|

市场调查报告书

商品编码

1604918

二次电池用黏合剂技术的开发情形及预测(~2035年)<2025> Development Status and Outlook of Binder Technology for Secondary Batteries (~2035) |

||||||

锂离子电池的特性受电极的影响很大,而优化电极结构是实现优异电池性能的重中之重。目前,不仅锂离子电池已进入实用阶段,研究部门也积极研究和重新审视正负极活性材料。非活性黏合剂不参与电极反应,以较低的重量比(5 wt% 或更低)维持电极的完整性并支持电化学过程。它们与活性材料和导电剂一起,在使电极发挥最佳性能方面发挥重要作用。然而,与其重要性相比,它们却很少受到关注。

虽然黏合剂只占电极的一小部分,但它对决定电极的整体性能起着至关重要的作用。它有助于正极和负极中的活性材料和导电剂牢固地黏附在集流体上并提高耐久性。黏合剂必须具备以下特性:(1)在电解质中具有电化学稳定性,(2)具有柔韧性且不溶,以及(3)具有抗氧化腐蚀的能力,尤其是在正极黏合剂的情况下。

因此,需要具有高黏合强度和弹性的功能性黏合剂,以有效地将活性材料和导电剂连接到集流体上,适应体积膨胀,并确保在充放电循环过程中电极结构的稳定性。近年来,随着对黏合剂筛选和设计的深入了解,重点已从简单地提供机械稳定性的结构支撑转移到开发也具有电化学优势的多功能黏合剂。

近年来,随着硅基负极材料的应用日益广泛,研究表明,黏合剂对锂化反应有显着的影响,有助于提高电极容量和循环稳定性。因此,我们正在积极开发下一代黏合剂。传统上,氟树脂PVDF(聚偏氟乙烯)一直是正极的主要黏合剂,而SBR(丁苯橡胶)或CMC(羧甲基纤维素)一直是负极的主要黏合剂。但由于硅基负极的体积膨胀较大,这些传统的黏结剂并不适用于硅基材料。

近年来,正极用PTFE(聚四氟乙烯)黏合剂备受关注,负极用PAA(聚丙烯酸)、PI(聚酰亚胺)等水性黏合剂也开始使用。这些水性黏合剂特别适用于利用水溶剂作为电解质的硅基阳极。与传统黏合剂相比,PAA和PI具有更高的拉伸强度和更强的黏合力,使其更能抵抗硅基负极的体积膨胀。此外,这些黏合剂包覆活性材料并有助于形成稳定的SEI(固体电解质界面)层,从而提高电极的稳定性和循环性能。

PTFE(聚四氟乙烯)是下一代阴极黏合剂,是用于干电极製程的黏合剂。作为一种具有优异耐化学性和耐热性的高疏水性材料,预计它将用于干电极製程和固态电池。

PVDF黏合剂由日本吴羽公司、比利时索尔维公司和法国阿科玛公司生产,SBR黏合剂由日本瑞翁公司生产,这意味着这些都是高成本材料,并且对海外供应商的依赖程度很高。

韩国Chemtros公司成功实现了正极黏合剂的国产化,韩国Hansol Chemical公司也实现了负极黏合剂的国产化,并向三星SDI和SK On供应。此外,LG化学、锦湖石油化学等也进入了阳极黏合剂供应市场。

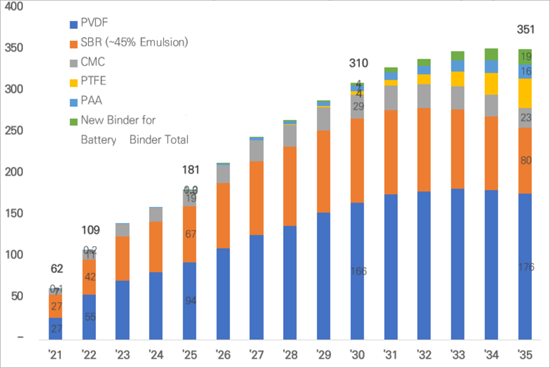

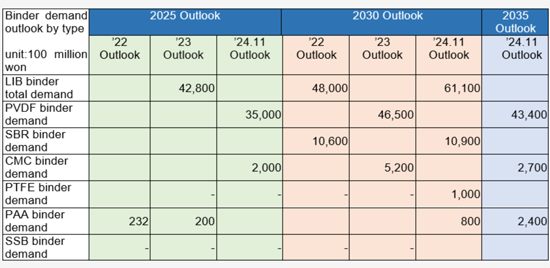

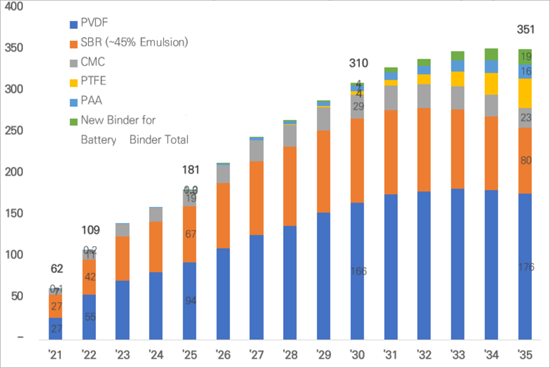

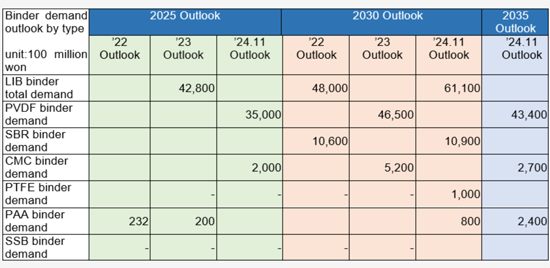

根据SNE Research 2024年11月的全球锂离子电池黏合剂需求预测,市场预计将从2025年的181.2吨成长到2030年的311.4吨。就价值而言,预计将从2025年的4.4兆韩元增长到2030年的6.11兆韩元。

本报告调查并分析了二次电池黏合剂市场,并根据锂离子电池市场的前景预测了黏合剂的需求和市场趋势。

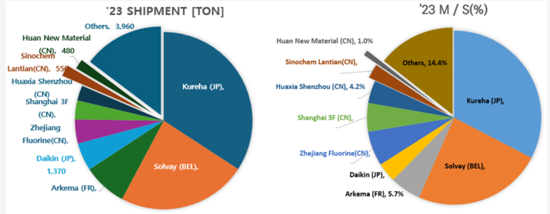

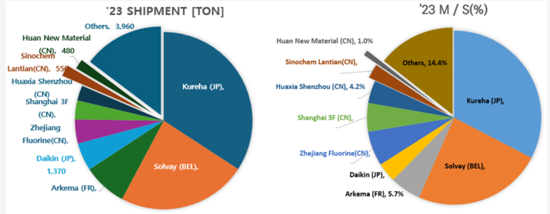

PVDF黏合剂製造商出货量与市场占有率(M/S)

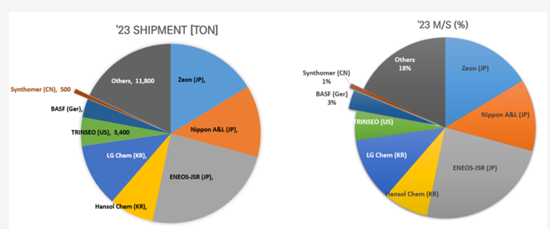

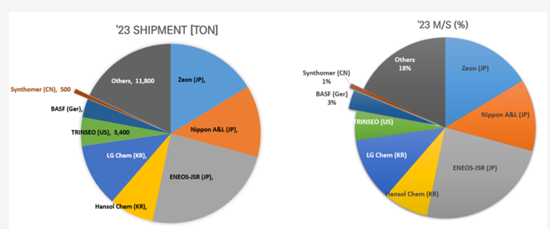

SBR黏合剂製造商出货量与市场占有率(M/S)

全球LIB用黏合剂(正极+负极)需求的预测(千吨)

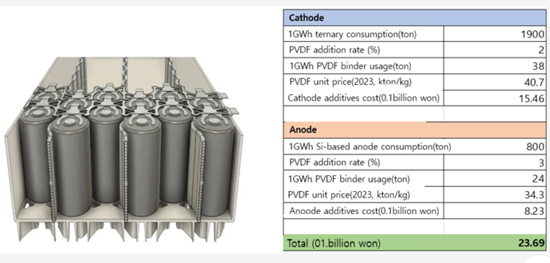

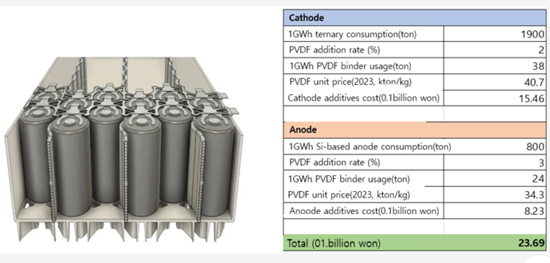

Tesla 4680电池的黏合剂成本分析

- 正极:NCM811,负极:硅基

- 1GWh 电池的 PVDF 阴极黏合剂要求和成本:约。 38吨

- 1GWh 电池的 PAA 阳极黏合剂的要求和成本:约。 24吨

目录

第1章 黏合剂概要

- 简介

- 定义、角色、要求

- 类别和类型

- 运作机制

- Binder 失败机制

- 黏合剂开发的高级策略

- 黏合剂性能评估技术

第2章 黏合剂的类型与研究开发活动

- 正极黏合剂

- 负极黏合剂

- 新一代电池黏合剂 (1)

- 4680 干式製程黏合剂

- 新一代电池黏合剂 (2)

第3章 黏合剂市场

- 黏合剂市场的整体前景(其他研究人员的前景)

- 全球 PVDF 市场对 LIB 的预测

- 全球电池市场需求展望

- LIB黏合剂的全球需求预测

- 锂离子电池黏合剂的价格前景

- LIB黏合剂市场规模预测

- 全球主要电池企业对正极黏合剂需求的预测

- 全球阳极黏合剂需求展望:主要电池公司

- 硅基阳极黏合剂市场前景

- 硅基阳极 PAA 黏合剂市场前景

- 全球 LFP 黏合剂需求展望(复合年增长率 12%)

- 特斯拉 4680 电池黏合剂成本分析

- LIB黏合剂製造商的出货量和M/S

- PVDF 黏合剂製造商的出货量和 M/S

- SBR 黏合剂製造商的出货量和 M/S

- CMC黏合剂製造商的出货量和M/S

第4章 黏合剂製造商情形

- Arkema Group

- BASF SE

- Solvay

- Kureha Corp.

- ZEON Corp.

- JSR Corp.

- Fujian Blue Ocean Co. Ltd (BLUE OCEAN & BLACK STONE)

- Dupont (CMC)

- Ashland Inc.

- MTI Corp.

- TRINSEO

- Xinxiang Jinbang Power Technology Co., Ltd.

- Chongqing Lihong Fine Chemical (CMC Binder Manufacturers)

- Chemtros

- Hansol Chemical

- Kumho Petrochemical

- Daikin Industry

- Nanografi Nano Technology

- Nippon Paper Group

- APV Engineered Coatings LLC

- Sichuan Indigo Materials Science & Technology (INDIGO)

- Guangzhou Songbai Chemical Co (Songbai)

- Nippon A&L Inc.

- Daicel Miraizu Ltd.

- Sinochem Group Co.

- Ube Corp.

- AOT Battery Equipment Technology

- Shanghai Huayi 3F New Materials

- GL Chem

第5章 附录(参考)(水系正极用黏合剂的成本的分析等)

第6章 参考文献

The characteristics of LIBs are largely determined by the electrodes, and optimizing the electrode structure is the top priority in order to achieve excellent battery performance. While the active materials of the cathode and anode are being studied and reviewed with much interest not only in currently commercialized LIBs but also in the research field, the inactive binder that does not participate in the electrode reaction maintains the integrity of the electrode with a low weight ratio (less than or equal to 5 wt%) and supports the electrochemical process, and occupies an important position in terms of implementing the performance of the electrode along with the active material and the conductive agent, but it is receiving less attention compared to its importance.

The binder occupies a very small portion of the electrode but plays a crucial role in determining the overall performance of the electrode. It helps active materials and conductive agents in both the cathode and anode adhere firmly to the current collector while enhancing durability. A binder must be (1) electrochemically stable in the electrolyte, (2) possess flexibility and insolubility, and (3) specifically for cathode binders, provide corrosion resistance against oxidation.

Therefore, a functional binder with high bonding strength and elasticity is required to effectively connect the active material and conductive agent to the current collector, accommodate volume expansion, and ensure a stable electrode structure during charge and discharge cycles. Recently, with deeper insights into binder screening and design, research has been shifting its focus from merely serving as a structural support for mechanical stabilization to developing multifunctional binders that also provide electrochemical advantages.

Recently, with the increasing adoption of silicon anode materials, research has shown that binders significantly influence the lithiation reaction, contributing to improved electrode capacity and cycle stability. This has led to active advancements in next-generation binder development. Traditionally, fluoropolymer-based PVDF (Polyvinylidene Fluoride) has been primarily used as a binder for cathodes, while SBR (Styrene-Butadiene Rubber) and CMC (Carboxymethyl Cellulose) have been used for anodes. However, due to the significant volume expansion of silicon anodes, these conventional binders are unsuitable for use with silicon-based materials.

Recently, PTFE (PolyTetraFluoroEthylene) binders have been gaining attention for cathodes, while water-based binders such as PAA (PolyAcrylic Acid) and PI (PolyImide) are increasingly used for anodes. These water-based binders are particularly suitable for silicon anodes, which utilize water-based solvents as electrolytes. Compared to conventional binders, PAA and PI offer higher tensile strength and stronger adhesion, making them more resistant to the volume expansion of silicon anodes. Additionally, these binders encapsulate the active material, helping to form a stable SEI (Solid Electrolyte Interphase) layer, which enhances electrode stability and cycle performance.

The next-generation cathode binder, PTFE (PolyTetraFluoroEthylene), is a binder for dry electrode processes. As a highly hydrophobic material with excellent chemical and thermal resistance, it is expected to gain attention for use in dry electrode processes and solid-state batteries.

PVDF binders are produced by Kureha (Japan), Solvay (Belgium), and Arkema (France), while SBR binders are manufactured by Zeon (Japan), making them high-cost materials with a high reliance on foreign suppliers.

For cathode binders, Chemtros (South Korea) has successfully localized production, while for anode binders, Hansol Chemical (South Korea) has also achieved domestic production and is supplying to Samsung SDI and SK On. Additionally, LG Chem and Kumho Petrochemical are entering the anode binder supply market.

According to SNE Research's global demand forecast for lithium-ion battery binders as of November 2024, the market is expected to grow from 181.2 kton in 2025 to 311.4 kton in 2030. In terms of value, it is projected to increase from KRW 4.4 trillion in 2025 to KRW 6.11 trillion in 2030.

The 2024 edition of the report has been enhanced with a particular focus on solid-state batteries and sodium-ion batteries, which have recently become hot topics. It includes thermal and dispersion properties of binders for these next-generation batteries and provides additional insights into the operational mechanisms and failure mechanisms of binders to improve understanding. Additionally, the report presents a chronological compilation of research on binder design, synthesis, and application in lithium-ion battery electrodes, covering all relevant literature published to date. For those seeking deeper technical details, references to the original papers have been included, allowing for further exploration of the subject.

Based on our lithium-ion battery market outlook, we have projected the demand and market trends for binders. In the appendix, we have included market size estimates and forecasts from external research institutions to help readers gain a comprehensive understanding of the overall market scale. For key binders such as PVDF, SBR, and CMC, the report includes detailed market data from 2021, 2022, and 2023, along with forecasts for 2024, providing a clear view of demand trends over time.

Finally, by compiling the most recent status and key products of binder manufacturers in 2024, this report aims to provide comprehensive insights for researchers and industry professionals. It is expected to contribute significantly to improving battery performance, including energy density, fast-charging capability, and long-term cycle life.

Strong Points of This Report :

- 1. Comprehensive overview and detailed technical content on binders

- 2. Key design and synthesis considerations derived from binder development case studies

- 3. Analysis of binder development trends and case studies for next-generation batteries, including Li-S batteries, solid-state batteries, and sodium-ion batteries (SIBs), in addition to LIBs

- 4. Binder market outlook based on SNE Research's battery forecasts, along with data on the binder market for LFP batteries

- 5. Detailed information on the latest developments and product status of major binder manufacturers

[PVDF Binder Manufacturers' Shipment Volume and Market Share (M/S)]

[SBR Binder Manufacturers' Shipment Volume and Market Share (M/S)]

Global LIB Binder(Cathode + Anode) Demand Forecast (kTon)

[Tesla 4680 Battery Binder Cost Analysis]

- Cathode: NCM811, Anode: Si-based

- PVDF cathode binder requirement and cost for 1 GWh battery: around 38 tons

- PAA anode binder requirement and cost for 1 GWh battery: around 24 tons

Table of Contents

1. Binder Overview

- 1.1. Introduction

- 1.2. Definition, Role, and Requirements

- 1.2.1. Role and Features

- 1.2.1.1. Mechanical Properties

- 1.2.1.1.1. Improvement of Adhesion and Mechanical Strength

- 1.2.1.1.2. Control of Volume Change

- 1.2.1.2. Mitigation of Interface Performance Degradation

- 1.2.1.3. Electrical Properties

- 1.2.1.3.1. Improvement of Electrical Conductivity

- 1.2.1.3.2. Improvement of Ion Conductivity

- 1.2.1.4. Thermal Properties

- 1.2.1.4.1. Improvement of Thermal Stability and Wide Temperature Operation Range

- 1.2.1.5. Dispersion Properties

- 1.2.1.5.1. Improvement of Electrode Homogeneity

- 1.2.1.1. Mechanical Properties

- 1.2.2. Requirements

- 1.2.1. Role and Features

- 1.3. Categories and Types

- 1.3.1. Types

- 1.4. Operation Mechanism

- 1.5. Binder Failure Mechanisms

- 1.6. Advanced Strategies for Binder Development

- 1.6.1. Improvement of Mechanical Bonding Strength

- 1.6.2. Improvement of Chemical Bonding Strength

- 1.6.3. Design of Multifunctional Integrated Binders

- 1.7. Binder Characterization Techniques

- 1.7.1. Evaluation of Binder Distribution and Composition in Cathode

2. Types of Binders and R&D Practices

- 2.1. Binder for Cathodes

- 2.1.1. Non-Aqueous Binders

- 2.1.2. Industry Status of PVDF Cathode Binders

- 2.1.3. Industry Status of (CMC+SBR) Anode Binders

- 2.1.4. Water-based Binders

- 2.1.5. Other Binders

- 2.1.5.1. Conductive Polymer

- 2.1.5.1.1. Polyacrylonitrile(PAN)

- 2.1.5.1. Conductive Polymer

- 2.2. Binders for Anodes

- 2.2.1. Insertable Anode Binder

- 2.2.1.1. Binders for Graphite Electrodes

- 2.2.1.2. Anode Binder for LTO

- 2.2.2. Alloy Anode Binders

- 2.2.2.1. Linear Polymer Binders

- 2.2.2.2. Crosslinked Polymer Binders

- 2.2.2.3. Branched and Extra-Large Polymer Binders

- 2.2.2.4. Conductive Polymer Binders

- 2.2.1. Insertable Anode Binder

- 2.3. Binder for Next-Generation Batteries (1)

- 2.3.1. Binders for Lithium-Sulfur (Li-S) Batteries

- 2.3.2 (4680)Binders for Dry Process

- 2.3.3. Binders for Sodium-Ion Batteries (SIB)

- 2.3.3.1. Development of Binders for SIB

- 2.3.3.2. Conventional Binders

- 2.3.3.2.1. PVDF

- 2.3.3.2.2. PAA

- 2.3.3.2.3. SA(Sodium Alginate)

- 2.3.3.2.4. CMC

- 2.3.3.3. New Binders

- 2.3.3.3.1. Conductive Binders

- 2.3.3.3.2. Cross-linking Binders

- 2.3.3.3.3. Self-healing Binders

- 2.3.3. Binders for Sodium-Ion Batteries (SIB)

- 2.4. Binder for Next-Generation Batteries (2)

- 2.4.1. Binders for Solid Electrolytes

- 2.4.1.1. Overview of All-Solid-State Batteries

- 2.4.1.2. Sulfide-based All-Solid-State Battery Technology

- 2.4.1.3. Manufacturing of All-Solid-State Cells and the Purpose of Binders

- 2.4.1.4. Binder Technology for Cathodes

- 2.4.1.4.1. Binder Technology for Wet Processes

- 2.4.1.4.2. Binder Technology for Dry Processes

- 2.4.1.5. Binder Technology for Electrolyte Layers

- 2.4.1.6. Binder Technology for Anodes

- 2.4.1.6.1. Binder Technology for Graphite-Based Anodes

- 2.4.1.6.2. Next Generation Binder Technology for Anodes

- 2.4.1. Binders for Solid Electrolytes

3. Binder Market

- 3.1. Overall Outlook for the Binders Market(Outlook by Other Researchers)

- 3.2. PVDF Market Outlook for Global LIBs

- 3.2.1. Global Battery Market Demand Outlook

- 3.2.1.1. Global LIB Demand Outlook by Form Factor (GWh, %)

- 3.2.1.2. Global LIB Cathode Material Demand Outlook (GWh, k ton)

- 3.2.1.3. Global LIB Anode Material Demand Outlook (k ton)

- 3.2.2. Global LIB Binder Demand Outlook

- 3.2.3. LIB Binder Price Outlook

- 3.2.4. LIB Binder Market Size Outlook

- 3.2.5. Global Cathode Binder Demand Outlook by Major Battery Companies

- 3.2.6. Global Anode Binder Demand Outlook by Major Battery Companies

- 3.2.7. Market Outlook for Binders for Silicon-based Anodes

- 3.2.8. PAA Binders for Silicon Anode Market Outlook

- 3.2.9. Global LFP Binder Demand Outlook (k ton)(CAGR 12%)

- 3.2.10. Binder cost analysis for 4680 batteries for Tesla

- 3.2.11. Shipments and M/S of LIB Binder Manufacturers

- 3.2.12. Shipments and M/S of PVDF Binder Manufacturers

- 3.2.13. Shipments and M/S of SBR Binder Manufacturers

- 3.2.14. Shipments and M/S of CMC Binder Manufacturers

- 3.2.1. Global Battery Market Demand Outlook

4. Binder Manufacturer Status

- Arkema Group

- BASF SE

- Solvay

- Kureha Corp.

- ZEON Corp.

- JSR Corp.

- Fujian Blue Ocean Co. Ltd (BLUE OCEAN & BLACK STONE)

- Dupont (CMC)

- Ashland Inc.

- MTI Corp.

- TRINSEO

- Xinxiang Jinbang Power Technology Co., Ltd.

- Chongqing Lihong Fine Chemical (CMC Binder Manufacturers)

- Chemtros

- Hansol Chemical

- Kumho Petrochemical

- Daikin Industry

- Nanografi Nano Technology

- Nippon Paper Group

- APV Engineered Coatings LLC

- Sichuan Indigo Materials Science & Technology (INDIGO)

- Guangzhou Songbai Chemical Co (Songbai)

- Nippon A&L Inc.

- Daicel Miraizu Ltd.

- Sinochem Group Co.

- Ube Corp.

- AOT Battery Equipment Technology

- Shanghai Huayi 3F New Materials

- GL Chem