|

市场调查报告书

商品编码

1413684

陶瓷/碳化硅全球市场分析(2022-2023)Ceramics / SiC Market Report (a Critical Materials Report) 2023-2024 |

||||||

本报告重点关注用于製造半导体加工设备零件和组件的工业陶瓷材料的市场和供应链,包括 SiC/CVD SiC、AlN、Al2O3、Y2O3 和 BN。SiC 经常用于需要高温封装或特定温控封装的 OEM 的载体(船、气体注射器、製造件)和组件,而传统的 Al2O3 和 AlN 陶瓷通常用于低温/蚀刻用途。使用这些零件的机器/工具製造商称为 OEM(原始设备製造商)。本报告仅涵盖半导体製造所使用的陶瓷。

陶瓷市场最新资讯和分析:概述 - 特色新闻稿:

目录

第一章执行摘要

第二章 研究范围、目的与方法

第三章市场展望

- 半导体产业市场现况及展望

- 世界经济

- 连结半导体产业与全球经济

- 半导体销售额成长率

- 台湾月度销售趋势

- 电子产品市场

- 电子产品市场

- 汽车销售

- 伺服器/IT

- 半导体製造业的成长与扩张

- 铸造厂扩建公告:概述

- 透过在世界各地扩大铸造厂来加速成长

- 资本支出趋势

- 技术路线图

- 政策和贸易议题

- 半导体材料概述

- 晶片可能受限于材料产能

- 生产计划

- 持续困扰西方世界的物流问题

- 增加晶圆输入数量

- 材料预测

第四章材料市场驱动因素与动态

- 陶瓷材料应用及供应商

- 热处理

- 干蚀刻製程

- 成膜:等离子CVD/PVD

- 外延工艺

- 原料短缺和供应链限制

- 原料趋势

- 技术驱动/材料变化与转型

- 尖端材料的趋势

- 传统材料的趋势/影响/状况(200mm/150mm)

- 区域趋势/驱动因素:评论

- EHS/物流/外部(天气)市场问题

第五章供应商市场状况

- 陶瓷整体市场规模及预测

- 陶瓷零件製造商:

- 陶瓷供应商整体市占率

- 陶瓷元件市场概况

- 市场趋势(2022-2023):OEM 和晶片製造商

- 併购 (M&A) 活动

- 现有供应商:设施扩建/新工厂

- 供应商或零件/产品线面临停产风险

- 价格趋势

- 氮化铝 (AlN) 细分市场

- AlN 竞争性市场占有率和活动

- 氧化铝(Al2O3)和其他氧化物(BN、YtO、ZrO)成分

- Al2O3 对汽车应用的机会与影响

- 碳化硅/CVD SiC 细分市场

- CVD碳化硅

- SiC 元件技术的替代方案

- 陶瓷市场:按地区划分的活动状况

- 陶瓷製造:按工艺细分

第六章 下层材料供应链

- 下层陶瓷毛坯製造商

- 氧化铝(Al2O3)製造工艺

- 垂直一体化氧化铝製造商

- 碳化硅 (SiC) 底层公司和物价水平

- 氧化钇粉生产厂商及价格水平

- 原物料企业併购

- 新工厂或扩建

- 面临工厂关闭和停产风险的产品

第七章 供应商概况(製造商)

第8章附录

This report is focused on technical ceramic materials market and supply-chain which includes SiC/ CVD SiC, AlN, Al2O3, Y2O3, and BN used in the production of components and assemblies for use in semiconductor process equipment. SiC is frequently used for both carriers (boats, gas injectors, and fabware) and components for OEMs where high temperature or specific thermal packages are required, while traditional Al2O3 and AlN ceramics are normally used for lower temperature / etch applications. The machines/tools manufacturers that use these components are referred to as OEMs (Original Equipment Manufacturers). This report targets ceramics used in the manufacture of semiconductors, only.

This report comes with 1 Bi-Yearly Update featuring updated market information and forecasting from the report analyst.

Table of Contents

1. Executive Summary

- 1.1. Highlight Material Segment Business Overview

- 1.2. Alumina

- 1.3. Aluminum Nitride (AlN) & SiC

- 1.4. CVD SiC

- 1.5. Al2O3 / HPA

- 1.6. Other Materials

- 1.7. M & A

- 1.8. General Comments

2. Scope, Purpose and Methodology

- 2.1. Scope

- 2.2. Purpose

- 2.3. Methodology

- 2.4. Overview of Other TECHCET CMR™ Reports

3. Market Outlook

- 3.1. Semiconductor Industry Market Status & Outlook

- 3.2. Global Economy

- 3.2.1. Semiconductor Industries Ties to the Global Economy

- 3.2.2. Semiconductor Sales Growth

- 3.2.3. Taiwan Monthly Sales Trends

- 3.3. Electronic Goods Market

- 3.3.1. Electronic Goods Market

- 3.3.2. Automotive Sales

- 3.3.3. Servers / IT

- 3.4. Semiconductor Fabrication Growth & Expansion

- 3.4.1. Fab Expansion Announcement Summary

- 3.4.2. Worldwide Fab Expansion Driving Growth

- 3.4.3. Equipment Spending Trends

- 3.4.4. Technology Roadmaps

- 3.4.5. Policy and Trade Issues

- 3.5. Semiconductor Materials Outlook

- 3.5.1. Could Materials Capacity Limit Chip

- Production Schedules

- 3.5.2. Continued Logistics Issues Plague the Western World

- 3.5.3. Wafer Start Growth

- 3.5.4. Materials Forecast

4. Material Market Drivers & Dynamics

- 4.1. Ceramic Material Applications and Suppliers

- 4.1.1. Thermal Processes

- 4.1.2. Dry Etching Process

- 4.1.3. Deposition: Plasma CVD and PVD

- 4.1.4. Epitaxial Process

- 4.2. Material Shortages and Supply Chain Constraints

- 4.3. Materials Trends

- 4.4. Technical Drivers / Material Changes and Transitions

- 4.4.1. Material Trends for the Leading-Edge

- 4.4.2. Trends/Impact/Status of Legacy Materials (200 mm & 150 mm)

- 4.5. Comment on Regional Trends/Drivers

- 4.6. EHS, Logistic, AND Exogenous (Weather) Market Issues

5. Supplier Market Landscape

- 5.1. Ceramics Overall Market Size and Forecast

- 5.1.1. Ceramic Components Fabricators:

- 5.2. Ceramic Suppliers Total Market Share Roll-up

- 5.3. Ceramic Component Market Summary

- 5.3.1. 2022 to 2023 Market Dynamics-OEMS and Chip Fabs

- 5.4. M&A Activity

- 5.5. Expansions or New Plants of Existing Suppliers

- 5.6. Suppliers or Parts/Product Line that Are at Risk of Discontinuation

- 5.7. Pricing Trends

- 5.8. Aluminum Nitride (AlN) Market Segment

- 5.8.1. AlN Competitive Market Shares & Activity

- 5.9. Alumina (Al2O3) and Other Oxides (BN, YtO, ZrO) Components

- 5.9.1. Al2O3 Opportunities and Impact of Automotive Applications

- 5.10. Silicon Carbide / CVD SiC Market Segment

- 5.10.1. CVD SiC

- 5.10.2. Alternatives to SiC Component Technology

- 5.11. Ceramics Market Regional Activity

- 5.12. Ceramic Fabrication by Process Segment

6. Sub tier material supply chain

- 6.1. Sub-Tier, Ceramic Blank Manufacturers

- 6.2. Aluminia (Al2O3) Production Process

- 6.2.1. Vertically Integrated Alumina Producers

- 6.3. Silicon Carbide-SiC Sub-tier Players & Price Points

- 6.4. Yttria Powder Production Players & Price Points

- 6.5. M&A of Raw Materials Companies

- 6.6. New Plants or Expansions

- 6.7. Plant Closures & Products at risk of discontinuation

7. Supplier profiles (Fabricators)

8. Appendices

Table of figures

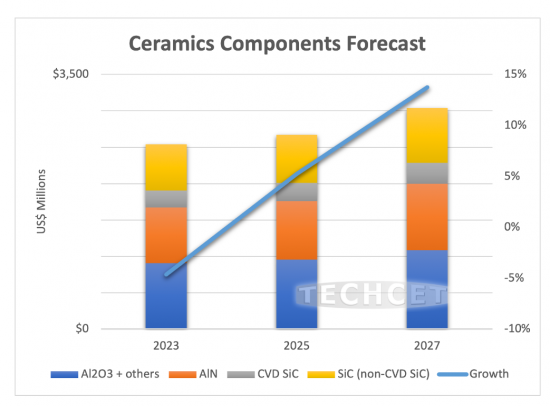

- Figure 1: Total Ceramics Market Forecast and Growth Estimates (2022-2027)

- Figure 2: Global Economy and the Electronics Supply Chain

- Figure 3: Worldwide Semiconductor Sales

- Figure 4: Monthly Sales Trends of Taiwan Outsource Manufacturers

- Figure 5: 2022 Semiconductor Chip Applications

- Figure 6: Mobile Phone Shipments WW Estimates

- Figure 7: Worldwide PC and Tablet Forecast, 2021, Q3

- Figure 8: Electrification Trend by World Region

- Figure 9: Semiconductor Spend per Vehicle Type

- Figure 10: Chip Expansions 2022-2027, about US$336 B

- Figure 11: US Chip Fab Expansions

- Figure 12: Overview of Logic Device Technology Roadmaps

- Figure 13: Europe Chip Expansion Upside

- Figure 14: 200mm Wafer Equiv Starts/year

- Figure 15: Global Semiconductor Materials Outlook

- Figure 16: Ceramic Products for Semiconductor Applications

- Figure 17: Fabricated Ceramics Components for Thermal Process

- Figure 18: Fabricated Ceramics Components for Dry Etching Process

- Figure 19: Total Ceramics Market Forecast and Growth Estimates (2020-2027)

- Figure 20: 2022 Market Shares for All Ceramics (incl. SiC/CVD SiC)

- Figure 21: WW Ceramics Components Forecast

- Figure 22: Aluminum Nitride (AlN) Components Forecast and Growth Estimate

- Figure 23: AlN Parts Fabricator Market Share Estimates (as a % of total revenues)

- Figure 24: Alumina (+ other oxides) Component Revenue Forecast Estimate

- Figure 25: Alumina + BN, Yt2O3, ZrO2 Parts Fabricator Market Share Estimate (as a % of total revenues)

- Figure 26: 99.8% and HPA (99.99) Alumina Components Forecast (metric tons)

- Figure 27: SiC Components Market Revenues ($M's USD)

- Figure 28: SiC (+ CVD SiC) Components Market Shares (as a % of total revenues)

- Figure 29: CVD SiC Components Market Forecast

- Figure 30: CVD SiC Components by Share of Application (as % of total revenues)

- Figure 31: CVD SiC Components Relative Pricing

- Figure 32: 2022 Regional Sales / Shares of Equipment Components (% of end-use location)

- Figure 33: 2023 Regional Performance Comparison of Fabricators by Country (1=2022 Revenue)

- Figure 34: 2022 Equipment and Ceramic Parts Demand by Technology Nodes

- Figure 35: Global Bauxite Mining Locations (as a % of total metric tons)

- Figure 36: Alumina Production by Region (as a % of total metric tons)

- Figure 37: Specialty Alumina Powder by Supplier (Raw Material as a % of total metric tons)

LIST OF TABLES

- Table 1: Ceramic Segment Revenues and CAGRs

- Table 2: TECHCET Critical Material Reports

- Table 3: Global GDP and Semiconductor Revenues

- Table 4: Table 3: IMF World Economic Outlook

- Table 5: Total Fabricated Ceramic Components Revenue History and Forecast*

- Table 6: Ceramic Fabricators (including SiC) Offerings

- Table 7: 2022 TECHCET WW Ceramics Components 5-year Forecast

- Table 8: Total SIC Components Market Revenues Forecast and CVD SiC Split ($M's USD)

- Table 9: Production Ranking of Ceramic Blank Manufacturers

- Table 10: Product Offerings and Purity of Leading Alumina Powder Producers

- Table 11: High Purity Silicon Carbide Powder Producers Ranking

- Table 12: High Purity Alumina Nitride Powder Producers Ranking