|

市场调查报告书

商品编码

1830066

细胞毒性药物和高效能原料药 (HPAPI) 製造市场:产业趋势及 2035 年全球预测 - 按产品类型、公司规模、业务规模、分子类型、高活性最终剂型类型和主要地区划分Cytotoxic Drugs & HPAPI Manufacturing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Product, Company Size, Scale of Operation, Type of Molecule, Type of Highly Potent Finished Dosage Form, and Key Geographies |

||||||

细胞毒性药物和高效能原料药 (HPAPI) 製造市场:概览

预计到 2035 年,全球细胞毒性药物和高效原料药 (HPAPI) 製造市场规模将从目前的 139.8 亿美元增长至 464.1 亿美元,预测期内复合年增长率为 12.75%。

细胞毒性药物和高效能原料药 (HPAPI) 製造市场的市场机会分布在以下细分领域:

产品类型

- HPAPI

- 高活性最终剂型

事业规模

- 前临床

- 临床试验

- 商业

分子类型

- 低分子

- 生技药品

高活性最终剂型类型

- 注射剂

- 口服固态剂

- 乳膏

- 其他

主要地区

- 北美(美国,加拿大,墨西哥)

- 欧洲(英国,义大利,德国,法国,西班牙,其他)

- 亚太地区(中国,印度,其他)

- 其他地区

细胞毒性药物与高效能原料药製造市场:成长与趋势

由于临床药理学和肿瘤学的进步,以及人们对标靶治疗的兴趣日益浓厚,全球研究人员和製药商越来越关注高效药物高效原料药 (HPAPI) 和细胞毒性药物。值得注意的是,全球 45% 的药品都属于高效药物,因此需要专门生产 HPAPI。然而,HPAPI 的生产过程复杂,面临许多课题。首要课题是防止生产过程中的交叉污染,其次是确保供应链中环境和工人的安全。此外,选择合适的控制和保护措施,包括设施、流程和个人防护装备 (PPE) 也至关重要。处理 HPAPI 通常需要持续投资于安全处理方法和先进的技术专长,这进一步增加了该领域的复杂性。因此,药物开发商越来越多地选择外包其生产流程。

合约製造业的巨大潜力和良好的成长前景促使大多数大型公司投资扩建或升级其现有的生产设施。一些合约製造组织 (CMO) 正在日本、中国、印度和巴西等新兴市场建立新工厂,以受益于这些地区不断下降的製造成本、熟练的劳动力和有利的监管环境。在整体市场扩张、近期技术创新和日益增长的外包趋势的推动下,预计该行业将在未来十年持续成长。

细胞毒性药物和高效能原料药 (HPAPI) 製造市场:关键洞察

本报告深入探讨了细胞毒性药物和高效原料药 (HPAPI) 製造市场的现状,并识别了行业内的潜在成长机会。主要发现包括:

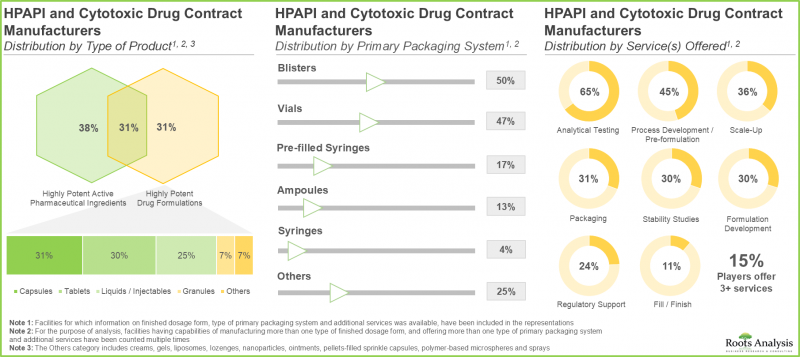

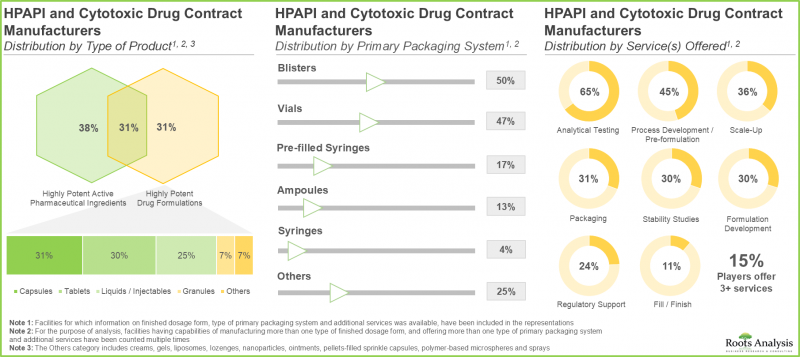

- 目前,超过 140 家公司声称拥有必要的专业知识,能够为不同规模的高效能化合物提供合约製造服务。

- 目前的市场格局高度分散,主要地区既有新进者,也有老牌企业。

- 利害关係人正在利用其专业知识,为各种高效能化合物提供合约製造服务。约 70% 的服务提供者俱备高效原料药 (HPAPI) 的分析测试能力。

- 合作活动的增加证明了人们对这一领域的兴趣日益浓厚。事实上,高效原料药和细胞毒性药物製造的合作伙伴数量已在近期达到高峰。

- 为了满足对高效能化合物日益增长的需求,CMO 正在谨慎投资,以扩大其设施和产能。这一趋势在美国、瑞士和英国尤为明显。

- 全球高效能原料药 (HPAPI) 的合约生产能力分散在各个地区,目前 80% 的产能位于大型公司旗下的工厂。

- 抗体药物偶联物是最受欢迎的高效化合物之一,目前有 30 多家公司声称提供此类生物製药的合约生产和偶联服务。

- 高效药物开发商可能会将其生产业务外包,预计基于服务的销售额将以每年 12.75% 的速度成长。

细胞毒性药物和高效能原料药製造市场:主要细分市场

高效原料药 (HPAPI) 细分市场在细胞毒性药物和高效能原料药製造市场中占最大占有率

依产品类型,市场细分为高效能原料药 (HPAPI) 和高效能成品剂型。目前,高效原料药 (HPAPI) 细分市场在细胞毒性药物和高效能原料药製造市场中占最大占有率。这一趋势在短期内不太可能改变。

在预测期内,大型公司很可能主导细胞毒性药物和高效原料药 (HPAPI) 製造市场。

依公司规模划分,市场分为中小型企业、中型企业、大型企业及超大型企业。目前,细胞毒性药物和高效能原料药 (HPAPI) 製造市场由大型公司主导。预计这一趋势将在未来十年持续下去。

按业务规模划分,商业规模很可能主导细胞毒性药物和高效原料药 (HPAPI) 製造市场。

依业务规模,市场分为临床前、临床及商业规模。目前,商业规模在细胞毒性药物和高效能原料药 (HPAPI) 製造市场中占有很大占有率。预计这一趋势将在未来几年持续下去。

在预测期内,生物製剂将成为细胞毒性药物和高效原料药 (HPAPI) 製造市场中成长最快的细分市场。

依分子类型划分,市场分为小分子和生物製剂。目前,小分子在细胞毒性药物和高效能原料药 (HPAPI) 製造市场中占主导地位。这主要得益于CMO对高效能小分子的投资和产能扩张。由于对高效药物的需求不断增长,预计未来十年生物製剂市场将以更快的速度成长。

在预测期内,口服FDF(药物开发配方)很可能在细胞毒性药物和高效原料药 (HPAPI) 製造市场中占主导地位。

依高活性最终剂型划分,市场分为注射剂、口服固体製剂、乳膏剂和其他FDF。值得注意的是,口服FDF目前在细胞毒性药物和高效能原料药 (HPAPI) 製造市场中占最大占有率。由于口服製剂的优势,例如製造商的成本效益以及患者使用的舒适性和易用性,预计未来十年趋势将保持不变。

欧洲将占最大的市场占有率。

依地区划分,市场分为北美、欧洲、亚太地区及亚太其他地区。欧洲公司占了大部分市场占有率。这是因为该地区拥有成熟的公司,拥有强大的产能和生产能力。值得注意的是,预计未来几年亚太市场将以更高的复合年增长率成长。

细胞毒性药物和高效原料药 (HPAPI) 製造市场参与者

- AbbVie

- Cambrex

- Catalent

- Pfizer CentreOne

- Piramal Pharma Solutions

- Abzena

- Aenova

- CARBOGEN AMCIS

- Hovione

- Lonza

- Intas Pharmaceuticals

- Scinopharm

- STA Pharmaceutical(a WuXi AppTec company)

- Syngene

- Teva API

初步研究概述

本研究中提出的观点和见解受到与多位利害关係人讨论的影响。本研究报告包含与以下产业利害关係人的详细访谈记录:

- A公司所有者兼董事

- B公司副总裁、营运长兼总经理

- C公司ILC Dover副总裁

- D公司前集团产品经理及前业务发展总监

- E公司业务发展总监

- F公司董事总经理

- G公司製剂及成品部门前总经理

- H公司前现场负责人

- I公司前高级业务发展经理

- J公司医药行销与销售经理

- K公司前业务发展工程师

细胞毒性药物与高效能原料药製造市场:研究主题

- 市场规模与机会分析:本研究报告对细胞毒性药物和高效原料药製造市场进行了深入分析,重点关注以下关键细分市场: [A] 产品类型,[B] 公司规模,[C] 企业规模,[D] 分子类型,[E] 高效成品剂型类型,[F] 主要地区。

- 市场格局:本报告对从事高效原料药 (HPAPI) 和细胞毒性药物合约生产的公司进行了全面评估,考虑了以下各种参数:A) 成立年份,[B] 公司规模(员工人数),[C] 总部所在地,[D] 生产设施所在地,[E] 生产设施面积,[F] 企业规模,[G] 生产的产品生产的分子类型,[H] 初级包装系统类型,[i] 获得的监管认证/认可,以及 [J] 提供的服务类型。

- 竞争分析:本报告对高效原料药 (HPAPI) 和细胞毒性药物的合约製造商进行了全面的竞争分析,考虑的因素包括:A) 供应商优势、[B] 服务优势等。

- 公司简介:本报告详细介绍了提供高效原料药 (HPAPI) 和细胞毒性药物合约製造服务的主要公司,重点关注:A) 公司概况、[B] 高效原料药 (HPAPI) 和细胞毒性药物相关服务组合、[C] 专用设施、[D] 最新发展和 [E] 明智的未来展望。

- 合作伙伴关係与协作:本分析基于相关参数分析了该领域建立的合作伙伴关係,例如:[A] 合作年份、[B] 合作类型、[C] 业务规模、[D] 产品类型、[E] 最活跃的参与者(签署的协议数量)和 [F] 细胞毒性药物和高效原料药 (HPAPI) 製造市场合作活动的区域分布。

- 近期扩张:本分析检视了该领域高效原料药 (HPAPI) 和细胞毒性药物合约製造商为提升生产能力而开展的各种扩张措施。本分析涵盖:[A] 扩张年份,[B] 扩张类型,[C] 公司规模,[D] 总部位置,[E] 企业规模,[F] 产品类型,[G] 扩张设施位置,[H]我们考虑了各种因素,例如:[i] 扩建设施的面积;[ii] 扩建投资金额;[J] 最活跃的参与者(近期扩建数量);以及 [K] 区域分布。

- 产能分析:我们根据各利害关係人发布的数据估算全球高效能原料药 (HPAPI) 的生产能力。此分析重点在于以下因素的可用产能分布:[A] 公司规模(小型、中型、大型);[B] 业务规模(临床前、临床、商业化);以及 [C] 主要地区(北美、欧洲、亚太地区)。

- 区域产能评估分析:一个区域产能评估框架,该框架基于多个参数比较主要地区的高效原料药 (HPAPI) 和细胞毒性药物的生产能力,例如:[A] 高效原料药 (HPAPI) 和细胞毒性药物的合约製造商数量;[B] 高效原料药 (HPAPI) 和细胞毒性药物的生产设施数量;[C] 储存设施数量;

- SWOT 分析:SWOT 分析重点突显可能影响产业发展的关键推动因素和课题。

- 案例研究:提供抗体药物偶联物 (ADC) 製造服务的公司的案例研究。本章也重点介绍了 ADC 的关键组成部分以及製造这些产品面临的主要课题。此外,本章还提供了提供 ADC 合约製造服务的公司清单。

目录

第1章 序文

第2章 摘要整理

第3章 简介

- 章概要

- 高活性API

第4章 市场形势

- 章概要

- HPAPI及细胞伤害性医药品的受託製造厂商:市场形势

第5章 企业竞争力分析

- 章节概要

- 假设和关键参数

- 研究方法

- 高效率原料药 (HPAPI) 合约生产组织:竞争分析

- 高效能原料药 (FDF) 合约製造商:竞争分析

- 高效原料药 (HPAPI) 与高效效力FDF合约生产组织:竞争分析

第6章 企业简介:北美的HPAPI及细胞伤害性医药品厂商

- 章概要

- AbbVie

- Cambrex

- Catalent

- Pfizer CentreOne

- Piramal Pharma Solutions

第7章 企业简介:欧洲的HPAPI及细胞伤害性医药品厂商

- 章概要

- Abzena

- Aenova

- CARBOGEN AMCIS

- Hovione

- Lonza

第8章 企业简介:亚太地区及其他地区的HPAPI及细胞伤害性医药品厂商

- 章概要

- Intas Pharmaceuticals

- Scinopharm

- STA Pharmaceutical(WuXi AppTec旗下)

- Syngene

- Teva API

第9章 伙伴关係和合作

- 章概要

- 伙伴关係模式

- HPAPI和细胞毒性药:伙伴关係和合作清单

第10章 最近的扩张

- 章概要

- HPAPI及细胞毒性药:最近的扩大一览

第11章 容量分析

第12章 地区能力评估分析

第13章 是製造还是购买意思决策架构

- 章概要

- 前提主要的参数

- 结论

第14章 与市场规模的评估机会分析

- 章概要

- 预测调查手法主要的前提条件

- 到2035年前的全球高活性API及细胞毒性药的契约製造市场

第15章 SWOT分析

第16章 案例:抗体药物复合体的受託製造

- 章概要

- 抗体药物复合体的主要成分

- ADC製造概要

- 供应链与手法迁移伴随的课题

- CMO合作伙伴选择时应该考虑的重点

- ADC契约製造服务供应商:市场形势

- 结论

第17章 结论

第18章 执行洞察

第19章 附录1:表格形式资料

第20章 附录2:企业·团体一览

Cytotoxic Drugs and HPAPI Manufacturing Market: Overview

As per Roots Analysis, the global cytotoxic drugs and HPAPI manufacturing market is estimated to grow from USD 13.98 billion in the current year to USD 46.41 billion by 2035, at a CAGR of 12.75% during the forecast period, till 2035.

The market opportunity for cytotoxic drugs and HPAPI manufacturing market has been distributed across the following segments:

Type of Product

- HPAPIs

- Highly Potent Finished Dosage Forms

Scale of Operation

- Preclinical

- Clinical

- Commercial

Type of Molecule

- Small Molecules

- Biologics

Type of Highly Potent Finished Dosage Form

- Injectables

- Oral Solids

- Creams

- Others

Key Geographies

- North America (US, Canada and Mexico)

- Europe (UK, Italy, Germany, France, Spain, and Rest of Europe)

- Asia-Pacific (China, India, and Rest of Asia-Pacific)

- Rest of the World

Cytotoxic Drugs and HPAPI Manufacturing Market: Growth and Trends

Due to the progress in clinical pharmacology and oncology, along with rising interest of players in targeted therapies, researchers and drug manufacturers worldwide are increasingly focusing on high potency active pharmaceutical ingredients (HPAPIs) and cytotoxic drugs. It is important to note that 45% of drugs worldwide are highly potent, necessitating the need for specialized production of HPAPIs. However, the manufacturing of HPAPIs involves a complicated process, leading to various challenges. The primary challenge is preventing cross-contamination during production, followed by ensuring the safety of the environment and workers involved in the supply chain. Additionally, selecting the appropriate containment and protective measures, including equipment, procedures, and personal protective equipment (PPE), is crucial. Handling HPAPIs typically requires ongoing investment in safe handling practices, and advanced technical expertise, which further complicates the field. As a result, drug developers are increasingly turning to outsourcing their manufacturing processes.

Owing to the significant potential and favorable growth prospects of the contract manufacturing sector, most of the leading pharmaceutical companies are seeking to invest in the expansion or enhancement of their existing manufacturing facilities. Several contract manufacturing organizations (CMOs) are establishing new facilities in emerging markets such as Japan, China, India, and Brazil to benefit from lower production costs, skilled labor, and favorable regulatory environments in these regions. Driven by the overall expansion of the market, recent technological innovations, and a rising trend towards outsourcing, the sector is expected to experience consistent growth in the next decade.

Cytotoxic Drugs and HPAPI Manufacturing Market: Key Insights

The report delves into the current state of the cytotoxic drugs & HPAPI manufacturing market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Presently, more than 140 players claim to have the required expertise to offer contract manufacturing services for highly potent compounds, across different scales of operation.

- The current market landscape is highly fragmented, featuring the presence of both new entrants and established players across key geographical regions.

- Leveraging their expertise, stakeholders are offering contract manufacturing services for a myriad of highly potent compounds; around 70% of the service providers possess analytical testing capability for HPAPIs.

- The growing interest in this domain is evident from the rise in partnership activity; in fact, the maximum number of collaborations related to HPAPI and cytotoxic drug manufacturing were inked in the recent past.

- In order to meet the rising demand for high potency compounds, CMOs have made elaborate investments to expand their facilities and capacities; this trend is most pronounced in the US, Switzerland and the UK.

- The installed global contract manufacturing capacity for HPAPIs is well distributed across different geographies; 80% of the present capacity is installed in facilities owned by very large players.

- Antibody Drug Conjugates are one of the most popular classes of highly potent compounds; more than 30 players currently claim to offer contract manufacturing / conjugation services for such biopharmaceuticals.

- It is anticipated that the highly potent drug developers are likely to outsource their manufacturing operations, enabling the service based revenues to grow at an annualized rate of 12.75%.

Cytotoxic Drugs & HPAPI Manufacturing Market: Key Segments

HPAPI Segment Occupies the Largest Share of the Cytotoxic Drugs and HPAPI Manufacturing Market

Based on the type of product, the market is segmented into HPAPI and highly potent finished dosage forms. At present, HPAPI segment holds the maximum share of the cytotoxic drugs & HPAPI manufacturing market. This trend is unlikely to change in the near future.

Very Large Players are Likely to Dominate the Cytotoxic Drugs & HPAPI Manufacturing Market During the Forecast Period

Based on the company size, the market is segmented into small, mid-sized, large and very large companies. At present, very large companies hold the maximum share of the cytotoxic drugs & HPAPI manufacturing market. This trend is likely to remain the same in the coming decade.

By Scale of Operation, Commercial Scale is Likely to Dominate the Cytotoxic Drugs and HPAPI Manufacturing Market

Based on scales of operation, the market is segmented into preclinical, clinical and commercial scales. It is worth highlighting that, at present, commercial scale holds a larger share of the cytotoxic drugs and HPAPI manufacturing market. This trend is likely to remain the same in the forthcoming years.

Biologics is the Fastest Growing Segment of the Cytotoxic Drugs and HPAPI Manufacturing Market During the Forecast Period

Based on the type of molecule, the market is segmented into small molecules and biologics. It is worth highlighting that, at present, small molecules dominate the cytotoxic drugs and HPAPI manufacturing market. This is primarily due to the fact the CMOs have invested and expanded their capabilities for highly potent small molecules. It is important to note the demand for highly potent drugs is on the rise, therefore the market for biologics is expected to grow at a faster pace in the coming decade.

Oral FDFs are Likely to Dominate the Cytotoxic Drugs and HPAPI Manufacturing Market During the Forecast Period

Based on the type of highly potent finished dosage forms, the market is segmented into injectables, oral solids, creams and other FDFs. It is worth highlighting that, at present, oral FDFs capture the highest share of the cytotoxic drugs and HPAPI manufacturing market. This trend is likely to remain the same in the coming decade owing to the benefits offered by oral formulations, such as cost-efficiency for manufacturers, comfort and ease of use for patients.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the world. The majority of the share is expected to be captured by players based in Europe. This is due to the fact that there are well-established players in this region with considerable installed capacities and capabilities. It is worth highlighting that, over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Cytotoxic Drugs & HPAPI Manufacturing Market

- AbbVie

- Cambrex

- Catalent

- Pfizer CentreOne

- Piramal Pharma Solutions

- Abzena

- Aenova

- CARBOGEN AMCIS

- Hovione

- Lonza

- Intas Pharmaceuticals

- Scinopharm

- STA Pharmaceutical (a WuXi AppTec company)

- Syngene

- Teva API

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Owner and Director, Company A

- Vice President and Chief Operating Officer and Business Director, Company B

- ILC Dover, Vice President, Company C

- Ex-Group Product Manager and Ex-Director-Business Development, Company D

- Business Development Director, Company E

- Managing Director, Company F

- Ex-Business Head, Formulations and Finished Products, Company G

- Ex-Site Head, Company H

- Ex-Senior Manager, Business Development, Company I

- Marketing and Sales Manager, Pharma, Company J

- Ex-Business Development Technician, Company K

Cytotoxic Drugs and HPAPI Manufacturing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the cytotoxic drugs and HPAPI manufacturing market, focusing on key market segments, including [A] type of product, [B] company size, [C] scale of operation, [D] type of molecule, [E] type of highly potent finished dosage form and [F] key geographical regions.

- Market Landscape: A comprehensive evaluation of companies involved in the contract manufacturing of HPAPI and cytotoxic drugs, considering various parameters, such as [A] year of establishment, [B] company size (in terms of number of employees), [C] location of headquarters, [D] location of manufacturing facility, [E] area of manufacturing facility, [F] scale of operation, [G] type of product manufactured, [H] type of highly potent finished dosage form, [G] Occupational Exposure Limit, [H] type of molecule manufactured, [H] type of primary packaging system, [I] regulatory certifications / accreditations received and [J] type of service(s) offered.

- Company Competitiveness Analysis: A comprehensive competitive analysis of HPAPI and cytotoxic drug contract manufacturers, examining factors, such as [A] supplier strength and [B] service strength.

- Company Profiles: In-depth profiles of key industry players offering contract manufacturing services for HPAPI and cytotoxic drugs, focusing on [A] company overviews, [B] HPAPI and cytotoxic drug-related service portfolio, [C] dedicated facilities, [D] recent developments and [E] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector based on relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] scale of operation, [D] type of product, [E] most active players (in terms of number of deals inked) and [F] regional distribution of partnership activity that have been undertaken in cytotoxic drugs and HPAPI manufacturing market.

- Recent Expansions: An examination of the different expansion efforts made by the HPAPI and cytotoxic drug contract manufacturers in this field to enhance their manufacturing capabilities. This analysis considers various factors, including the [A] year of expansion, [B] type of expansion, [C] company size, [D] location of headquarters, [E] scale of operation, [F] type of product, [G] location of expanded facility, [H] area of expanded facility, [I] amount invested in expansions, [J] most active players (in terms of number of recent expansions) and [K] geographical distribution.

- Capacity Analysis: Estimation of global HPAPI manufacturing capacity, derived from data provided by various stakeholders in the public domain. This analysis emphasizes the distribution of the available capacity on the basis of [A] company size (small, mid-sized and large), [B] scale of operation (preclinical, clinical and commercial) and [C] key geographical regions (North America, Europe and Asia-Pacific).

- Regional Capability Assessment Analysis: A regional capability assessment framework that compares the HPAPI and cytotoxic drug manufacturing capabilities across key geographies, based on several parameters, such as [A] the number of HPAPI and cytotoxic drug contract manufacturers, [B] number of HPAPI and cytotoxic drug manufacturing facilities, [C] number of facility expansions and [D] installed HPAPI capacity in that particular geographical region.

- SWOT Analysis: A SWOT analysis, focusing on key drivers and challenges that are likely to impact the industry's evolution.

- Case Study: A case study on companies offering manufacturing services for antibody drug conjugate (ADCs). The chapter also highlights the key components of ADCs and the key challenges associated with the manufacturing of these products. Further, the chapter presents a list of players that provide contract manufacturing services for ADCs.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What are the factors that are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Frequently Asked Questions

- 1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. High Potency Active Pharmaceutical Ingredients

- 3.2.1. Classification by Potency

- 3.2.1.1. Classification of HPAPIs

- 3.2.2. Different Types of HPAPIs

- 3.2.2.1. Antibody Drug Conjugates

- 3.2.2.2. Cytotoxic Drugs

- 3.2.2.3. Peptides

- 3.2.2.4. Hormones

- 3.2.2.5. Beta-Lactam Compounds

- 3.2.2.6. Prostaglandins

- 3.2.2.7. Cytostatics

- 3.2.2.8. Steroids

- 3.2.3. Considerations for Handling HPAPIs

- 3.2.4. Contract Manufacturing of HPAPIs and Cytotoxic Drugs

- 3.2.4.1. Key Considerations While Selecting a Contract Manufacturing Partner

- 3.2.5. Regulatory Considerations for Manufacturing HPAPIs

- 3.2.6. Concluding Remarks

- 3.2.1. Classification by Potency

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. HPAPI and Cytotoxic Drug Contract Manufacturers: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters

- 4.2.5. Analysis by Location of Manufacturing Facility

- 4.2.6. Analysis by Area of Manufacturing Facility

- 4.2.7. Analysis by Scale of Operation

- 4.2.8. Analysis by Type of Product Manufactured

- 4.2.9. Analysis by Location of Manufacturing Facility and Type of Product Manufactured

- 4.2.10. Analysis by Type of Finished Dosage Form

- 4.2.11. Analysis by Occupational Exposure Limit (OEL)

- 4.2.12. Analysis by Type of Molecule Manufactured

- 4.2.13. Analysis by Type of Primary Packaging System

- 4.2.14. Analysis by Regulatory Certification / Accreditation Received

- 4.2.15. Analysis by Type of Service(s) Offered

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions and Key Parameters

- 5.3. Methodology

- 5.4. HPAPI Contract Manufacturers: Company Competitiveness Analysis

- 5.4.1. HPAPI Contract Manufacturers based in North America

- 5.4.2. HPAPI Contract Manufacturers based in Europe

- 5.4.3. HPAPI Contract Manufacturers based in Asia-Pacific and Rest of the World

- 5.5. Highly Potent FDF Contract Manufacturers: Company Competitiveness Analysis

- 5.5.1. Highly Potent FDF Contract Manufacturers based in North America

- 5.5.2. Highly Potent FDF Contract Manufacturers based in Europe

- 5.5.3. Highly Potent FDF Contract Manufacturers based in Asia-Pacific and Rest of the World

- 5.6. HPAPI and Highly Potent FDF Contract Manufacturers: Company Competitiveness Analysis

- 5.6.1. HPAPI and Highly Potent FDF Contract Manufacturers based in North America

- 5.6.2. HPAPI and Highly Potent FDF Contract Manufacturers based in Europe

- 5.6.3. HPAPI and Highly Potent FDF Contract Manufacturers based in Asia-Pacific and Rest of the World

6. COMPANY PROFILES: HPAPI AND CYTOTOXIC DRUG MANUFACTURERS IN NORTH AMERICA

- 6.1. Chapter Overview

- 6.2. AbbVie

- 6.2.1. Company Overview

- 6.2.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 6.2.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Cambrex

- 6.3.1. Company Overview

- 6.3.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 6.3.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.3.4. Recent Developments and Future Outlook

- 6.4. Catalent

- 6.4.1. Company Overview

- 6.4.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 6.4.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Pfizer CentreOne

- 6.5.1. Company Overview

- 6.5.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 6.5.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.5.4. Recent Developments and Future Outlook

- 6.6. Piramal Pharma Solutions

- 6.6.1. Company Overview

- 6.6.2. HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- 6.6.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 6.6.4. Recent Developments and Future Outlook

7. COMPANY PROFILES: HPAPI AND CYTOTOXIC DRUG MANUFACTURERS IN EUROPE

- 7.1. Chapter Overview

- 7.2. Abzena

- 7.2.1. Company Overview

- 7.2.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 7.2.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.2.4. Recent Developments and Future Outlook

- 7.3. Aenova

- 7.3.1. Company Overview

- 7.3.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 7.3.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.3.4. Recent Developments and Future Outlook

- 7.4. CARBOGEN AMCIS

- 7.4.1. Company Overview

- 7.4.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 7.4.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.4.4. Recent Developments and Future Outlook

- 7.5. Hovione

- 7.5.1. Company Overview

- 7.5.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 7.5.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.5.4. Recent Developments and Future Outlook

- 7.6. Lonza

- 7.6.1. Company Overview

- 7.6.2. HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- 7.6.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 7.6.4. Recent Developments and Future Outlook

8. COMPANY PROFILES: HPAPI AND CYTOTOXIC DRUG MANUFACTURERS IN ASIA-PACIFIC AND REST OF

THE WORLD

- 8.1. Chapter Overview

- 8.2. Intas Pharmaceuticals

- 8.2.1. Company Overview

- 8.2.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 8.2.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.2.4. Recent Developments and Future Outlook

- 8.3. Scinopharm

- 8.3.1. Company Overview

- 8.3.2. HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- 8.3.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.3.4. Recent Developments and Future Outlook

- 8.4. STA Pharmaceutical (a WuXi AppTec company)

- 8.4.1. Company Overview

- 8.4.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 8.4.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.4.4. Recent Developments and Future Outlook

- 8.5. Syngene

- 8.5.1. Company Overview

- 8.5.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 8.5.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.5.4. Recent Developments and Future Outlook

- 8.6. Teva API

- 8.6.1. Company Overview

- 8.6.2. HPAPI and Cytotoxic Drug Manufacturing Focused Service Offerings

- 8.6.3. Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- 8.6.4. Recent Developments and Future Outlook

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. HPAPI and Cytotoxic Drugs: List of Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnership

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Year and Type of Partnership

- 9.3.4. Analysis by Scale of Operation

- 9.3.5. Analysis by Type of Product

- 9.3.6. Analysis by Type of Partnership and Type of Product

- 9.3.7. Analysis of Amount Invested Via Acquisitions

- 9.3.8. Analysis by Type of Partner

- 9.3.9. Most Active Players: Analysis by Number of Partnerships

- 9.3.10. Analysis by Geography

- 9.3.10.1. Intracontinental and Intercontinental Deals

- 9.3.10.2. International and Local Deals

10. RECENT EXPANSIONS

- 10.1. Chapter Overview

- 10.2. HPAPI and Cytotoxic Drugs: List of Recent Expansions

- 10.2.1. Analysis by Year of Expansion

- 10.2.2. Analysis by Type of Expansion

- 10.2.3. Analysis by Year and Type of Expansion

- 10.2.4. Analysis by Company Size and Location of Headquarters

- 10.2.5. Analysis by Scale of Operation

- 10.2.6. Analysis by Type of Expansion and Scale of Operation

- 10.2.7. Analysis by Type of Product

- 10.2.8. Analysis by Type of Expansion and Type of Product

- 10.2.9. Analysis by Location of Expanded Facility

- 10.2.10. Analysis by Type of Expansion and Location of Expanded Facility

- 10.2.11. Analysis by Expanded Facility Area

- 10.2.12. Analysis by Amount Invested on Expansions

- 10.2.13. Most Active Players: Analysis by Number of Recent Expansions

- 10.2.14. Geographical Analysis

- 10.2.14.1. Analysis by Continent

- 10.2.14.2. Analysis by Country

11. CAPACITY ANALYSIS

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. HPAPI Contract Manufacturers: Global Installed Capacity

- 11.3.1. Analysis by Range of Installed Capacity

- 11.3.2. Analysis by Company Size

- 11.3.3. Analysis by Scale of Operation

- 11.3.4. Analysis by Location of Manufacturing Facility

- 11.3.4.1. Analysis of HPAPI Contract Manufacturing Capacity Installed in North America

- 11.3.4.2. Analysis of HPAPI Contract Manufacturing Capacity Installed in Europe

- 11.3.4.3. Analysis of HPAPI Contract Manufacturing Capacity Installed in Asia-Pacific and Rest of the World

- 11.3.5. Concluding Remarks

12. REGIONAL CAPABILITY ASSESSMENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Assumptions and Key Parameters

- 12.3. HPAPI and Cytotoxic Drug Manufacturing Capabilities in North America

- 12.4. HPAPI and Cytotoxic Drug Manufacturing Capabilities in Europe

- 12.5. HPAPI and Cytotoxic Drug Manufacturing Capabilities in Asia-Pacific

- 12.6. HPAPI and Cytotoxic Drug Manufacturing Capabilities in Rest of the World

- 12.7. Concluding Remarks

13. MAKE VERSUS BUY DECISION MAKING FRAMEWORK

- 13.1. Chapter Overview

- 13.2. Assumptions and Key Parameters

- 12.2.1. Scenario 1

- 12.2.1. Scenario 2

- 12.2.1. Scenario 3

- 12.2.1. Scenario 4

- 13.3. Concluding Remarks

14. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 14.1. Chapter Overview

- 14.2. Forecast Methodology and Key Assumptions

- 14.3. Global HPAPI and Cytotoxic Drug Contract Manufacturing Market, till 2035

- 14.3.1. HPAPI and Cytotoxic Drug Contract Manufacturing Market: Analysis by Type of Product, till 2035

- 14.3.2. HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Company Size, till 2035

- 14.3.3. HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Scale of Operation, till 2035

- 14.3.4. HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Type of Molecule, till 2035

- 14.3.5. HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Type of Highly Potent Finished Dosage Forms, till 2035

- 14.3.6 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Analysis by Geography, till 2035

- 14.3.7. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in North America, till 2035

- 14.3.7.1. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the US, till 2035

- 14.3.7.2. HPAPI and Cytotoxic Drug Contract Manufacturing Market in Canada, till 2035

- 14.3.7.3. HPAPI and Cytotoxic Drug Contract Manufacturing Market in Mexico, till 2035

- 14.3.8. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Europe, till 2035

- 14.3.8.1. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the UK, till 2035

- 14.3.8.2. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Italy, till 2035

- 14.3.8.3. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Germany, till 2035

- 14.3.8.4. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in France, till 2035

- 14.3.8.5. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Spain, till 2035

- 14.3.8.6. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of Europe, till 2035

- 14.3.9. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Asia-Pacific, till 2035

- 14.3.9.1. HPAPI and Cytotoxic Drug Contract Manufacturing Market in China, till 2035

- 14.3.9.2. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in India, till 2035

- 14.3.9.3. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of Asia-Pacific, till 2035

- 14.3.10. HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the Rest of the World, till 2035

15. SWOT ANALYSIS

- 15.1. Chapter Overview

- 15.2. Strengths

- 15.3. Weaknesses

- 15.4. Opportunities

- 15.5. Threats

- 15.6. Concluding Remarks

16. CASE-IN-POINT: CONTRACT MANUFACTURING OF ANTIBODY DRUG CONJUGATES

- 16.1. Chapter Overview

- 16.2. Key Components of Antibody Drug Conjugates

- 16.2.1. Antibody

- 16.2.2. Cytotoxin

- 16.2.3. Linker

- 16.3. Overview of ADC Manufacturing

- 16.3.1. Key Process Steps

- 16.3.2. Challenges Associated with ADC Manufacturing

- 16.3.3. Growing Trend of Outsourcing in ADC Manufacturing

- 16.4. Challenges Associated with Supply Chain and Method Transfer

- 16.4.1. Growing Demand for One-Stop-Shops and Integrated Service Providers

- 16.5. Key Considerations for Selecting a CMO Partner

- 16.6. ADC Contract Manufacturing Service Providers: Overall Market Landscape

- 16.6.1. Analysis by Year of Establishment

- 16.6.2. Analysis by Company Size

- 16.6.3. Analysis by Location of Headquarters

- 16.6.4. Analysis by Service(s) Offered

- 16.7. Concluding Remarks

17. CONCLUDING REMARKS

18. EXECUTIVE INSIGHTS

- 18.1. Chapter Overview

- 18.2. Company A

- 18.2.1. Company Snapshot

- 18.2.2. Interview Transcript: Vice President and Chief Operating Officer and Business Director

- 18.3. Company B

- 18.3.1. Company Snapshot

- 18.3.2. Interview Transcript: Ex-Group Product Manager and Ex-Director-Business Development

- 18.3.3. Interview Transcript: Business Development Associate

- 18.4. Company C

- 18.4.1. Company Snapshot

- 18.4.2. Interview Transcript: Business Development Director

- 18.5. Company D

- 18.5.1. Company Snapshot

- 18.5.2. Interview Transcript: Managing Director

- 18.6. Company E

- 18.6.1. Company Snapshot

- 18.6.2. Interview Transcript: Ex-Business Head, Formulations and Finished Products

- 18.7. Company F

- 18.7.1. Company Snapshot

- 18.7.2. Interview Transcript: Ex-Site Head, Grangemouth

- 18.8. Company G

- 18.8.1. Company Snapshot

- 18.8.2. Interview Transcript: Ex-Senior Manager, Business Development

- 18.9. Company H

- 18.9.1. Company Snapshot

- 18.9.2. Interview Transcript: Marketing and Sales Manager, Pharma

- 18.10. Company I

- 18.10.1. Company Snapshot

- 18.10.2. Interview Transcript: Ex-Business Development Technician

19. APPENDIX 1: TABULATED DATA

20. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 3.1 APIs and HPAPIs: Occupational Exposure Limit

- Table 3.2 Occupational Exposure Limit and Occupational Exposure Band System: International Safety Systems

- Table 3.3 SafeBridge: Categorization System

- Table 3.4 Merck: Categorization System

- Table 3.5 Lonza: Categorization System

- Table 3.6 Ampac Fine Chemicals: Categorization System

- Table 3.7 Helsinn: Categorization System

- Table 3.8 Alkermes: Categorization System

- Table 4.1 HPAPI and Cytotoxic Drugs Contract Manufacturers: List of Service Providers

- Table 4.2 HPAPI and Cytotoxic Drugs Contract Manufacturers: Information on Scale of Operation, Type of Product Manufactured and Type of Highly Potent Finished Dosage Forms (FDFs)

- Table 4.3 HPAPI and Cytotoxic Drugs Contract Manufacturers: Information on Occupational Exposure Limit, and Type of Molecule Manufactured

- Table 4.4 HPAPI and Cytotoxic Drugs Contract Manufacturers: Information on Type of Primary Packaging and Type of Regulatory Certification / Accreditation

- Table 4.5 HPAPI and Cytotoxic Drugs Contract Manufacturers: Information on Type of Services Offered

- Table 6.1 Leading HPAPI and Cytotoxic Drug Manufacturers in North America

- Table 6.2 AbbVie: Company Snapshot

- Table 6.3 AbbVie: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 6.4 AbbVie: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 6.5 AbbVie: Recent Developments and Future Outlook

- Table 6.6 Cambrex: Company Snapshot

- Table 6.7 Cambrex: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 6.8 Cambrex: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 6.9 Cambrex: Recent Developments and Future Outlook

- Table 6.10 Catalent: Company Snapshot

- Table 6.11 Catalent: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 6.12 Catalent: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 6.13 Catalent: Recent Developments and Future Outlook

- Table 6.14 Pfizer CentreOne: Company Snapshot

- Table 6.15 Pfizer CentreOne: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 6.16 Pfizer CentreOne: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 6.17 Pfizer CentreOne: Recent Developments and Future Outlook

- Table 6.18 Piramal Pharma Solutions: Company Snapshot

- Table 6.19 Piramal Pharma Solutions: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 6.20 Piramal Pharma Solutions: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 6.21 Piramal Pharma Solutions: Recent Developments and Future Outlook

- Table 7.1 Leading HPAPIs and Cytotoxic Drug Manufacturers in Europe

- Table 7.2 Abzena: Company Snapshot

- Table 7.3 Abzena: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 7.4 Abzena: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 7.5 Abzena: Recent Developments and Future Outlook

- Table 7.6 Aenova: Company Snapshot

- Table 7.7 Aenova: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 7.8 Aenova: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 7.9 Aenova: Recent Developments and Future Outlook

- Table 7.10 CARBOGEN AMCIS: Company Snapshot

- Table 7.11 CARBOGEN AMCIS: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 7.12 CARBOGEN AMCIS: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 7.13 CARBOGEN AMCIS: Recent Developments and Future Outlook

- Table 7.14 Hovione: Company Snapshot

- Table 7.15 Hovione: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 7.16 Hovione: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 7.17 Hovione: Recent Developments and Future Outlook

- Table 7.18 Lonza: Company Snapshot

- Table 7.19 Lonza: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 7.20 Lonza: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 7.21 Lonza: Recent Developments and Future Outlook

- Table 8.1 Leading HPAPI and Cytotoxic Drug Manufacturers in Asia-Pacific

- Table 8.2 Intas Pharmaceuticals: Company Snapshot

- Table 8.3 Intas Pharmaceuticals: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 8.4 Intas Pharmaceuticals: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 8.5 Intas Pharmaceuticals: Recent Developments and Future Outlook

- Table 8.6 Scinopharm: Company Snapshot

- Table 8.7 Scinopharm: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 8.8 Scinopharm: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 8.9 Scinopharm: Recent Developments and Future Outlook

- Table 8.10 STA Pharmaceutical (a WuXi AppTec company): Company Snapshot

- Table 8.11 STA Pharmaceutical (a WuXi AppTec company): HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 8.12 STA Pharmaceutical (a WuXi AppTec company): Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 8.13 STA Pharmaceutical (a WuXi AppTec company): Recent Developments and Future Outlook

- Table 8.14 Syngene: Company Snapshot

- Table 8.15 Syngene: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 8.16 Syngene: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 8.17 Syngene: Recent Developments and Future Outlook

- Table 8.18 Teva API: Company Snapshot

- Table 8.19 Teva API: HPAPI and Cytotoxic Drugs Manufacturing Focused Service Offerings

- Table 8.20 Teva API: Dedicated HPAPI and Cytotoxic Drug Manufacturing Facilities

- Table 8.21 Teva API: Recent Developments and Future Outlook

- Table 9.1 HPAPI and Cytotoxic Drugs Contract Manufacturing: List of Partnerships and Collaborations, since 2014

- Table 10.1 HPAPI and Cytotoxic Drugs Contract Manufacturing: List of Recent Expansions, since 2014

- Table 11.1 Capacity Analysis: Company Size of CMO

- Table 11.2 Capacity Analysis: Average Capacity by Company Size of CMO

- Table 11.3 HPAPI Manufacturing Global Installed Capacity: Total Capacity by Company Size (Liters)

- Table 16.1 Commonly Used Cytotoxins for ADCs

- Table 16.2 ADC Contract Manufacturing Service Providers: List of Companies

- Table 16.3 ADC Contract Manufacturing Service Providers: Information on Type of Service(s) Offered

- Table 18.1 BSP Pharmaceuticals: Company Snapshot

- Table 18.2 Catalent: Company Snapshot

- Table 18.3 CordenPharma: Company Snapshot

- Table 18.4 ProJect Pharmaceutics: Company Snapshot

- Table 18.5 Alphora Research: Company Snapshot

- Table 18.6 Piramal Healthcare: Company Snapshot

- Table 18.7 Helsinn: Company Snapshot

- Table 18.8 Cerbios-Pharma: Company Snapshot

- Table 18.9 Idifarma: Company Snapshot

- Table 19.1 HPAPIs and Cytotoxic Drugs Contract Manufacturers: Distribution by Year of Establishment

- Table 19.2 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Company Size

- Table 19.3 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Table 19.4 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Table 19.5 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Company Size and Location of Headquarters

- Table 19.6 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Manufacturing Facility (Region-wise)

- Table 19.7 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Manufacturing Facility (Country-wise)

- Table 19.8 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Area of Manufacturing Facility (sq. ft.)

- Table 19.9 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Scale of Operation

- Table 19.10 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Product Manufactured

- Table 19.11 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Manufacturing Facility and Type of Product Manufactured

- Table 19.12 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Finished Dosage Form

- Table 19.13 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Occupational Exposure Limit (OEL)

- Table 19.14 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Molecule Manufactured

- Table 19.15 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Primary Packaging System

- Table 19.16 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Regulatory Certification / Accreditation Received

- Table 19.17 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Service(s) Offered

- Table 19.18 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2014

- Table 19.19 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 19.20 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 19.21 Partnerships and Collaborations: Distribution by Scale of Operation

- Table 19.22 Partnerships and Collaborations: Distribution by Type of Product

- Table 19.23 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Product

- Table 19.24 Partnerships and Collaborations: Distribution of Amount Invested Via Acquisitions (USD Million)

- Table 19.25 Partnerships and Collaborations: Distribution of Type of Partner

- Table 19.26 Most Active Players: Distribution by Number of Partnerships

- Table 19.27 Partnerships and Collaborations: Intracontinental and Intercontinental Deals

- Table 19.28 Partnerships and Collaborations: International and Local Deals

- Table 19.29 Recent Expansions: Distribution by Year of Expansion

- Table 19.30 Recent Expansions: Distribution by Type of Expansion

- Table 19.31 Recent Expansions: Distribution by Year and Type of Expansion

- Table 19.32 Recent Expansions: Distribution by Company Size and Location of Headquarters

- Table 19.33 Recent Expansions: Distribution by Scale of Operation

- Table 19.34 Recent Expansions: Distribution by Type of Expansion and Scale of Operation

- Table 19.35 Recent Expansions: Distribution by Type of Product

- Table 19.36 Recent Expansions: Distribution by Type of Expansion and Type of Product

- Table 19.37 Recent Expansions: Distribution by Location of Expanded Facility

- Table 19.38 Recent Expansions: Distribution by Type of Expansion and Location of Expanded Facility

- Table 19.39 Recent Expansions: Distribution by Expanded Facility Area (sq. ft.)

- Table 19.40 Recent Expansions: Distribution by Amount Invested (USD Million)

- Table 19.41 Most Active Players: Distribution by Number of Recent Expansions

- Table 19.42 Recent Expansions: Continent-wise Distribution

- Table 19.43 Recent Expansions: Country-wise Distribution

- Table 19.44 HPAPI Manufacturing Global Installed Capacity: Distribution by Range of Installed Capacity (Liters)

- Table 19.45 HPAPI Contract Manufacturing Installed Capacity: Distribution by Company Size

- Table 19.46 HPAPI Contract Manufacturing Installed Capacity: Distribution by Scale of Operation

- Table 19.47 HPAPI Contract Manufacturing Installed Capacity: Distribution by Location of Manufacturing Facility

- Table 19.48 HPAPI Contract Manufacturing Capacity Installed in North America

- Table 19.49 HPAPI Contract Manufacturing Capacity Installed in Europe

- Table 19.50 HPAPI Contract Manufacturing Capacity Installed in Asia-Pacific and Rest of the World

- Table 19.51 Global HPAPI and Cytotoxic Drugs Contract Manufacturing Market, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.52 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Distribution by Type of Product, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.53 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Distribution by Company Size, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.54 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Distribution by Scale of Operation, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.55 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Distribution by Type of Molecule, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.56 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Distribution by Type of Highly Potent Finished Dosage Forms, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.57 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Distribution by Regions, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.58 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in North America, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.59 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the US, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.60 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Canada, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.61 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Mexico, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.62 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Europe, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.63 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the UK, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.64 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Italy, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.65 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Germany, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.66 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in France, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.67 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Spain, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.68 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of Europe, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.69 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Asia-Pacific, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.70 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in China, till 2035: Conservative, Base and Optimistic Scenario(USD Billion)

- Table 19.71 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in India, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.72 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of Asia-Pacific, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

- Table 19.73 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of the World, till 2035: Conservative, Base and Optimistic Scenario (USD Billion)

List of Figures

- Figure 2.1. Executive Summary: Overall Market Landscape

- Figure 2.2. Executive Summary: Partnerships and Collaborations

- Figure 2.3. Executive Summary: Recent Expansions

- Figure 2.4. Executive Summary: Capacity Analysis

- Figure 2.5. Executive Summary: Market Sizing and Opportunity Analysis

- Figure 3.1 Characteristics of HPAPIs

- Figure 3.2 Categorization of HPAPIs

- Figure 3.3 Different Types of HPAPIs

- Figure 4.1 HPAPIs and Cytotoxic Drugs Contract Manufacturers: Distribution by Year of Establishment

- Figure 4.2 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Company Size

- Figure 4.3 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Figure 4.4 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Figure 4.5 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Company Size and Location of Headquarters

- Figure 4.6 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Manufacturing Facility (Region-wise)

- Figure 4.7 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Manufacturing Facility (Country-wise)

- Figure 4.8 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Area of Manufacturing Facility

- Figure 4.9 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Scale of Operation

- Figure 4.10 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Product Manufactured

- Figure 4.11 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Location of Manufacturing Facility and Type of Product Manufactured

- Figure 4.12 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Finished Dosage Form

- Figure 4.13 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Occupational Exposure Limit (OEL)

- Figure 4.14 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Molecule Manufactured

- Figure 4.15 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Primary Packaging System

- Figure 4.16 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Regulatory Certification / Accreditation Received

- Figure 4.17 HPAPI and Cytotoxic Drugs Contract Manufacturers: Distribution by Type of Service(s) Offered

- Figure 5.1 HPAPI Contract Manufacturers based in North America

- Figure 5.2 HPAPI Contract Manufacturers based in Europe

- Figure 5.3 HPAPI Contract Manufacturers based in Asia-Pacific and Rest of the World

- Figure 5.4 Highly Potent FDF Contract Manufacturers based in North America

- Figure 5.5 Highly Potent FDF Contract Manufacturers based in Europe

- Figure 5.6 Potent FDF Contract Manufacturers based in Asia-Pacific and Rest of the World

- Figure 5.7 HPAPI and Highly Potent FDF Contract Manufacturers based in North America

- Figure 5.8 HPAPI and Highly Potent FDF Contract Manufacturers based in Europe

- Figure 5.9 HPAPI and Highly Potent FDF Contract Manufacturers based in Asia-Pacific and Rest of the World

- Figure 9.1 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2014

- Figure 9.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 9.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 9.4 Partnerships and Collaborations: Distribution by Scale of Operation

- Figure 9.5 Partnerships and Collaborations: Distribution by Type of Product

- Figure 9.6 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Product

- Figure 9.7 Partnerships and Collaborations: Distribution of Amount Invested Via Acquisitions (USD Million)

- Figure 9.8 Partnerships and Collaborations: Distribution of Type of Partner

- Figure 9.9 Most Active Players: Distribution by Number of Partnerships

- Figure 9.10 Partnerships and Collaborations: Intracontinental and Intercontinental Deals

- Figure 9.11 Partnerships and Collaborations: International and Local Deals

- Figure 10.1 Recent Expansions: Distribution by Year of Expansion

- Figure 10.2 Recent Expansions: Distribution by Type of Expansion

- Figure 10.3 Recent Expansions: Distribution by Year and Type of Expansion

- Figure 10.4 Recent Expansions: Distribution by Company Size and Location of Headquarters

- Figure 10.5 Recent Expansions: Distribution by Scale of Operation

- Figure 10.6 Recent Expansions: Distribution by Type of Expansion and Scale of Operation

- Figure 10.7 Recent Expansions: Distribution by Type of Product

- Figure 10.8 Recent Expansions: Distribution by Type of Expansion and Type of Product

- Figure 10.9 Recent Expansions: Distribution by Location of Expanded Facility (Region-Wise)

- Figure 10.10 Recent Expansions: Distribution by Type of Expansion and Location of Expanded Facility

- Figure 10.11 Recent Expansions: Distribution by Expanded Facility Area (sq. ft.)

- Figure 10.12 Recent Expansions: Distribution by Amount Invested on Expansions (USD Million)

- Figure 10.13 Most Active Players: Distribution by Number of Expansions

- Figure 10.14 Recent Expansions: Continent-wise Distribution

- Figure 10.15 Recent Expansions: Country-wise Distribution

- Figure 11.1 HPAPI Manufacturing Global Installed Capacity: Distribution by Range of Installed Capacity (Liters)

- Figure 11.2 HPAPI Contract Manufacturing Installed Capacity: Distribution by Company Size

- Figure 11.3 HPAPI Contract Manufacturing Installed Capacity: Distribution by Scale of Operation

- Figure 11.4 HPAPI Contract Manufacturing Installed Capacity: Distribution by Location of Manufacturing Facility

- Figure 11.5 HPAPI Contract Manufacturing Capacity Installed in North America

- Figure 11.6 HPAPI Contract Manufacturing Capacity Installed in Europe

- Figure 11.7 HPAPI Contract Manufacturing Capacity Installed in Asia-Pacific and Rest of the World

- Figure 12.1. Regional Capability Analysis: HPAPI and Cytotoxic Drug Manufacturing in North America

- Figure 12.2. Regional Capability Analysis: HPAPI and Cytotoxic Drug Manufacturing in Europe

- Figure 12.3. Regional Capability Analysis: HPAPI and Cytotoxic Drug Manufacturing in Asia-Pacific

- Figure 12.4. Regional Capability Analysis: HPAPI and Cytotoxic Drug Manufacturing in Rest of the World

- Figure 12.5. Regional Capability Analysis: Comparison of HPAPI and Cytotoxic Drug Manufacturing Capabilities across Different Regions

- Figure 13.1 Make versus Buy Decision Making: Framework

- Figure 13.2 Make versus Buy Decision Making: Possible Scenario Descriptions

- Figure 14.1 Global HPAPI and Cytotoxic Drugs Contract Manufacturing Market, till 2035 (USD Billion)

- Figure 14.2 HPAPI and Cytotoxic Drugs Contract Manufacturing Market, till 2035: Distribution by Type of Product (USD Billion)

- Figure 14.3 HPAPI and Cytotoxic Drugs Contract Manufacturing Market: Distribution by Company Size (USD Billion)

- Figure 14.4 HPAPI and Cytotoxic Drugs Contract Manufacturing Market, till 2035: Distribution by Scale of Operation (USD Billion)

- Figure 14.5 HPAPI and Cytotoxic Drugs Contract Manufacturing Market, till 2035: Distribution by Type of Molecule (USD Billion)

- Figure 14.6 HPAPI and Cytotoxic Drugs Contract Manufacturing Market, till 2035: Distribution by Type of Highly Potent Finished

Dosage Forms (USD Billion)

- Figure 14.7 HPAPI and Cytotoxic Drugs Contract Manufacturing Market, till 2035: Distribution by Geography (USD Billion)

- Figure 14.8 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in North America, till 2035 (USD Billion)

- Figure 14.9 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the US, till 2035 (USD Billion)

- Figure 14.10 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Canada, till 2035 (USD Billion)

- Figure 14.11 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Mexico, till 2035 (USD Billion)

- Figure 14.12 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Europe, till 2035 (USD Billion)

- Figure 14.13 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the UK, till 2035 (USD Billion)

- Figure 14.14 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Italy, till 2035 (USD Billion)

- Figure 14.15 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Germany, till 2035 (USD Billion)

- Figure 14.16 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in France, till 2035 (USD Billion)

- Figure 14.17 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Spain, till 2035 (USD Billion)

- Figure 14.18 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of Europe, till 2035 (USD Billion)

- Figure 14.19 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Asia-Pacific, till 2035 (USD Billion)

- Figure 14.20 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in China, till 2035 (USD Billion)

- Figure 14.21 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in India, till 2035 (USD Billion)

- Figure 14.22 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in the Rest of Asia-Pacific, till 2035 (USD Billion)

- Figure 14.23 HPAPI and Cytotoxic Drugs Contract Manufacturing Market in Rest of the World, till 2035 (USD Billion)

- Figure 15.1 HPAPIs and Cytotoxic Drugs Contract Manufacturing: SWOT Analysis

- Figure 15.2 Comparison of SWOT Factors: Harvey Ball Analysis

- Figure 16.1 Key Components of an ADCs

- Figure 16.2 ADC Manufacturing: Key Process Steps

- Figure 16.3 Key Parameters while Selecting a CMO Partner

- Figure 16.4 ADC Contract Manufacturing Service Providers: Distribution by Year of Establishment

- Figure 16.5 ADC Contract Manufacturing Service Providers: Distribution by Company Size

- Figure 16.6 ADC Contract Manufacturing Service Providers: Distribution by Location of Headquarters

- Figure 16.7 ADC Contract Manufacturing Service Providers: Distribution by Type of Service(s) Offered

- Figure 16.8 ADC Contract Manufacturing Service Providers: Distribution by Location of Headquarters and Type of Service(s) Offered