|

市场调查报告书

商品编码

1784311

超过体积膨胀的下一代硅系负极材料:Patent Report(2025年)<2025> Patent Report: Next-Generation Si-Anode Material Beyond Volume Expansion |

||||||

由于高能量密度电池需求的快速成长,硅基负极材料的全球技术趋势和市场前景已成为研发的重点。特别是,针对SiO-SiC复合负极技术的专利分析清晰地表明,硅基负极材料具有巨大的潜力,能够克服石墨基材料的局限性,并支持下一代储能系统的发展。

硅基负极技术的兴起主要源于对高能量密度电池的快速增长的需求,旨在延长电动车的续航里程。电动车市场的快速成长导致人们越来越需要提高单节电池的单次充电续航里程。因此,提高电池容量已成为核心竞争因素,而理论容量几乎是石墨10倍的硅基负极材料已成为领先选择。

在过程中,材料的结构演变也取得了显着进展。虽然二氧化硅基复合材料最初是主流,但近年来,碳化硅基复合材料凭藉其优异的导电性和结构稳定性备受关注。顺应这一趋势,研究正积极从传统的 "核壳" 结构(即包覆或键合硅)转向能够有效吸收硅膨胀的 "蛋黄-壳" 结构。

此外,随着中国率先加强材料国产化策略,韩国和日本企业也积极准备自主生产和采购硅基负极材料。

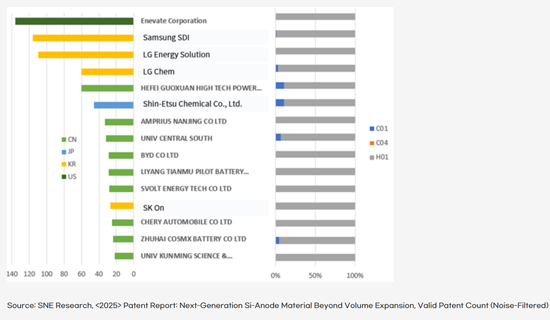

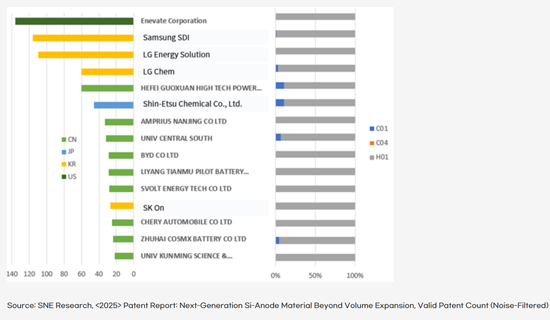

最后,对硅基负极材料的专利分析和技术发展趋势进行深入研究后发现,专利申请的主要领域大致可分为复合材料结构设计和批量生产过程。在复合结构设计领域,SiC-SiO2、Si/C 和 Si@C 结构体係以及多孔结构的开发是关键主题。韩国 LG Energy Solution 和三星 SDI 等公司正积极申请复合结构设计和介面稳定技术的专利,以拓展实现高能量密度电池的方法。日本信越化学工业株式会社 (Shin-Etsu) 则利用其在硅基材料合成和表面改质(Si/C 涂层)方面的专长,致力于提高硅基负极材料的品质和良率。

本报告调查并分析了全球硅基负极材料市场,提供了专利申请的最新情况、各公司的技术战略、美国、中国、韩国和日本等主要国家的专利趋势以及最新的研发趋势。

目录

第1章 简介

- 分析的背景和目的

- 硅系负极材料概要

- 硅系负极材料结构

- Si/SiO/SiC

- 硅系负极材料的缺点

- 硅系负极材料的发电的历史

- 对硅系负极材料的缺点的解决的办法

- 专利的范围和调查方法

第2章 专利申请趋势的简介

- 原始资料/有效专利选择

- 专利申请趋势:依年份

- 申请人趋势:依国家

- 技术发展阶段

- 国内主要应用趋势

- 主要申请人的应用趋势

第3章 主要专利的调查

- 重点专利清单及技术分类

- 主要专利趋势分析

- 已转让及争议专利简介

第4章 结论·附录

- 主要专利

- Sila

- GROUP14

- Shenzhen

- Resonac

- ENEVATE

- Stanford

- Large Kettle

- Shin-Etsu

- BTR

- LG Chemical Co., Ltd.

- SDI

- 结论与暗示

- 附录1. 主要专利点的清单

The global technology trends and market outlook for silicon-based anode materials are emerging as a critical R&D focus, driven by the rapidly growing demand for high-energy-density batteries. In particular, patent analysis centered on SiO-SiC composite anode technologies highlights the increasing potential of silicon-based anode materials to overcome the limitations of graphite-based materials and support the development of next-generation energy storage systems.

The need for patent analysis on silicon-based anode materials can largely be explained in three aspects.

First, the protection of intellectual property rights and the securing of technological leadership serve as important drivers. Considering the unique nature of silicon-based anodes-having higher theoretical capacity than conventional graphite while needing to address the issue of expansion during repeated charge-discharge cycles-companies must file more detailed patents to understand the technological directions of competitors and protect their own innovations. In particular, the rapid increase in patent applications related to silicon-based composite anodes in countries such as the U.S., China, and Korea heightens the possibility of companies becoming involved in intellectual property disputes.

Second, companies need to analyze essential patents in order to identify potential patent disputes or issues in advance.

Lastly, the expiration of key patents and how to effectively utilize the resulting gaps remain critical challenges. If SiO-based patents dominate major markets, companies will need to develop SiC-based composite structures or new surface coating technologies.

The background behind the rise of silicon anode technology can first be attributed to the rapid increase in demand for high-energy-density batteries aimed at extending electric vehicle driving range. As the EV market has grown rapidly, the need for longer driving distances per charge at the cell level has intensified. Accordingly, improving battery capacity has become a core competitive factor, and silicon-based anode materials-with a theoretical capacity nearly 10 times that of graphite-have emerged as a strong alternative.

In this process, structural evolution of the materials has also progressed noticeably. While SiO-based composites were initially mainstream in the industry, SiC-based composites, with advantages in electrical conductivity and structural stability, have recently gained prominence. Reflecting this trend, research has been actively shifting from conventional "core-shell" approaches that coat or combine silicon, toward "yolk-shell" structures that can effectively absorb silicon expansion.

In addition, as China takes the lead in strengthening material localization strategies, Korean and Japanese companies are also beginning preparations to produce and procure silicon anode materials independently.

Lastly, a closer look at the patent analysis and technological development trends of silicon anode materials reveals that the core patent application areas can largely be divided into composite structure design and mass production processes. In the area of composite structure design, key themes include SiC-SiO, Si/C, and Si@C structural systems, as well as the development of porous architectures. Korean companies such as LG Energy Solution and Samsung SDI are actively filing patents related to composite structure design and interfacial stabilization technologies, thereby expanding methodologies for implementing high-energy-density batteries. Japan's Shin-Etsu, leveraging its expertise in Si-based material synthesis and surface modification (Si/C coating), is focusing on improving the quality and yield of silicon-based anode materials.

Ultimately, patent analysis of silicon-based anode materials goes beyond merely assessing the current state of technology-it serves as a foundational effort that will shape the core competitiveness of the secondary battery industry in the future. Through this, companies can not only systematically protect their own technologies, but also establish a platform for leading continuous innovation in a rapidly evolving market.

Strong Points of This Report:

- 1. Provides a multifaceted analysis of the current status of patent applications and competitor technology strategies for silicon-based anode materials as alternatives to graphite.

- 2. Compares and summarizes patent trends by major countries, including the United States, China, South Korea, and Japan.

- 3. Outlines the latest R&D trends shifting from SiO-based composites to SiC composites and yolk-shell structures, allowing readers to grasp changes in market trends at a glance.

- 4. Includes patent comparisons by company (e.g., BTR, BYD, LG Energy Solution, Samsung SDI, Shin-Etsu).

- 5. Covers a wide range of silicon-based anode technologies applicable to the entire battery industry-including EV batteries and ESS-making it broadly useful for material companies, battery manufacturers, and related research institutions.

Table of Contents

1. Introduction

- 1.1. Analysis Background and Purpose

- 1.2. Overview of Silicon Anode Materials

- 1.2.1. Structures of Silicon Anode Materials

- 1.2.2. Si/SiO/SiC

- 1.2.3. Disadvantages of Silicon Anode Materials

- 1.3. Power generation history of Silicon Anode. materials

- 1.3.1. Solution to the Shortcomings of Silicon Anode Materials

- 1.4. Patent Scope and Investigation Method

2. Introduction to Patent Application Trends

- 2.1. Raw Data / Valid Patent Selection

- 2.2. Trends in patent applications by year

- 2.3. Trends of Applicants by Country

- 2.4. Technology growth stage

- 2.5. Major National Applications Trends

- 2.6. Key applicant application trends

3. Investigation of key patents

- 3.1. Key patent list and technology classification

- 3.2. Identifying Key Patent Trends

- 3.3. Transfer, Introduction of Dispute Patents

4. Conclusion & Appendix

- 4.1. Key Patents

- 4.1.1. Sila

- 4.1.2. GROUP14

- 4.1.3. Shenzhen

- 4.1.4. Resonac

- 4.1.5. ENEVATE

- 4.1.6. Stanford

- 4.1.7. Large Kettle

- 4.1.8. Shin-Etsu

- 4.1.9. BTR

- 4.1.10. LG Chemical Co., Ltd.

- 4.1.11. SDI

- 4.2. Conclusions and Implications

- 4.3. Appendix 1. List of Key Patent Points