|

市场调查报告书

商品编码

1849802

次世代定序市场:2035年前的产业趋势和全球预测 - 各元件类型,各NGS技术类型,各使用技术,各应用领域,各对象治疗领域,各目的,各终端用户,各地区Next Generation Sequencing Market: Industry Trends and Global Forecasts, Till 2035: Distribution by Type of Component, Type of NGS Technique, Technology Used, Application Area, Target Therapeutic Area, Purpose, End Users and Geographical Regions |

||||||

次世代定序市场预计将从目前的 86 亿美元成长到 2040 年的 465 亿美元,预测期内复合年增长率 (CAGR) 为 18.4%。

次世代定序市场机会分布在以下几个细分领域:

NGS技术类型

- 目标定序

- 全基因测序/全EXOME定序

- RNA定序

- 其他

使用技术类型

- 合成各技术定序

- 离子半导体技术

- 奈米孔洞定序技术

- 其他技术

应用领域

- 临床应用

- 研究及应用

对象治疗领域

- 肿瘤学的疾病

- 遗传基因疾病

- 生殖疾病

- 其他

治疗目的

- 诊断

- 风险评估

- 无症状性评估

- 筛检

- 其他

终端用户

- 学术·研究机关

- 医院及诊所

- 製药·生物科技企业

- 其他的终端用户

地区

- 北美

- 欧洲

- 亚太地区

- 中东·北非

- 南美

北美市场

- 美国

- 加拿大

欧洲市场

- 德国

- 英国

- 法国

- 义大利

- 英国

- 西班牙

亚太地区市场

- 中国

- 韩国

- 印度

- 澳洲

- 其他

中东·北非市场

- 沙乌地阿拉伯

- 阿拉伯联合大公国

- 其他

南美市场

- 巴西

- 阿根廷

- 其他

次世代定序市场成长与趋势

次世代定序技术能够确定整个基因组的序列,从而了解与多种疾病相关的基因变异。同时对整个基因组进行定序的能力,为研究和分子疾病诊断开闢了广阔的前景。

慢性病的盛行率逐年显着上升,引发了人们的严重担忧。根据美国国立卫生研究院 (NIH) 的报告,近 60% 的美国人患有至少一种慢性病,这表明慢性病风险正在增加。为了缓解这一担忧,研究人员正在利用下一代定序技术,透过宏基因组学研究,在分子层面分析疾病。除了疾病诊断之外,次世代定序还有助于标靶疗法的设计、识别和开发。

目前,由于实施成本高、需要熟练人员以及企业内部NGS工作流程基础设施不足,下一代定序平台的普及应用受到限制。为了解决这些问题,多家产业公司(例如Illumina和PacBio)提供次世代定序服务。

外包NGS解决方案经济高效,能够缩短分析时间,并确保定序资料的准确性。这些优势吸引了许多政府机构和产业领导企业的关注,他们目前正参与多项国家基因组图谱绘製计画。此外,下一代定序技术对临床试验产生了重大影响,提高了志愿者参与率,并帮助研究人员就正在评估的药物和技术做出更明智的决策。

预计该领域的持续研究和创新将显着促进这些定序技术的应用,从而推动下一代定序市场的成长。

次世代定序市场关键洞察

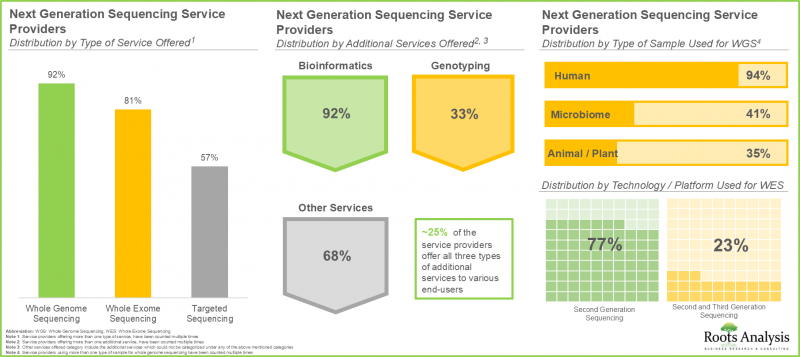

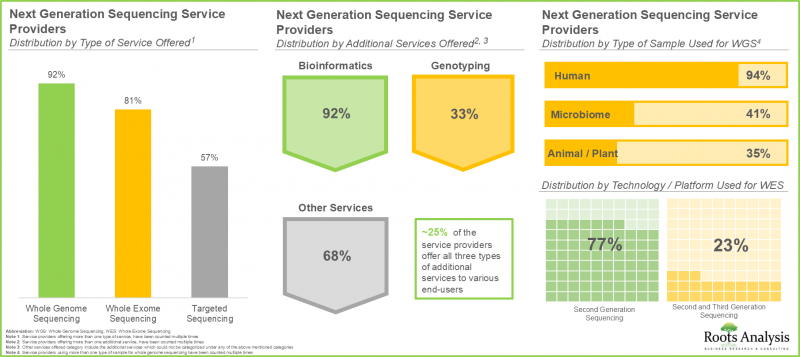

本报告深入分析了下一代定序市场的现状,并指出了该行业的潜在成长机会。本报告的主要结论包括:

- 超过 45% 的下一代定序服务提供者是小型企业,这表明市场中新进入者的数量正在增加。

- 约 95% 的次世代定序服务提供者提供全基因组定序服务,其中约 85% 也提供额外的生物资讯服务。

- 提供下一代定序技术的公司中,近40%为中型企业,其中75%位于北美。

- 由于NGS技术的需求不断增长,其应用领域显着扩展,目前约有25种技术可用于全基因组定序和标靶定序。

- 自2020年以来,全球已提交并获得授权的专利超过3060项,这些专利专注于下一代技术/平台的研发。

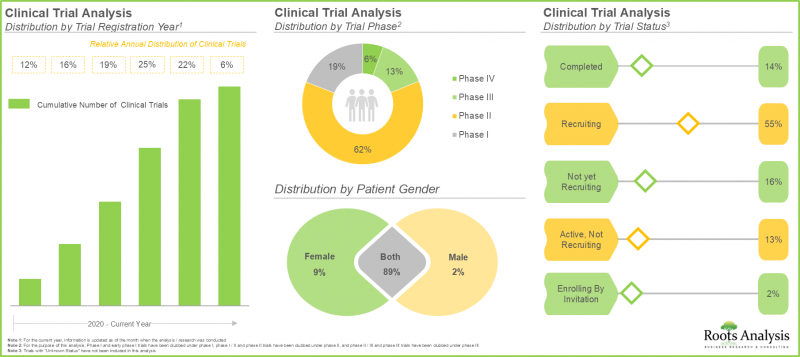

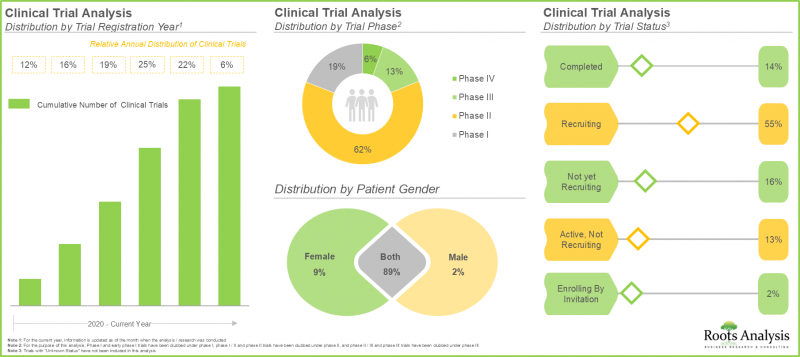

- 近年来,该领域的临床试验入组数量显着增加,目前超过60%的下一代定序试验处于II期。

- 大型製药公司对次世代定序领域的兴趣日益浓厚,这体现在近期推出的一系列措施中。

- 预计到2035年,下一代定序市场将以18.4%的复合年增长率成长,其中北美将占大部分市场占有率,其次是欧洲。

- 预计市场机会将分布在各个细分领域,包括组件类型、NGS技术类型、所用技术、应用领域、治疗领域、目标和最终用户。

次世代定序市场的主要细分领域

耗材细分市场占次世代定序市场的大部分占有率

依组件类型划分,下一代定序市场分为耗材、服务和设备。今年,耗材细分市场占了整个市场的大部分占有率(67%),预计这一趋势将持续(复合年增长率18.7%)。

标靶定序技术在次世代定序市场中占最大占有率。

本报告按NGS技术类型将市场规模细分为标靶定序、全基因组/全外显子定序、RNA定序和其他技术。目前,标靶定序技术占了整体市场最大的占有率(45%)。然而,预计到2035年,全基因组/全外显子定序技术将以相对较高的复合年增长率(19.5%)成长。

预计奈米孔定序技术将以更高的复合年增长率成长。

本报告依所用技术将市场细分为合成定序、离子半导体技术、奈米孔定序和其他技术。目前,合成定序技术在下一代定序市场中占最大占有率(82%),预计这一趋势将保持不变。然而,预计到 2035 年,奈米孔定序技术领域的复合年增长率将相对较高(20.5%)。

临床应用引领下一代定序市场

次世代定序市场规模可根据应用领域进一步细分为多个子领域,例如临床和研究应用。目前,临床应用占了整个市场最大的占有率(57%)。预计到 2035 年,该领域将以相对较高的复合年增长率成长(21.1%)。

肿瘤疾病将占最大市场占有率

该领域揭示了市场在各个标靶治疗领域的分布情况,包括肿瘤疾病、遗传疾病、生殖系统疾病和其他治疗领域。目前,肿瘤疾病占了下一代定序市场最大的占有率(50%),预计这一趋势将保持不变。这很可能是由于人们越来越倾向于使用下一代定序技术,以在分子层面进行癌症的早期诊断和预防。然而,预计到 2035 年,其他治疗领域细分市场将以相对较高的复合年增长率 (CAGR) 成长。

诊断将占最大的市场占有率

次世代定序市场根据用途进一步细分为各种子细分市场,例如诊断、风险评估、预后评估、筛检和其他用途。目前,诊断细分市场 (58%) 占市场主导地位,预计这一趋势将保持不变。然而,预计到 2035 年,其他用途细分市场将以相对较高的复合年增长率 (CAGR) 成长。

学术和研究机构占大部分市场占有率

全球市场按最终用户细分,包括学术和研究机构、医院和诊所、製药和生物技术公司以及其他最终用户。目前,学术和研究机构占下一代定序市场最大占有率(45%),预计这一趋势将保持不变。然而,医院和诊所领域预计在预测期内(至 2035 年)将以相对较高的复合年增长率 (CAGR) 增长(21.7%)。

北美将引领下一代定序市场

次世代定序市场分布于多个地区,包括北美、欧洲/亚太地区、中东/北非和拉丁美洲。然而,北美目前占大部分市场占有率(51%),预计这一趋势将持续。

参与次世代定序市场的公司范例

- Illumina

- MGI Tech

- Oxford Nanopore Technologies

- Pacific Biosciences

- Thermo Fisher Scientific

次世代定序市场研究报告

本研究报告涵盖下一代定序市场的各个面向,包括:

- 市场规模和机会分析:本报告深入分析了下一代定序市场的当前市场机会和未来成长潜力,重点关注关键市场细分,例如:A) 组件类型,B) NGS 技术类型,C) 使用的技术类型,D) 应用领域,E) 目标治疗领域,以及 F) 地区。

- 市场影响分析:本报告全面分析了可能影响市场成长的各种因素,包括:A) 推动因素,B) 阻碍因素,C) 市场推动因素,以及 D) 现有挑战。

- 市场概览:A] 参与次世代定序领域的服务提供者列表,并基于全基因组定序所用样本类型进行分析;[B] 全基因组定序所用技术/平台类型;[C] 全外显子定序所用样本类型分析;[D] 全显子类型;[C] 全外显子定序所使用样本类型分析;[D] 全显子类型;公司成立年份;[H] 公司规模;[H] 总部所在地。

- 技术概览:深入的技术概览分析,提供以下资讯:A] 应用类型;[B] 技术/平台运行时间;[C] 最大输出量;[D] 最高品质;[E] 所用定序技术;[F] 公司成立年份;[G] 公司规模;[H] 总部所在地。

- 技术竞争分析:基于多种相关参数(例如 A] 技术供应商的优势、B] 平台的优势)深入分析技术竞争力。

- 公司简介:包含以下资讯:A] 公司概况、B] 财务资讯(如有)、C] 下一代定序服务组合、D] 近期发展、E] 未来展望。

- 专利分析:基于多种相关参数(包括 A] 专利类型、B] 专利公开年份、C] 专利申请年份、D] 专利管辖区、E] 专利合作分类 (CPC) 代码、F] 申请人类型)深入分析 2020 年以来下一代定序领域已提交/已授权的专利。

- 临床试验分析:对已完成/正在进行的与下一代定序相关的临床试验进行深入分析,分析参数包括:[A] 研究註册年份,[B] 入组患者人数,[C] 研究阶段,[D] 研究参数包括:[A] 研究註册年份,[B] 入组患者人数,[C] 研究阶段,[D] 研究状态,[E] 目标患者人群,[F] 患者性别,[G] 申办方/合作方设计。

目录

第1章 序文

第2章 调查手法

- 章概要

- 调查的前提

- 资料库建立

- 计划调查手法

- 坚牢的品管

第3章 市场动态

- 章概要

- 预测调查手法

- 市场评估组成架构

- 预测工具和技巧

- 重要的考虑事项

- 限制事项

第4章 宏观经济指标

- 章概要

- 市场动态

- 结论

第5章 摘要整理

第6章 简介

第7章 次世代定序服务供应商:市场形势

- 章概要

- 次世代定序服务供应商:产业参与企业的市场形势

- 次世代定序服务供应商:产业外的参与企业一览

第8章 次世代定序:科技的形势

- 章概要

- 次世代定序:技术形势

- 次世代定序:科技/平台供应商的形势

第9章 次世代定序技术/平台:竞争分析

- 章概要

- 前提主要的参数

- 调查手法

- 次世代定序技术/平台:竞争分析

第10章 企业简介:次世代定序服务供应商

- 章概要

- Admera Health

- Applied Biological Materials

- BGI Genomics

- CD Genomics

- DNA Link

- Eurofins Genomics

- Gene by Gene

- GENEWIZ

- MedGenome

- Novogene

- Psomagen

- Veritas

- Xcerlis Labs

第11章 企业简介次世代定序技术供应商

- 章概要

- Illumina

- MGI Tech

- Oxford Nanopore Technologies

- Pacific Biosciences

- Thermo Fisher Scientific

第12章 专利分析

- 章概要

- 范围与调查手法

- 次世代定序:专利分析

- 专利基准分析

- 专利评估

- 引用数前几名的专利

第13章 临床试验的分析

- 章概要

- 范围与调查手法

- 次世代定序:临床试验分析

第14章 大型製药公司的分析

- 章概要

- 范围与调查手法

- 配合措施各年度分析

第15章 案例研究:政府主导的次世代定序举措

第16章 市场影响分析:促进因素,阻碍因素,机会,课题

第17章 全球次世代定序市场

第18章 次世代定序市场:各零件

第19章 次世代定序市场:各NGS技术类型

第20章 次世代定序市场:各使用技术

第21章 次世代定序市场:各应用领域

第22章 次世代定序市场:各对象治疗领域

第23章 次世代定序市场:各目的

第24章 次世代定序市场:各终端用户

第25章 次世代定序市场:各地区

第26章 结论

第27章 执行洞察

第28章 附录1:表格形式资料

第29章 附录2:企业·团体一览

Next Generation Sequencing Market: Overview

The next generation sequencing market is estimated to grow from USD 8.6 billion in the current year and reach USD 46.5 billion by 2040, representing a higher CAGR of 18.4% during the forecast period.

The opportunity for next generation sequencing market has been distributed across the following segments:

Type of NGS Technique

- Targeted Sequencing

- Whole Genome Sequencing / Whole Exome Sequencing

- RNA Sequencing

- Other Techniques

Type of Technology Used

- Sequencing by Synthesis Technology

- Ion Semiconductor Technology

- Nanopore Sequencing Technology

- Other Technologies

Application Area

- Clinical Applications

- Research and Applied Applications

Target Therapeutic Area

- Oncological Disorders

- Genetic Disorders

- Reproductive Disorders

- Other Therapeutic Areas

Purpose

- Diagnosis

- Risk Assessment

- Presymptomatic Assessment

- Screening

- Other Purposes

End users

- Academic and Research Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other End Users

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Market in North America

- US

- Canada

Market in Europe

- Germany

- UK

- France

- Italy

- UK

- Spain

Market in Asia-Pacific

- China

- South Korea

- India

- Australia

- Rest of the Asia-Pacific

Market in Middle East and North Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and North Africa

Market in Latin America

- Brazil

- Argentina

- Rest of Latin America

Next Generation Sequencing Market: Growth and Trends

Next generation sequencing involves the sequencing of whole genomes to understand genetic variations associated with a wide range of diseases. The ability to sequence entire genomes at the same time has created wide possibilities for both research and the molecular diagnosis of diseases.

The prevalence of chronic diseases has significantly increased over the years, raising serious concerns. According to the report of , nearly six out of 10 Americans are suffering from at least one chronic disease, indicating the growing risk of chronic diseases. In order to mitigate this concern, researchers are leveraging next generation sequencing for analyzing diseases at molecular level through metagenomics studies. In addition to disease diagnosis, next generation sequencing helps to design , identify and develop targeted therapies.

Currently, next generation sequencing platforms experience limited adoption because of high installation costs, the need for skilled personnel, and inadequate in-house infrastructure to carry out NGS workflows. To tackle these issues, various industry companies (such as Illumina and PacBio) are providing next generation sequencing services.

Outsourcing NGS solutions is economical, shortens analysis duration, and ensures precision in producing sequencing data. Such advantages of outsourcing next generation sequencing have attracted the interest of various government agencies and industry leaders who are currently involved in several initiatives related to multiple national genome mapping. Moreover, next-generation technologies have demonstrated great effectiveness in clinical trials, leading to a rise in volunteer participation in these trials, which assists researchers in making more informed decisions regarding the assessed drug or technology.

Ongoing research and innovation in this domain are expected to lead to a significant rise in the adoption of these sequencing techniques, propelling the growth of the next generation sequencing market.

Next Generation Sequencing Market: Key Insights

The report delves into the current state of the next generation sequencing market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

- Over 45% of the next generation sequencing service providers are small players; this is indicative of the increase in number of new entrants within the market.

- ~95% of the next generation sequencing service providers offer whole genome sequencing services; of these, around 85% of the service providers offer additional services for bioinformatics.

- Close to 40% of the companies engaged in offering next generation sequencing technologies are mid-sized firms; further, ~75% of the firms are based in North America.

- The rising demand for NGS technologies has led to a notable increase in its application sectors, with around 25 technologies currently used for both whole genome sequencing and targeted sequencing.

- Since 2020, more than 3,060 patents have been filed / granted focused on the research and development of next generation technologies / platforms across the globe.

- In recent years, a significant increase in the number of registered clinical trials has been observed in this domain; over 60% of the trials focused on next generation sequencing are currently in phase II.

- The rising interest of big pharma players in the field of next generation sequencing is reflected by the wide array of initiatives established in the recent past; ~75% of the initiatives were focused collaborations with other players.

- The next generation sequencing market is anticipated to grow at a CAGR of 18.4% till 2035; majority of the market share is likely to be occupied by North America, followed by Europe.

- The market opportunity is projected to be well distributed across various segments, such as type of component, type of NGS technique, technology used, application area, target therapeutic area, purpose and end users.

Next Generation Sequencing Market: Key Segments

Consumables Segment Capture the Majority of the Next Generation Sequencing Market

In terms of type of component, the next generation sequencing market is segmented in consumables and services and instruments. In the current year, the consumables segment captures the majority share (67%) in the overall market and this trend is likely to remain unchanged in the future as well (CAGR of 18.7%).

Targeted Sequencing Segment Captures the Maximum Share of the Next Generation Sequencing Market

This next generation sequencing market report highlights the segmentation of the market size into targeted sequencing, whole genome sequencing / whole exome sequencing, RNA sequencing and other techniques, based on the type of NGS technique. Currently, the targeted sequencing segment captures the maximum share (45%) in the overall market. However, whole genome sequencing / whole exome sequencing segment is expected to grow at a relatively higher CAGR (19.5%), during the forecast period, till 2035.

Nanopore Sequencing Technology Segment is Likely to Grow at a Higher CAGR

This market report highlights the segmentation of the market into sequencing by synthesis technology, ion semiconductor technology, nanopore sequencing technology and other technologies, based on the type of technology used. Currently, the sequencing by synthesis technology segment captures the maximum next generation sequencing market share (82%) and this trend is likely to remain unchanged in the future as well. However, nanopore sequencing technology segment is expected to grow at a relatively higher CAGR (20.5%), during the forecast period, till 2035.

Clinical Applications Segment Leads the Next Generation Sequencing Market

The next generation sequencing market size is further divided into various sub-segments based on the application area, such as clinical applications, and research and applied applications. Currently, the clinical applications segment captures the maximum share (57%) in the overall market. This segment is expected to grow at a relatively higher CAGR (21.1%), during the forecast period, till 2035.

Oncological Disorders Capture the Highest Market Share

This segment highlights the distribution of market across various target therapeutic area such as, oncological disorders, genetic disorders, reproductive disorders and other therapeutic area. Currently, oncological disorders occupy the highest next generation sequencing market share (50%), and this trend is likely to remain unchanged. This can be attributed to the growing preference of next generation sequencing technologies for early diagnosis and prevention of cancer at molecular level. However, the other therapeutic areas segment is likely to grow at a relatively higher CAGR (26.6%) during the forecast period, till 2035.

Diagnosis Segment Captures the Highest Market Share

The next generation sequencing market is further divided into various sub-segments based on the purpose such as diagnosis, risk assessment, presymptomatic assessment, screening and other purposes. Currently, the market is driven by the diagnosis segment (58%) in the overall market, and this trend is likely to remain unchanged. However, other purposes segment is expected to grow at a relatively higher CAGR (20.1%), during the forecast period, till 2035.

Academic And Research Institutes Hold the Majority of the Market Share

The global market is segmented into different end users, including academic and research institutes, hospitals and clinics, pharmaceutical and biotechnology companies, and other end users. Currently, the academic and research institutes segment captures the maximum next generation sequencing market share (45%), and this trend is likely to remain unchanged in the future as well. However, we anticipate hospitals and clinics segment to grow at a relatively higher CAGR (21.7%) during the forecast period, till 2035.

North America will Propel the Next Generation Sequencing Market

Next generation sequencing market is distributed across various geographies, such as North America, Europe and Asia-Pacific, Middle East and North Africa and Latin America., North America is likely to capture the majority (51%) of the current market share, and this trend is likely to remain unchanged in the future.

Example Players in the Next Generation Sequencing Market

- Illumina

- MGI Tech

- Oxford Nanopore Technologies

- Pacific Biosciences

- Thermo Fisher Scientific

Next Generation Sequencing Market: Research Coverage

The report on next generation sequencing market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of next generation sequencing market , focusing on key market segments, including [A] type of component, [B] type of NGS technique, [C] type of technology used, [D] application area, [E] target therapeutic area and [F] geographical regions.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Market Landscape: The report features a list of service providers involved in the next generation domain, along with analyses based on [A] type of sample used for whole genome sequencing, [B] type of technology / platform used for whole genome sequencing and [C] analysis by type of sample used for whole exome sequencing [D] analysis by type of technology / platform used for whole exome sequencing [E] analysis by type of sample used for targeted sequencing, [F] analysis by type of technology / platform used for targeted sequencing [G] year of establishment, [H] company size [I] location of headquarters.

- Technology Landscape: An insightful technology landscape analysis, presenting information on [A] type of application, [B] technology / platform run time [C] maximum output [D] maximum quality, [E] sequencing technique used, [F] year of establishment, [G] company size [H] location of headquarters.

- Technology Competitiveness Analysis: An insightful technology competitiveness, based on various relevant parameters, such as [A] technology provider strength, and [B] platform strength.

- Company Profiles: Comprehensive profiles of prominent players that are engaged in offering next generation sequencing services and next generation sequencing technologies, featuring information on [A] company overview, [B] financial information (if available), [C] next generation sequencing service portfolio, [D] recent developments, and [E] future outlook statements.

- Patent Analysis: A detailed analysis of patents filed / granted since 2020 in the next generation sequencing domain, based on several relevant parameters, such as [A] type of patent, [B] patent publication year, [C] patent application year, [D] patent jurisdiction, [E] cooperative patent classification (CPC) symbols, and [F] type of applicant.

- Clinical Trial Analysis: A detailed clinical trial analysis of completed / ongoing clinical trials related to next-generation sequencing relevant information across parameters, such as [A] trial registration year, number of patients enrolled, [B] trial phase, [C] trial status, [D] target patient population, [E] patient gender, [F] type of sponsor / collaborator and [G] study design

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Genome Sequencing

- 6.3. Types of Genome Sequencing

- 6.4. History and Evolution of Next Genration Sequencing

- 6.5. Generations of Next generation sequencing Technology

- 6.5.1. First Generation DNA Sequencers

- 6.5.2. Second Generation HT-NGS Platforms

- 6.5.3. Third Generation HT-NGS Platforms

- 6.5.3.1. Heliscope Single Molecule Sequencer

- 6.5.3.2. Single Molecule Real Time (SMRT(TM)) Sequencer

- 6.5.3.3. Single Molecule Real Time (RNAP) Sequencer

- 6.5.3.4. Multiplex Polony Technology

- 6.5.3.5. Nanopore DNA Sequencer

- 6.5.3.6. The Ion Torrent Sequencing Technology

- 6.6. Comparison of First, Second and Third Generation Technologies

- 6.7. Applications of Genome Sequencing

- 6.8. Challenges Associated with Genome Sequencing

- 6.9. Future Perspectives

7. NEXT GENERATION SEQUENCING SERVICE PROVIDERS: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Next Genration Sequencing Service Providers: Overall Market Landscape of Industry Players

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Company Size and Location of Headquarters (Region)

- 7.2.5. Analysis by Type of Service Offered

- 7.2.6. Analysis by Additional Service Offered

- 7.2.7. Analysis by Type of Sample Used for Whole Genome Sequencing

- 7.2.8. Analysis by Type of Technology / Platform Used for Whole Genome Sequencing

- 7.2.9. Analysis by Type of Sample Used for Whole Exome Sequencing

- 7.2.10. Analysis by Type of Technology / Platform Used for Whole exome Sequencing

- 7.2.11. Analysis by Type of Sample Used for Targeted Sequencing

- 7.2.12. Analysis by Type of Technology / Platform Used for Targeted Sequencing

- 7.3. Next Genration Sequencing Service Providers: List of Non-Industry Players

8. NEXT-GENERATION SEQUENCING: TECHNOLOGY LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Next Genration Sequencing: Technology Landscape

- 8.2.1. Analysis by Type of Application

- 8.2.2. Analysis by Technology / Platform Run Time (Hours)

- 8.2.3. Analysis by Maximum Output (Gb)

- 8.2.4. Analysis by Maximum Base Pair Reads per Run (Million)

- 8.2.5. Analysis by Maximum Quality

- 8.2.6. Analysis by Sequencing Technique Used

- 8.3. Next-generation Sequencing: Technology / Platform Providers Landscape

- 8.3.1. Analysis by Year of Establishment

- 8.3.2. Analysis by Company Size

- 8.3.3. Analysis by Location of Headquarters (Country and Region)

- 8.3.4. Analysis by Company Size and Location of Headquarters (Region)

9. NEXT GENERATION SEQUENCING TECHNOLOGIES / PLATFORMS: COMPETITIVE ANALYSIS

- 9.1. Chapter Overview

- 9.2. Assumptions and Key Parameters

- 9.3. Methodology

- 9.4. Next generation sequencing Technologies / Platforms: Competitive Analysis

- 9.4.1. Next generation sequencing Technologies / Platforms Provided by Players based in North America

- 9.4.2. Next generation sequencing Technologies / Platforms Provided by Players based in Europe and Asia-Pacific

10. COMPANY PROFILES: NEXT GENERATION SEQUENCING SERVICE PROVIDERS

- 10.1. Chapter Overview

- 10.2. Admera Health

- 10.2.1. Company Overview

- 10.2.2. Service Portfolio

- 10.2.3. Recent Developments and Future Outlook

- 10.3. Applied Biological Materials

- 10.4. BGI Genomics

- 10.5. CD Genomics

- 10.6. DNA Link

- 10.7. Eurofins Genomics

- 10.8. Gene by Gene

- 10.9. GENEWIZ

- 10.10. MedGenome

- 10.11. Novogene

- 10.12. Psomagen

- 10.13. Veritas

- 10.14. Xcerlis Labs

11. COMPANY PROFILES: NEXT GENERATION SEQUENCING TECHNOLOGY PROVIDERS

- 11.1. Chapter Overview

- 11.2. Illumina

- 11.2.1. Company Overview

- 11.2.2. Technology / Platform Portfolio

- 11.2.3. Financial Information

- 11.3. MGI Tech

- 11.4. Oxford Nanopore Technologies

- 11.5. Pacific Biosciences

- 11.6. Thermo Fisher Scientific

12. PATENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scope And Methodology

- 12.3. Next-generation Sequencing: Patent Analysis

- 12.3.1. Analysis by Patent Publication Year

- 12.3.2. Analysis by Type of Patent and Publication Year

- 12.3.3. Analysis by Patent Application Year

- 12.3.4. Analysis by Patent Jurisdiction

- 12.3.5. Analysis by CPC Symbols

- 12.3.6. Analysis by Type of Applicant

- 12.3.7. Leading Industry Players: Analysis by Number of Patents

- 12.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 12.4. Patent Benchmarking Analysis

- 12.4.1. Analysis by Patent Characteristics

- 12.5. Patent Valuation

- 12.6. Leading Patents by Number of Citations

13. CLINICAL TRIALS ANALYSIS

- 13.1. Chapter Overview

- 13.2. Scope and Methodology

- 13.3. Next-generation Sequencing: Clinical Trial Analysis

- 13.3.1. Analysis by Trial Registration Year

- 13.3.2. Analysis of Number of Patients Enrolled by Trial Registration Year

- 13.3.3. Analysis by Trial Phase

- 13.3.4. Analysis of Number of Patients Enrolled by Trial Phase

- 13.3.5. Analysis by Trial Status

- 13.3.6. Analysis by Trial Registration Year and Trial Status

- 13.3.7. Analysis by Target Patient Population

- 13.3.8. Analysis by Patient Gender

- 13.3.9. Analysis by Study Design

- 13.3.9.1. Analysis by Type of Allocation

- 13.3.9.2. Analysis by Type of Intervention Model

- 13.3.9.3. Analysis by Type of Masking

- 13.3.9.4. Analysis by Trial Purpose

- 13.3.10. Analysis by Type of Sponsor / Collaborator

- 13.3.11. Leading Players: Analysis by Number of Clinical Trials

- 13.3.12. Analysis by Geography

- 13.3.12.1. Analysis of Clinical Trials by Geography

- 13.3.12.2. Analysis of Clinical Trials by Geography and Trial Status

- 13.3.12.3. Analysis of Patients Enrolled by Geography and Trial Status

14. BIG PHARMA ANALYSIS

- 14.1 Chapter Overview

- 14.2. Scope and Methodology

- 14.3. Analysis by Year of Initiative

- 14.3.1. Analysis by Type of Initiative

- 14.3.2. Analysis by Type of Collaboration

- 14.3.3. Analysis by Focus Area

- 14.3.4. Most Active Big Pharma Players: Analysis by Number of Initiatives

15. CASE STUDY: NEXT GENERATION SEQUENCING INITIATIVES SPONSORED BY GOVERNMENT

- 15.1. Chapter Overview

- 15.2. Next-generation Sequencing: List of Government Sponsored Initiatives

- 15.2.1. Analysis by Initiative Establishment Year

- 15.2.2. Analysis by Aim and Objective of Initiative

- 15.2.3. Analysis by Geographical Reach

- 15.2.4. Analysis by Number of Individual's Genome Sequenced

- 15.2.5. Analysis by Focus Area

- 15.2.6. Analysis by Type of Partner

- 15.2.7. Analysis by Type of Sponsor

16. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17. GLOBAL NEXT GENERATION SEQUENCING MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Next Generation Sequencing Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 17.3.1. Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1. Scenario Analysis

- 17.4. Key Market Segmentations

18. NEXT GENERATION SEQUENCING MARKET: BY TYPE OF COMPONENT

- 18.1. Chapter Overview

- 18.2. Assumptions and Methodology

- 18.3. Next Generation Sequencing Market: Distribution by Type of Component

- 18.3.1. Next Generation Sequencing Market for Consumables, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.3.2. Next Generation Sequencing Market for Services, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.3.3. Next Generation Sequencing Market for Instruments, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19 NEXT GENERATION SEQUENCING MARKET: BY TYPE OF NGS TECHNIQUE

- 19.1. Chapter Overview

- 19.2. Assumptions and Methodology

- 19.3. Next Generation Sequencing Market: Distribution by Type of NGS technique

- 19.3.1. Next Generation Sequencing Market for Targeted Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.3.2. Next Generation Sequencing Market for Whole Genome Sequencing / Whole Exome Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.3.3. Next Generation Sequencing Market for RNA Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.3.4. Next Generation Sequencing Market for Other Techniques, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. NEXT GENERATION SEQUENCING MARKET: BY TYPE OF TECHNOLOGY USED

- 20.1. Chapter Overview

- 20.2. Assumptions and Methodology

- 20.3. Next Generation Sequencing Market: Distribution by Type of Technology Used

- 20.3.1. Next Generation Sequencing Market for Sequencing by Synthesis Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till2035)

- 20.3.2. Next Generation Sequencing Market for Ion Semiconductor Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.3.3. Next Generation Sequencing Market for Nanopore Sequencing Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.3.4. Next Generation Sequencing Market for Other Technologies, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. NEXT GENERATION SEQUENCING MARKET: BY APPLICATION AREA

- 21.1. Chapter Overview

- 21.2. Assumptions and Methodology

- 21.3. Next Generation Sequencing Market: Distribution by Application Area

- 21.3.1. Next Generation Sequencing Market for Clinical Applications, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.3.2. Next Generation Sequencing Market for Research and Applied Applications, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. NEXT GENERATION SEQUENCING MARKET: BY TARGET THERAPEUTIC AREA

- 22.1. Chapter Overview

- 22.2. Assumptions and Methodology

- 22.3. Next Generation Sequencing Market: Distribution by Target Therapeutic Area

- 22.3.1. Next Generation Sequencing Market for Oncological Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.3.2. Next Generation Sequencing Market for Genetic Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.3.3. Next Generation Sequencing Market for Reproductive Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.3.4. Next Generation Sequencing Market for Other Therapeutic Areas, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.4. Data Triangulation and Validation

23. NEXT GENERATION SEQUENCING MARKET: BY PURPOSE

- 23.1. Chapter Overview

- 23.2. Assumptions and Methodology

- 23.3. Next Generation Sequencing Market: Distribution by Purpose

- 23.3.1. Next Generation Sequencing Market for Diagnosis, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.3.2. Next Generation Sequencing Market for Risk Assessment, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.3.3. Next Generation Sequencing Market for Presymptomatic Assessment, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.3.4. Next Generation Sequencing Market for Screening, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.3.5. Next Generation Sequencing Market for Other Purposes, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.4. Data Triangulation and Validation

24. NEXT GENERATION SEQUENCING MARKET: BY END USERS

- 24.1. Chapter Overview

- 24.2. Assumptions and Methodology

- 24.3. Next Generation Sequencing Market: Distribution by End Users

- 24.3.1. Next Generation Sequencing Market for Academic and Research Institutes, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.3.2. Next Generation Sequencing Market for Hospitals and Clinics, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.3.3. Next Generation Sequencing Market for Pharmaceutical and Biotechnology Companies, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.3.4. Next Generation Sequencing Market for Other End Users, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.4. Data Triangulation and Validation

25. NEXT GENERATION SEQUENCING MARKET: BY GEOGRAPHICAL REGIONS

- 25.1. Chapter Overview

- 25.2. Assumptions and Methodology

- 25.3. Next Generation Sequencing Market: Distribution by Geographical Regions

- 25.3.1. Next Generation Sequencing Market in North America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.1.1. Next Generation Sequencing Market in the US, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.1.2. Next Generation Sequencing Market in Canada, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2. Next Generation Sequencing Market in Europe, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.1. Next Generation Sequencing Market in Germany, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.2. Next Generation Sequencing Market in France, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.3. Next Generation Sequencing Market in Italy, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.4. Next Generation Sequencing Market in Spain, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.5. Next Generation Sequencing Market in the UK, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.2.6. Next Generation Sequencing Market in Rest of Europe, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3. Next Generation Sequencing Market in Asia-Pacific, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.1. Next Generation Sequencing Market in China, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.2. Next Generation Sequencing Market in India, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.3. Next Generation Sequencing Market in Japan, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.4. Next Generation Sequencing Market in South Korea, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.5. Next Generation Sequencing Market in Singapore, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.3.6. Next Generation Sequencing Market in Rest of Asia-Pacific, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4. Next Generation Sequencing Market in Middle East and North Africa, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4.1. Next Generation Sequencing Market in Egypt, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4.2. Next Generation Sequencing Market in Israel, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4.3. Next Generation Sequencing Market in Saudi Arabia, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.4.4. Next Generation Sequencing Market in Rest of Middle East and North Africa, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.5. Next Generation Sequencing Market in Latin America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.5.1. Next Generation Sequencing Market in Brazil, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.5.2. Next Generation Sequencing Market in Argentina, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.5.3. Next Generation Sequencing Market in Rest of Latin America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.3.1. Next Generation Sequencing Market in North America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- 25.4. Next Generation Sequencing Market, by Geographical Regions: Market Dynamics Assessment

- 25.4.1. Penetration Growth (P-G) Matrix

- 25.4.2. Market Movement Analysis

- 25.5. Data Triangulation and Validation

26. CONCLUDING REMARKS

27. EXECUTIVE INSIGHTS

28. APPENDIX 1: TABULATED DATA

29. APPENDIX 1: TABULATED COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Comparison of First, Second and Third Generation Sequencing Technologies

- Table 7.1 Next generation sequencing Service Providers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 7.2 Next generation sequencing Service Providers: Information on Type of Service Offered and Additional Service Offered

- Table 7.3 Next generation sequencing Service Providers: Information on Type of Sample Used and Type of Technology / Platform Used for Whole Genome Sequencing, Whole Exome Sequencing and Targeted Sequencing

- Table 7.4 Next generation sequencing Service Providers: List of Non-Industry Players

- Table 8.1 Next generation sequencing Technologies / Platforms: Information on Provider, Type of Application and Technology Run Time (Hours)

- Table 8.2 Next generation sequencing Technologies / Platforms: Information on Maximum Output, Maximum Base Pair Reads Per Run, Maximum Quality and Sequencing Technique

- Table 8.3 Next generation sequencing Technology / Platform Providers: Information on Year of Establishment, Company Size, Location of Headquarters (Country and Region)

- Table 10.1 Next generation sequencing Service Providers: List of Companies Profiled

- Table 10.2 Admera Health: Company Overview

- Table 10.3 Admera Health: Service Portfolio

- Table 10.4 Admera Health: Recent Developments and Future Outlook

- Table 10.5 Applied Biological Materials: Company Overview

- Table 10.6 Applied Biological Materials: Service Portfolio

- Table 10.7 BGI: Company Overview

- Table 10.8 BGI: Service Portfolio

- Table 10.9 BGI: Recent Developments and Future Outlook

- Table 10.10 CD Genomics: Company Overview

- Table 10.11 CD Genomics: Service Portfolio

- Table 10.12 DNA Link: Company Overview

- Table 10.13 DNA Link: Service Portfolio

- Table 10.14 Eurofins Genomics: Company Overview

- Table 10.15 Eurofins Genomics: Service Portfolio

- Table 10.16 Gene by Gene: Company Overview

- Table 10.17 Gene by Gene: Service Portfolio

- Table 10.18 Genewiz: Company Overview

- Table 10.19 Genewiz: Service Portfolio

- Table 10.20 Medgenome: Company Overview

- Table 10.21 Medgenome: Service Portfolio

- Table 10.22 Medgenome: Recent Developments and Future Outlook

- Table 10.23 Novogene: Company Overview

- Table 10.24 Novogene: Service Portfolio

- Table 10.25 Novogene: Recent Developments and Future Outlook

- Table 10.26 Psomagen: Company Overview

- Table 10.27 Psomagen: Service Portfolio

- Table 10.28 Psomagen: Recent Developments and Future Outlook

- Table 10.29 Veritas: Company Overview

- Table 10.30 Veritas: Service Portfolio

- Table 10.31 Veritas: Recent Developments and Future Outlook

- Table 10.32 Xcelris Labs: Company Overview

- Table 10.33 Xcelris Labs: Service Portfolio

- Table 11.1 Next generation sequencing Technology / Platform Providers: List of Companies Profiled

- Table 11.2 Illumina: Company Overview

- Table 11.3 Illumina: Technology / Platform Portfolio

- Table 11.4 MGI Tech: Company Overview

- Table 11.5 MGI Tech: Technology / Platform Portfolio

- Table 11.6 Oxford Nanopore Technologies: Company Overview

- Table 11.7 Oxford Nanopore Technologies: Technology / Platform Portfolio

- Table 11.8 Pacific Biosciences: Company Overview

- Table 11.9 Pacific Biosciences: Technology / Platform Portfolio

- Table 11.10 Thermo Fisher Scientific: Company Overview

- Table 11.11 Thermo Fisher Scientific: Technology / Platform Portfolio

- Table 12.1 Patent Analysis: Top CPC Sections

- Table 12.2 Patent Analysis: Top CPC Symbols

- Table 12.3 Patent Analysis: Top CPC Codes

- Table 12.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 12.5 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 12.6 Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 15.1 Next generation sequencing Initiatives: Information on Initiative Establishment Year, Aim and Objective of Initiative, and Geographical Reach,

- Table 15.2 Next generation sequencing Initiatives: Information on Number of Individual's Genome Sequenced, Focus Area, Type of Partner and Type of Sponsor

- Table 28.1 Next generation sequencing Service Providers: Distribution by Year of Establishment

- Table 28.2 Next generation sequencing Service Providers: Distribution by Company Size

- Table 28.3 Next generation sequencing Service Providers: Distribution by Location of Headquarters

- Table 28.4 Next generation sequencing Service Providers: Distribution by Company Size and Location of Headquarters (Region)

- Table 28.5 Next generation sequencing Service Providers: Distribution by Type of Service Offered

- Table 28.6 Next generation sequencing Service Providers: Distribution by Additional Service Offered

- Table 28.7 Next generation sequencing Service Providers: Distribution by Type of Sample Used for Whole Genome Sequencing

- Table 28.8 Next generation sequencing Service Providers: Distribution by Type of Technology / Platform Used for Whole Genome Sequencing

- Table 28.9 Next generation sequencing Service Providers: Distribution by Type of Sample Used for Whole Exome Sequencing

- Table 28.10 Next generation sequencing Service Providers: Distribution by Type of Technology / Platform Used for Whole Exome Sequencing

- Table 28.11 Next generation sequencing Service Providers: Distribution by Type of Sample Used for Targeted Sequencing

- Table 28.12 Next generation sequencing Service Providers: Distribution by Type of Technology / Platform Used for Targeted Sequencing

- Table 28.13 Next generation sequencing Technologies / Platforms: Distribution by Type of Application

- Table 28.14 Next generation sequencing Technologies / Platforms: Distribution by Technology / Platform Run Time (Hours)

- Table 28.15 Next generation sequencing Technologies / Platforms: Distribution by Maximum Output (Gb)

- Table 28.16 Next generation sequencing Technologies / Platforms: Distribution by Maximum Base Pair Reads Per Run (Million)

- Table 28.17 Next generation sequencing Technologies / Platforms: Distribution by Maximum Quality

- Table 28.18 Next generation sequencing Technologies / Platforms: Distribution by Sequencing Technique Used

- Table 28.19 Next generation sequencing Technology / Platform Providers: Distribution by Year of Establishment

- Table 28.20 Next generation sequencing Technology / Platform Providers: Distribution by Company Size

- Table 28.21 Next generation sequencing Technology / Platform Providers: Distribution by Location of Headquarters (Country and Region)

- Table 28.22 Next generation sequencing Technology / Platform Providers: Distribution by Company Size and Location of Headquarters (Region)

- Table 28.23 Illumina: Annual Revenues, FY 2019 Onwards (USD Billion)

- Table 28.24 Oxford Nanopore Technologies: Annual Revenues, FY 2020 Onwards (GBP Billion)

- Table 28.25 Pacific Biosciences: Annual Revenues, FY 2019 Onwards (USD Billion)

- Table 28.26 Thermo Fischer Scientific: Annual Revenues, FY 2019 Onwards (USD Billion)

- Table 28.27 Patent Analysis: Distribution by Type of Patent

- Table 28.28 Patent Analysis: Cumulative Distribution by Patent Publication Year, Since 2020

- Table 28.29 Patent Analysis: Distribution by Type of Patent and Publication Year, Since 2020

- Table 28.30 Patent Analysis: Distribution by Patent Application Year, Since 2010

- Table 28.31 Patent Analysis: Distribution by Patent Jurisdiction

- Table 28.32 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant, Since 2020

- Table 28.33 Leading Industry Players: Distribution by Number of Patents

- Table 28.34 Leading Non-Industry Players: Distribution by Number of Patents

- Table 28.35 Patent Analysis: Distribution by Patent Age

- Table 28.36 Next-generation Sequencing: Patent Valuation

- Table 28.37 Clinical Trial Analysis: Cumulative Year-wise Trend, Since 2020

- Table 28.38 Clinical Trial Analysis: Distribution of Number of Patients Enrolled by Trial Registration Year, Since 2020

- Table 28.39 Clinical Trial Analysis: Distribution by Trial Phase

- Table 28.40 Clinical Trial Analysis: Distribution of Number of Patients Enrolled by Trial Phase

- Table 28.41 Clinical Trial Analysis: Distribution by Trial Status

- Table 28.42 Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Status, Since 2020

- Table 28.43 Clinical Trial Analysis: Distribution by Target Patient Population

- Table 28.44 Clinical Trial Analysis: Distribution by Patient Gender

- Table 28.45 Clinical Trial Analysis: Distribution by Type of Allocation

- Table 28.46 Clinical Trial Analysis: Distribution by Type of Intervention Model

- Table 28.47 Clinical Trial Analysis: Distribution by Type of Masking

- Table 28.48 Clinical Trial Analysis: Distribution by Trial Purpose

- Table 28.49 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Table 28.50 Leading Players: Distribution by Number of Clinical Trials

- Table 28.51 Clinical Trial Analysis: Distribution of Clinical Trials by Geography

- Table 28.52 Clinical Trial Analysis: Distribution of Clinical Trials by Geography and Trial Status

- Table 28.53 Clinical Trial Analysis: Distribution of Patients Enrolled by Geography and Trial Status

- Table 28.54 Big Pharma Initiatives: Distribution by Year of Initiative, Since 2020

- Table 28.55 Big Pharma Initiatives: Distribution by Type of Initiative

- Table 28.56 Big Pharma Initiatives: Distribution by Type of Collaboration

- Table 28.57 Big Pharma Initiatives: Distribution by Focus Area

- Table 28.58 Most Active Big Pharma Players: Distribution by Number of Initiatives

- Table 28.59 Next generation sequencing Initiatives: Distribution by Initiative Establishment Year

- Table 28.60 Next generation sequencing Initiatives: Distribution by Aim and Objective of Initiative

- Table 28.61 Next generation sequencing Initiatives: Distribution by Geographical Reach (Region)

- Table 28.62 Next generation sequencing Initiatives: Distribution by Number of Individual's Genome Sequenced

- Table 28.63 Next generation sequencing Initiatives: Distribution by Focus Area

- Table 28.64 Next generation sequencing Initiatives: Distribution by Type of Partner

- Table 28.65 Next generation sequencing Initiatives: Distribution by Type of Sponsor

- Table 28.66 Global Next Generation Sequencing Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.67 Global Next Generation Sequencing Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Table 28.68 Global Next Generation Sequencing Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Table 28.69 Next Generation Sequencing Market: Distribution by Type of Component

- Table 28.70 Next Generation Sequencing Market for Consumables, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.71 Next Generation Sequencing Market for Services, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.72 Next Generation Sequencing Market for Instruments, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.73 Next Generation Sequencing Market: Distribution by Type of NGS technique

- Table 28.74 Next Generation Sequencing Market for Targeted Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.75 Next Generation Sequencing Market for Whole Genome Sequencing / Whole Exome Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.76 Next Generation Sequencing Market for RNA Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.77 Next Generation Sequencing Market for Other Techniques, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.78 Next Generation Sequencing Market: Distribution by Type of Technology Used

- Table 28.79 Next Generation Sequencing Market for Sequencing by Synthesis Technology, Historical Trends (2828-2824) and Forecasted Estimates (2825-2835) (USD Billion)

- Table 28.80 Next Generation Sequencing Market for Ion Semiconductor Technology, Historical Trends (2828-2824) and Forecasted Estimates (2825-2835) (USD Billion)

- Table 28.81 Next Generation Sequencing Market for Nanopore Sequencing Technology, Historical Trends (2828-2824) and Forecasted Estimates (2825-2835) (USD Billion)

- Table 28.82 Next Generation Sequencing Market for Other Technologies, Historical Trends (2828-2824) and Forecasted Estimates (2825-2835) (USD Billion)

- Table 28.83 Next Generation Sequencing Market: Distribution by Application Area

- Table 28.84 Next Generation Sequencing Market for Clinical Applications, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.85 Next Generation Sequencing Market for Research and Applied Applications, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.86 Next Generation Sequencing Market: Distribution by Target Therapeutic Area

- Table 28.87 Next Generation Sequencing Market for Oncological Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.88 Next Generation Sequencing Market for Genetic Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.89 Next Generation Sequencing Market for Reproductive Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.90 Next Generation Sequencing Market for Other Therapeutic Areas, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.91 Next Generation Sequencing Market: Distribution by Purpose

- Table 28.92 Next Generation Sequencing Market for Diagnosis, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.93 Next Generation Sequencing Market for Risk Assessment, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.94 Next Generation Sequencing Market for Presymptomatic Assessment, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.95 Next Generation Sequencing Market for Screening, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.96 Next Generation Sequencing Market for Other Purposes, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.97 Next Generation Sequencing Market: Distribution by End users

- Table 28.98 Next Generation Sequencing Market for Academic and Research Institutes, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.99 Next Generation Sequencing Market for Hospitals and Clinics, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.100 Next Generation Sequencing Market for Pharmaceutical and Biotechnology Companies, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.101 Next Generation Sequencing Market for Other End Users, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.102 Next Generation Sequencing Market: Distribution by Geographical Regions

- Table 28.103 Next Generation Sequencing Market in North America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.104 Next Generation Sequencing Market in the US, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.105 Next Generation Sequencing Market in Canada, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.106 Next Generation Sequencing Market in Europe, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.107 Next Generation Sequencing Market in Germany, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.108 Next Generation Sequencing Market in France, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.109 Next Generation Sequencing Market in Italy, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.110 Next Generation Sequencing Market in Spain, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.111 Next Generation Sequencing Market in the UK, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.112 Next Generation Sequencing Market in Rest of Europe, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.113 Next Generation Sequencing Market in Asia-Pacific, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.114 Next Generation Sequencing Market in China, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.115 Next Generation Sequencing Market in India, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.116 Next Generation Sequencing Market in Japan, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.117 Next Generation Sequencing Market in South Korea, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.118 Next Generation Sequencing Market in Singapore, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.119 Next Generation Sequencing Market in Rest of Asia-Pacific, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.120 Next Generation Sequencing Market in Middle East and North Africa, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.121 Next Generation Sequencing Market in Egypt, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.122 Next Generation Sequencing Market in Israel, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.123 Next Generation Sequencing Market in Saudi Arabia, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.124 Next Generation Sequencing Market in Rest of Middle East and North Africa, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.125 Next Generation Sequencing Market in Latin America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.126 Next Generation Sequencing Market in Brazil, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.127 Next Generation Sequencing Market in Argentina, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 28.128 Next Generation Sequencing Market in Rest of Latin America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Market Assessment Framework

- Figure 4.1 Lessons Learnt from Past Recessions

- Figure 5.1 Executive Summary: Market Landscape

- Figure 5.2 Executive Summary: Market Trends

- Figure 5.3 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 Workflow of Whole Genome Sequencing

- Figure 6.2 Types of Sequencing

- Figure 6.3 Evolution of Next-generation Sequencing

- Figure 6.4 Third Generation HT-NGS Platforms

- Figure 6.5 Applications of Genome Sequencing

- Figure 6.6 Challenges Associated with Genome Sequencing

- Figure 7.1 Next generation sequencing Service Providers: Distribution by Year of Establishment

- Figure 7.2 Next generation sequencing Service Providers: Distribution by Company Size

- Figure 7.3 Next generation sequencing Service Providers: Distribution by Location of Headquarters

- Figure 7.4 Next generation sequencing Service Providers: Distribution by Company Size and Location of Headquarters (Region)

- Figure 7.5 Next generation sequencing Service Providers: Distribution by Type of Service Offered

- Figure 7.6 Next generation sequencing Service Providers: Distribution by Additional Service Offered

- Figure 7.7 Next generation sequencing Service Providers: Distribution by Type of Sample Used for Whole Genome Sequencing

- Figure 7.8 Next generation sequencing Service Providers: Distribution by Type of Technology / Platform Used for Whole Genome Sequencing

- Figure 7.9 Next generation sequencing Service Providers: Distribution by Type of Sample Used for Whole Exome Sequencing

- Figure 7.10 Next generation sequencing Service Providers: Distribution by Type of Technology / Platform Used for Whole Exome Sequencing

- Figure 7.11 Next generation sequencing Service Providers: Distribution by Type of Sample Used for Targeted Sequencing

- Figure 7.12 Next generation sequencing Service Providers: Distribution by Type of Technology / Platform Used for Targeted Sequencing

- Figure 8.1 Next generation sequencing Technologies / Platforms: Distribution by Type of Application

- Figure 8.2 Next generation sequencing Technologies / Platforms: Distribution by Technology / Platform Run Time (Hours)

- Figure 8.3 Next generation sequencing Technologies / Platforms: Distribution by Maximum Output (Gb)

- Figure 8.4 Next generation sequencing Technologies / Platforms: Distribution by Maximum Base Pair Reads Per Run (Million)

- Figure 8.5 Next generation sequencing Technologies / Platforms: Distribution by Maximum Quality

- Figure 8.6 Next generation sequencing Technologies / Platforms: Distribution by Sequencing Technique Used

- Figure 8.7 Next generation sequencing Technology / Platform Providers: Distribution by Year of Establishment

- Figure 8.8 Next generation sequencing Technology / Platform Providers: Distribution by Company Size

- Figure 8.9 Next generation sequencing Technology / Platform Providers: Distribution by Location of Headquarters (Country and Region)

- Figure 8.10 Next generation sequencing Technology / Platform Providers: Distribution by Company Size and Location of Headquarters (Region)

- Figure 9.1 Competitive Analysis: Next generation sequencing Technologies / Platforms Provided by Players based in North America

- Figure 9.2 Competitive Analysis: Next generation sequencing Technologies / Platforms Provided by Players based in Europe and Asia-Pacific

- Figure 11.1 Illumina: Annual Revenues, FY 2019 Onwards (USD Billion)

- Figure 11.2 Oxford Nanopore Technologies: Annual Revenues, FY 2020 Onwards (GBP Billion)

- Figure 11.3 Pacific Biosciences: Annual Revenues, FY 2019 Onwards (USD Billion)

- Figure 11.4 Thermo Fischer Scientific: Annual Revenues, FY 2019 Onwards (USD Billion)

- Figure 12.1 Patent Analysis: Distribution by Type of Patent

- Figure 12.2 Patent Analysis: Cumulative Distribution by Patent Publication Year, Since 2020

- Figure 12.3 Patent Analysis: Distribution by Type of Patent and Publication Year, Since 2020

- Figure 12.4 Patent Analysis: Distribution by Patent Application Year, Since 2010

- Figure 12.5 Patent Analysis: Distribution by Patent Jurisdiction

- Figure 12.6 Patent Analysis: Distribution by CPC Symbols

- Figure 12.7 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant, Since 2020

- Figure 12.8 Leading Industry Players: Distribution by Number of Patents

- Figure 12.9 Leading Non-Industry Players: Distribution by Number of Patents

- Figure 12.10Patent Benchmarking Analysis: Distribution of Patent Characteristics (CPC Codes) by Leading Industry Players

- Figure 12.11 Patent Benchmarking Analysis: Distribution of Leading Industry Players by Patent Characteristics (CPC Codes)

- Figure 12.12 Patent Analysis: Distribution by Patent Age

- Figure 12.13 Next-generation Sequencing: Patent Valuation

- Figure 13.1 Clinical Trial Analysis: Cumulative Year-wise Trend, Since 2020

- Figure 13.2 Clinical Trial Analysis: Distribution of Number of Patients Enrolled by Trial Registration Year, Since 2020

- Figure 13.3 Clinical Trial Analysis: Distribution by Trial Phase

- Figure 13.4 Clinical Trial Analysis: Distribution of Number of Patients Enrolled by Trial Phase

- Figure 13.5 Clinical Trial Analysis: Distribution by Trial Status

- Figure 13.6 Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Status, Since 2020

- Figure 13.7 Clinical Trial Analysis: Distribution by Target Patient Population

- Figure 13.8 Clinical Trial Analysis: Distribution by Patient Gender

- Figure 13.9 Clinical Trial Analysis: Distribution by Type of Allocation

- Figure 13.10 Clinical Trial Analysis: Distribution by Type of Intervention Model

- Figure 13.11 Clinical Trial Analysis: Distribution by Type of Masking

- Figure 13.12 Clinical Trial Analysis: Distribution by Trial Purpose

- Figure 13.13 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Figure 13.14 Leading Players: Distribution by Number of Clinical Trials

- Figure 13.15 Clinical Trial Analysis: Distribution of Clinical Trials by Geography

- Figure 13.16 Clinical Trial Analysis: Distribution of Clinical Trials by Geography and Trial Status

- Figure 13.17 Clinical Trial Analysis: Distribution of Patients Enrolled by Geography and Trial Status

- Figure 14.1 Big Pharma Initiatives: Distribution by Year of Initiative, Since 2020

- Figure 14.2 Big Pharma Initiatives: Distribution by Type of Initiative

- Figure 14.3 Big Pharma Initiatives: Heat Map Analysis by Type of Initiative

- Figure 14.4 Big Pharma Initiatives: Distribution by Type of Collaboration

- Figure 14.5 Big Pharma Initiatives: Heat Map Analysis by Type of Collaboration

- Figure 14.6 Big Pharma Initiatives: Distribution by Focus Area

- Figure 14.7 Big Pharma Initiatives: Heat Map Analysis by Focus Area

- Figure 14.8 Most Active Big Pharma Players: Distribution by Number of Initiatives

- Figure 15.1 Next Generation Sequencing Initiatives: Distribution by Initiative Establishment Year

- Figure 15.2 Next Generation Sequencing Initiatives: Distribution by Aim and Objective of Initiative

- Figure 15.3 Next Generation Sequencing Initiatives: Distribution by Geographical Reach (Region)

- Figure 15.4 Next Generation Sequencing Initiatives: Distribution by Number of Individual's Genome Sequenced

- Figure 15.5 Next Generation Sequencing Initiatives: Distribution by Focus Area

- Figure 15.6 Next Generation Sequencing Initiatives: Distribution by Type of Partner

- Figure 15.7 Next generation sequencing Initiatives: Distribution by Type of Sponsor

- Figure 17.1 Global Next Generation Sequencing Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.2 Global Next Generation Sequencing Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Figure 17.3 Global Next Generation Sequencing Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Figure 18.1 Next Generation Sequencing Market: Distribution by Type of Component

- Figure 18.2 Next Generation Sequencing Market for Consumables, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.3 Next Generation Sequencing Market for Services, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.4 Next Generation Sequencing Market for Instruments, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.1 Next Generation Sequencing Market: Distribution by Type of NGS technique

- Figure 19.2 Next Generation Sequencing Market for Targeted Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.3 Next Generation Sequencing Market for Whole Genome Sequencing / Whole Exome Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.4 Next Generation Sequencing Market for RNA Sequencing, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.5 Next Generation Sequencing Market for Other Techniques, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.1 Next Generation Sequencing Market: Distribution by Type of Technology Used

- Figure 20.2 Next Generation Sequencing Market for Sequencing by Synthesis Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.3 Next Generation Sequencing Market for Ion Semiconductor Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.4 Next Generation Sequencing Market for Nanopore Sequencing Technology, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.5 Next Generation Sequencing Market for Other Technologies, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.1 Next Generation Sequencing Market: Distribution by Application Area

- Figure 21.2 Next Generation Sequencing Market for Clinical Applications, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.3 Next Generation Sequencing Market for Research and Applied Applications, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.1 Next Generation Sequencing Market: Distribution by Target Therapeutic Area

- Figure 22.2 Next Generation Sequencing Market for Oncological Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.3 Next Generation Sequencing Market for Genetic Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.4 Next Generation Sequencing Market for Reproductive Disorders, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.5 Next Generation Sequencing Market for Other Therapeutic Areas, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.1 Next Generation Sequencing Market: Distribution by Purpose

- Figure 23.2 Next Generation Sequencing Market for Diagnosis, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.3 Next Generation Sequencing Market for Risk Assessment, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.4 Next Generation Sequencing Market for Presymptomatic Assessment, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.5 Next Generation Sequencing Market for Screening, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.6 Next Generation Sequencing Market for Other Purposes, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 24.1 Next Generation Sequencing Market: Distribution by End users

- Figure 24.2 Next Generation Sequencing Market for Academic and Research Institutes, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 24.3 Next Generation Sequencing Market for Hospitals and Clinics, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 24.4 Next Generation Sequencing Market for Pharmaceutical and Biotechnology Companies, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 24.5 Next Generation Sequencing Market for Other End Users, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 25.1 Next Generation Sequencing Market: Distribution by Geographical Regions

- Figure 25.2 Next Generation Sequencing Market in North America, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 25.3 Next Generation Sequencing Market in the US, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 25.4 Next Generation Sequencing Market in Canada, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035) (USD Billion)