|

市场调查报告书

商品编码

1857194

智慧照明市场:产业趋势及全球预测(至 2035 年)-按组件类型、连接类型、照明类型、照明技术类型、安装类型、应用、销售管道和主要地区划分Smart Lighting Market, Till 2035: Distribution by Type of Component, Type of Connectivity, Lighting, Lighting Technology, Installation, Type of Application, Type of Sales Channel, Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

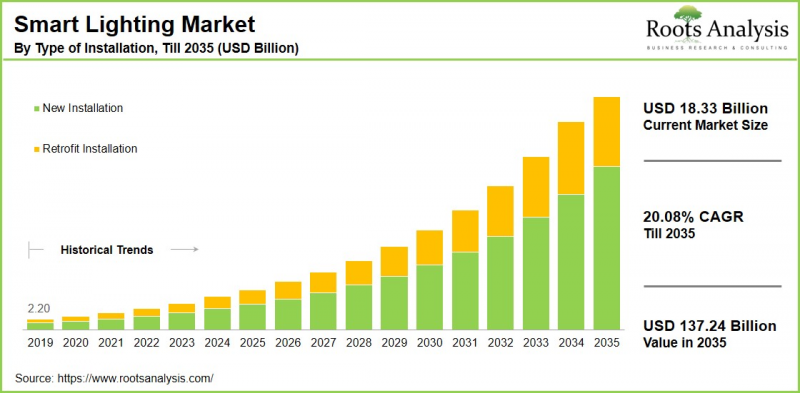

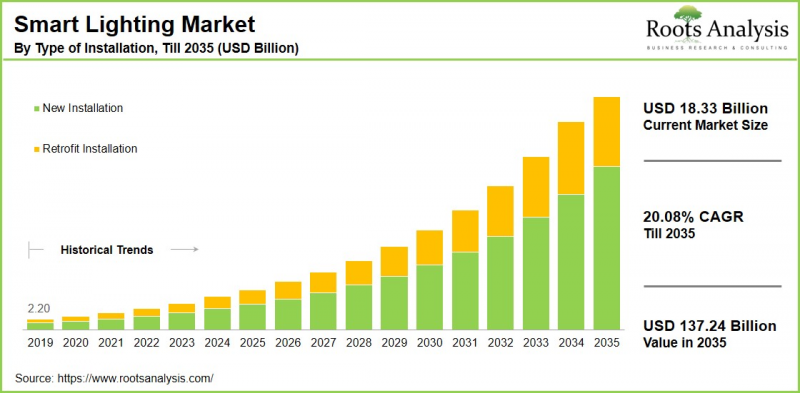

预计全球智慧照明市场在预测期内将以 20.08% 的复合年增长率成长,从目前的 183.3 亿美元成长到 2035 年的 1,372.4 亿美元。

智慧照明分布在以下几个市场区隔:

元件类型

- 硬体设备

- 照明设备

- 照明控制

- 调光器和交换器

- 闸道器

- 人感感测器右

- 集线器连接智慧右

- 软体

- 云端基础

- 内部部署

- 服务

- 咨询

- 设计&工程

- 安装

- 维修

连接类型

- 混合

- 有线的

- 数位·可寻址·照明·接口(DALI)

- 电力线控制(PLC)

- 乙太网路供电(PoE)

- 无线

- Bluetooth

- EnOcean

- Wi-Fi

- ZigBee

- 6LoWPAN

照明类型

- 照明设备

- 照明控制

- 智慧灯泡

照明技术类型

- CFL

- 日光灯

- 卤素

- 白炽灯

- LED

安装类型

- 新

- 改造

用途

- 室内

- 商业用

- 产业用

- 住宅

- 室外

- 建筑物

- 高速公路

- 公共照明

- 运动场

销售管道

- 直接

- 间接销售

地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他的北美各国

- 欧洲

- 奥地利

- 比利时

- 丹麦

- 法国

- 德国

- 爱尔兰

- 义大利

- 荷兰

- 挪威

- 俄罗斯

- 西班牙

- 瑞典

- 瑞士

- 英国

- 其他欧洲各国

- 亚洲

- 中国

- 印度

- 日本

- 新加坡

- 韩国

- 其他亚洲各国

- 南美

- 巴西

- 智利

- 哥伦比亚

- 委内瑞拉

- 其他的南美各国

- 中东·北非

- 埃及

- 伊朗

- 伊拉克

- 以色列

- 科威特

- 沙乌地阿拉伯

- 阿拉伯联合大公国

- 其他的MENA各国

- 全球其他地区

- 澳洲

- 纽西兰

- 其他的国家

智慧照明市场成长与趋势

智慧照明是家庭自动化和能源效率领域的新兴趋势。随着互联设备的普及和人们对永续生活需求的不断增长,智慧照明有望彻底改变我们照亮生活环境的方式。与传统照明不同,智慧照明可以透过各种先进技术和介面进行管理或自动化,包括语音助理、感测器、行动装置和网路连接。

智慧照明的优点包括:个人化客製化、远端管理、自适应照明、节能、增强安全性和提升安全性。这些优势使其成为极具吸引力的选择,在包括家庭、工作场所、商业设施和户外空间在内的各种环境中,都能提供便利性和高效性。

在永续发展方面,智慧照明日益被认为是国家发展和环境影响的重要组成部分。在商业和工业领域实施智慧照明,预计同时改善经济和环境。根据联合国 "立即行动" (UN Act Now)的数据,能源供应业占全球温室气体排放量的35%。然而,不断提高人们对能源消耗环境影响的认识的努力正在促使全球温室气体排放量增速放缓,而智慧照明在这一进程中发挥关键作用。

透过利用自动化、人工智慧和物联网技术,利害关係人正在提供具有远端控制、语音启动和节能功能的先进智慧照明解决方案。智慧照明的这些特性显着增强了房主管理照明偏好的能力,使其拥有前所未有的控制力和灵活性。由于上述因素,智慧照明市场预计在预测期内将显着成长。

目录

第1章 序文

第2章 调查手法

第3章 经济以及其他的计划特有的考虑事项

第4章 宏观经济指标

第5章 摘要整理

第6章 简介

第7章 竞争情形

第8章 企业简介

- 章概要

- Acuity Brands

- Cisco Systems

- Deco Lighting

- Dialight

- Eaton

- General Electric

- Honeywell International

- Hubbell Incorporated

- LIFX

- Philips Lighting

第9章 价值链分析

第10章 SWOT分析

第11章 全球智慧照明市场

第12章 各元件类型的市场机会

第13章 各连接类型的市场机会

第14章 各照明类型的市场机会

第15章 各照明技术类型的市场机会

第16章 安装各类型的市场机会

第17章 各用途的市场机会

第18章 各销售管道的市场机会

第19章 北美智慧照明的市场机会

第20章 欧洲的智慧照明的市场机会

第21章 亚洲的智慧照明的市场机会

第22章 中东·北非(MENA)的智慧照明的市场机会

第23章 南美的智慧照明的市场机会

第24章 其他地区的智慧照明的市场机会

第25章 表格形式资料

第26章 企业·团体一览

第27章 客制化的机会

第28章 ROOT的订阅服务

第29章 着者详细内容

Smart Lighting Market Overview

As per Roots Analysis, the global smart lighting market size is estimated to grow from USD 18.33 billion in the current year to USD 137.24 billion by 2035, at a CAGR of 20.08% during the forecast period, till 2035.

The opportunity for smart lighting market has been distributed across the following segments:

Type of Component

- Hardware

- Lights & Luminaires

- Light Control

- Dimmers & Switches

- Gateways

- Motion Sensing Lights

- Smart Lights Connected with Hubs

- Software

- Cloud-Based

- On-Premise

- Service

- Consulting

- Design & Engineering

- Installation

- Maintenance

Type of Capability

- Hybrid

- Wired

- Digital Addressable Lighting Interface (DALI)

- Power Line Control (PLC)

- Power Over Ethernet (PoE)

- Wireless

- Bluetooth

- EnOcean

- Wi-Fi

- ZigBee

- 6LoWPAN

Type of Lighting

- Fixtures

- Lighting Controls

- Smart Bulbs

Type of Lighting Technology

- CFL

- Fluorescent

- Halogen

- Incandescent

- LED

Type of Installation

- New Installation

- Retrofit Installation

Type of Application

- Indoor

- Commercial

- Industrial

- Residential

- Outdoor

- Architectural

- Highways & Roadways

- Lighting for Public Places

- Stadium

Type of Sales Channel

- Direct

- Indirect

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Smart Lighting Market: Growth and Trends

Smart lighting represents a new trend in the realm of home automation and energy efficiency. As connected devices become more prevalent and the demand for sustainable living increases, smart lighting is poised to transform how we illuminate our living environments. In contrast to conventional lighting, smart lights can be managed or automated using various sophisticated technologies and interfaces, including voice assistants, sensors, mobile devices, and network connections.

The benefits of smart lighting include customization, remote management, adaptive illumination, energy savings, enhanced security, and improved safety. These benefits make it an attractive option for a range of settings, such as residences, workplaces, commercial properties, and outdoor spaces, offering both convenience and efficiency.

Regarding sustainability, smart lighting is increasingly recognized as a vital component in the development of nations and their environmental impact. Implementing smart lighting in commercial and industrial sectors has the potential to enhance both the economy and the environment. According to information from the United Nations Act Now, the energy supply industry is responsible for 35% of global greenhouse gas emissions. Nevertheless, ongoing efforts to raise awareness about the environmental effects of energy consumption have contributed to a slowdown in the global rate of greenhouse gas emissions, with smart lighting playing a significant role in this progress.

By utilizing automation, AI, and IoT technologies, stakeholders are providing advanced smart lighting solutions that feature remote control, voice activation, and energy-efficient functionalities. These characteristics of smart lighting greatly enhance homeowners' ability to manage their lighting preferences with unparalleled control and flexibility. As a result of the above mentioned factors, the smart lighting market is expected to grow significantly throughout the forecast period.

Smart Lighting Market: Key Segments

Market Share by Type of Component

Based on type of component, the global smart lighting market is segmented into hardware, software, and services. According to our estimates, currently, the hardware components, particularly lights and luminaires, captures the majority of the market share. This can be attributed to the increasing demand and sales for smart bulbs and IoT-connected lighting devices.

However, the software segment is expected to grow at a higher CAGR during the forecast period, due to the rising adoption of IoT technologies integrated with smart lighting has led to higher software demand, which is crucial for controlling smart lights via devices like smartphones and tablets. Additionally, the capability of smart lights to connect with platforms such as Alexa, Google, Siri, and others enhances the growth of this segment by providing voice control features through these systems.

Market Share by Type of Connectivity

Based on type of connectivity, the global smart lighting market is segmented into hybrid, wired, and wireless. According to our estimates, currently, the wired segment captures the majority of the market share during the forecast period. This can be ascribed to the increasing implementation of smart lighting in both commercial and industrial sectors. Additionally, it is widely utilized across various sectors such as office buildings, shopping centers, and educational facilities where reliable and controlled lighting systems are crucial.

On the other hand, the wireless segment, which includes Bluetooth, EnOcean, Wi-Fi, ZigBee, and 6lowpan, is expected to grow at a higher CAGR during the forecast period. This is due to the rising demand for wireless connectivity, which is propelled by its high data transmission rates and capability to connect directly to home networks without the need for extra hubs or gateways.

Moreover, Bluetooth connectivity provides user-friendly direct control via smartphones and tablets without requiring an internet connection, significantly boosting the growth of this segment.

Market Share by Type of Lighting

Based on type of lighting, the global smart lighting market is segmented into fixtures, lighting controls, and smart bulbs. According to our estimates, currently, the smart bulbs segment captures the majority of the market share. Smart bulbs are favored by consumers due to their affordability, user-friendly nature, and broad compatibility, which significantly contributes to the growth of this segment. Additionally, the lower upfront costs and straightforward installation further enhance the demand for smart bulbs, driving market expansion.

On the other hand, the fixtures segment is expected to grow at a higher CAGR during the forecast period. This can be attributed to the rise in new construction within both the residential and commercial sectors, which often require comprehensive lighting solutions where smart fixtures, integrated with smart bulbs and controls, are essential.

Market Share by Type of Lighting Technology

Based on type of lighting technology, the global smart lighting market is segmented into CFL, fluorescent, halogen, incandescent, and LED. According to our estimates, currently, the Light Light-emitting diode (LED) segment captures the majority of the market share. This can be attributed to the advantages of LED, such as cost savings, compatibility with smart technology and energy efficiency.

On the other hand, the incandescent lighting segment is expected to grow at a higher CAGR during the forecast period. Incandescent lighting, one of the earliest forms of electric lighting, continues to be in demand due to its simplicity and compatibility for replacement with existing fixtures, which does not require special controls or devices.

Market Share by Type of Installation

Based on type of installation, the global smart lighting market is segmented into new installation and retrofit installation. According to our estimates, currently, the new installation segment captures the majority of the market share and this trend is unlikely to change in future. This can be attributed to the increased uptake of smart lighting in new buildings, where such systems can be easily integrated into initial construction plans, allowing for optimal wiring and placement.

On the other hand, the retrofit segment is expected to grow at a higher CAGR during the forecast period, driven by the rising consumer interest in SMART LIGHTING technologies aimed at enhancing living spaces with minimal disturbances.

Market Share by Type of Application

Based on type of application, the global smart lighting market is segmented into indoor (commercial, industrial and residential) and outdoor (architectural, highways & roadways, lighting for public places and stadiums). According to our estimates, currently, the indoor segment captures the majority of the market share, due to the rapid urbanization occurring globally. This is especially true in developing nations, which are increasingly incorporating smart lighting systems into their new infrastructure projects, including buildings, schools, hospitals, and more.

On the other hand, the outdoor segment is expected to grow at a higher CAGR during the forecast period. This can be attributed to the rise of smart city initiatives, along with the development of highways and roadways across the globe.

Market Share by Type of Sale Channels

Based on type of sale channels, the global smart lighting market is segmented into direct sales and indirect sales. According to our estimates, currently, the indirect sales channel captures the majority of the market share, due to the rapid urbanization occurring globally. This can be attributed to the collaborations with e-commerce platforms, retailers, and distributors, which have enhanced the availability of smart lighting products. These channels offer extensive consumer reach and logistical support, creating more opportunities for manufacturers in the smart lighting sector.

Market Share by Geographical Regions

Based on geographical regions, the smart lighting market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, Europe captures the majority share of the market, due to the widespread adoption of smart lighting technology and a strong focus on energy efficiency and sustainability. However, the market in Asia Pacific is expected to grow at relatively higher CAGR during the forecast period.

Example Players in Smart Lighting Market

- Acuity Brands

- Cisco Systems

- Cree

- Deco Lighting

- Dialight

- Eaton

- General Electric

- Honeywell International

- Hubbell Incorporated

- Koninklijke Philips

- LIFX

- Lutron Electronics

- Osram Licht

- Philips Lighting

- Samsung Electronics

- Syska

Smart Lighting Market: Research Coverage

The report on the smart lighting market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the smart lighting market, focusing on key market segments, including [A] type of component, [B] type of connectivity, [C] type of lighting, [D] type of lighting technology, [E] type of installation, [F] type of application, [G] type of sales channel and [H] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the smart lighting market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the smart lighting market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] smart lighting portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the smart lighting market

Key Questions Answered in this Report

- How many companies are currently engaged in smart lighting market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.2.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7 Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.5.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.5.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Smart Lighting

- 6.2.1. Type of Component

- 6.2.2. Type of Connectivity

- 6.2.3. Type of Lighting

- 6.2.4. Type of Lighting Technology

- 6.2.5. Type of Installation

- 6.2.6. Type of Application

- 6.2.7. Type of Sales Channel

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Smart Lighting: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2.1. Acuity Brands*

- 8.2.1.1. Company Overview

- 8.2.1.2. Company Mission

- 8.2.1.3. Company Footprint

- 8.2.1.4. Management Team

- 8.2.1.5. Contact Details

- 8.2.1.6. Financial Performance

- 8.2.1.7. Operating Business Segments

- 8.2.1.8. Service / Product Portfolio (project specific)

- 8.2.1.9. MOAT Analysis

- 8.2.1.10. Recent Developments and Future Outlook

- 8.2.2. Cisco Systems

- 8.2.3. Deco Lighting

- 8.2.4. Dialight

- 8.2.5. Eaton

- 8.2.6. General Electric

- 8.2.7. Honeywell International

- 8.2.8. Hubbell Incorporated

- 8.2.9. LIFX

- 8.2.10. Philips Lighting

- 8.2.1. Acuity Brands*

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL Smart Lighting Market

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Smart Lighting Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Smart Lighting Market for Hardware: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Smart Lighting Market for Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Smart Lighting Market for Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF CONNECTIVITY

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Smart Lighting Market for Hybrid: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Smart Lighting Market for Wired: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Smart Lighting Market for Wireless: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF LIGHTING

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Smart Lighting Market for Fixtures: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Smart Lighting Market for Lighting Controls: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Smart Lighting Market for Smart Bulbs: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF LIGHTINHG TECHNOLOGY

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Smart Lighting Market for CFL: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Smart Lighting Market for Fluorescent: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Smart Lighting Market for Halogen: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9 Smart Lighting Market for Incandescent: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.10. Smart Lighting Market for LED: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.11. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF INSTALLATION

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Smart Lighting Market for New Installation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Smart Lighting Market for Retrofit Installation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Smart Lighting Market for Indoor: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Smart Lighting Market for Outdoor: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON TYPE OF SALES CHANNEL

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Smart Lighting Market for Direct Sales Channels: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Smart Lighting Market for Indirect Sales Channels: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Data Triangulation and Validation

19. MARKET OPPORTUNITIES FOR SMART LIGHTING IN NORTH AMERICA

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Smart Lighting Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.1. Smart Lighting Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.2. Smart Lighting Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.3. Smart Lighting Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.4. Smart Lighting Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR SMART LIGHTING IN EUROPE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Smart Lighting Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.1. Smart Lighting Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.2. Smart Lighting Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.3. Smart Lighting Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.4. Smart Lighting Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.5. Smart Lighting Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.6. Smart Lighting Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.7. Smart Lighting Market in Italy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.8. Smart Lighting Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.9. Smart Lighting Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.10. Smart Lighting Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.11. Smart Lighting Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.12. Smart Lighting Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.13. Smart Lighting Market in Switzerland: Historical Trends(Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.14. Smart Lighting Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.15. Smart Lighting Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR SMART LIGHTING IN ASIA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Smart Lighting Market in Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.1. Smart Lighting Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.2. Smart Lighting Market in India: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.3. Smart Lighting Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Smart Lighting Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.5. Smart Lighting Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.6. Smart Lighting Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR SMART LIGHTING IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Smart Lighting Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Smart Lighting Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 22.6.2. Smart Lighting Market in Iran: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.3. Smart Lighting Market in Iraq: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.4. Smart Lighting Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.5. Smart Lighting Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.6. Smart Lighting Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.7. Smart Lighting Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.8. Smart Lighting Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR SMART LIGHTING IN LATIN AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Smart Lighting Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Smart Lighting Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Smart Lighting Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Smart Lighting Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Smart Lighting Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Smart Lighting Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Smart Lighting Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR SMART LIGHTING IN REST OF THE WORLD

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Smart Lighting Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Smart Lighting Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Smart Lighting Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Smart Lighting Market in Other Countries

- 24.7. Data Triangulation and Validation