|

市场调查报告书

商品编码

1891242

病毒载体及质粒DNA生产市场(第七版)-产业趋势及全球预测(至2035年)-依企业规模、载体、应用、治疗领域、製造商及地区划分Viral Vector and Plasmid DNA Manufacturing Market (7th Edition): Industry Trends and Global Forecasts, till 2035 - Distribution by Scale of Operation, Vector Manufactured, Application Area, Therapeutic Area, Manufacturer and Geographical Regions |

||||||

病毒载体与质粒DNA生产市场

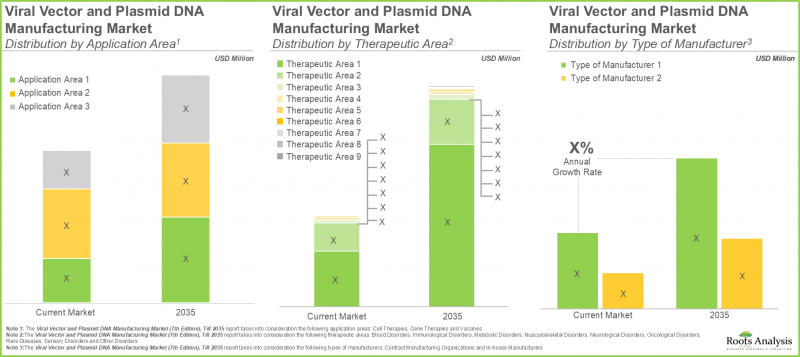

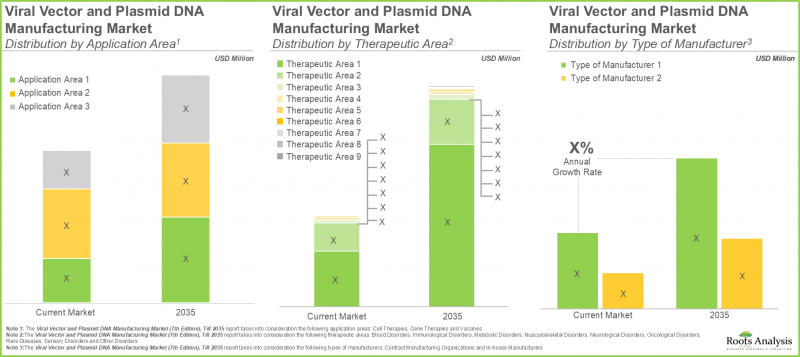

预计全球病毒载体和质粒DNA生产市场在预测期内将以9.87%的复合年增长率增长,从目前的8.43亿美元增长到2035年的21.61亿美元。

病毒载体与质粒DNA生产市场

市场规模和机会分析基于以下参数进行细分:

企业规模

- 临床前阶段

- 临床阶段

- 商业化阶段

应用领域

- 细胞疗法

- 基因工程疗法

- 疫苗

载体型别

- 腺相关病毒载体 (AAV)

- 腺病毒载体

- 慢病毒载体

- 逆转录病毒载体

- 非病毒载体

- 其他

治疗领域

- 肿瘤学

- 罕见疾病

- 免疫系统疾病

- 神经系统疾病

- 感觉障碍

- 代谢性疾病

- 血液系统疾病

- 肌肉骨骼疾病

- 传染病

- 眼科疾病

- 其他

生产商类型

- 内部生产商

- 合约生产商组织机构

地理区域

- 北美

- 欧洲

- 亚太地区

- 中东和北非

- 拉丁美洲

病毒载体与质粒DNA生产市场 - 成长与趋势

病毒载体和非病毒载体已成为将遗传物质递送至目标细胞的重要工具,并构成了现代细胞和基因疗法的基础。近年来,全球约有30种基于病毒载体的疗法获得监管机构批准,目前美国有超过500种候选药物正在进行临床试验。核准药物数量的增加和持续的研究推动了对大规模病毒载体生产的需求。然而,该领域面临许多挑战,包括免疫原性风险和病毒载体分析的复杂性。为了应对这些挑战,开发人员正越来越多地探索非病毒载体作为更安全、更易于规模化生产的选择。

为了满足日益增长的载体需求,业界正在推动各种製程改进。特别是,康宁生命科学公司开发了高密度细胞培养系统,例如 HYPERStack 和 CellSTACKs,利用透气膜技术提高载体产量。该公司还引入了自动化系统,以简化工作流程、减少人工劳动并缩短生产週期。这些技术创新正在为全球高效、可靠且经济的载体生产奠定基础。

根据病毒载体和质粒 DNA 生产市场报告,目前全球有 300 多家来自工业和非工业领域的公司正致力于支持不断扩大的细胞疗法、基因疗法和基于载体的疫苗研发管线。投资、策略联盟和设施扩建进一步推动了该行业的扩张,显示各方坚定致力于应对生产挑战。这些发展表明,病毒和非病毒载体的生产将迎来显着增长,并成为即将到来的基因疗法浪潮的重要组成部分。

病毒载体和质粒DNA生产市场 - 主要发现

本报告深入分析了全球病毒载体和质粒DNA生产市场的现状,并指出了该行业的潜在成长机会。报告的主要发现包括:

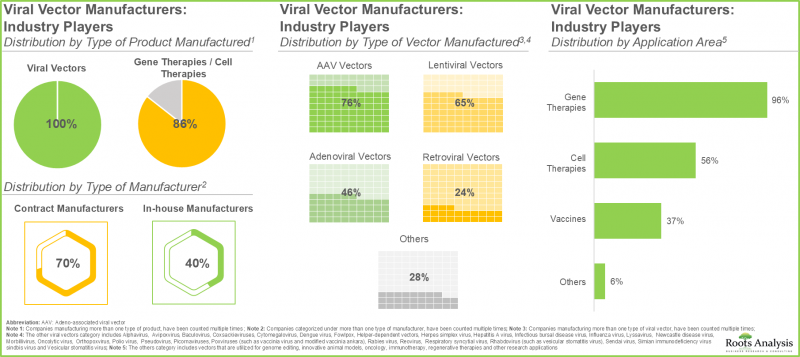

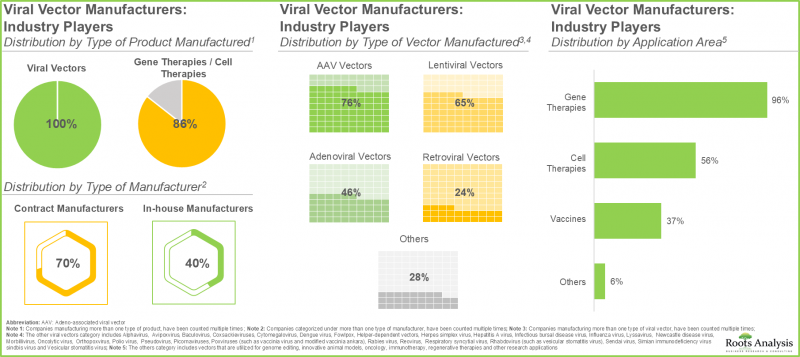

- 目前,超过130家产业参与者声称具备生产各种类型病毒载体的必要能力,以满足自身需求和/或合约服务安排。

- 在目前的市场格局中,约70%的病毒载体生产市场由合约製造商主导,其中约20%具备生产所有类型病毒载体的能力。

- 该产业约50%的公司具备在临床前、临床和商业化三个阶段开展业务的能力。

- 我们绘製了世界各地不同载具製造商的设施分布图。尤其值得一提的是,欧洲已成为病毒和非病毒载体生产的主要中心。

- 约85%的非产业参与者从事AAV载体生产,另有80%专注于基因治疗载体的生产。

- 大多数技术(43%)用于生产治疗神经系统疾病的载体,其次是肿瘤治疗(30%)。

- 目前,各参与者正在进行近150项扩建项目,凸显了基于载体的细胞和基因治疗领域日益增长的兴趣和投资。

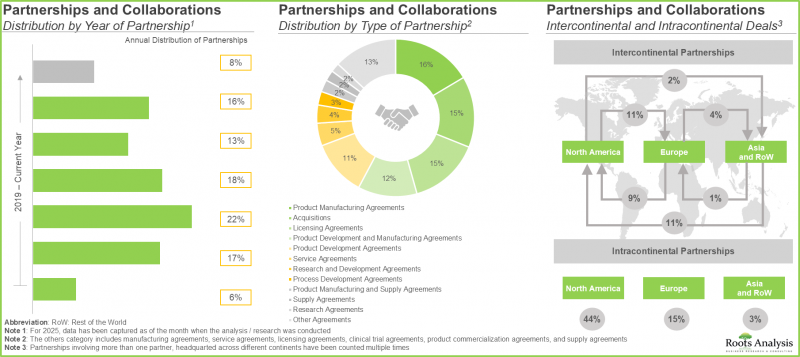

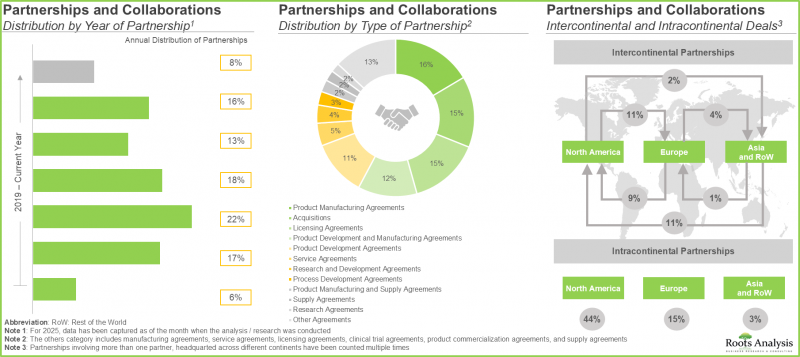

- 近期国内外利害关係人签署的众多合作协议也反映了该领域日益增长的利益。

- 为了提高效率并优化生产流程,预计多家载体和基因治疗创新企业将与载体和基因治疗生产商建立策略联盟。

- 全球超过65%的基因治疗和载体生产能力用于病毒载体生产,其中约55%的病毒载体生产能力位于北美。

- 鑑于目前有多种载体类型处于不同的研发阶段,预计未来十年对这些载体的需求将显着增长。

- 载体生产产业的整体市场机会预计将以9.87%的复合年增长率成长,且成长预计将广泛分布于不同规模的企业、载体类型和地理区域。

- 从长远来看,基于载体的肿瘤疗法(市场占有率超过60%)预计将推动该市场的成长。

病毒载体和质粒DNA生产市场 - 主要细分市场

临床细分市场在病毒载体和质粒DNA生产市场中占最大的收入占有率。

该市场依业务规模分为临床前、临床及商业化三个阶段。对病毒载体和质粒DNA生产市场的分析表明,受众多正在进行的基因和细胞疗法临床试验的高需求驱动,临床细分市场今年的市场占有率更高(50%)。值得注意的是,商业化阶段市场预计在预测期内将以13%的复合年增长率显着成长。这主要得益于细胞和基因疗法领域的进步,目前大多数疗法都处于后期研发阶段,预计将在近期进入市场。

慢病毒载体在病毒载体和质粒DNA生产市场中占最大占有率。

依载体类型划分,整个市场包括AAV载体、腺病毒载体、慢病毒载体、逆转录病毒载体、非病毒载体和其他载体。今年,慢病毒载体占了25%的显着市场。目前,多种基于慢病毒载体的基因和细胞疗法正处于后期临床开发阶段。此外,预计AAV载体的市占率在预测期内也将显着成长,复合年增长率将达到13%。这主要归功于AAV载体的优势,例如能够高效转导至多种细胞类型以及递送大量DNA。

预计基因治疗将占病毒载体和质粒DNA生产市场的大部分占有率。

依应用领域划分,整个市场可分为细胞治疗、基因治疗和疫苗。目前,基因治疗中使用的载体占最大的市场占有率(49%)。这主要归因于核准用于多种适应症的基因疗法数量不断增加,显着提高了对高品质载体生产的需求。此外,预计细胞治疗中使用的载体占有率将显着增长,在预测期内复合年增长率将达到11%。这一趋势主要受目前正在进行临床试验的疗法数量不断增加的推动。

肿瘤领域将占病毒载体和质粒DNA生产市场最大的占有率。

根据病毒载体和质粒DNA生产市场预测,受全球肿瘤疾病发生率上升的推动,今年基于载体的肿瘤疾病治疗疗法将占最大的市场占有率(47%)。此外,受核准用于眼科疾病的细胞和基因疗法数量不断增加的推动,预计基于载体的眼科疾病治疗疗法在预测期内将以31%的复合年增长率增长。

预期合约生产领域将主导病毒载体和质粒DNA生产市场。

此部分阐述了各类製造商(包括合约製造商和内部製造商)的市场分布。目前,合约生产领域(57%)预计将主导市场,并在预测期内以更高的复合年增长率(11%)成长。这一趋势归因于合约生产组织 (CMO) 提供的可扩展性和灵活性,使其能够快速响应不断变化的生产需求并应对不断增长的生产需求。

预计亚太地区和中东及北非地区将推动病毒载体和质粒 DNA 生产市场的成长。

目前,北美占最大的市占率 (54%)。这得归功于该地区先进的医疗保健体系和研究环境。同时,亚太地区和中东及北非市场预计在预测期内将分别以 11% 的较高复合年增长率 (CAGR) 成长。这主要归因于神经系统疾病治疗需求的成长。 这主要是由于慢性疾病(包括遗传性疾病、罕见疾病和遗传性疾病)的盛行率不断上升,以及对高效先进疗法的需求日益增长。

病毒载体和质粒DNA生产市场的主要参与者

- Advanced BioScience Laboratories

- AGC Biologics

- Aldevron

- Celonic

- Catalent Biologics

- Charles River Laboratories

- Novartis

- Oxford BioMedica

病毒载体和质粒DNA生产市场 - 研究范围

- 市场规模和机会分析:本报告对病毒载体和质粒DNA生产市场进行了详细分析,重点关注以下关键市场细分:[A] 企业规模,[B] 生产载体类型,[C] 应用领域,[D] 治疗领域,[E] 生产商类型,以及 [F] 地理区域。 市场情境 1:基于多个相关参数(例如 [A] 成立年份、[B] 公司规模、[C] 总部所在地、[D] 产品类型、[E] 生产设施所在地、[F] 製造商类型、[G] 业务规模、[H] 应用领域)对病毒载体和质粒 DNA 生产市场进行详细评估。 市场情境 2:基于多个相关参数(例如 [A] 成立年份、[B] 公司规模、[C] 总部所在地、[D] 产品类型、[E] 业务规模、[F] 应用领域)对参与质粒 DNA 和基因治疗生产的行业参与者进行详细评估。

- 市场情境 3:基于相关参数(例如 [A] 成立年份、[B] 载体生产设施所在地、[C] 製造商类型、[D] 业务规模、[E] 生产的载体类型、[F] 应用领域),对参与病毒载体、非病毒载体及其他新型载体和基因疗法生产的非行业参与者进行详细评估。

- 技术趋势:基于 [A] 技术类型、[B] 技术目标、[C] 规模、[D] 载体类型和 [E] 应用领域,对该市场中各公司提供/开发的技术进行深入分析。

- 公司竞争力分析:对参与载体和基因疗法生产的主要公司进行全面的竞争分析,考察 [A] 供应能力、[B] 生产能力和 [C] 服务能力等因素。

- 公司简介:详细介绍目前在北美、欧洲和亚太地区病毒载体和质粒DNA生产市场运营的主要公司,重点关注[A]成立年份、[B]总部所在地、[C]产品组合、[D]生产设施、[E]近期发展和[F]未来前景。

- 合作关係:深入分析基因治疗、非病毒载体和病毒载体生产市场中已建立的合作关係,分析基于各种相关参数,例如[A]成立年份、[B]合作类型、[C]合作伙伴类型和[D]最活跃的参与者。

- 近期扩张:分析旨在增强公司在病毒和非病毒载体生产方面能力的近期扩张,分析基于多个参数,包括:[A]扩张年份、[B]扩张类型、[C]载体类型、[D]应用领域和[E]扩张的地理位置。

- 策略伙伴分析:基于多项参数(包括:[A] 开发人员实力,[B] 产品实力,[C] 载体类型,[D] 治疗领域,以及 [E] 产品线实力)对载体和基因治疗产品製造商(载体疗法开发商与载体纯化产品开发商)的潜在战略合作伙伴进行深入分析。

- 新兴载体:深入探讨目前正在研究用于开发基因修饰疗法的其他病毒和非病毒基因递送方法的新兴趋势。

- 关键洞察:基于相关参数(载体类型、企业规模、製造商类型)、(载体类型和组织类型)以及(总部所在地和主要载体生产基地的地理位置)对质粒DNA和病毒载体製造领域的当前市场趋势进行深入分析。

- 成本分析:分析可能影响载体定价的各种因素,并描述产品开发商/製造商在确定载体价格时可能采用的不同模型/方法。

- 可行性分析框架:该框架深入分析了病毒载体和非病毒载体生产商在决定是自行生产还是使用合约生产组织 (CMO) 的服务时应考虑的各种因素。

- 波特五力分析:对基因治疗、非病毒载体和病毒载体生产市场中存在的五种竞争力量进行定性分析,包括:[A] 新进入者的威胁;[B] 药物研发者的议价能力;[C] 载体和基因治疗生产商的议价能力;[D] 替代技术的威胁能力;[C] 载体和基因治疗生产商的议价能力;[D] 替代技术的威胁能力;以及 [E] 现有竞争对手之间的竞争压力。

- 产能分析:基于公开资讯以及从一手和二手研究中获得的见解,估算产业参与者载体生产设施的总装置容量。该分析还涵盖了依公司规模(小型、中型、大型)、总部所在地(依地区:北美、欧洲、亚太地区、世界其他地区)和生产设施所在地划分的全球产能分布。

- 需求分析:对病毒载体和非病毒载体的当前及未来需求进行详细分析。该分析考虑了基于各种相关参数(例如[A]目标患者群体、[B]给药频率和[C]剂量强度)评估市售基因疗法和基于载体的疗法的临床试验。

- 市场影响分析:对可能影响基因疗法、非病毒载体和病毒载体生产市场成长的因素进行详细分析。该分析还包括对[A]关键驱动因素、[B]潜在限制因素、[C]新兴机会和[D]现有挑战的识别和分析。

目录

第一章:引言

第二章:研究方法

第三章:市场动态

第四章:宏观经济指标

- 章节概述

- 市场动态

第五章:摘要整理

第六章:引言

- 章节概述

- 病毒与非病毒基因传递技术

- 病毒载体类型

- 非病毒载体型

- 使用非病毒载体进行基因传递

- 病毒和非病毒载体的应用

- 载体开发的最新趋势製造

- 载体製造

- 未来展望

第七章 病毒载体製造商(产业参与者):市场概况

- 章节概述

- 病毒载体与基因治疗製造商:市场概况

第八章 质粒DNA製造商(产业参与者):市场概况

- 章节概述

- 质粒DNA与基因治疗製造商:市场概况

第九章 病毒载体与质粒DNA製造商(非产业参与者):市场概况

- 章节概述

- 病毒载体和质粒DNA製造商(非产业参与者):市场概况

第十章 载具製造技术展望

第11章 竞争分析

- 章节概述

- 研究方法与关键参数

- 病毒载体产生者:竞争分析

- 质粒DNA生产商:竞争分析

第12章 北美载体生产商

- 章节概述

- 主要参与者

- Advanced BioScience Laboratories

- Catalent Biologics

- Charles River Laboratories

- Thermo Fisher Scientific

- VectorBuilder

- 其他主要参与者

- AGC Biologics

- Aldevron

- Matica Biotechnology

- Resilience

第11章第 13 章:欧洲载体生产商

- 章节概述

- 主要参与者

- Lonza

- Touchlight

- 其他主要参与者

- BioNTech 创新製造服务(BioNTech 子公司)

- Biovian

- Celonic

- 製程创新中心

- CEVEC 製药

- NorthX 生物製剂

- 诺华

- Oxford BioMedica

- 赛诺菲

第 14 章:亚太地区载体生产商

第 15 章:亚太地区载体生产商

- 章节概述

- 主要参与者主要参与者

- CoJourney

- Esco Aster

- 无锡康普科技

- 其他主要参与者

- Altruist Biotechnology

- 江苏普信生物製药

- Nikon CeLL Innovation

第十六章 波特五力分析

- 章节概述

- 研究方法与假设

- 关键参数

- 结论

第十七章:伙伴关係与合作

第十八章:近期扩张

- 章节概述

- 扩张型

- 载具製造:近期扩张

章节第 19 章:策略伙伴分析

第 20 章:新兴载体

第 21 章:主要的洞察

第 22 章:成本分析

- 章节概述

- 导致病毒载体和质粒 DNA 疗法价格高的因素

- 病毒载体与质粒 DNA 疗法:定价模型

- 结论

第 23 章:外包:可行/不可行架构

第 24 章:产能分析

第 25 章:需求分析

- 章节概述

- 假设与研究方法

- 全球对病毒载体和质粒 DNA 疗法的需求质粒DNA至2035年

- 全球病毒载体和质粒DNA的临床需求至2035年

- 全球病毒载体和质粒DNA的商业需求至2035年需求

- 供需分析

第26章 市场影响分析:驱动因素、限制因素、机会与挑战

第27章 全球载具製造市场

第28章 载体製造市场(依企业规模划分)

第29章 载体製造市场(依载体类型划分)

第30章 载体製造市场(依应用领域划分)

第31章 载体製造市场(依治疗领域划分)

第32章 载体製造市场(依製造商划分)

第33章 载体製造市场(依地区划分)

章节34. 市场机会分析:北美

第35章:市场机会分析:欧洲

第36章:市场机会分析:亚太地区

第37章:市场机会分析:中东与北非

第38章:市场机会分析:拉丁美洲

第39章:研究分析

第40章:结论

第41章:高阶主管见解

第42章:附录一:表格资料

第43章:公司与组织清单

Viral Vector and Plasmid DNA Manufacturing Market

As per Roots Analysis, the global viral vector and plasmid DNA manufacturing market is estimated to grow from USD 843 million in the current year to USD 2,161 million by 2035, at a CAGR of 9.87% during the forecast period, till 2035.

Viral Vector and Plasmid DNA Manufacturing Market

The market sizing and opportunity analysis has been segmented across the following parameters:

Scale of Operation

- Preclinical

- Clinical

- Commercial

Application Area

- Cell Therapies

- Gene Therapies

- Vaccines

Type of Vector Manufactured

- AAV Vectors

- Adenoviral Vectors

- Lentiviral Vectors

- Retroviral Vectors

- Non-viral Vectors

- Other Vectors

Therapeutic Area

- Oncological Disorders

- Rare Disorders

- Immunological Disorders

- Neurological Disorders

- Sensory Disorders

- Metabolic Disorders

- Blood Disorders

- Musculoskeletal Disorders

- Infectious Diseases

- Ophthalmic Disorders

- Other Disorders

Type of Manufacturer

- In-house Manufacturers

- Contract Manufacturing Organizations

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Viral Vector and Plasmid DNA Manufacturing Market: Growth and Trends

Viral and non-viral vectors have become essential instruments for transferring genetic material into target cells, constituting the foundation of contemporary cell and gene therapies. In recent years,, approximately 30 therapies utilizing viral vectors have gained global regulatory approval, with more than 500 candidates currently in clinical trials in the US. The increase in approvals and continuing research has driven the need for extensive viral vector production. Nonetheless, this field encounters numerous challenges, such as risks of immunogenicity and the intricate character of viral vector analysis. To address these challenges, developers are progressively investigating the possibilities of non-viral vectors as more secure and scalable options.

To satisfy the increasing need for vectors, the sector has launched various process improvements. Interestingly, Corning Life Sciences has created high-density cell culture systems, such as HYPERStack and CellSTACKs, which utilize gas-permeable film technology to improve vector yields. The firm has additionally launched automation systems to enhance workflows, decrease manual involvement, and speed up production schedules. These advancements in technology have generated momentum for more efficient, reliable, and economical vector production globally.

Currently, more than 300 players from both industry and non-industry sectors worldwide are engaged in efforts to back the growing pipeline of cell therapies, gene therapies, and vector-based vaccines, according to the viral vectors and plasmid DNA manufacturing market report. The expansion in this sector is additionally driven by investments, strategic partnerships, and facility expansions, demonstrating a solid dedication to addressing production challenges. These advancements indicate that manufacturing for both viral and non-viral vectors is set for significant growth, positioning them as essential contributors to the upcoming wave of genetic therapies.

Viral Vector and Plasmid DNA Manufacturing Market: Key Insights

The report delves into the current state of the global viral vector and plasmid DNA manufacturing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 130 industry players claim to have the necessary capabilities to manufacture different types of viral vectors for in-house requirements and / or contract service engagements.

- The current viral vector manufacturing market landscape features the presence of around 70% contract manufacturers; among these, about 20% players have capability to manufacture all types of viral vectors.

- Close to 50% of the companies in this domain have the capability to operate across all three scales of operation, namely preclinical, clinical and commercial.

- We have mapped the locations of facilities established by different vector manufacturers worldwide; notably, Europe emerged as the prominent viral and non-viral vector manufacturing hub.

- Around 85% of the non-industry players are engaged in the manufacturing of AAV vectors; further, close to 80% of the organizations are focused on manufacturing vectors for gene therapy applications.

- Majority (43%) of the technologies are being utilized for manufacturing vectors that can be used for the treatment of neurological disorders, followed by oncological disorders (30%).

- Presently, close to 150 expansions have been undertaken by various players, underscoring the growing interest and investment in the vector-based cell and gene therapy domain.

- The rising interest in this domain is also reflected by the number of partnerships that have been inked in the recent past, involving both international and local stakeholders.

- In order to increase efficiency and optimize the manufacturing processes, several vector and gene therapy innovators are anticipated to forge strategic alliances with vector and gene therapy manufacturers.

- Over 65% of the global installed gene therapy and vector manufacturing capacity is dedicated to viral vector manufacturing; ~55% of viral vector manufacturing capacity is installed in the facilities located in North America.

- Given that there are several types of vectors being evaluated across various stages of development, the demand for such vectors is anticipated to rise significantly over the next decade.

- The overall opportunity associated with vector manufacturing domain is anticipated to grow at the CAGR of 9.87%; it is likely to be well distributed across different, scales of operation, types of vectors and geographical regions.

- Over the long term, vector-based therapies for oncological disorders, which hold more than 60% market share are expected to drive the growth of this market.

Viral Vector and Plasmid DNA Manufacturing Market: Key Segments

Clinical Segment Occupies the Highest Revenue Share in the Viral Vector and Plasmid DNA Manufacturing Market

The market is segmented across various scales of operation such as preclinical, clinical and commercial. As per viral vector and plasmid DNA manufacturing market analysis, in the current year, the clinical segment occupies the higher market share (50%). This is a result of the high demand from numerous ongoing gene and cell therapy clinical trials. It is worth mentioning that the commercial stage segment is likely to witness a significant growth rate with a CAGR of 13% during the forecast period. This results from the advancing cell and gene therapy field, where the majority of therapies are in later development stages and are expected to enter the market in short-term.

Lentiviral Vector Segment Holds the Largest Viral Vector and Plasmid DNA Manufacturing Market Share

In terms of the type of vector manufactured, the overall market includes AAV vectors, adenoviral vectors, lentiviral vectors, retroviral vectors, non-viral vectors and other vectors. In the current year, lentiviral vector segment occupies the higher market share (25%). Several lentiviral vector based gene therapies and cell therapies are currently in the late stage of clinical development. Further, the market is likely to witness a substantial increase in the share of AAV vectors market share, growing at a CAGR of 13% during the forecast period. This is ascribed to advantages offered by AAV vectors, such as efficient transduction of various cell types and their ability to deliver large amounts of DNA.

Gene Therapy is Likely to Capture Majority of the Viral Vector and Plasmid DNA Manufacturing Market Share

Based on application area, the overall marker includes cell therapy, gene therapy and vaccine. Currently, vectors that are used in gene therapy segments occupy the highest market share (49%). This is due to the rising number of approved gene therapies for multiple indications, which has substantially increased the demand for high-quality vector production. Further, the market is likely to witness a substantial increase in the share of vectors that are used for cell therapy manufacturing, growing at a CAGR of 11% during the forecast period. This trend is due to an increasing number of therapies that are currently in clinical trials.

Oncological Disorders Segment Holds the Largest Viral Vector and Plasmid DNA Manufacturing Market Share

As per viral vector and plasmid DNA manufacturing market forecast, in the current year, vector-based therapies for the treatment of oncological disorders occupy the highest market share (47%), due to the growing incidence of such disorders across the globe. Further, vector-based therapies for the treatment of ophthalmic disorders are likely to grow at a CAGR of 31% during the forecast period. This is because of the growing number of approvals for cell and gene therapies for eye disorders.

Contract Manufacturing Segment is Likely to Dominate the Viral Vector and Plasmid DNA Manufacturing Market

This segment highlights the distribution of market across various types of manufacturers, such as contract manufacturing and in-house manufacturing. Currently, contract manufacturer segment (57%) is likely to dominate the market and is expected to grow at a higher CAGR (11%) during the forecast period. This trend arises from the ability of CMOs to provide scalability and flexibility, allowing them to quickly adjust to evolving manufacturing needs and handle increasing production demands.

Asia-Pacific and Middle East and North Africa is Likely to Propel the Growth of the Viral Vector and Plasmid DNA Manufacturing Market

Currently, North America (54%) captures the highest market share. This results from the developed healthcare system and research environment in North America. In contrast, the Asia-Pacific, and Middle East and North Africa markets are expected to expand at a comparatively higher CAGR of 11% each, during the forecast period. This is attributed to the growing prevalence of chronic conditions such as neurological conditions, genetic conditions, and rare illnesses and the heightened need for efficient and sophisticated treatments.

Primary Research Overview

Discussions with multiple stakeholders in this domain influenced the opinions and insights presented in this study. The market report includes transcripts of the following other third-party discussions:

- Chief Executive Officer, mid-sized company, Netherlands

- Chief Executive Officer and Chief Scientific Officer, small company, Germany

- Former Executive and Scientific Director, small company, Belgium

- Co-Founder and President, mid-sized company, France

- Former Director, Netherlands-based company

- Director, Massachusetts-based organization

- Former Scientific Director, France-based organization

- Former Managing Director, small company, Japan

- Scientific Director, small company, US

- Key Account Management, mid-sized company, Germany

- Head of Project Management, small company, Germany

- Director of Business Development, small company, US

- ATMP Key Account Manager, France-based organization

- Chief Scientific Officer, small company, France

- Director of Marketing and Technical Support, mid-sized company, France

- Head of Communications, mid-sized company, Spain

- Independent Consultant

Example Players in the Viral Vector and Plasmid DNA Manufacturing Market

- Advanced BioScience Laboratories

- AGC Biologics

- Aldevron

- Celonic

- Catalent Biologics

- Charles River Laboratories

- Novartis

- Oxford BioMedica

Viral Vector and Plasmid DNA Manufacturing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the viral vector and plasmid DNA manufacturing market, focusing on key market segments, including [A] scale of operation, [B] type of vector manufactured, [C] application area, [D] therapeutic area, [E] type of manufacturer and [F] geographical regions.

- Market Landscape 1: A detailed assessment of the viral vector and plasmid DNA manufacturing market based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of product manufactured, [E] location of manufacturing facility, [F] type of manufacturer, [G] scale of operation, and [H] application area.

- Market Landscape 2: A detailed assessment of the industry players engaged in manufacturing plasmid DNA and gene therapies based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of product manufactured, [E] scale of operation, and [F] application area.

- Market Landscape 3: A detailed assessment of the non-industry players engaged in the manufacturing of viral, non viral and other novel types of vectors and gene therapies, based on relevant parameters such as [A] year of establishment, [B] location of vector manufacturing facility, [C] type of manufacturer, [D] scale of operation, [E] type of vector manufactured and [F] application area.

- Technology Landscape: An in-depth analysis of the technologies offered / developed by the companies engaged in this market, based on the [A] type of technology, [B] purpose of technology, [C] scale of, [D] type of vector, and [E] application area.

- Company Competitiveness Analysis: A comprehensive competitive analysis of key players engaged in manufacturing vectors and gene therapies, examining factors, such as [A] supplier strength [B] manufacturing strength and [C] service strength.

- Company Profiles: In-depth profiles of prominent players based in regions, namely North America, Europe and Asia-Pacific that are currently involved in the viral vector and plasmid DNA manufacturing market, focusing on [A] year of establishment, [B] location of headquarters, [C] product portfolio, [D] manufacturing facilities, [E] recent developments and [F] an informed future outlook.

- Partnerships and Collaborations An insightful analysis of the partnerships and collaborations established in gene therapy, non viral vector and viral vector manufacturing market based on various relevant parameters, including [A] year of partnership, [B] type of partnership, [C] type of partner and [D] most active players.

- Recent Expansions: An analysis of the recent expansions undertaken by various companies in order to augment their respective capabilities related to viral vector and non viral vector manufacturing, based on several parameters, such as [A] year of expansion, [B] type of expansion, [C] type of vector, [D] application area and [E] geographical location of the expansion.

- Strategic Partner Analysis: An insightful analysis evaluating the potential strategic partners (comparing vector based therapy developers and vector purification product developers) for vector and gene therapy product manufacturers, based on several parameters, such as [A] developer strength, [B] product strength, [C] type of vector, [D] therapeutic area and [E] pipeline strength.

- Emerging Vectors: An elaborate discussion on the emerging trends of other viral / non viral gene delivery approaches that are currently in research for the development of therapies involving genetic modification.

- Key Insights: An insightful analysis, highlighting the contemporary market trends in the plasmid DNA and viral vector manufacturing domain, based on relevant parameters, such as (type of vector, scale of operation and type of manufacturer), (type of vector and type of organization) and (location of headquarters and geographical location of key vector manufacturing hubs).

- Cost Price Analysis: An analysis of various factors that are likely to influence the pricing of vectors, featuring different models / approaches that may be adopted by product developers / manufacturers in order to decide the prices of their proprietary vectors.

- Go / No-Go Framework Analysis: An insightful go / no-go framework analysis, highlighting various factors that needs to be considered by viral vector and non viral vector manufacturing companies while deciding whether to manufacture their respective products in-house or engage the services of a CMO.

- Porter's Five Forces Analysis: A qualitative analysis, highlighting the five competitive forces prevalent in gene therapy, non viral vector and viral vector manufacturing market, including [A] threats for new entrants, [B] bargaining power of drug developers, [C] bargaining power of vector and gene therapy manufacturers, [D] threats of substitute technologies and [E] rivalry among existing competitors.

- Capacity Analysis: An estimate of the overall, installed vector manufacturing capacity of industry players based on the information available in the public domain, and insights generated from both secondary and primary research. The analysis also highlights the distribution of global capacity by company size (small, mid-sized and large), location of headquarters (region) (North America, Europe, Asia Pacific and the rest of the world) and location of manufacturing facility.

- Demand Analysis: An in-depth analysis to estimate the current and future demand for viral vectors and non viral vectors, taking into consideration the marketed gene therapies and clinical studies evaluating vector-based therapies, based on various relevant parameters, such as [A] target patient population, [B] dosing frequency and [C] dose strength.

- Market Impact Analysis: An in-depth analysis of the factors that can impact the growth of gene therapy, non viral vector and viral vector manufacturing market. It also features identification and analysis of [A] key drivers, [B] potential restraints, [C] emerging opportunities, and [D] existing challenges.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the current global capacity of developers?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Key Questions Answered

- 1.5. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Viral and Non-Viral Gene Transfer Techniques

- 6.3. Viral Vectors Used in Genetically Modified Therapies

- 6.4. Types of Viral Vectors

- 6.4.1. Adeno-associated Viral Vectors

- 6.4.1.1. Overview

- 6.4.1.2. Design and Manufacturing

- 6.4.1.3. Advantages

- 6.4.1.4. Limitations

- 6.4.2. Adenoviral Vectors

- 6.4.2.1. Overview

- 6.4.2.2. Design and Manufacturing

- 6.4.2.3. Advantages

- 6.4.2.4. Limitations

- 6.4.3. Lentiviral Vectors

- 6.4.3.1. Overview

- 6.4.3.2. Design and Manufacturing

- 6.4.3.3. Advantages

- 6.4.3.4. Limitations

- 6.4.4. Retroviral Vectors

- 6.4.4.1. Overview

- 6.4.4.2. Design and Manufacturing

- 6.4.4.3. Advantages

- 6.4.4.4. Limitations

- 6.4.5. Other Viral Vectors

- 6.4.5.1. Alphavirus

- 6.4.5.2. Foamy Virus

- 6.4.5.3. Herpes Simplex Virus

- 6.4.5.4. Sendai Virus

- 6.4.5.5. Simian Virus

- 6.4.5.6. Vaccinia Virus

- 6.4.5.7. Chimeric Viral Vectors

- 6.4.1. Adeno-associated Viral Vectors

- 6.5. Types of Non-Viral Vectors

- 6.5.1. Plasmid DNA

- 6.5.2. Liposomes, Lipoplexes and Polyplexes

- 6.5.3. Oligonucleotides

- 6.5.4. Other Non-Viral Vectors

- 6.6. Gene Delivery using Non-Viral Vectors

- 6.6.1. Biolistic Methods

- 6.6.2. Electroporation

- 6.6.3. Receptor Mediated Gene Delivery

- 6.6.4. Gene Activated Matrix (GAM)

- 6.7. Applications of Viral and Non-Viral Vectors

- 6.7.1. Cell and Gene Therapy

- 6.7.2. Vaccine

- 6.8. Current / Ongoing Trends in Vector Development / Manufacturing

- 6.8.1. Vector Engineering

- 6.8.2. Cargo Engineering

- 6.9. Vector Manufacturing

- 6.9.1. Types of Vector Manufacturers

- 6.9.2. Viral Vector Manufacturing Processes

- 6.9.2.1. Vector Production

- 6.9.2.2. Adherent and Suspension Cultures

- 6.9.2.3. Unit Process Versus Multiple Parallel Processes

- 6.9.2.4. Cell Culture Systems for Production of Viral Vectors

- 6.9.2.4.1. Small Scale / Laboratory Scale Cell Culture Systems

- 6.9.2.4.2. Large Scale Cell Culture Systems

- 6.9.2.4.2.1. Stirred Tank Reactor Systems

- 6.9.2.4.2.2. Fixed Bed Reactors / Packed Bed Reactors

- 6.9.2.4.2.3. Wave Bioreactor Systems

- 6.9.2.5. Serum-Containing versus Serum-Free Media

- 6.9.3. Bioprocessing of Viral Vectors

- 6.9.3.1. AAV Vector Production

- 6.9.3.2. Adenoviral Vector Production

- 6.9.3.3. Lentiviral Vector Production

- 6.9.3.4. Y -Retroviral Vector Production

- 6.9.4. Key Challenges Associated with Vector Manufacturing

- 6.10. Future Perspectives

7. VIRAL VECTOR MANUFACTURERS (INDUSTRY PLAYERS): MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Viral Vector and Gene Therapy Manufacturers: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Type of Product Manufactured

- 7.2.5. Analysis by Type of Manufacturer

- 7.2.6. Analysis by Scale of Operation

- 7.2.7. Analysis by Type of Viral Vector Manufactured

- 7.2.8. Analysis by Application Area

8. PLASMID DNA MANUFACTURERS (INDUSTRY PLAYERS): MARKET LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Plasmid DNA and Gene Therapy Manufacturers: Overall Market Landscape

- 8.2.1. Analysis by Year of Establishment

- 8.2.2. Analysis by Company Size

- 8.2.3. Analysis by Location of Headquarters

- 8.2.4. Analysis by Type of Company

- 8.2.5. Analysis by Type of Venture

- 8.2.6. Analysis by Type of Services Offered

- 8.2.7. Analysis by Type of Plasmid DNA Manufactured

- 8.2.8. Analysis by Grade of Plasmid DNA Manufactured

- 8.2.9. Analysis by Cell Bank

- 8.2.10. Analysis by Scale of Operation

- 8.2.11. Analysis by Application Area

- 8.2.12. Analysis by Viral Vector Used

- 8.2.13. Analysis by Type of Vaccine Developed

- 8.2.14. Analysis by Number of Facilities

9. VIRAL VECTOR AND PLASMID DNA MANUFACTURERS (NON-INDUSTRY PLAYERS): MARKET LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Viral Vector and Plasmid DNA Manufacturers (Non-Industry Players): Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Type of Vector

- 9.2.5. Analysis by Scale of Operation

- 9.2.6. Analysis by Type of Manufacturer

- 9.2.7. Analysis by Application Area

10. VECTOR MANUFACTURING TECHNOLOGIES LANDSCAPE

- 10.1. Chapter Overview

- 10.2. Vector Manufacturing Technologies: Overall Market Landscape

- 10.2.1. Analysis by Type of Technology

- 10.2.2. Analysis by Purpose of Technology

- 10.2.3. Analysis by Scale of Operation

- 10.2.4. Analysis by Type of Vector

- 10.2.5. Analysis by Application Area

- 10.2.6. Most Active Players: Analysis by Number of Technologies

11. COMPANY COOMPETITIVENESS ANALYSIS

- 11.1. Chapter Overview

- 11.2. Methodology and Key Parameters

- 11.3. Viral Vector Manufacturers: Company Competitiveness Analysis

- 11.3.1. Players based in North America

- 11.3.2. Players based in Europe

- 11.3.3. Players based in Asia-Pacific and Rest of the World

- 11.4. Plasmid DNA Manufacturers: Company Competitiveness Analysis

- 11.4.1. Players based in North America

- 11.4.2. Players based in Europe

- 11.4.3. Players based in Asia-Pacific and Rest of the World

12. VECTOR MANUFACTURERS BASED IN NORTH AMERICA

- 12.1. Chapter Overview

- 12.2. Key Players

- 12.2.1. Advanced BioScience Laboratories

- 12.2.1.1. Company Overview

- 12.2.1.2. Vector Manufacturing Portfolio

- 12.2.1.3. Recent Developments and Future Outlook

- 12.2.2. Catalent Biologics

- 12.2.2.1. Company Overview

- 12.2.2.2. Financial Information

- 12.2.2.3. Vector Manufacturing Portfolio

- 12.2.2.4. Recent Developments and Future Outlook

- 12.2.3. Charles River Laboratories

- 12.2.3.1. Company Overview

- 12.2.3.2. Financial Information

- 12.2.3.3. Vector Manufacturing Portfolio

- 12.2.3.4. Recent Developments and Future Outlook

- 12.2.4. Thermo Fisher Scientific

- 12.2.4.1. Company Overview

- 12.2.4.2. Financial Information

- 12.2.4.3. Vector Manufacturing Portfolio

- 12.2.4.4. Recent Development and Future Outlook

- 12.2.5. VectorBuilder

- 12.2.5.1. Company Overview

- 12.2.5.2. Financial Information

- 12.2.5.3. Vector Manufacturing Portfolio

- 12.2.5.4. Recent Developments and Future Outlook

- 12.2.1. Advanced BioScience Laboratories

- 12.3. Other Key Players

- 12.3.1. AGC Biologics

- 12.3.1.1. Company Overview

- 12.3.1.2. Vector Manufacturing Portfolio

- 12.3.2. Aldevron

- 12.3.2.1. Company Overview

- 12.3.2.2. Vector Manufacturing Portfolio

- 12.3.3. Matica Biotechnology

- 12.3.3.1. Company Overview

- 12.3.3.2. Vector Manufacturing Portfolio

- 12.3.4. Resilience

- 12.3.4.1. Company Overview

- 12.3.4.2. Vector Manufacturing Portfolio

- 12.3.1. AGC Biologics

13. VECTOR MANUFACTURERS BASED IN EUROPE

- 13.1. Chapter Overview

- 13.2. Key Players

- 13.2.1. Lonza

- 13.2.1.1. Company Overview

- 13.2.1.2. Financial Information

- 13.2.1.3. Vector Manufacturing Portfolio

- 13.2.1.4. Recent Developments and Future Outlook

- 13.2.2. Touchlight

- 13.2.2.1. Company Overview

- 13.2.2.2. Vector Manufacturing Portfolio

- 13.2.2.3. Recent Developments and Future Outlook

- 13.2.1. Lonza

- 13.3. Other Key Players

- 13.3.1. BioNTech Innovative Manufacturing Service (a subsidiary of BioNTech)

- 13.3.1.1. Company Overview

- 13.3.1.2. Vector Manufacturing Portfolio

- 13.3.2. Biovian

- 13.3.2.1. Company Overview

- 13.3.2.2. Vector Manufacturing Portfolio

- 13.3.3. Celonic

- 13.3.3.1. Company Overview

- 13.3.3.2. Vector Manufacturing Portfolio

- 13.3.4. Centre for Process Innovation

- 13.3.4.1. Company Overview

- 13.3.4.2. Vector Manufacturing Portfolio

- 13.3.5. CEVEC Pharmaceuticals

- 13.3.5.1. Company Overview

- 13.3.5.2. Vector Manufacturing Portfolio

- 13.3.6. NorthX Biologics

- 13.3.6.1. Company Overview

- 13.3.6.2. Vector Manufacturing Portfolio

- 13.3.7. Novartis

- 13.3.7.1. Company Overview

- 13.3.7.2. Vector Manufacturing Portfolio

- 13.3.8. Oxford BioMedica

- 13.3.8.1. Company Overview

- 13.3.8.2. Vector Manufacturing Portfolio

- 13.3.9. Sanofi

- 13.3.9.1. Company Overview

- 13.3.9.2. Vector Manufacturing Portfolio

- 13.3.1. BioNTech Innovative Manufacturing Service (a subsidiary of BioNTech)

14. VECTOR MANUFACTURERS BASED IN ASIA-PACIFIC

15. VECTOR MANUFACTURERS IN ASIA-PACIFIC

- 15.1. Chapter Overview

- 15.2. Key Players

- 15.2.1. CoJourney

- 15.2.1.1. Company Overview

- 15.2.1.2. Vector Manufacturing Portfolio

- 15.2.1.3. Recent Developments and Future Outlook

- 15.2.2. Esco Aster

- 15.2.2.1. Company Overview

- 15.2.2.2. Vector Manufacturing Portfolio

- 15.2.2.3. Recent Developments and Future Outlook

- 15.2.3. Wuxi AppTec

- 15.2.3.1. Company Overview

- 15.2.3.2. Financial Information

- 15.2.3.3. Vector Manufacturing Portfolio

- 15.2.3.4. Recent Developments and Future Outlook

- 15.2.1. CoJourney

- 15.3. Other Key Players

- 15.3.1. Altruist Biotechnology

- 15.3.1.1. Company Overview

- 15.3.1.2. Vector Manufacturing Portfolio

- 15.3.2. Jiangsu Puxin Biopharmaceutical

- 15.3.2.1. Company Overview

- 15.3.2.2. Vector Manufacturing Portfolio

- 15.3.3. Nikon CeLL innovation

- 15.3.3.1. Company Overview

- 15.3.3.2. Vector Manufacturing Portfolio

- 15.3.1. Altruist Biotechnology

16. PORTER'S FIVE FORCES ANALYSIS

- 16.1. Chapter Overview

- 16.2. Methodology and Assumptions

- 16.3. Key Parameters

- 16.3.1. Threats of New Entrants

- 16.3.2. Bargaining Power of Suppliers

- 16.3.3. Bargaining Power of Buyers

- 16.3.4. Threats of Substitute Products

- 16.3.5. Rivalry Among Existing Competitors

- 16.4. Concluding Remarks

17. PARTNERSHIPS AND COLLAORATIONS

- 17.1. Chapter Overview

- 17.2. Partnership Models

- 17.3. Vector Manufacturing: Partnerships and Collaborations

- 17.3.1. Analysis by Year of Partnership

- 17.3.2. Analysis by Type of Partnership

- 17.3.3. Analysis by Scale of Operation

- 17.3.4. Analysis by Type of Vector Manufactured

- 17.3.5. Analysis by Therapeutic Area

- 17.3.6. Analysis by Application Area

- 17.3.7. Most Active Players: Analysis by Number of Partnerships

- 17.3.8. Analysis by Geography

- 17.3.8.1. Local and International Agreements

- 17.3.8.2. Intercontinental and Intracontinental Agreements

18. RECENT EXPANSIONS

- 18.1. Chapter Overview

- 18.2. Type of Expansions

- 18.3. Vector Manufacturing: Recent Expansions

- 18.3.1. Analysis by Year of Expansion

- 18.3.2. Analysis by Type of Expansion

- 18.3.3. Analysis by Year and Type of Expansion

- 18.3.4. Most Active Players: Analysis by Number of Expansions

- 18.3.5. Most Active Players: Analysis by Amount Invested

- 18.3.6. Analysis by Type of Manufacturing Facility

- 18.3.7. Analysis by Scale of Operation

- 18.3.8. Analysis by Type of Vector Manufactured

- 18.3.9. Analysis by Application Area

- 18.3.10. Analysis by Geography

- 18.3.10.1. Intercontinental and Intracontinental Expansions

- 18.3.10.2. Analysis by Location of Expansion

19. STRATEGIC PARTNER ANAYSIS

- 19.1. Chapter Overview

- 19.2. Methodology and Key Parameters

- 19.3. Strategic Partner Analysis: Viral Vector based Therapy Developers

- 19.3.1. Opportunity for AAV Vector based Therapy Developers

- 19.3.1.1. Most Likely Partners

- 19.3.1.2. Likely Partners

- 19.3.1.3. Less Likely Partners

- 19.3.1.4. Least Likely Partners

- 19.3.2. Opportunity for Adenoviral Vector based Therapy Developers

- 19.3.2.1. Most Likely Partners

- 19.3.2.2. Likely Partners

- 19.3.2.3. Less Likely Partners

- 19.3.2.4. Least Likely Partners

- 19.3.3. Opportunity for Lentiviral Vector based Therapy Developers

- 19.3.3.1. Most Likely Partners

- 19.3.3.2. Likely Partners

- 19.3.3.3. Less Likely Partners

- 19.3.3.4. Least Likely Partners

- 19.3.4. Opportunity for Retroviral Vector based Therapy Developers

- 19.3.4.1. Most Likely Partners

- 19.3.4.2. Likely Partners

- 19.3.4.3. Less Likely Partners

- 19.3.4.4. Least Likely Partners

- 19.3.5. Opportunity for Other Viral Vector based Therapy Developers

- 19.3.5.1. Most Likely Partners

- 19.3.5.2. Likely Partners

- 19.3.5.3. Less Likely Partners

- 19.3.5.4. Least Likely Partners

- 19.3.1. Opportunity for AAV Vector based Therapy Developers

20. EMERGING VECTORS

- 20.1. Chapter Overview

- 20.1.1. Alphavirus based Vectors

- 20.1.2. Anc80 based Vectors

- 20.1.3. Bifidobacterium longum based Vectors

- 20.1.4. Cytomegalovirus based Vectors

- 20.1.5. Listeria monocytogenes based Vectors

- 20.1.6. Minicircle DNA based Vectors

- 20.1.7. Myxoma Virus based Vectors

- 20.1.8. Self-Complementary Vectors

- 20.1.9. Sendai Virus based Vectors

- 20.1.10. Sleeping Beauty Transposons

- 20.1.11. Vaccinia Virus and Modified Vaccinia Ankara based Vectors

- 20.1.12. Chimeric Viral Vectors

21. KEY INSIGHTS

- 21.1. Chapter Overview

- 21.2. Vector and Gene Therapy Manufacturers: Key Insights

- 21.2.1. Analysis by Type of Manufacturer, Type of Vector Manufactured and Scale of Operation

- 21.2.2. Analysis by Type of Vector Manufactured and Company Size

- 21.2.3. Analysis by Type of Organization and Geography

- 21.2.3.1. Contract Manufacturing Organizations

- 21.2.3.2. In-House Manufacturers

- 21.2.3.3. In-House and Contract Manufacturing Organizations

- 21.2.4. Analysis by Type of Vector Manufactured and Location of Headquarters

- 21.2.4.1. AAV Vector Manufacturers

- 21.2.4.2. Adenoviral Vector Manufacturers

- 21.2.4.3. Lentiviral Vector Manufacturers

- 21.2.4.4. Retroviral Vector Manufacturers

- 21.2.4.5. Plasmid DNA Manufacturers

22. COST PRICE ANALYSIS

- 22.1. Chapter Overview

- 22.2. Factors Contributing to High Price of Viral Vector and Plasmid DNA based Therapies

- 22.3. Viral Vector and Plasmid DNA based Therapies: Pricing Models

- 22.3.1. Pricing Models Based on Expert Opinions

- 22.3.2. Pricing Models Based on Manufacturing Cost

- 22.3.2.1. Pricing Models Based on Technology Used

- 22.3.2.2. Pricing Models Based on Scale of Operation

- 22.3.2.3. Pricing Models Based on Type of Client

- 22.3.3. Prices of Different Types of Vectors

- 22.4. Concluding Remarks

23. OUTSOURCING: GO / NO-GO FRAMEWORK

- 23.1. Chapter Overview

- 23.2. Outsourcing: Go / No-Go Framework

- 23.3. Vector Manufacturing Outsourcing: Go / No-Go Framework

- 23.3.1. Key Parameters and Assumptions

- 23.3.2. Methodology

- 23.3.3. Results and Interpretations

- 23.3.3.1. Outsourcing: Go / No-Go Framework for Small Companies

- 23.3.3.2. Outsourcing: Go / No-Go Framework for Mid-Sized Companies

- 23.3.3.3. Outsourcing: Go / No-Go Framework for Large Companies

24. CAPACITY ANALYSIS

- 24.1. Chapter Overview

- 24.2. Methodology and Key Assumptions

- 24.3. Viral Vector and Plasmid DNA Manufacturing: Global Installed Capacity

- 24.4. Viral Vector Manufacturing: Global Installed Capacity

- 24.4.1. Analysis by Company Size

- 24.4.2. Analysis by Scale of Operation

- 24.4.3. Analysis by Location of Headquarters (Region)

- 24.4.4. Analysis by Location of Manufacturing Facility

- 24.5. Plasmid DNA Manufacturing: Global Installed Capacity

- 24.5.1. Analysis by Company Size

- 24.5.2. Analysis by Scale of Operation

- 24.5.3. Analysis by Location of Headquarters (Region)

- 24.5.4. Analysis by Location of Manufacturing Facility

25. DEMAND ANALYSIS

- 25.1. Chapter Overview

- 25.2. Assumptions and Methodology

- 25.3. Global Demand for Viral Vectors and Plasmid DNA, Till 2035

- 25.4. Global Clinical Demand for Viral Vectors and Plasmid DNA, Till 2035

- 25.4.1. Analysis by Type of Vector

- 25.4.2. Analysis by Type of Therapy

- 25.4.3. Analysis by Therapeutic Area

- 25.4.4. Analysis by Geography

- 25.5. Global Commercial Demand for Viral Vectors and Plasmid DNA, Till 2035

- 25.5.1. Analysis by Type of Vector

- 25.5.2. Analysis by Type of Therapy

- 25.5.3. Analysis by Therapeutic Area

- 25.5.4. Analysis by Geography

- 25.6. Demand and Supply Analysis

26. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 26.1. Chapter Overview

- 26.2. Market Drivers

- 26.3. Market Restraints

- 26.4. Market Opportunities

- 26.5. Market Challenges

27. GLOBAL VECTOR MANUFACTURING MARKET

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Global Vector Manufacturing Market, Historical Trends (2018-2022) and Forecasted Estimates (2023-2035)

- 27.3.1. Scenario Analysis

- 27.3.1.1. Conservative Scenario

- 27.3.1.2. Optimistic Scenario

- 27.3.1. Scenario Analysis

- 27.4. Key Market Segmentations

28. VECTOR MANUFACTURING MARKET, BY SCALE OF OPERATION

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Vector Manufacturing Market: Distribution by Scale of Operation

- 28.3.1. Preclinical Scale: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.3.2. Clinical Scale: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.3.3. Commercial Scale: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 28.4. Data Triangulation and Validation

29. VECTOR MANUFACTURING MARKET, BY TYPE OF VECTOR MANUFACTURED

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Vector Manufacturing Market: Distribution by Type of Vector

- 29.3.1. AAV Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.2. Adenoviral Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.3. Lentiviral Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.4. Retroviral Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.5. Non-Viral Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.3.6. Other Vectors: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 29.4. Data Triangulation and Validation

30. VECTOR MANUFACTURING MARKET, BY APPLICATION AREA

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Vector Manufacturing Market: Distribution by Application Area

- 30.3.1. Cell Therapy: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 30.3.2. Gene Therapy: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 30.3.3. Vaccines: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 30.4. Data Triangulation and Validation

31. VECTOR MANUFACTURING MARKET, BY THERAPEUTIC AREA

- 31.1. Chapter Overview

- 31.2. Key Assumptions and Methodology

- 31.3. Vector Manufacturing Market: Distribution by Therapeutic Area

- 31.3.1. Oncological Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.2. Rare Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.3. Immunological Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.4. Neurological Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.5. Sensory Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.6. Metabolic Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.7. Blood Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.8. Musculoskeletal Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.9. Infectious Diseases: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.10. Ophthalmic Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.3.11. Other Disorders: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 31.4. Data Triangulation and Validation

32. VECTOR MANUFACTURING MARKET, BY TYPE OF MANUFACTURER

- 32.1. Chapter Overview

- 32.2. Key Assumptions and Methodology

- 32.3. Vector Manufacturing Market: Distribution by Type of Manufacturer

- 32.3.1. In-house Manufacturers: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 32.3.2. Contract Manufacturing Organizations: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 32.4. Data Triangulation and Validation

33. VECTOR MANUFACTURING MARKET, BY GEOGRAPHICAL REGION

- 33.1. Chapter Overview

- 33.2. Key Assumptions and Methodology

- 33.3. Vector Manufacturing Market: Distribution by Geographical Region

- 33.3.1. North America: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.3.2. Europe: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.3.3. Asia-Pacific: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.3.4. Middle East and North Africa: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.3.5. Latin America and Rest of the World: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 33.4. Data Triangulation and Validation

34. MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 34.1. Vector Manufacturing Market in North America: Distribution by Scale of Operation

- 34.1.1. Vector Manufacturing Market in North America for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.1.2. Vector Manufacturing Market in North America for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.1.3. Vector Manufacturing Market in North America for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2. Vector Manufacturing Market in North America: Distribution by Type of Vector Manufactured

- 34.2.1. Vector Manufacturing Market in North America for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.2. Vector Manufacturing Market in North America for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.3. Vector Manufacturing Market in North America for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.4. Vector Manufacturing Market in North America for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.5. Vector Manufacturing Market in North America for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.2.6. Vector Manufacturing Market in North America for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.3. Vector Manufacturing Market in North America: Distribution by Application Area

- 34.3.1. Vector Manufacturing Market in North America for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.3.2. Vector Manufacturing Market in North America for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.3.3. Vector Manufacturing Market in North America for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4. Vector Manufacturing Market in North America: Distribution by Therapeutic Area

- 34.4.1. Vector Manufacturing Market in North America for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.2. Vector Manufacturing Market in North America for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.3. Vector Manufacturing Market in North America for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.4. Vector Manufacturing Market in North America for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.5. Vector Manufacturing Market in North America for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.6. Vector Manufacturing Market in North America for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.7. Vector Manufacturing Market in North America for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.8. Vector Manufacturing Market in North America for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.9. Vector Manufacturing Market in North America for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.10. Vector Manufacturing Market in North America for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.4.11. Vector Manufacturing Market in North America for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.5. Vector Manufacturing Market in North America: Distribution by Type of Manufacturer

- 34.5.1. Vector Manufacturing Market in North America for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 34.5.2. Vector Manufacturing Market in North America for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

35. MARKET OPPORTUNITY ANALYSIS: EUROPE

- 35.1. Vector Manufacturing Market in Europe: Distribution by Scale of Operation

- 35.1.1. Vector Manufacturing Market in Europe for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.1.2. Vector Manufacturing Market in Europe for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.1.3. Vector Manufacturing Market in Europe for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2. Vector Manufacturing Market in Europe: Distribution by Type of Vector Manufactured

- 35.2.1. Vector Manufacturing Market in Europe for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.2. Vector Manufacturing Market in Europe for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.3. Vector Manufacturing Market in Europe for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.4. Vector Manufacturing Market in Europe for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.5. Vector Manufacturing Market in Europe for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.2.6. Vector Manufacturing Market in Europe for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.3. Vector Manufacturing Market in Europe: Distribution by Application Area

- 35.3.1. Vector Manufacturing Market in Europe for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.3.2. Vector Manufacturing Market in Europe for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.3.3. Vector Manufacturing Market in Europe for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4. Vector Manufacturing Market in Europe: Distribution by Therapeutic Area

- 35.4.1. Vector Manufacturing Market in Europe for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.2. Vector Manufacturing Market in Europe for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.3. Vector Manufacturing Market in Europe for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.4. Vector Manufacturing Market in Europe for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.5. Vector Manufacturing Market in Europe for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.6. Vector Manufacturing Market in Europe for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.7. Vector Manufacturing Market in Europe for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.8. Vector Manufacturing Market in Europe for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.9. Vector Manufacturing Market in Europe for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.10. Vector Manufacturing Market in Europe for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.4.11. Vector Manufacturing Market in Europe for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.5. Vector Manufacturing Market in Europe: Distribution by Type of Manufacturer

- 35.5.1. Vector Manufacturing Market in Europe for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 35.5.2. Vector Manufacturing Market in Europe for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

36. MARKET OPPORTUNITY ANALYSIS: ASIA-PACIFIC

- 36.1. Vector Manufacturing Market in Asia-Pacific: Distribution by Scale of Operation

- 36.1.1. Vector Manufacturing Market in Asia-Pacific for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.1.2. Vector Manufacturing Market in Asia-Pacific for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.1.3. Vector Manufacturing Market in Asia-Pacific for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2. Vector Manufacturing Market in Asia-Pacific: Distribution by Type of Vector Manufactured

- 36.2.1. Vector Manufacturing Market in Asia-Pacific for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.2. Vector Manufacturing Market in Asia-Pacific for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.3. Vector Manufacturing Market in Asia-Pacific for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.4. Vector Manufacturing Market in Asia-Pacific for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.5. Vector Manufacturing Market in Asia-Pacific for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.2.6. Vector Manufacturing Market in Asia-Pacific for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.3. Vector Manufacturing Market in Asia-Pacific: Distribution by Application Area

- 36.3.1. Vector Manufacturing Market in Asia-Pacific for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.3.2. Vector Manufacturing Market in Asia-Pacific for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.3.3. Vector Manufacturing Market in Asia-Pacific for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4. Vector Manufacturing Market in Asia-Pacific: Distribution by Therapeutic Area

- 36.4.1. Vector Manufacturing Market in Asia-Pacific for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.2. Vector Manufacturing Market in Asia-Pacific for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.3. Vector Manufacturing Market in Asia-Pacific for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.4. Vector Manufacturing Market in Asia-Pacific for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.5. Vector Manufacturing Market in Asia-Pacific for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.6. Vector Manufacturing Market in Asia-Pacific for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.7. Vector Manufacturing Market in Asia-Pacific for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.8. Vector Manufacturing Market in Asia-Pacific for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.9. Vector Manufacturing Market in Asia-Pacific for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.10. Vector Manufacturing Market in Asia-Pacific for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.4.11. Vector Manufacturing Market in Asia-Pacific for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.5. Vector Manufacturing Market in Asia-Pacific: Distribution by Type of Manufacturer

- 36.5.1. Vector Manufacturing Market in Asia-Pacific for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 36.5.2. Vector Manufacturing Market in Asia-Pacific for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

37. MARKET OPPORTUNITY ANALYSIS: MIDDLE EAST AND NORTH AFRICA

- 37.1. Vector Manufacturing Market in Middle East and North Africa: Distribution by Scale of Operation

- 37.1.1. Vector Manufacturing Market in Middle East and North Africa for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.1.2. Vector Manufacturing Market in Middle East and North Africa for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.1.3. Vector Manufacturing Market in Middle East and North Africa for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2. Vector Manufacturing Market in Middle East and North Africa: Distribution by Type of Vector Manufactured

- 37.2.1. Vector Manufacturing Market in Middle East and North Africa for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.2. Vector Manufacturing Market in Middle East and North Africa for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.3. Vector Manufacturing Market in Middle East and North Africa for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.4. Vector Manufacturing Market in Middle East and North Africa for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.5. Vector Manufacturing Market in Middle East and North Africa for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.2.6. Vector Manufacturing Market in Middle East and North Africa for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.3. Vector Manufacturing Market in Middle East and North Africa: Distribution by Application Area

- 37.3.1. Vector Manufacturing Market in Middle East and North Africa for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.3.2. Vector Manufacturing Market in Middle East and North Africa for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.3.3. Vector Manufacturing Market in Middle East and North Africa for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4. Vector Manufacturing Market in Middle East and North Africa: Distribution by Therapeutic Area

- 37.4.1. Vector Manufacturing Market in Middle East and North Africa for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.2. Vector Manufacturing Market in Middle East and North Africa for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.3. Vector Manufacturing Market in Middle East and North Africa for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.4. Vector Manufacturing Market in Middle East and North Africa for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.5. Vector Manufacturing Market in Middle East and North Africa for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.6. Vector Manufacturing Market in Middle East and North Africa for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.7. Vector Manufacturing Market in Middle East and North Africa for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.8. Vector Manufacturing Market in Middle East and North Africa for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.9. Vector Manufacturing Market in Middle East and North Africa for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.10. Vector Manufacturing Market in Middle East and North Africa for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.4.11. Vector Manufacturing Market in Middle East and North Africa for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.5. Vector Manufacturing Market in Middle East and North Africa: Distribution by Type of Manufacturer

- 37.5.1. Vector Manufacturing Market in Middle East and North Africa for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 37.5.2. Vector Manufacturing Market in Middle East and North Africa for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

38. MARKET OPPORTUNITY ANALYSIS: LATIN AMERICA

- 38.1. Vector Manufacturing Market in Latin America: Distribution by Scale of Operation

- 38.1.1. Vector Manufacturing Market in Latin America for Preclinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.1.2. Vector Manufacturing Market in Latin America for Clinical, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.1.3. Vector Manufacturing Market in Latin America for Commercial, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2. Vector Manufacturing Market in Latin America: Distribution by Type of Vector Manufactured

- 38.2.1. Vector Manufacturing Market in Latin America for AAV Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.2. Vector Manufacturing Market in Latin America for Adenoviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.3. Vector Manufacturing Market in Latin America for Lentiviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.4. Vector Manufacturing Market in Latin America for Retroviral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.5. Vector Manufacturing Market in Latin America for Non-Viral Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.2.6. Vector Manufacturing Market in Latin America for Other Vectors, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.3. Vector Manufacturing Market in Latin America: Distribution by Application Area

- 38.3.1. Vector Manufacturing Market in Latin America for Cell Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.3.2. Vector Manufacturing Market in Latin America for Gene Therapy, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.3.3. Vector Manufacturing Market in Latin America for Vaccines, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4. Vector Manufacturing Market in Latin America: Distribution by Therapeutic Area

- 38.4.1. Vector Manufacturing Market in Latin America for Oncological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.2. Vector Manufacturing Market in Latin America for Rare Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.3. Vector Manufacturing Market in Latin America for Immunological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.4. Vector Manufacturing Market in Latin America for Neurological Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.5. Vector Manufacturing Market in Latin America for Sensory Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.6. Vector Manufacturing Market in Latin America for Metabolic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.7. Vector Manufacturing Market in Latin America for Blood Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.8. Vector Manufacturing Market in Latin America for Musculoskeletal Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.9. Vector Manufacturing Market in Latin America for Infectious Diseases, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.10. Vector Manufacturing Market in Latin America for Ophthalmic Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.4.11. Vector Manufacturing Market in Latin America for Other Disorders, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.5. Vector Manufacturing Market in Latin America: Distribution by Type of Manufacturer

- 38.5.1. Vector Manufacturing Market in Latin America for In-house Manufacturer, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 38.5.2. Vector Manufacturing Market in Latin America for Contract Manufacturers, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

39. SURVEY ANALYSIS

- 39.1. Chapter Overview

- 39.2. Analysis by Seniority Level of Respondents

- 39.3. Analysis by Type of Manufacturer

- 39.4. Analysis by Scale of Operation

- 39.5. Analysis by Type of Vector Manufactured

40. CONCLUDING REMARKS

41. EXECUTIVE INSIGHTS

42. APPENDIX I: TABULATED DATA

43. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Key Features of Viral Vectors

- Table 6.2 Key Features of Small-scale Cell Culture Systems

- Table 7.1 Viral Vector and Gene Therapy Manufacturers: List of Industry Players

- Table 7.2 Viral Vector and Gene Therapy Manufacturers (Industry Players): Information on Location of Vector Manufacturing Facility, Type of Manufacturer and Scale of Operation