|

市场调查报告书

商品编码

1413699

锗和镓供应链:美国和半导体产业面临的风险Germanium and Gallium Supply-Chain Risks for the US and the Semiconductor Industry (Executive Edition) |

||||||

锗和镓都是生产射频 (RF) 感测器设备、5G、IT 通讯和汽车电子产品所必需的关键金属。中国是全球领先的精炼锗和镓生产国,这增加了美国半导体供应链的风险。全球供应风险进一步放大,特别是最近中国宣布了有关两种金属出口许可要求的公告。

这份报告分析了美国的全球锗(Ge)和镓(Ga)供应链,调查了各产品供应链的基本结构和主要特征,以及目前面临的挑战和风险。

目录

第一章 调查范围

第 2 章执行摘要

第三章 锗

- 锗 (Ge) 概述:为什么它很重要?

- 锗:它用于哪些类型的半导体?

- 锗:它从哪里来?

- 它是如何製作的?- 从矿石到最终产品

- 北美主要的锗来源:

- GeH4製造方法

- 半导体产业的 Ge 最终用途产品供应商

- 美国GeH4製造商

- 锗溅镀靶材和基板

- GeH4 供应链追踪

- 美国锗进口来源及组成

- 锗:建设美国新产能

- 锗:谁使用它?- 对于半导体装置製造商

- 锗原料价格走势

第4章 镓

- 镓 (Ga) 概述:为何如此重要?

- 镓:它用于什么样的电子设备?

- 镓:它从哪里来?

- 它是如何製作的?- 从矿石到最终产品

- 半导体产业 Ga 最终用途产品供应商

- 追踪镓供应链

- 美国进口镓的地点和配方

- 镓:建设美国新产能

- 镓:谁使用它?- 对于半导体装置製造商

- 镓原料价格走势

第五章 中国Ga/Ge贸易限制

第六章 镓、锗地缘政治风险及评估

第七章 参考资料

The electronic materials advisory firm providing business and technology information on semiconductor supply chains - has uncovered a significant supply chain risk for germanium and gallium for the global semiconductor market. Both germanium and gallium are critical metals essential to producing RF and sensor devices, 5G, IT communications, and automotive applications. China is the world's leading producer of refined germanium and gallium, which has increased risk for the US semiconductor supply chain. Global supply risks have been further amplified by recent announcements from China regarding export permit requirements for both metals, as explained in TECHCET's new Report on Germanium and Gallium Supply Chain Risks.

TABLE OF CONTENTS

1. SCOPE

2. EXECUTIVE SUMMARY

3. GERMANIUM

- 3.1. GERMANIUM OVERVIEW-WHY IS IT IMPORTANT?

- 3.2. GERMANIUM-WHAT KINDS OF SEMICONDUCTOR IS IT USED FOR?

- 3.3. GERMANIUM-WHERE DOES IT COME FROM?

- 3.4. HOW IS IT MADE? FROM ORE TO END USE PRODUCT

- 3.4.1. Leading North American Sources of Germanium:

- 3.4.2. How is GeH4 made?

- 3.5. SUPPLIERS OF GE END USE PRODUCTS TO THE SEMICONDUCTOR INDUSTRY

- 3.5.1. US GeH4 Producers

- 3.5.2. Germanium Sputter Targets and Substrates

- 3.5.3. Tracing the GeH4 Supply Chain

- 3.6. GERMANIUM US IMPORTS-ORIGINATING LOCATION AND MIX

- 3.7. GERMANIUM-BUILDING NEW US CAPACITY

- 3.8. GERMANIUM-WHO USES IT? SEMICONDUCTOR DEVICE MANUFACTURERS

- 3.9. GERMANIUM RAW MATERIAL PRICE TRENDS

4. GALLIUM

- 4.1. GALLIUM OVERVIEW-WHY IS IT IMPORTANT?

- 4.2. GALLIUM-WHAT KIND OF ELECTRONIC DEVICES IS IT USED FOR?

- 4.3. GALLIUM WHERE DOES GALLIUM COME FROM?

- 4.4. HOW IS IT MADE? FROM ORE TO END USE PRODUCT

- 4.5. SUPPLIERS OF GA END USE PRODUCTS TO THE SEMICONDUCTOR INDUSTRY

- 4.5.1. Tracking the Gallium Supply Chain

- 4.6. GALLIUM US IMPORTS-ORIGINATING LOCATION AND MIX

- 4.7. GALLIUM-BUILDING NEW US CAPACITY

- 4.8. GALLIUM-WHO USES IT? SEMICONDUCTOR DEVICE MANUFACTURERS

- 4.9. GALLIUM RAW MATERIAL PRICE TRENDS

5. CHINA GA & GE TRADE RESTRICTIONS

6. GALLIUM AND GERMANIUM GEOPOLITICAL RISKS & ASSESSMENT

7. REFERENCES

FIGURES

- FIGURE 1: GERMANIUM AND GALLIUM PRODUCTION BY REGION ESTIMATES

- FIGURE 2: US GERMANIUM USE APPLICATIONS ESTIMATE (AS A PERCENT OF TOTAL WEIGHT) 2022

- FIGURE 3: SILICON-GERMANIUM (SIGE) IS CRUCIAL IN 2 NM GAA-FET FABRICATION

- FIGURE 4: 2021 GERMANIUM PRODUCTION ESTIMATES AS A PERCENTAGE OF TOTAL OUTPUT (TONS)

- FIGURE 5: GEO2 AND GECL4 PRODUCTION FROM GE CONCENTRATE

- FIGURE 6: AIR LIQUIDE (VOLTAIX) GERMANE PLANT IN BRANCHBURG, NJ (USA)

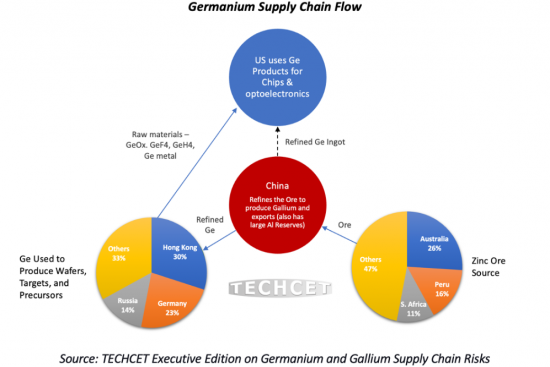

- FIGURE 7: GERMANIUM ORE TO FINISHED PRODUCTS INTO THE US --SUPPLY CHAIN FLOW

- FIGURE 8: GERMANIUM US IMPORTS BY COUNTRY OF ORIGIN

- FIGURE 9: SEMICONDUCTOR DEVICE MANUFACTURERS USING SIGE TECHNOLOGY BY REGION (AS A PERCENT OF 200MM EQUIVALENT CAPACITY*)

- FIGURE 10: GERMANIUM PRICE TRENDS 2018 TO 2023

- FIGURE 11: GERMANIUM METAL SHANGHAI METAL MARKET FUTURES (PRICES PER KG)

- FIGURE 12: CHINA WROUGHT AND UNWROUGHT GERMANIUM EXPORT FOR JAN-AUG 2023

- FIGURE 13: WORLD GALLIUM PRODUCTION AS A PERCENT OF TOTAL VOLUME (METRIC TONS)

- FIGURE 14: GALLIUM PRECURSOR SUPPLY CHAIN

- FIGURE 15: EXAMPLE OF MOLECULAR BEAM EPITAXY SYSTEM

- FIGURE 16: GALLIUM ORE TO FINISHED PRODUCTS INTO THE US --SUPPLY CHAIN FLOW

- FIGURE 17: US GALLIUM IMPORTS SHOWING COUNTRY DEPENDENCY

- FIGURE 18: : SEMICONDUCTOR DEVICE & LED MANUFACTURERS USING GAAS/GAN/GAP BY REGION

- FIGURE 19: GALLIUM METAL PRICE TRENDS 2018-2023

- FIGURE 20: GALLIUM METAL SHANGHAI METAL MARKET FUTURES (PRICES PER KG)

- FIGURE 21: CHINA WROUGHT AND UNWROUGHT GA EXPORTS 2023

TABLES

- TABLE 1: ELECTRONIC DEVICES AND THEIR USE OF GERMANIUM

- TABLE 2: GERMANIUM SEMICONDUCTOR VALUE CHAIN

- TABLE 3: MOST POPULAR APPLICATIONS FOR GALLIUM SUBSTRATES INCLUDE GAAS AND GAN COMPOUND

- TABLE 4: GA-CONTAINING SEMICONDUCTOR PROCESS MATERIALS SUPPLIERS AND LOCATIONS

- TABLE 5: GALLIUM SEMICONDUCTOR VALUE CHAIN