|

市场调查报告书

商品编码

1869570

全球逆变器市场(至 2035 年):依产品、额定功率、电压、连接方式、销售通路、最终用户、地区、产业趋势及预测Inverter Market, Till 2035: Distribution by Product, Power Rating, Voltage, Connection, Sales Channel, End-User, and Geographical Regions: Industry Trends and Global Forecasts |

||||||

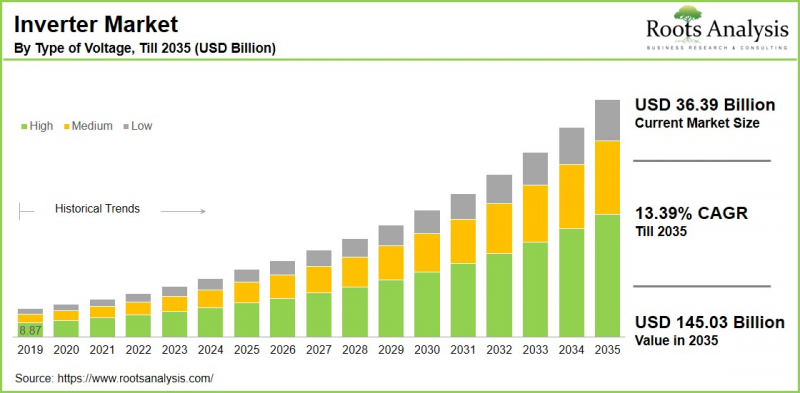

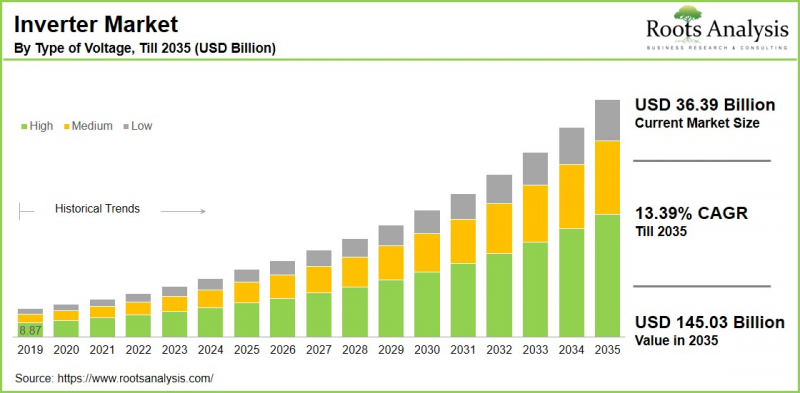

全球逆变器市场预计将从目前的 363.9 亿美元成长到 2035 年的 1,450.3 亿美元,预测期内复合年增长率 (CAGR) 为 13.39%。

逆变器市场:成长与趋势

逆变器产业正引领高效创新走向未来。逆变器产业正成为全球转型为永续能源解决方案过程中不可或缺的一部分。逆变器对于充分发挥再生能源的潜力至关重要,并且在现代能源系统中扮演着越来越重要的角色。逆变器是一种利用半导体将直流电 (DC) 转换为交流电 (AC) 的电子设备。直流电的电压通常较低,而交流电的电压通常与 120V 或 240V 的电网电压相符。

根据开关波形的配置,市面上有多种逆变器,包括併网逆变器、离网逆变器、混合逆变器和微型逆变器。每种逆变器都有不同的电路设计、效率和优势。从家庭用户到大型工业设施,逆变器技术的优势正在各个领域中得到应用。

此外,逆变器的一个关键优势在于,即使电网或再生能源输入出现波动,它们也能提供可靠且稳定的电源。这项特性推动了逆变器在住宅和商业环境中的广泛应用。为此,各利益相关者正迅速推出具有独特功能和卓越性能的产品,以把握这一机会。因此,在技术进步和能源需求(尤其是再生能源需求)不断增长的推动下,预计逆变器市场将在预测期内保持稳定成长。

本报告分析了全球逆变器市场,并提供了市场规模估算、机会分析、竞争格局和公司概况。

目录

第一章:引言

第二章:研究方法

第三章:经济及其他专案特定考量

第四章:宏观经济指标

第五章:摘要整理

第六章:引言

第七章:竞争格局

第八章:公司简介

- 章节概述

- ABB

- Delta

- Enphase

- Fronius

- 概述电气

- 华为

- 电力电子

- 施耐德

- SMA

- SolarEdge

- 阳光电源

- TMEIC

第九章:价值链分析

第十章:SWOT分析

第十一章:全球逆变器市场

第十二章:依产品类型划分的市场机会

第十三章:以功率等级划分的市场机会

第十四章:以电压类型划分的市场机会

第十五章:以连结方式类型划分的市场机会

第十六章:依销售通路类型划分的市场机会

第十七章:依最终使用者类型划分的市场机会

第十八章:北美逆变器市场机会

第十九章:欧洲逆变器市场机会

第二十章:亚洲逆变器市场机会

第二十一章:中东和北非(MENA)逆变器市场机会

第二十二章:拉丁美洲逆变器市场机会

第二十三章:世界其他地区逆变器市场机会

第二十四章:表格资料

第25章:公司与组织清单

第26章:客製化服务

第27章:Roots订阅服务

第28章:作者资讯

Inverter Market Overview

As per Roots Analysis, the global inverter market size is estimated to grow from USD 36.39 billion in the current year to USD 145.03 billion by 2035, at a CAGR of 13.39% during the forecast period, till 2035.

The opportunity for inverter market has been distributed across the following segments:

Type of Product

- Central Inverter

- Hybrid Inverter

- Micro Inverter

- String Inverter

Type of Power Rating

- Below10k W

- 10-50kW

- 50-100kW

- Above 100kW

Type of Voltage

- High

- Low

- Medium

Type of Connection

- Grid-Tied

- Stand Alone

Type of Sales Channel

- Direct

- Indirect

Type of End User

- Automotive

- Photovoltaic Plants

- Residential

- Others

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Inverter Market: Growth and Trends

The inverter industry is leading the charge towards a future characterized by efficiency and innovation. The inverter sector is becoming a vital element in the global transition to sustainable energy solutions. Inverters are crucial in realizing the full potential of renewable energy sources, making them an increasingly important part of contemporary energy systems. An inverter is an electronic device that utilizes semiconductors to transform direct current (DC) into alternating current (AC). Typically, direct current has a lower voltage, while AC matches the grid supply voltage, which can be either 120V or 240V.

The market features a range of inverters based on the configuration of the switching waveform, including grid-tied inverters, off-grid inverters, hybrid inverters, microinverters, and others. Each of these inverters possesses distinct circuit designs, efficiencies, and benefits. From individual homes to extensive industrial operations, the benefits of inverter technology are enhancing various sectors.

Moreover, a significant advantage of inverters lies in their capacity to deliver a reliable and stable power supply, even when there are fluctuations in the grid or renewable energy inputs. This capability contributes to the growing popularity of inverters in both residential and commercial environments. In response to this, stakeholders are introducing a unique array of features and functionalities to capitalize on this opportunity. As a result, with ongoing technological progress and the rising demand for energy, particularly renewable energy, the inverter market is expected to grow at a steady pace during the forecast period.

Inverter Market: Key Segments

Market Share by Type of Product

Based on type of product, the global inverter market is segmented into central inverters, hybrid inverters, microinverters, and string inverters. According to our estimates, currently, the central inverter segment captures the majority of the market share during the forecast period. This can be attributed to the increased installation of solar photovoltaic systems across residential, commercial, and utility-scale projects.

However, the string inverter segment is expected to grow at a higher CAGR during the forecast period, due to its affordability, ease of use, dependability, and versatility in applications such as rooftops, small commercial buildings, and community solar projects.

Market Share by Type of Power Rating

Based on type of power rating, the global inverter market is segmented into below10k W, 10kW-50kW, 50-100kW, and above 100kW. According to our estimates, currently, the 10kW -50kW segment captures the majority of the market share during the forecast period, owing to its adaptability and extensive range of applications.

However, the above 100kW category is expected to grow at a higher CAGR during the forecast period, fuelled by the increasing demand from utility-scale solar projects, where high-power inverters are essential for generating large quantities of electricity to be supplied to the grid.

Market Share by Type of Voltage

Based on type of voltage, the global inverter market is segmented into high, low, and medium. According to our estimates, currently, the high voltage segment captures the majority of the market share. This can be attributed to the growth in power generation within the transmission and distribution sector to address the increasing demand for electricity.

However, the low-voltage inverters segment is expected to grow at a higher CAGR during the forecast period. This growth can be attributed to the varied applications of low-voltage inverters in residential spaces and small to medium-sized commercial solar projects are contributing to the growth of the low-voltage inverter market.

Market Share by Type of Connection

Based on type of connection, the global inverter market is segmented into grid-tied and stand-alone connections. According to our estimates, currently, the grid-tied segment captures the majority of the market share. This can be attributed to the widespread adoption of solar power systems for residential use, particularly grid-tied systems. Further, the increase in rooftop installations and large-scale projects aimed at providing a stable and reliable power supply are contributing factors to the segment's growth.

Market Share by Type of Distribution Channel

Based on type of distribution channel, the global inverter market is segmented into direct and indirect sales. According to our estimates, currently, direct sales channel captures the majority of the market share and this trend is unlikely to change in the future as well.

This can be attributed to the fact that direct sales enable manufacturers to provide tailored inverter solutions that address the unique needs of large projects, and their technical expertise ensures essential support for intricate installations and extensive projects.

Market Share by Type of End User

Based on type of end user, the global inverter market is segmented into automotive, photovoltaic plants, residential, and others. According to our estimates, currently, the residential segment captures the majority of the market share and this trend is unlikely to change in the future as well. This can be attributed to the increased demand for rooftop solar installations and government initiatives like tax credits and rebates to encourage clean energy.

However, the automotive sector is expected to grow at a higher CAGR during the forecast period, due to the rising adoption of electric vehicles, where inverters are essential for converting direct current from the battery to alternating current for the electric motor.

Market Share by Geographical Regions

Based on geographical regions, the inverter market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently Asia captures the majority share of the market. In terms of both production and demand, Asia significantly dominates the market, driven by an increasing number of consumers leaning towards electric vehicles and solar energy. Moreover, North America is expected to experience a higher CAGR during this forecast period, fueled by greater adoption of clean energy solutions, robust government initiatives, tax incentives, and concerns for the environment.

Example Players in Inverter Market

- ABB

- Delta

- Enphase

- Fronius

- General Electric

- Huawei

- Power Electronic

- Schneider

- SMA

- SolarEdge

- Sungrow

- TMEIC

Inverter Market: Research Coverage

The report on the inverter market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the inverter market, focusing on key market segments, including [A] type of product, [B] type of power rating, [C] type of voltage, [D] type of connection, [E] type of sales channel, [F] type of end-user, and [G] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the inverter market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the inverter market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] inverter portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the inverter market

Key Questions Answered in this Report

- How many companies are currently engaged in inverter market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Inverter Market

- 6.2.1. Type of Product

- 6.2.2. Type of Power Rating

- 6.2.3. Type of Voltage

- 6.2.4. Type of Connection

- 6.2.5. Type of Sales Channel

- 6.2.6. Type of End User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Interactive Display: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. ABB*

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- 8.3. Delta

- 8.4. Enphase

- 8.5. Fronius

- 8.6. General Electric

- 8.7. Huawei

- 8.8. Power Electronics

- 8.9. Schneider

- 8.10. SMA

- 8.11. SolarEdge

- 8.12. Sungrow

- 8.13. TMEIC

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL INVERTER MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Integrated Circuit Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Inverter Market for Central Inverter: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Inverter Market for Hybrid Inverter: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Inverter Market for Micro Inverter: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Inverter Market for String Inverter: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.10. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF POWER RATING

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Inverter Market for Below10k W: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Inverter Market for 10-50kW: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Inverter Market for 50-100kW: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Inverter Market for Above 100kW: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF VOLTAGE

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Inverter Market for High: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Inverter Market for Low: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Inverter Market for Medium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF CONNECTION

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Inverter Market for Grid-Tied: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Inverter Market for Stand Alone: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF SALES CHANNEL

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Inverter Market for Direct: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Inverter Market for Indirect: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF END USER

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Inverter Market for Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Inverter Market for Photovoltaic Plants: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Inverter Market for Residential: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Inverter Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.10. Data Triangulation and Validation

18. MARKET OPPORTUNITIES FOR INVERTER IN NORTH AMERICA

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Inverter Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.1. Inverter Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.2. Inverter Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.3. Inverter Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.6.4. Inverter Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Data Triangulation and Validation

19. MARKET OPPORTUNITIES FOR INVERTER IN EUROPE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Inverter Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.1. Inverter Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.2. Inverter Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.3. Inverter Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.4. Inverter Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.5. Inverter Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.6. Inverter Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.7. Inverter Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.8. Inverter Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.9. Inverter Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.10. Inverter Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.11. Inverter Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.12. Inverter Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.13. Inverter Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.14. Infrared Circuit Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.6.15. Inverter Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR INVERTER IN ASIA

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Inverter Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.1. Inverter Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.2. Inverter Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.3. Inverter Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.4. Inverter Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.5. Inverter Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.6.6. Inverter Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR INVERTER IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Inverter Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.1. Inverter Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 21.6.2. Inverter Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.3. Inverter Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.4. Inverter Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.5. Inverter Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.6. Inverter Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.7. Inverter Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.6.8. Inverter Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR INVERTER IN LATIN AMERICA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Inverter Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Inverter Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Inverter Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Inverter Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Inverter Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.5. Inverter Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.6. Inverter Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR INVERTER IN REST OF THE WORLD

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Inverter Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Inverter Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Inverter Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Inverter Market in Other Countries

- 23.7. Data Triangulation and Validation