. DetaiBio

- 12.5.1. Company Overview

- 12.5.2. Antibody Discovery Service Portfolio

- 12.5.3. Recent Developments and Future Outlook

- 12.6. ImmunoPrecise Antibodies

- 12.6.1. Company Overview

- 12.6.2. Financial Information

- 12.6.3. Antibody Discovery Service Portfolio

- 12.6.4. Recent Developments and Future Outlook

- 12.7. Integral Molecular

- 12.7.1. Company Overview

- 12.7.2. Antibody Discovery Service Portfolio

- 12.7.3. Recent Developments and Future Outlook

- 12.8. Syd Labs

- 12.8.1. Company Overview

- 12.8.2. Antibody Discovery Service Portfolio

- 12.8.3. Recent Developments and Future outlook

13. ANTIBODY DISCOVERY SERVICE PROVIDERS: COMPANY PROFILES OF PLAYERS BASED IN EUROPE

- 13.1. Chapter Overview

- 13.2. BIOTEM

- 13.2.1. Company Overview

- 13.2.2. Antibody Discovery Service Portfolio

- 13.2.3. Recent Developments and Future Outlook

- 13.3. FairJourney Biologics

- 13.3.1. Company Overview

- 13.3.2. Antibody Discovery Service Portfolio

- 13.3.3. Recent Developments and Future Outlook

- 13.4. Fusion Antibodies

- 13.4.1. Company Overview

- 13.4.2. Financial Information

- 13.4.3. Antibody Discovery Service Portfolio

- 13.4.4. Recent Developments and Future Outlook

- 13.5. Proteogenix

- 13.5.1. Company Overview

- 13.5.2. Antibody Discovery Service Portfolio

- 13.5.3. Recent Developments and Future Outlook

14. ANTIBODY DISCOVERY SERVICE PROVIDERS: COMPANY PROFILES OF PLAYERS BASED IN ASIA-PACIFIC

- 14.1. Chapter Overview

- 14.2. Aragen Life Sciences

- 14.2.1. Company Overview

- 14.2.2. Antibody Discovery Service Portfolio

- 14.2.3. Recent Developments and Future Outlook

- 14.3. ChemPartner

- 14.3.1. Company Overview

- 14.3.2. Antibody Discovery Service Portfolio

- 14.3.3. Recent Developments and Future Outlook

- 14.4. Viva Biotech

- 14.4.1. Company Overview

- 14.4.2. Financial Information

- 14.4.3. Antibody Discovery Service Portfolio

- 14.4.4. Recent Developments and Future Outlook

- 14.5. WuXi Biologics

- 14.5.1. Company Overview

- 14.5.2. Financial Information

- 14.5.3. Antibody Discovery Service Portfolio

- 14.5.4. Recent Developments and Future Outlook

15. ANTIBODY DISCOVERY TECHNOLOGY / PLATFORM PROVIDERS: COMPANY PROFILES OF PLAYERS BASED IN NORTH AMERICA

- 15.1. Chapter Overview

- 15.2. Ablexis

- 15.2.1. Company Overview

- 15.2.2. Antibody Discovery Technology / Platform Portfolio

- 15.2.3. Recent Developments and Future Outlook

- 15.3. Harbour BioMed

- 15.3.1. Company Overview

- 15.3.2. Antibody Discovery Technology / Platform Portfolio

- 15.3.3. Financial Information

- 15.3.4. Recent Developments and Future Outlook

- 15.4. Immunome

- 15.4.1. Company Overview

- 15.4.2. Antibody Discovery Technology / Platform Portfolio

- 15.4.3. Recent Developments and Future Outlook

16. ANTIBODY DISCOVERY TECHNOLOGY / PLATFORM PROVIDERS: COMPANY PROFILES OF PLAYERS BASED IN EUROPE

- 16.1. Chapter Overview

- 16.2. Genmab

- 16.2.1. Company Overview

- 16.2.2. Antibody Discovery Technology / Platform Portfolio

- 16.2.3. Financial Information

- 16.2.4. Recent Developments and Future Outlook

- 16.3. Isogenica

- 16.3.1. Company Overview

- 16.3.2. Antibody Discovery Technology / Platform Portfolio

- 16.3.3. Recent Developments and Future Outlook

SECTION V: MARKET TRENDS

17. PARTNERSHIPS AND COLLABORATIONS

- 17.1. Chapter Overview

- 17.2. Partnership Models

- 17.3. Antibody Discovery Services and Platforms: Partnerships and Collaborations

- 17.3.1. Analysis by Year of Partnership

- 17.3.2. Analysis by Type of Partnership

- 17.3.3. Analysis by Year and Type of Partnership

- 17.3.4. Analysis by Type of Antibody

- 17.3.5. Key Technologies: Analysis by Number of Partnerships

- 17.3.6. Most Active Players: Analysis by Number of Partnerships

- 17.3.7. Analysis by Geography

- 17.3.7.1. Local and International Agreements

- 17.3.7.2. Intracontinental and Intercontinental Agreements

18. FUNDING AND INVESTMENT ANALYSIS

- 18.1. Chapter Overview

- 18.2. Types of Funding

- 18.3. Antibody Discovery Service and Platform Providers: Funding and Investment Analysis

- 18.3.1. Analysis by Year of Funding

- 18.3.1.1. Cumulative Year-wise Trend of Funding Instances

- 18.3.1.2. Cumulative Year-wise Trend of Amount Invested

- 18.3.2. Analysis by Type of Funding

- 18.3.2.1. Analysis by Funding Instances

- 18.3.2.2. Analysis by Amount Invested

- 18.3.3. Analysis by Year and Type of Funding

- 18.3.4. Analysis by Number of Funding Instances and Type of Players

- 18.3.5. Analysis by Type of Player Amount Invested

- 18.3.6. Analysis by Geography

- 18.3.7. Most Active Players: Analysis by Number of Funding Instances

- 18.3.8. Most Active Players: Analysis by Amount Invested

- 18.3.9. Leading Investors: Analysis by Number of Funding Instances

- 18.3.1. Analysis by Year of Funding

- 18.4. Summary of Investments

SECTION VI: MARKET OPPORTUNITY ANALYSIS

19. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 19.1. Chapter Overview

- 19.2. Market Drivers

- 19.3. Market Restraints

- 19.4. Market Opportunities

- 19.5. Market Challenges

- 19.6. Conclusion

20. GLOBAL ANTIBODY DISCOVERY SERVICES MARKET

- 20.1. Chapter Overview

- 20.2. Assumptions and Methodology

- 20.3. Antibody Discovery Services Market, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 20.3.1. Scenario Analysis

- 20.3.1.1. Conservative Scenario

- 20.3.1.2. Optimistic Scenario

- 20.3.1. Scenario Analysis

- 20.4. Key Market Segmentations

21. ANTIBODY DISCOVERY SERVICES MARKET, BY ANTIBODY DISCOVERY STEP

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Antibody Discovery Services Market: Distribution by Antibody Discovery Step

- 21.3.1. Antibody Discovery Services Market for Hit Generation, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 21.3.2. Antibody Discovery Services Market for Lead Selection, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 21.3.3. Antibody Discovery Services Market for Lead Optimization, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 21.4. Data Triangulation and Validation

22. ANTIBODY DISCOVERY SERVICES MARKET, BY TYPE OF ANTIBODY DISCOVERY METHOD

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Antibody Discovery Services Market: Distribution by Type of Antibody Discovery Method

- 22.3.1. Antibody Discovery Services Market for Hybridoma-based Methods, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 22.3.2. Antibody Discovery Services Market for Phage Display Library-based Methods, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 22.3.3. Antibody Discovery Services Market for Transgenic Animal-based Methods, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 22.3.4. Antibody Discovery Services Market for Yeast Display-based Methods, Historical Trends (since 2020) and Forecasted Estimate, (till 2035)

- 22.3.5. Antibody Discovery Services Market for Single Cell-based Methods, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 22.3.6. Antibody Discovery Services Market for Other Methods, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 22.4. Data Triangulation and Validation

23. ANTIBODY DISCOVERY SERVICES MARKET, BY NATURE OF ANTIBODY

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Antibody Discovery Services Market: Distribution by Nature of Antibody

- 23.3.1. Antibody Discovery Services Market for Human Antibodies, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 23.3.2. Antibody Discovery Services Market for Humanized Antibodies, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 23.3.3. Antibody Discovery Services Market for Chimeric Antibodies, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 23.3.4. Antibody Discovery Services Market for Murine Antibodies, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 23.4. Data Triangulation and Validation

24. ANTIBODY DISCOVERY SERVICES MARKET, BY THERAPEUTIC AREA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Antibody Discovery Services Market: Distribution by Therapeutic Area

- 24.3.1. Antibody Discovery Services Market for Oncological Disorders, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 24.3.2. Antibody Discovery Services Market for Immunological Disorders, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 24.3.3. Antibody Discovery Services Market for Infectious Diseases, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 24.3.4. Antibody Discovery Services Market for Cardiovascular Disorders, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 24.3.5. Antibody Discovery Services Market for Neurological Disorders, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 24.3.6. Antibody Discovery Services Market for Other Disorders, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 24.4. Data Triangulation and Validation

25. ANTIBODY DISCOVERY SERVICES MARKET, BY TYPE OF ANTIBODY

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Antibody Discovery Services Market: Distribution by Type of Antibody

- 25.3.1. Antibody Discovery Services Market for Monoclonal Antibodies, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 25.3.2. Antibody Discovery Services Market for Bispecific Antibodies, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 25.3.3. Antibody Discovery Services Market for Immunoconjugates, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 25.4. Data Triangulation and Validation

26. ANTIBODY DISCOVERY SERVICES MARKET, BY GEOGRAPHICAL REGIONS

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Antibody Discovery Services Market: Distribution by Geographical Regions

- 26.3.1. Antibody Discovery Services Market in North America, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.1.1. Antibody Discovery Services Market in the US, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.1.2. Antibody Discovery Services Market in Canada, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.2. Antibody Discovery Services Market in Europe, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.2.1. Antibody Discovery Services Market in Germany, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.2.2. Antibody Discovery Services Market in the UK, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.2.3. Antibody Discovery Services Market in France, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.2.4. Antibody Discovery Services Market in Italy, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.2.5. Antibody Discovery Services Market in Spain, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.2.6. Antibody Discovery Services Market in Rest of Europe, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.3. Antibody Discovery Services Market in Asia-Pacific, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.3.1. Antibody Discovery Services Market in China, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.3.2. Antibody Discovery Services Market in Japan, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.3.3. Antibody Discovery Services Market in India, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.3.4. Antibody Discovery Services Market in South Korea, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.3.5. Antibody Discovery Services Market in Australia, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.4. Antibody Discovery Services Market in Middle East and North Africa, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.4.1. Antibody Discovery Services Market in Egypt, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.4.2. Antibody Discovery Services Market in Israel, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.4.3. Antibody Discovery Services Market in Saudi Arabia, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.4.4. Antibody Discovery Services Market in Rest of Middle East and North Africa, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.5. Antibody Discovery Services Market in Latin America, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.5.1. Antibody Discovery Services Market in Brazil, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.5.2. Antibody Discovery Services Market in Argentina, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.5.3. Antibody Discovery Services Market in Mexico, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.5.4. Antibody Discovery Services Market in Rest of Latin America, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.3.1. Antibody Discovery Services Market in North America, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 26.4. Antibody Discovery Services Market, by Geographical Regions: Market Dynamics Assessment

- 26.4.1. Penetration Growth (P-G) Matrix

- 26.4.2. Market Movement Analysis

- 26.5. Data Triangulation and Validation

27. GLOBAL ANTIBODY DISCOVERY TECHNOLOGIES / PLATFORMS MARKET

- 27.1. Chapter Overview

- 27.2. Assumptions and Methodology

- 27.3. Antibody Discovery Technologies / Platforms Market: Forecasted Estimates, till 2035

- 27.3.1. Scenario Analysis

- 27.3.1.1. Conservative Scenario

- 27.3.1.2. Optimistic Scenario

- 27.3.1. Scenario Analysis

- 27.4. Key Market Segmentations

28. ANTIBODY DISCOVERY TECHNOLOGIES / PLATFORMS MARKET, BY TYPE OF ANTIBODY

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Antibody Discovery Technologies / Platforms Market: Distribution by Type of Antibody

- 28.3.1. Antibody Discovery Technologies / Platforms Market for Monoclonal Antibodies, Forecasted Estimates (till 2035)

- 28.3.2. Antibody Discovery Technologies / Platforms Market for Bispecific Antibodies, Forecasted Estimates (till 2035)

- 28.3.3. Antibody Discovery Technologies / Platforms Market for Antibody Drug Conjugates, Forecasted Estimates (till 2035)

- 28.3.4. Antibody Discovery Technologies / Platforms Market for Other Antibodies, Forecasted Estimates (till 2035)

- 28.4. Data Triangulation and Validation

29. ANTIBODY DISCOVERY TECHNOLOGIES / PLATFORMS MARKET, BY TYPE OF END-USER

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Antibody Discovery Technologies / Platforms Market: Distribution by Type of End-User

- 29.3.1. Antibody Discovery Technologies / Platforms Market for In-house, Forecasted Estimates (till 2035)

- 29.3.2. Antibody Discovery Technologies / Platforms Market for Contract Research Organizations, Forecasted Estimates (till 2035)

- 29.4. Data Triangulation and Validation

30. ANTIBODY DISCOVERY TECHNOLOGIES / PLATFORMS MARKET, BY GEOGRAPHICAL REGIONS

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Antibody Discovery Technologies / Platforms: Distribution by Geographical Regions

- 30.3.1. Antibody Discovery Technologies / Platforms Market in North America, Forecasted Estimates (till 2035)

- 30.3.1.1. Antibody Discovery Technologies / Platforms Market in the US, Forecasted Estimates (till 2035)

- 30.3.1.2. Antibody Discovery Technologies / Platforms Market in Canada, Forecasted Estimates (till 2035)

- 30.3.2. Antibody Discovery Technologies / Platforms Market in Europe, Forecasted Estimates (till 2035)

- 30.3.2.1. Antibody Discovery Technologies / Platforms Market in Switzerland, Forecasted Estimates (till 2035)

- 30.3.2.2. Antibody Discovery Technologies / Platforms Market in Germany, Forecasted Estimates (till 2035)

- 30.3.2.3. Antibody Discovery Technologies / Platforms Market in the UK, Forecasted Estimates (till 2035)

- 30.3.2.4. Antibody Discovery Technologies / Platforms Market in France, Forecasted Estimates (till 2035)

- 30.3.2.5. Antibody Discovery Technologies / Platforms Market in Rest of Europe, Forecasted Estimates (till 2035)

- 30.3.3. Antibody Discovery Technologies / Platforms Market in Asia-Pacific, Forecasted Estimates (till 2035)

- 30.3.3.1. Antibody Discovery Technologies / Platforms Market in China, Forecasted Estimates (till 2035)

- 30.3.3.2. Antibody Discovery Technologies / Platforms Market in Singapore, Forecasted Estimates (till 2035)

- 30.3.3.3. Antibody Discovery Technologies / Platforms Market in Japan, Forecasted Estimates (till 2035)

- 30.3.3.4. Antibody Discovery Technologies / Platforms Market in South Korea, Forecasted Estimates (till 2035)

- 30.3.1. Antibody Discovery Technologies / Platforms Market in North America, Forecasted Estimates (till 2035)

- 30.4. Market Dynamics Assessment

- 30.4.1. Penetration Growth (P-G) Matrix

- 30.5. Data Triangulation and Validation

31. LICENSING DEAL STRUCTURE

- 31.1. Chapter Overview

- 31.2. Key Parameters

- 31.3. Assumptions and Methodology

- 31.3.1. Overall Cash Flow for Licensee Companies

- 31.3.1.1. Total Expenses Incurred by a Licensee

- 31.3.1.2. Revenues Generated by a Licensee

- 31.3.2. Overall Cash Flow for Licensor

- 31.3.2.1. Total Expenses Incurred by the Licensor

- 31.3.2.2. Revenues by the Licensor

- 31.3.1. Overall Cash Flow for Licensee Companies

- 31.4. Key Analytical Outputs

- 31.4.1. Scenario 1: Variation of Upfront Payments and Milestone Payments

- 31.4.2. Scenario 2: Variation of Upfront Payments and Sales based Royalties

- 31.4.3. Scenario 1: Variation of Milestone Payments and Sales based Royalties

32. CASE IN POINT: DRUG DISCOVERY PROCESSES OF TOP SELLING ANTIBODIES

- 32.1. Chapter Overview

- 32.2. Humira (Adalimumab)

- 32.2.1. Drug Overview

- 32.2.2. Discovery Process and Method

- 32.2.3. Historical Sales

- 32.3. Keytruda (Pembrolizumab)

- 32.3.1. Drug Overview

- 32.3.2. Discovery Process and Method

- 32.3.3. Historical Sales

- 32.4. Stelara (Ustekinumab)

- 32.4.1. Drug Overview

- 32.4.2. Discovery Process and Method

- 32.4.3. Historical Sales

- 32.5. Opdivo (Nivolumab)

- 32.5.1. Drug Overview

- 32.5.2. Discovery Process and Method

- 32.5.3. Historical Sales

- 32.6. Darzalex (Daratumumab)

- 32.6.1. Drug Overview

- 32.6.2. Discovery Process and Method

- 32.6.3. Historical Sales

33. FUTURE GROWTH OPPORTUNITIES IN ANTIBODY DISCOVERY

- 33.1. Chapter Overview

- 33.2. Upcoming Trends in Drug Discovery

- 33.3. Anticipated Shift from Monoclonal Antibodies to Other Novel Antibody Formats

- 33.3.1. Technological Advancements to Overhaul Conventional Antibody Discovery Processes

- 33.3.2. Transition to CADD-based Approaches to Help Achieve Better Operational Efficiencies

- 33.3.3. Rising Demand for Antibody-based Treatment Options for Non-Oncological Indications

- 33.4. Future Growth Opportunities in Emerging Economies

- 33.5. Concluding Remarks

SECTION VII: OTHER EXCLUSIVE INSIGHTS

34. CONCLUDING INSIGHTS

35. EXECUTIVE INSIGHTS

SECTION VIII: APPENDICES

36. APPENDIX I: TABULATED DATA

37. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Features of Different Isotypes of Antibodies

- Table 6.2 Mechanism of Action of Therapeutic Antibodies Against Different Target Classes

- Table 6.3 Differences Between Polyclonal and Monoclonal Antibodies

- Table 7.1 Antibody Discovery Methods: Advantages and Disadvantages

- Table 7.2 List of Approved Monoclonal Antibodies

- Table 7.3 Approval Timeline: Fully Human Monoclonal Antibodies

- Table 8.1 Antibody Discovery Service Providers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 8.2 Antibody Discovery Service Providers: Information on Type of Antibody Discovery Service Offered

- Table 8.3 Antibody Discovery Service Providers: Information on Type of Antibody Discovery Supported

- Table 8.4 Antibody Discovery Service Providers: Information on Type of Antibody Discovery Method Used

- Table 8.5 Antibody Discovery Service Providers: Information on Animal Model Used

- Table 8.6 Antibody Discovery Service Providers: Information on Application Area

- Table 9.1 List of Antibody Discovery Technologies / Platforms

- Table 9.2 Antibody Discovery Technologies / Platforms: Information on Antibody Discovery Method Used

- Table 9.3 Antibody Discovery Technologies / Platforms: Information on Type of Antibody Discovery Supported

- Table 9.4 Antibody Discovery Technologies / Platforms: Information on Animal Model Used

- Table 9.5 Antibody Discovery Technology / Platform Providers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 10.1 Company Competitiveness Scores Allotted to Service Providers based in North America (Peer Group I)

- Table 10.2 Company Competitiveness Scores Allotted to Service Providers based in Europe (Peer Group II)

- Table 10.3 Company Competitiveness Scores Allotted to Service Providers based in Asia-Pacific (Peer Group III)

- Table 11.1 Technology Competitiveness Analysis: Antibody Discovery Technologies / Platforms Provided by Players Headquartered in North America (Peer Group I)

- Table 11.2 Company Competitiveness Scores Allotted to Service Providers based in Europe (Peer Group II)

- Table 11.3 Company Competitiveness Scores Allotted to Service Providers based in Asia-Pacific (Peer Group III)

- Table 12.1 Antibody Discovery Service Providers in North America: List of Companies Profiled

- Table 12.2 Abwiz Bio: Company Snapshot

- Table 12.3 Abwiz Bio: Antibody Discovery Service Portfolio

- Table 12.4 Abzena: Company Snapshot

- Table 12.5 Abzena: Antibody Discovery Service Portfolio

- Table 12.6 Abzena: Recent Developments and Future Outlook

- Table 12.7 Creative Biolabs: Company Snapshot

- Table 12.8 Creative Biolabs: Antibody Discovery Service Portfolio

- Table 12.9 Creative Biolabs: Recent Developments and Future Outlook

- Table 12.10 DetaiBio: Company Snapshot

- Table 12.11 DetaiBio: Antibody Discovery Service Portfolio

- Table 12.12 DetaiBio: Recent Developments and Future Outlook

- Table 12.13 ImmunoPrecise Antibodies: Company Snapshot

- Table 12.14 ImmunoPrecise Antibodies: Antibody Discovery Service Portfolio

- Table 12.15 ImmunoPrecise Antibodies: Recent Developments and Future Outlook

- Table 12.16 Integral Molecular: Company Snapshot

- Table 12.17 Integral Molecular: Antibody Discovery Service Portfolio

- Table 12.18 Integral Molecular: Recent Developments and Future Outlook

- Table 12.19 Syd Labs: Company Snapshot

- Table 12.20 Syd Labs: Antibody Discovery Service Portfolio

- Table 13.1 Antibody Discovery Service Providers in Europe: List of Companies Profiled

- Table 13.2 BIOTEM: Company Snapshot

- Table 13.3 BIOTEM: Antibody Discovery Service Portfolio

- Table 13.4 BIOTEM: Recent Developments and Future Outlook

- Table 13.5 FairJourney Biologics: Company Snapshot

- Table 13.6 FairJourney Biologics: Antibody Discovery Service Portfolio

- Table 13.7 FairJourney Biologics: Recent Developments and Future Outlook

- Table 13.8 Fusion Antibodies: Company Snapshot

- Table 13.9 Fusion Antibodies: Antibody Discovery Service Portfolio

- Table 13.10 Fusion Antibodies: Recent Developments and Future Outlook

- Table 13.11 ProteoGenix: Company Snapshot

- Table 13.12 ProteoGenix: Antibody Discovery Service Portfolio

- Table 13.13 ProteoGenix: Recent Developments and Future Outlook

- Table 14.1 Antibody Discovery Service Providers in Asia-Pacific: List of Companies Profiled

- Table 14.2 Aragen Life Sciences: Company Snapshot

- Table 14.3 Aragen Life Sciences: Antibody Discovery Service Portfolio

- Table 14.4 Aragen Life Sciences: Recent Developments and Future Outlook

- Table 14.5 ChemPartner: Company Snapshot

- Table 14.6 ChemPartner: Antibody Discovery Service Portfolio

- Table 14.7 ChemPartner: Recent Developments and Future Outlook

- Table 14.8 Viva Biotech: Company Snapshot

- Table 14.9 Viva Biotech: Antibody Discovery Service Portfolio

- Table 14.10 Viva Biotech: Recent Developments and Future Outlook

- Table 14.11 WuXi Biologics: Company Snapshot

- Table 14.12 WuXi Biologics: Antibody Discovery Service Portfolio

- Table 14.13 WuXi Biologics: Recent Developments and Future Outlook

- Table 15.1 Antibody Discovery Technology / Platform Providers in North America: List of Companies Profiled

- Table 15.2 Ablexis: Company Snapshot

- Table 15.3 Ablexis: Antibody Discovery Platform Portfolio

- Table 15.4 Ablexis: Recent Developments and Future Outlook

- Table 15.5 Harbour BioMed: Company Snapshot

- Table 15.6 Harbour BioMed: Antibody Discovery Platform Portfolio

- Table 15.7 Harbour BioMed: Recent Development and Future Outlook

- Table 15.8 Immunome: Company Snapshot

- Table 15.9 Immunome: Antibody Discovery Platform Portfolio

- Table 15.10 Immunome: Recent Developments and Future Outlook

- Table 16.1 Antibody Discovery Technology / Platform Providers in Europe: List of Companies Profiled

- Table 16.2 Genmab: Company Snapshot

- Table 16.3 Genmab: Antibody Discovery Platform Portfolio

- Table 16.4 Genmab: Recent Developments and Future Outlook

- Table 16.5 Isogenica: Company Snapshot

- Table 16.6 Isogenica: Antibody Discovery Platform Portfolio

- Table 16.7 Isogenica: Recent Developments and Future Outlook

- Table 17.1 Antibody Discovery Services and Platforms Market: List of Partnerships and Collaborations, Since 2021

- Table 17.2 Partnerships and Collaborations: Information on Type of Agreement

- Table 18.1 Antibody Discovery Services and Platforms Market: List of Funding and Investments, Since 2021

- Table 27.1 Antibody Discovery Technologies Market: Average Upfront Payment and Average Milestone Payment, Since 2021 (USD Million)

- Table 27.2 Licensing Deals: Tranches of Milestone Payments

- Table 31.1 Scenario 1: Multiple Cases of Varying Upfront and Milestone Payments

- Table 31.2 Scenario 2: Multiple Cases of Varying Upfront Payment and Sales based Royalties

- Table 31.3 Multiple Cases of Varying Milestone Payment and Sales based Royalties

- Table 32.1 Top Seven Selling Therapeutic Antibodies, 2024

- Table 33.1 Antibody Discovery Services and Platform Providers Headquartered in Asia-Pacific

- Table 35.1 Antibody Solutions: Company Snapshot

- Table 35.2 Adimab: Company Snapshot

- Table 35.3 ImmunoPrecise Antibodies: Company Snapshot

- Table 35.4 Abveris Antibody: Company Snapshot

- Table 35.5 Nidus BioSciences: Company Snapshot

- Table 35.6 AvantGen: Company Snapshot

- Table 35.7 Single Cell Technology: Company Snapshot

- Table 35.8 Distributed Bio (acquired by Charles River): Company Snapshot

- Table 35.9 AbCellera: Company Snapshot

- Table 35.10 AbGenics Life Sciences: Company Snapshot

- Table 35.11 CDI Laboratories: Company Snapshot

- Table 35.12 AP Biosciences: Company Snapshot

- Table 35.13 YUMAB: Company Snapshot

- Table 35.14 Antibody Solutions: Company Snapshot

- Table 35.15 Ligand Pharmaceuticals: Company Snapshot

- Table 35.16 LakePharma (acquired by Curia): Company Snapshot

- Table 36.1 Antibody Discovery Service Providers: Distribution by Year of Establishment

- Table 36.2 Antibody Discovery Service Providers: Distribution by Company Size

- Table 36.3 Antibody Discovery Service Providers: Distribution by Location of Headquarters (Region)

- Table 36.4 Antibody Discovery Service Providers: Distribution by Location of Headquarters (Country)

- Table 36.5 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Service Offered

- Table 36.6 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Supported

- Table 36.7 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Method Used

- Table 36.8 Antibody Discovery Service Providers: Distribution by Animal Model Used

- Table 36.9 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Method Used and Type of Antibody Discovery Supported

- Table 36.10 Antibody Discovery Service Providers: Distribution by Type of Antibody Discovery Service Offered and Location of Headquarters

- Table 36.11 Antibody Discovery Service Providers: Distribution by Application Area

- Table 36.12 Antibody Discovery Technologies / Platforms: Distribution by Type of Antibody Discovery Method Used

- Table 36.13 Antibody Discovery Technologies / Platforms: Distribution by Type of Antibody Discovery Supported

- Table 36.14 Antibody Discovery Technologies / Platforms: Distribution by Animal Model Used

- Table 36.15 Antibody Discovery Technologies / Platforms: Distribution by Antibody Discovery Method Used and Type of Antibody Discovery Supported

- Table 36.16 Antibody Discovery Technologies / Platforms: Distribution by Type of Antibody Discovery Method and Location of Headquarters of the Technology / Platform Provider

- Table 36.17 Antibody Discovery Technology / Platform Providers: Distribution by Year of Establishment

- Table 36.18 Antibody Discovery Technology / Platform Providers: Distribution by Company Size

- Table 36.19 Antibody Discovery Technology / Platform Providers: Distribution by Location of Headquarters (Region)

- Table 36.20 Antibody Discovery Technology / Platform Providers: Distribution by Location of Headquarters (Country)

- Table 36.21 Most Active Players: Distribution by Number of Technologies / Platforms

- Table 36.22 ImmunoPrecise Antibodies: Consolidated Financial Details (CAD Million), Since 2022

- Table 36.23 Fusion Antibodies: Business Segment-wise Revenues and Consolidated Financial Details (GBP Million), Since 2021

- Table 36.24 Viva Biotech: Consolidated Financial Details (RMB Billion), Since 2021

- Table 36.25 WuXi Biologics: Business Segment-wise Revenues and Consolidated Financial Details (RMB Billion), Since 2021

- Table 36.26 Genmab: Consolidated Financial Details (DKK Billion), Since 2021

- Table 36.27 Harbour BioMed: Consolidated Financial Details (USD Million), FY 2021-H1 FY 2024

- Table 36.28 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2021

- Table 36.29 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 36.30 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2021

- Table 36.31 Partnerships and Collaborations: Distribution by Type of Antibody

- Table 36.32 Key Technologies: Distribution by Number of Partnerships

- Table 36.33 Most Active Players: Distribution by Number of Partnerships

- Table 36.34 Partnerships and Collaborations: Distribution by Country

- Table 36.35 Partnerships and Collaborations: Distribution by Region

- Table 36.36 Funding and Investment Analysis: Cumulative Year-wise Trend, Since 2020

- Table 36.37 Funding and Investment Analysis: Cumulative Year-wise Trend of Amount Invested, Since 2020 (USD Million)

- Table 36.38 Funding and Investment Analysis: Distribution of Funding Instances by Type of Funding

- Table 36.39 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 36.40 Funding and Investment Analysis: Distribution by Year and Type of Funding, Since 2020

- Table 36.41 Funding and Investment Analysis: Distribution by Number of Funding Instances and Type of Player

- Table 36.42 Funding and Investment Analysis: Distribution by Type of Player and Amount Invested

- Table 36.43 Funding and Investment Analysis: Distribution by Geography

- Table 36.44 Most Active Players: Distribution by Number of Funding Instances

- Table 36.45 Most Active Players: Distribution by Amount Invested (USD Million)

- Table 36.46 Leading Investors: Distribution by Number of Funding Instances

- Table 36.47 Global Antibody Discovery Services Market, Historical Trends (since 2020) and Forecasted Estimates (till 2035): Base Scenario (USD Million)

- Table 36.48 Global Antibody Discovery Services Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Million)

- Table 36.49 Global Antibody Discovery Services Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Million)

- Table 36.50 Global Antibody Discovery Services Market: Distribution by Type of Antibody Discovery Step

- Table 36.51 Antibody Discovery Services Market for Hit Generation: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.52 Antibody Discovery Services Market for Lead Selection: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.53 Antibody Discovery Services Market for Lead Optimization; Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.54 Global Antibody Discovery Services Market: Distribution by Type of Antibody Discovery Method

- Table 36.55 Antibody Discovery Services Market for Hybridoma-based Methods: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.56 Antibody Discovery Services Market for Phage Display-based Methods: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.57 Antibody Discovery Services Market for Transgenic Animal-based Methods: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.58 Antibody Discovery Services Market for Yeast Display-based Methods; Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.59 Antibody Discovery Services Market for Single Cell-based Methods: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.60 Antibody Discovery Services Market for Other Methods: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.61 Global Antibody Discovery Services Market: Distribution by Nature of Antibody

- Table 36.62 Antibody Discovery Services Market for Human Antibodies: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.63 Antibody Discovery Services Market for Humanized Antibodies: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.64 Antibody Discovery Services Market for Chimeric Antibodies: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.65 Antibody Discovery Services Market for Murine Antibodies: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.66 Global Antibody Discovery Services Market: Distribution by Therapeutic Area

- Table 36.67 Antibody Discovery Services Market for Oncological Disorders: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.68 Antibody Discovery Services Market for Immunological Disorders: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.69 Antibody Discovery Services Market for Infectious Diseases: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.70 Antibody Discovery Services Market for Cardiovascular Disorders: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.71 Antibody Discovery Services Market for Neurological Disorders: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.72 Antibody Discovery Services Market for Other Disorders: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.73 Antibody Discovery Services Market: Distribution by Type of Antibody

- Table 36.74 Antibody Discovery Services Market for Monoclonal Antibodies: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.75 Antibody Discovery Services Market for Bispecific Antibodies: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.76 Antibody Discovery Services Market for Immunoconjugates: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.77 Antibody Discovery Services Market: Distribution by Geographical Regions

- Table 36.78 Antibody Discovery Services Market in North America: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.79 Antibody Discovery Services Market in the US: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.80 Antibody Discovery Services Market in Canada: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.81 Antibody Discovery Services Market in Europe: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.82 Antibody Discovery Services Market in Germany: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.83 Antibody Discovery Services Market in the UK: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.84 Antibody Discovery Services Market in France: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.85 Antibody Discovery Services Market in Italy: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.86 Antibody Discovery Services Market in Spain: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.87 Antibody Discovery Services Market in the Rest of Europe: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.88 Antibody Discovery Services Market in Asia-Pacific: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.89 Antibody Discovery Services Market in China: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.90 Antibody Discovery Services Market in Japan: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.91 Antibody Discovery Services Market in India: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.92 Antibody Discovery Services Market in South Korea: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.93 Antibody Discovery Services Market in Australia: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.94 Antibody Discovery Services Market in Middle East and North Africa: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.95 Antibody Discovery Services Market in Egypt: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.96 Antibody Discovery Services Market in Israel: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.97 Antibody Discovery Services Market in Saudi Arabia: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.98 Antibody Discovery Services Market in the Rest of Middle East and North Africa: Historical Trends (since 2020) and Forecasted Estimates (till 2035) (USD Million)

- Table 36.99 Antibody Discovery Services Market in Latin America: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.100 Antibody Discovery Services Market in Brazil: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 36.101 Antibody Discovery Services Market in Argentina: Historical Trends (since 2020) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)