|

市场调查报告书

商品编码

1413700

晶片扩产对美国化学品供应链的影响Impact of Chip Expansion on US Chemical Supply-Chain |

||||||

本报告分析了美国半导体製造化学品供应链的结构和最新发展,并考虑了近期美国晶片产量增加的趋势对化学品供应链的影响。

主要优点

- 我们提供美国湿式化学品的供需趋势(数量/收入基础)、晶圆起始需求以及美国主要晶片代工厂排名等资讯。

- 本报告面向有兴趣了解支援晶片製造的美国半导体供应链趋势的任何人,包括业务开发经理、供应链经理和金融投资/顾问。

- 单一使用者授权:使用 2FA(双重认证)为一人提供 techcet.com 的入口网站登入存取权限。使用者可以自由使用购买的报告中的资料进行内部和外部演示,并附有适当的版权声明。

样本视图

目录

第一章执行摘要

第二章 现状

- 国内製造业萎缩

- 全球市场占有率:按国家划分

- 全球市场趋势对产业前景的影响

- 材料市场仍然重要

- 美国晶片市场扩张对湿式化学品需求的影响

- 逻辑电路製造对湿化学品的需求增加

- 先进设备带来的材料增加

- 当前供应商:供应链特征

- 当前供应商:市场排名

- 当前供应商:市场动态

第三章 从预测到现状的变化

- 已宣布和计划的铸造厂扩建:最新信息

- 晶片与科学法 (2022)

- 小费法规定

- 美国新铸造厂

- 美国铸造厂/工厂扩建活动

- 美国晶片扩产对产能影响

- 晶片扩容导致湿化学品需求变化

- 湿化学品的需求:给供应商的强烈讯息

第四章 需求、供给与生产能力

- 本报告中使用的术语定义

- 半导体扩张推动材料需求成长

- 预计产能短缺

- 化学品需求预测、製造能力与缺口

- 纯度概览

- 国内晶圆代工厂扩张计画加速

- 湿化学品需求成长率:依类型

- 化学品需求增加75%

- 湿化学品供需预测

- 硫酸(H2SO)的展望

- 异丙醇(IPA)前景

- 过氧化氢(H2O2)前景

- 盐酸(HCL)前景

- 氢氧化铵 (NH4OH) 展望

- 氢氟酸(HF)前景

- 磷酸(H3PO4)前景

- 硝酸(HNO3)前景

- 主要供应商概况

第五章 市场调整展望

- 预期市场调整

- 预期行为

- 供应商在美国的工厂扩建活动

- SAMSUNG/TSMC影响力

- 参与者的评论

第六章 进口依赖与挑战

- 美国对湿化学品进口的依赖

- 导入状态的变化

- “进口或不进口,这是一个问题。”

第 7 章 包装与纯度

- 不断变化的包装要求

- 对超高纯度的需求:责任还是机会?

- 化学纯度的趋势

- 提高纯度要求

- 运输管理和需求演变

第八章 TECHCET评估:风险与机会

- TECHCET 评估:一般结果

- TECHCET评估:国际考虑

- TECHCET 评级:供应商担忧

附录 A:超高压化学品製造

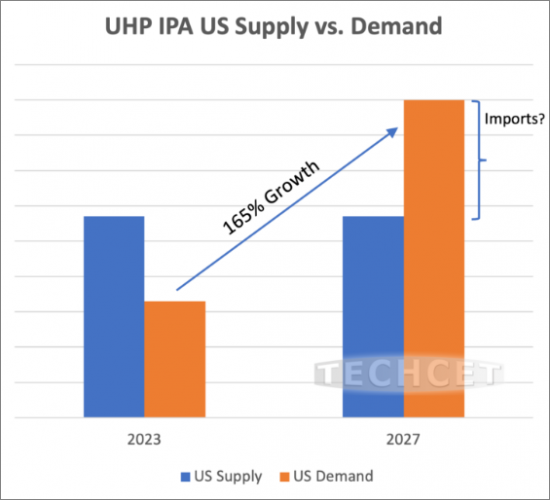

The electronic materials advisory firm providing business and technology information on semiconductor supply chains -- is forecasting a jump in the US domestic share of the semiconductor material market to 13-15% by 2027, as support grows for incoming fab expansions. While this outlook is looking generally positive for the US semiconductor industry, uncertainties with timing expansions have made it difficult for suppliers to plan effectively and CHIPS Act funding does not seem to be helping. In many cases, suppliers are "expansion-ready," and are just awaiting demand signals from chip manufacturers. As a result, much of the incremental US wet chemical capacity is focused on an "import first, build later" strategy, meaning capacity is being used to warehouse, possibly purify, repackage, and distribute imported chemicals, rather than manufacture them domestically. This is the case in regard to IPA, as shown in the graph below. Although the potential growth is high, the timing is uncertain.

TABLE OF CONTENTS

1.0. EXECUTIVE SUMMARY

- 1.1. EXECUTIVE SUMMARY - EXPANSIONS HAVE A MAJOR IMPACT ON WAFER STARTS

- 1.2. EXECUTIVE SUMMARY - CHEMICAL DEMAND GROW ACCELERATES

- 1.3. EXECUTIVE SUMMARY - MATERIALS INCREASES ACROSS THE SPECTRUM

- 1.4. EXECUTIVE SUMMARY - CAPACITY SHORTFALLS EXPECTED

- 1.5. EXECUTIVE SUMMARY - IMPORT DEPENDENCIES

- 1.6. EXECUTIVE SUMMARY - BY CHEMICAL (NO SIGNIFICANT CHANGE FROM 2022)

- 1.7. EXECUTIVE SUMMARY - "IMPORT FIRST, BUILD LATER"

2.0. THE CURRENT STATE OF AFFAIRS

- 2.1. SHRINKING DOMESTIC MANUFACTURING

- 2.2. GLOBAL MARKET SHARE BY COUNTRY

- 2.3. GLOBAL DYNAMICS IMPACT INDUSTRY OUTLOOK

- 2.4. MATERIAL MARKETS REMAIN SIGNIFICANT

- 2.5. IMPACT OF US CHIP EXPANSION ON WET CHEMICAL DEMAND

- 2.6. WET CHEMICAL DEMAND INCREASE LED BY LOGIC MANUFACTURING

- 2.7. ADVANCED DEVICES DRIVE MATERIALS INCREASES

- 2.8. CURRENT SUPPLIERS - SUPPLY CHAIN CHARACTERISTICS

- 2.8.1. CURRENT SUPPLIERS - MARKET RANKINGS

- 2.8.2. CURRENT SUPPLIERS - MARKET DYNAMICS

3.0. THE FORECAST CHANGES TO THE STATUS QUO

- 3.1. ANNOUNCED AND PLANNED FAB EXPANSIONS UPDATE

- 3.2. CHIPS AND SCIENCE ACT OF 2022

- 3.3. CHIPS ACT PROVISIONS

- 3.4. NEW FABS IN THE US

- 3.5. US FAB/PLANT EXPANSION ACTIVITY

- 3.6. US CHIP EXPANSION EFFECT ON CAPACITY

- 3.7. CHIP EXPANSION CHANGES IN WET CHEMICAL DEMAND

- 3.8. WET CHEMICAL DEMAND - A STRONG MESSAGE TO SUPPLIERS

4.0. SUPPLY, DEMAND & CAPACITY

- 4.1. DEFINITIONS OF THE TERMS USED THROUGHOUT THIS REPORT

- 4.2. SEMICONDUCTOR EXPANSION DRIVES MATERIALS DEMAND GROWTH

- 4.3. CAPACITY SHORTFALLS EXPECTED

- 4.4. CHEMICAL DEMAND FORECAST, MANUFACTURING CAPABILITIES & GAP

- 4.5. PURITY OVERVIEW

- 4.6. DOMESTIC FAB EXPANSION PLANS ACCELERATE

- 4.7. DEMAND GROWTH BY WET CHEMICAL TYPE

- 4.8. CHEMICAL VOLUME DEMAND GROWS BY 75%

- 4.9. WET CHEMICAL SUPPLY/DEMAND FORECASTS

- 4.9.1. SULFURIC ACID (H2SO) OUTLOOK

- 4.9.1.1. US IMPORTS OF UHP H2SO4

- 4.9.1.2. H2SO4 US MARKET LANDSCAPE

- 4.9.2. ISOPROPYL ALCOHOL (IPA) OUTLOOK

- 4.9.2.1. US IMPORTS OF UHP IPA

- 4.9.2.2. IPA US MARKET LANDSCAPE

- 4.9.3. HYDROGEN PEROXIDE (H2O2) OUTLOOK

- 4.9.3.1 US IMPORTS OF UHP H2O2

- 4.9.3.2. H2O2 US MARKET LANDSCAPE

- 4.9.4. HYDROCHLORIC ACID (HCL) OUTLOOK

- 4.9.4.1 US IMPORTS OF UHP HCL

- 4.9.4.2. HCL US MARKET LANDSCAPE

- 4.9.5. AMMONIUM HYDROXIDE (NH4OH) OUTLOOK

- 4.9.5.1 US IMPORTS OF UHP NH4OH

- 4.9.5.2. NH4OH US MARKET LANDSCAPE

- 4.9.6. HYDROFLUORIC ACID (HF) OUTLOOK

- 4.9.6.1 US IMPORTS OF UHP HF

- 4.9.6.2. HF US MARKET LANDSCAPE

- 4.9.7. PHOSPHORIC ACID (H3PO4) OUTLOOK

- 4.9.7.1 US IMPORTS OF UHP H3PO4

- 4.9.7.2. H3PO4 US MARKET LANDSCAPE

- 4.9.8. NITRIC ACID (HNO3) OUTLOOK

- 4.9.8.1 US IMPORTS OF UHP HNO3

- 4.9.8.2. HNO3 US MARKET LANDSCAPE

- 4.9.1. SULFURIC ACID (H2SO) OUTLOOK

- 4.10. KEY SUPPLIERS SUMMARY

5.0. ANTICIPATED MARKET ADJUSTMENTS

- 5.1. ANTICIPATED MARKET ADJUSTMENTS

- 5.2. ANTICIPATED ACTIONS

- 5.3. SUPPLIER US PLANT EXPANSION ACTIVITY

- 5.4. THE SAMSUNG/TSMC EFFECT

- 5.5. COMMENTS FROM THE PARTICIPANTS

6.0 DEPENDENCIES & CHALLENGES OF IMPORTS

- 6.1. US DEPENDENCE ON WET CHEMICAL IMPORTS

- 6.2. A CHANGING IMPORT PICTURE

- 6.3. "TO IMPORT OR NOT TO IMPORT, THAT IS THE QUESTION"

7.0 PACKAGING & PURITY

- 7.1. EVOLVING PACKAGING REQUIREMENTS

- 7.2. ULTRA HIGH PURITY DEMANDS - A LIABILITY OR OPPORTUNITY?

- 7.3. CHEMICAL PURITY TRENDS

- 7.3.1. EVER INCREASING PURITY REQUIREMENTS

- 7.4 SHIP TO CONTROL & EVOLVING REQUIREMENTS

8.0 TECHCET'S ASSESSMENT OF RISKS AND OPPORTUNITIES

- 8.1. TECHCET'S ASSESSMENT - GENERAL OBSERVATIONS

- 8.2. TECHCET'S ASSESSMENT - INTERNATIONAL CONSIDERATIONS

- 8.3. TECHCET'S ASSESSMENT - SUPPLIER CONCERNS

APPENDIX A: MANUFACTURING UHP CHEMICALS

FIGURES

- FIGURE 1: 2023 US CHIP FAB CAPACITY - 33.9 M WAFERS (200MM EQUIV.)

- FIGURE 2: 2027 US CHIP FAB CAPACITY - 46.4 M WAFERS (200MM EQUIV.)

- FIGURE 3: US ANNUAL WAFER CAPACITY FORECAST 2023-2027 (200MM EQUIV.)

- FIGURE 4: SEMICONDUCTORS LEAD US EXPORTS

- FIGURE 5: US SEMICONDUCTOR INDUSTRY IS STRONG, DESPITE LIMITED MANUFACTURING PRESENCE. (REVENUES AS A PERCENT OF TOTAL SALES BY HQ LOCATION)

- FIGURE 6: 2022 GLOBAL SEMICONDUCTOR MATERIALS MARKET BY SEGMENT (US$71.7B)

- FIGURE 7: US WET CHEMICAL DEMAND BY CHIP FABRICATOR 2023-2027 (200MM EQUIV. WAFERS)

- FIGURE 8: US WAFER START CAPACITY FOR LOGIC DEVICES BY NODE, 2023-2027 (200MM EQUIV. WAFERS)

- FIGURE 9: US WAFER CAPACITY FOR MEMORY DEVICES BY NODE, 2023-2027 (200MM EQUIV. WAFERS)

- FIGURE 10: SEMICONDUCTOR DEMAND AS A PERCENT OF TOTAL

- FIGURE 11: INVESTMENT IN GLOBAL CHIP EXPANSIONS 2022-2027 ($500 B USD)

- FIGURE 12: US CHIP EXPANSIONS 2023-2027

- FIGURE 13: CHIP EXPANSION EXPECTED TO GROW ANNUAL CAPACITY >35% TO 46.4M (200MM EQUIV.)

- FIGURE 14: WET CHEMICAL DEMAND WILL RISE 75% FROM LEADING CHIP FABS 2023-2027

- FIGURE 15: US WAFER START GROWTH BY DEVICE TYPE AND NODE

- FIGURE 16: US 2023 -- 2027 US WET CHEMICAL DEMAND FORECAST

- FIGURE 17: US H2SO4 SUPPLY VS. DEMAND VOLUME (MKG)

- FIGURE 18: US H2SO4 UHP GRADE -- DEPENDENCE ON IMPORTS

- FIGURE 19: US H2SO4: 71% GROWTH, 11% CAGR

- FIGURE 20: US SUPPLY VS. DEMAND VOLUME (MKG)

- FIGURE 21: US IPA UHP GRADE -- INCREASING DEPENDENCE ON IMPORTS

- FIGURE 22: US IPA VOLUME DEMAND 92% GROWTH 14% CAGR

- FIGURE 23: US H2O2 SUPPLY VS. DEMAND (MKG)

- FIGURE 24: US H2O2 UHP GRADE -- DEPENDENCE ON IMPORTS

- FIGURE 25: US H2O2 US VOLUME DEMAND 80% GROWTH 13% CAGR

- FIGURE 26: US HCL SUPPLY VS. DEMAND (MKG)

- FIGURE 27: US HCL UHP GRADE -- DEPENDENCE ON IMPORTS

- FIGURE 28: US HCI US DEMAND 70% GROWTH 11% CAGR

- FIGURE 29: US NH4OH SUPPLY VS. DEMAND (MKG)

- FIGURE 30 US NH4OH UHP GRADE DEPENDENCE ON IMPORTS

- FIGURE 31: US NH4OH US VOLUME DEMAND 77% GROWTH 12% CAGR

- FIGURE 32: US HF SUPPLY VS. DEMAND (MKG)

- FIGURE 33: US HF UHP GRADEDEPENDENCE ON IMPORTS

- FIGURE 34: US HF VOLUME DEMAND 59% GROWTH, 10% CAGR

- FIGURE 35: US H3PO4 SUPPLY VS. DEMAND (MKG)

- FIGURE 36: US H3PO4 UHP GRADE - DEPENDENCY ON IMPORTS

- FIGURE 37: US H3PO4 US VOLUME DEMAND79% GROWTH, 12% CAGR

- FIGURE 38: US HNO3 SUPPLY VS. DEMAND (MKG)

- FIGURE 39: US HNO3 UHP GRADE - DEPENDENCE ON IMPORTS

- FIGURE 40: US HNO3 US VOLUME DEMAND 33% GROWTH, 6% CAGR

- FIGURE 41: RENDERING OF TSMC'S ARIZONA FACILITY

- FIGURE 42: CHINA TO US OCEAN FREIGHT EXPORT PRICE TRENDS

- FIGURE 43: SHIP TO CONTROL FOR PROCESS CHEMICALS EXAMPLE

TABLES

- TABLE 1: CHEMICAL VOLUME GROWTH 2023-2027

- TABLE 2: US WET CHEMICAL EXCESS/SHORTFALLS EXPECTED

- TABLE 3: DEPENDENCY OF UHP PRODUCTS ON IMPORTS WITHOUT ADDITIONAL DOMESTIC CAPACITY

- TABLE 4: US DOMESTIC TIER I TOP 3 SUPPLIERS BY VOLUME SUPPLIED

- TABLE 5: US FAB RAMP FORECAST (200MM EQUIV.)

- TABLE 6: WET CHEMICALS WITH THE HIGHEST DEMAND GROWTH IN THE US 2027/2023

- TABLE 7: CAPACITY SHORTFALLS EXPECTED (SAME AS TABLE 2)

- TABLE 8: UHP AND IC GRADE SPLIT USED FOR GRAPHS

- TABLE 9: US SEMICONDUCTOR CHEMICAL VOLUME GROWTH 2027/2023

- TABLE 10: SUMMARY OF KEY US SUPPLIERS

- TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY, PAGE 1 OF 3

- TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY, PAGE 2 OF 3

- TABLE 11: SUPPLIER US CHEMICAL PLANT EXPANSION ACTIVITY, PAGE 3 OF 3

- TABLE 12: COMMENTS FROM THE SELECTED PARTICIPANTS

- TABLE 13: 2027 IMPORTS AS A PERCENTAGE OF UHP AND TOTAL DEMAND

- TABLE 14: INCREASING DEPENDENCY OF UHP PRODUCTS ON IMPORTS

- TABLE 15: EVOLVING PACKAGING REQUIREMENTS

- TABLE 16: PURITY REQUIREMENTS

- TABLE 17: COMMENTS FROM THE SELECTED PARTICIPANTS